1. How Stocks Predict Presidential Elections

Posted June 29, 2020 by Joshua M Brown

Ryan Detrick from LPL Financial made my Chart o’ the Day today…

Here’s Ryan:

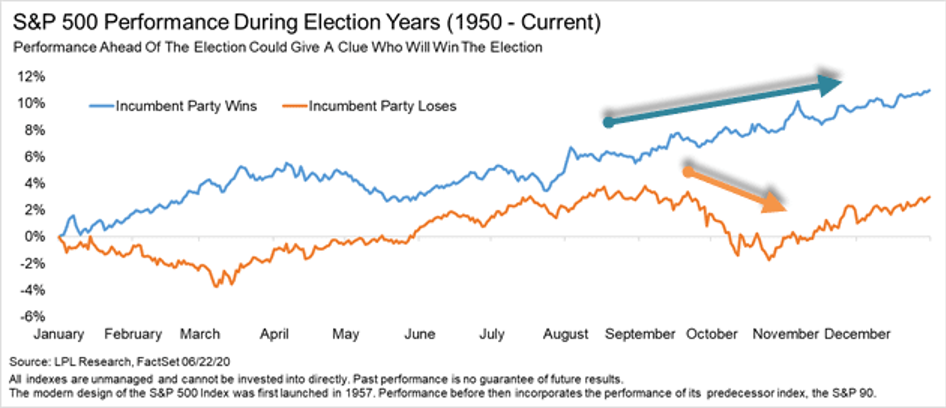

Turns out, since 1928, the stock market has accurately predicted the winner of the election 87% of the time and every single year since 1984. It is quite simple. When the S&P 500 Index has been higher the three months before the election, the incumbent party usually won, while when stocks were lower, the incumbent party usually lost.

Ryan cites the stock market losing streak preceding Hillary Clinton’s attempt to hang onto the presidency for her incumbent party as just the latest example of this measure getting things right.

The clock starts ticking in early August.

2. Historical Odds of Stock Market Rising in Second Half of Calendar Year

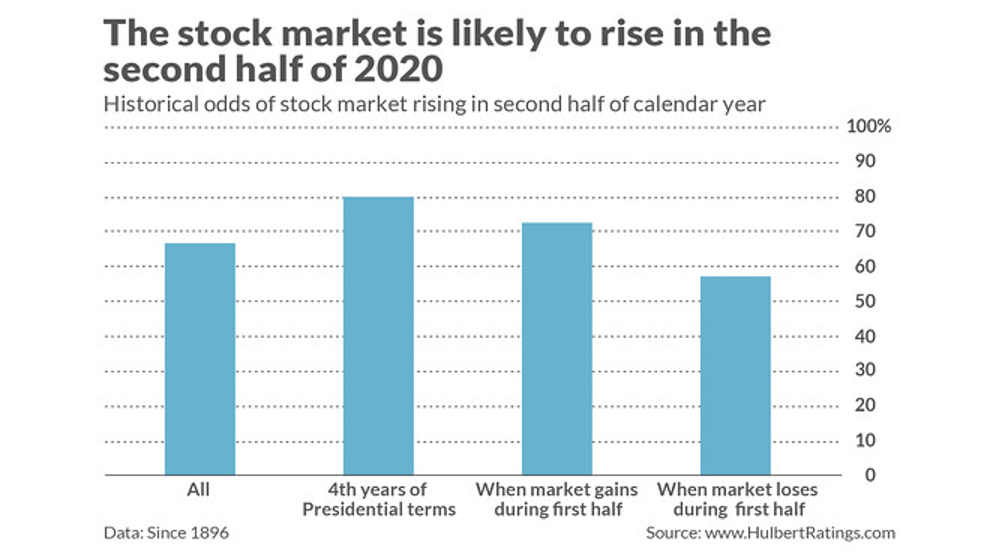

The accompanying chart presents the relevant data for the Dow Jones Industrial Average DJIA, +0.84% since its creation in 1896. In the second halves of the 123 calendar years since then, the market has risen 82 times — precisely two-thirds of the time. The chart also shows that, depending on how you slice and dice the data, the odds appear to be slightly higher or lower than that. However, none of the chart’s differences is significant at the 95% confidence level that statisticians often use when determining if a pattern is genuine.

Mark Hulbert–There’s a 2-out-of-3 chance U.S. stocks will climb over the next 6 months — which is right about average

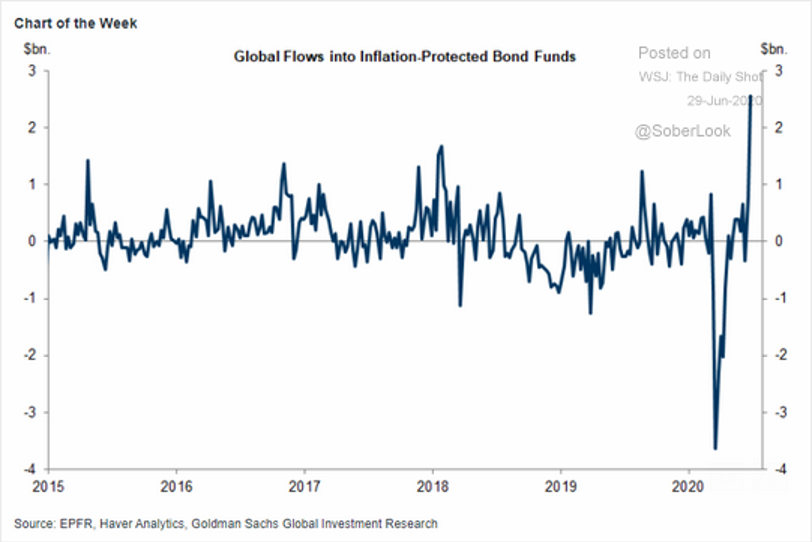

3. Global Flows into Inflation-Protected Bonds

The Daily Shot

TIP ETF—Inflation Protected Bond ETF

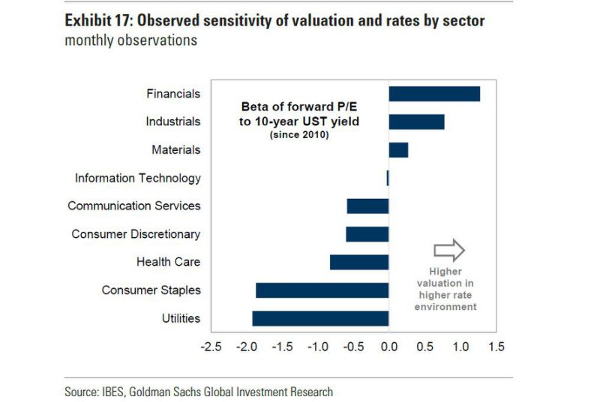

4. Goldman Says Tech Valuations to Remain Intact if Rates Go Higher

Joanna Ossinger

(Bloomberg) — If Treasury yields rise, technology stocks are likely to be able to maintain their valuations while some consumer stocks may struggle, according to Goldman Sachs Group Inc.

“Price/earnings multiples in sectors with strong secular growth, such as Info Tech, show little correlation with 10-year U.S. Treasury yields since 2011; their valuations can move higher in low-rate environments (because of their long duration) or high-rate environments (because of their high near-term growth expectations),” strategists led by Ryan Hammond wrote in a note June 29.

Growth expectations for the near-term become more important when rates rise in a low-rate environment, Goldman said, noting that the firm’s rates strategists see expansion expectations lifting 10-year U.S. Treasury yields by 45 basis points through year-end. That boosts cyclical shares, insulates long-duration equities with high growth, and weighs on defensive stocks.

Goldman sees net upside risk to S&P 500 multiples and prices if monetary policy remains loose and growth expectations improve, which it envisions as the most likely scenario.

“High multiples of Software & Services appear supported by fundamentals, while Household & Personal Products valuations are stretched,” the strategists said.

Goldman also looked at U.S. stocks’ valuations based on factors including their equity duration, near-term growth expectations and margins. Those trading at the biggest discounts to their modeled valuation include Bristol-Myers Squibb Co., Cigna Corp. and Western Digital Corp., they said. Those trading richest versus the models included Expedia Group Inc., Abiomed Corp. and Netflix Inc., they said.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

https://finance.yahoo.com/news/goldman-says-tech-valuations-remain-092434367.html

5. Toyota, Volkswagen And Daimler: Here Are The Corporate Bonds The Fed Is Buying The Most

by Tyler Durden ZERO HEDGE

Sun, 06/28/2020 – 17:00

TwitterFacebookRedditEmailPrint

Two weeks ago the Fed sparked a mini market rally after it again announced that it would buy corporate bonds (not just ETFs), something it had said it would do three months prior yet which either the algos or the Robinhooders never quite grasped and which sent stocks soaring, even though it wasn’t actual news.

That said, there was some actual news in the Fed’s announcement.

Recall that initially, the Fed’s Secondary Market Corporate Credit Facility, or SMCCF was structured to hold two types of investments, “Eligible Individual Corporate Bonds” and “Eligible ETFs”. On Monday, June 15, the Fed introduced a third category: “Eligible Broad Market Index Bonds”. This new category allows the Fed to immediately begin buying individual corporate bonds in much larger volume than previously anticipated (for more read “The Fed’s $250 Billion Debt-Buying “Index” Loophole“).

And while it remains unclear just how static the index is or will be, on Sunday the Fed finally unveiled the constituents of said Index of “Eligible Broad Market” bonds: it consists of 794 names ranging from auto giants Toyota, Volkswagen and Daimler at the top, all the way through Valspar, Washington Gas Light and Westside Intermodal. This is what the Fed said:

The Broad Market Index is intended generally to track the composition of the broad, diversified universe of secondary market bonds that meet the criteria specified in the Term Sheet for Eligible Broad Market Index Bonds, subject to generally applicable issuer-level caps specified by the Term Sheet. It will be recalculated at least every 4-5 weeks, and the list of bonds that are eligible for purchase will be refreshed more frequently to add or remove those bonds that newly meet or no longer meet the eligibility requirements. The Broad Market Index will be published roughly once a month.

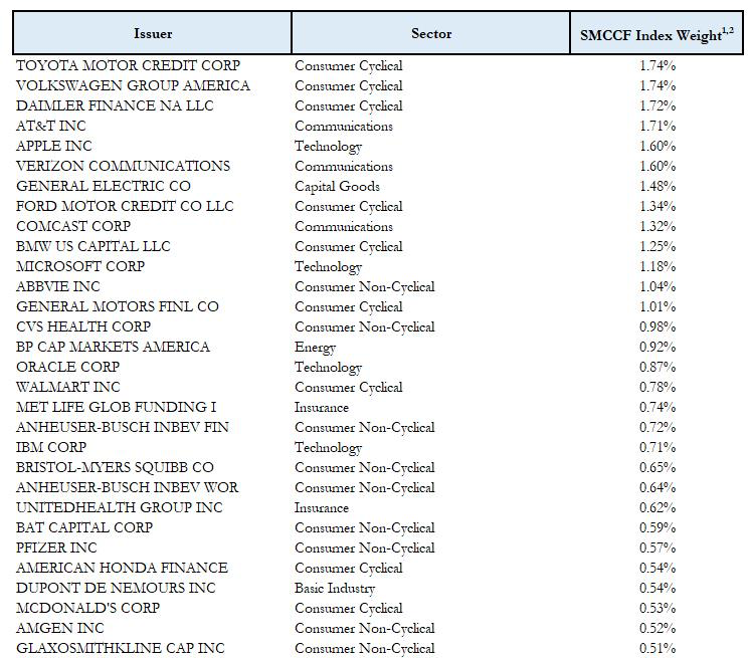

The top 30 constituents by index weight are shown below:

Of note: just 6 names comprise 10% of the entire index, and as noted above, these are led by Toyota, Volkswagen, Daimler – all of which are foreign companies and thus will beg the question how do purchases of foreign corporate bonds help the American middle class.

Additionally, the Fed is buying a lot of AT&T, Apple And Verizon. While these are at least US companies, the next question is how does the Fed purchasing Apple bonds, and enabling the company to fund even more buybacks, help Main Street America?

6. Gasoline Sale vs. Price

Average Daily Volume Sales Per Capita

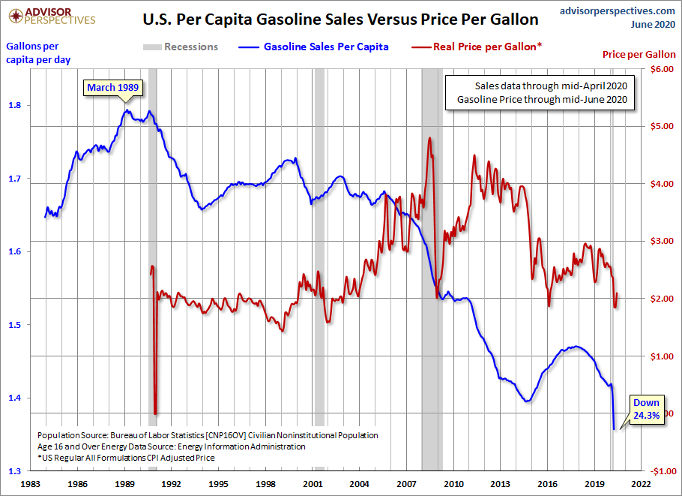

The next chart adjusts the 12-month MA of sales volume for population growth based on the monthly data for Civilian Non-Institutional Population over age 16 from the Bureau of Labor Statistics, via the St. Louis FRED repository. What we see here is that gasoline sales on a per-capita basis are 11.7% lower than at the end of the Great Recession and we are in a new COVID-19 related recession per the NBER. The gallons-per-capita series includes the complete EIA data, but since we’re using the 12-month MA, the blue line starts in 1984. We see the double peak in March 1989 (the all-time high) and August 1990. The latest per-capita daily average is 24.3% below the 1989 high and at an all-time low.

https://www.advisorperspectives.com/dshort/updates/2020/06/18/gasoline-volume-sales-april-2020

7. The US bought up 90% of the world’s supply of remdesivir for the next 3 months, and patents mean many countries won’t be able to get any

- The US has struck a deal with Gilead Sciences to purchase more than 90% of the global supply of remdesivir.

- Remdesivir has been shown to help moderately ill patients recover more quickly from COVID-19, and is the only treatment that has been proved to be effective.

- HHS secretary Alex Azar called it an “amazing deal,” but it leaves many countries with few options.

- The treatment, which was previously donated by Gilead, has now been priced at $2,340 per course for developed nations, including the US.

https://www.businessinsider.com/us-buys-nearly-all-worlds-remdesivir-for-next-three-months-2020-7

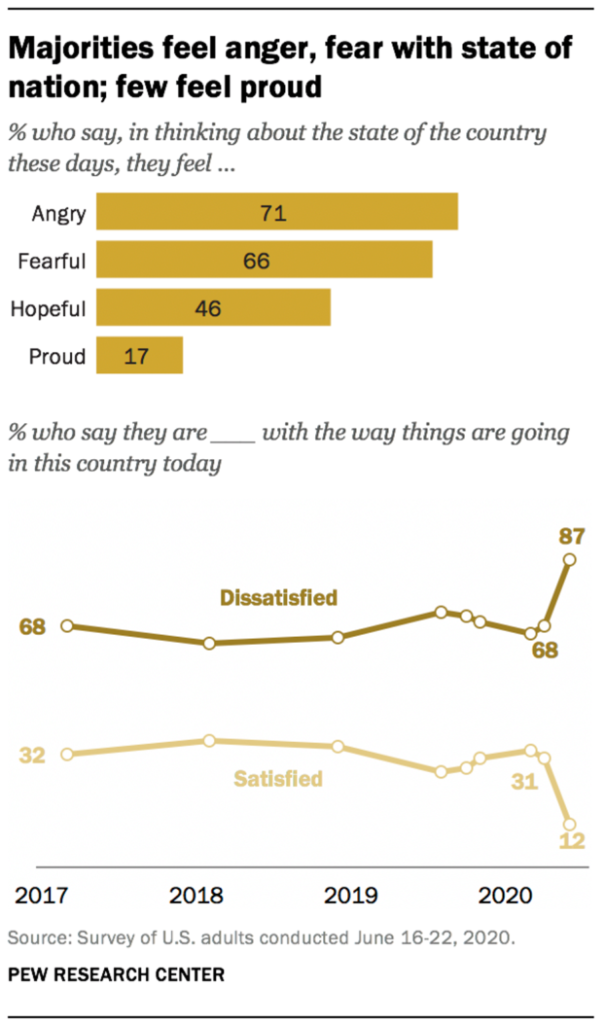

8. Latest Pew Research Poll

9. 10 Steps to Financial Freedom

Originally posted June 30, 2020

FacebookTwitterEmailLinkedInPinterest

What are the steps to financial freedom? Imagine waking up every day without the financial burdens of this life. What would it look like to work at a job you love, instead of one that simply pays the bills? Or to not have to work at all. To live your life without economic limits. To retire early if you so choose. But what are the steps to reach this reality?

In the most general terms, financial freedom is the ability to live off of the savings and investments that you’ve accumulated throughout your life. By having enough money in the bank as well as other accounts, you’ll be able to take back the steering wheel of your life. The direction your life takes is now completely up to you. Now that doesn’t mean there won’t be problems… there most certainly will. What it means is when those problems arise, you’ll be much more equipped to deal with them. Your new found financial freedom will allow you to make smarter decisions, without the stress of financial burden.

The goals and steps to financial freedom aren’t just about early retirement or quitting your job. In fact, many people who support the F.I.R.E. (Financial Independence, Retire Early) movement, don’t actually want to retire early. They just want the direction of their life, including their job to be dictated by them and not by their employer. They want to focus more on their health and family. More time to travel. More time to learn new skills. To give back to the world. All of these amazing things can be possible if you are willing to put forth the effort.

10 Steps to Financial Freedom

Unless you’re holding out for some future inheritance or you’re one of the lucky few who wins the lottery, you’re going to have to do it the old-fashioned way. Hard work and discipline. Here are 10 basic steps to financial freedom:

1. Find Gainful Employment

Income is a huge part of reaching financial freedom. Paying off debt gets a lot easier if you have a job that pays well. If your current job pays very little, you may want to consider a side hustle or pursuing a more lucrative career field. In the future, once your savings reach a certain point, you will have more job options that aren’t so dependent on income.

2. Become a Budgeting Expert

Before you can start paying off debt or saving, you need to master budgeting. John Bogle, founder of Vanguard says you can triple your returns if all you do is control your expenses and emotions. Budgeting can be difficult. Many times it involves a great deal of sacrifice. But budgets aren’t all bad. Make sure to include some flexibility in your budget or you might risk burning out before long. Put your budget to work for you and it will be your best friend.

3. Manage Your Credit

Pay off your credit cards every month. Many people say to completely get rid of credit cards, while others maximize their benefits with rewards programs. There are many approaches to managing credit. Managing your credit is huge step towards financial freedom. Here are the pros and cons of credit cards.

4. Pay Down Debt

The first step to paying off debt is to make a list of all of your debts. No matter how big or small, any money you owe someone else should be on this list. There are many types of debt that you may have. Here are some of the most common:

- Credit card debt

- Car loan debt

- Student loan debt

- Medical debt

- Personal loan debt

- Mortgage debt

- Home equity debt

Read the full article: How to Pay off Debt Fast

5. Create an Emergency Fund

Having an emergency fund means you have enough money on hand when an unforeseen event occurs. Think of it as a financial safety net. In a perfect scenario you should have at least three months of income saved. This will allow you to continue to pay the bills if you or a family member loses their job, gets sick, gets fired or if you have a car or a new roof that needs to be replaced. There are many things that happen in life that are unexpected. You will want to be prepared when the time comes. DO NOT TOUCH THE EMERGENCY FUND. It is there for an emergency… not so you can take a nice vacation.

6. Maximize Retirement Funds

Tax advantage vehicles like Roth, IRA, SEPs and 529 accounts are a crucial step in reaching financial freedom and building wealth. If your work offers a 401(k) or a 403(b) retirement account, take full advantage of it. Not only are these funds tax advantaged, they’re also a source of free funds if your company matches.

7. Invest Extra Funds

Anyone can be an investor, no matter the size of your bank account. And the longer you wait, the more you miss out on compound interest, which can grow your original investment exponentially. Take those extra funds and put them to work. Many people are so intimidated by the idea of investing, that they put it off or even worse… don’t do it at all. The sooner you start investing, the sooner you’ll reach financial freedom. We’re here to help!

8. Create Passive Income

Many of the people who have reached financial freedom have done so by creating passive income streams. This can be done in many ways. For instance, on the investing side you have dividend stocks, bonds or real estate. But you can also create passive income by creating goods or services that continually generate sales. Digital artwork, books and music royalties are all examples of this. Whatever your method, passive income is a hands-off way to let your work, work for you.

9. Tax Planning

Understanding taxes is a huge step towards financial freedom. Working with a tax professional can save you thousands of dollars each year. Contribute to retirement accounts. Donate to charities with retirement funds. Also, arrange your investments based on tax efficiency. To learn more, read Marc Lichtenfeld’s 3 Tax Saving Tips.

10. Stay Financially Engaged

You know the old saying… “you can do anything you put your mind to”? It may sound silly, but it’s as true as it ever was. Being actively engaged in your financial future is our last and arguably most important step to financial freedom. The hard work and discipline you show now will lay the buildable foundation for wealth creation and your financial freedom.

For more information on steps to financial freedom, sign up for our free Investment U e-letter. Additionally, explore the Financial Freedom section of our site. This is only the beginning. Start your journey to financial freedom today and never look back!

10. 5 Lessons On Being Wrong-James Clear

Being wrong isn’t as bad as we make it out to be. I have made many mistakes and I have discovered five major lessons from my experiences.

1. Choices that seem poor in hindsight are an indication of growth, not self-worth or intelligence. When you look back on your choices from a year ago, you should always hope to find a few decisions that seem stupid now because that means you are growing. If you only live in the safety zone where you know you can’t mess up, then you’ll never unleash your true potential. If you know enough about something to make the optimal decision on the first try, then you’re not challenging yourself.

2. Given that your first choice is likely to be wrong, the best thing you can do is get started. The faster you learn from being wrong, the sooner you can discover what is right. For complex situations like relationships or entrepreneurship, you literally have to start before you feel ready because it’s not possible for anyone to be truly ready. The best way to learn is to start practicing.

3. Break down topics that are too big to master into smaller tasks that can be mastered. I can’t look at any business and tell you what to do. Entrepreneurship is too big of a topic. But, I can look at any website and tell you how to optimize it for building an email list because that topic is small enough for me to develop some level of expertise. If you want to get better at making accurate first choices, then play in a smaller arena. As Neils Bohr, the Nobel Prize-winning physicist, famously said, “An expert is a person who has made all the mistakes that can be made in a very narrow field.”

4. The time to trust your gut is when you have the knowledge or experience to back it up. You can trust yourself to make sharp decisions in areas where you already have proven expertise. For everything else, the only way to discover what works is to adopt a philosophy of experimentation.

5. The fact that failure will happen is not an excuse for expecting to fail. There is no reason to be depressed or give up simply because you will make a few wrong choices. Even more crucial, you must try your best every time because it is the effort and the practice that drives the learning process. They are essential, even if you fail. Realize that no single choice is destined to fail, but that occasional failure is the cost you have to pay if you want to be right. Expect to win and play like it from the outset.

Your first choice is rarely the optimal choice. Make it now, stop judging yourself, and start growing.

Disclaimer

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publically available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only