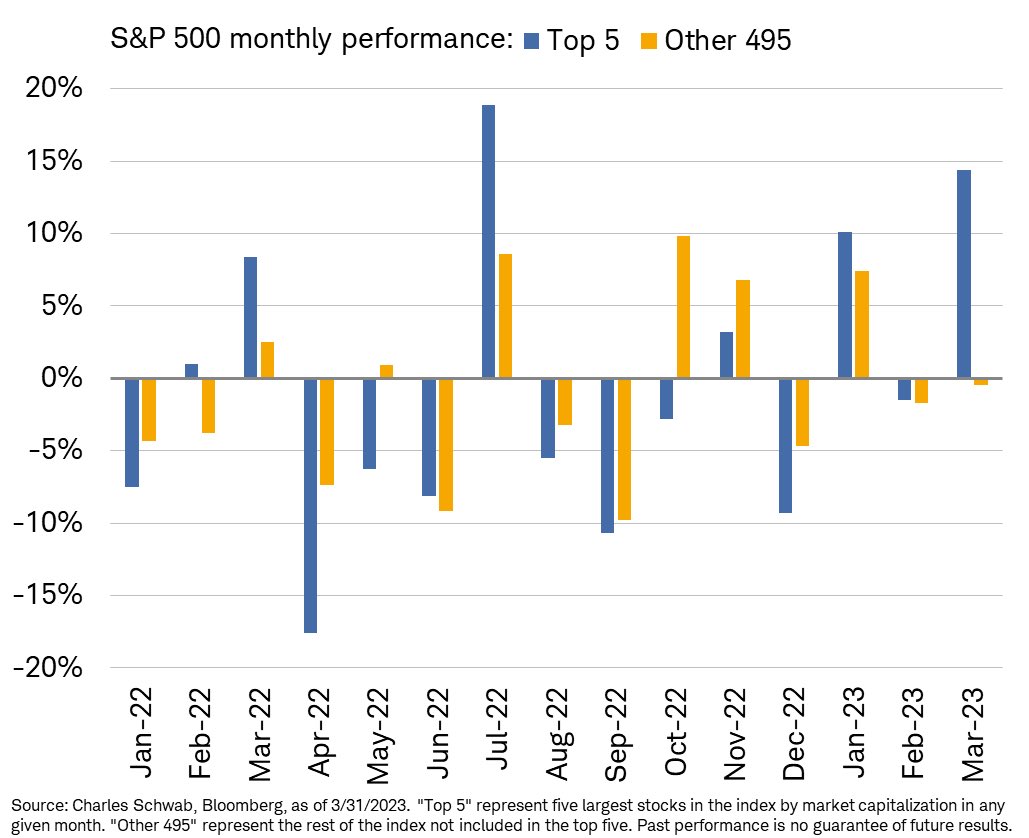

1. Feb and March 2023….Top 5 S&P Stocks vs. Other 495

Liz Ann Sonder Schwab

https://twitter.com/LizAnnSonders

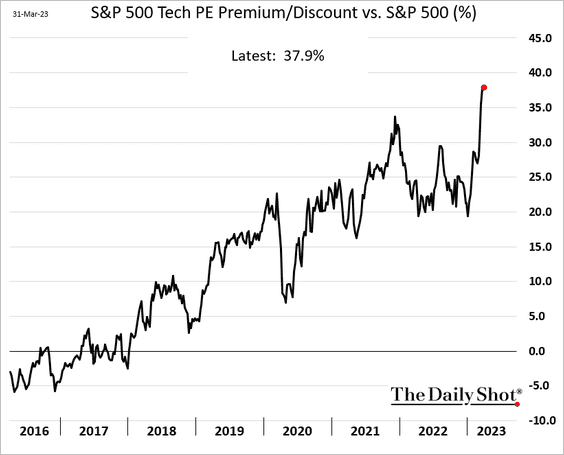

2. Tech Shares Trading at Large Premium to the Rest of S&P

Equities: Tech shares are trading at a substantial premium to the S&P 500.

Source: The Daily Shot

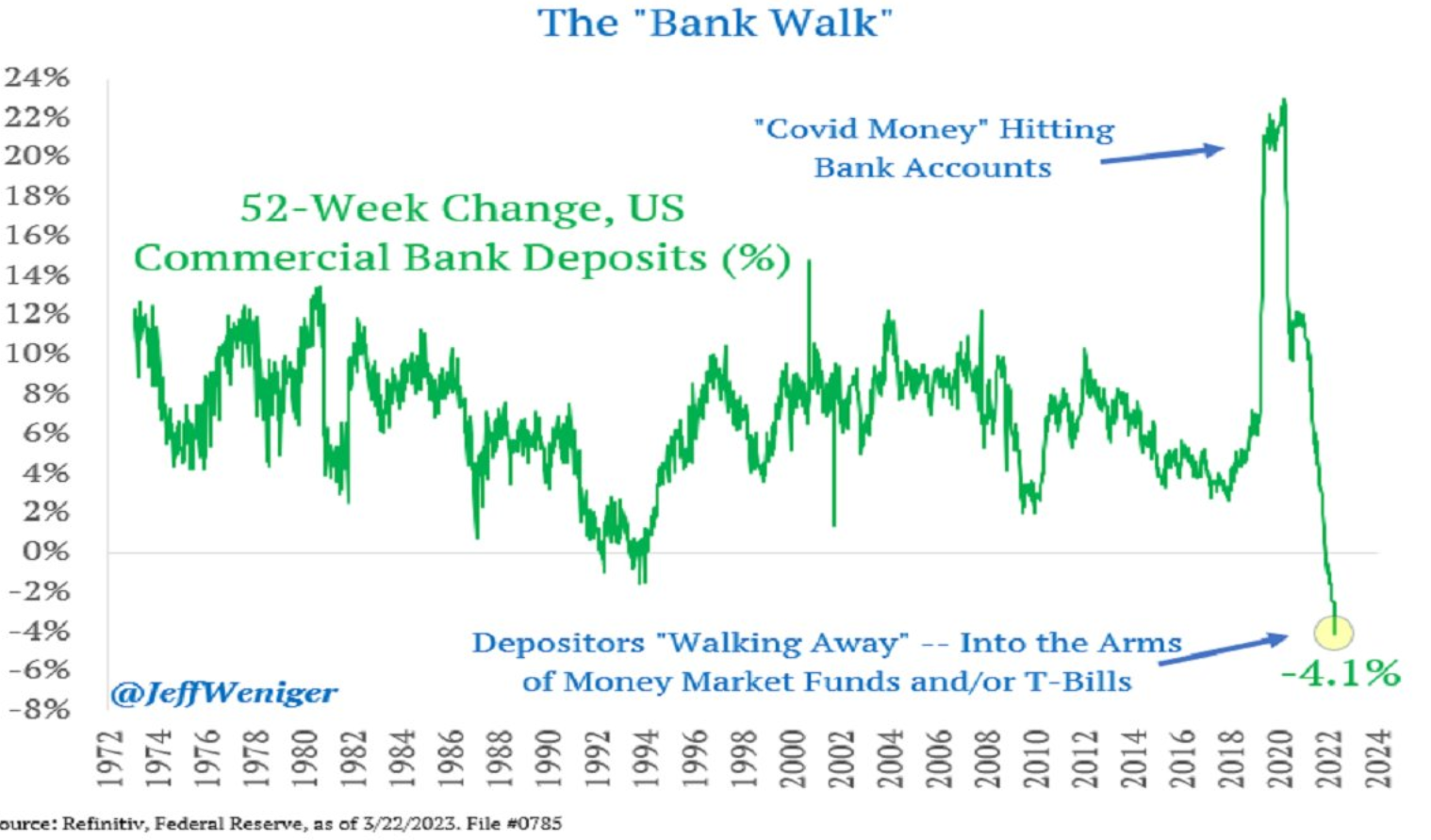

3. Covid Bank Accounts Whipsaw

@JeffWeniger Wisdom Tree

https://twitter.com/JeffWeniger

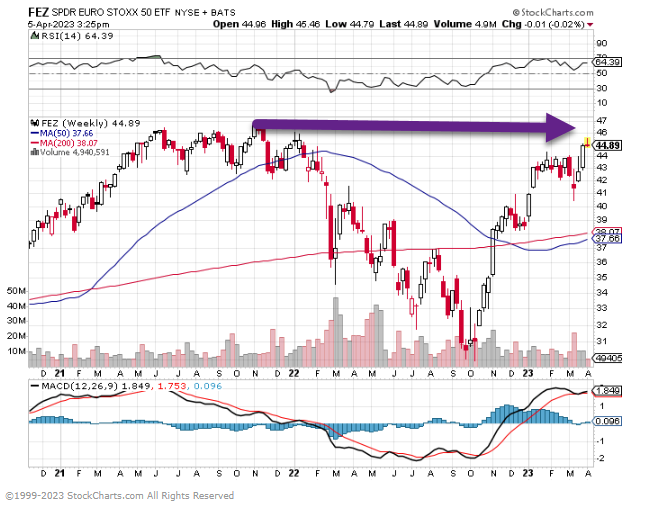

4. Europe’s Mega Cap Index FEZ—About to Break to New Highs.

5. Gold and Silver—Gold Breaks Out to 3-Year Highs

Silver No Break Out Yet…approaching 2022 highs

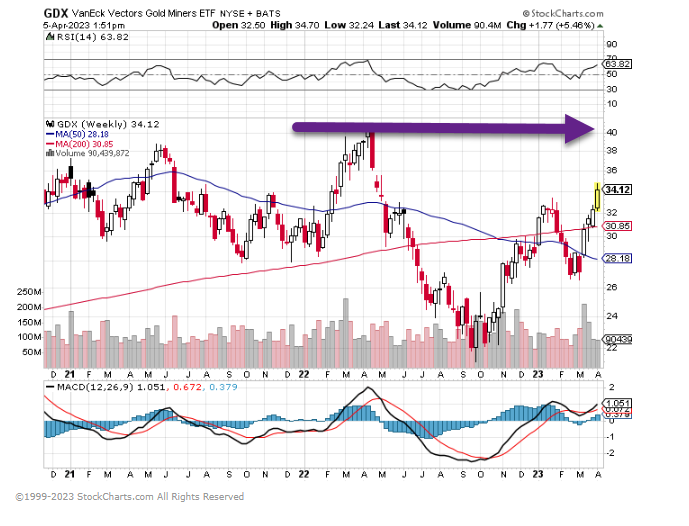

6. Gold and Silver Miners.

GDX Gold Miners-no highs yet

Silver Miners well off 2021 highs

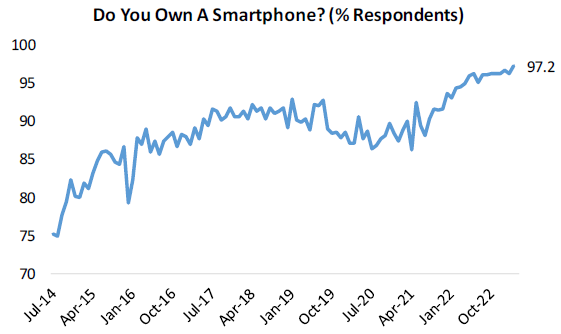

7. Bespoke Investment Group–Smartphones Closing in on TAM; Longer Replacement Cycles

For nearly ten years now we’ve been running our Pulse survey of 1,500 US consumers balanced to census that asks them dozens of questions related to personal finance and economic sentiment. With nearly ten years of data, these survey results are invaluable and give us as good of a read on consumer trends as we can find. (If you would like to learn more about our monthly Bespoke Consumer Pulse survey and the report we produce that accompanies it, you can do so here.)

Along with broader questions about things like employment, credit card payments, new home purchases, and risk tolerance, we also dive into consumer interest across things like smartphones, streaming services, social media use, and e-commerce. In regards to smartphones, every month we ask survey takers a simple question: “Do you own a smartphone?” Below is a chart showing the percentage of respondents that answered “yes” to that question on a monthly basis dating back to July 2014.

In the mid-2010s when we began asking the question, our survey results showed that smartphone penetration in the US was still between 75-85%. By 2020, that number had moved up to ~90%, and since then it has steadily ticked higher to its current level of 97.2%, which hit a new all-time high this month. At 97.2%, there’s basically no runway left when it comes to the total addressable market (TAM) of smartphones in the US. Everyone has one at this point!

The two main competitors in the smartphone space are iPhones and Androids. In our monthly Pulse survey, we closely track trends in this space for investors and companies that are interested in this data.

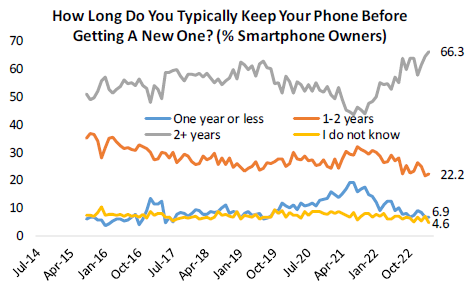

Along with there now being basically no room to expand smartphone ownership in the US, another problem for smartphone makers is that consumers are replacing them less often. Below are the results from a question we ask survey-takers on how long they typically keep their smartphone before getting a new one. Most respondents to this question typically keep their smartphones for 2+ years before replacing them, but this number actually started to trend lower from 2019 through mid-2021. During that time, respondents reporting that they replace their smartphones every year or less ticked higher. This trend shifted again in 2021, however, and since then we’ve seen a larger and larger share of respondents say that they typically keep their smartphone for 2+ years. Longer replacement cycles mean fewer sales, which is why it’s important for a company like Apple (AAPL) to introduce meaningful new iPhone features that will get consumers to replace their existing iPhones sooner. (Also, remember that longer-lasting batteries and more durable hardware are great for customers, but they also increase the replacement cycle.)

If you would like to check out our full Bespoke Consumer Pulse report, here’s a link that tells you how to do that.

8. Walmart Ecommerce vs. Amazon.

Aisle meet you online

Walmart has revamped its website and app to look less like a standard online storefront, and a little more like a social media feed, with video content and big glossy images of products.

The retail giant’s e-commerce chief explained the importance of the digital refresh, saying “everyone knows that 90% of the U.S. population lives within 15 miles of a Walmart store, but the closest store to our customers is the one in their pockets”. That store is getting bigger, busier and more lucrative for Walmart every single quarter.

Walmart vs. AmazonWalmart, like almost every other company that sells anything on the internet, got a huge boost from the pandemic when consumers were forced to change their shopping habits. Domestic e-commerce sales soared 43% in 2020 alone and, while they generally cooled off a little last year, Walmart’s are still going strong. That may even be a bit of an understatement — Walmart’s online business accounted for 13% of its total sales last year, and its growth mirrors the pattern from the kings of e-commerce themselves, Amazon. Indeed, Walmart’s US online sales are tracking on a comparable trajectory to Amazon’s, growing from ~$3bn of sales per quarter to ~$17bn of sales per quarter in a similar amount of time — Amazon’s growth period just happened to start 12 years earlier.

Walmart’s growth is obviously less novel, buying online is much more common than it used to be, but it’s impressive nonetheless considering it’s not the company’s core focus. If the slick new social-media-inspired interfaces work, the comparison with Amazon could last a little longer.

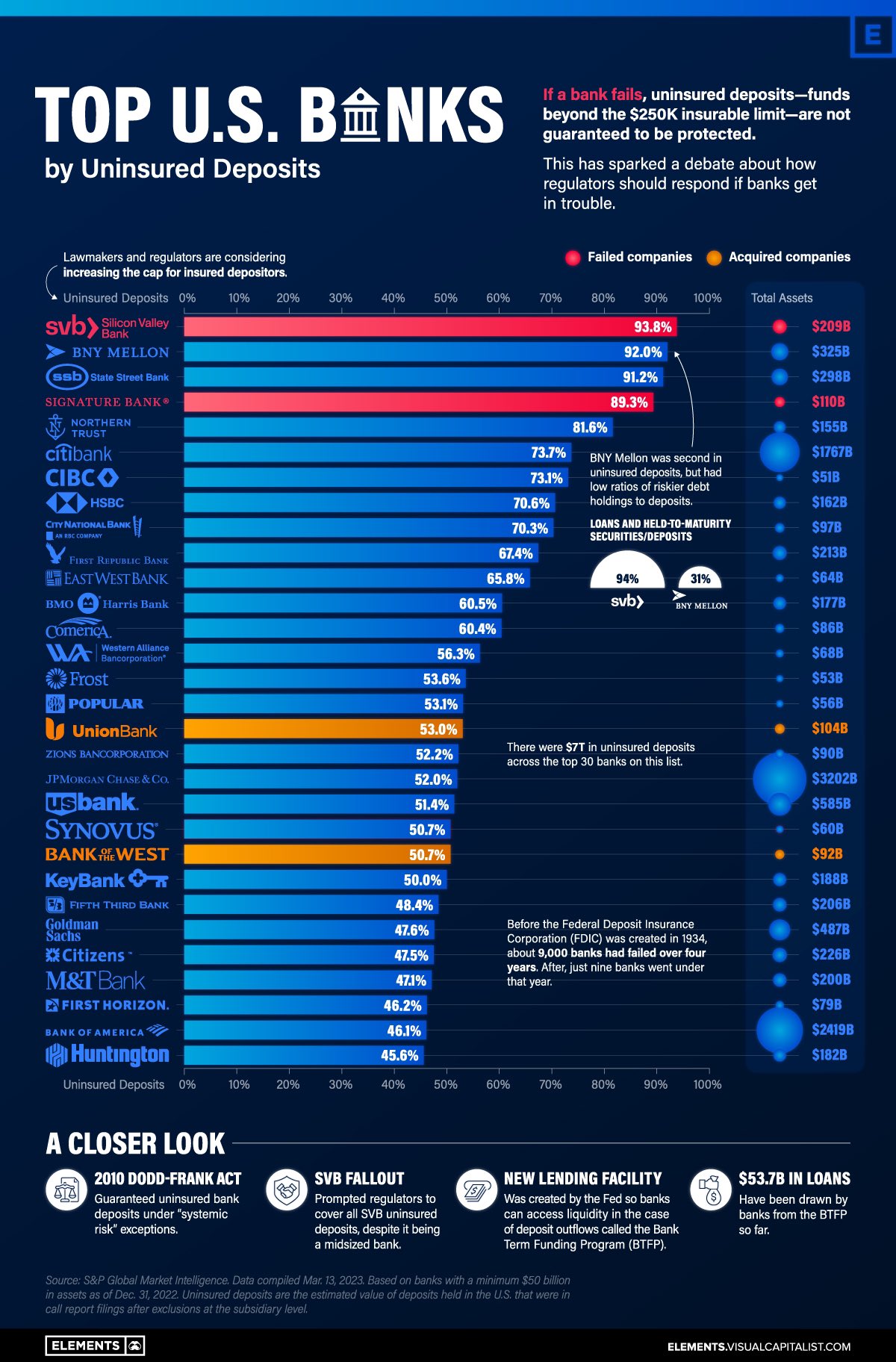

9. Top U.S. Banks by Uninsured Deposits.

https://www.visualcapitalist.com

10. Five Ways to Live with Integrity

|

https://www.psychologytoday.