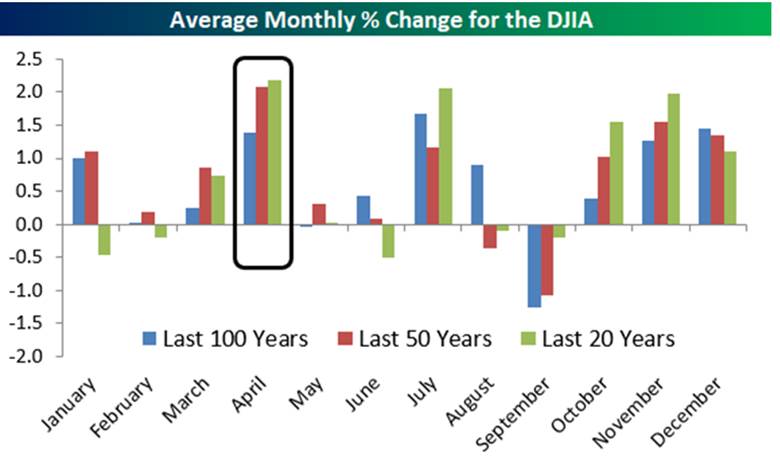

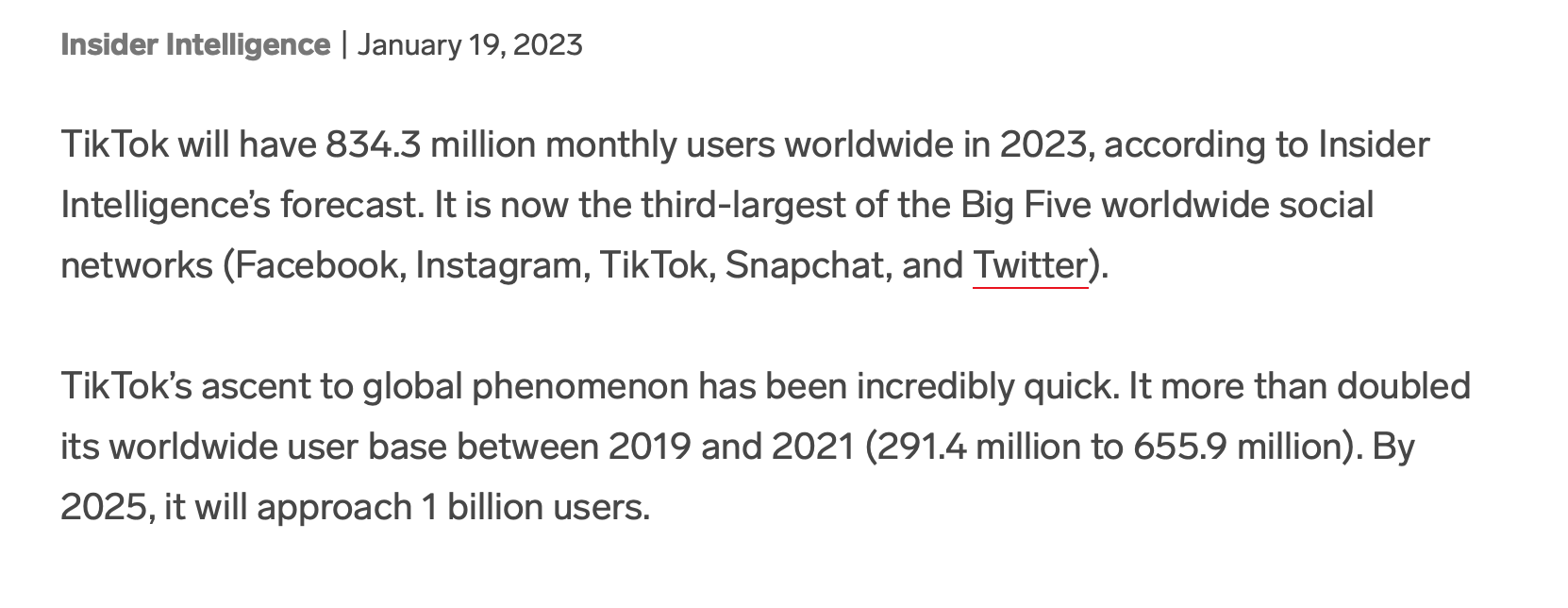

1. Seasonality April Strong for Stocks

From Dave Lutz at Jones Trading Bespoke notes Over the last 20 and 50 years, April has been the strongest month of the year for stocks. Over the last 50 years, the Dow has averaged a gain of 2.09% in April with positive returns 66% of the time. Over the last 20 years, the Dow has averaged a gain of 2.18% in April with positive returns 85% of the time

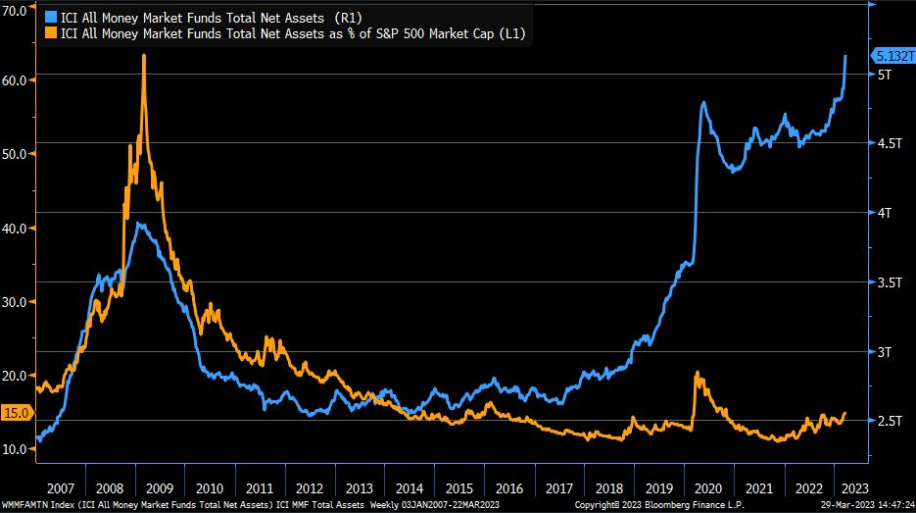

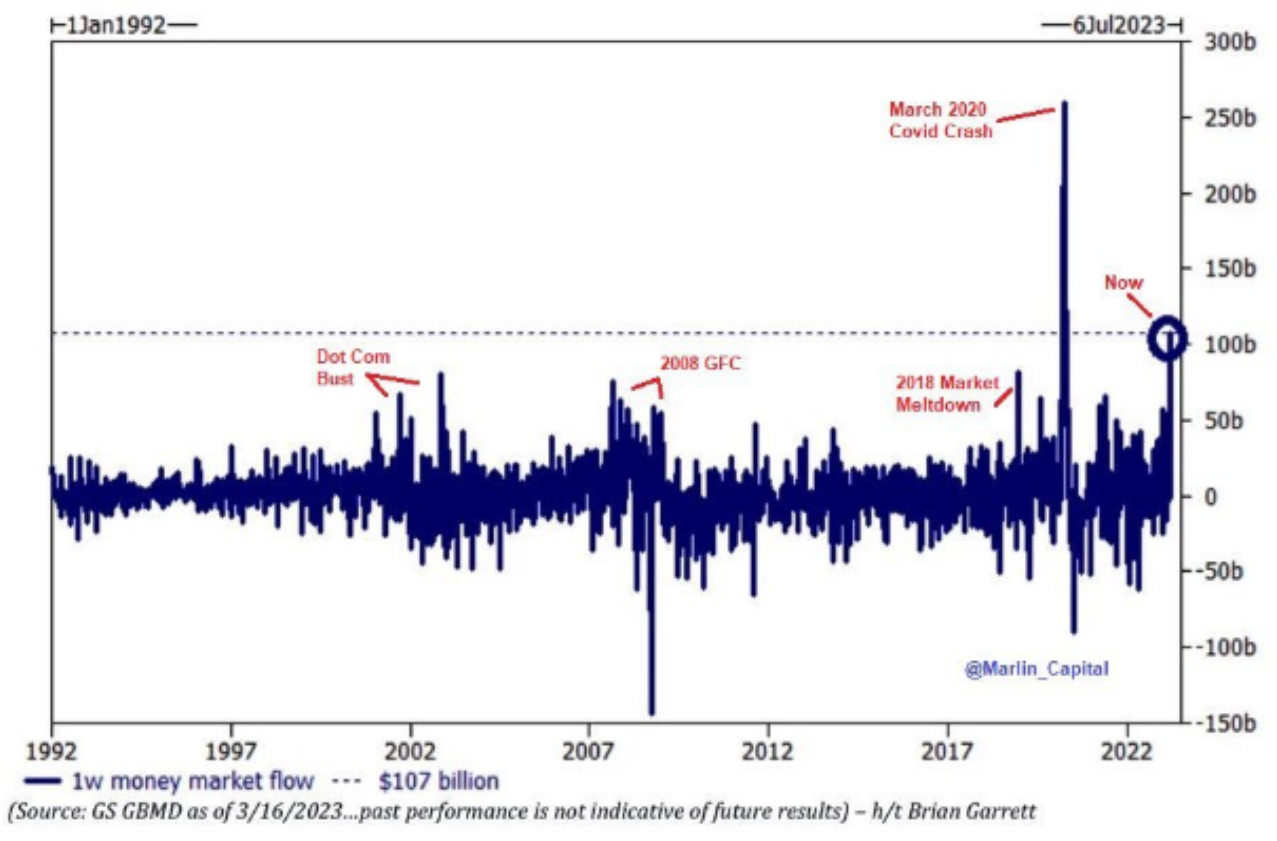

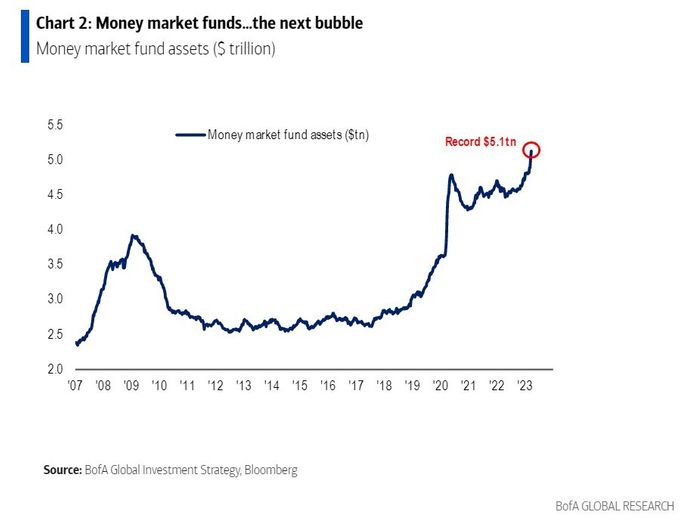

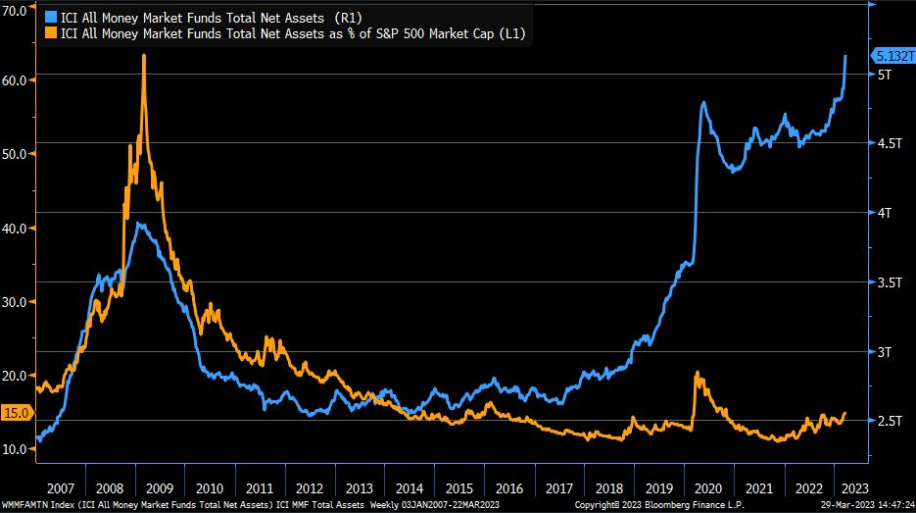

2. Money Market Flows Massive But Not as a % of S&P Market Cap….Not Large.

Liz Ann Sonders Schwab Lots of focus on fact that money market mutual fund assets (blue) have surged to new high of late, but as a % of S&P 500 market cap (orange), share is still below COVID bear market level

https://www.linkedin.com/in/lizannsonders/

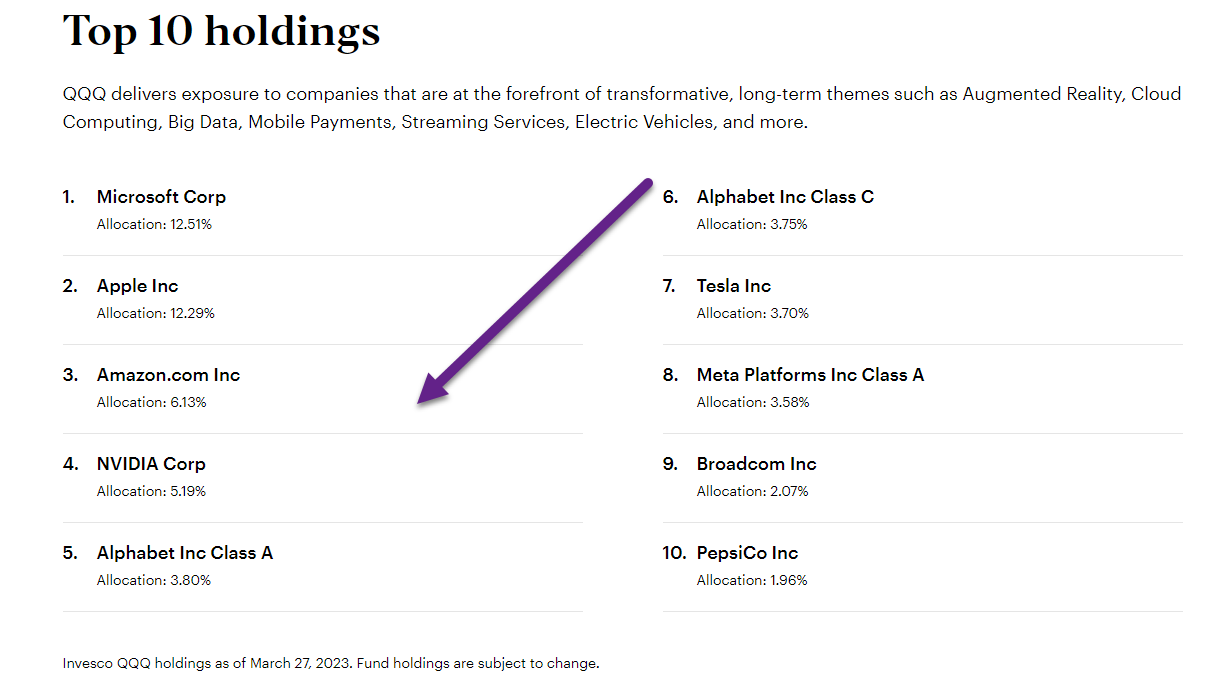

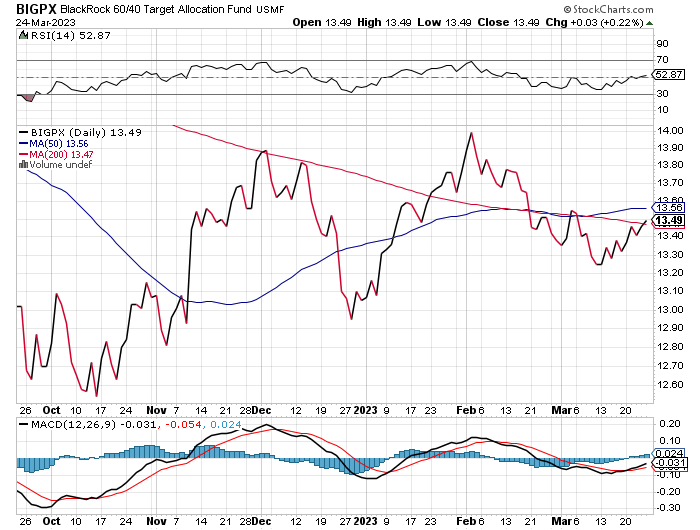

3. Another QQQ Beating Everything Chart.

This chart is QQQ vs. Low Volatility Stocks SPLV…50day thru 200day to upside

www.stockcharts.com

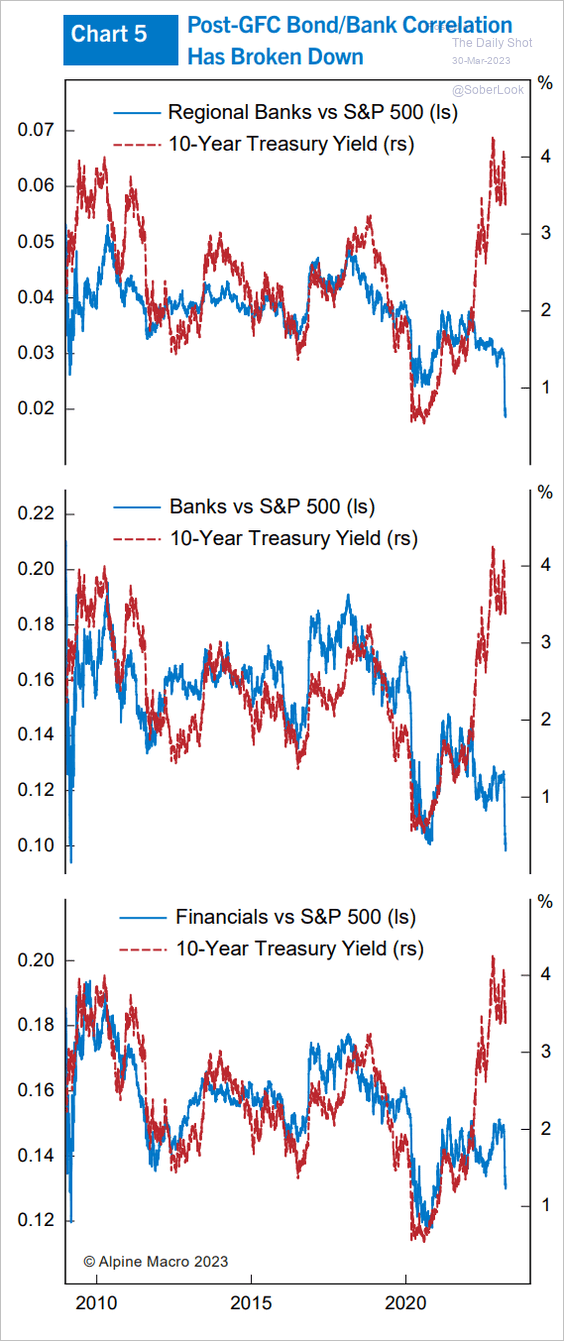

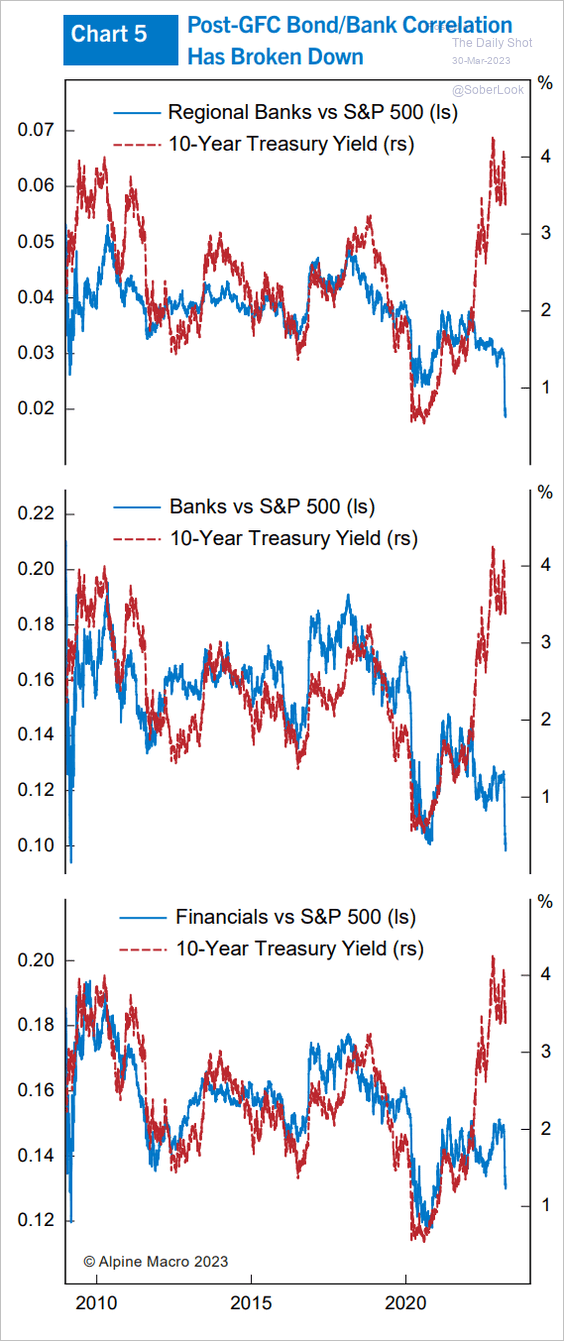

4. Since 2008 Banks Have Traded Inline with 10 Year Treasury….Now Massively Diverging.

Equities: Financials’ share prices have massively diverged from bond yields.

Source: Alpine Macro https://dailyshotbrief.com/

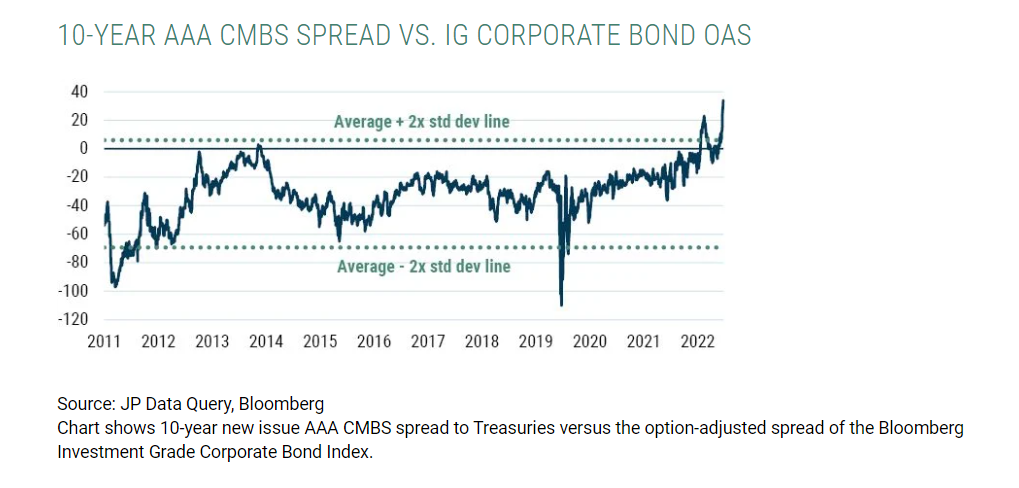

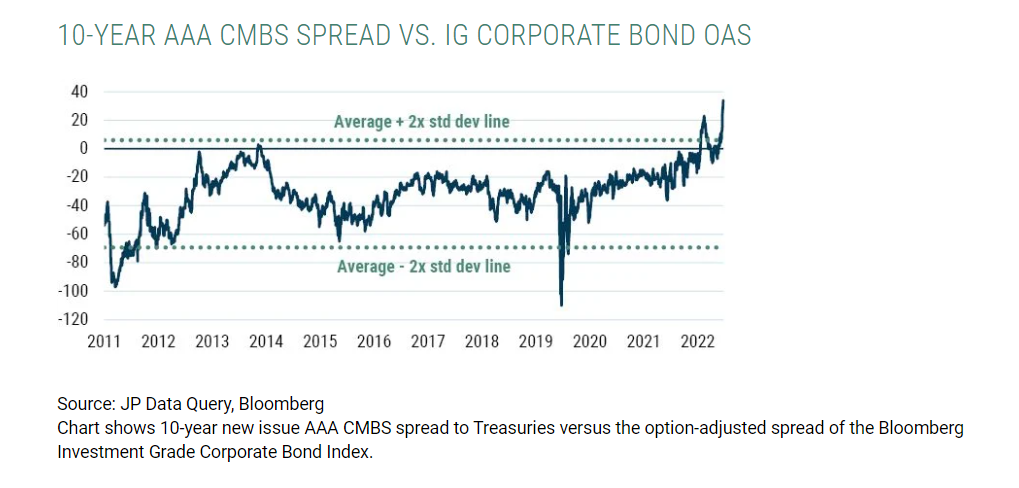

5. CMBS Spreads the Cheapest in History vs. Comparable Corporate Bonds

GMO Research

https://www.gmo.com/americas/research-library/aaa-cmbs-loss-remote-liquid-and-cheaper-than-ig_insights/?utm_medium=email&utm_source=episerver-campaign&utm_campaign=article-subscription-push&utm_content=Insights&email=mtopley%40lansingadv.com&first_name=matthew&last_name=topley&company=Lansing+Street+Advisors

CMBS Spreads: The Basics

A CMBS spread, also referred to as a CMBS credit spread, is the difference between the interest rate of a CMBS loan and the underlying index on which the interest rate is based on. Since the vast majority of CMBS loans are based on the swap rate, spreads can usually be determined by taking the interest rate of a loan and subtracting the swap rate. Spreads compensate a lender for their risk, as well as providing for some of the profit that the lender will make as a result of the CMBS transaction. Increased spreads also mean increased profits (and risks) for CMBS investors. https://www.multifamily.loans/apartment-finance-blog/cmbs-spreads-what-you-need-to-know/

What Is a Commercial Mortgage-Backed Security (CMBS)?

- CMBS are secured by mortgages on commercial properties rather than residential real estate.

- Commercial mortgage-backed securities are in the form of bonds, and the underlying loans typically are contained within trusts.

- The loans in a CMBS act as collateral—with principal and interest passed on to investors—in the event of default.

https://www.investopedia.com/terms/c/cmbs.asp

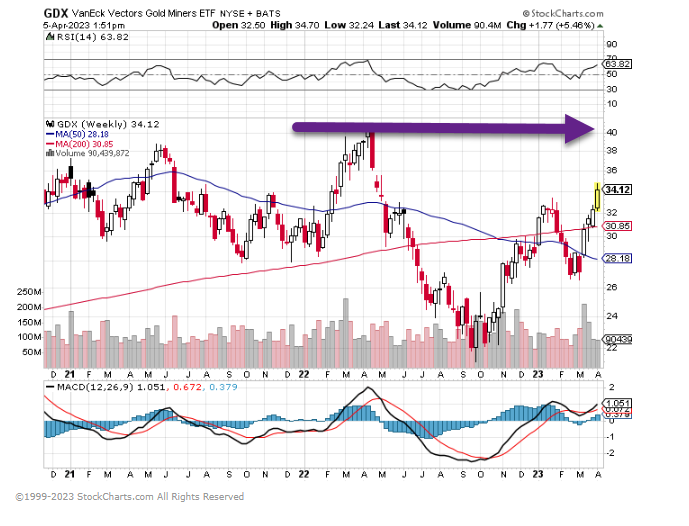

6. GLD Gold ETF $196 is Breakout Going Back to January 2020

GLD right at 2022 highs….2020 high $196

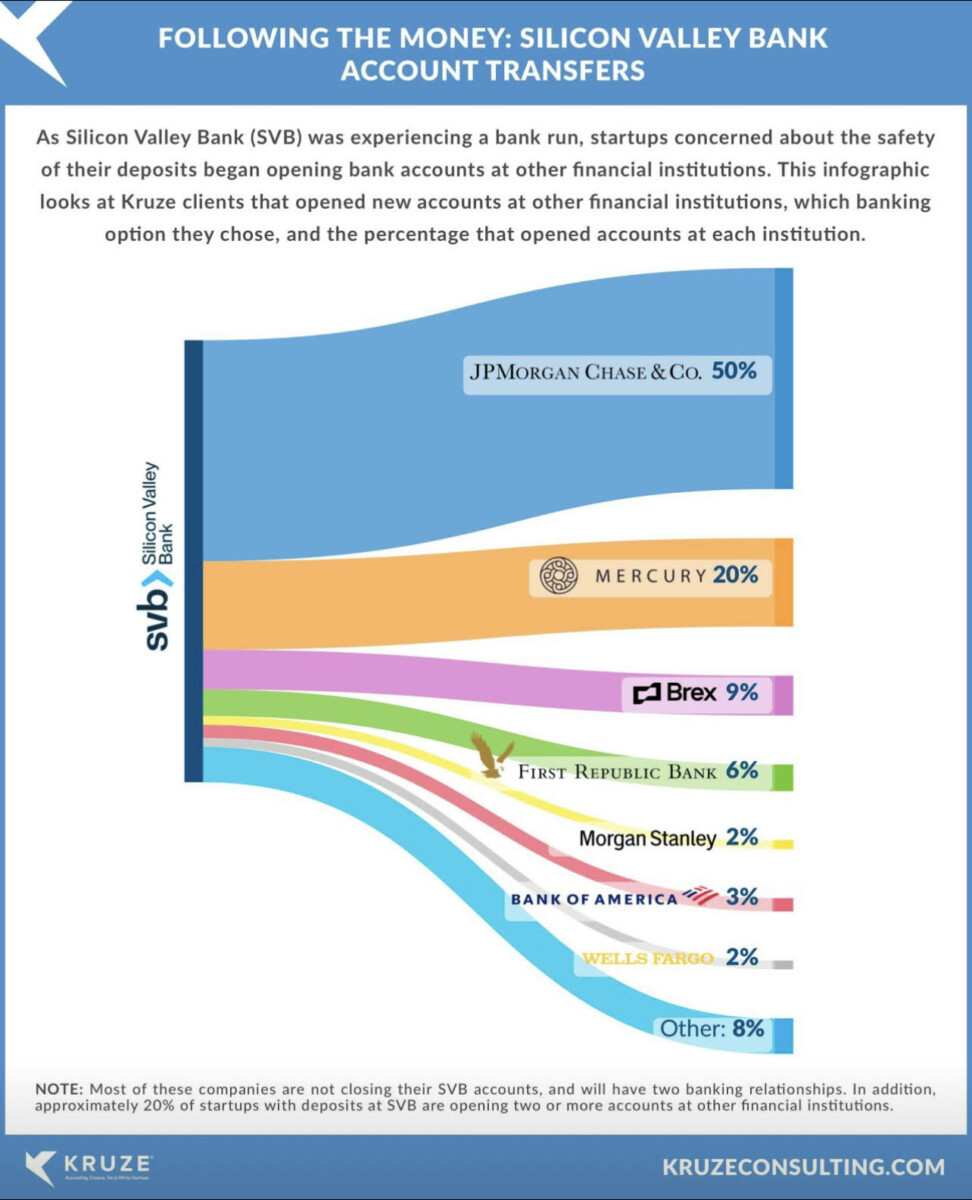

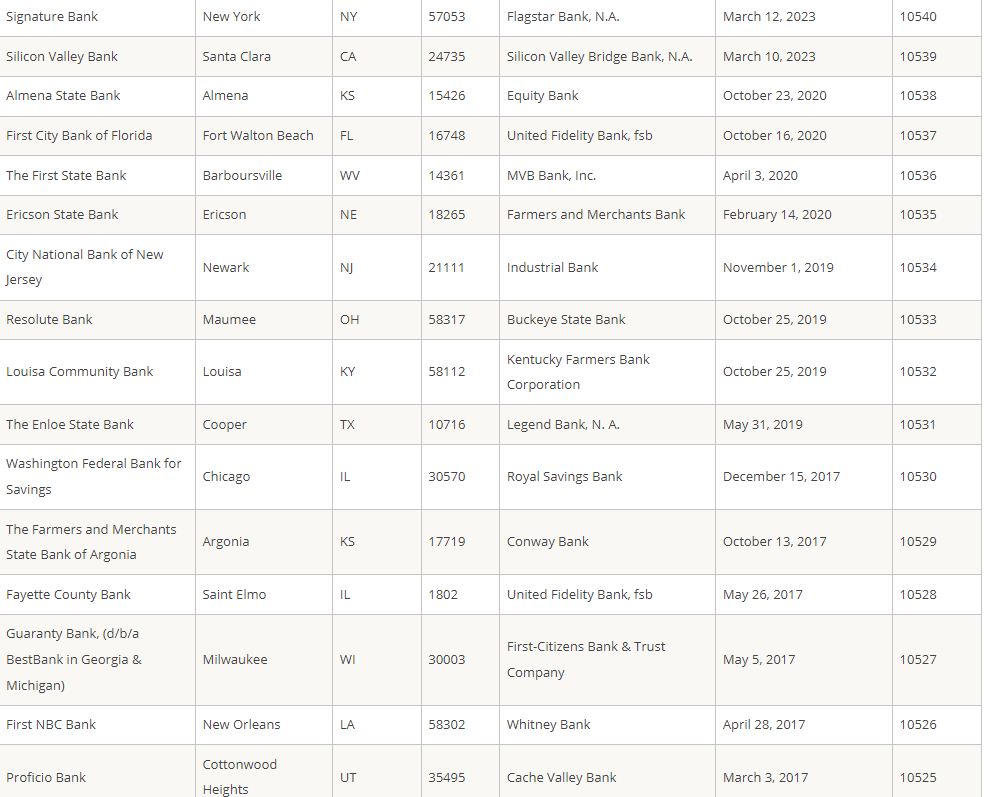

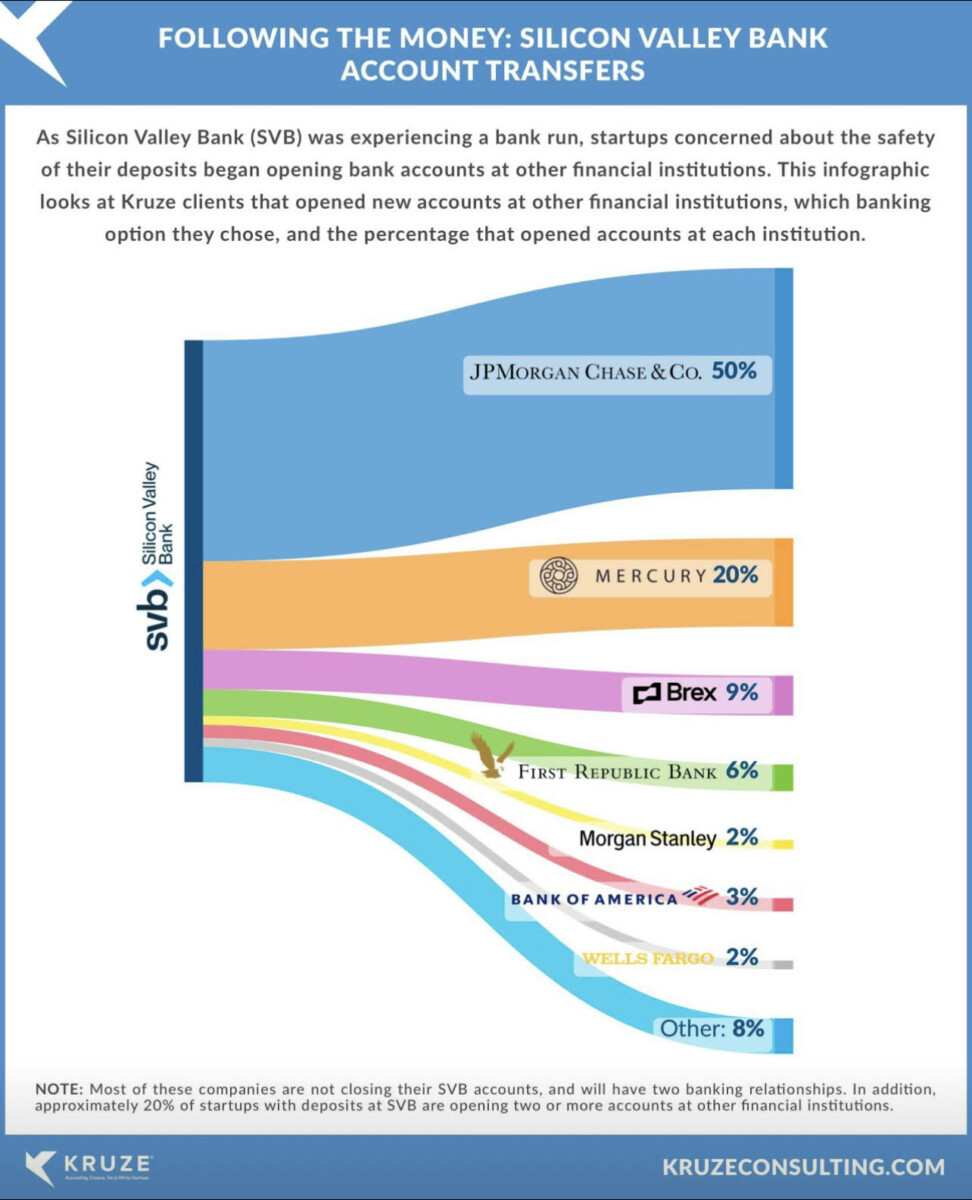

7. Where did Silicon Valley Transfers Go? JP Morgan

Found at Barry Ritholtz Blog The Big Picture

https://rithotlz.com/2023/03/10-thursday-am-reads-425/

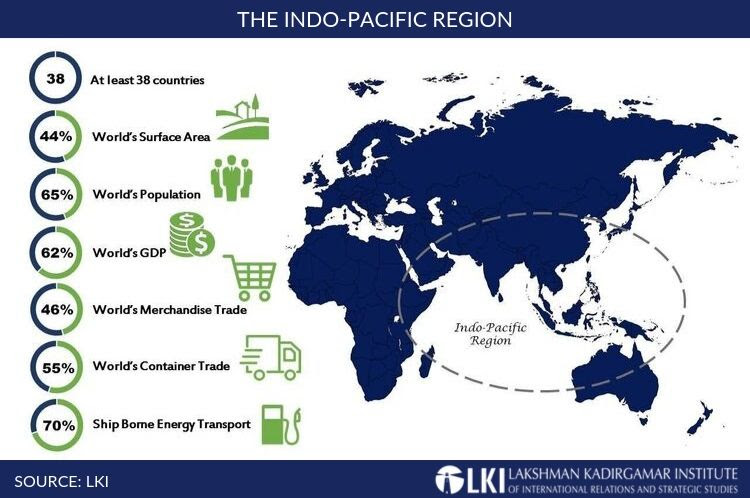

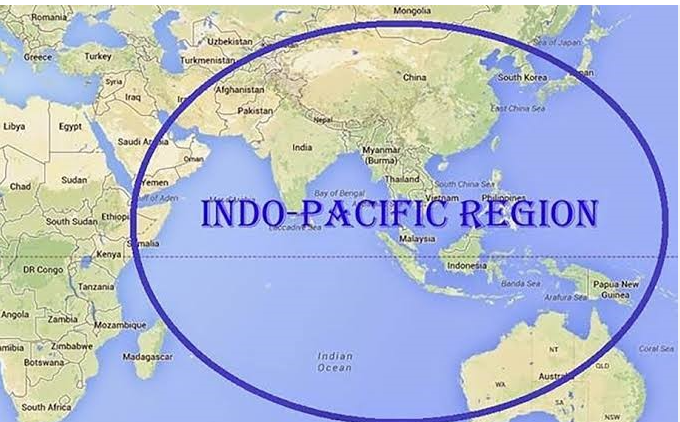

8. Russia says oil sales to India soared 22-fold last year

Sales to India surged in 2022 as European buyers turned to other markets after the Ukraine war, Russian deputy PM says.

Russian oil sales to India surged more than 22-fold last year as European buyers turned to other markets following the conflict in Ukraine, Russia’s deputy prime minister has said.

“Most of our energy resources were redirected to other markets, to the markets of friendly countries,” Alexander Novak said in comments carried by Russian news agencies on Tuesday.

“If for example, we take oil supplies to India, they increased 22 times last year,” he said.

Russia shifted its oil exports to India and China last year as European Union nations sought to end their reliance on Russian energy supplies after Moscow sent troops into neighbouring Ukraine.

The EU imposed an embargo on seaborne Russian oil in December alongside a price cap on Russian crude that was agreed with the Group of Seven industrialised powers.

The shift has meant cheaper Russian energy imports for “friendly” countries, mainly China and India.

Novak said energy revenues accounted for 42 percent of Russia’s federal budget in 2022 and that the country’s energy industry was sustainable, despite the challenges faced by Western sanctions.

Novak, who is in charge of Russia’s energy sector, also noted that supplies to China were increasing as a “result of the great work that has been done in the industry”.

Russia, a major producer and key ally of the OPEC oil cartel, cut crude production by 500,000 barrels per day this month in response to the Western sanctions.

Novak announced last week that the output reduction, which amounts to 5 percent of daily production, would continue through June.

He said the move was part of a response to Western penalties targeting Russia’s oil industry that aim to limit Moscow’s ability to finance its military.

The International Energy Agency this month said Russia’s oil-export revenue sank by almost half in February compared with last year.

https://www.aljazeera.com/news/2023/3/28/russia-says-oil-sales-to-india-soared-22-fold-last-year

9. What Binge Drinking Does to the Brain, and the Gut

In young people, establishing habits that are hard to overcome. Scott C. Anderson Psychology Today

KEY POINTS

- Binge drinking alters the gut microbiota.

- Changes in specific bacteria are associated with emotional and cognitive deficits.

- Binge drinking in young people can establish lifelong habits that may be hard to overcome.

“The hard part about being a bartender is figuring out who is drunk and who is just stupid.” –Richard Braunstein

John Cryan and Ted Dinan are a pair of dynamic Irish researchers who, over the past decade, have been busily advancing the remarkable science of the gut-brain axis. They coined the term psychobiotic to refer to probiotics and prebiotics that can improve your mood. The idea that mere gut microbes could affect the lofty human brain is humbling. As Cryan puts it, “If microbes are controlling the brain, then microbes are controlling everything.”

Cryan, Dinan, and their team at APC Microbiome, based at University College Cork, recently looked at what happens to gut microbes in young binge drinkers. Once again, there was an interesting connection between gut microbes and the brain—in this case, the boozy brain.

Binge Drinking, Gut Microbiota, and Cognition

The study, appearing in The Lancet and headed by Carina Carbia, found that binge drinking among young people aged 18 to 25 had a long-term impact on their gut microbiota and their cognition. Bingeing increased inflammation and slowed reaction times. Testing showed bingers had emotional deficits and alcohol cravings that were strongly associated with their altered microbiota. Cryan says, “This study highlights the importance of the gut microbiota in regulating craving, social cognition, and emotional functioning.”

I had the wonderful opportunity to write a book with Cryan and Dinan: The Psychobiotic Revolution from National Geographic. During our collaboration, a Guinness or two may have been downed, but no bingeing. We were writing for the layperson, but our prose pales next to Ireland’s legendary hard-drinking bards. The Emerald Isle is known for outstanding literature and enthusiastic imbibing, often pursued simultaneously. Dubliners James Joyce, Oscar Wilde, Jonathan Swift, and Samuel Beckett were brilliant writers who were all known to crawl the pubs for a drop or two. Some of these pubs are famed for that literary patronage.

Irish playwright George Bernard Shaw famously declared that whiskey is liquid sunshine. Less cheerfully, he also asserted that “alcohol is the anesthesia by which we endure the operation of life.” The Irish novelist Brendan Behan, well-known for both his wit and his binges, once described himself as a drinker with a writing problem. Funny, yes; but, sadly, drinking led to his death after he collapsed at the Harbour Lights Bar in Dublin. He was only 41.

Short of killing you, binge drinking can have more subtle effects, including blunted emotional perception. The APC study found that binge drinkers had a difficult time recognizing expressions of sadness or disgust.

Alcohol Cravings

Specific microbial species were associated with impulsive behavior and cravings for alcohol. We now know that many of our cravings may be encouraged by these tiny creatures. By secreting neurotransmitters like serotonin and dopamine, they yank our reins to guide us to their favorite foods. When we binge drink, we encourage a certain class of party bacteria that tend to draw us back to the bar for another round. Some species of Alistipes, for instance, are reduced by binge drinking, while species of Veillonella are increased. You might blame Veillonella for that urge to celebrate.

The study defined binge drinking as “consumption of a large amount of alcohol within a short period of time, leading to a blood alcohol concentration of at least 0.8 g/l.” That works out to about five drinks in a single sitting, which is more common in Ireland (19 percent) than the European average (6 percent). However, averages are deceptive, and Ireland is not the booziest country in Europe. It has some stiff competition from Germany, Latvia, and the Czech Republic, among others.

Still, Ireland has a reputation for drinking, deserved or not. Tina Fey, the comedic actress (with some Irish heritage) said, “In a study, scientists report that drinking beer can be good for the liver. I’m sorry, did I say ‘scientists’? I meant Irish people.” So, perhaps an Irish study of bingeing isn’t totally inappropriate.

Drinking is a deeply entrenched part of humankind. In fact, throughout most of our history, alcohol has been a lifesaver, killing the ubiquitous pathogens in ordinary water. Louis Pasteur, eponymous for killing microbes, said that “wine is the most healthful and most hygienic of beverages.” Alcohol, produced by microbial fermentation, is a potent antiseptic. Pasteur knew that it takes a microbe to fight a microbe.

For as long as there have been guts, beneficial microbes have made a home there, and they play an important role in fending off pathogens. They are an unsung but important part of our immune system.

Our gut microbes, some of which can double in number every half hour, respond quickly to our dietary and drinking habits. As mentioned, depending on what we consume, some microbes thrive while others languish. Amazingly, the complex communities they form can alter our mood and cognition.

Long-Term Problems

These alterations can be persistent, and bingeing at a young age may set us up for lifelong behaviors that can be hard to reset. So, if you are thinking of taking an alcoholiday to visit Margaritaville, pace yourself. Your booze-loving bacteria may enjoy a binge, but the joy you find in the evening will be subtracted from the following morning. Worse yet, you may be setting yourself up for enduring behavioral problems.

Quitting is an obvious solution, but, for many, that can be tough. As Henny Youngman put it: “When I read about the evils of drinking I gave up reading.” But, like many things in life, the dose makes the poison. A recent large study of 4 million Koreans found that three glasses of alcohol or more per day was associated with an increase in rates of dementia. However, one or two glasses a day lowered dementia rates compared with those of teetotalers.

That should cheer moderate drinkers and encourage the rest of us to drink less. Binge drinking, it turns out, might not be the smartest move.

Facebook/LinkedIn image: Hananeko_Studio/Shutterstock

https://www.psychologytoday.com/us/blog/mood-by-microbe/202302/what-binge-drinking-does-to-your-gut-and-your-brain

10. Stress Management

How to Deal with Constantly Feeling Overwhelmed

by Rebecca Zucker HBR

Summary. The cognitive impact of feeling perpetually overwhelmed can range from mental slowness, forgetfulness, confusion, difficulty concentrating or thinking logically, to a racing mind or an impaired ability to problem solve. When we have too many demands on our…more

Our work lives have become increasingly demanding, presenting us with ever more complex challenges at a near-relentless pace. Add in personal or family needs, and it’s easy to feel constantly overwhelmed. In their book, Immunity to Change, Harvard professors Robert Kegan and Lisa Lahey discuss how the increase in complexity associated with modern life has left many of us feeling “in over our heads.” When this is the case, the complexity of our world has surpassed our “complexity of mind” or our ability to handle that level of complexity and be effective. This has nothing to do with how smart we are, but with how we make sense of the world and how we operate in it.

Our typical response to ever-growing workloads is to work harder and put in longer hours, rather than to step back and examine what makes us do this and find a new way of operating. I have a few clients who fit this description. When we started working together, they each had already resorted to getting up at 4 AM to do work. Sue, who works for a tech company that recently went public, is leading many simultaneous projects and is fearful she’ll miss an important email. Ajay, a senior leader at a late-stage start-up, needs the extra quiet time to try to make a dent in his ever-growing to-do list, but feels like he’s trying to dig himself out of a hole that just keeps getting deeper. Maria, a start-up co-founder, felt constantly overwhelmed as her company started to scale. While CEOs of trillion dollar companies like Apple’s Tim Cook, wake up at 3:45 AM, most of us don’t have quite this level of responsibility.

The cognitive impact of feeling perpetually overwhelmed can range from mental slowness, forgetfulness, confusion, difficulty concentrating or thinking logically, to a racing mind or an impaired ability to problem solve. When we have too many demands on our thinking over an extended period of time, cognitive fatigue can also happen, making us more prone to distractions and our thinking less agile. Any of these effects, alone, can make us less effective and leave us feeling even more overwhelmed. If you are feeling constantly overwhelmed, here are some key strategies to try:

Pinpoint the primary source of overwhelm. Ask yourself the question, “What one or two things, if taken off my plate would alleviate 80% of the stress that I feel right now?” While you may still be responsible for these items and cannot actually take them off your plate, this question can still help you identify a significant source of your stress. If it’s a big project that’s almost done, finish it. Or, if it’s the sheer size of the task or project that is overwhelming you, break it down into more manageable components, ask for additional resources or renegotiate the deadline if you are able — or all of the above.

Set boundaries on your time and workload. This can include “time boxing” the hours you spend on a task or project, leaving the office by a certain time, or saying no to specific types of work. Ajay realized he was spending a significant amount of time mediating conflicts between various team members, which was not only an unproductive use of his time, but also reinforced their behavior of escalating issues to him instead of learning to resolve these problems themselves. Saying “no” to these escalations and setting expectations that they do their best to work out these issues before coming to him, created more breathing room for him to focus on his priorities with fewer distractions.

Challenge your perfectionism. Perfectionism can lead us to make tasks or projects bigger than they need to be, which can lead to procrastination and psychological distress. As things pile up, the sense of overwhelm grows, which can then lead to more procrastination and more overwhelm. Sheryl Sandberg famously said, “Done is better than perfect.” Know when “good” is “good enough” by asking yourself, “What is the marginal benefit of spending more time on this task or project?” If the answer is very little, stop where you are and be done with it. Part of this is also recognizing that we cannot do everything perfectly. Sue was finally able to accept that sometimes an email will be overlooked, and that if it’s important enough, the other person will follow up with her.

Outsource or delegate. Ask yourself, “What is the highest and best use of my time?” Activities that don’t fall within your answer can be taught and/or delegated to others. This can include managing selected projects, delegating attending certain meetings, having a team member conduct the initial interviews for an open position, or outsourcing the cleaning of your home and meal preparation. Maria had the revelation that she should delegate the weekly Sales meeting that she had always led to — of all people — the Head of Sales! She realized she had hired this person over a year ago but was still clinging to certain responsibilities that “she had always done,” and had never fully empowered him, for fear of giving up control. In the end, she admitted all she really needed was an email update. By letting go of this one task, she freed up 52 hours a year to focus on other high-priority strategic issues.

Challenge your assumptions. If feeling overwhelmed is an ongoing struggle, it is likely that you have assumptions that are keeping you stuck in unproductive behaviors. Kegan and Lahey refer to these as “Big Assumptions.” For Sue, it was the belief that “If something falls through the cracks, I’d fail and wouldn’t be able to recover from it.” In Ajay’s case, it was his belief that “If I’m not there to help others, I won’t be needed and people will question my value.” For Maria, her assumption was “If I lose control, others will mess up, and the company will fail.” While these big assumptions felt real to each leader, these limiting beliefs were not likely 100% true and kept them stuck in old patterns that significantly contributed to their sense of overwhelm. By identifying and debunking these beliefs over time, they were able to broaden their previously contracted view of the world, which in turn allowed them to reduce their overwhelm and provided them with a greater sense of agency.

While we may all feel overwhelmed from time to time in our demanding work and personal lives, employing the above strategies can help mitigate the frequency and extent to which we feel this way.

Read more on Stress management or related topics Personal productivity and Managing yourself

- Rebecca Zucker is an executive coach and a founding partner at Next Step Partners, a leadership development firm. Her clients have included Amazon, Clorox, Morrison Foerster, Norwest Venture Partners, The James Irvine Foundation, and high-growth technology companies like DocuSign and Dropbox. You can follow her on Twitter: @rszucker

https://hbr.org/2019/10/how-to-deal-with-constantly-feeling-overwhelmed?utm_campaign=hbr&utm_medium=social&utm_source=linkedin