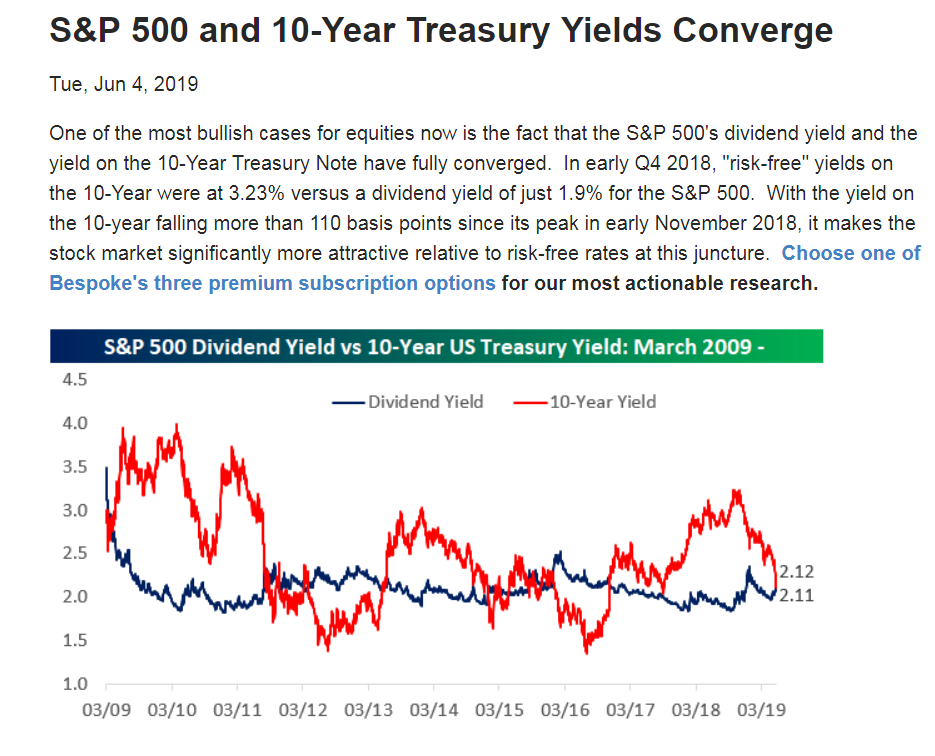

1.S&P Dividend Yield and 10 Year Treasury Yield Converge.

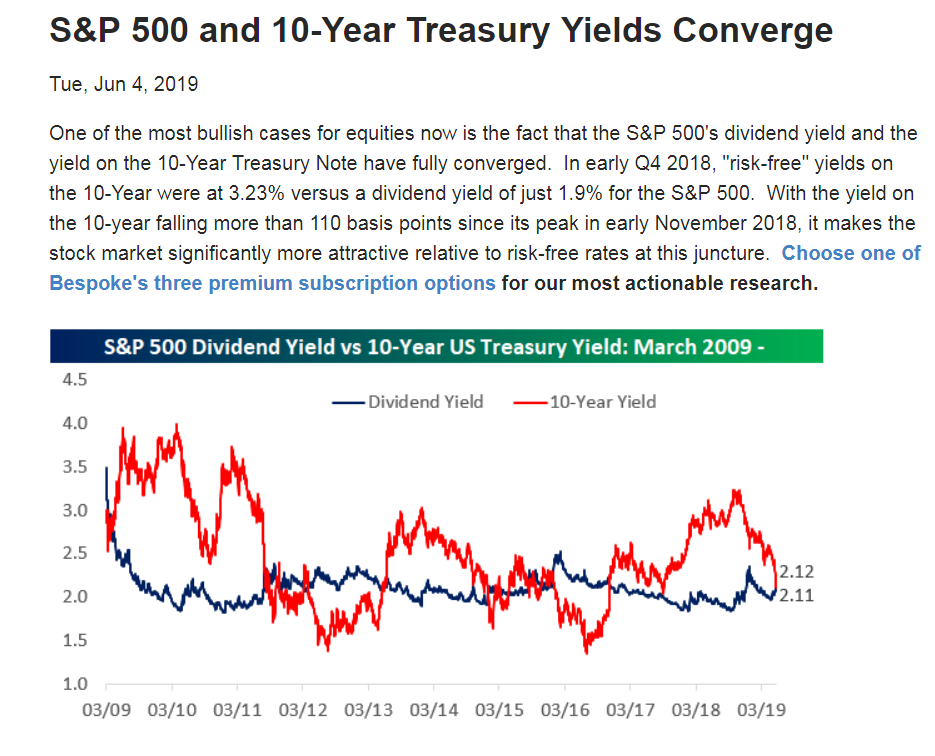

This chart from TD Securities shows that traders in the fed fund futures market now foresee around two rate cuts before the end of 2019 as heightening trade tensions have stoked worries over the economic outlook. Expectations of easier policy gained ground on Friday after President Donald Trump threatened to wield tariffs against Mexican imports unless the country stemmed the flow of migrants to the U.S. southern border.

“When the industry starts to move toward commoditization over the next decade,” says Henderson, “Colombia is the only place that makes sense.” An equatorial climate and low-cost, skilled labor give Colombia a clear advantage in agricultural trade. And that makes the nation a threat to North American companies like Canopy Growth (ticker: CGC), Tilray (TLRY) andAurora Cannabis (ACB). These firms have invested hundreds of millions of dollars in building the climate-controlled grow-operations needed to grow weed in cold latitudes.

Most Canadian companies nurse the long-term hope of getting their production costs below two Canadian dollars per gram of cannabis. Colombian producers say their costs will start well below 50 cents a gram—and go down from there.

The Next Threat to Big Marijuana Companies Comes From Way South of the Border

Bill Alpert

https://www.barrons.com/articles/colombia-marijuana-production-51559321831?mod=hp_DAY_7

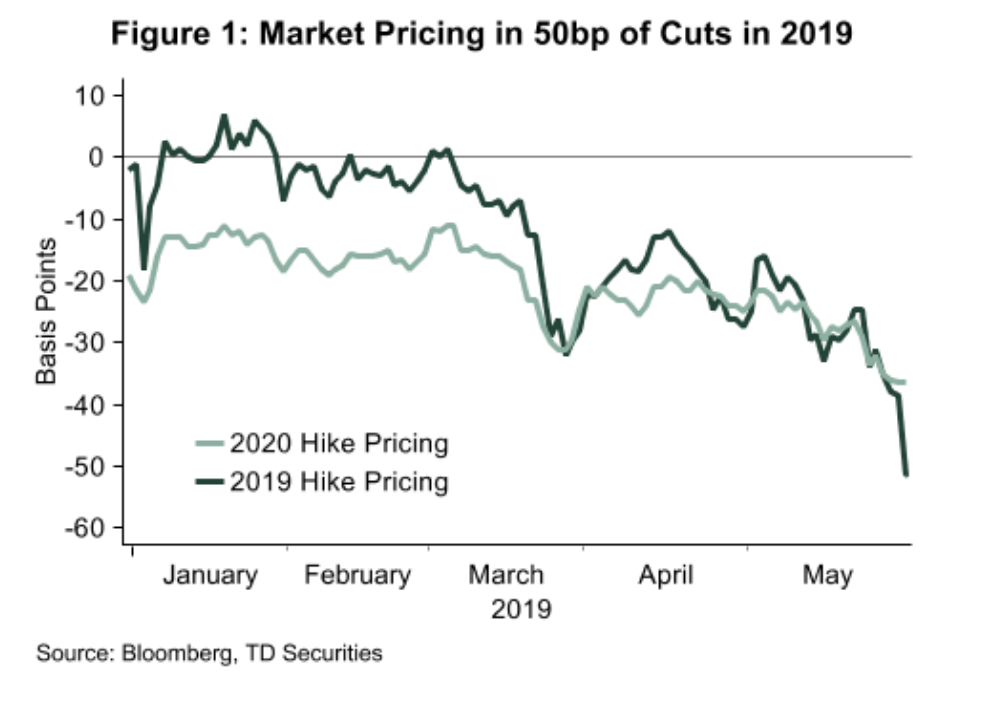

Investors seeking yield are piling into the riskiest corner of the municipal bond market at a pace not seen in decades.

They have poured $8 billion into funds that deal in high-yield muni bonds—or junk munis—this year, the most through May since at least 1992, according to Refinitiv data. Muni-bond funds overall have attracted $37 billion during that same period, the most in almost three decades.

Funds dealing in high-yield munis have drawn $8 billion as investors search further afield for returns

By Gunjan Banerji

https://www.wsj.com/articles/risky-municipal-bonds-are-on-a-hot-streak-11558949401?mod=itp_wsj&ru=yahoo

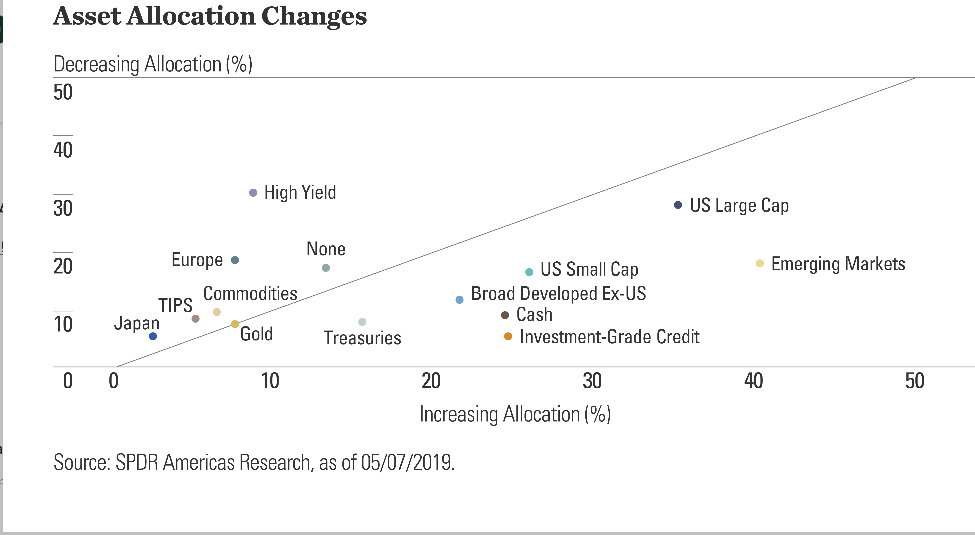

With respect to asset allocation trends, the chart below reveals where investors are willing to increase or decrease exposure as we head into the second half of 2019. Any asset class below the line indicates more bullish sentiment, where respondents are more inclined to increase allocations relative to the percentage seeking to decrease. Investment-grade credit has the highest ratio of increase to decrease percentages, reflecting the strongest agreement among respondents on where to position. This indicates investors’ preference to move up in quality this late in the cycle.

Emerging markets is a key area where investors are increasing allocations, with 40% of those surveyed indicating that they plan to do so. This is likely a result of the attractive valuations in the region combined with supportive demographic trends. However, we note that this survey was taken while trade tensions appeared to be softening. As recent rhetoric has reignited fears of a trade war escalation, the results of this survey might look somewhat different today.

On the bearish side, investors cited high yield bonds as an area where they plan to reduce allocations, with 30% planning a decrease. High yield not only had the highest decrease percentage, but also had the highest ratio of decrease to increase. As credit spreads continue to tighten—currently they’re 34% below the long-term 20-year median—high yield bonds present less upside relative to downside on a forward-looking basis,1 and may partially explain these survey results.

Consistent with our theme of ‘cautiously optimistic’ attitudes toward US equity markets, US large cap results were mixed. While investors are planning to increase their small-cap allocations, they are also expecting to increase allocations to cash. Lastly, while broad developed ex-US is on the bullish side of the ledger, specific country or region allocations to Europe or Japan are not. The latter reflects the unwillingness of investors to take on country- or region-specific risk, but rather be broadly diversified outside the US.

https://global.spdrs.com/blog/post/2019/May/2019-midyear-survey-investors-remain-confident-albeit-less-willing-to-take-on-risk.html?WT.mc_id=em_spdr-insider_us_ssga_may19&link=textlink2&mkt_tok=eyJpIjoiTmpneU56azVNREJsTm1GaiIsInQiOiJVaHpSb0tjc0duclRwQm81OVNRYWY3eE50Smk2K0xVMlNaMDZhZVBVSkRaTXBjSGU5dEhhYjh5dHNlck9hOWdZUGtqZFwvcVdHNHBaa0R0WmVJbTJQamtkSVF6U2V2RnNDQXJkN0lTenRlc1N6aVFObzNNR2dcL2VjZXk3SU5XRlUwIn0%3D Continue reading