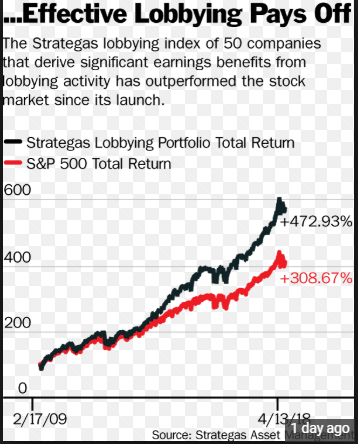

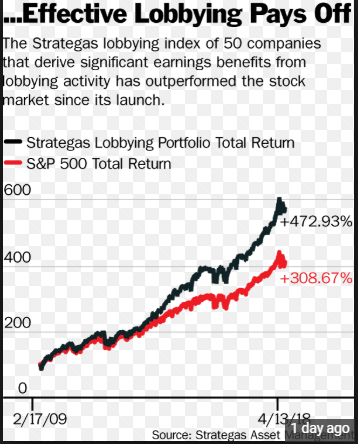

1.Corporate Lobbying is Big Business and It Shows Up in Returns.

About 10 years ago, Strategas devised a “lobbying” index of companies that get the most bang for their lobbying buck, including interactions with regulators. The index, it says, has outperformed the Standard & Poor’s 500 for nearly a decade by an average of almost five percentage points annually. The lobbying index returned an average 14.4% annually from its 2009 launch through April 13, versus 9.5% for the S&P 500. About $1 billion of assets are pegged to the performance of the Strategas index.

https://www.barrons.com/articles/lobbying-index-beats-the-market-1524863200

https://www.barrons.com/articles/lobbying-index-beats-the-market-1524863200

Continue reading →