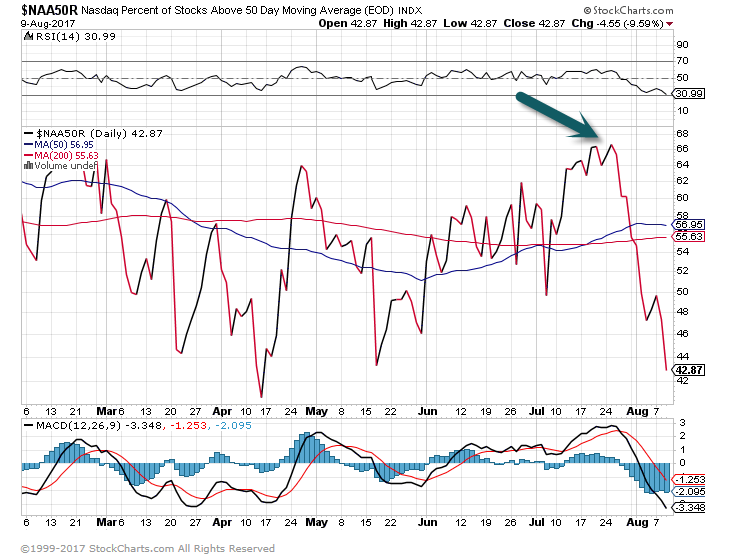

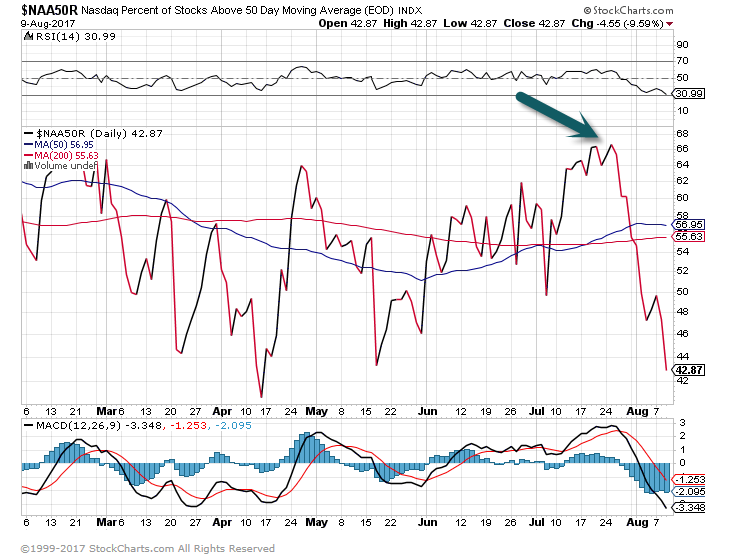

1.Interesting Charts ….Nasdaq Percentage of Stocks Above 50day and 200day Fell Hard at End of July.

Naz Above 50day

Naz above 200day

https://www.whartonhillia.com/viewpoints/2017/8/4/under-the-hood-august-2017

Aug 3, 2017

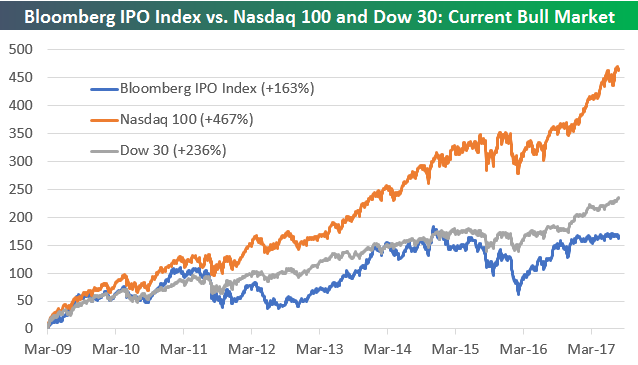

One index that hasn’t been participating in the market’s rally this year is the Bloomberg IPO Index, which is made up of companies that have IPOd within the past year. We just wanted to show you a quick chart to highlight the weakness for IPO stock performance.

Below is a chart comparing the performance of the Bloomberg IPO Index to the Nasdaq 100 and the Dow Jones Industrial Average since the bull market began back in March 2009. As shown, the Tech-heavy Nasdaq 100 is up by far the most at +467%, which might make you assume that IPOs would also be doing pretty well. But even the Dow 30 has outperformed the IPO Index and by quite a bit at that! Since the bull market began, the Dow is up 236% on a simple price return basis, while the IPO index brings up the rear in this group with a gain of just 163%. Over the past year, the IPO index has basically traded completely sideways.

https://www.bespokepremium.com/think-big-blog/bloomberg-ipo-index-remains-sluggish/