1. Crude Oil Charts.

Crude oil ran back up to 200 day and rolled over.

Crude oil weekly chart….Held 200week average…$120 to $66 on sell off.

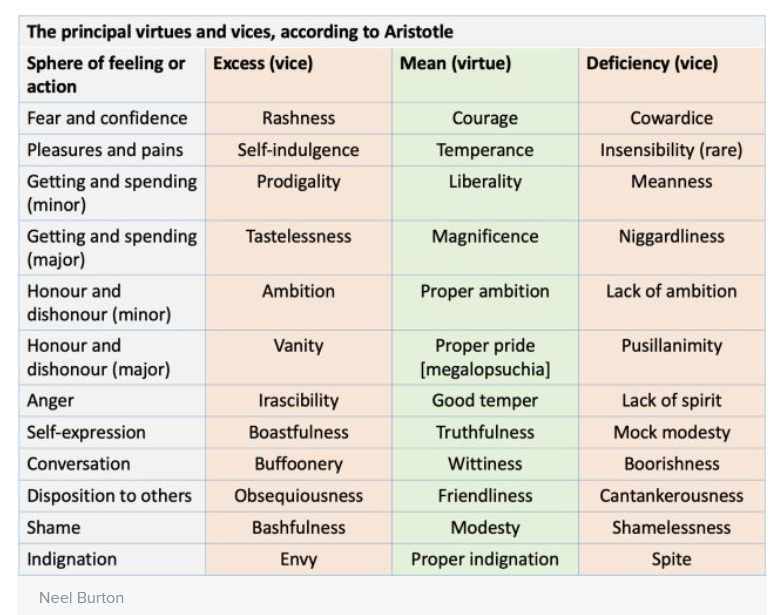

2. Vanguard 10 Year Outlook for 60/40 Big Improvement.

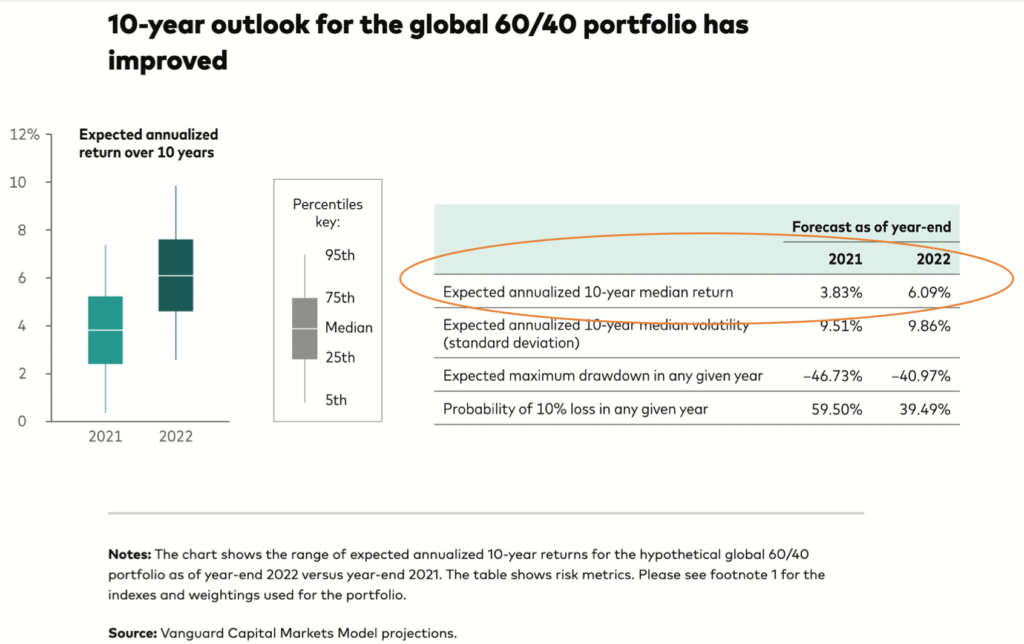

3. Credit Spreads.

Christine Idzelis. Marketwatch

“On net, the credit spreads do not, as of now, signal recession,” said Silvia. “Moody’s Baa spread is the dog that didn’t bark.”

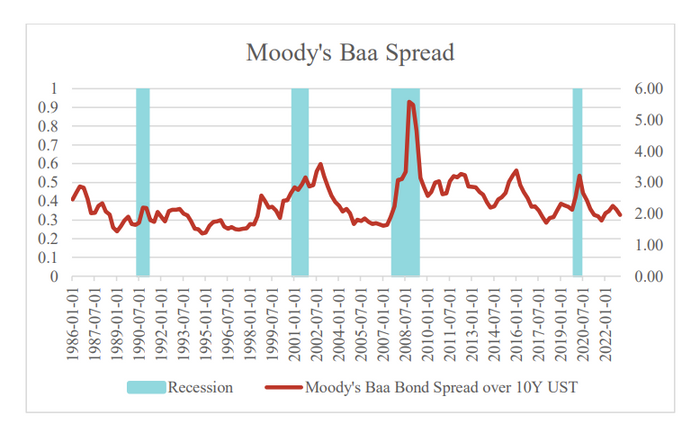

The current spread has not broken above to a higher level on a sustained basis, as seen just before or during the early phase of a recession in past periods, said Silvia, citing the fourth quarter of 1998, first quarter of 2008 and the fourth quarter of 2018 as examples. But “the caution flag remains out” for investors, according to his note. Investors are worried that bank lending standards will become tighter, prompting a recession in the next year, he said. “As illustrated in the graph below, a sharp rise in the benchmark measurement of tighter standards does signal an oncoming recession,” said Silvia. “We saw this in 1999 and very sharp rises in 2007, and the 2020 period.”

DYNAMIC ECONOMIC STRATEGY NOTE DATED APRIL 19, 2023

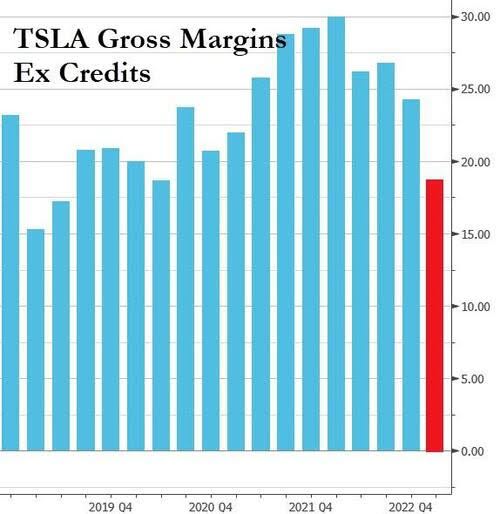

4. Tesla Gross Margins Drop Below 20%

From Zerohedge Blog

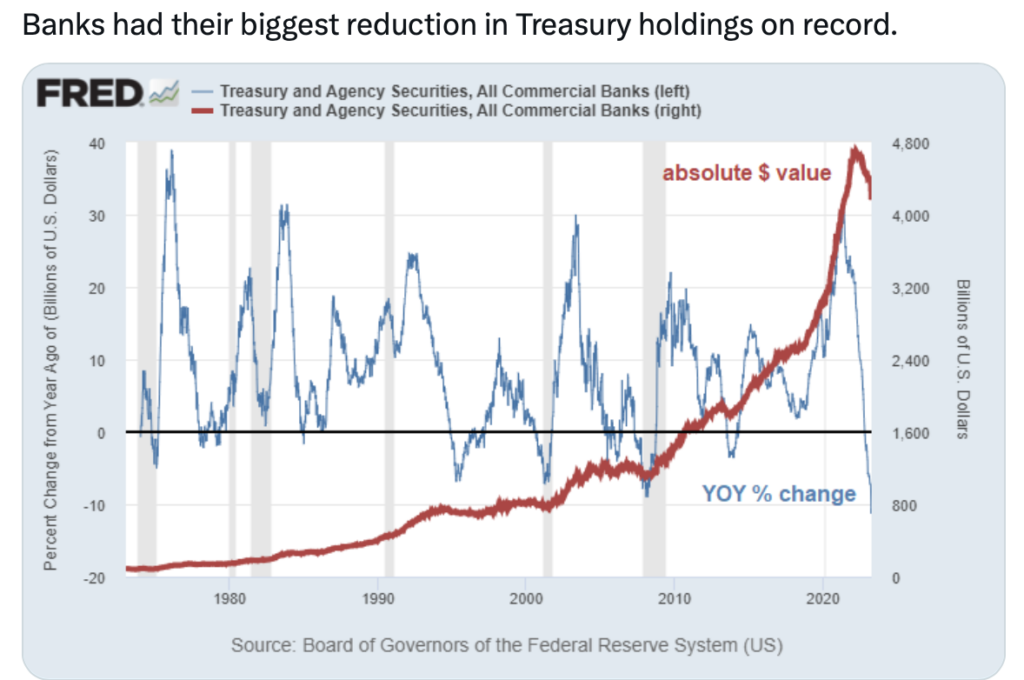

5. Banks Reduce Treasury Holdings

https://twitter.com/LynAldenContact

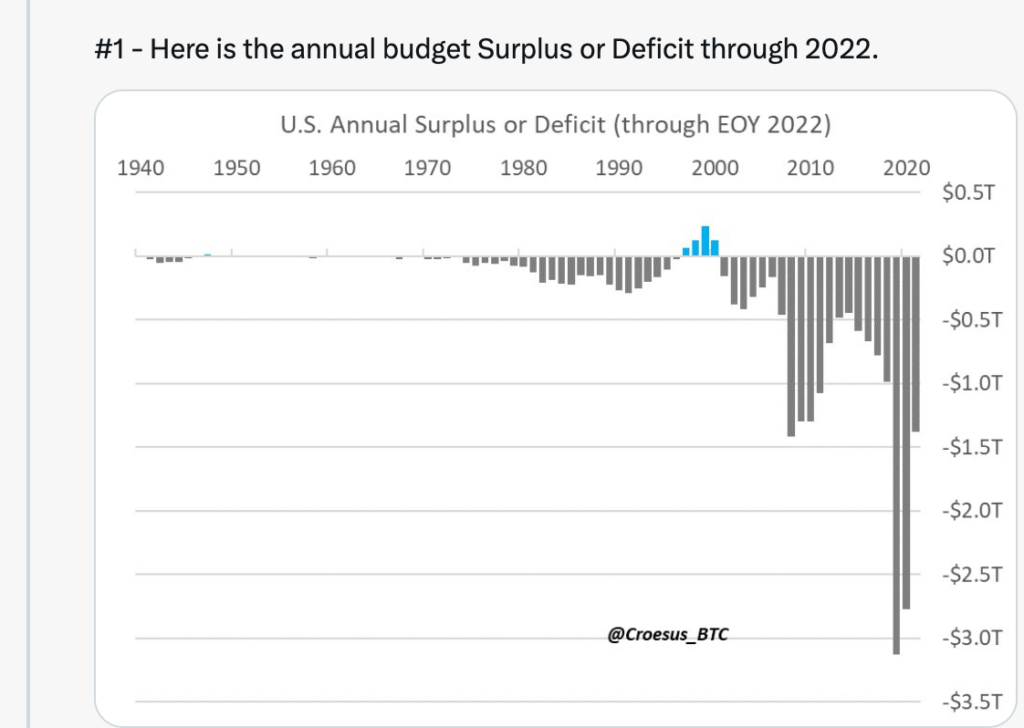

6. Annual Budget Deficit Updated Chart

Jesse Myers

https://twitter.com/Croesus_BTC

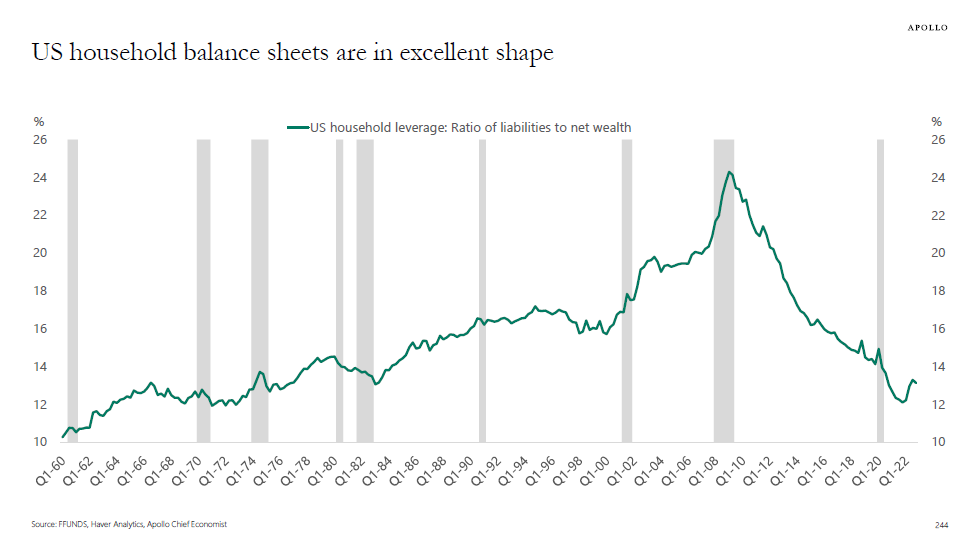

7. U.S. Household Balance Sheets in Excellent Shape.

Torsten Slok, Ph.D.Chief Economist, Partner Apollo Global Management-US households are in excellent shape, the ratio of liabilities to net wealth has declined 50% since the 2008 financial crisis, and household leverage is currently at levels last seen in the early 1980s, see chart below. If the unemployment rate rises, consumer spending will slow down, but the starting point for US households is very strong.

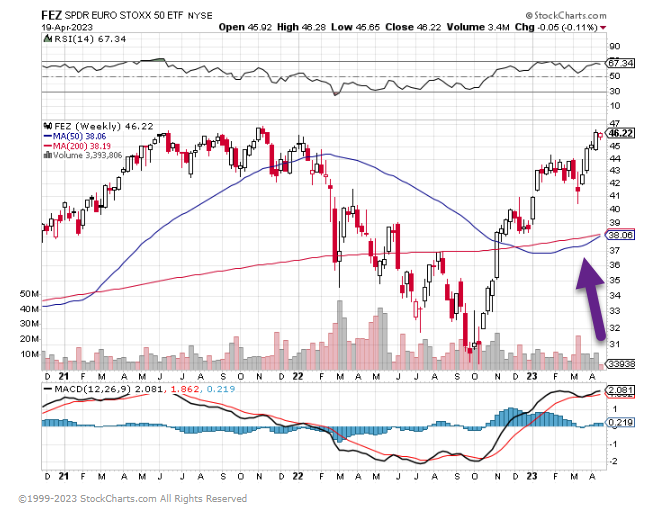

8. Euro Large Cap 50 One Tick From Break Out Highs

$47 print new highs

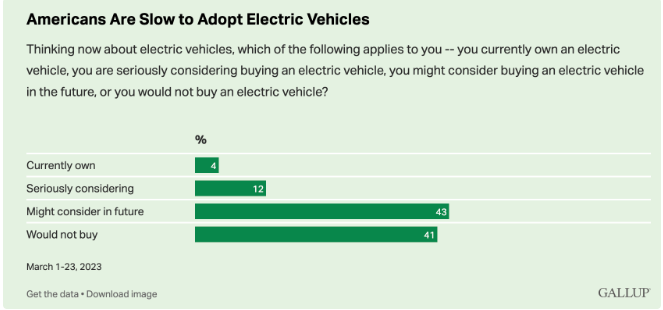

9. Americans Are Slow to Adopt Electric Vehicles

Barry Ritholtz Blog

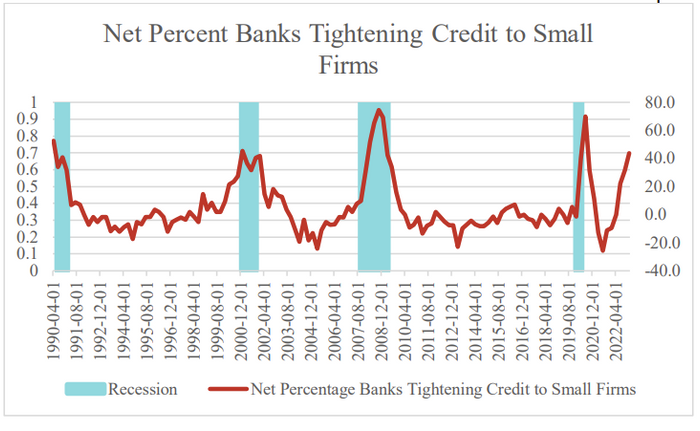

10. The Principal Virtues and Vices.

Neel Burton M.D. Psychology Today