1. Apple is Worth More than the Entire U.S. Small Cap Stock Index.

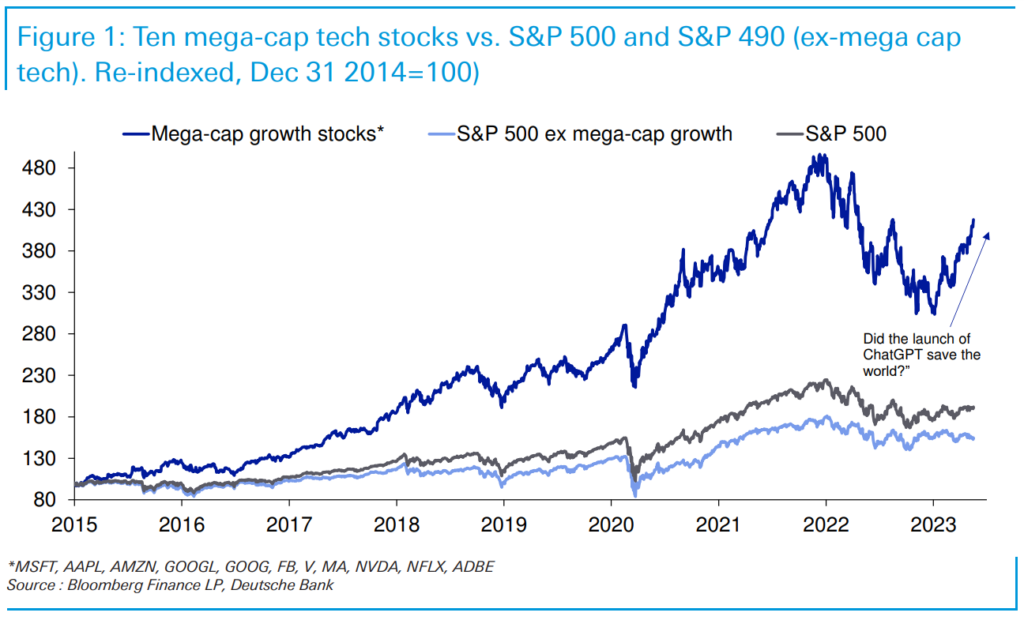

Barrons–But at some point in the past couple of weeks, depending on data providers, Apple’s market capitalization, at $2.76 trillion, topped the combined market cap of the entire Russell 2000RUT –0.62% index of small-cap stocks. And it gets worse. Today’s five biggest stocks—Apple, Microsoft (MSFT), Alphabet(GOOGL), Amazon.com (AMZN), and Nvidia (NVDA)—have a combined market cap of about $8.7 trillion, almost 25% of the S&P 500 cap and about 3.2 times the $2.7 trillion Russell cap. That, says Michael Arone, chief investment strategist at State Street’s U.S. SPDR exchange-traded fund business, is now larger than the five biggest stocks were relative to the Russell 2000 at the peak of the dot-com boom in 1999 and 2000.

Chart AAPL vs. IWM (small cap Russell 2000)

Al Root at allen.root@dowjones.com

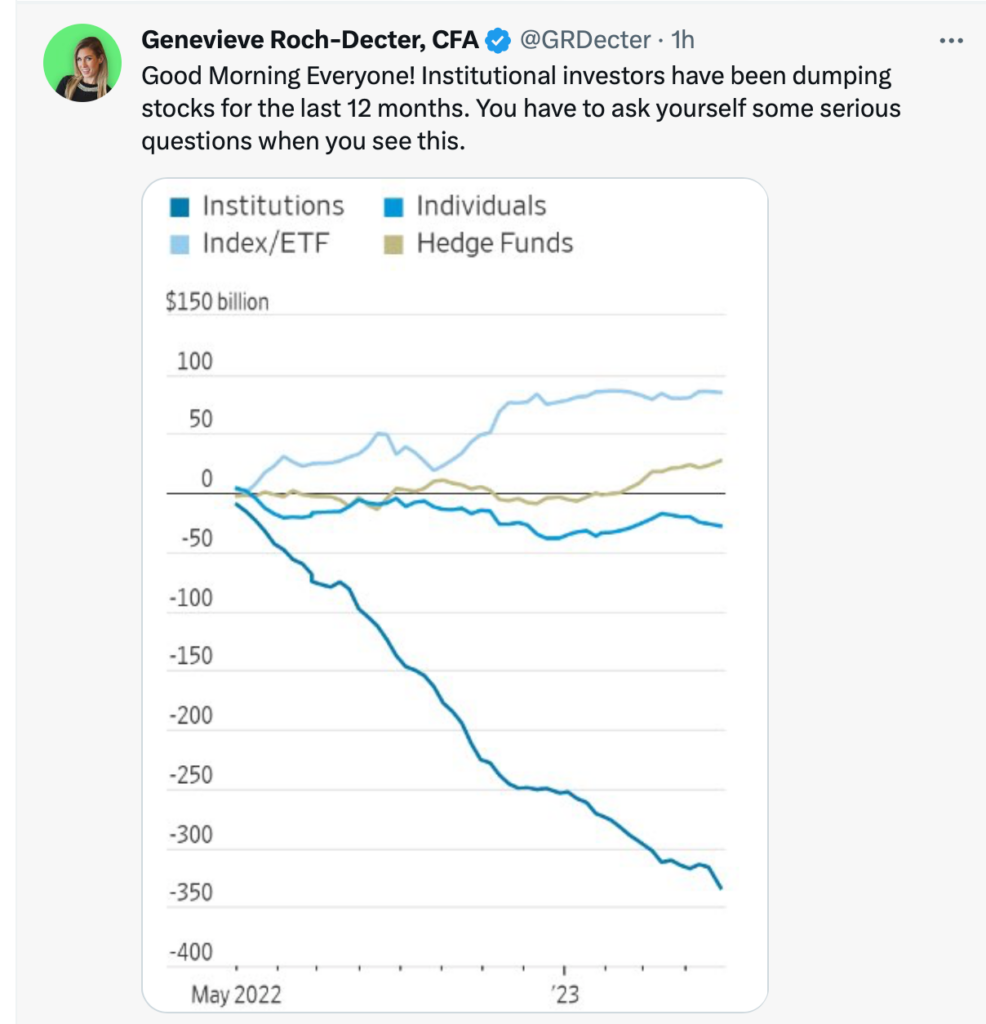

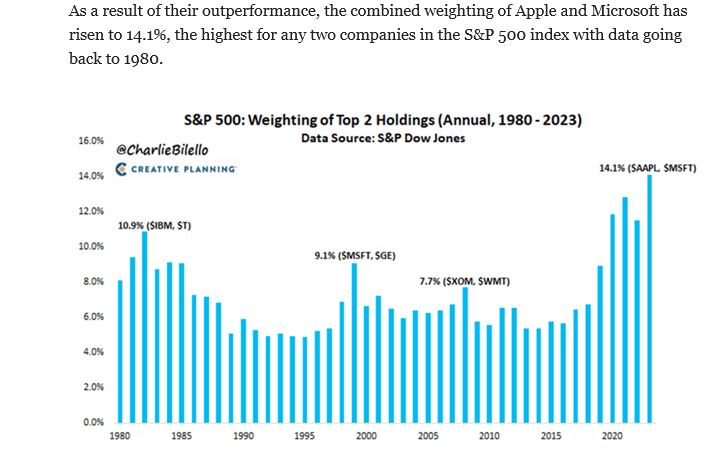

2. Apple and MSFT 14.1% of S&P….NVDA Trading at 29X Sales.

Here are the 10 highest Price to Sales Ratios in Nasdaq 100 today…

1. NVIDIA $NVDA: 29x

2. Lucid $LCID: 18x

3. Intuitive Surgical $ISRG: 18x

4. Seagen $SGEN: 17x

5. DexCom $DXCM: 16x

6. Datadog $DDOG: 16x

7. Cadence $CDNS: 16x

8. CrowdStrike $CRWD: 15x

9. Verisk $VRSK: 15x

10. CoStar $CSGP: 14x

3. NVDA Earnings this Week….Right at Pre-Tech Sell Off Highs

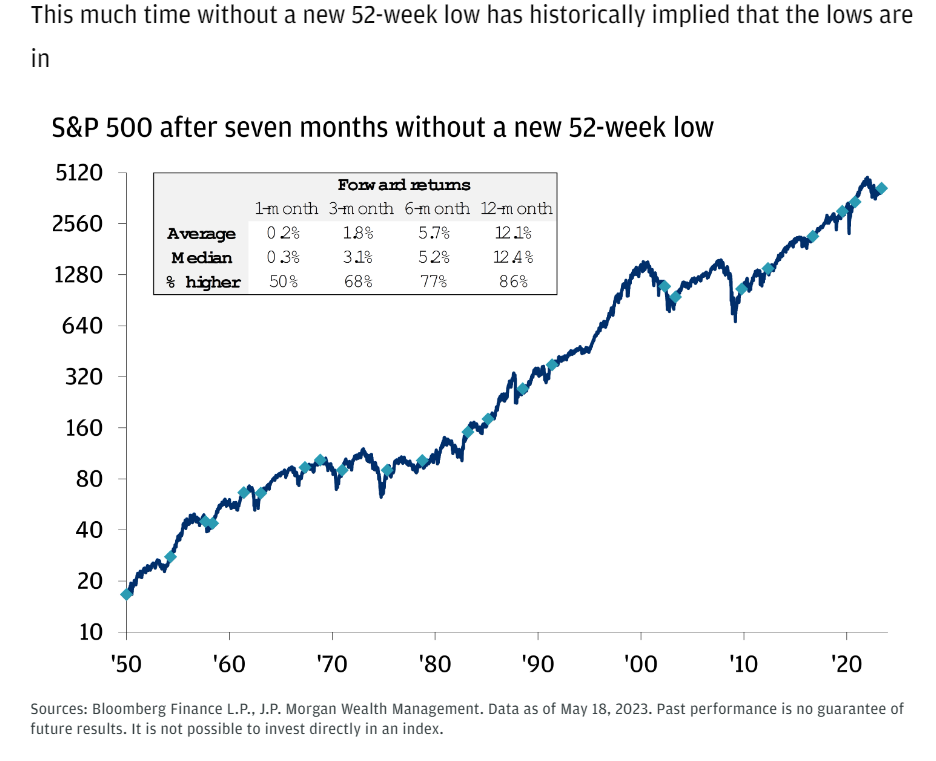

4. Seven Months Without New Lows.

JP Morgan Private Wealth.

5. Budweiser Only Gets 30% of Profits from U.S. and Canada.

Andrew Bary Barrons https://www.barrons.com/articles/buy-bud-stock-price-pick-848b3e7a?mod=past_editions

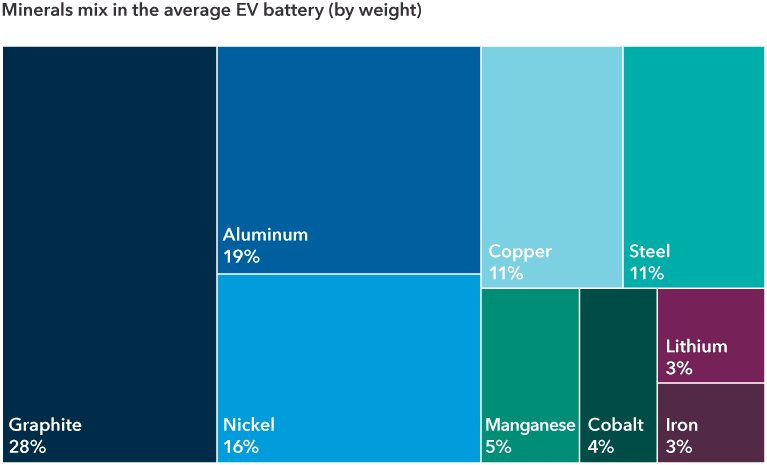

6. Mineral Mix in Average EV Battery

Capital Group

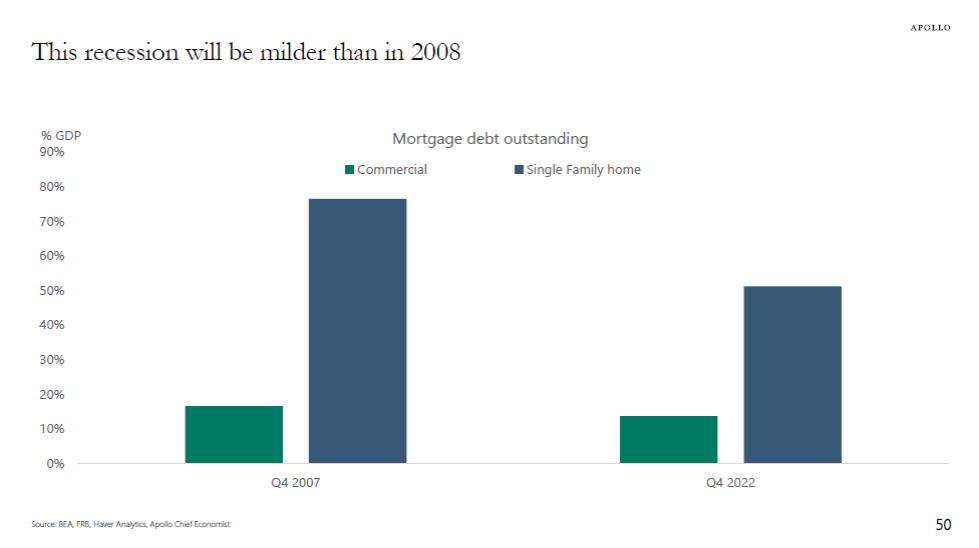

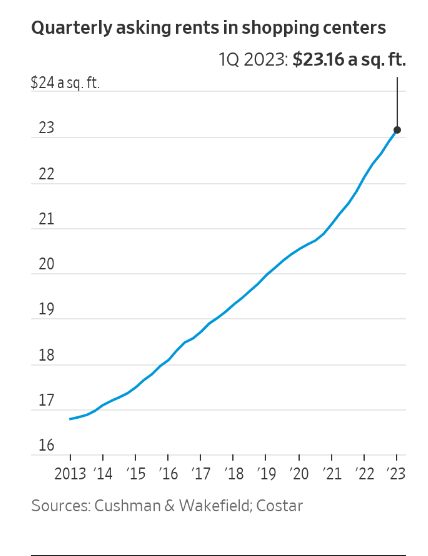

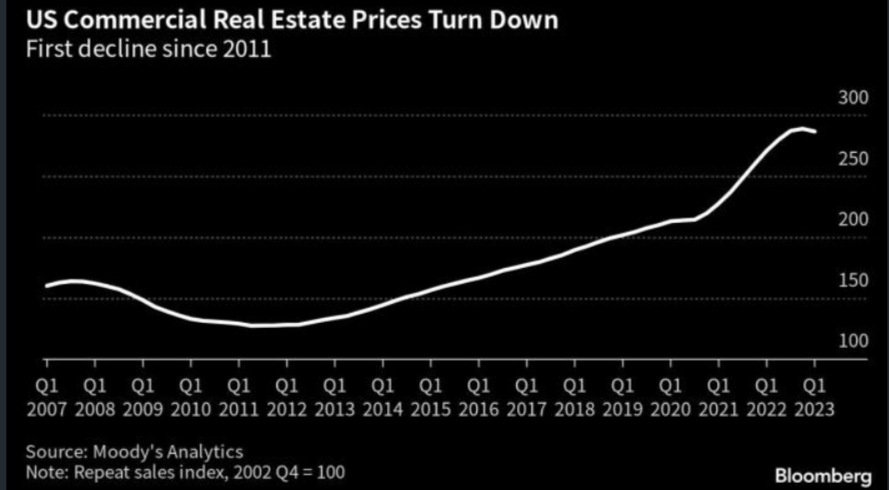

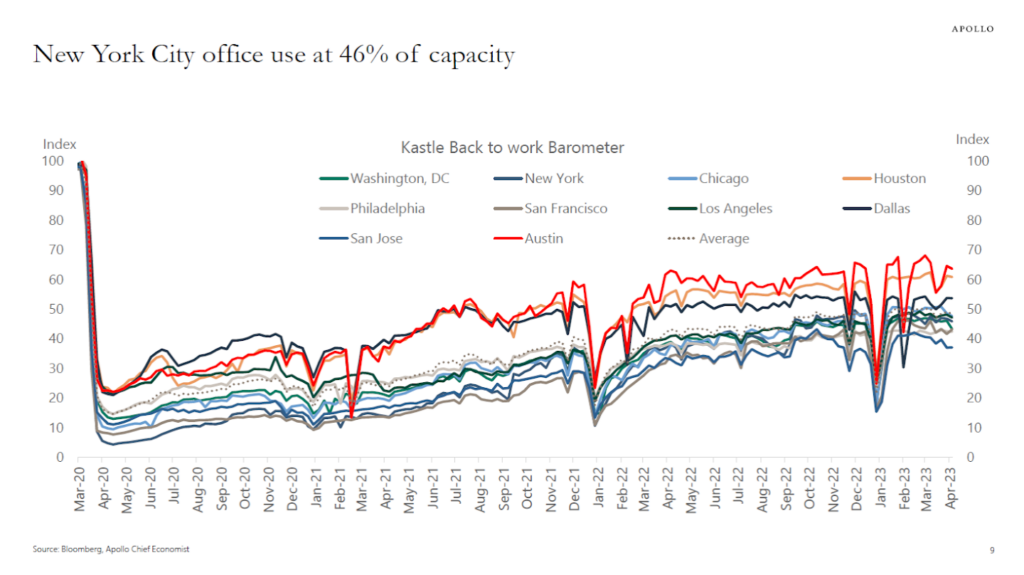

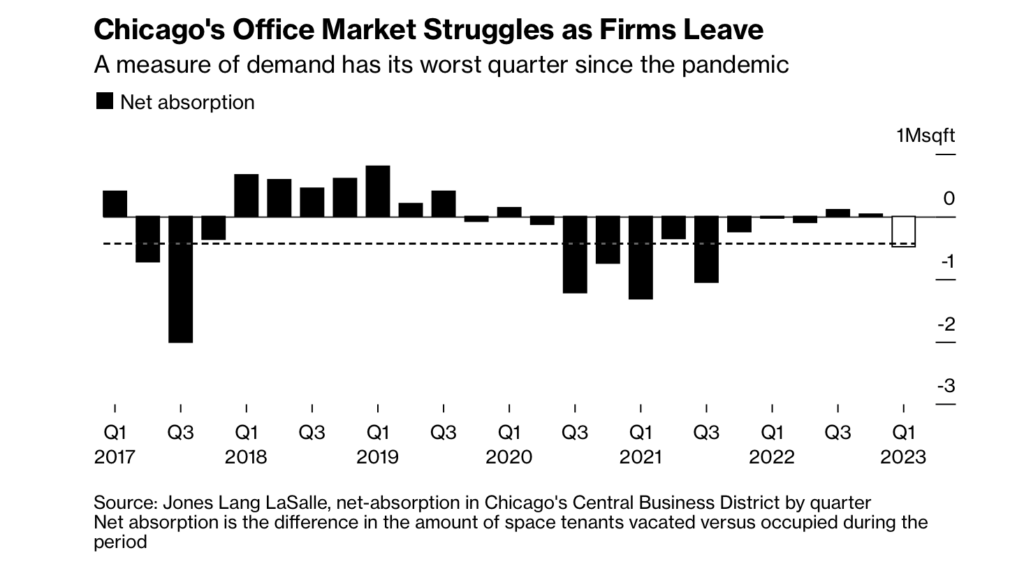

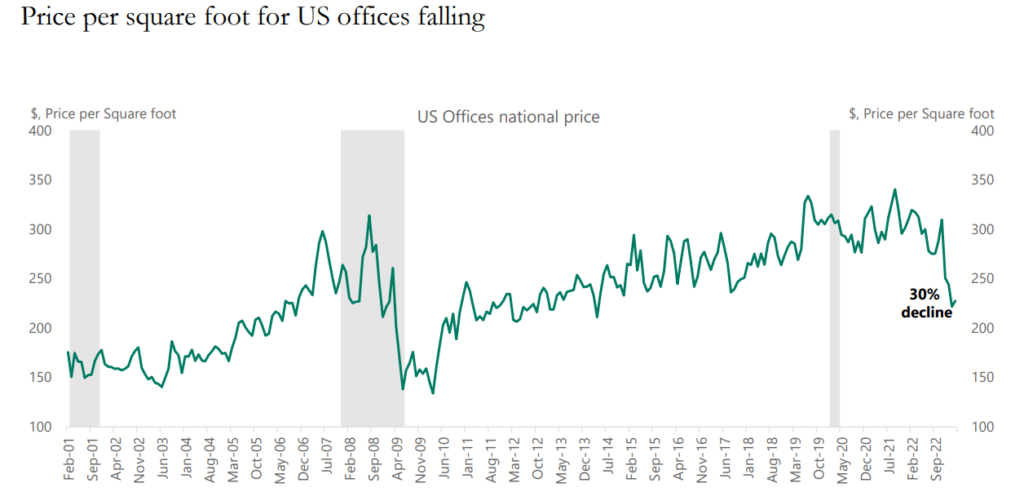

7. Price Per Sq Foot for Offices -30%

Torsten Slok Apollo Group

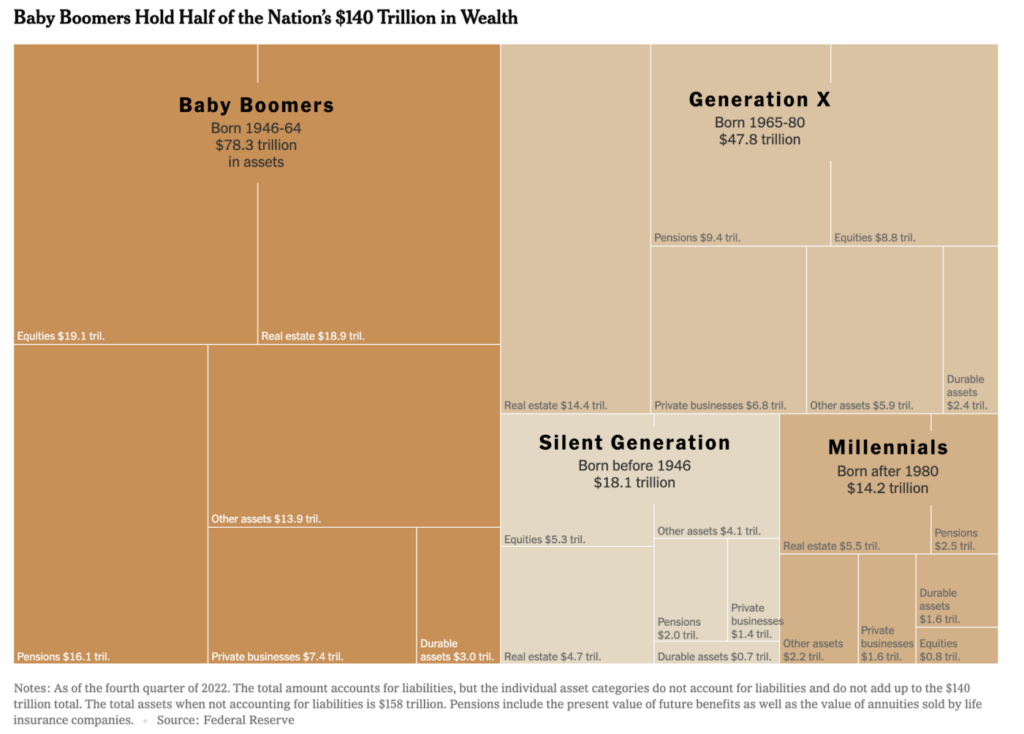

8. The Greatest Wealth Transfer in History Is Here….Baby Boomers $78 Trillion

https://ritholtz.com/2023/05/weekend-reads-565/

9. Largest Endowments in World Dominated by U.S. Universities.

The Largest Endowment Funds The largest endowment funds can be compared on a grand economic scale, in terms of assets.

To put it all into perspective, the largest 50 endowment funds represent over a trillion dollars in assets. Or for a more singular example, look at Harvard’s fund, which has an endowment greater than the entire GDP of countries like Serbia, Bolivia, or Slovenia.

Here’s how the top 50 rank.

|

Rank |

Endowment Fund |

Total Assets |

Region |

|

1 |

Ensign Peak Advisors, Inc |

$124,000,000,000 |

North America |

|

2 |

Japan Science and Technology Agency |

$80,700,000,000 |

Asia |

|

3 |

Stanford University |

$75,143,751,000 |

North America |

|

4 |

Harvard Management Company |

$72,781,329,000 |

North America |

|

5 |

Yale University |

$56,223,259,000 |

North America |

|

6 |

Princeton University |

$44,460,038,000 |

North America |

|

7 |

MIT Investment Management Company |

$42,526,492,000 |

North America |

|

8 |

Duke University |

$30,385,835,000 |

North America |

|

9 |

New York University |

$27,840,535,000 |

North America |

|

10 |

Columbia University in the City of New York |

$24,698,782,000 |

North America |

|

11 |

University of Notre Dame |

$24,599,541,000 |

North America |

|

12 |

KAUST Investment Management Company |

$23,500,000,000 |

Middle East |

|

13 |

Emory University |

$20,458,905,000 |

North America |

|

14 |

Johns Hopkins University |

$18,037,751,000 |

North America |

|

15 |

Church Pension Fund |

$17,773,649,171 |

North America |

|

16 |

University of Chicago |

$17,276,136,000 |

North America |

|

17 |

Ohio State University |

$16,006,851,000 |

North America |

|

18 |

Northwestern University |

$15,855,683,000 |

North America |

|

19 |

Washington University in St Louis |

$15,103,569,000 |

North America |

|

20 |

Penn State University, Office of Investment Management |

$15,017,272,000 |

North America |

|

21 |

Notre Dame of Maryland University |

$14,938,580,253 |

North America |

|

22 |

Cornell University |

$14,850,618,000 |

North America |

|

23 |

University of Southern California |

$14,495,427,000 |

North America |

|

24 |

Vanderbilt University |

$13,883,495,000 |

North America |

|

25 |

University of Virginia Investment Management Compnay |

$13,811,076,000 |

North America |

|

26 |

University of Tokyo |

$13,285,270,000 |

Asia |

|

27 |

National University of Singapore |

$12,626,100,000 |

Asia |

|

28 |

UNC Management Company |

$11,986,857,000 |

North America |

|

29 |

University of Michigan Office of Investments |

$11,900,000,000 |

North America |

|

30 |

General Authority of Awqaf |

$11,238,371,192 |

Middle East |

|

31 |

Church Commissioners for England |

$11,197,700,000 |

Europe |

|

32 |

J.Paul Getty Trust |

$10,778,927,000 |

North America |

|

33 |

Trinity Wall Street Episcopal Church |

$9,932,419,000 |

North America |

|

34 |

Unitersity of Utah |

$9,827,602,000 |

North America |

|

35 |

Brown University |

$9,793,108,000 |

North America |

|

36 |

Kamehameha Schools |

$9,326,013,000 |

North America |

|

37 |

Dartmouth College |

$9,078,340,000 |

North America |

|

38 |

Hong Kong Jockey Club |

$8,603,580,000 |

Asia |

|

39 |

Rice University |

$8,424,555,000 |

North America |

|

40 |

The Leona M. and Harry B. Helmsley Charitable Trust |

$8,313,588,000 |

North America |

|

41 |

University of Pittsburgh |

$8,011,856,000 |

North America |

|

42 |

Nature Conservancy |

$7,870,380,000 |

North America |

|

43 |

University of Toronto Asset Management Corporation |

$7,329,730,000 |

North America |

|

44 |

University of Rochester |

$7,149,025,000 |

North America |

|

45 |

Virginia Commonwealth University |

$6,985,495,306 |

North America |

|

46 |

Purdue University |

$6,755,500,000 |

North America |

|

47 |

University of Miami |

$6,582,600,000 |

North America |

|

48 |

University of Minnesota |

$6,304,508,000 |

North America |

|

49 |

Caltech Investment Office |

$6,252,584,000 |

North America |

|

50 |

Metropolitan Museum of Art of New York City |

$5,588,554,000 |

North America |

https://www.zerohedge.com/personal-finance/these-are-worlds-top-50-endowment-funds

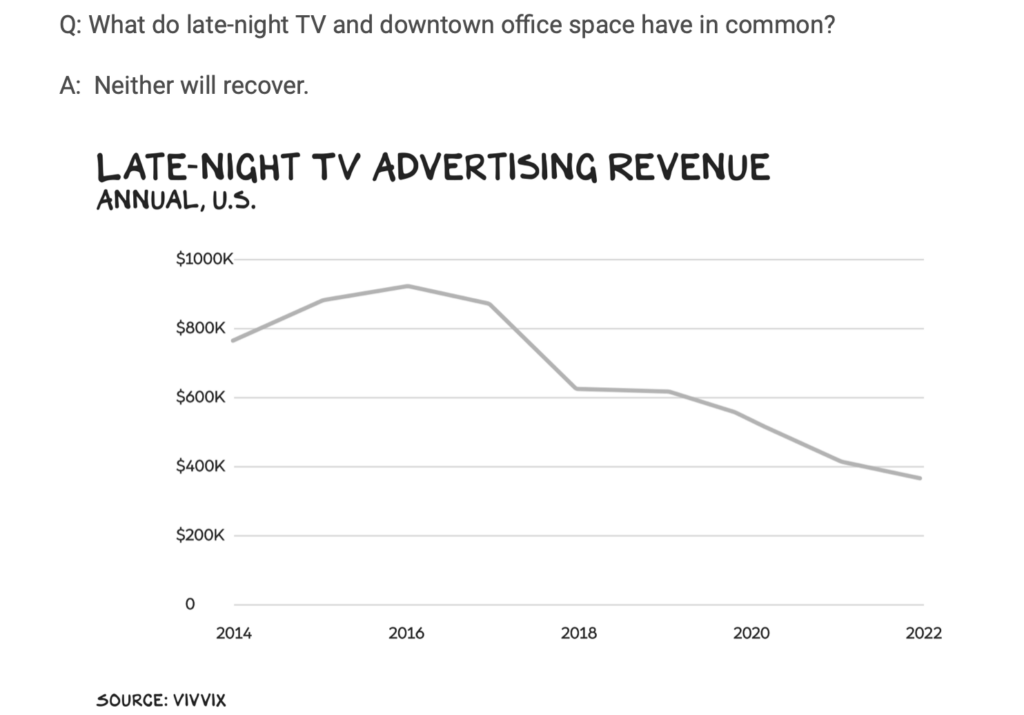

10. Late-Night TV RIP

Scott Galloway