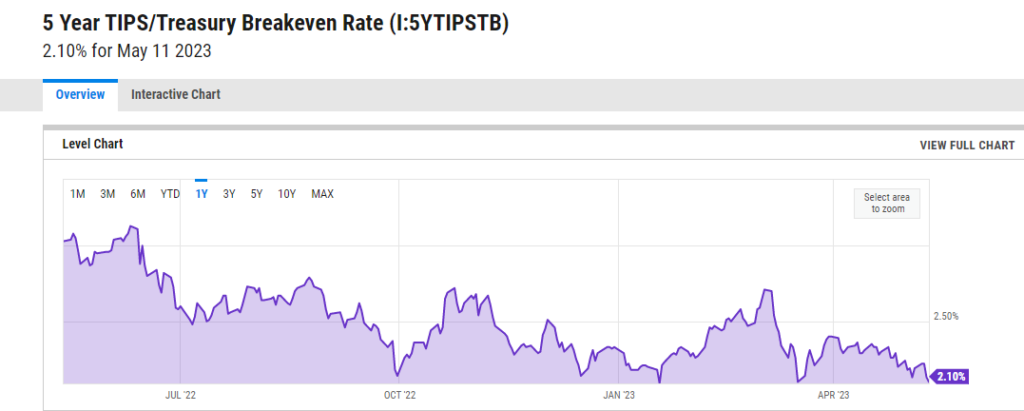

1. 5-Year TIPS Break-Even at FED Target 2%

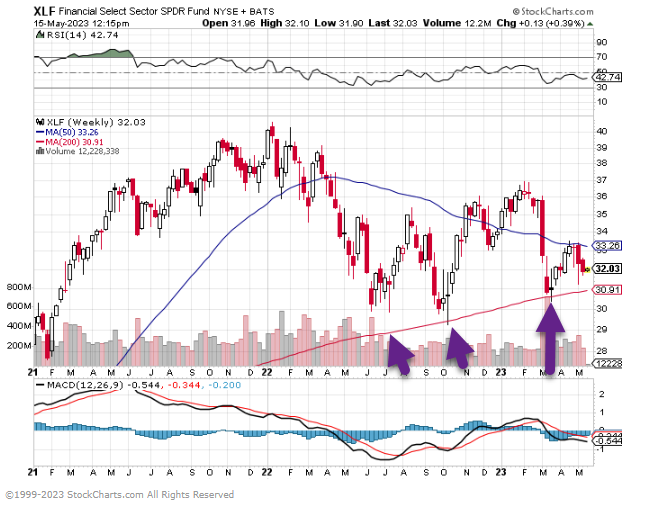

2. Re-Visit of XLF Financials ETF Chart

XLF still holding 200 week moving average …50week still above 200week

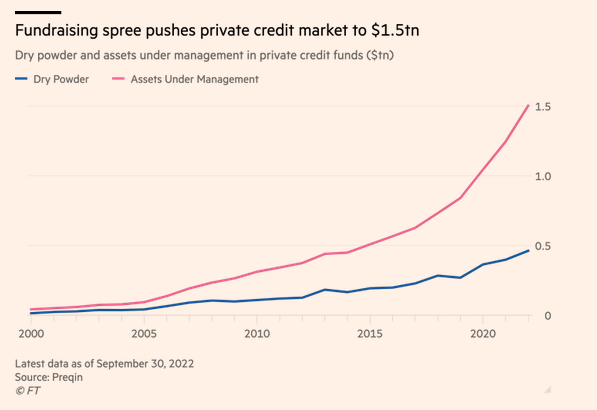

3. Howard Marks on Private Credit.

From Dave Lutz at Jones Trading OAKTREE WARNS– Howard Marks, the co-founder of $172bn investment group Oaktree Capital Management, has warned that the boom in private credit will soon be tested as higher interest rates and slower economic growth heap pressure on corporate America. The 77-year-old billionaire told the Financial Times that big asset managers had competed aggressively to lend to the largest private equity groups as money poured into their coffers in 2020and 2021, raising questions over the due diligence the funds conducted when they agreed to provide multibillion-dollar loans. “Did the managers make good credit decisions, ensuring an adequate margin of safety, or did they invest fast because they could accumulate more capital? We’ll see”

Data provider Preqin estimates the private credit market, which includes loans for corporate takeovers, has grown to about $1.5tn from roughly $440bn a decade ago. Fundraising has been brisk, eclipsing $150bn every year since 2019. But part of that influx of capital was lent when markets were on a seemingly unstoppable march higher — before the US Federal Reserve began aggressively raising interest rates. Competition among private lenders pushed borrowing costs down at the time.

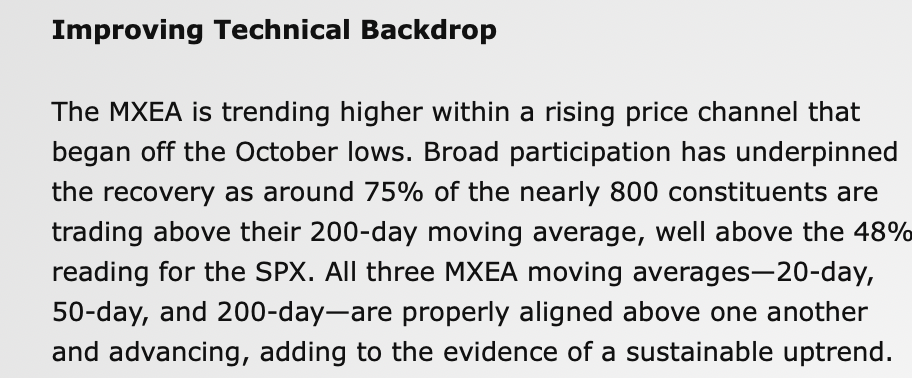

4. International Breadth Stronger than U.S….75% of Names Above 200day.

LPL Research

https://lplresearch.com/2023/05/12/tides-turning-toward-international-stocks/#more-27545

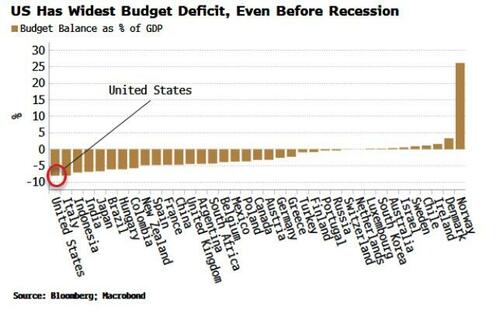

5. U.S. Budget Deficit is Widest Ever Entering a Recession

Zerohedge The US’s budget deficit is currently running at 8% of GDP, wider than any other major country, and already significantly more than where it was prior to previous recessions.

https://www.zerohedge.com/markets/bond-market-about-get-intimidating-again

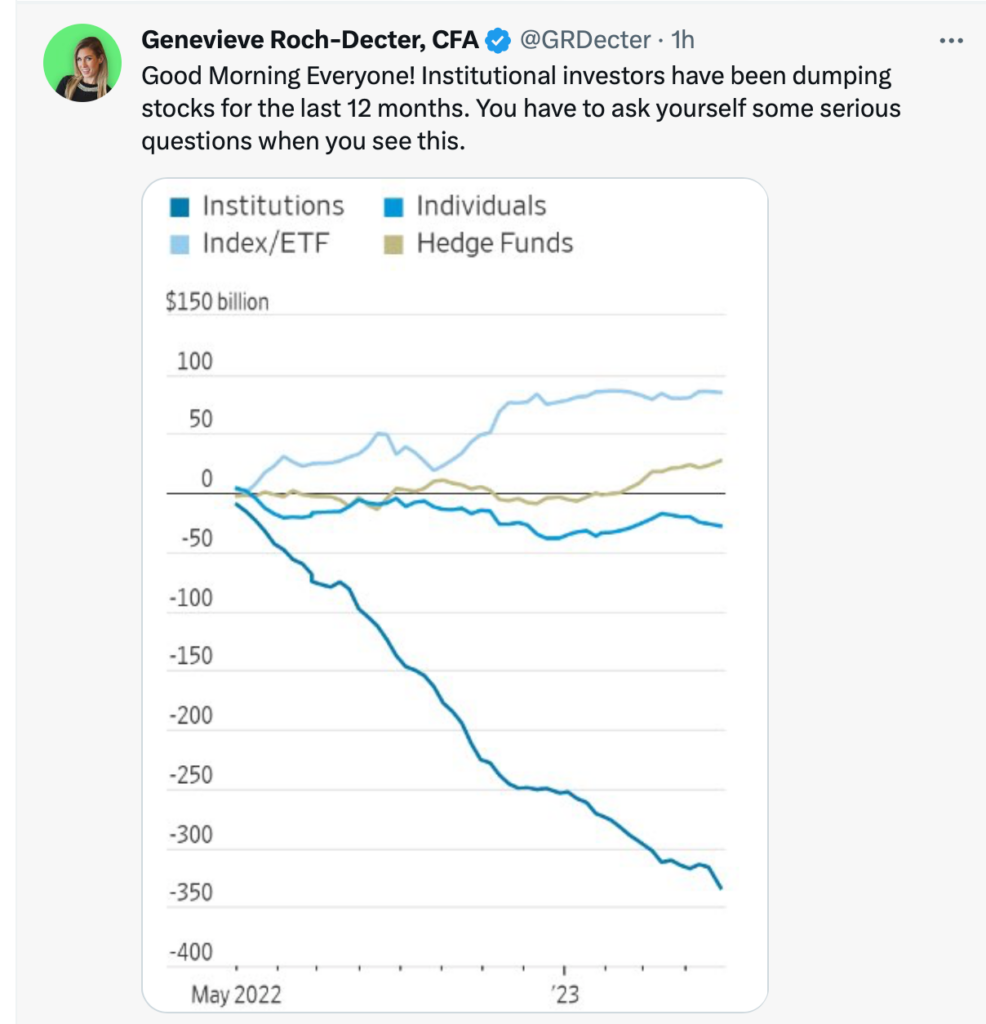

6. Institutional Money Selling Stocks for 12 Months.

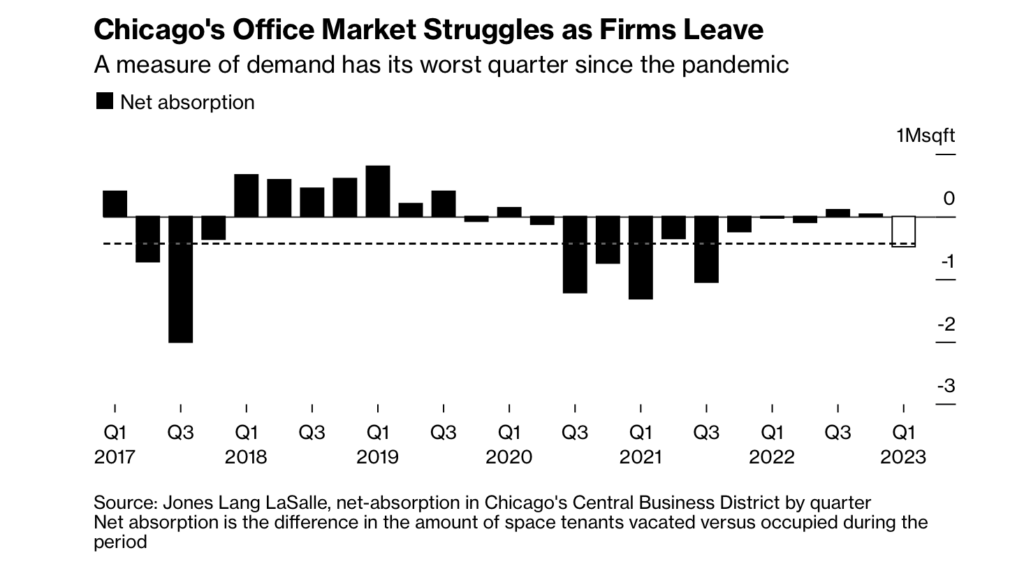

7. Chicago Office Space 22% Vacancy…Bad Quarter of Demand.

Bloomberg-Things aren’t looking up for the commercial real estate market, with the city’s office-vacancy rate reaching a record 22.4% in the first quarter. Even tech companies, once seen as a bright opportunity for Chicago’s future, are retrenching: Salesforce Inc. and Meta Platforms Inc. are giving up almost 240,000 square feet (22,300 square meters) of space. By

8. U.S. Retail Gas Prices -30% from Highs

Y-Charts

https://ycharts.com/indicators/us_gas_price

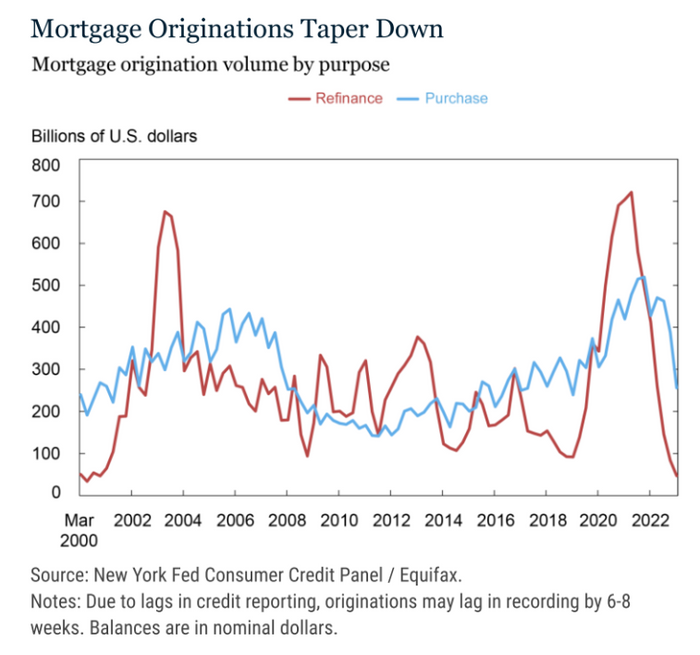

9. 14 million mortgages were refinanced during ‘pandemic boom.’ That makes life very difficult for home buyers.

Aarthi Swaminathan Marketwatch

The great pandemic mortgage refinance boom is most definitely over, but the aftershock is still rippling through the housing market. Homeowners are holding up home sales, as their ultra-low prize is too precious to give up.

During the early days of coronavirus pandemic in 2020 and 2021, mortgage rates fell sharply, and millions of homeowners jumped at the opportunity to refinance. The 30-year mortgage fell down to 2.65% in early January of 2021, according to Freddie Mac data FMCC, +2.11%.

The Federal Reserve Bank of New York estimated that 14 million mortgages were refinanced during the “pandemic refinancing boom.”

The surge in refinancing was, in part, due to strong household balance sheets and an increased need for housing, the New York Fed said in a blog post published Monday. The average homeowner who refinanced saw their monthly payment drop by $220, the Fed said.The biggest share of mortgages that were refinanced originated from 2015 onwards, the NY Fed. said. Older mortgages, such as those originated before 2010, were the least likely to be refinanced.

Homeowners most likely to refinance their mortgage owed a balance of $400,000 to $500,000 on their mortgage, the NY Fed concluded. “The mortgage refinancing boom is over, but its impact will be seen for decades to come,” Andrew Haughwout, director of household and public policy research at the NY Fed, said in a statement.

10. 10 Ways to Declutter Your Mind

How to feel lighter and more hopeful using these powerful, yet simple tools. Shonda Moralis MSW, LCSW

KEY POINTS

- Cluttered minds can weigh people down and cause unnecessary stress.

- Individuals can use simple practices to declutter and spring clean their minds.

- It just takes a few minutes a day to create healthy, sustainable habits.

This time of year often brings thoughts of spring cleaning our homes—throwing open the windows, decluttering, and organizing. A fresh start to a new season feels light and hopeful.

It’s also the perfect time to spring clean our minds (and our lives in general) by taking stock and recommitting to our priorities.

Whether house or mind, attempting a massive overhaul all at once is not recommended—taking it one small step at a time is far more effective for sustainability and follow-through.

The following are some easy, fun tips to spruce up your life in manageable, bite-sized pieces:

Begin with your mindset.

Let go of thoughts that don’t serve you. We find evidence for what it is we focus on. If my mind is trained on what’snot going well, I will notice the negative more—and vice versa. We can habituate our minds to be on the lookout for the good stuff daily.

Be in the moment. We spend so much of our time in the past or in the future and miss out on what is happening right in front of us. Notice when you are worrying (the future) or rehashing (the past) and come back to what’s here now. (Meditation also helps train our minds to be more in the present moment.)

Do a daily brain dump. Get all of your to-do’s, worries, and thoughts down on paper first thing in the morning, or keep a notebook and pencil by your bed to jot down random thoughts when your mind is full late at night.

Do a digital or screen detox. Spend a weekend day or shorter block of time screen-free in order to make room for creative thought.

Surroundings

Where in your life could you use more organization? Even if you are a well-organized person, there is usually at least one area that can be streamlined—emails, finances, paperwork, the sock drawer—pick one. If you need some motivation, set a timer for 10 minutes or blast your favorite music.

Priorities

Reflect: After the upheaval of the past few years, what have you learned? What do you want to let go of, and what gets to stay? If you’ve acclimated to a slower pace or more downtime, you might keep one day on the weekend for unscheduled rest or fun.

Identify your top four values (what matters most to you—think nature, learning, community), and let them guide your actions and priorities. Knowing our top values helps keep our priorities and actions in check. If family is one of your top values, for example, each time you decide whether or not to take on a work project or say yes to a social engagement, ask yourself if you are allowing enough family time.

Energy

Track your energy: Notice your level of energy when engaged in various activities or tasks. Do you love to garden? You might feel relaxed, calm, and content. Carve out time for more of that (and less social media, which likely drains you). Does cooking dinner and deciding what to make tire you out? Meal plan, assign other family members to make dinner on certain nights, or order a meal subscription service. When possible, do more of what energizes you and less of what drains you. What can you add, delete, or delegate from your to-do list?

Get outside and get moving. Spring ushers in a renewed sense of energy. Moving our bodies helps calm our minds and opens up creative thought.

Cold water swimming is trending to boost energy and ward off depression. Cold bodies of water are decidedly not for me. I do, however, love to step outside in the morning with my cup of coffee, listen to the birds sing, and let the cold air wake me up, starting the day refreshed.

Start a new healthy habit. Be intentional about what habit you choose. What do you want to do and why? Knowing our why helps renew our motivation when it inevitably flags. I might, for example, begin stretching five minutes a day to increase flexibility, lessen stiffness, and prevent injuries, and it feels great!

Which one life spring cleaning tip will you experiment with today

–

https://www.psychologytoday.com/us/blog/breathe-mama-breathe/202305/10-ways-to-declutter-your-mind