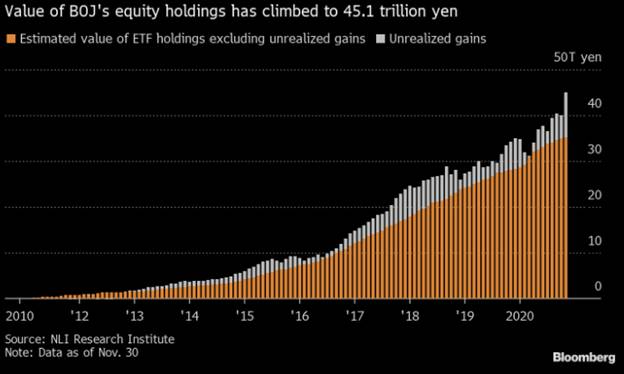

1. Bank of Japan Increasing Equity Buying During Pandemic…….Now Long $400B of Japanese Stocks.

WHALE BUYER– The Bank of Japan has taken over as the biggest owner of the nation’s stocks, with the total value of its holdings climbing well above $400 billion – Massive exchange-traded fund purchases by the BOJ to support the market amid the pandemic this year combined with subsequent valuation gains pushed its Japanese equity portfolio to 45.1 trillion yen ($434 billion) in November.