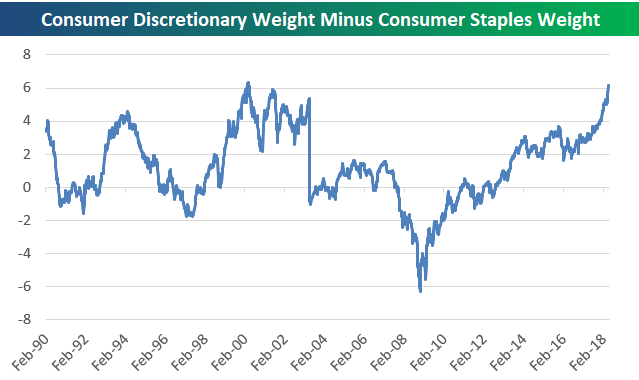

1.Spread Between Defensive Consumer Staples and Consumer Discretionary Has Only Been Higher in 2000

On page 6 of this month’s report, we provide the chart below which shows the spread between the weightings for Consumer Discretionary and Consumer Staples. At +6.12 percentage points, the only time Consumer Discretionary’s weight versus Consumer Staples has been higher was in April 2000.