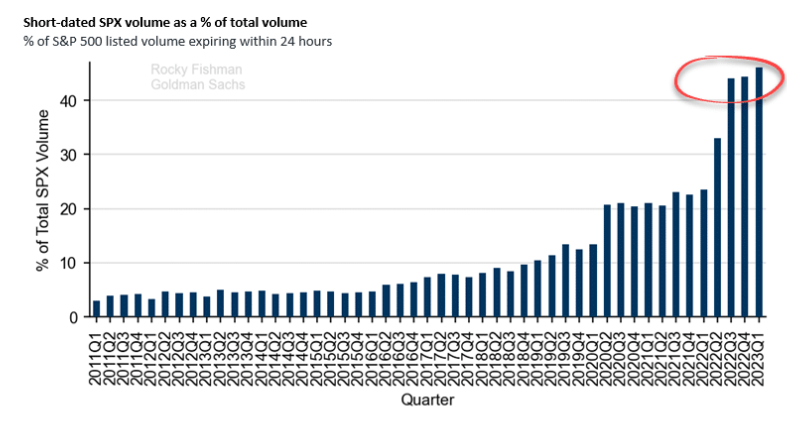

1. 2022 Speculation Comeback…Retail Order Flow Higher than Covid.

Found at Irrelevant Investor Blog https://theirrelevantinvestor.com/

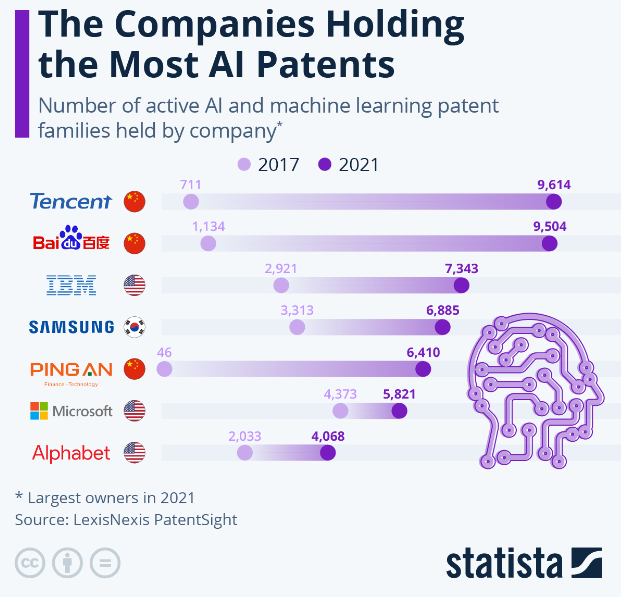

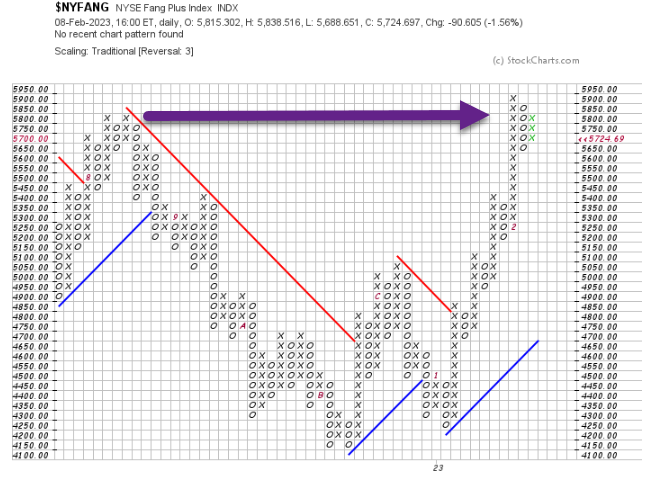

2. FANG+ Stocks Update

FANG Plus Index Broke Above Summer 2022 Highs

50Day Turning Up But Still Below 200Day on Chart

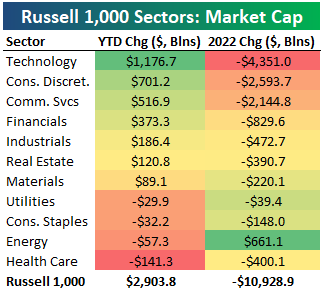

3. $2.9 Trillion in Market Cap Added

Bespoke Investment Group After seeing the total market cap for the Russell 1,000 fall by $10.9 trillion in 2022, we’ve seen a rebound of $2.9 trillion in market cap so far in 2023. Below is a look at the total change in market cap by sector across the Russell 1,000 so far in 2023 and for all of 2022. The Tech sector saw its market cap fall $4.35 trillion last year, and it has seen its market cap rise by $1.176 trillion to start 2023. Consumer Discretionary’s market cap has risen by $701 billion, followed by Communication Services at $516.9 billion and Financials at $373 billion.

Four sectors have actually seen their market caps fall this year. Health Care’s market cap has fallen the most at -$141 billion, while Energy has fallen $57 billion, Consumer Staples has declined $32.2 billion, and Utilities has fallen $29.9 billion.

https://www.bespokepremium.com/interactive/posts/think-big-blog/2-9-trillion-in-market-cap-added

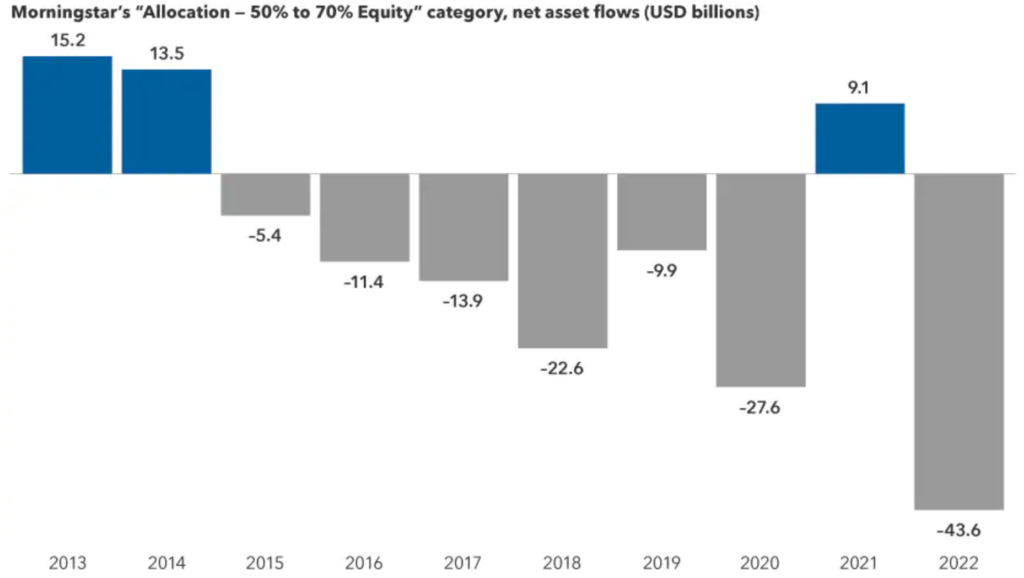

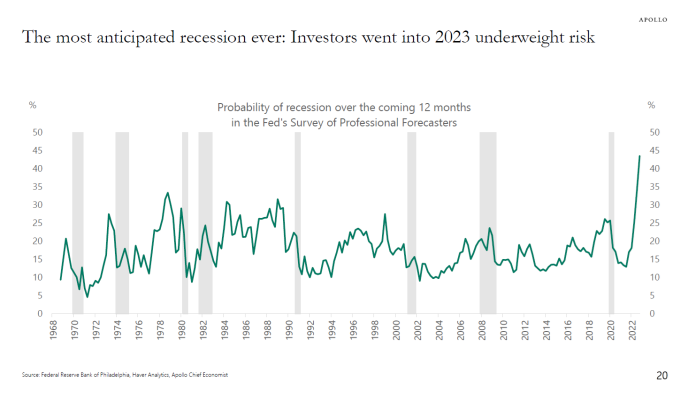

4. Probability of Recession Survey was Highest Ever

Torsten Slok Investors have been underperforming their benchmarks because they entered 2023 underweight equities, expecting a slowdown that still hasn’t happened, see chart below.

Torsten Slok, Ph.D.-Chief Economist, Partner

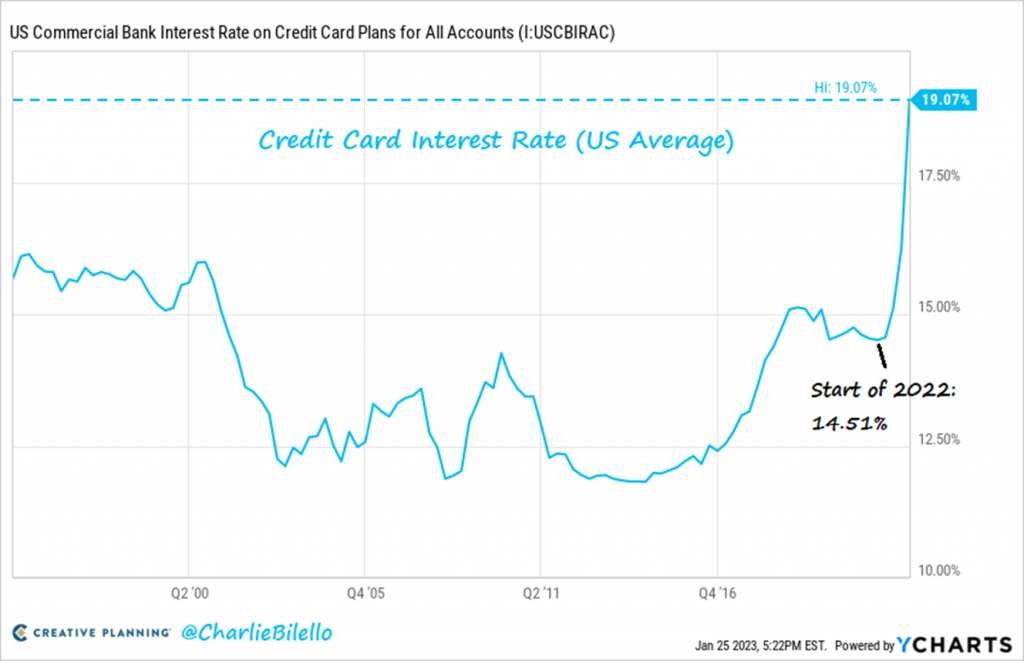

5. Junk Bond Spreads Well Below Highs

Dave Lutz at Jones Trading CREDIT LEADS– Prices of risky US companies’ debt have risen sharply this year as investors bet the Federal Reserve will bring inflation under control without triggering a damaging recession. Yields on US junk bonds — debt sold by businesses with low credit ratings — have fallen by more than one percentage point since the end of 2022, according to an Ice Data Services index, trading at an average of 7.97 per cent. The decline reflects a sharp increase in prices. In turn, the gap between junk yields and those of US government bonds has narrowed by more than 0.8 percentage points to less than 4 percentage points — the first time it has sat below that level since last April. The shrinking “spread” implies waning expectations of debt defaults for the $1.8tn low-grade corporate bond market.

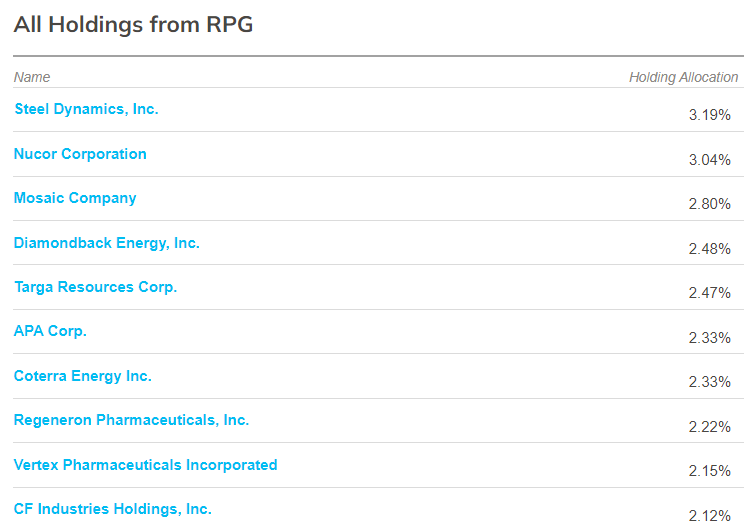

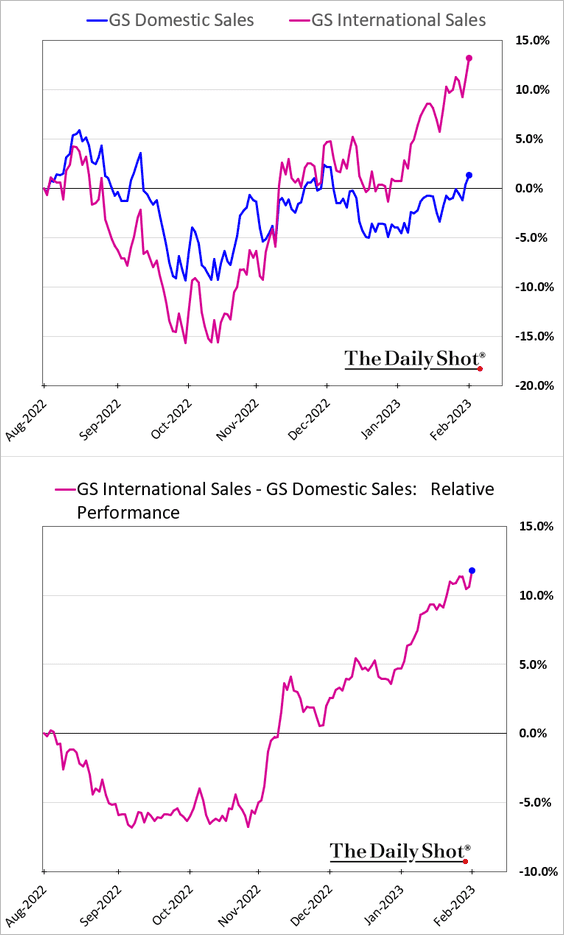

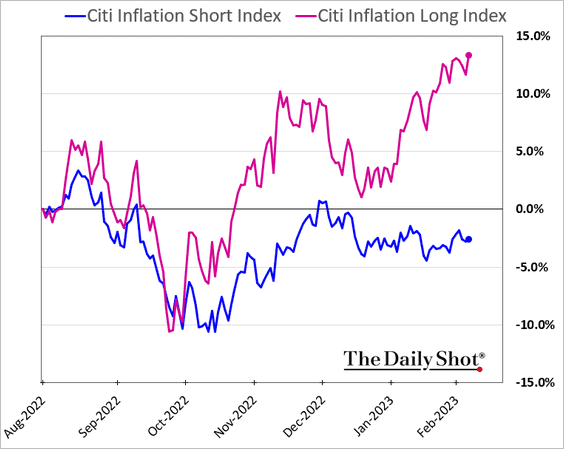

6. Inflation Related Stocks Still Outperforming.

Equities: Despite slowing inflation, companies that benefit form higher prices have been outperforming.

Source: The Daily Shot

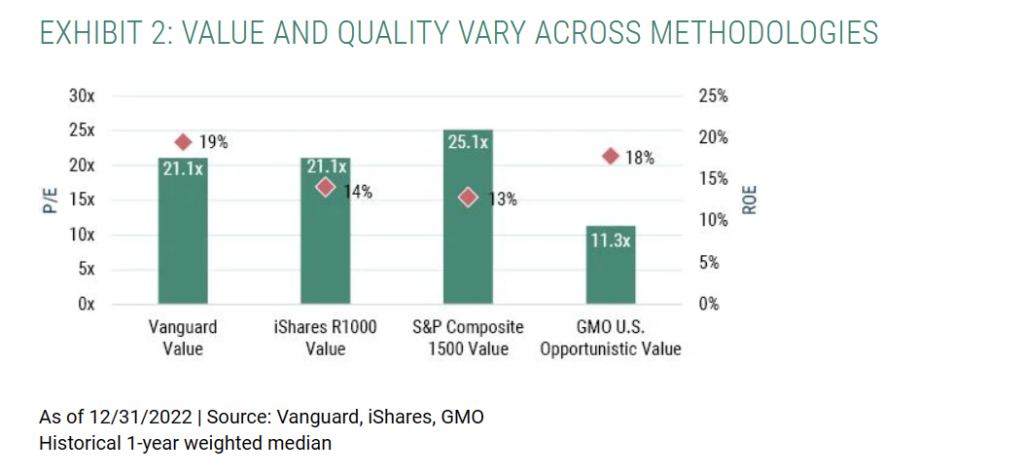

7. Value ETFs/Funds Trading Over 20X P/E

What Is Value? Methodology Matters (gmo.com)

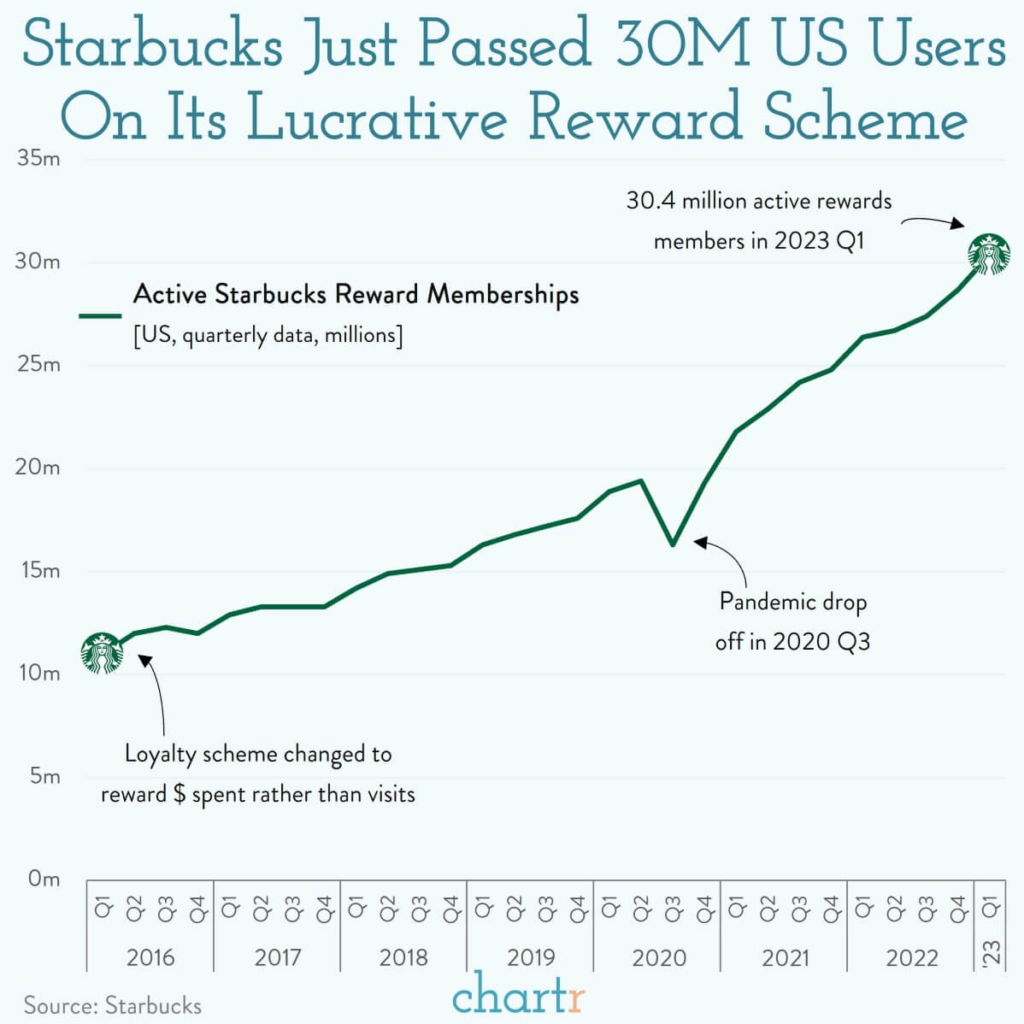

8. Starbucks Growth in Active Rewards Members

9. Electrification Targets for Carmakers

Paul Jacobs EVBoosters.com

https://www.linkedin.com/in/pauljanjacobs/

10. A neuroscientist shares the 4 ‘highly coveted’ skills that set introverts apart: ‘Their brains work differently’

Cnbc Friederike Fabritius, Contributor@FRIEDERIKEFAB

Being the most talkative person in the room may be a good way to get people’s attention, but it doesn’t necessarily mean you have the best ideas.

As a neuroscientist, I’ve worked with large companies like Google and Deloitte on how to attract and retain top talent, and I’ve found that employers tend to favor extroverts.

But there are some surprising strengths that introverts bring to the table, and they shouldn’t be overlooked.

As bestselling author Susan Cain points out in her book, “Quiet: The Power of Introverts in a World That Can’t Stop Talking”: “Extroverts are more likely to focus on what’s happening around them. It’s as if extroverts are seeing ‘what is,’ while their introverted peers are asking ‘what if.’”

What sets introverts apart from extroverts

Don’t get me wrong: Both extroverts and introverts have wonderful qualities. But research shows that introverts may have the upper hand.

Here are four highly coveted skills that set introverts apart from everyone else:

1. Introverts think more.

Gray matter, which exists in the outer most layer of the brain, serves to process and release new information in the brain.

One Harvard study found that introverts’ brains work differently, and have thicker gray matter compared to extroverts. In people who are strongly extroverted, gray matter was consistently thinner. Introverts also showed more activity in the frontal lobes, where analysis and rational thought take place.

Another study that scanned brains of both introverts and extroverts found that, even in a relaxed state, the introverted brain was more active, with increased blood flow.

2. Introverts can focus longer.

When Albert Einstein — a known introvert — was a child, his teachers thought he was a quiet loner who seemed a million miles away, lost in his thoughts.

Einstein said: “It’s that I stay with problems longer.” This ability to focus intensely is a key characteristic of introverts, who often have more extended focus than extroverts.

Because they enjoy spending time alone, introverts tend to be more willing than extroverts to put in the hours alone necessary to master a skill.

3. Introverts are often “gifted” in a specific field.

On average, introverts and extroverts are the same in terms of intelligence. But statistics show that around 70% of gifted people are introverts.

People are considered “gifted” when they exhibit above-average intelligence or a superior talent for something, such as music, art or math.

If your workplace is dominated by extroverts who criticize those who prefer to work alone — or skip after-work cocktails — as “not team players,” it may inadvertently alienate gifted people.

4. Introverts do the right thing.

Introverts tend to be less swayed by external events and driven more by their inner moral compass.

A 2013 study on social conformity found that extroverts are more willing to go along with the opinion of the majority, even if it’s wrong. Extroverts are more likely than introverts to succumb to social pressure.

The researchers concluded: “The higher the pressure, a larger number of conforming responses are given by extroverts.” In contrast, “there is no difference in conforming responses given to high- and low-pressure levels by introverts.”

How to create a workplace where introverts thrive

Introverts are often exhausted in their workplace because many of their colleagues don’t know how to harness the power introversion.

Here’s how managers can create an introvert-friendly workplace:

· Respect boundaries. It takes up to 23 minutes for a person to regain focus after they’ve been interrupted. Don’t expect people to answer every email or Slack message immediately.

· Brainstorm alone. Letting people shout ideas at each other in a room sounds like fun. But research shows that if you want to maximize creativity, let people generate ideas by themselves before sharing them in a group. Bonus: Your introverts will be far more comfortable sharing.

· Shorten meetings. Many introverts, as you can probably guess, are not fans of meetings. Let go of the idea that the entire office has to be invited to every meeting so that no one feels left out.

· Don’t force a certain type of communication. The introverts in your office may prefer emails, while the extroverts might enjoy handling business on the phone. Encourage people decide how they want to communicate, like whether to turn their cameras on or off, even if it differs from yours.

· Provide the option of privacy. Extroverts may love to see everybody all the time, but introverts tend to need privacy. The solution is a flexible work environment that provides silence and private space for introverts, and lively, interactive open space for extroverts.

As an introvert, my general message to employers is, “Let my people rest.” Like it or not, the future of work is all about more choices, autonomy, and a culture that embraces introversion.

Friederike Fabritius, MS, is a neuroscientist and trailblazer in the field of neuroleadership. She has given talks at large organizations including Google, Accenture, Deloitte, BMW and Audi, and serves on the prestigious German Academy of Science and Engineering. She is also the best-selling author of “The Leading Brain: Neuroscience Hacks to Work Smarter” and “The Brain-Friendly Workplace: Why Talented People Quit and How to Get Them to Stay.” Follow her on Facebook, Instagram and Twitter.