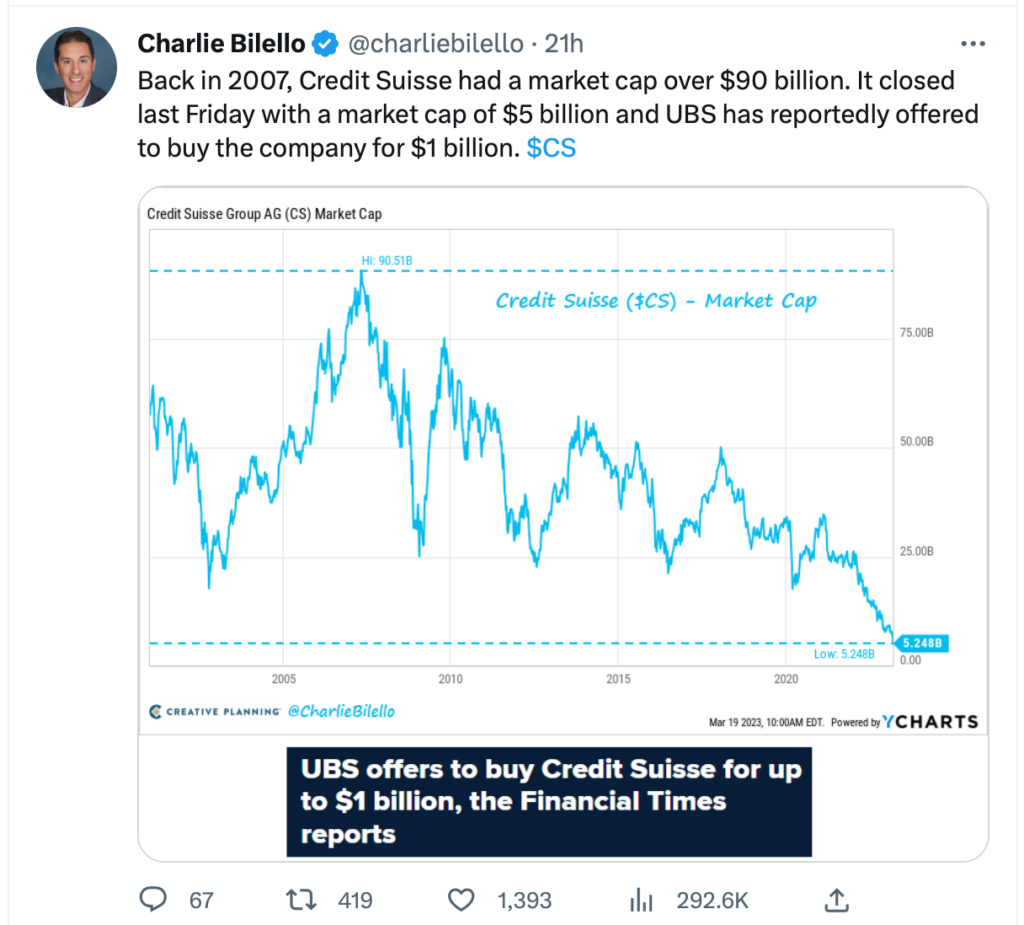

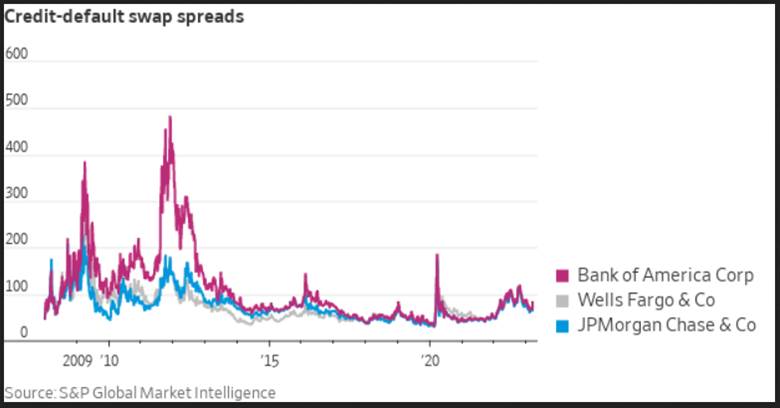

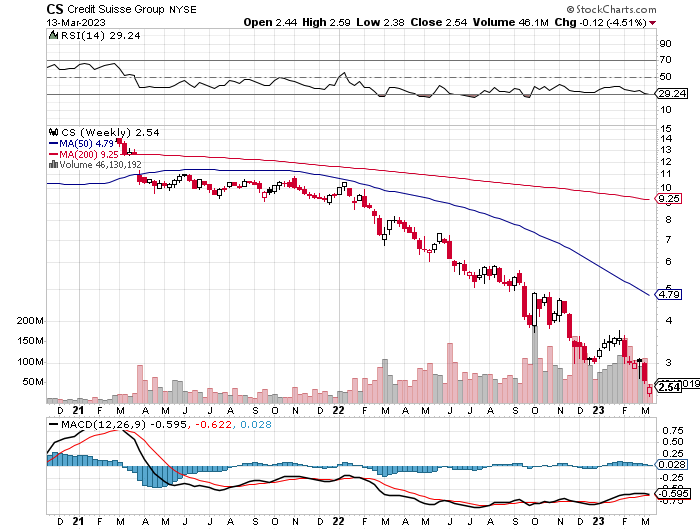

1. After Credit Suisse Bailout….UBS CDS Straight Up.

The Market does not like the UBS take under of Credit Suisse.

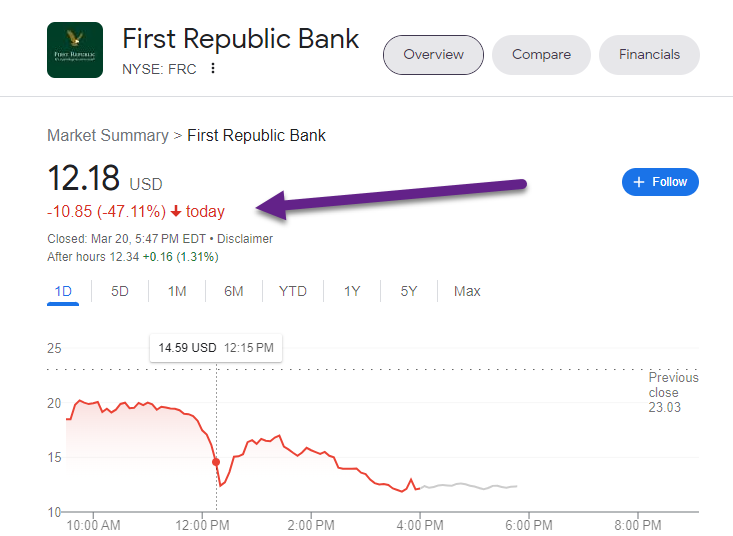

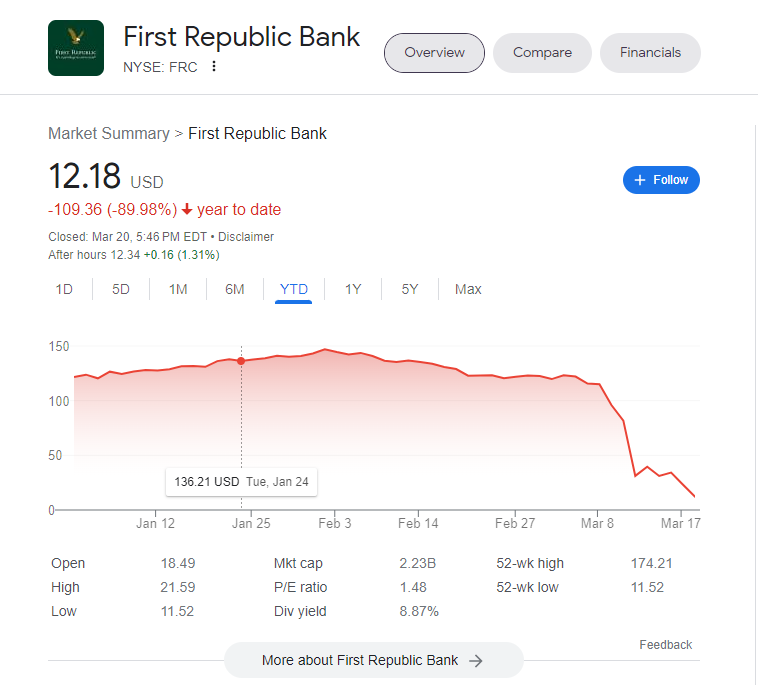

2. First Republic Bank -47% in One Day After Bailout.

90% Year to Date

https://www.google.com/search?q=frc+chart&rlz=1C1CHBF_enUS898US898&oq=frc+chart&aqs=chrome..69i57j69i59l2.1544j0j7&sourceid=chrome&ie=UTF-8

3. S&P Financials Performance vs. Broad Market Equals Covid Dive

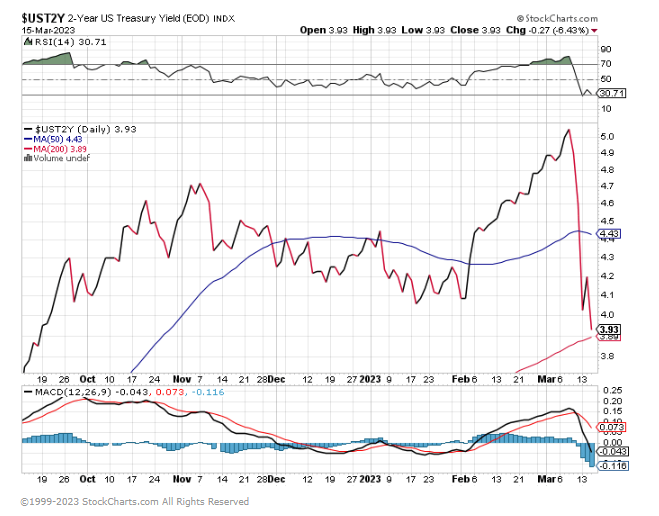

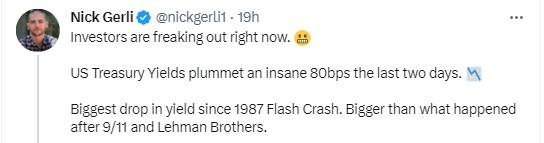

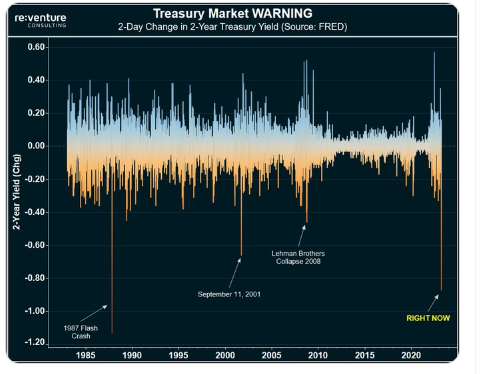

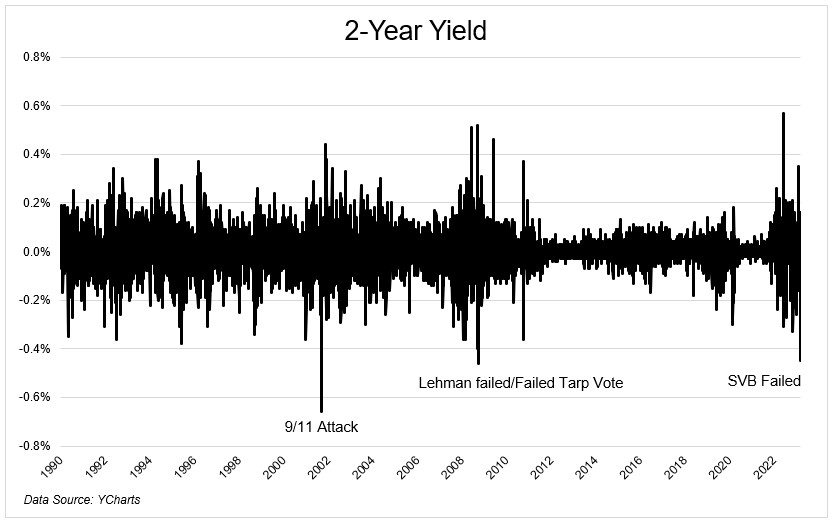

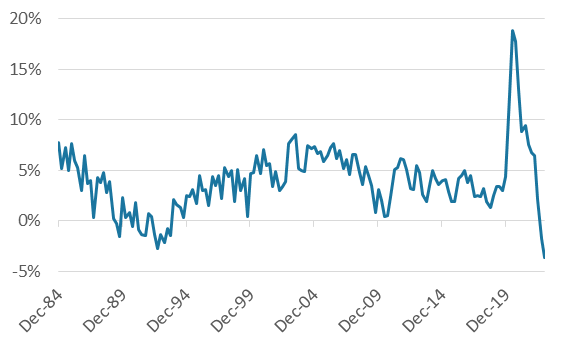

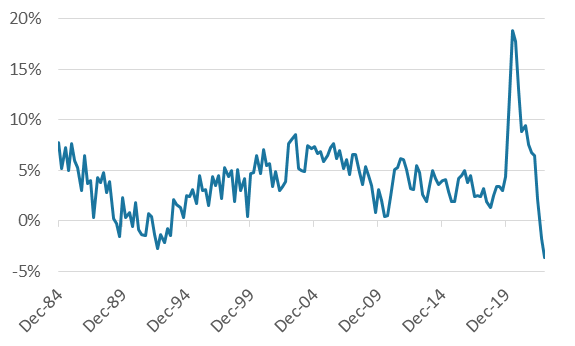

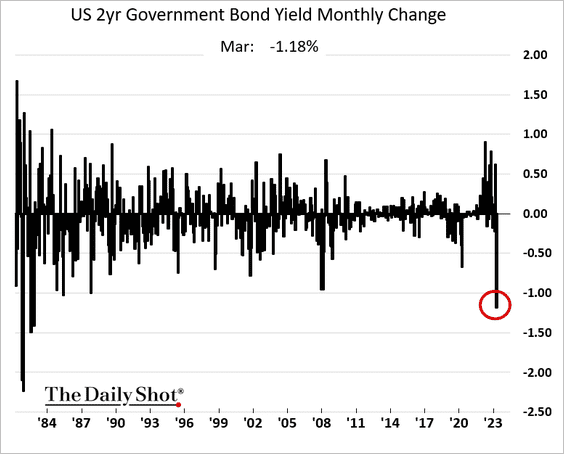

4. The Biggest Monthly Decline of 2-Year Yields Since 1980’s

The United States: The month-to-date decline has been the biggest since the early 1980s.

Source: The Daily Shot https://dailyshotbrief.com/

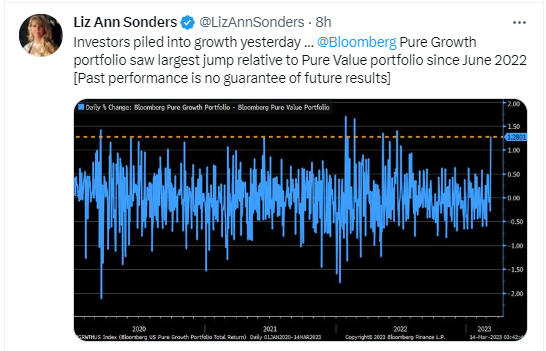

5. Tech has Reversed All of 2022 Underperformance in Less than 3 Months

The tech sector has reversed nearly all of its 2022 underperformance in less than 3 months…

6. The Biggest Monthly Decline of 2-Year Yields Since 1980’s

The United States: The month-to-date decline has been the biggest since the early 1980s.

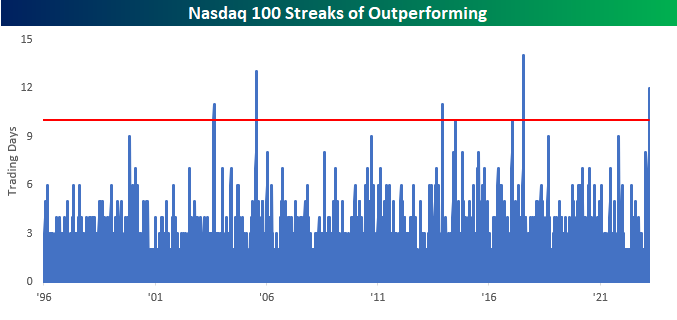

7. Tech has Reversed All of 2022 Underperformance in Less than 3 Months

Dave Lutz at Jones Trading The tech sector has reversed nearly all of its 2022 underperformance in less than 3 months…

8. Amazon Another Large Layoff…Doubled Its Physical Footprint in 2020-2022

CNBC For the past year, Jassy has been trimming expenses across the company. Many unproven bets, like Amazon’s Scout delivery robot, a virtual tours service, Care telehealth program, and a video-calling device for kids were axed. He made the decision to shutter all of its 4-star, Pop Up and Books stores and, earlier this year, announced Amazon would close some Fresh supermarkets and Go cashierless convenience marts. Drone delivery, one of Bezos’ pet projects, is struggling mightily to get off the ground as it, too, faces cost cuts

Annie Palmer@ANNIERPALMER https://www.cnbc.com

Amazon trying to form a base in chart this year…watch to see if it holds lows

9. The Market Voted Negative on UBS/CS Merger Yesterday….Will Swiss Franc Still be Safe Haven? Another Chart to Watch.

Swiss economy dependent on the financial sector

10. How to Start Your Day Relaxed

Try these tips to help kick off your day in a calm, relaxed state of mind.

There are a group of people in the world who are very lucky. These are the ones who never seem to worry about anything. Stress washes over them, and they are able to just take whatever the world throws at them and deal with it, all the time keeping their blood pressure in check.

For most of us, it’s a lot more work than that to keep calm and be relaxed even in our normal, day-to-day lives. With this in mind, we need to make an effort to try and adjust our habits to include some stress-relieving tricks and help us find a little calmer in our day.

Start The Day Off Right

Experts agree that allowing the body to wake naturally is far better for you, and less stressful, than having a jarring alarm interrupt your beauty sleep. Of course, that’s the ideal, but when there is a job to get to, and a family to get fed and out of the door, it’s just not practical.

As a compromise, try and see if you can have at least one day a week when you can turn off the alarm and let the daylight gradually wake you. Just one day a week will give your body a break from the routine.

Take A Deep Breath

Various studies have been done on how important it is to breathe ‘right’, so once you’re up, open a window and take a good few, deep breaths.

Don’t worry if it’s raining or snowing, or if the sun’s beaming down. The weather doesn’t matter. It’s getting that air into your lungs that’s the important thing.

Obviously, if you live next to an overpass or similar, feel free to give this step a miss.

“Sometimes the most important thing in a whole day is the rest we take between two deep breaths”. – Etty Hillesum

Wash That Stress Right Out of Your Hair

Most of us enjoy a nice long soak in the bath, but it’s best to save that for the evening. In the morning, take a shower instead to help get the blood pumping.

Don’t listen to the doom and gloom of the early morning news while you are in there, either. Belt out a couple of upbeat songs.

Don’t worry about whether you’re in tune, or getting the words right, just let it go and release the energy.

Color Me Happy

Although there are those who proclaim that what we wear is not important and that clothes do not define us, there is another side to the story. Of course, they don’t define us, but they can be important in helping us feel good and calm and more able to face the day.

Plenty of us have an outfit that we love and that makes us feel confident and good when we wear it, but there’s more to clothes than that.

Color can play an important part too. White has associations with innocence and peace, whilst blue and green are both linked to tranquility, calmness, and balance.

Alternatively, if you want to inject a bit of optimism into your day, go for a splash of yellow.

Need to feel strong and powerful? Put on something red.

Don’t worry, you don’t have to dress in that color head to foot, just a tie, or a piece of jewelry in your happy color will all be of benefit.

Eat Right, Feel Right

Next, it’s that ‘most important meal of the day’, breakfast. There are plenty of people who skip breakfast, replacing it instead with a coffee grabbed on the way to work, but there’s a definite benefit, both physically and mentally, by making sure you get a decent start to the day, food-wise.

If you think about it, you’ve been effectively fasting all night, so it’s time to refuel your body for the day ahead. Going out on an empty stomach before taking in a big hit of caffeine isn’t going to do anything to build up that calm, relaxed state of mind you’re aiming for.

Porridge is a great start to the day as the oats not only release their energy gradually, but they’re also rich in B vitamins, which are useful in the fight against stress.

These vitamins are found in many whole grain foods, so if you don’t fancy a bowl of steaming porridge in the summer, try a bowl of muesli topped off with a fresh banana, and you’ll be setting your body up for a calm and relaxed morning.

Think Positive

Now you’re ready to head out of the door, there’s just one more thing; the power of positive thinking. Say to yourself, ‘I am calm and relaxed’. Repeat this several times. Although some studies indicate that saying this out loud is the most effective, in real life, it might not always be possible, so just take a few moments to yourself and repeat it in your head.

There’s plenty for us to stress about these days, both at home and in the world in general, but the more we can do, however small, to try to calm and prepare ourselves against these factors, the better we will feel. And the better we feel, the better those around us feel, which can only be good news.

https://addicted2success.com/life/how-to-start-your-day-relaxed/