1. Nasdaq and Russell 2000 Spread Highest Since 2000

Bespoke Investment Group–Nasdaq – Russell Spread Pulling the Rubber Band Tight

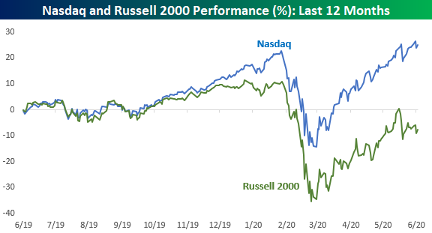

The Nasdaq has been outperforming every other US-based equity index over the last year, and nowhere has the disparity been wider than with small caps. The chart below compares the performance of the Nasdaq and Russell 2000 over the last 12 months. While the performance disparity is wide now, through last summer, the two indices were tracking each other nearly step for step. Then last fall, the Nasdaq started to steadily pull ahead before really separating itself in the bounce off the March lows. Just to illustrate how wide the gap between the two indices has become, over the last six months, the Nasdaq is up 11.9% compared to a decline of 15.8% for the Russell 2000. That’s wide!

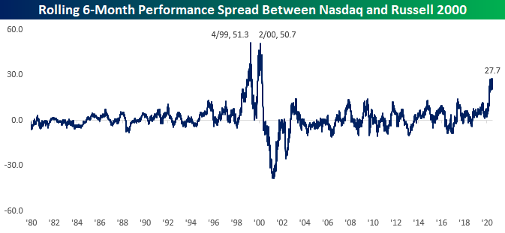

In order to put the recent performance disparity between the two indices into perspective, the chart below shows the rolling six-month performance spread between the two indices going back to 1980. With a current spread of 27.7 percentage points, the gap between the two indices hasn’t been this wide since the days of the dot-com boom. Back in February 2000, the spread between the two indices widened out to more than 50 percentage points. Not only was that period extreme, but ten months before that extreme reading, the spread also widened out to more than 51 percentage points. The current spread is wide, but with two separate periods in 1999 and 2000 where the performance gap between the two indices was nearly double the current level, that was a period where the Nasdaq REALLY outperformed small caps.

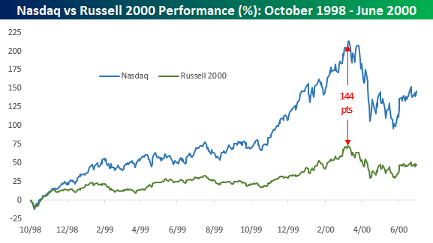

To illustrate the magnitude of the Nasdaq’s outperformance over the Russell 2000 from late 1998 through early 2000, the chart below shows the performance of the two indices beginning in October 1998. From that point right on through March of 2000 when the Nasdaq peaked, the Nasdaq rallied more than 200% compared to the Russell 2000 which was up a relatively meager 64%. In any other environment, a 64% gain in less than a year and a half would be excellent, but when it was under the shadow of the surging Nasdaq, it seemed like a pittance. Like what you see? Click here to view Bespoke’s premium membership options for our best research available.

2. America’s total indebtedness was lower in 2019 than in 2007

Barrons

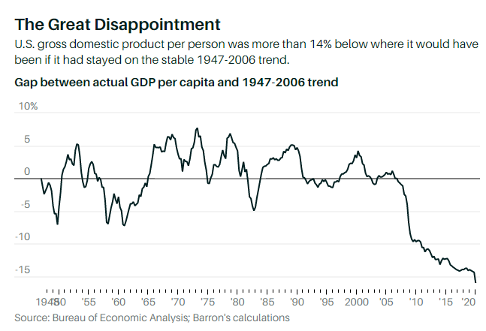

The growth in federal government debt after the financial crisis may have looked large, but it was too small to offset the private sector’s retrenchment and meet the massive growth in demand from investors needing hedges for their portfolios, from pension plans, and from foreign savers. Debt securities and loans owed by the private sector peaked at 290% of national income in 2008 and dropped to 225% by 2019. Over the same period, federal government debt rose from 43% to 88%. Even though federal government debt tripled in dollar terms, America’s total indebtedness was lower in 2019 than in 2007.

If the Government Doesn’t Borrow Freely Now to Cover Cost of the Virus, Many Will Pay Later

Matthew C. Klein https://www.barrons.com/articles/if-the-government-doesnt-borrow-freely-now-to-cover-the-cost-of-the-virus-many-will-pay-later-51593194917?mod=past_editions?mod=article_signInButton

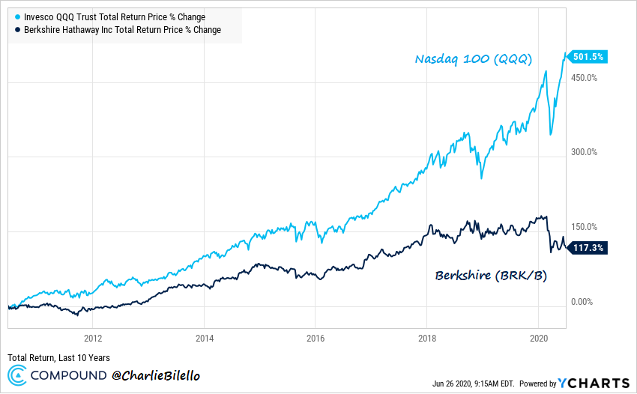

3. Warren Buffett vs. Nasdaq Last 10 Years ….Nasdaq 100 +500% vs. Berkshire +117%

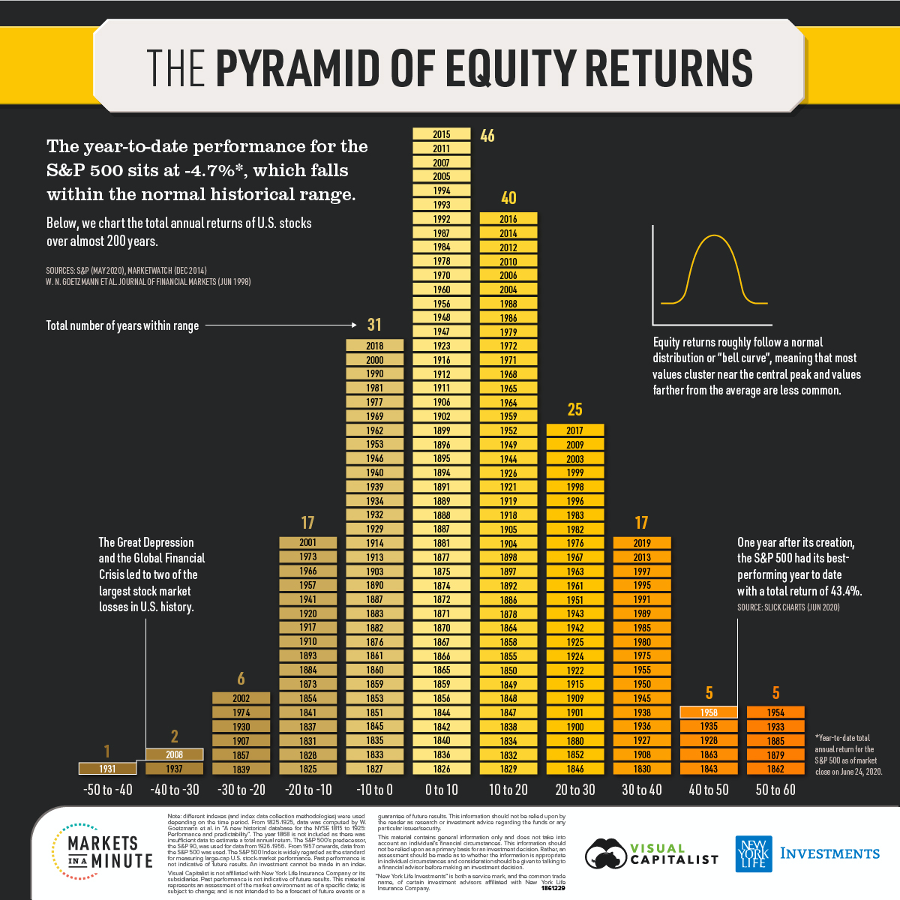

4. The Pyramid of Equity Returns

The Pyramid of Equity Returns: Almost 200 Years of U.S. Stock Performance Jenna Ross

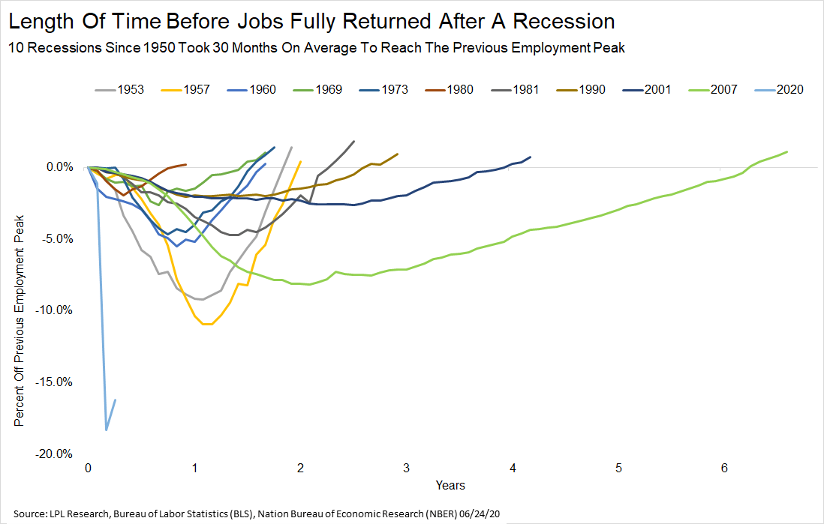

5. Job Recover 30 Months Plus

Investors are awaiting the Labor Department’s monthly jobs report, which will be released on Thursday, due to the July 4 holiday being observed this year on Friday. The report for May showed a surprising 2.5 million jobs added, confounding expectations for another big decline and, perhaps, raising the expectations for a big bounce next week. The average estimate of economists surveyed by MarketWatch is for 3 million jobs to be added in June and the unemployment rate to fall again to 12% from 13.3%. A disappointment on Thursday could shock investors and flatten the market to the same degree that May’s report helped to spark a powerful uptrend.Moreover, many have warned that a full recovery in jobs, which now sees some 30 million Americans collecting unemployment benefits, could take years to return to pre-coronavirus levels.“As good as the recent economic data has been, we want to make it clear, it could still take years for the economy to fully come back,” wrote Ryan Detrick, senior market strategist at LPL Financial, in a Friday research note.He notes that during the 10 recessions since 1950, it took an average of 30 months for lost jobs to recover, and none of those recessions saw labor-market declines of the magnitude and celerity of this recession (see attached chart):

7 reasons the stock market may face a severe bout of turbulence next week and beyond—only one is rising coronavirus cases Mark DeCambre

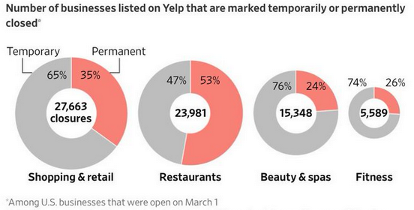

6. Number of Businesses on YELP Marked Temporarily or Permanently Closed

From Dave Lutz at Jones Trading

7. Unemployment Rate Best for New Immigrants by Country

Unemployment differences between native and foreign born residents

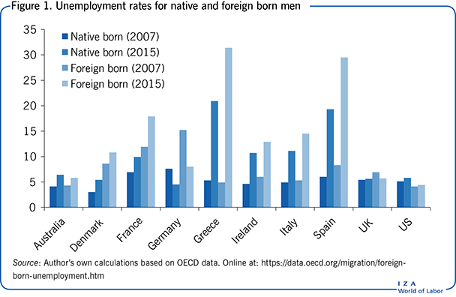

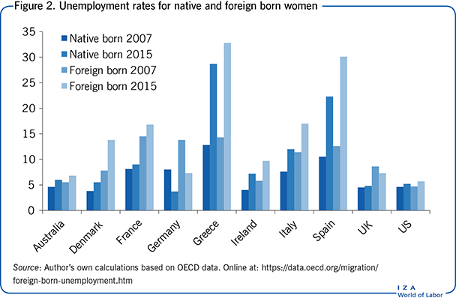

There is considerable variation in unemployment rates between natives and immigrants across OECD countries, as shown in the illustration on page 1. For example, in some countries the diference is very high—due to wider labor market difficulties, especially high overall levels of unemployment (e.g. Spain and Greece)—whilst it is relatively low in others, including some with a long-established history of receiving immigrants (e.g. the UK and the US). The unemployment gap between native and foreign born residents was highest in Belgium and Sweden in 2015 (where it exceeded 10 percentage points). In contrast to most countries, immigrants actually had lower rates of unemployment than natives in both Israel and the US. In addition to cross-country variations in overall levels of unemployment between the native and foreign born, there are also gaps by gender, as shown in Figure 1 and Figure 2. In some countries, such as Spain and Greece, unemployment rates for the foreign born were relatively high in 2015 for both men and women. By contrast, there were quite large differences by gender elsewhere, including in Denmark and Italy, where rates for foreign born women were relatively high compared with those for men, and in Ireland where the reverse was the case.

Why does unemployment differ for immigrants? Unemployment risk varies greatly across immigrant groups depending on language skills, culture, and religion Stephen Drinkwater

University of Roehampton, UK, and IZA, Germany

8. Millennials Can’t Afford Homes After Exiting the Basement

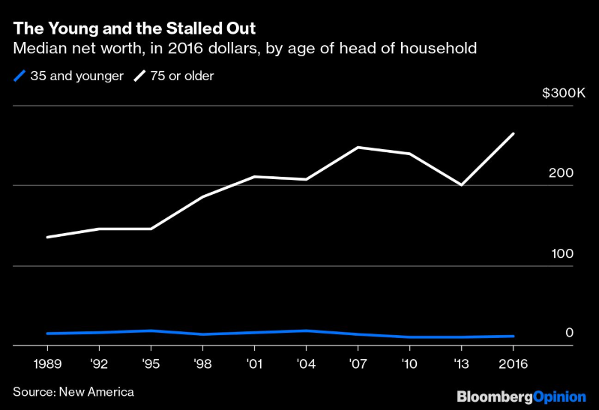

(Bloomberg Opinion) — Just a few years ago, the millennial generation — generally defined as those born from the early 1980s through the mid-1990s — was synonymous with youthful rebellion. But now, as the millennials ease into early middle age, they’re finding their path out of their parents’ basement to be a lot harder than it was for earlier generations.

The fundamental problem is that millennials aren’t building wealth. The wealth of the median household headed by someone 35 or younger has actually shrunk in inflation-adjusted terms since the mid-2000s, even as the wealth of older Americans has continued to grow:

A recent analysis by the Center for Household Financial Stability at the Federal Reserve Bank of St. Louis found that millennials have 34% less wealth than would have been predicted from the experience of earlier generations. The gap is much larger for those without a bachelor’s degree.

Many analysts have zeroed in on housing as the reason millennials have failed to match their predecessors. As of 2019, millennials owned only 5% of the U.S. housing stock, compared with 15% for the previous generation at the same age. The homeownership rate for households headed by Americans younger than 35 was 43% in 2005, but only 31% in 2015. Instead of accumulating mortgage debt like their predecessors, they’ve racked up student loans and consumer debt.

Of course, millennials will eventually inherit their baby boomer parents’ wealth, including houses. But much of this transfer won’t happen for another decade or two, meaning that many millennials will pass through their prime family-forming years without the stability and life options that wealth and homeownership provide. That is already weighing on fertility rates, exacerbating the problem of population aging. Furthermore, inherited wealth will perpetuate stark racial disparities, with Black and Hispanic millennials receiving little compared to their White peers.

A large fraction of millennials are thus on track to be a sad and lost generation, too old for the young rebellious independent bohemian life, but too poor and indebted to move to the suburbs and start families. The U.S. government needs to think about policies to prevent this from happening.

The most obvious policy is to cancel some of the existing stock of student-loan debt — most of which is owned by the federal government — and to switch to an income-based repayment model for future student loans. But this will primarily help educated millennials, who are not as far behind in terms of wealth-building as those without a bachelor’s degree. Another option is to implement wealth taxes and hand the money out as basic income. But income takes a long time to turn into wealth, even if the recipients save much of what they get.

The best method for building broad-based middle-class wealth is still homeownership. Houses are a physical, tangible asset that people of all walks of life can understand and feel confident in. Unlike other forms of wealth, a mortgage also nudges people toward saving more of their income. This is probably why the middle class tends to hold most of its wealth in houses.

The U.S. used to facilitate mass wealth-building via homeownership. The GI Bill helped WW II veterans buy homes en masse, and the expansion of the suburbs gave them and the boomers who followed plenty of new homes to buy. But those homes have appreciated in price and nationwide construction has stalled, leaving many millennials priced out of the market amid a slow-growing stock of housing. Today, U.S. housing, rather than a driver of wealth accumulation, has become an engine of intergenerational inequality.

Some countries have done a better job than the U.S. of using housing to build and transfer wealth across generations. One of these is Singapore. Although most of Singapore’s housing is government-built and is technically government-owned, the government allows occupants to buy and sell 99-year leases that essentially function as title deeds. Homeownership, therefore, is near-universal. The government also gives out subsidies to help young families buy starter homes. Because the government manages the supply of new homes, it can ensure that young people earn a decent return by the time they retire.

The U.S. could adapt this system to promote mass homeownership and wealth creation for millennials and later generations. The government could build and sell new housing, especially in inner-ring suburbs, potentially using eminent domain to keep construction costs low. Young people — especially young families — could get down-payment assistance to buy their first home. By carefully managing the amount of new housing construction, the government could make sure that home prices appreciated enough to provide people with a decent return over their lifetime, but not too much to price younger people out of the market.

Each generation would thus get to enjoy what the WW II generation and boomers enjoyed — the security and personal freedom of owning a home at a young age, coupled with the knowledge that their wealth would appreciate over time. And because down-payment assistance would be funded by progressive taxation, the system would redistribute wealth to those who weren’t born with rich parents.

The alternative — letting young Americans reach middle age without a stake in the U.S. economic system — is both sad and frightening to contemplate because it could lead not just to ennui but to unrest. A housing system built loosely on the Singaporean model would allow today’s young people to enjoy the same life progression as their parents and grandparents, preserving the American dream in perpetuity.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Noah Smith is a Bloomberg Opinion columnist. He was an assistant professor of finance at Stony Brook University, and he blogs at Noahpinion.

For more articles like this, please visit us at bloomberg.com/opinion

©2020 Bloomberg L.P.

9. 12 Running Mistakes That Could Be Hurting Your Progress (or Your Body)

By Lynette ArceneauxJune 28, 2020

Every runner hopes to avoid injuries, boost their fitness and improve their overall health, but whether newbie or pro, all runners are vulnerable to missteps that can dash those goals. Don’t fall prey to hubris.

“Any runner who reads the list of mistakes will agree with every tip the experts offer,” says Matt Fitzgerald, sports nutritionist and author of The New Rules of Marathon and Half-Marathon Nutrition. “But there will be those who believe, with every fiber of their being, that they don’t need to follow [the advice] because it just couldn’t possibly apply to them.”

Read on to make sure you’re not sabotaging yourself with some of these common running mistakes.

1. Increasing Mileage Too Quickly

Whether you’re ramping up mileage or speed, doing too much too soon is one of the biggest causes of injury. While you may think that more always equals better, Jamie Glick, director of Glick Physical Therapy and a marathon runner, warns that increasing more than 10-percent each week puts you at a higher risk for injury and burnout.

Fix It

“The general rule is to increase your mileage by no more than 10 percent each week,” says Chris Mosier, coach at Empire Triathlon Club in New York. This allows runners to slowly and steadily build up their proficiency over time. So if you ran a total of 15 miles last week, don’t run more than 16.5 miles this week.

The Beginner-Friendly Guide to Running

2. Not Warming Up With Dynamic Movements

A proper warm-up is essential to staying injury free, Mosier says. Before your run, perform dynamic warm-up drills (ones that involve movement), not static stretches (ones that you hold in place).

A 2013 review published in the Scandinavian Journal of Medicine & Science in Sports found that static stretches can reduce muscle strength by nearly 5.5 percent (or more when a stretch is held longer), cut muscle power by two percent and reduce power by nearly three percent.

Fix It

“Dynamic warm-up movements can include front and side lunges, high knees and butt kicks while running in place and side shuffling,” he says. “If you don’t have time to warm up before your run, treat the first mile of your run as a warm-up to allow your body to ease into your workout.”

The 8 Best Stretches to Do Before Running

3. Wearing Old, Unsupportive Shoes

Just like anything else you use frequently, your running shoes get worn down over time, meaning they’re not as supportive as they were when you first bought them. “Running in old shoes can lead to unnecessary pain or even injury,” says Jamie Walker, the CEO and co-founder of SweatGuru.

Walker says that running shoes have a 300- to 500-mile lifespan at the most. “If you start to feel a difference in your tread, it’s probably time to replace the shoes,” she says.

Fix It

When you’re buying new running shoes, be sure to get properly fitted at a local running or sporting goods store, Walker says. They can tell you if you’re over- or under-pronating or need any other type of corrective cushioning. “Try them before you buy them. Take a jog around the store. Try different shoes to contrast and compare,” she says.

How to Find the Best Running Shoes for You

4. Failing to Cross-Train

If you’re a runner, you run, right? But that shouldn’t be all you do day after day. You need to mix up your workout routine to ensure that you’re not neglecting any muscles. An unbalanced regimen can lead to muscle imbalances, and thus, injury.

“Runners are incredibly strong in one direction but are often weak and immobile in lateral movements and dorsiflexion, leading to problems with ankle stability, plantar fasciitis, shin splints, Achilles problems and more,” says Matt Ferguson, co-inventor and CEO of AFX (Ankle Foot maXimizer).

Fix It

Ferguson suggests yoga, swimming, strength-training workouts and exercises that specifically focus on the typical muscle imbalances for runners, such as barefooted side lunges or front lunges using a stability platform.

The Best Cross-Training Workouts for Runners

5. Not Fueling Appropriately

Think of your body as a finely tuned machine. If you don’t give it the proper fuel — or not fuel at all — your machine won’t operate optimally. You either won’t be able to run as fast, hit a wall halfway through or injure yourself.

“Eating a balanced diet will help ensure that you’re able to meet your running and fitness goals,” says Lora Mays, a Road Runners Club of America certified running coach.

Fix It

A balanced, healthy diet will center around fresh fruits and vegetables, whole grains, lean protein and healthy fats. And while you may be fine going on a shorter fasted run, if you’re ramping up the miles, you’ll want to eat a meal 2 to 3 hours before or a snack 30 minutes before.

“And don’t wait long to eat afterward,” Fitzgerald says. “During the first 45 minutes to an hour after a strenuous run, the muscles are in a unique biochemical state that allows for faster, more efficient nutrient absorption.”

Lastly, remember to stay hydrated. “If you’re going out for a long-distance run, consider carrying a hand bottle or hydration pack,” Walker says.

How to Plan the Perfect Marathon-Training Diet

6. Overtraining

Trainer Carl Ewald, race director for the ODDyssey Half Marathon, trained one runner who simply refused to stick to the training plan, instead running seven days a week and sometimes doubling the plan’s mileage.

“Two years in a row he ended up injured and missed every race he trained for,” he says. This year, however, he followed the plan and did amazingly well on his first half marathon, then went on to do great on the full marathon, Ewald says. “Overtraining is clearly one of the biggest things folks do to sabotage their training plans,” he says.

Fix It

Stick to your training plan — ideally one that doesn’t increase weekly mileage by more than 10 percent — and listen to your body. If you notice signs of overtraining (decreased performance, excessive fatigue, agitation, moodiness, insomnia and loss of appetite, according to the American Council on Exercise), pull back and add a few more rest or active recovery days.

Do You Have an Unhealthy Relationship With Running? Here Are 4 Ways to Tell

7. Being a One-Trick Pony

It’s true what they say about the comfort zone — nothing grows there. The same goes for your running. If you run the same 3-mile loop day after day, you’re not going to see progress. “While it’s good to have a favorite route, don’t get stuck on it,” Walker says.

Eventually, your body will adapt to your usual routine and you’ll plateau. “Many runners like to get in the comfortable aerobic zone and cruise, causing the body to get more efficient and burn less calories,” says personal trainer Andrew Chaddick of The Houstonian Club.

Fix It

“If you’re running flats, change it up with a hill run,” Walker says. “If you go for long, slow, steady runs, mix in a track workout.” Or consider adding intervals to your usual route. “Interval training breaks you out of your rut, forcing your body to use more energy, improve technique and get faster,” Chaddick says.

The Best Running Workouts to Transform Your Training

8. Tensing Your Upper Body

It may feel like contracting your shoulders and biceps as you pump your arms faster and faster will help you set a PR, but it’s actually counterproductive. “Carrying tension in your shoulders and upper body wastes energy and slows runners down,” Mosier says, urging runners to relax.

That’s because, if you’re expending energy keeping your upper-body muscles flexed, that’s taking up energy that could be going to your legs, glutes and core.

Fix It

“Drop your shoulders and keep your elbows bent at 90 degrees,” Mosier says. As you run, occasionally perform a mental checklist of your upper body, he says. Make sure your jaw, shoulders and arms are relaxed, check the bend in your elbows and the way you’re swinging your arms.

Your Head-to-Toe Guide to Proper Running Form

9. Running Only on Pavement

Pounding the pavement may be runner speak for going for a run, but all that pounding isn’t doing your body any favors. “Concrete, like that in sidewalks, is the least forgiving surface,” Mosier says.

Chaddick agrees, adding, “Running on pavement is often repetitive and jarring.” That can make you prone to shin splints or aches and pains in your ankles, knees or hips.

Fix It

“If you can run on blacktop, trails or any other softer surface, do it,” Mosier says. And Chaddickadvocates for trail running, noting that it’s easier on the joints and challenging to the muscles, while making the miles fly by through evolving scenery. “Running a trail is an adventure that combines the best of interval training, fartlek running, functional strength and dynamic obstacles.”

How to Transition From Treadmill to Trail — the Safe Way

10. Improper Foot Strike

Watch how your foot hits the pavement as you land. Often, if your heel hits first, it’s a sign that your hips are behind your feet and your foot is flexed too far. “It’s essentially like putting on the brakes every time you move forward,” Mosier says. “And it takes more effort to get your hips over your feet so you can properly push off.”

Fix It

Mosier recommends running on a softer surface for short periods of time to find your natural stride but cautions runners to make sure they don’t try to overcompensate by landing on their toes. According to a December 2019 review published in the journal Sports Medicine, neither heel strike nor toe strike have an advantage in preventing injury or running faster. You want to aim for a mid-foot strike.

5 Things You Need to Know About Underpronation

11. Not Investing in Expertise

Runners are often willing to spend exorbitant amounts of money on the latest high-quality, high-tech equipment, Ferguson says, “but if you suggest they hire a running coach or go to a physical therapist to address biomechanical issues, the response is often that it’s too expensive.”

He compares it to a golfer who purchases the very best golf clubs available but spends nothing on lessons, then wonders why his game remains poor.

Fix It

“If you want to run fast and stay healthy, wear last years’ tech hoodie and invest in some proper training,” he says. Ask around at your local running store for coach referrals or find one online through the Road Runners Club of America.

9 Reasons to Join a Running Club Whether You’re a Newbie or Ultrarunner

12. Setting Unrealistic Goals

“It’s important to set realistic goals for yourself,” Walker says. “Don’t overdo it, listen to your body and be kind to yourself.”

Mays agrees, saying people often set unrealistic goals when they first start running. “They go from couch potato to hoping they can run a marathon in three months.” And just like with adding too many miles too quickly (see #1 on this list), that’s a recipe for injury and overtraining.

Fix It

Before setting a goal to complete a race or similar fitness event, start walking or running to see where you are, Mays says. “You can then set a goal based on your current fitness level.” And again, make sure you’re not increasing your mileage by more than 10 percent each week.

Training for a Race? Here’s Exactly Where to Start

REFERENCES

https://www.livestrong.com/article/13727463-running-mistakes/

10. 5 Lessons Most People Learn Way Too Late in Life

It’s best to learn these lessons while you’re still young.BY QUORA

Getty Images

“What are the lessons people most often learn too late in life?” originally appeared on Quora–the place to gain and share knowledge, empowering people to learn from others and better understand the world.

Answer by Alyssa Satara, co-founder at Refugee Code Academy, on Quora:

1. Perception is reality

It’s true. The way you interpret and understand the world directly affects your beliefs and the way you live your life. Perception creates bias as much as it creates understanding. It creates fear as much as it creates curiosity.

Do you want your reality to be narrow or vast?

Will the bliss that ignorance provides be sufficient, or do you need more?

The truth is most people want more. Even if it is on a subconscious level. Humans tend to trail blaze. From cradle to the grave, our society emphasizes the importance of education. Learning and discovering is what we do, but still it is increasingly hard to understand what you don’t understand.

So how do you learn to know what you don’t know? Start by asking yourself: What don’t I know? What do you want to learn more about?

Most importantly, understand that it’s OK to be wrong. In error there is growth.

2. Everything is temporary

Your good times are temporary and your bad times are temporary. So when you’re up, enjoy it, bask in it, and be grateful for it. And when you’re down, know you will get through it. Know that it’s not the end, and that it’s just a rough patch. Life is full of twists and turns, ups and downs, and surprises.

We forget that it’s about the journey not the destination.

There is a lesson in everything. I think it’s hard for a lot of people–especially young people–to appreciate life. Recognizing the full worth of your hardships and your blunders is key to appreciating the journey. It’s just as important to stay humble and be grateful for the joys life brings you.

Everything is temporary, so make the most out of all of it.

3. The importance of being present

“If you are depressed, you are living in the past. If you are anxious, you are living in the future. If you are at peace, you are living in the present.” —Lao Tzu

More often than not, we tend to worry about what’s to come, or dwell on something that’s already happened. While it’s crucial to care and consider your future, be careful not to let it hinder your present. Moments turn into memories. Enjoy the moment while you have it.

It usually takes a lifetime of piled up worries for a person to realize: Worrying isn’t productive.

Living in the past is equally unproductive. There are definitely benefits in being able to reflect on yourself and on your past. Paying attention to what you’ve been through and how that makes you feel matters. It takes a lot of emotional energy to grieve, process, and overcome.

The balance of being able to take time to reflect, and to prioritize your future while spending the majority of your day in the present, is beyond valuable, it’s life changing.

4. Do what you love, love what you do

There was a huge mosaic near my university in London that said that those words. I was grateful to walk past it almost every day and remind myself of the importance of loving your career and loving what you do. Your work is a considerably large aspect in your life that you dedicate yourself to. If you aren’t happy in your career, that unhappiness will seep into other aspects of your life. And while nothing is perfect, it’s important to work on yourself and position yourself to reach the goals and satisfactions you desire.

Most importantly: Invest in yourself.

This goes for your non-work life, too. What habits and hobbies do you want to stop? Which ones do you want to develop? It’s important to be conscious of the type of people and activities you surround yourself with. Information is like nutrients to your brain, be aware of what you are feeding yourself. Success isn’t one triumphant moment. Success is a series of moments (and choices) leading up to bigger moments.

You are the only person who can get in the way of living every day doing what you love.

Bob Dylan said it best when he said “What’s money? A man is a success if he gets up in the morning and goes to bed at night and in between does what he wants to do.”

5. Being happy takes work

The happiest people tend to be the ones who’ve worked the most on themselves. Being happy takes a lot of work. It’s just as much work–if not more– to be unhappy. So choose wisely. Being happy means at some point you decided to take control of your life. It means you decided to not be a victim and to put that energy back into yourself. Sometimes it’s hard, but you have to pull yourself up and push yourself forward.

Your lifetime is a series of developments and personal growth.

One of the worst things you can do for self-development is comparing yourself to other people. It’s easy to get caught up in jealousy and wanting what other people have. Especially with the way we interact with social media. You have to remember that people tend to show only the best parts of their lives on those platforms. It’s not fair to yourself when you see that and think “I want to do that” or “I want to look like that”. Not only does that distract you from being appreciative of what you have in our own life, it doesn’t provide any productive input to yourself. Most often, your perception of someone’s life is a fallacy. And even if it isn’t, focus on yourself. It’s your journey and your path that you should be concerned with.

Being happy takes practice. Whether it’s you learning to let go of your ego, or forming more self-loving habits…it takes practice. You only have one life, work as hard as you can to make it your best life.

This question originally appeared on Quora–the place to gain and share knowledge, empowering people to learn from others and better understand the world. You can follow Quora on Twitter, Facebook, and Google+. More questions:

https://www.inc.com/quora/5-lessons-most-people-learn-way-too-late-in-life.html

Disclaimer

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publically available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only