1. Tuition Revenue Has Fallen at 61% of Colleges During the Pandemic

From Barry Ritholtz Blog

Source: Chronicle of Higher Education https://ritholtz.com/2023/03/sunday-reads-314/

2. AAII Sentiment Poll….Less Than 25% of Investors are Bullish

Bespoke Investment Group Sentiment Back to Bearish The consistency of declines throughout February and to start the month of March has sent sentiment decisively lower. The latest data from the American Association of Individual Investors (AAII) showed 23.4% of respondents reported as bullish, up modestly from 21.6% last week but still down significantly from 34.1% two weeks ago. With less than a quarter of respondents reporting as bullish, bullish sentiment continues to sit firmly below its historical average of 37.5% for a record 67 straight weeks.

https://www.bespokepremium.com/interactive/posts/think-big-blog/sentiment-back-to-bearish

3. Bank of Americas Sell Side Indicator Lining Up with AAII Poll in #2

Barrons At February’s close, Bank of America’s Sell Side Indicator, a measure of Wall Street sentiment, was still leaning Sell, but the metric was only 1.5 percentage points away from where Sell would become Buy. When that happens, the S&P 500 has a 95% chance of being positive 12 months later, with an expected return of 16%, making this the most bullish of BofA’s market metrics. By

Carleton English

https://www.barrons.com/articles/stock-market-dow-nasdaq-s-p-500-253c4a1a?mod=past_editions

4. Private Equity Dry Powder Up 15.6% End of 2022 vs. 2021 to $3.7 Trillion-Bain Capital

https://www.bain.com/insights/private-equity-outlook-global-private-equity-report-2023/

5. Crude Oil Production Still Below 2019 Peaks

Avi Salzman -Barrons

6. New York Stock Exchange and Nasdaq Dominate Global Listings

WSJ New York’s dominance over London has grown over time. At the end of last year, the combined market cap of listed companies at the NYSE and Nasdaq was $40.3 trillion, roughly 13 times the $3.1 trillion at the London Stock Exchange LSEG 1.94%increase; green up pointing triangle, according to data from the World Federation of Exchanges. A decade earlier, the combined market cap at the two U.S. exchanges was about six times LSE’s total market cap, WFE data shows.

By Ben Dummett, Alexander Osipovichand Josh Mitchell

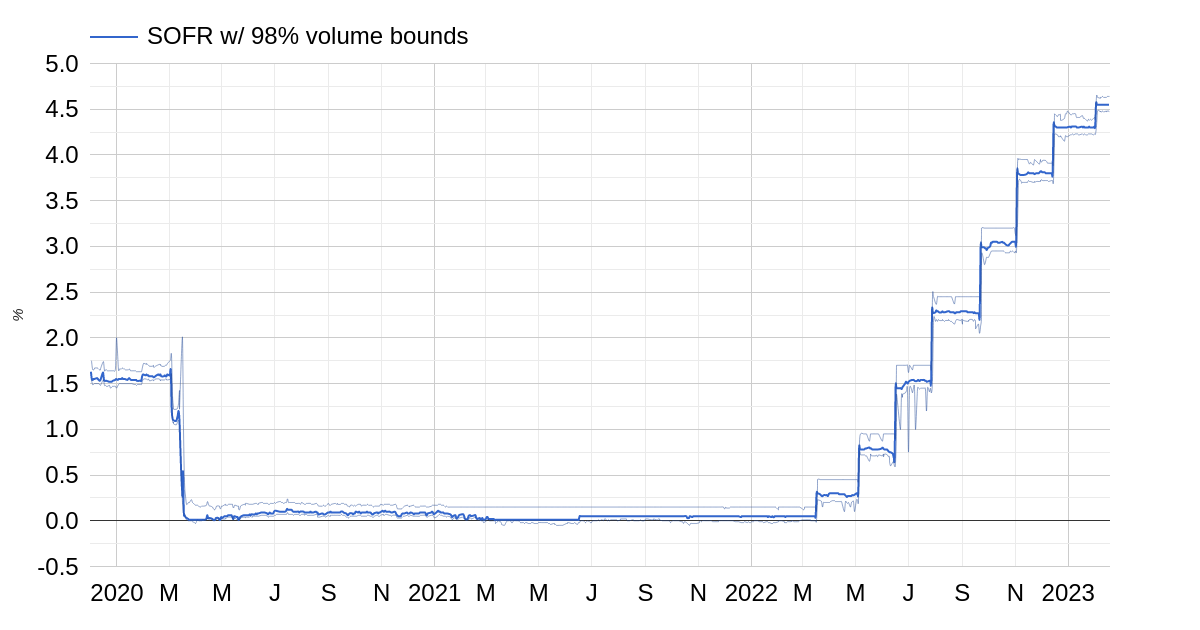

7. 40% of U.S. Mortgages were Locked in During Pandemic at Low Rates

(Bloomberg) — More than 40% of all US mortgages were originated in 2020 or 2021, when the pandemic drove borrowing costs to historic lows and triggered a refinancing boom, according to data from Black Knight.

That’s good news for all the homeowners who locked in cheap loans — but maybe not so great for the Federal Reserve, as it seeks to cool the economy by raising interest rates.

Almost one-quarter of all mortgages are 2021 vintage, according to Black Knight, a mortgage technology and data provider. That year, the average cost of a 30-year fixed-rate loan touched a low of 2.8%. Another 18% of home loans date from the previous year, when the pandemic hit.

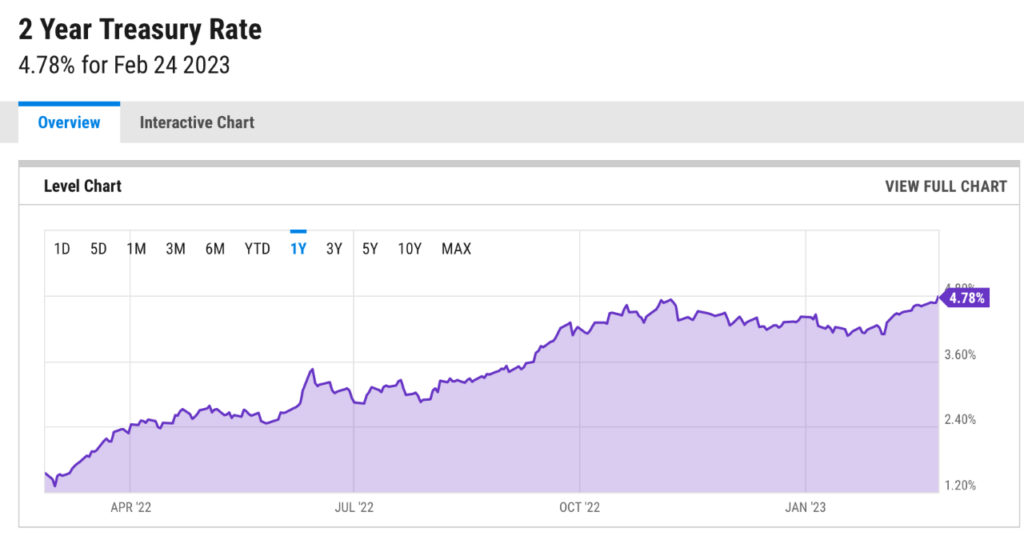

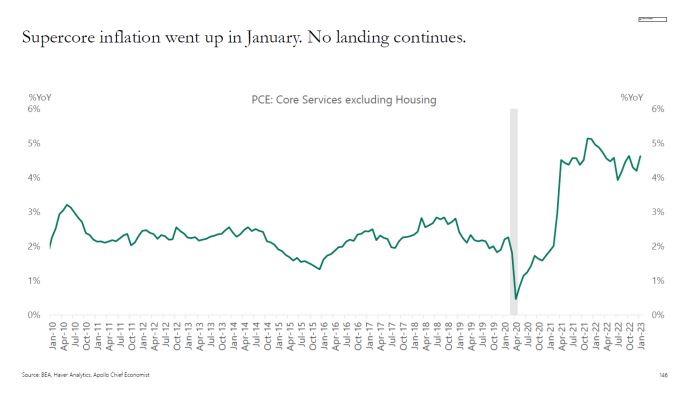

The numbers illustrate one obstacle for the Fed, which is hiking rates at the steepest pace in decades to rein in inflation.

One way that monetary tightening works is by damping consumer demand, as credit becomes more expensive. That’s having an impact on housing markets now, because new buyers have to pay 7% or more. But the large majority of American homeowners have fixed mortgages, mostly much cheaper than today’s going rate. Those who refinanced in the pandemic have locked in extra purchasing power for potentially decades ahead.

Things used to be different when more Americans had mortgages that carried variable interest rates. In a report this week, UBS economists estimated that the share of floating-rate debt in the US mortgage pile has shrunk to about 5%, from a peak of around 40% in 2006. That’s one reason for the “lower responsiveness of household credit to higher rates,” they wrote.

Still, even if the shift to fixed-rate mortgages makes the Fed’s anti-inflation campaign a little harder, there’s an obvious upside.

The last time the Fed hiked rates by a comparable amount was in the mid-2000s when adjustable-rate mortgages were widespread. The result: Housing markets crashed — and not long afterwards, so did the world economy.

©2023 Bloomberg L.P. https://www.bnnbloomberg.ca/sorry-fed-most-us-mortgage-rates-were-locked-in-during-pandemic-lows-1.1890930

8. Institutional CFA’s MBA’s Turn to Reddit for Stock Picks

Institutional Investors Are Using Reddit to Make Investment Decisions. Here’s Where They Lurk.

And it’s not just Reddit — digital media from newsletters to TikTok are also playing a role.

At long last, the Reddit retail investors may finally be enjoying their day in the sun: Major institutional investors are taking note of what they do — and they’re making investment decisions based on it.

A new survey shows that 58 percent of the institutional investors polled have made an investment decision based on information they found on Reddit.

Since 2020, when retail trading began to take off, the social media forum site has become a haven for retail traders interested in both meme stocks like AMC and plain vanilla passive investing.

The Brunswick Group surveyed 257 institutional investors in North America, the United Kingdom, and the European Union about how they use social media and other digital tools to inform their investment decisions. The majority of the respondents — 94 percent — were either portfolio managers or buy-side analysts.

“It’s kind of impressive year over year, not only how much they’re absorbing the information, but also [that they’re] making decisions based on it,” said Janelle Nowak-Santo, a partner at Brunswick.

The survey pointed out a convergence between institutional and retail investors, with institutions tapping into sites like Reddit and traditionally retail-oriented newsletters and podcasts for information.

In fact, according to the survey, 49 percent of respondents consider Reddit to be of “high importance” when it comes to evaluating a stock. This result is similar to TikTok’s ranking, and trails sites like YouTube and Instagram by about 10 percentage points.

“There’s an inundation of information from all sources,” Nowak-Santo said. “I’d have to guess that in order to be prudent in their research, they’re actually using more of that information to make their decisions.”

So where on Reddit are these investors finding this information? The survey showed that popular investor subreddits include r/investing and r/cryptocurrency, with over half of all respondents saying that they follow those forums. Others that are commonly referenced include r/WallStreetBets and r/personalfinance. And their popularity may grow in the months to come, with 46 percent of respondents saying that they plan to increase their use of the platform.

“I think that’s just another interesting insight that [shows that] this gap between institutional and retail is narrowing,” Nowak-Santo said.

But Reddit is less important when it comes to data harvesting via machine learning, AI, and natural language processing. Just 23 percent of those surveyed said their firms are harvesting data from the social media site.

Google search results, perhaps not surprisingly, are the most popular place to harvest data. YouTube, however, ranks second, with 47 percent of investors tapping into the video platform’s data.

The survey also showed that investors are turning their focus from traditional mediums to newsletters and podcasts. In fact, 61 percent said they plan to increase their use of e-mail newsletters for equity evaluation in the coming year, while half of respondents said the same for podcasts.

These platforms are also considered to be more trustworthy than social media, ranking fourth and fifth, respectively, among those who took the survey, after investor relation sites, Google, and LinkedIn.

Among those surveyed, the Robinhood Snacks newsletter was most popular, tied with Value Investor Insight. Meanwhile, The Economist’s Money Talks is the favorite podcast among investors, with Invest Like the Best trailing close behind

9. All Portland Walmart Stores To “Permanently Close” Amid Theft Wave

BY TYLER DURDENIn order to address the issue of shoplifting and retail theft, the final two Walmart stores in the city of Portland will shutter their doors in late March.

FOX 12 Oregon reported that the Walmart locations at 1123 North Hayden Meadows Drive and 4200 Southeast 82nd Avenue at the Eastport Plaza would close on Mar. 24.

“The decision to close these stores was made after a careful review of their overall performance. We consider many factors, including current and projected financial performance, location, population, customer needs, and the proximity of other nearby stores when making these difficult decisions. After we decide to move forward, our focus is on our associates and their transition, which is the case here,” a spokesperson with Walmart told the local media outlet.

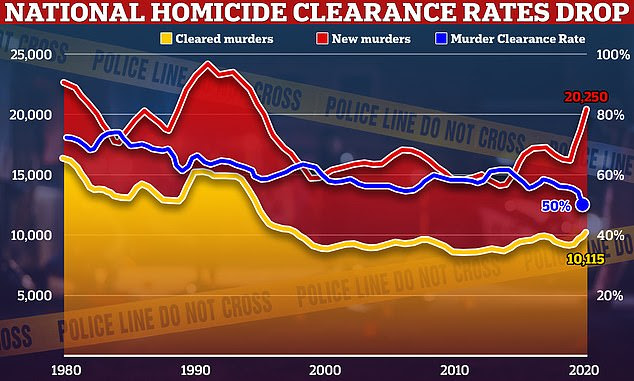

The announced closures come amid a wave of violent crime across the Portland metro area, which includes retail thefts, armed robberies, and homicides. The city has also seen a surge of violent protests from ANTIFA and BLM groups.

Oregon Live reported that in 2022, Portland set a new record for homicides with 101 cases, surpassing the previous year’s record of 92. Meanwhile, a National Retail Federation report revealed that retailers experienced an average surge of 26.5% in organized retail crime (ORC) incidents in 2021 compared to the previous year.

Data from the Portland Police Bureau indicated that between January 2022 and January 2023, the city witnessed more than 6,000 burglary incidents. Additionally, the data revealed over 27,000 larceny offenses.

An exodus of businesses will only hurt low-income residents who need the pricing power at discount stores.

Recall a similar exodus with other retailers is happening in other progressive cities across the US, such as San Francisco.

https://www.zerohedge.com/political/all-portland-walmart-stores-permanently-close-amid-theft-wave

10. Here’s the No. 1 thing that ‘destroys’ relationships, say researchers who studied couples for 50 years

Dr. Jessica Griffin, Contributor@THEDRJESSICA

Dr. Pepper Schwartz, Contributor@PEPPERSCHWARTZ

As a psychologist and sexologist, we’ve been studying relationships for more than 50 years combined, and we’ve found that no matter how you slice it, most of them fail because of poor communication.

In his book “What Predicts Divorce?”, psychologist Dr. John Gottman identifies the four most problematic types of communication in relationships, based on his studies of 40,000 couples:

- Contempt: Expressing a lack of respect for our partners (e.g., name-calling, eye-rolling, ridiculing).

- Criticism: Attacking a partner’s character.

- Defensiveness: Protecting from criticism by using excuses or shifting blame.

- Stonewalling: Withdrawing from communication by ignoring, zoning out or acting busy.

Of these four, Gottman says, the biggest predictor of a failed relationship is contempt.

What does contempt look like?

Contempt is more than criticism or saying something negative. It’s when one partner asserts that they are smarter, have better morals, or are simply a better human being than the other.

The partner on the receiving end feels unworthy and unloved.

For example, continually interrupting the other person is disrespectful. But it turns into contempt when the interruption is not an overeager desire to talk, but rather a statement that the partner has nothing interesting or important to say.

It could be as obvious as a spouse saying, “Oh, he’s not worth listening to. He couldn’t tell a story to save his life.”

When this type of behavior becomes more than rare — and when it is either unrecognized or delivered with intent — any relationship, much less a marriage, is in trouble.

How contempt destroys relationships

Contempt makes it impossible for partners to feel like they have each other’s back. Instead of “it’s you and me against the problem,” partners are now the opponents. They never know when they might be attacked or undermined.

This often stems from individuals feeling that they are standing up for themselves, which is usually a healthy thing to do. But the problem is that they are standing up for themselves against their partner, trying to raise themselves up while tearing their partner down.

Contempt isn’t just bad for relationships — it’s also bad for our health. We need one another to survive. Contempt cuts off or threatens those ties to other people.

Research has shown that individuals who use contempt in their communication have higher rates of disease, including cancer, heart disease, and other illnesses such as colds or the flu.

How to eliminate contempt in your relationship

1. Identify and share negative feelings.

When we don’t know how to name or talk about negative feelings, it’s tempting to take them out on others.

For example: “I can’t believe you are canceling our date night to meet with your friends. You’re a selfish jerk. You never think about my feelings!”

To avoid contemptuous communication, use this formula instead:

- State what you’re feeling: “I feel annoyed and sad because I was looking forward to spending time together.”

- Add a request: “I’d like to avoid this happening in the future by talking about it first before changing plans.”

- Invite your partner to the conversation: “Do you think we can do that?”

2. Create a culture of appreciation.

Expressing appreciation helps us notice more of our partner’s positive qualities rather than the negatives.

Ideally, we want our positive statements and gestures to outweigh the negative ones — the magic ratio is at least five positive statements or feelings to one negative one.

Track your communication patterns over a week. How often are you engaging in negative interactions (e.g., nagging, criticizing, ignoring, eye-rolling) versus positive ones (e.g., praising, complementing, doing something nice for the other partner)?

The following week, interact with your partner using the magic ratio. Do you feel differently?

You can also try each making a list of 20 things you love about each other. Read them out loud, and challenge yourselves by adding to the list over time.