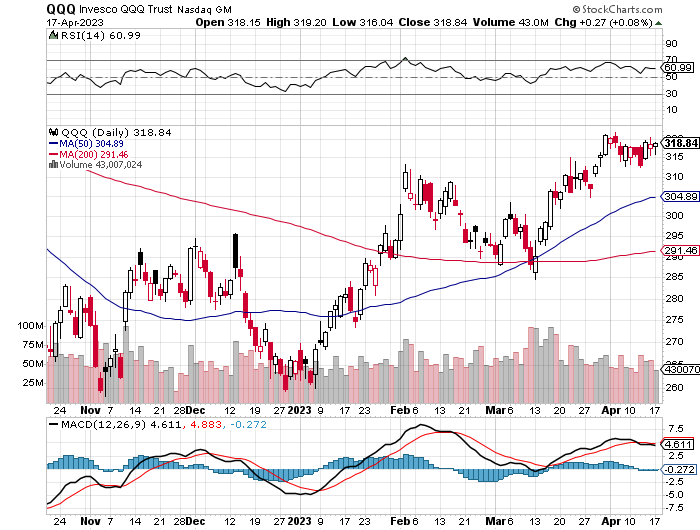

1. Nasdaq 100 30x trailing earnings to 40x trailing earnings in 2 Months.

Following a 20% rally in the year-to-date, the tech-heavy Nasdaq 100 now trades at nearly 40 times trailing earnings, Verdad Weekly Research relays, citing data from Capital IQ, up from just over 30 times in early January. From Grant Interest Rate Observer https://www.grantspub.com/

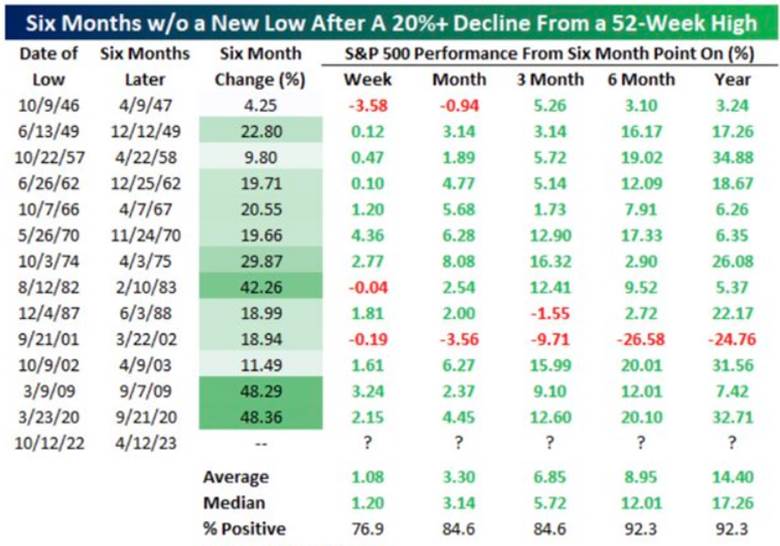

2. History….Six Months After 20% Correction

From Dave Lutz at Jones Trading It’s been 6 months since the S&P’s low – “Since WW2, we found 13 prior periods in which the SPX made a major low after a 20%+ drop and then didn’t make a new low in the next six months .. Six and twelve months after,.. the S&P 500 was higher 12 times” says Bespoke.

https://www.bespokepremium.com/interactive/research/think-big-blog/

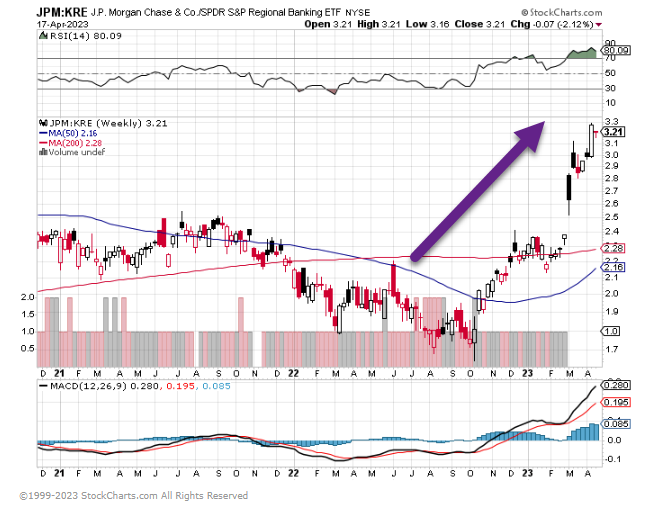

3. JP Morgan vs. Regional Banks

This chart compares JP Morgan stock vs. regional bank ETF

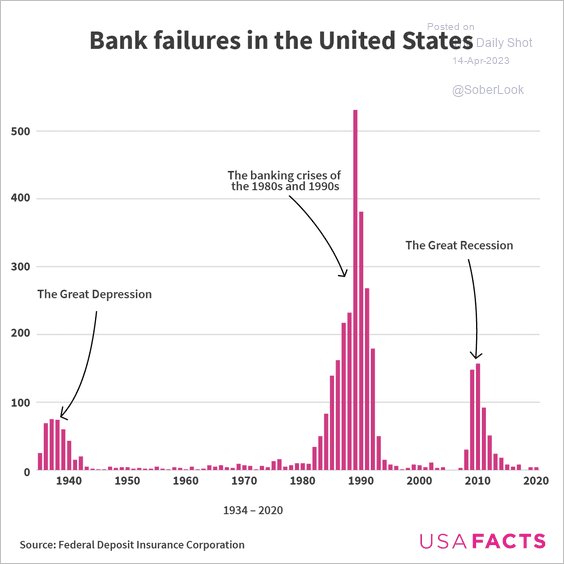

4. History of Bank Failures in U.S.

The Daily Shot Brief

https://dailyshotbrief.com/

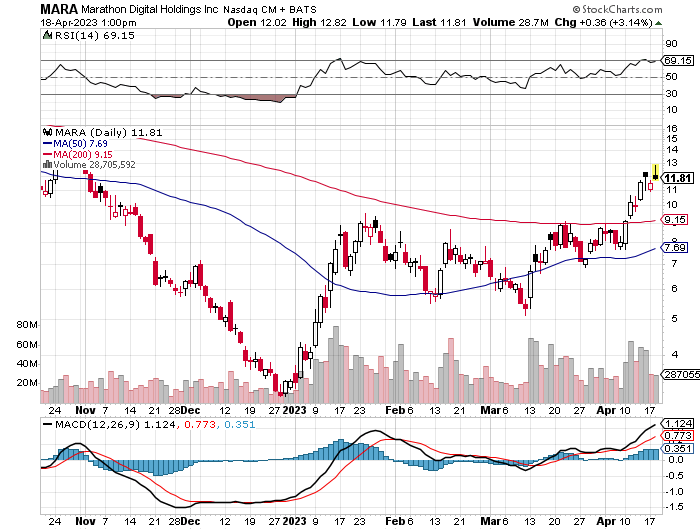

5. Bitcoin Miner Stocks.

RIOT +300% Off Lows

MARA +350%

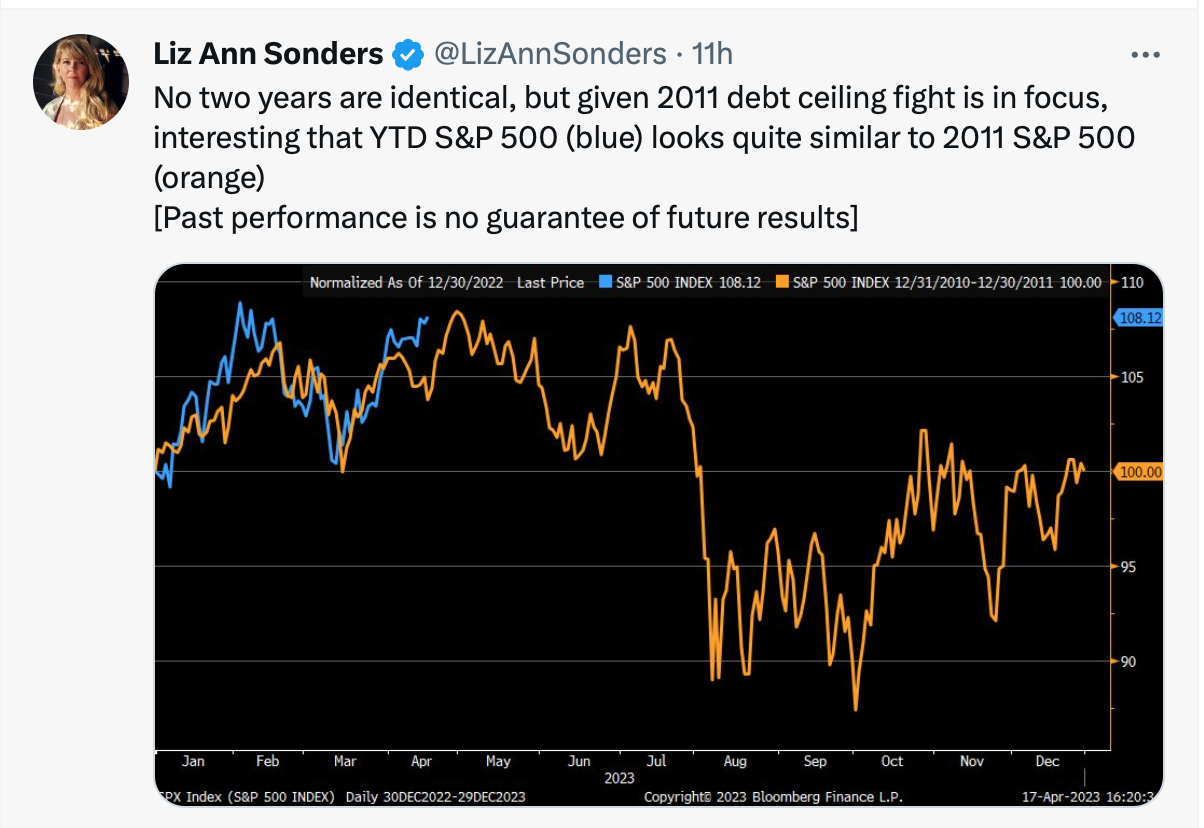

6. Debt Ceiling Coming this Summer?

https://twitter.com/LizAnnSonders

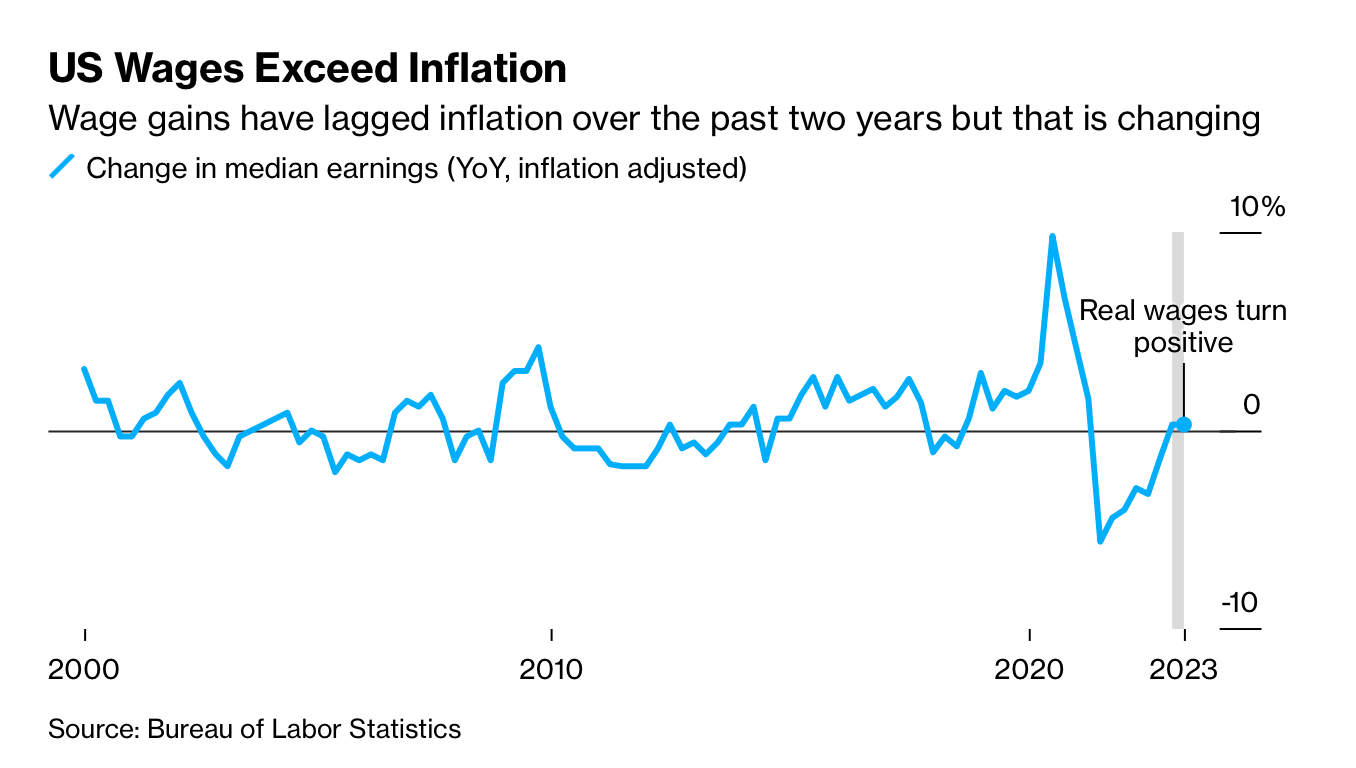

7. U.S. Wages Exceed Inflation

Bloomberg Molly Smithhttps://www.bloomberg.

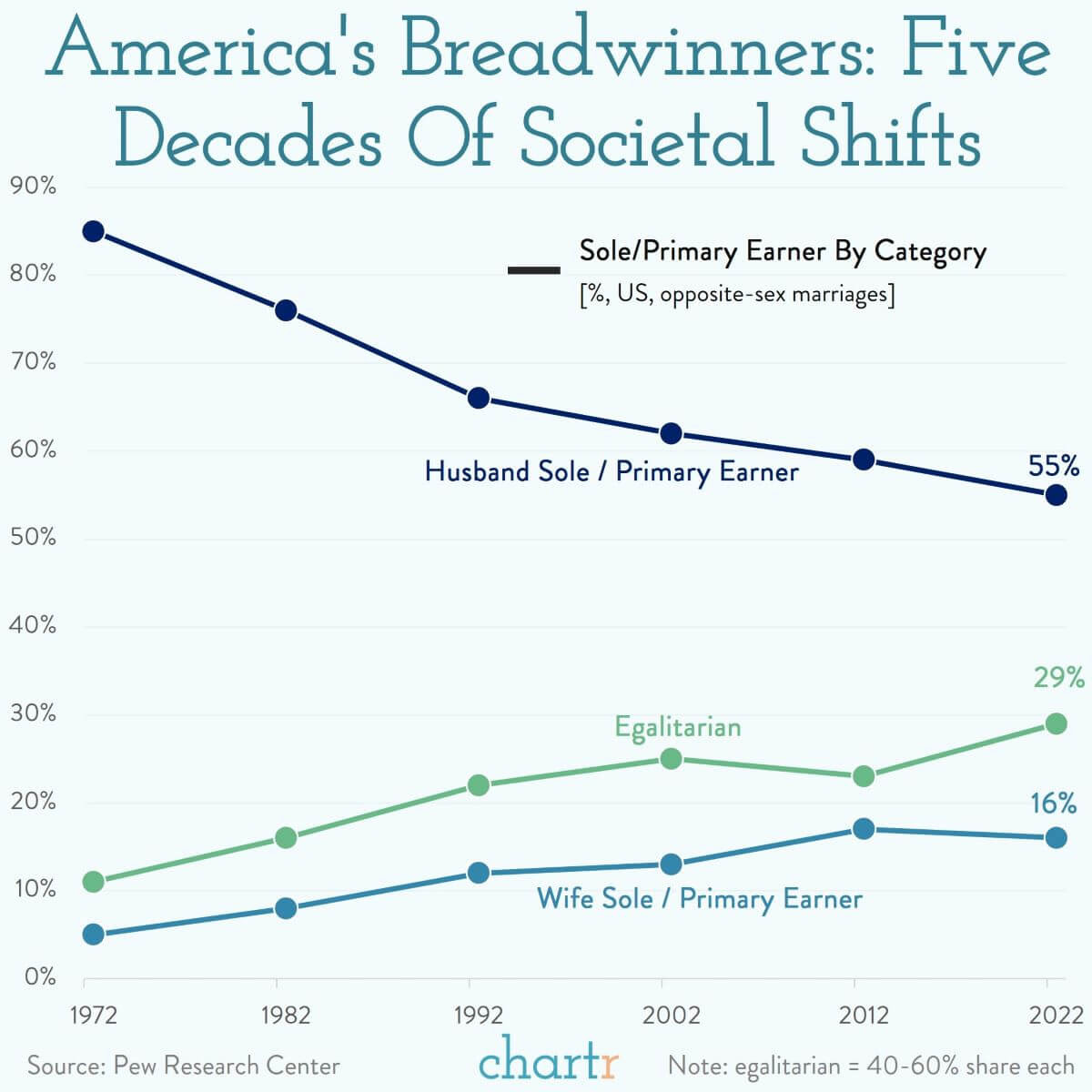

8. Women Becoming Breadwinner

Chartr For richer, for poorer New analysis of government figures by Pew Research Center reveals that women in opposite-sex marriages are increasingly earning more than, or the same as, their husbands.

The study found that men are now the sole or primary earners in just 55% of American marriages compared to 85% in 1972, with a large portion of those households now “egalitarian” — marriages where the husband and wife each account for 40-60% of the household’s total income.

BreadwinnersOne of the more notable findings from the study is that 16% of opposite-sex marriages now have the wife as the primary or sole breadwinner. That’s a proportion that has more than tripled in the last 50 years, but was actually a slight drop on the equivalent study from 2012. The rise of wives as breadwinners is unsurprising in the context of wider societal shifts in America, as the female share of overall income in North America continues to rise, and women now account for nearly 60% of college students across the country. However, while their share of marital earnings is on the up, Pew Research also found that women are still doing the larger share of work around the home too, spending ~2 more hours a week on caregiving responsibilities and more than double the amount of time on housework.

9. IWM Small Cap Stocks….Holding Lows 3rd Time

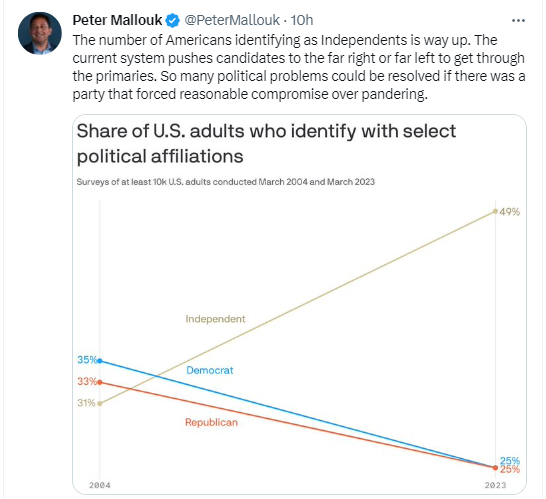

https://twitter.com/PeterMallouk

10. Rich vs Wealthy: A Comprehensive Guide to Different Financial Lifestyles

Posted April 18, 2023 by Nick Maggiulli

What does it truly mean to be rich vs wealthy? Is there a difference between them, or are they merely two sides of the same coin? While these terms might seem interchangeable at first glance (I’ve been guilty of this many times before), they actually represent two distinct mindsets that can significantly impact your financial future.

In this blog post, I will do a deep dive on the rich vs wealthy debate to debunk common misconceptions on the subtle, yet critical differences that set these financial lifestyles apart. By the end, you’ll not only have a newfound understanding of these terms, but also a clearer vision about which of these is right for you.

To start, let’s take a look at what it means to be rich.

Defining Rich

“Rich” typically refers to individuals who have a high income or possess a substantial amount of money. This status is usually characterized by:

- A high salary or business income

- A luxurious lifestyle

- Expensive possessions such as cars, homes, and designer items

- Short-term financial success

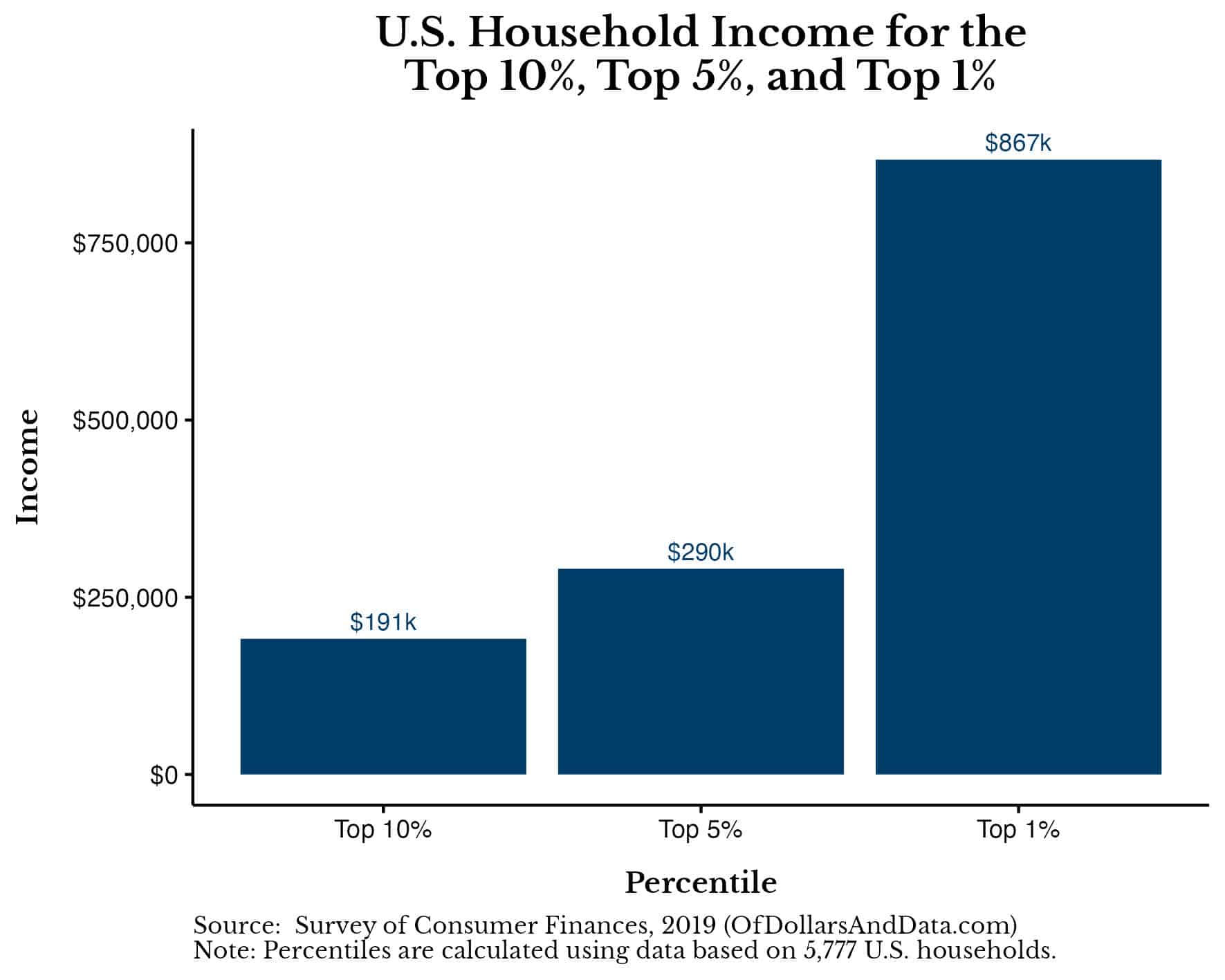

While there is no one-size-fits-all definition of what income level is considered rich, the top 10%, top 5%, and top 1% of U.S. household incomes are a good benchmark to consider:

Though these income levels could classify someone as “rich”, as I have mentioned before, factors such as age, education level, and where you live should also be incorporated into the discussion.

Additionally, it’s important to remember that having a high level of income doesn’t guarantee financial stability or lasting prosperity. In fact, a high income can create a false sense of financial security, leading individuals to overspend and neglect building wealth for the long term. In this sense, being rich isn’t about a particular level of income, but a consumption-focused mindset (and the luxury lifestyle that comes along with it).

History is rife with examples of rich celebrities and athletes that lost it all thanks to their poor financial choices. However, my favorite case study is The Vanderbilts. Not only did the Vanderbilts buy nine mansions on Fifth Avenue in New York City (some of the most expensive real estate in the world), but they also threw extravagant parties where they dined on horseback and regularly lit their cigars with $100 bills (in the early 1900s!). It wasn’t long before everything came crashing down in the Great Depression and they lost the bulk of their family fortune.

The key takeaway from their example is that prioritizing material possessions can lead to a precarious financial situation, even for the richest among us. This is why, as we’ll see in the next section, being wealthy requires a different approach to money management altogether.

Defining Wealthy

Being wealthy is about more than just having money. It’s about accumulating assets and resources that generate income for long-term financial security. This financial status is characterized by:

- A diverse portfolio of investments

- Passive income streams

- Financial independence

- Long-term financial planning and stability

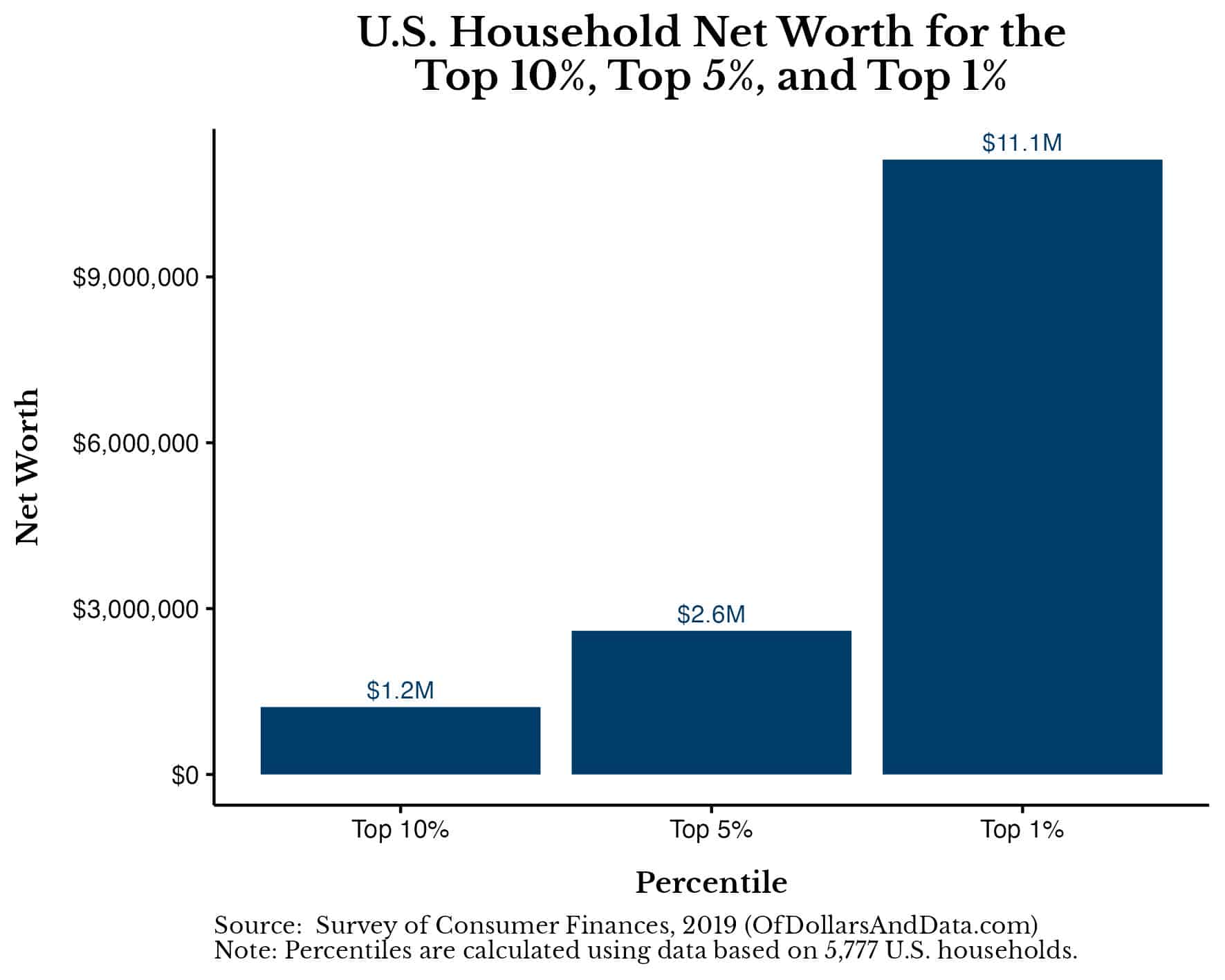

Though we don’t have an explicit definition of “wealthy”, the net worth needed to be in the top 10%, top 5%, and top 1% of U.S. households, according to the Survey of Consumer Finances (SCF), is a decent proxy:

If you are shocked by these amounts, I wouldn’t worry. These net worth figures are highly dependent on age, education level, and your geographical location (just like the income numbers in the prior section). If you are younger, have less education, or live in a lower cost of living area, you are likely much wealthier than these figures suggest.

But this misses a bigger point on what it really means to be wealthy. Because being wealthy isn’t a number, it’s a lifestyle. A lifestyle where you don’t have to actively work for your income. A lifestyle where you can pursue your passions and interests. A lifestyle where you are free to do what you want.

So, while age and geographic location are important, your wants and needs will have a much bigger impact on how wealthy you actually feel. This is why I like to say:

Your net worth doesn’t determine how wealthy you are, your desires do.

Therefore, if you want to feel wealthier you can either: (1) increase your net worth or (2) decrease your desires. This is how you can have far less than someone else while still feeling like you have much more.

How to Become Financially Wealthy

No matter how you decide to go about it, the journey to wealth often begins with a shift in mindset. You will need to turn your focus away from short-term material gain and towards a more strategic, long-term approach to managing your finances. Here are a few ways you can do this:

- Focus on raising your income: If there’s one idea I wish I could relay to every person about personal finance, it’s that income is the key to building wealth. Besides those successful business owners who built extreme wealth (i.e. billionaires), basically everyone else did it through their income. So, if you want to build more wealth, you should focus on raising your income over the long run. I’ve detailed some ways to do this in Ch. 3 of Just Keep Buying if you want to learn more.

- Invest in a diverse set of income producing assets: Once you have raised your income, the next step is to use that extra income to acquire income producing assets and don’t stop. By purchasing income producing assets over time, you can re-build yourself as a financial asset equivalent that can provide you with income when you are unwilling or unable to work in the future. While it’s great to work hard for your money, it’s even better when your money works hard for you.

- Create additional streams of income: In the process of buying income producing assets, you will create additional income streams for yourself (e.g. from dividends and interest). But I wouldn’t stop there. There are many other income streams that you should consider (i.e. royalties, products, etc.) as well. The primary benefit of having multiple income streams is that you reduce your overall financial risk. Having extra streams of income in case you lose your main one (likely your job) can be a financial lifesaver when you need it most.

- Plan for the life you want: While building wealth is important, knowing what you want to do with your wealth is even more important. Because without a plan for how you want to use your wealth, you may end up feeling empty once you’ve built it. I have previously written about how this occurs for some in the Financial Independence Retire Early (FIRE) community, but it doesn’t have to be that way. By figuring out what you actually want out of life, you can take more purposeful steps toward building wealth in the way that matches your long term goals. That’s how you become wealthy

If you are interested in learning more about this subject, I recommend reading about where millionaires keep their money and why it’s not where you think.

Now that we have spent some time defining “rich” and “wealthy”, let’s highlight the key differences in the rich vs wealthy discussion to illustrate where you should focus your future efforts.

Rich vs Wealthy: What are the Differences?

Imagine two individuals, Mr. Rich and Ms. Wealthy, who represent the contrasting financial mindsets we’ve covered above.

Mr. Rich earns an impressive salary and loves to showcase his success with luxury cars, designer clothes, and extravagant vacations. He is the life of the party and appears to have it all. However, his high-income is matched by his high spending habits, leaving him with little savings or investments. Should his income suddenly disappear, Mr. Rich’s financial situation would quickly crumble, revealing the facade of his seemingly successful lifestyle.

Ms. Wealthy, on the other hand, earns a similar income to Mr. Rich but chooses to live a more modest lifestyle. She invests a significant portion of her earnings into a diverse portfolio of income producing assets that creates passive income streams, such as rental properties and dividend stocks. While she may not have the outward appearance of success, Ms. Wealthy enjoys true financial freedom, knowing that her assets and income will continue to support her lifestyle, regardless of whether she works.

The key differences between Mr. Rich and Ms. Wealthy illustrate these contrasting approaches to personal finance:

- Spending vs Saving: Mr. Rich’s spending habits leave him with little financial cushion, while Ms. Wealthy’s savings and investments grow her net worth.

- Active vs Passive Income: Mr. Rich relies on his salary to maintain his lifestyle, while Ms. Wealthy’s passive income streams provide her with financial stability and independence.

- Appearance vs Reality: Mr. Rich focuses on the outward display of success, while Ms. Wealthy prioritizes her long-term financial well-being and freedom.

Through the example of Mr. Rich and Ms. Wealthy, we can see how the choices we make can impact our financial future.

The Bottom Line

Understanding the difference between rich vs wealthy is crucial for anyone looking to achieve long-term financial success. By recognizing that wealth is about more than just money, you can make the conscious decision to focus on not just building assets and income streams, but also on designing the life you truly desire.

Of course, this is easier said than done. Building wealth can take decades and knowing yourself can take even longer. But, if you do the work and spend the time figuring out what you want, you may just find that becoming wealthy isn’t as out of reach as you once imagined.

Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter or checking out my prior work in e-book form. https://ofdollarsanddata.com/