1. Dividend contributions to large-cap total returns

Regardless of investment style, dividends have made a significant contribution to the long-term total return of U.S. large-cap equities.

BMO Global Asset Dividend contributions to large-cap total returns | BMO Global Asset Management (bmogam.com)

2. April Thru August is Bullish Seasonal Period for U.S. Treasurys

Most Bullish Seasonal Period For Treasurys Runs From April Through August-Guggenheim Research

Monthly basis point change in 10-year yields relative to full-year trend, 2010-2019

|

Source: Guggenheim Investments, Haver Analytics. Data as of 3.23.2021. Note: Monthly average constant maturity 10-year Treasury yield. Interquartile range is shown here as middle four observations out of ten.

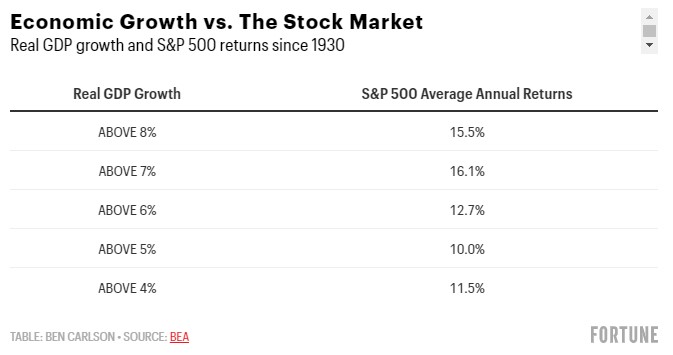

3. Can the Stock Market Crash During an Economic Boom?

Posted March 30, 2021 by Ben Carlson A Wealth of Common Sense Blog

https://awealthofcommonsense.com/2021/03/can-the-stock-market-crash-during-an-economic-boom/

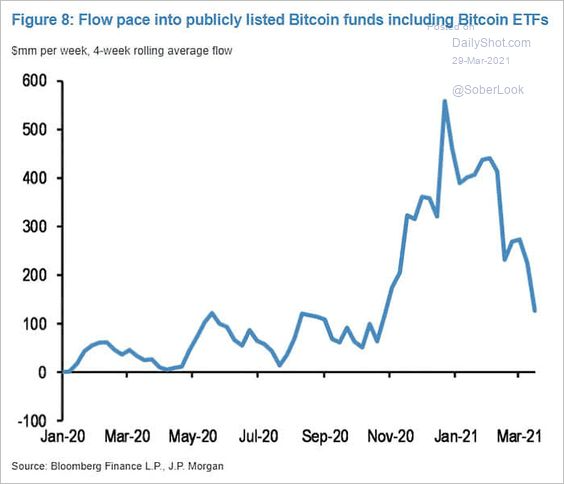

4. Flows into Bitcoin Funds have Slowed Dramatically

While the price of Bitcoin remains near all-time highs, there is evidence of waning enthusiasm for this poster child of the current speculative market environment.

The chart below illustrates that the pace of capital flows into publicly traded Bitcoin funds has steadily declined from the peak of late 2020 despite an increase in the number of available funds and a rising Bitcoin price.

This decline in Bitcoin capital flows, along with the recent underperformance of the Nasdaq versus the S&P 500 and a decline in call option buying, suggests that the current speculative fervour may be beginning to weaken.

A sobering of investor behaviour may make markets vulnerable to a significant pullback, given the current lofty heights of both investor optimism and valuation at which they now sit.

If you found this post of interest, you’ll find the Global Investment Letter of value. To view free sample issues and to receive our weekly investment comment please visit: https://lnkd.in/e3BaS3P

https://www.linkedin.com/in/jonathanbaird88/

5. VW Group Making Up Some Serious Ground in EV Cars Delivered.

| Voltswagen No, we didn’t come up with that one. Voltswagen was the actual new name (for about 24 hours) that automotive giant Volkswagen Group announced for their US subsidiary this week, in a bid to promote the company’s renewed focus on electric vehicles and its new all-electric SUV. Initially leaked as an upcoming April Fools joke, the name change was later confirmed on official VW corporate channels, before company spokesman Mark Gillies said on Tuesday that the statement was indeed an early April Fool’s Day joke. For a company found guilty of lying in a big way about emissions (Dieselgate), this was a high-risk gag and the delivery was poor. Joke or not (we actually don’t mind the name), VW Group is a lot more serious about its ambitions for electric vehicles. Last year, between the company’s 12+ brands (full list of them here) the group delivered around 230,000 all-electric vehicles. That might only be around 2% of Volkswagen Group’s total vehicle deliveries, but it is already almost half of Tesla’s sales. The road ahead VW Group expects to spend €35bn ($41bn) on electric mobility over the next 5 years. With 12 individual brands to manage there’s a decent chance they mess something up as they transition to electric, but even accounting for some serious execution risk, that kind of investment could see Volkswagen Group become the biggest EV seller in the world. |

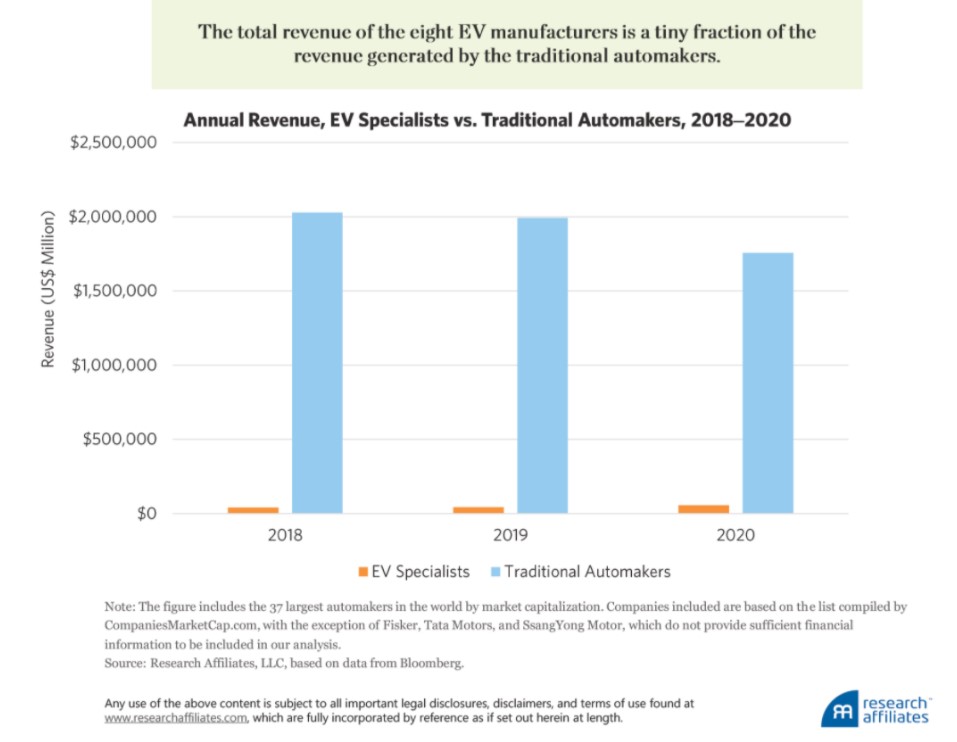

6. Annual Revenue EV Specialists vs. Traditional Auto.

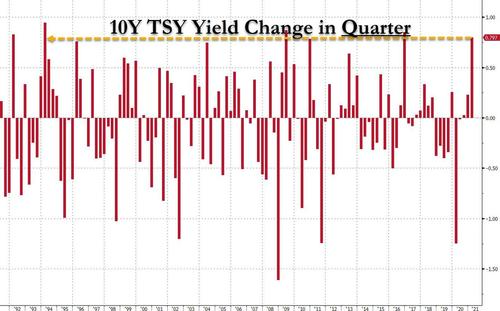

7. If Yields Rise 7bps Today, Q1 Will Be The Worst Quarterly Rout For Treasurys In The 21st Century

BY TYLER DURDEN

WEDNESDAY, MAR 31, 2021 – 11:45 AM

On the last day of Q1, the quarter seems to be ending very much how it began, with Treasury yields rising to fresh highs as investors await the announcement of further spending proposals in President Biden’s infrastructure package while buying stocks first (the S&P just hit a new all time high) and asking questions later.

Indeed, as DB’s Henry Allen writes, the rise in 10yr Treasury yields in Q1 so far had reached a massive +82.7bps (0.797bps at the time of writing), which puts them just shy of the 21st century’s other quarterly records back in Q4 2016 (+85bps) when President Trump won the presidential election, and Q2 2009 (+87bps) as the global economy was climbing out of the financial crisis. Of note: even the 2013 taper tantrum was a far more modest, and slow move compared to what we have seen now.

And while everyone is waiting for Biden to reveal further details from his infrastructure package on Wednesday, should today’s Biden speech spark a further climb in yields, that could then leave this as the biggest quarterly rise going all the way back to the Great Bond Massacre of Q1 1994, when yields blew out +94.4bps.

8. Small Cap Growth Stocks -15% Correction but Held Support.

IWO-Small Cap Growth ETF…-15% peak to trough but bouncing at Jan 1 support levels

9. NFTs: Frequently Asked Questions

MORNING BREW

We answered five big, basic questions about non-fungible tokens.

NFT is the latest acronym you probably feel pressured to pretend you’re an expert on. We want to make sure you can name-drop it in your next Zoom happy hour, and answer any follow up questions without skipping a single forkful of salad.

Here’s the most efficient FAQ we could muster.

What is an NFT? Is it a cryptocurrency?

Non-Fungible Tokens are unique, easily verifiabledigital assets that can represent items such as GIFs, images, videos, music albums, and more. Anything that exists online can be purchased as an NFT, theoretically.

An NFT is “a type of cryptographic token,” Emerging Tech Brew writer Ryan Duffy explains, but NFTs are different from cryptocurrencies because they’re not interchangeable. Think of Pokémon cards: You can trade them, but a Gastly is not the same as a holographic Charizard. But a bitcoin is indistinguishable from another bitcoin.

Why would I want to own an NFT? Can I make money on it?

One reason to buy an NFT is for its emotional value, which isn’t so different from physical objects…unless you’re a total utilitarian. No one buys lip gloss because they need it. They buy it for the way it makes them feel. The same can be true for a GIF, image, video, or other digital asset.

The other reason is because you think it’s valuable…and will only increase in value. And yes, you can make money off of an NFT by buying and reselling it for more.

How do you buy an NFT?

The process varies based on what platform you use. And there are a lot of platforms.

On Top Shot for instance, you register to join a waitlist that can be thousands of NBA fans long. When a digital asset goes on sale, you’re randomly chosen to buy it. While Top Shot accepts USD as well as crypto, some platforms only accept cryptocurrencies, like OpenSea.

How do you know your NFT is authentic?

NFT ownership is recorded on the blockchain, and that entry acts as a digital pink slip. Defining the blockchain is a whole ‘nother can of worms that you can read about here.

- Where is the blockchain? It’s decentralized, so it exists across many people’s computers in encrypted bits and pieces.

Are NFTs new?

They’re newly popular, but not new. Andrew Steinwold traces their origins all the way back to blockchain-backed Colored Coins in 2012, but they didn’t move into the mainstream until CryptoKitties had everyone buying virtual cats in 2017.

Recently, as Google search trends indicate, interest in NFTs has exploded. The creators of CryptoKitties started Top Shot, a platform that allows fans to buy, sell, and trade NBA highlights, and digital artwork is now being auctioned by Christie’s.

NFTs: Frequently Asked Questions (morningbrew.com)

10. 5 Tips to Read 100 Books a Year

By Daniel Ally | April 4, 2016 | 3

Reading isn’t always an easy habit to develop, but it’s one that can help you improve your life. To be successful, at whatever you do, you must increase the quantity and quality of the books you read.

When I first started really reading at 21, I read slowly, and I wasn’t getting much out of the books. I would finish one or two a month—and I wouldn’t even remember what I learned. My level of comprehension and lack of speed began to frustrate me.

So one day, as I was fighting my way through a chapter, I got so mad at myself, I went on a quest to find out how I could read more books, and get the most out of them in less time.

For the last several years, I’ve been increasing the number of books I read. I went from reading one or two nonfiction books a month to five-plus. That soon increased to six to eight books every month, and now I read more than 10—which is about a book every three days. Adding it all up, that’s around 100 books a year… because of these five techniques:

1. Learn how to speed-read.

Read a book on speed-reading. One of my favorite books on the subject is called Breakthrough Rapid Reading by Peter Kump.

I use my hand to guide myself along the pages. This method helps me stop reading aloud so much in my head. It also forces my eyes to read faster by skimming and scanning. Now, instead of reading 200 words per minute, I read more than 1,000.

2. Don’t read cover to cover.

To say you have to read every book you encounter cover to cover is a myth. If you do, you’re taking too much time on trivial content.

Average books offer just a couple major ideas, good books offer a couple more and great books offer the most. Most books are average. An average author could write a 20-page book with all of his or her ideas, but that kind of book won’t sell to the public—so they generally add 200 extra pages to fluff it up.

Now don’t get me wrong, great authors don’t add fluff to their books. But how many great books worth reading over and over again can you really find? So if we’re assuming that most books out there are average, do you think it would make sense to read them from cover to cover? Definitely not!

Instead you might want to skim the entire book in five minutes to get the main idea. Use the table of contents, which will help you understand the ideas dispersed throughout the book. Make notations on the pages you want to revisit.

Next, read more deeply, closer to 30 minutes, on your second visit. Only take time to reread the best parts of the book. It’s like a scanning process, but one that allows you to absorb the material with good understanding.

Finally, if the book is worth another read, take an hour or two to read it for the third time. If you can read your favorite parts in the book again, you should be able to remember your material for a while.

Imagine that! You’ve just read a book in less than three hours.

The key here is that it’s more important to get the best information from 10 books than it would be to get all the less-than-the-best information from one book. In an entire year, you can get through 120 books while another person will only finish 12 of them.

3. Set time limits.

Setting time limits on what you read can keep you focused.

Give yourself four hours to read a 200- to 300-page book. Do it with unadulterated focus. Let there be no distraction as you romance your book.

The key here is to know what you want to get out of each book that you read. If you force yourself to get the most out of a book in four hours, I guarantee you will be able to do it. However, if you give yourself one month, there’s no discipline, because your attention will be offset.

Too many people waste time doing research while they read. If you’re looking up a word or doing research while you’re reading, your attention will shift and it will take longer to finish. Instead, take control of the book; don’t let the book take control of you. If there’s a section that you don’t understand, make a note of it and return to it later. Do the same with unfamiliar words.

4. Read the easy books first.

This is about building confidence. If you start reading an academic 1,000-page textbook, this may prohibit your reading speed.

Start with a quick 100- to 150-page book. Get a stack of them on all different subjects. Aim to read one to two of them a week—and watch yourself progressively improve. Eventually, you can add the bigger books once you build the confidence.

Some books are complicated and hard to digest, like autobiographies and obscure nonfictions. You don’t want to get mixed up with these at first, especially as you start your speed-reading tour. Start small, then grow big!

5. Only read the best books.

Before you begin a book, decide if it is worth reading. You probably picked up the book to find a solution to one of your problems. Within the first 10 minutes, you should be able to decide if the book will help you solve that problem.

Rate your book on a scale of 1 to 10, “1” being the worst and “10” being the best. Make sure you stay on top of your reading by only reading the books that captivate your attention. If you’re reading a book that doesn’t interest you or bores you completely, put it aside.

This means that you should organize your books, too. Line up 10 to 20 books and choose a few out of the stack every month. Always replenish the stack when you finish.

Reading books lead to magnificent experiences. Take advantage. Enjoy the stories. Fill yourself up with usable knowledge and wisdom.

Our libraries are paved with gold. But you have to know how to use the gold you have.

Articles

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.