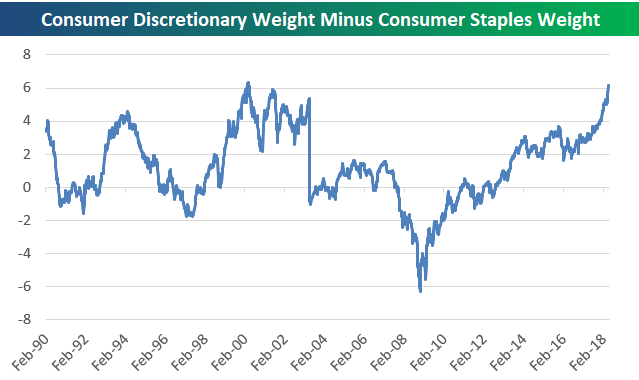

1.Spread Between Defensive Consumer Staples and Consumer Discretionary Has Only Been Higher in 2000

On page 6 of this month’s report, we provide the chart below which shows the spread between the weightings for Consumer Discretionary and Consumer Staples. At +6.12 percentage points, the only time Consumer Discretionary’s weight versus Consumer Staples has been higher was in April 2000.

https://www.bespokepremium.com/think-big-blog/

2.FANG Now 29% of Nasdaq Composite.

Nasdaq -4% Off Highs Still Leading Dow and S&P YTD.

3.Can We Get to 4% On 10 Year With Inflation Below 3%?

To Get to Dimon’s 4% Yield, Inflation Needs to Hit 3%: UBS Asset

By Andreea Papuc and Ruth Carson

Jaime Dimon’s warning that investors should be prepared for benchmark U.S. yields to climb to 4 percent has drawn some skepticism.

There’s just not enough inflationary pressures in the world’s largest economy to force the Federal Reserve’s hand on interest rates and send 10-year note yields to 4 percent, in the view of Anne Anderson at UBS Asset Management. Dimon, the JPMorgan Chase & Co. chief executive officer, said Tuesday that “people should be prepared” for 4 percent, and that higher rates would amount to normalization if they climbed alongside a strong economy.

“I find it hard to make it work,” said Anderson, who chairs a global fixed-income rates and foreign-exchange panel at the UBS unit. “It would mean inflation has moved suddenly from 2 to 3 percent — there are not enough rigidities in the U.S. economy for that to happen so quickly.”

Headline consumer prices, due out this week in the U.S., are forecast to rise 2.5 percent in April from a year before, and aren’t seen hitting 3 percent for any quarter through October 2019 in Bloomberg surveys of economists.

Dimon isn’t alone, though — Franklin Templeton bond chief Michael Hasenstab says that with U.S. growth at 3 percent and inflation at 2 percent, 10-year Treasuries normally ought to be yielding 4.5 to 5 percent. “Certainly above 4 percent” the economy can handle, he said.

“An uber bear scenario is 4 percent by the end of 2018,” said Anderson, head of Asia Pacific fixed income and credit at UBS Asset Management in Sydney.

— With assistance by Eric Lam

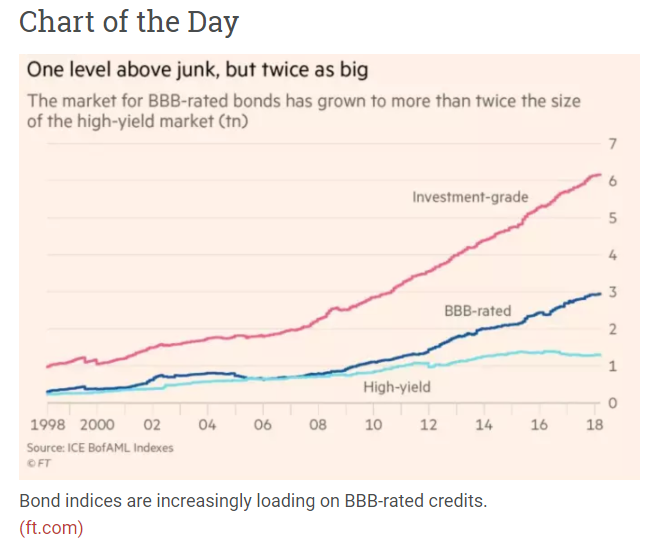

4.BBB Rated Bonds Twice the Size of High Yield Bond Market.

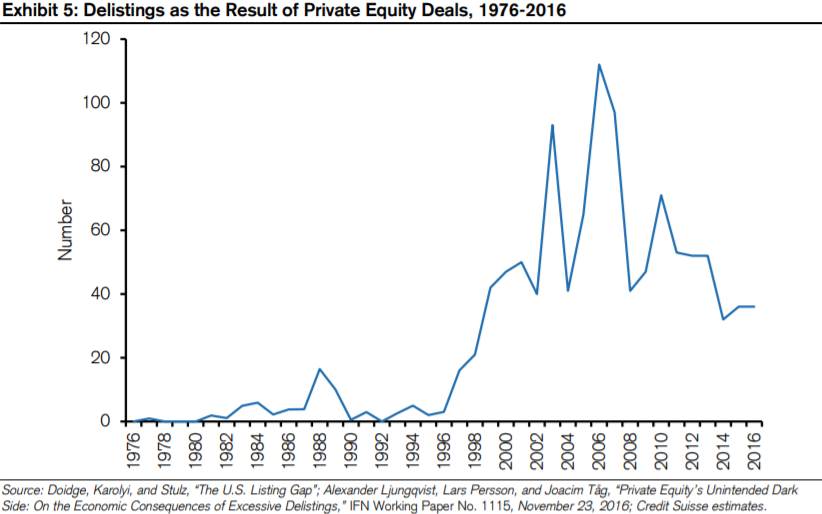

5.The Incredible Shrinking Stock Market and The Role of Private Equity.

While notable in its own right, the decline in the number of public companies has been accompanied by a mass migration of capital into private equity as some of the world’s largest pension funds remain strapped for reliable returns.

Source: Credit Suisse

Private equity raised a record $453 billion from investors in 2017, bringing the available pool of money to invest to $1 trillion, industry tracker Preqin said earlier this year. The amount of money raised exceeded the previous record of $414 billion set in 2007.

Much of the new capital flow has helped balloon so-called megafunds (those with more than $4.5 billion), with raises for all buyout megafunds up over 90 percent year over year, according to McKinsey, which concluded that had growth in the largest funds stalled in 2017, overall fundraising would have fallen by 4 percent.

At the top of the list of top fundraisers, Apollo took in $24.6 billion last year, and the firm manages a total of $69 billion in private equity assets.

The stock market is shrinking and that’s a good thing, private equity honchos say

- “We’re a better model for governance. We don’t have to deal with all the hassles of the public boards,” says Jonathan Sokoloff of Leonard Green & Partners.

- The number of publicly traded U.S. companies has been cut in half over the past 20 years, falling to 3,671 from 7,322 by 2016, according to Credit Suisse.

- Private equity raised a record $453 billion from investors in 2017, affording managers more than $1 trillion to funnel into ventures, Preqin reported.

6.China is 45% of Worldwide Chip Demand and It Imports 90% of Chips…Not for Long.

China closing in on massive new chip fund in bid to dominate US semiconductor industry

Danny Crichton@dannycrichton / Yesterday

China’s government has made technological independence from the United States one of its highest priorities. And now it appears to be putting its money where its messaging has been.

According to The Wall Street Journal, China is close to finalizing a $47 billion investment fund that would finance semiconductor research and chip startup development. The fund, formally the China Integrated Circuit Industry Investment Fund Co., appears to be underwritten predominantly by government capital sources.

Such a fund has been rumored for months, with the size of the fund ranging widely. Just two weeks ago, Reuters reported the fund would be $19 billion, while Bloomberg reported $31.5 billion two months ago. The exact number appears to be under intense negotiation among the Chinese leadership, and is also responsive to the increasingly tense trade negotiations with the United States.

If the $47 billion number pans out, it would be identical in size to a $47 billion fund that was financed by Tsinghua University, China’s leading engineering university, to spur the development of an indigenous semiconductor industry back in 2015.

China is highly dependent on foreign tech in its semiconductor industry, importing 90 percent of its chips in order to power its fast-growing economy. The Chinese government has always been wary of that dependency, but its fears were heightened in recent weeks after the United States banned American companies from selling components to ZTE, a prominent Chinese telecom equipment manufacturer.

Chinese President Xi Jinping has gone on something of an indigenous innovation tour in recent weeks, visiting factories across the country and encouraging further investment in the country’s technology industry. From the Communist Party of China’s official newspaper the People’s Daily two weeks ago, “National rejuvenation relies on the ‘hard work’ of the Chinese people, and the country’s innovation capacity must be raised through independent efforts, President Xi Jinping said on Tuesday.”

While the numbers discussed are eye-popping, so are the costs of developing leading-edge semiconductor technology. As semiconductors have grown more complex, costs have skyrocketed to maintain Moore’s Law. Intel spent more than $13 billion on R&D expenses alone in 2017, according to IC Insights, with Qualcomm, Broadcom, and Samsung each spending more than $3 billion.

While China may try to play catchup in the broad category of semiconductors, it is strategically placing its money on new areas like 5G wireless and artificial intelligence-focused chips where it might become a leading provider of technology. Concerns over 5G in particular have galvanized American attention on Qualcomm and its ability to compete in what is rare virgin territory in the telecom equipment space.

For American companies like Intel and Qualcomm, which are used to holding de facto monopolies on entire swaths of the semiconductor market, the renewed competition from China is going to pressure them to push their tech forward faster.

https://techcrunch.com/2018/05/07/china-chip-fund/

Implications for semiconductor players

China released the high-level framework for its new national semiconductor policy in June 2014; the details and the long-term effects of its new approach to developing the industry remain to be seen. Will it lead to a world-class semiconductor industry, or will Chinese semiconductor companies continue to lag behind global players? Three medium-term effects seem likely.

Pressure for localization will increase. China’s strong desire for national champions may further tilt the system in favor of local players. According to industry estimates, Chinese original-equipment manufacturers will design more than half of the world’s phones in 2015.1 1. Ian Mansfield, “Chinese phone manufacturers expected to take half the market in 2015,” Cellular News, March 10, 2014, cellular-news.com. Under the national-champions model, they may be encouraged to take advantage of domestic suppliers’ low-cost strategies and strong local technical support. Additionally, in the wake of global data-privacy and security concerns, there has been even more of a push from the Chinese government for state-owned and private enterprises to purchase from local system suppliers (that, in turn, are more likely to source from local semiconductor vendors).

More partnership opportunities will arise for second-tier players. Many of the Chinese government’s previous policies have not offered opportunities for global players to benefit. However, government leaders in China’s semiconductor sector are now beginning to realize that the country needs to partner with global technology companies to improve the local talent base and supply chain. As a result, they are more open than ever to “win–win” engagements between global players and national champions. For their part, top-tier multinational semiconductor companies traditionally have had less incentive to share their intellectual property or transfer technology to China. As such, second-tier players may fare better in this evolving ecosystem since they have less to lose than global giants—and everything to gain. In the winner-takes-all semiconductor markets, these players may benefit from their Chinese partners’ deep pockets, becoming better able to match the investments of market leaders.

Chinese companies will become more aggressive in pursuing international mergers and acquisitions. Indeed, it would be quite difficult for Chinese players to build a complete and competitive semiconductor value chain without capitalizing on foreign assets; collaborations between Chinese and global players probably will not be enough to meet the country’s objectives. We should expect China to continue to actively seek opportunities to acquire global intellectual property and expertise, usually with the intent of transferring them back home. What’s still to be determined, however, is how global governments will react to proposed deals in light of the emerging policy and market changes.

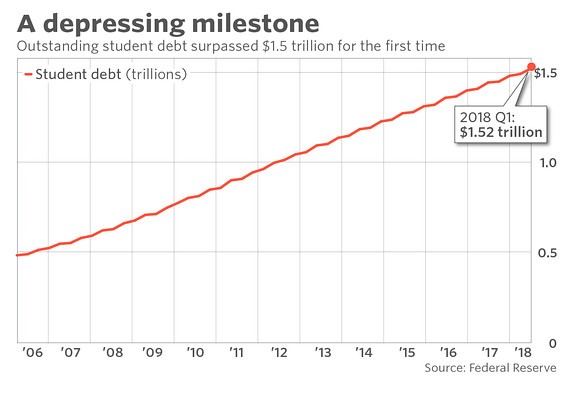

7.Student debt just hit $1.5 trillion…$600B to $1.5T in Just 10 Years.

It stood at about $600 billion 10 years ago

Outstanding student debt surpassed $1.5 trillion.

America’s student loan problem just surpassed a depressing milestone.

Outstanding student debt reached $1.521 trillion in the first quarter of 2018, according to the Federal Reserve, hitting $1.5 trillion for the first time. Though the marker is somewhat arbitrary, it offers a reminder of how quickly student debt has grown—jumping from about $600 billion 10 years ago to more than $1.5 trillion today—and that the factors fueling the increase aren’t likely to disappear any time soon.

“People pay attention to milestones,” said Mark Kantrowitz, a financial aid expert. When student debt surpassed $1 trillion in 2012, “it definitely caused a shift in coverage of student loans in the news media,” he said. In theory, that helps raise awareness of the issue for student advocates, lawmakers and, in particular, borrowers when considering what college to attend. But Kantrowitz added, “What’s more important is the impact on individual borrowers.”

https://www.marketwatch.com/story/student-debt-just-hit-15-trillion-2018-05-08

8.7 Common Roadblocks to Clear Communication

Dan WHalen

Last night, I had one of my weaker moments of recent memory. I was at dinner with one of the dearest friends I have, casually discussing ideas for our evening together. We exchanged playful banter with one another, taking shots at each other’s inconsistencies with planning and executing.

In what felt like out of nowhere, the conversation leveled-up from meaningless nonsense to abrupt authenticity. I chose to ignore what was best for the conversation’s resolve and blurt out what first came to mind in defense of myself. I reached low for this one — to the depths my own insecurity.

My comment centered around his newfound relationship, that of which he was extremely excited about and invested in. My first attempt to retract my statement was to no avail. I stated that I felt attacked in that moment and that what I said was the only place I felt I could reach to silence anything further. But that wasn’t it.

The reality was my comment came from a much nastier, yet far more relatable place. Where it really came from was my jealousy of his newfound relationship, and my continuation of navigating life without a special person to share it with. I attacked my friend with the very thing I wanted most for myself.

Furthermore, I met his acknowledgement of my inconsistencies with aggression, as it’s clearly an area I’ve refused to confront for quite some time. Sometimes what shows up in the heat of the moment is more about short-term survival than long-term connection. It’s important that we remain grounded in our understanding that what our minds cook up and serve us isn’t always meant to eat.

Here are seven common linguistic patterns blocking us from the fulfilling relationships we always dreamed of:

- 1.Mind-Reading

There’s arguably no better way to make someone feel limited in their existence as attempting to predict what they’re going to say. One of the most precious gifts in life for human beings is a distinct voice. If I choose to cut it down by robbing them of their expression, I’m effectively taking away both of our voices in the process. If I’m being a truly uplifting friend or partner, I’m listening to them as who they could be and not who the past says that they are.

- 2.Labeling

Name-calling was once relegated to elementary school bickering, but it’s appalling to see how often it takes place among adults — especially those that care for each other. Labels are defined constructs of language, meaning there is a ceiling on the person they can become when I assign said label.

Moreover, the rapidness in which I want to label is startling — one correlated instance and I’m already inclined to box others in. By calling someone a name, I’m communicating that I’m not willing to put in the effort to understand their unique situation. I’m all for being lazy every now and again, but not at the expense of others.

- 3.Generalizing

The sister to labeling, generalizing is equally as lazy and equally as diminishing. Just because a person’s behavior repeats itself, it does not mean it’s “always” or “never” going to be a certain way.

By believing this to be true, I not only drive a wedge in my communication with others but the way in which I communicate with myself. I slowly depreciate my sense of curiosity and wonder by assuming that what’s so will always or never be — leaving very little reason to put forth any additional effort.

When I generalize, I check out from life. I throw my mind into neutral and look for what else may be wrong. I must keep my foot on the gas and look — really look — at what may be beneath the surface-level explanation I so desperately want to run with.

“All generalizations are false, including this one.” – Mark Twain

- 4.Jumping to Conclusions

Actions produce outcomes. We have thoughts about outcomes and feelings about thoughts, but we cannot think or feel an outcome in our external reality. Rather that succumbing to our thoughts and feelings about the events that unfold in our lives, we can take action to gain a firmer grasp on what was being communicated or the meaning behind what transpired.

- 5.Moralizing

Everyone has had a friend that can not control their temptation to advise what you should or shouldn’t be doing. And odds are, that person didn’t stay your friend for very long. Telling people what they need to do or how to live their life when the advice is unsolicited is a quick way to alienate your closest confidants.

If you really want to give advice that badly, you won’t be asked for it without being a supreme listener. Earn your platform to provide insight by lending both ears, as opposed to steamrolling the conversation with your mouth.

- 6.Re-directing

I used to have a nasty habit of calling people I care about to share something going on with me by means of asking about them first. I felt uncomfortable simply sharing outright what I wanted to and decided I would ask about them prior to, knowing I had little to no interest in that moment about anything but my issue I wanted to work through.

People can sense this immediately and it doesn’t make for a very empowering experience for either party, often resulting in a breakdown instead of a breakthrough. If I have something I want to confront in my life with another person, I ask them upfront if they would be willing to listen and work through it with me. Giving people a choice results in everything we want from our feeble attempts at manipulation.

“There is only one you for all time. Fearlessly be yourself.” – Anthony Rapp

- 7.Lying

My word is all I have. If I lose my word, I lose my ability to create something — anything — with another human being. The short-term resolve, satisfaction or avoidance is not worth it. Tell the truth. And I don’t mean “real talk” — essentially complaining disguised as truth. I mean the authentic truth — the one about where I’m imperfect and I’m pretending not to be. That one gets me much further with the people in my life.

This also includes the friend of mine I referenced earlier. Once I shared with him the source of my comment, I was met with compassion and respect. This wouldn’t have been possible had I not stepped outside of the temptation to leverage one of the aforementioned roadblocks. They may seem like an easy way to transition in the moment, but the cost of a meaningful and lasting connection is far too severe a price to pay.

Which of these seven roadblocks do you run into most frequently? Let us know your plan to get around it in the comments below!

https://addicted2success.com/success-advice/7-common-roadblocks-to-clear-communication/