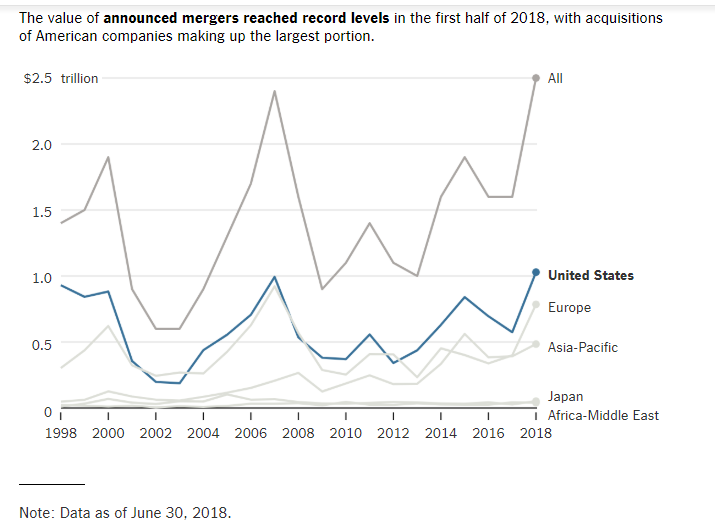

1.A Record $2.5 Trillion in Mergers Were Announced in the First Half of 2018

By Stephen Grocer

July 3, 2018

More than $2.5 trillion in mergers were announced during the first half of the year, as fears of Silicon Valley’s growing ambitions helped drive a record run of deal-making.

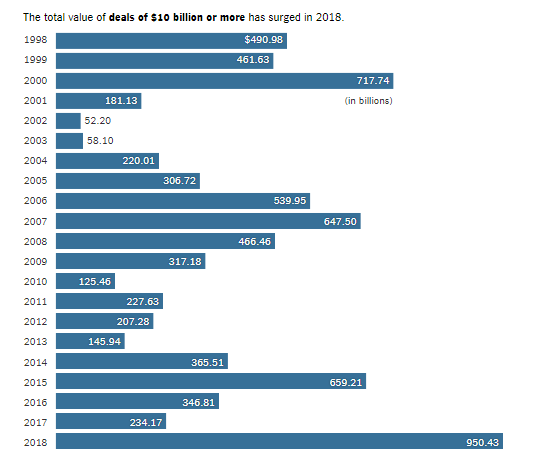

Four of the 10 biggest deals were struck in part to fend off competition from the largest technology companies as the value of acquisitions announced during the first six months of the year increased 61 percent from the same period in 2017, according to data compiled by Thomson Reuters. That has put mergers in 2018 on pace to surpass $5 trillion, which would top 2015 as the largest yearly total on record.

Even rising global trade tensions did not manage to stifle acquisitions: Deals involving companies based in different countries nearly doubled compared with the first half of last year, and accounted for more than 40 percent of all announced transactions.