1.Record Oil Collapse…USO ETF See Record Inflows.

USO-Record $552m inflows on Friday….$1.6B for the week

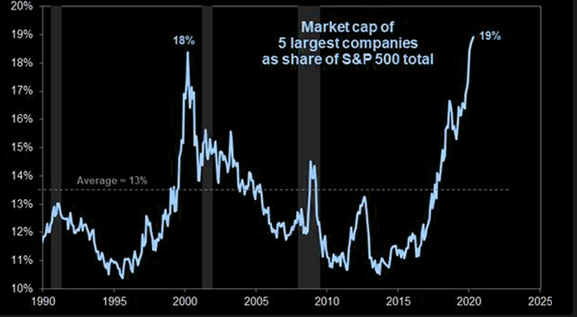

Bloggers note we now have New highs for concentration at the top as measured by the market cap of 5 largest S&P companies as a % of S&P500 (as per yesterday)

From Dave Lutz at Jones Trading

Continue reading

Reformed Broker Josh Brown

Barrons

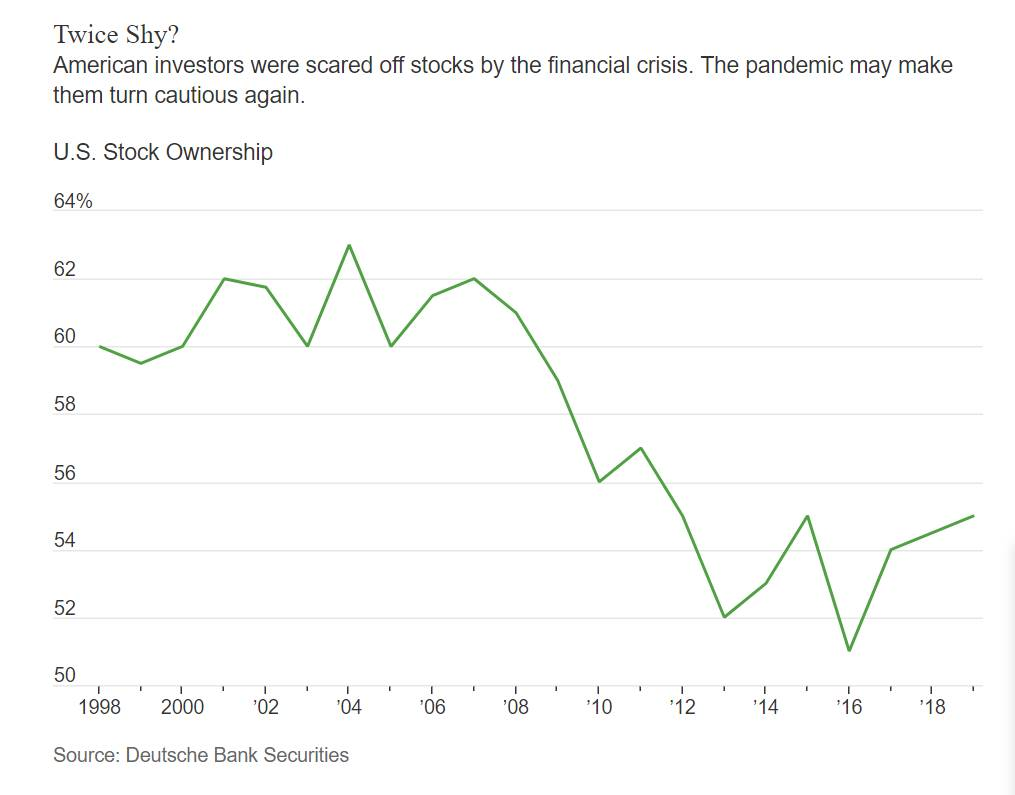

Get Ready for a PostCoronavirus World. The Economy Will Never Be the Same.–By Reshma Kapadia

Continue reading