1. 30 Year Treasury-20% Off Highs.

30 Year Treasury 50day and 200day rolling over negative

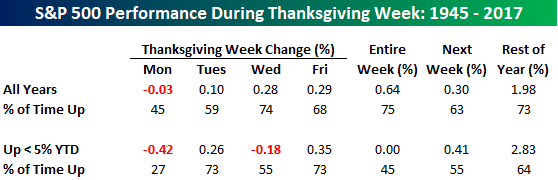

Thanksgiving week has historically been a positive time for the equity market. Since WWII, the S&P 500 has averaged a gain of 0.64% during Thanksgiving week with gains three-quarters of the time. Market trends heading into this Thanksgiving aren’t as positive for the bulls, though. As shown in the table below, during years where the S&P 500 was positive but up less than 5% YTD heading into Thanksgiving week, the index’s average change during the week has been 0.00% with gains less than half of the time.

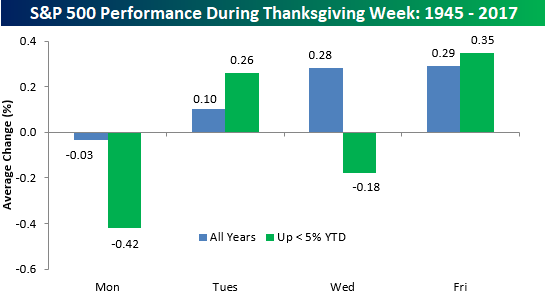

On a day to day basis, for both all years since WWII and in years where the S&P 500 was up less than 5% heading into Thanksgiving week, Monday has been the worst trading day as it is the only day of the week with negative average returns and positive returns less than half of the time. Tuesdays and Friday, however, have been positive days, though, with average gains of 0.10% and 0.29%, respectively. Additionally, for those years where the S&P 500 was up YTD but up less than 5%, Tuesdays and Fridays have been even stronger with average gains of 0.26% and 0.35%, respectively.

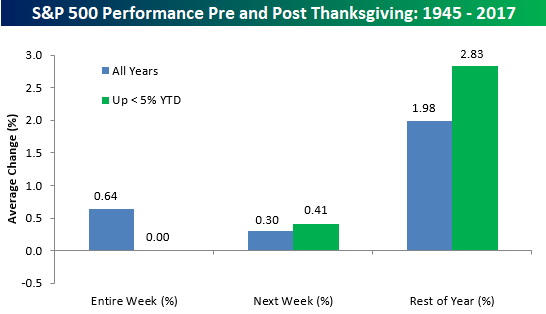

As we move past Thanksgiving, though, seasonal trends for the market based on this year’s performance so far improve. In those years where the S&P 500 was up less than 5% YTD heading into Thanksgiving week, the average gains the week after Thanksgiving was 0.41% with positive returns 55% of the time. For the remainder of the year, average returns were even stronger at +2.83%. Not bad for a period of just over five weeks!

Jefferies

3Q earnings did not materialize as the positive catalyst investors were hoping for following Powell PBS, Pence China speech & US-China sentiment deterioration, PPG pre-announcement, IMF global growth downgrade, etc – all in early October.

The qualitative commentary from Q3 included slowing demand in China/EM/Europe (particularly auto), margin pressure, and trade war impact.

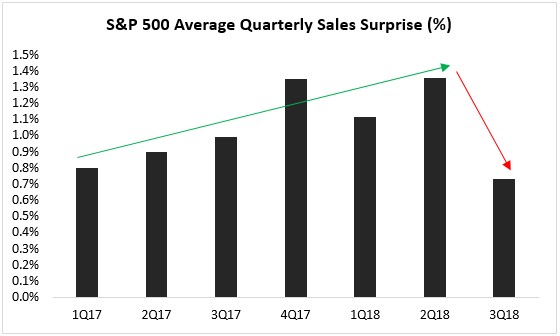

The average sales surprise was the lowest going back to 1Q17 – breaking a largely positive surprise trend over the prior 6 quarters.

Source: Jefferies Trading Desk

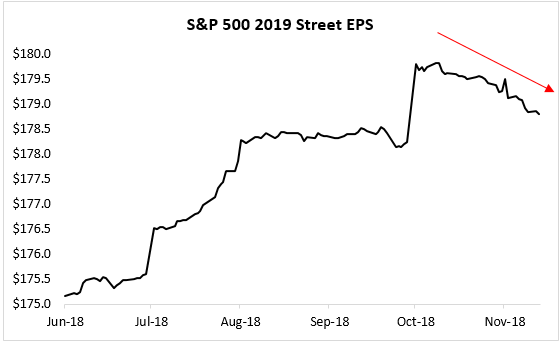

Through and following Q3 earnings, 2019 consensus EPS has been revised lower.

Again, the trend is more worrisome than the dollar amount – thus far – reduced.

Source: Jefferies Trading Desk

Percy Allison vix

Equity Trading, Desk Strategist

Jefferies LLC

Asian investors are proving less and less eager to buy U.S. government bonds, even as the Treasury Department prepares to sell $1.3 trillion of new debt in the new fiscal year.

Foreigners increased their holdings of Treasurys by $78 billion in the first eight months of this calendar year, according to the Treasury. That is just over half of what they bought in the same period last year.

Holdings have particularly stagnated in a number of emerging Asian economies—including South Korea, Singapore, Thailand and Taiwan—which have prized U.S. government debt as a capital bulwark since the 1997 Asian currency crisis.

Many observers assume the U.S. has no trouble finding demand for its debt in the vast pool of world-wide governments, financial institutions, mutual funds and individual investors who want to own the world’s major risk-free asset. Yet the Treasury is finding fewer buyers in some parts of the world, leaving domestic investors such as mutual funds to pick up the slack.

Where to Find Treasury Buyers? Not Asia

The erosion of demand in emerging Asian markets reflects their maturation into more stable economies

https://www.wsj.com/articles/where-to-find-treasury-buyers-not-asia-1541422801?reflink=e2twmkts.\

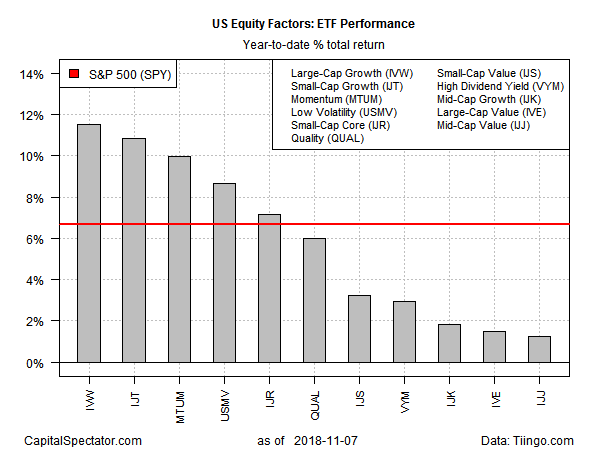

The sharp swings in the stock market in recent weeks haven’t dented the year-to-date performance edge that’s prevailed for large- and small-cap growth stocks in the US over their value counterparts, based on a set of exchange-traded funds through yesterday’s close (Nov. 7).

Large-cap growth still holds the lead for The Capital Spectator’s set of US equity factor ETFs so far in 2018. The iShares S&P 500 Growth (IVW) is up a strong 11.5% year to date. Running slightly behind in second place is iShares S&P Small-Cap 600 Growth (IJT), which is ahead by 10.9% so far in 2018.

Value, by comparison, is far behind in this year’s equity factor horse race. Dead last for year-to-date results at the moment: iShares S&P Mid-Cap 400 Value (IJJ), currently posting a slight 1.3 gain. The second-weakest performance this year: iShares S&P 500 Value (IVE), which is ahead by 1.5%.

Meanwhile, the broad market this year is up 6.7%, based on the SPDR S&P 500 (SPY).

The Capital Spectator

https://www.capitalspectator.com/growth-continues-to-crush-value-this-year-for-us-equity-factors/