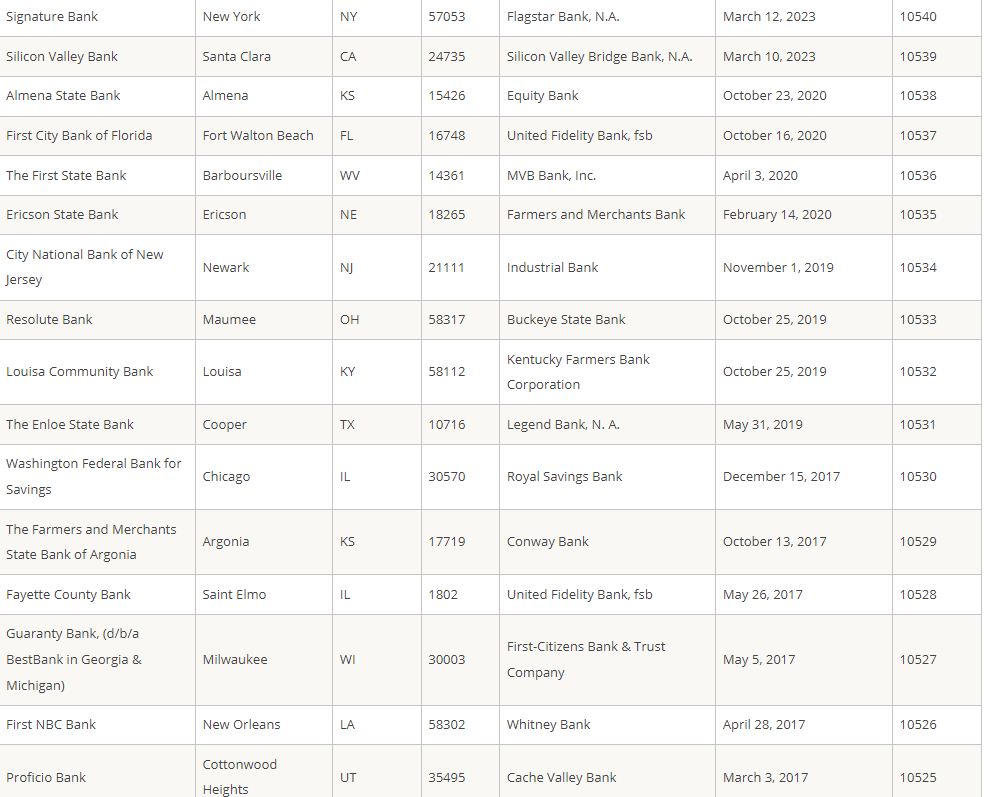

1. FDIC Failed Bank List-75 Banks Failed in Last 10 Years…All Depositors Back Stopped.

FDIC Website List https://www.fdic.gov/

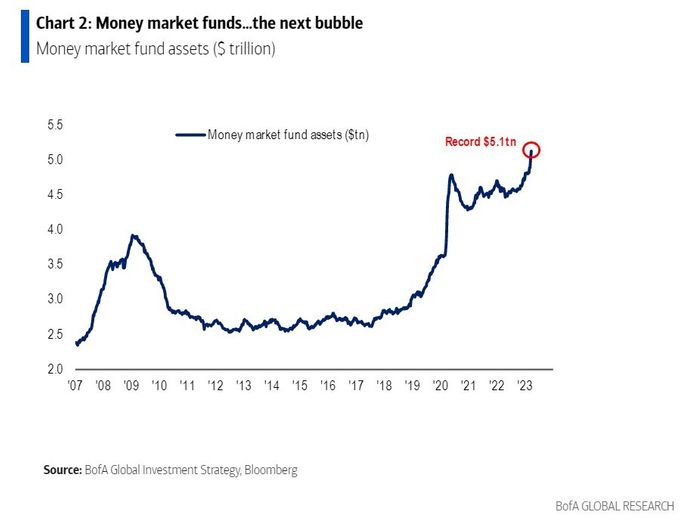

2. Money Markets are the New Hot Asset

Steve Goldstein Marketwatch

Another bubble has emerged, courtesy of the bank-sector crisis which has already felled three U.S. regional banks.

Bank of America analysts led by the Michael Hartnett say money-market funds are the new hot asset.

They point out that assets under management for money funds has now exceeded $5.1 trillion, up over $300 billion over the past four weeks. They also counted the biggest weekly flows to cash since March 2020, the biggest six-week inflow to Treasurys ever, and the largest weekly outflow from investment-grade bonds since Oct. 2022.

The last two times money-market fund assets surged — in 2008 and in 2020 — the Federal Reserve slashed interest rates. Hartnett is fond of the saying, “markets stop panicking when central banks start panicking,” and he noted a surge in emergency Fed discount window borrowing has historically occurred around a big stock-market low.

There is one difference this time, in that inflation is a reality and that labor markets, not just in the U.S. but in other industrialized nations, remains exceptionally strong. The Bank of America team counted 46 interest rate hikes this year, including by the Swiss National Bank after its rescue of Credit Suisse last week.

History, according to the BofA team, says to sell the last interest rate hike. “Credit and stock markets are too greedy for rate cuts, not fearful enough of recession,” they say. After all, when banks borrow from the Fed in an emergency, they tighten lending standards, which in turn results in less lending, and that leads to less small-business optimism, which eventually cracks the labor market.

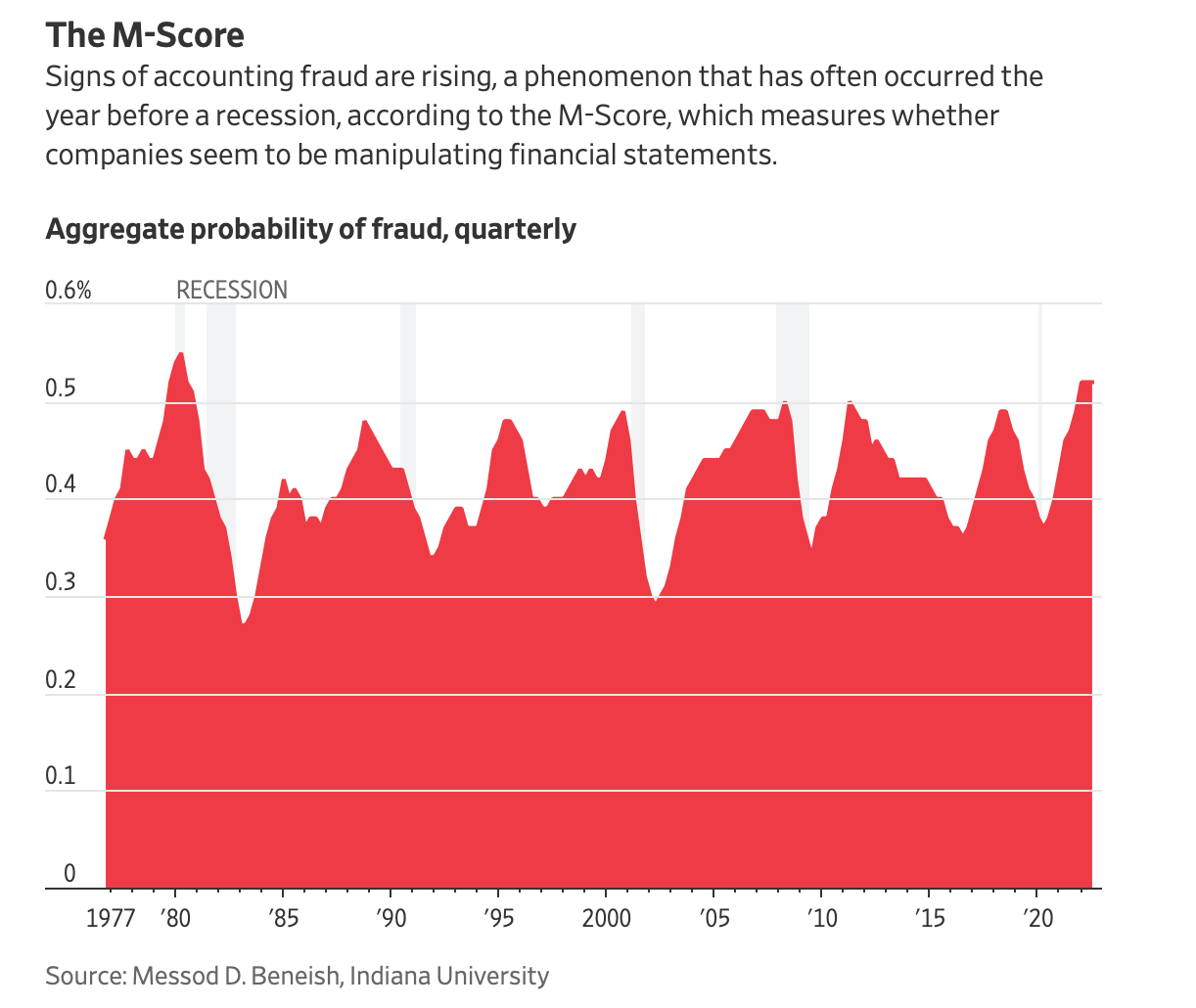

3. Signs of Accounting Fraud on the Rise

WSJ Josh Zumbrun Manipulation of earnings from Corporate America is on the rise, an ominous omen for the U.S. economy. That is the conclusion of new research on accounting fraud, using a technique that flagged Enron as an earnings manipulator several years before the energy company’s spectacular 2001 implosion.

“We think this is a measure of misinformation in the economy,” said Dr. Beneish. The new aggregate measure was published in a December paper, and the latest data—compiled in March and shared with The Wall Street Journal—shows that the collective probability of fraud across major companies is the highest in over 40 years.

https://www.wsj.com/articles/accounting-fraud-indicator-signals-coming-economic-trouble-506568a0

4. Biotech ETF -22% in 6 Weeks.

5. Apple Chart…50day thru 200day to Upside.

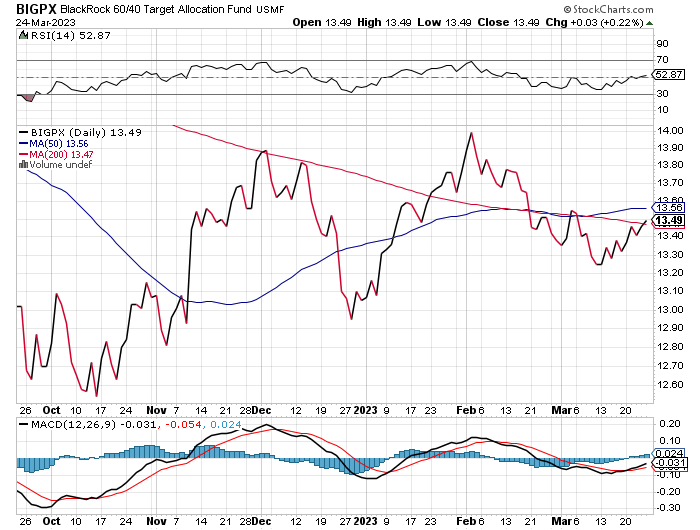

6. 60/40 Portfolio Closes Above 200 Day Moving Average….

50day thru 200day to upside if February

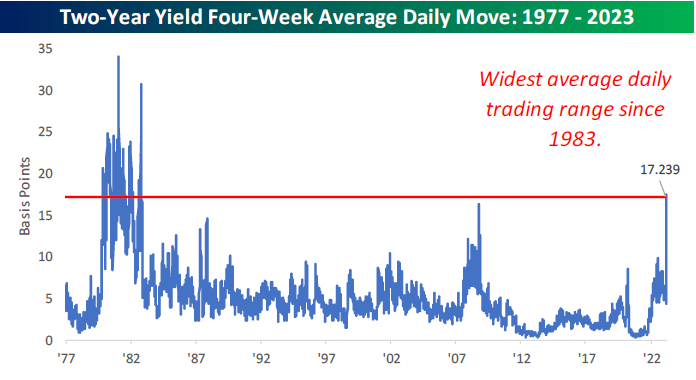

7. Two-Year Treasury More Volatile than 2008 Great Financial Crisis

Bespoke Investment Group Below is one chart from this week’s Bespoke Report that you may find interesting. The most concerning aspect of the treasury market has been intraday volatility. Traditionally, the two-year Treasury has been one of the least volatile areas of financial markets, but over the last month, the average daily move in the two-year yield has been over 17 basis points (bps), exceeding the peak volatility of the financial crisis to the most volatile trading since 1983. These are not the types of moves you would expect to see in a well-functioning market and provide another example of something that’s ‘broken’ in the aftermath of the Fed’s most aggressive tightening cycle in forty years.

https://www.bespokepremium.com/interactive/posts/think-big-blog/the-bespoke-report-3-24-23-shaking-it-off

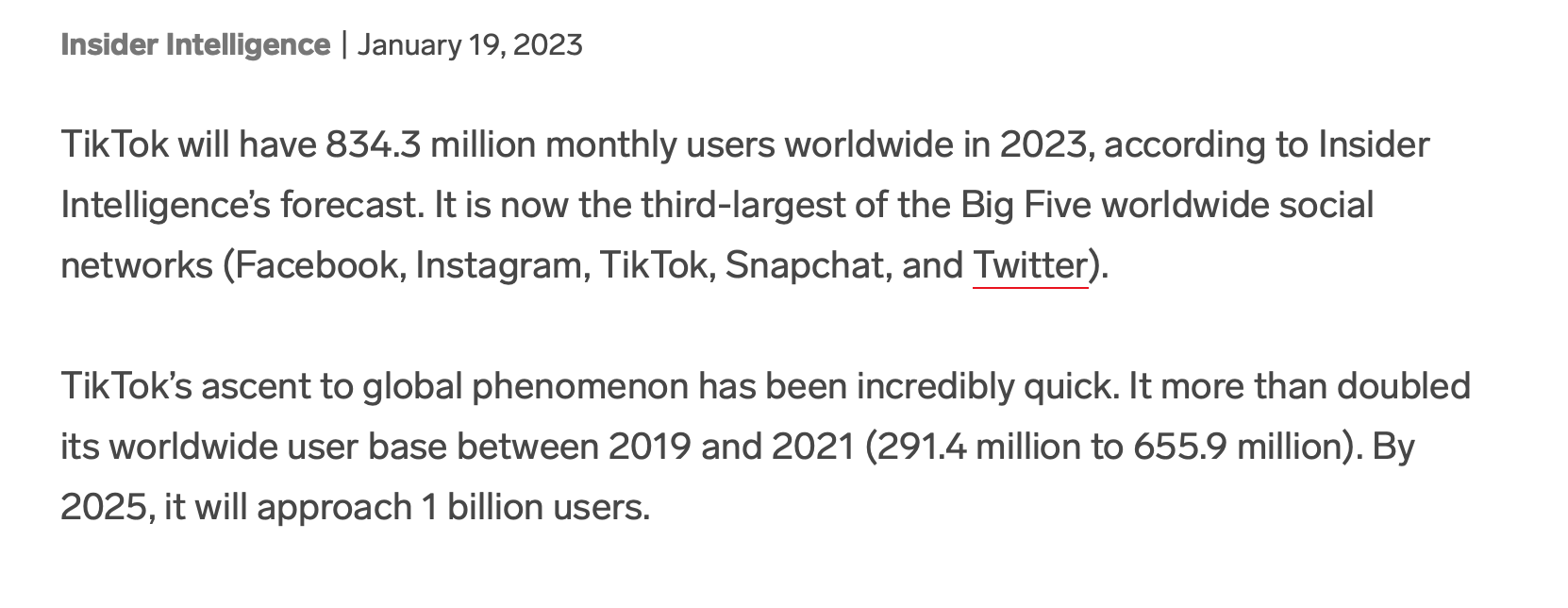

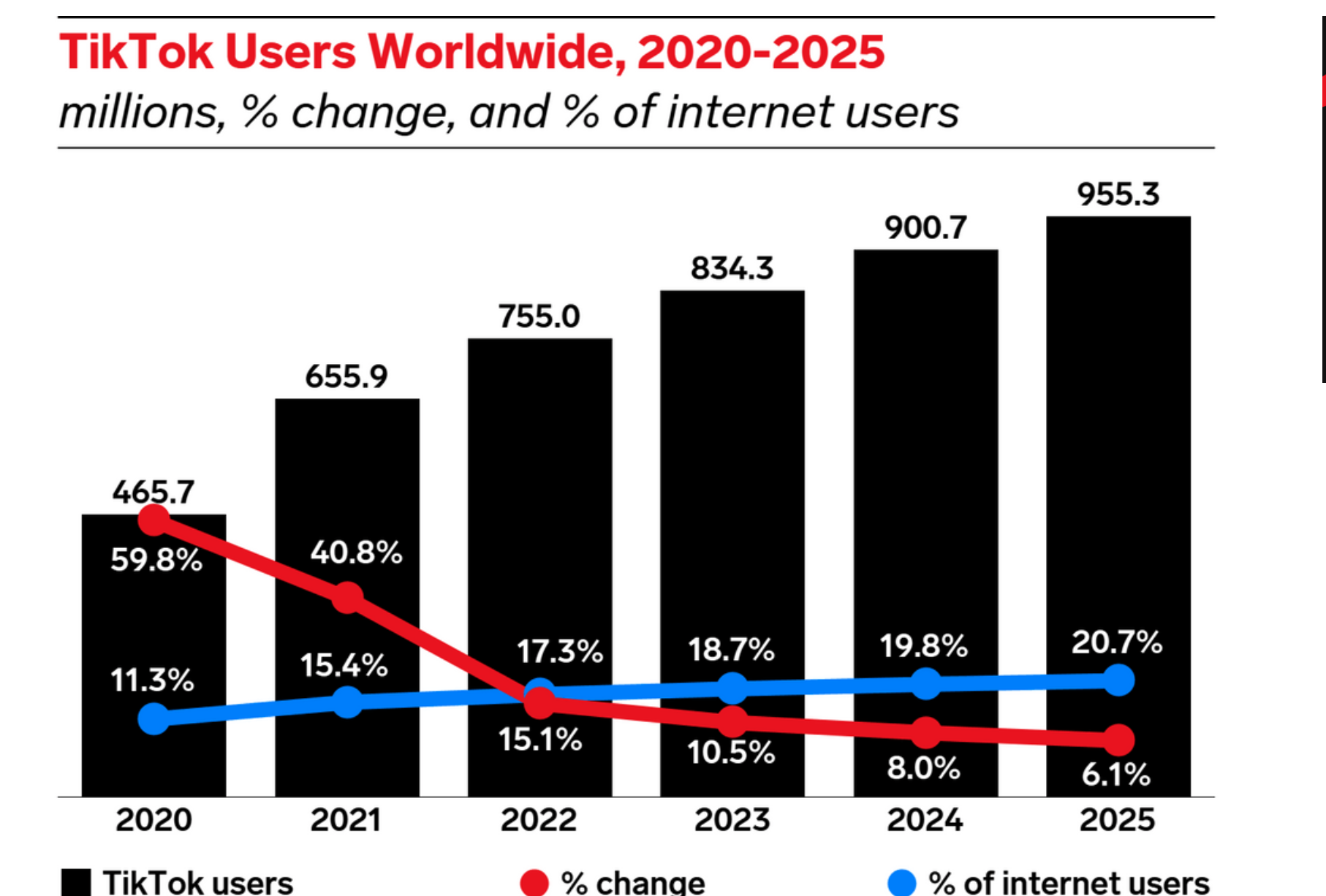

8. Tik Tok 834M Users Worldwide

https://www.insiderintelligence.com/charts/global-tiktok-user-stats/

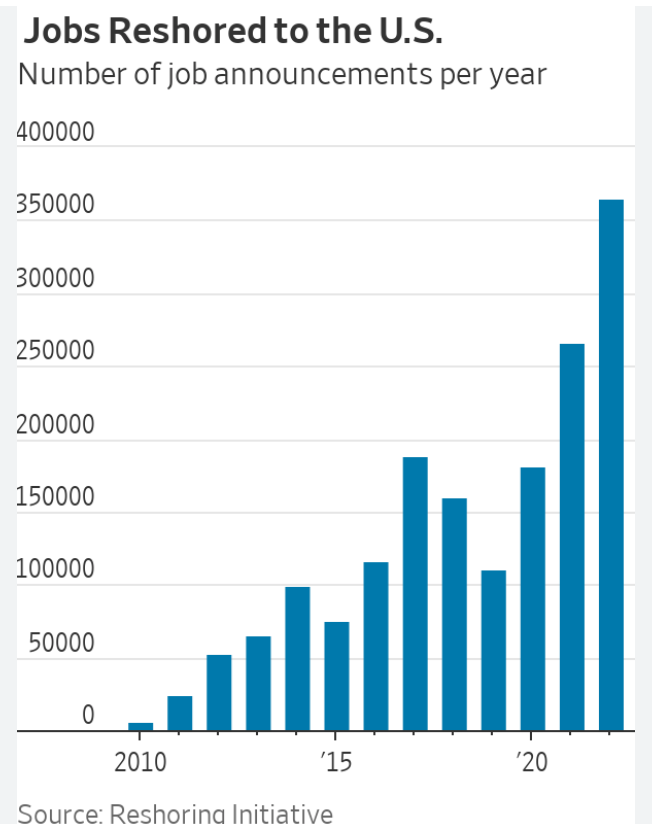

9. 360,000 Jobs Reshored to the U.S. Last Year

WSJ

10. Farnam Street What it Means to Do Your Best….

What it means to do your best:

Doing your best is about the position you find yourself in when you show up. Over the long term, the average person who constantly puts themselves in a good position beats the genius who finds themselves in a poor position. What looks like talent is often good positioning. And the best way to put yourself in a good position is with good preparation.

— Source

Insight

“When you first start to study a field, it seems like you have to memorize a zillion things. You don’t. What you need is to identify the core principles – generally three to twelve of them – that govern the field. The million things you thought you had to memorize are simply various combinations of the core principles.”

— John T. Reed in Succeeding

Tiny Thought

Do my expectations match the level of effort I’m giving?

Etc.

Exact portions

“Every Sunday morning, Jeff (Bezos) makes pancakes. He wakes up early. He gets the Betty Crocker cookbook out every time, and I’m like, “OK, you’re the smartest man in the world; why don’t you have this memorized yet?” But he opens it up every time: Exact portions make the best pancakes in the world.”

— Source