1. NIO –EV 10 Bagger

Chinese EV Stock $1.20-$45 One Year.

“I can’t invest now. The stock market is too high.”

Everybody who has ever put a dollar into the market has had this thought at some point in time. But all-time highs are nothing to fear. In fact, returns are stronger after all-time highs because rising prices attract more buyers which leads to higher prices. This tends to continue until something comes along and knocks this cycle off of its course.

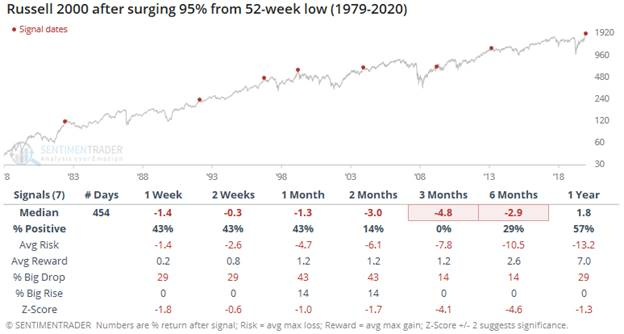

That said, SentimenTrader notes a surge of 95% off a low has preceded losses in the small-cap index over the next 3 months every time