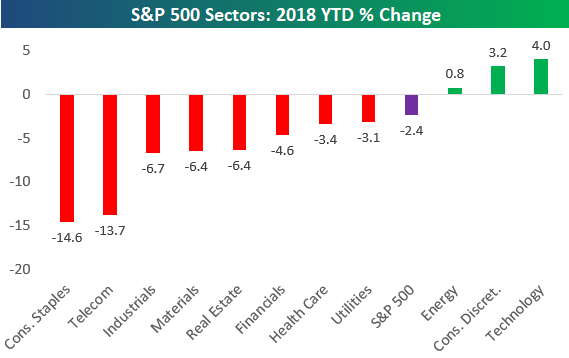

1. Tech and Consumer Discretionary Still Leading Sectors….No Shift Yet to Traditional Defensive Sectors.

Bespoke’s Sector Snapshot — 5/3/18

May 3, 2018

If you’re not yet a subscriber and would like to see the report, please start a two-week free trial to Bespoke Premium now.

Below is one of the many charts included in this week’s Sector Snapshot, which highlights the year-to-date percentage change of the eleven S&P 500 sectors. At this point, just three sectors are still in positive territory, while eight are in the red. Consumer Staples and Telecom are down the most with declines of more than 13%.

https://www.bespokepremium.com/think-big-blog/

2. One Year Treasury Yield Now Exceeds S&P Dividend Yield

Yardeni

http://blog.yardeni.com/2018/05/the-dividend-yield-scare.html

Found at www.abnormalreturns.com

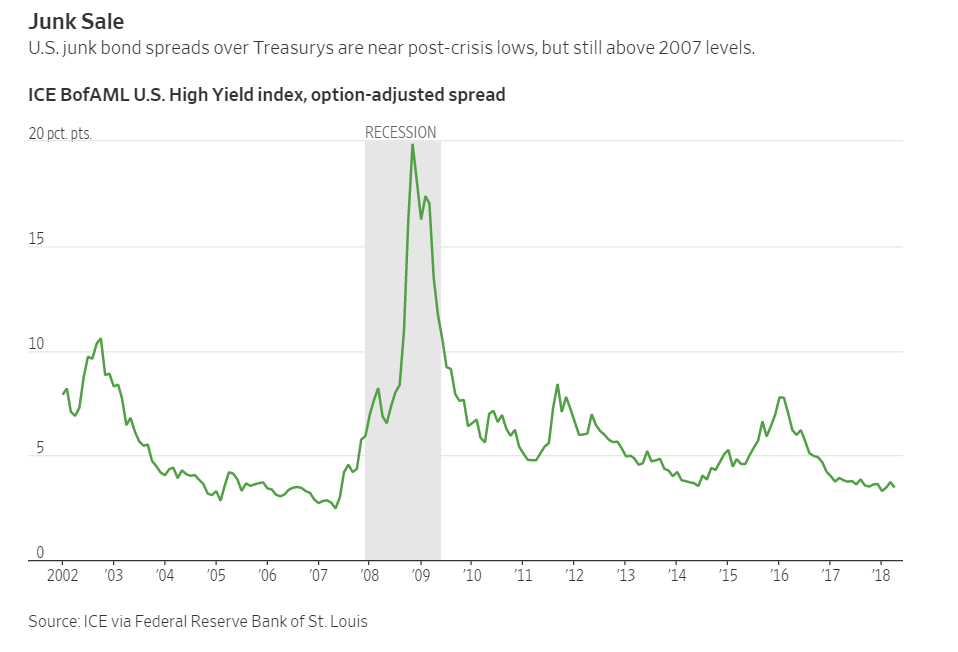

3. Junk Spreads Close to 2007 Levels.

One thing owners of junk bonds are usually sure of is that when the borrower defaults, they will get a veto on cash going to shareholders, to junior debtors or into new deals.

Not any more. Junk bonds financing private-equity firm KKR & Co.’s latest buyout subvert the usual order by allowing such payments to go ahead even after a formal default.

The $1.4 billion of bonds, to repay temporary borrowing for the buyout of Unilever PLC’s margarine business, mark a new low in the quality of covenants protecting lenders and are yet another sign of the wall of money chasing the higher yield on offer from junk bonds.

Several recent bonds have allowed what are known as restricted payments even when a company is in technical default—so that, for example, a planned takeover or joint venture wouldn’t be derailed. Flora Food Group, Unilever’s business, appears to be the first explicitly to allow them after a formal “event of default,” which should put creditors at the front of the line.

Watch Out: Junk Bonds Are Getting Junkier

Increased demand has allowed high-yield issuers to get away with weaker covenants that would never have been accepted in the past

https://www.wsj.com/articles/watch-out-junk-bonds-are-getting-junkier-1525366053?mod=ITP_businessandfinance_0&tesla=y

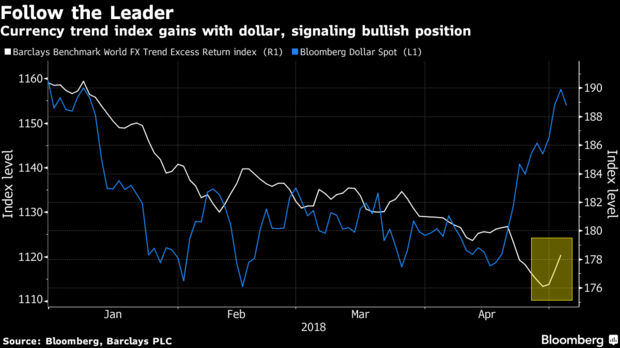

4. Follow Up to My Comments Earlier in the Week About Dollar Strength…Quant Shorts Get Squeezed.

The Robots Have Dropped Their Dollar Short – For Now

Dani Burger and Sid Verma

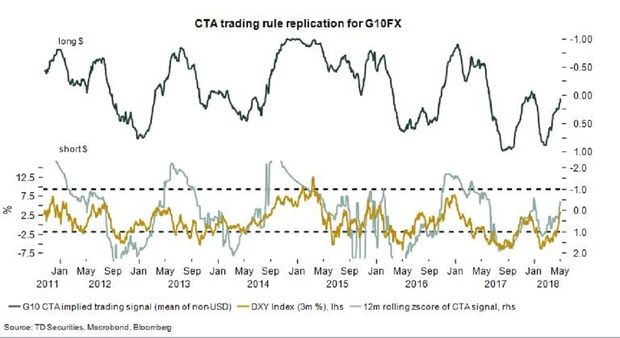

CTA positions are dollar neutral after large shorts: Bridgeton

Quant buying power to boost greenback likely “exhausted”

For clues on whether the dollar’s uptrend still has juice, look to the robots.

Automated trend-followers, known as commodity trading advisers, have flipped to neutral from a big short position on the greenback in recent weeks, a shift that helped accelerate the currency’s surprise advance. Now they’ve blown through all their stop-losses, and it could spell bad news for bulls from here.

As hedge-fund counterparts continue to bet on declines, CTA exposures are nearly flat on the dollar after they were forced to pare losses across G-10 currencies including the euro, yen, and British pound, quant researchers said. The upshot is that greenback bears are no longer fighting a headwind posed by automated buying from a group with combined assets of some $277 billion.

“Much of the ‘forced buying’ in these crosses has been exhausted,” said Peter Hahn, co-founder of Bridgeton Research Group, a quantitative research firm. “This could result in more subtle influences from their flows than those recently witnessed as they hit stop-outs.”

Wall Street has been caught off guard by the greenback’s gains of late, conjuring a myriad of theories to explain the out-of-consensus move, from America’s growing interest-rate gap with developed peers to easing growth momentum in Europe. Even though the rally has sputtered in the wake of the Federal Reserve meeting, the Bloomberg Dollar Spot Index remains on track for its biggest three-week advance since 2016.

Looking for a Trade

Trend-followers take a position across asset classes and, if momentum looks extreme, they will seek to profit from a shift back to the mean. CTA assets have doubled over the past decade, according to BarclayHedge data, to $277 billion at the end of 2017.

Models that seek to re-engineer trading strategies show CTAs have shifted from short positions to effectively neutral on the dollar, according to Bridgeton and Toronto-Dominion Bank.

“The dollar is now a momentum trade with some breaks of the key moving averages and the macro-community looking for a trade,” said Mark McCormick, the North American head of foreign-exchange strategy at Toronto-Dominion Bank.

TD model shows CTAs have sharply shifted to neutral on the dollar after extended shorts.

CTAs acted as the gasoline that helped fuel recent dollar gains, according to Mark Connors, head of risk advisory at Credit Suisse Group AG. “Both global macro and CTAs can push around an FX pair,” he said.

The theory goes that if fast-money investors helped spur outsize gains, not backed by fundamentals, the greenback’s advance could well be on thin ice. But not all hope is extinguished for bulls: CTAs could also lend momentum to an upward move if the greenback manages to break more technical levels.

“Should the strong U.S. dollar trend endure, trend-follower CTAs will, at certain levels, continue buying,” Bridgeton’s Hahn said. “They have enormous aggregate potential buying power up to their maximum deployable long risk.”

Breakouts

The outlook for the currency appears finely balanced, with plenty of ammunition for bulls and bears alike. The greenback looks cheap relative to its interest-rate gap with Germany, with the two-year spread at a record, while lackluster industrial and inflation data this week suggest a slowdown in euro-area growth. Extended bearish bets among hedge funds and other speculators raise the possibility of short covering.

On the other hand, the currency’s relative strength index — a measure of momentum — is the most overbought since 2016.

All eyes are now on breakout levels. Bloomberg’s dollar gauge passed its 200-day moving average this week, for the first time since May 2017, while the euro dropped below the same trendline versus the greenback. Similar tests are near for both the pound and yen against the dollar.

“It’s really a question of technicals,” said Thierry Wizman, a global rate and currency strategist at Macquarie Group Ltd. in New York. “CTAs are certainly not long the dollar yet — what we have seen so far seems more like short-position covering.”

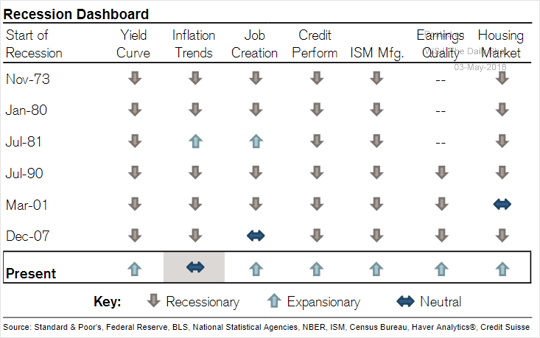

5. Interesting Recession Dashboard from Credit Suisse…No Red Signals.

The United States: Here is an updated “recession dashboard” from Credit Suisse.

Source: Credit Suisse

Source: Credit Suisse

https://dailyshotbrief.com/

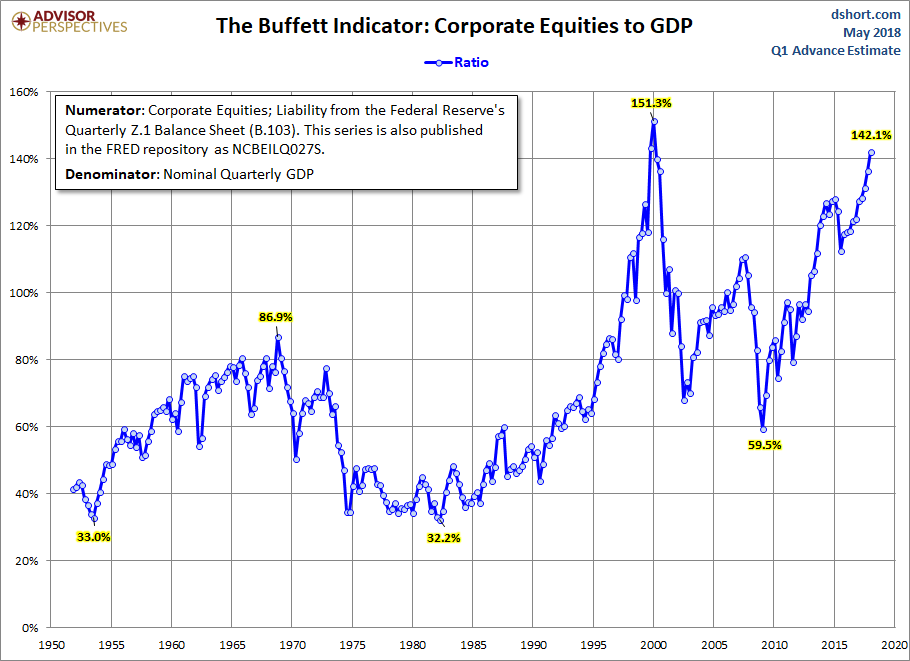

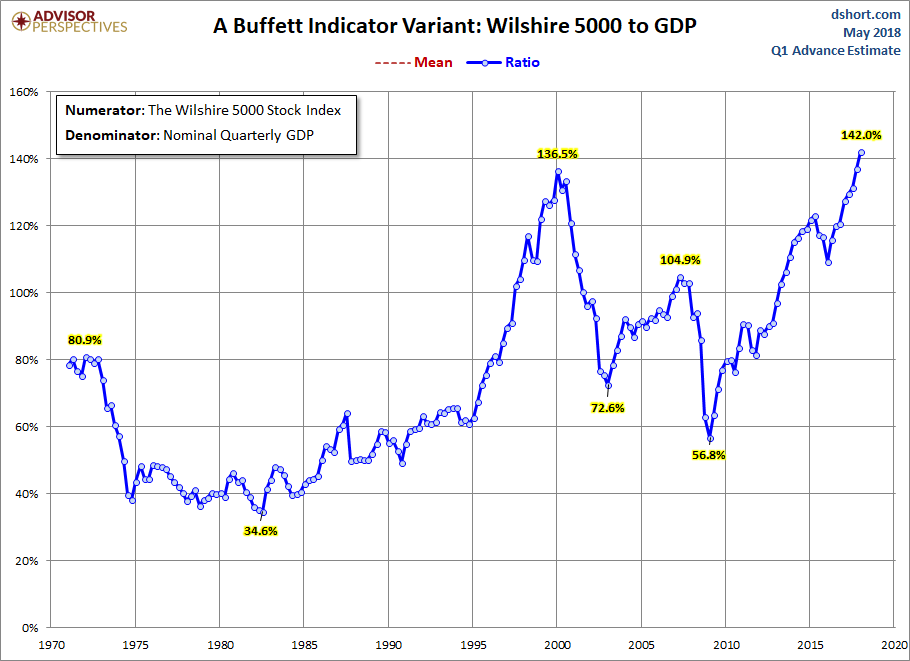

6. Warren Buffet Investment Woodstock this Week….Checking in on Warren’s Market Cap to GDP Ratio

Not a timing mechanism for markets.

Doug Short

The Latest Data

The denominator in the charts below now includes the Advance Estimate of Q1 GDP. The latest numerator value is extrapolated based on the quarterly change in the Wilshire 5000. The current reading is 142.1%, up from 136.4% the previous quarter and an interim high.

Here is a more transparent alternate snapshot over a shorter timeframe using the Wilshire 5000 Full Cap Price Index divided by GDP. We’ve used the St. Louis Federal Reserve’s FRED repository as the source for the stock index numerator (WILL5000PRFC). The Wilshire Index is a more intuitive broad metric of the market than the Fed’s rather esoteric “Nonfinancial corporate business; corporate equities; liability, Level”. This Buffett variant is also at its interim high.

7. Read of the Day….Goldman Sachs to Open a Bitcoin Trading Operation

By Nathaniel Popper

May 2, 2018

SAN FRANCISCO — Most big banks have tried to stay far away from the scandal-tainted virtual currency Bitcoin.

But Goldman Sachs, perhaps the most storied name in finance, is bucking the risks and moving ahead with plans to set up what appears to be the first Bitcoin trading operation at a Wall Street bank.

In a step that is likely to lend legitimacy to virtual currencies — and create new concerns for Goldman — the bank is about to begin using its own money to trade with clients in a variety of contracts linked to the price of Bitcoin.

While Goldman will not initially be buying and selling actual Bitcoins, a team at the bank is looking at going in that direction if it can get regulatory approval and figure out how to deal with the additional risks associated with holding the virtual currency.

Rana Yared, one of the Goldman executives overseeing the creation of the trading operation, said the bank was cleareyed about what it was getting itself into.

“I would not describe myself as a true believer who wakes up thinking Bitcoin will take over the world,” Ms. Yared said. “For almost every person involved, there has been personal skepticism brought to the table.”

Image

Justin Schmidt, left, who will run Goldman Sachs’s Bitcoin operation, with Marianna Lopert-Schaye, vice president of principal strategic investments, and Neema Raphael, who leads research and development.CreditAndres Kudacki for The New York Times

Still, the suggestion that Goldman Sachs, among the most vaunted banks on Wall Street and a frequent target for criticism, would even consider trading Bitcoin would have been viewed as preposterous a few years ago, when Bitcoin was primarily known as a way to buy drugs online.

Bitcoin was created in 2009 by an anonymous figure going by the name Satoshi Nakamoto, who talked about replacing Wall Street banks — not giving them a new revenue line.

Over the last two years, however, a growing number of hedge funds and other large investors around the world have expressed an interest in virtual currencies. Tech companies like Square have begun offering Bitcoin services to their customers, and the commodity exchanges in Chicago started allowing customers to trade Bitcoin futures contracts in December.

But until now, regulated financial institutions have steered clear of Bitcoin, with some going so far as to shut down the accounts of customers who traded Bitcoin. Jamie Dimon, the chief executive of JPMorgan Chase, famously called it a fraud, and many other bank chief executives have said Bitcoin is nothing more than a speculative bubble.

Ms. Yared said Goldman had concluded that Bitcoin is not a fraud and does not have the characteristics of a currency. But a number of clients wanted to hold it as a valuable commodity, similar to gold, given the limited quantity of Bitcoin that can ever be “mined” in a complex, virtual system.

“It resonates with us when a client says, ‘I want to hold Bitcoin or Bitcoin futures because I think it is an alternate store of value,’” she said.

Ms. Yared said the bank had received inquiries from hedge funds, as well as endowments and foundations that received virtual currency donations from newly minted Bitcoin millionaires and didn’t know how to handle them. The ultimate decision to begin trading Bitcoin contracts went through Goldman’s board of directors.

The step comes with plenty of uncertainties. Bitcoin prices are primarily set on unregulated exchanges in other countries where there are few measures in place to prevent market manipulation.

Since the beginning of the year, the price of Bitcoin has plunged — and recovered significantly — as traders have faced uncertainty about how regulators will deal with virtual currencies.

“It is not a new risk that we don’t understand,” Ms. Yared said. “It is just a heightened risk that we need to be extra aware of here.”

Goldman has already been doing more than most banks in the area, clearing trades for customers who want to buy and sell Bitcoin futures on the Chicago Mercantile Exchange and the Chicago Board Options Exchange.

In the next few weeks — the exact start date has not been set — Goldman will begin using its own money to trade Bitcoin futures contracts on behalf of clients. It will also create its own, more flexible version of a future, known as a non-deliverable forward, which it will offer to clients.

Image

“It is not a new risk that we don’t understand,” said Rana Yared, an executive overseeing the creation of the Bitcoin operation. “It is just a heightened risk that we need to be extra aware of here.”CreditAndres Kudacki for The New York Times

The bank’s first “digital asset” trader, Justin Schmidt, joined Goldman two weeks ago to handle the day-to-day operations, a hiring that was first reported by Tearsheet. In his last job, Mr. Schmidt, 38, was an electronic trader at the hedge fund Seven Eight Capital. In 2017, he left that job to trade virtual currencies on his own.

He will initially be placed on Goldman’s foreign currency desk because Bitcoin trading has the most similarity to movements in emerging market currencies, Ms. Yared said.

Mr. Schmidt is looking at trading actual Bitcoin — or physical Bitcoin, as it is somewhat ironically called — if the bank can secure regulatory approval from the Federal Reserve and New York authorities.

The firm also has to find a way to confidently hold Bitcoin for customers without its being stolen by hackers, as has happened to many Bitcoin exchanges. Mr. Schmidt and Ms. Yared said the current options for holding Bitcoin for clients did not yet meet Wall Street standards.

Goldman is known for pushing the envelope in the trading of complicated products. The firm faced significant criticism after the financial crisis for its profitable trading of so-called synthetic derivatives tied to the subprime mortgage markets.

Since the crisis, Goldman has made a big push to position itself as the most technologically sophisticated firm on Wall Street. Among other things, it has started an online lending service, known as Marcus, that has brought the firm into contact with retail customers for the first time. The virtual currency trading, though, will be available only to big institutional investors.

Mr. Schmidt said Goldman’s sophistication was a big part of the reason he was open to the job, despite many other opportunities in the virtual currency world.

“In terms of having a trusted institutional player, it has been something I have been looking for in my own crypto trading — but it didn’t exist,” he said.

Follow Nathaniel Popper on Twitter: @nathanielpopper

https://www.nytimes.com/2018/05/02/technology/bitcoin-goldman-sachs.html

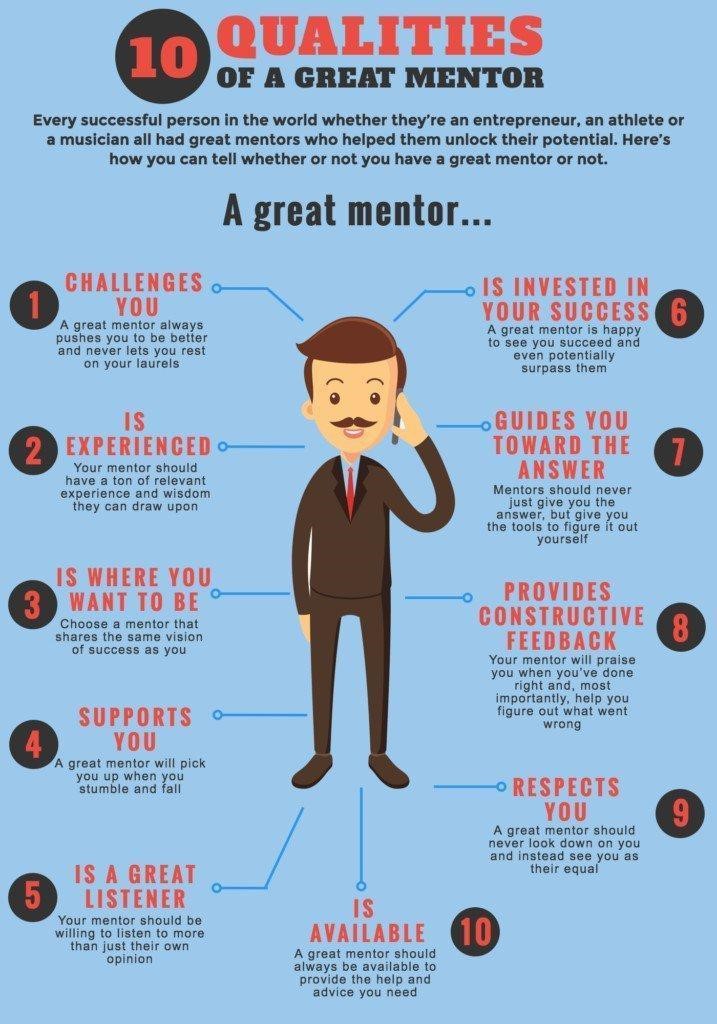

8. 10 Qualities of a Great Mentor.

https://www.linkedin.com/in/drdoro/

https://www.linkedin.com/in/drdoro/