1. What Happens After 20% Rallies Off S&P Lows

JP Morgan Wealth Management

Is the coast clear? Investing amid the rally | J.P. Morgan Private Bank (jpmorgan.com)

2. 308 of 503 S&P Companies Still 20% Below Peak

Cresset Jack Ablin Of the S&P ‘s 503 companies, 308 are trading more than 20 per cent below their peak: they represent 38 per cent of the blue-chip Index’s market cap. Nearly half of Index constituents are off more than 30 per cent from their peak. While deteriorating growth is not a bullish catalyst, most stocks appear to have already priced in a recession.

Since When Does a Slowing Economy Mean Risk On? | Cresset Capital

3. Is the Magnificent 7 High Growth? 130 Companies Growing 25%+

Richard Bernstein Research

A once-in-a-generation opportunity (rbadvisors.com)

4. Non-Tech Leading November Rally-WSJ

5. Bearish Put Options Buying in Crude Oil

6. Small Cap India New Highs +27% YTD

7. Argentina New Highs

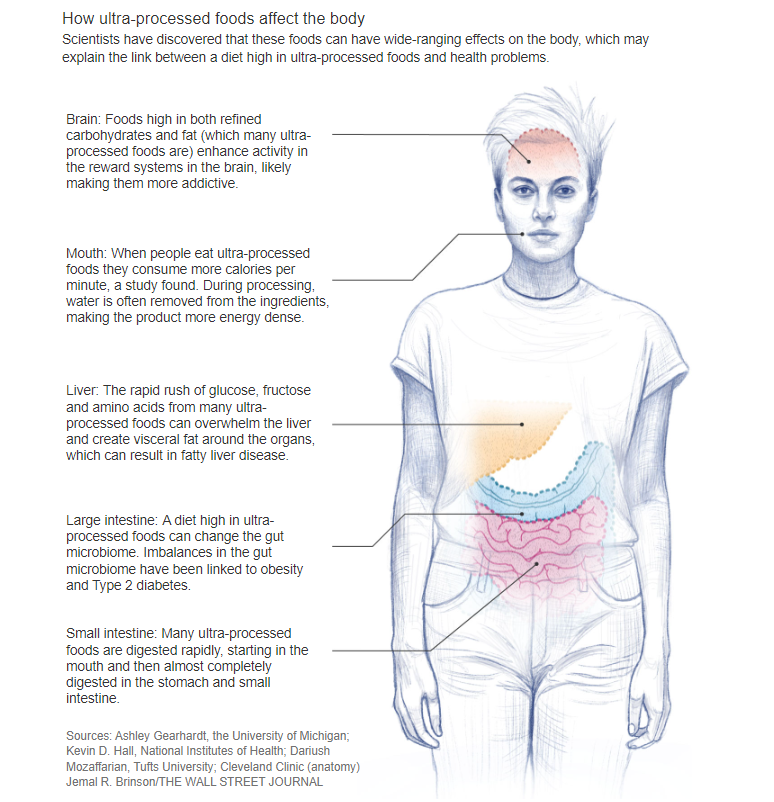

8. GLP-1 Weight Loss Reducing Food Consumption

Capital Group

Weight loss drugs could reshape industries beyond health care | Capital Group

9. Biggest Seasonal Hiring Yet at Amazon

10. 40% of people willfully choose to be ignorant. Here’s why

We all have a place in our lives where we look the other way and pretend everything is fine. It’s a built-in excuse to act selfishly.

KEY TAKEAWAYS

- Willful ignorance occurs when someone intentionally avoids information about the negative consequences of their actions.

- A new meta-analysis found that 40% of people will choose to remain ignorant of how their decisions affect others.

- The evidence suggests that willful ignorance provides people with a built-in excuse to act selfishly.

Do you have an uncle who believes vaccines cause autism but refuses to study the reams of research showing them to be safe? What about a friend who avoids information about factory animal farming so they can eat cheap meat guilt-free? Or how about that CEO who claims their business is ethically minded, yet doesn’t investigate its supply chain for exploitation of the environment or the impoverished?

Each is an example of what psychologists call willful ignorance — the intentional act of avoiding information that reveals the negative consequences of one’s actions. Not to judge: We all have a place in our lives where we look the other way and pretend everything is fine. It may be personal, political, or professional in nature, but just below the conscious surface, we know our actions don’t align with our stated values.

“Examples [of] willful ignorance abound in everyday life,” Linh Vu, a doctoral candidate at the University of Amsterdam, said. “We wanted to know just how prevalent and how harmful willful ignorance is, as well as why people engage in it.”

To find out, Vu and a team of researchers performed the first meta-analysis on the current empirical evidence of willful ignorance, and it was published in the Psychological Bulletin, a peer-reviewed journal published by the American Psychological Association. They compared the results of 22 studies with a total of more than 6,000 participants. Here’s what they found.

Moral wiggle room

The classic experiment for studying willful ignorance is known as the moral wiggle room task. It was designed by Jason Dana, an associate professor of marketing and management at Yale. Participants are randomly assigned the role of decision-maker or recipient. The decision-maker is given a choice: They can take either a $5 or $6 payout. If they take the $5 payout, the recipient will receive $5 as well. If they take the $6 payout, the recipient will receive $1.

When provided with this information by a researcher, the majority of decision-makers act altruistically. They sacrifice the slightly larger payout for themselves to give the recipient more money. On average, only about a quarter of decision-makers act selfishly. But this full-information condition is simply the control. The experiment really begins when the researchers become less forthcoming.

In the experimental condition, the decision-makers can still choose between the $5 or $6 payouts, but this time they are not told what the recipient will receive. There’s a 50-50 chance the recipient will receive $5 or $1. Importantly, the decision-makers can ask the researchers what payout the recipient will receive, and they can do so at no cost to themselves. In other words, while the decision-makers start out blind to the consequences of their actions, they don’t have to stay that way if they don’t want to.

In Dana’s original 2007 study, 44% of decision-makers in the experimental condition chose to remain willfully ignorant and took the selfish option.

Some studies in the meta-analysis were variations on this original design. For instance, one version of the game included ultimatum bargaining where the recipient could accept or reject the decision-maker’s offer. If they reject it, both participants walk away empty-handed. Another version had group members vote on payouts for the group and an unknown recipient.

But across all the studies, the researchers found Dana’s original split to be fairly consistent. On average, 40% of people chose not to learn about the consequences of their actions, and such ignorance was associated with less altruism compared to those who became informed.

Ignorance as an excuse

The researchers hypothesized two potential motivations for willful ignorance. First, they thought willful ignorance may offer a built-in excuse for not acting generously. If a person doesn’t know the consequences of their actions, the internal logic goes, then they still can consider themselves a morally upstanding individual even if they decide to act selfishly. Willful ignorance serves to protect their self-image.

The second potential motivation is known as “cognitive inattentiveness.” That is, people dislike thinking more than they have to. It may stem from laziness, not paying attention, or not wanting to take the time to learn more. Whatever the case, they favor the quick-and-easy decision — even if they would have acted altruistically had they been informed upfront.

To test this, the researchers compared the choices of participants who chose to inform themselves with those who learned about the consequences by default. The researchers reasoned that if the driver was cognitive inattentiveness, then the percentage of altruism would be roughly the same between the two.

On the other hand, if those who chose to learn about the consequences acted more generously, this would suggest that those informed by default would have “self-selected” to remain ignorant if given the option. And that’s what they found. Across the studies, participants who chose to be informed of the consequences were 7% more likely to make the altruistic choice.

Being righteous is often costly, demanding people to give up their time, money, and effort. Ignorance offers an easy way out.

Shaul Shalvi

“The findings are fascinating as they suggest a lot of the altruistic behaviors we observe are driven by a desire to behave as others expect us to,” Shaul Shalvi, co-author and a professor of behavioral ethics at the University of Amsterdam, said in a statement.

He added: “A part of the reasons why people act altruistically is due to societal pressures as well as their desire to view themselves in a good light. Since being righteous is often costly, demanding people to give up their time, money, and effort. Ignorance offers an easy way out.”

With that said, the analysis couldn’t eliminate cognitive inattentiveness as a potential motivation. In fact, willful ignorance could be the cumulative effect of many motivations, including those not considered in the meta-analysis, such as reputation. The data simply suggest that maintaining a positive self-image is one of those motivations.

The Enron Complex as seen at night. After the Enron scandal came to light in 2001, CEO Jeffrey Skilling mounted a legal defense of willful ignorance. He claimed he remained unaware of the corporation’s fraudulent practices. It didn’t work, and he was found guilty of conspiracy, securities fraud, and other charges in 2006. (Credit: eflon / Flickr)

A little less ignorant about willful ignorance

The meta-analysis does have limitations that should be mentioned. To start, participants overwhelmingly came from Europe and the U.S., meaning the results may not be replicated in other cultures. The studies also looked at willful ignorance in the lab versus actual decisions in the real world. Finally, they focused on discrete tasks, meaning they were only performed once. It’s possible that continuous rounds of give-and-take between decision-maker and recipient would yield different results (like in many game theory games).

Still, the authors conclude that “taken together, the aggregate evidence suggests ignorance is indeed in part ‘willful’ and driven by excuse-seeking and self-image maintenance motives.” Thanks to them, we are all a little less ignorant about ignorance.

https://bigthink.com/neuropsych/people-choose-willful-ignorance/

From Barry Ritholtz Blog