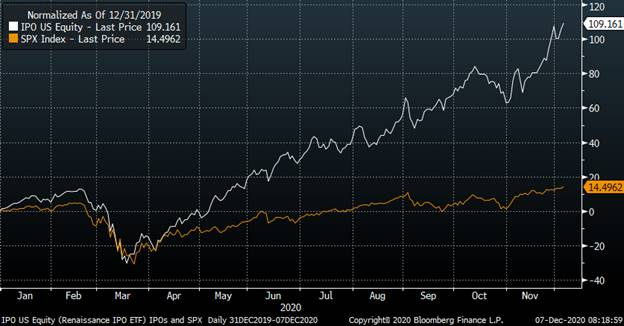

1. IPO ETF is +100% 2020.

December is set to be the busiest year-end on record for initial public offerings in the U.S., with DoorDash Inc. and Airbnb Inc. ready to start trading this week in long-awaited listings – The two startups, which are aiming to raise a combined $6.2 billion at the top-end of their price ranges, will propel the month’s IPO volume to all-time high, surpassing the $8.3 billion mark set in December of both 2001 and 2003. DoorDash upped the price range for its stock in a Friday filing, while Airbnb plans to boost the proposed price range of its initial public offering to between $56 and $60 a share. The IPO ETF is a double in 2020!

From Dave Lutz at Jones Trading

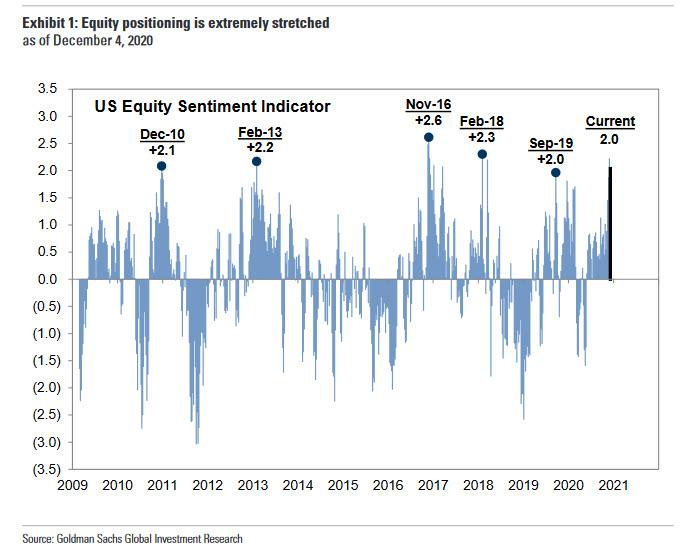

2. Goldman Sachs Sentiment Indicator on U.S. Stocks 2 Standard Deviations Above Normal

Sounding surprisingly similar to Goldman, which as we reported earlier today issued an almost identical warning, when it observed that its sentiment indicator is now +2.0 standard deviations above average…

Found at Zerohedge.

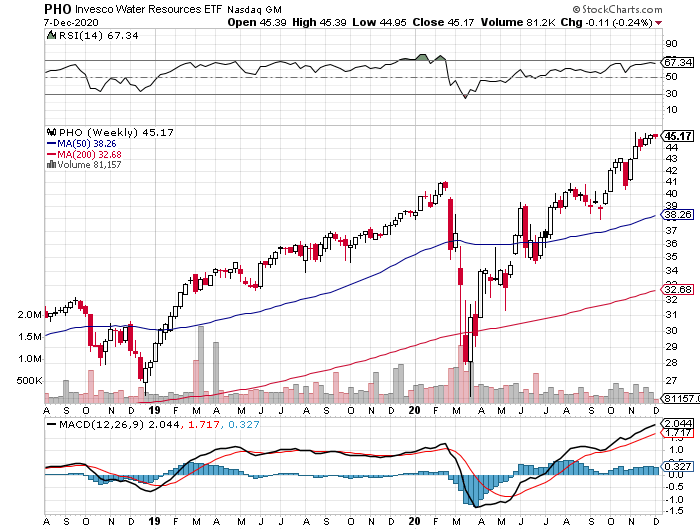

3. Water ETF Breaks Out to New Highs.

Water ETF Almost Double Off Bottom …3% of the worlds water is fresh

©1999-2020 StockCharts.com All Rights Reserved

4. Water futures set to join likes of gold and oil and trade on Wall Street for first time ever

Dec. 7, 2020, 09:30 PM

Getty Images

- Future contracts tied to the spot price of water are set to trade on Wall Street for the first time ever this week.

- The CME Group is launching the contracts, linked to the $1.1 billion California spot water market.

- The water contracts will allow farmers and investors alike to hedge against, or bet on the potential for water scarcity.

- One high profile investor that may be eyeing an investment in the water contracts: Michael Burry of “The Big Short.”

- Visit Business Insider’s homepage for more stories.

The CME Group is set to launch futures contracts tied to the spot price of water for the first time ever this week.

The contracts will allow investors and farmers alike to bet on the future price of water. The contracts are tied to the $1.1 billion California spot water market.

While water will officially join the likes of gold, oil, and other commodities in being traded on Wall Street, the contracts will be financially settled. This means buyers of the contracts who hold on through expiration won’t be greeted by a delivery of millions of gallons of water like they would for other commodity based futures like oil and grain.

The water contracts are tied to the Nasdaq Veles California Water Index which was launched two years ago. The index is driven by the volume-weighted average of the transaction prices in California’s five largest and most actively traded water markets.

Contracts will each represent 10 acre-feet of water, equal to about 3.26 million gallons.

One high-profile investor potentially looking to capitalize on the newly launched water future contracts is Michael Burry of “The Big Short.”

Burry highlighted water as one of his top investment ideas following the great financial crisis of 2008, as he sees demand for the life-sustaining natural resource to continue climbing as supply falls due to population growth and climate change.

But farmers will likely utilize the water contracts more than investors, as they look to hedge out their input costs amid an increasingly uncertain climate environment.

The CME Group initially announced the launch of water futures back in September.

“With nearly two-thirds of the world’s population expected to face water shortages by 2025, water scarcity presents a growing risk for businesses and communities around the world, and particularly for the $1.1 billion California water market,” said Tim McCourt, CME Group Global Head of Equity Index and Alternative Investment Products.

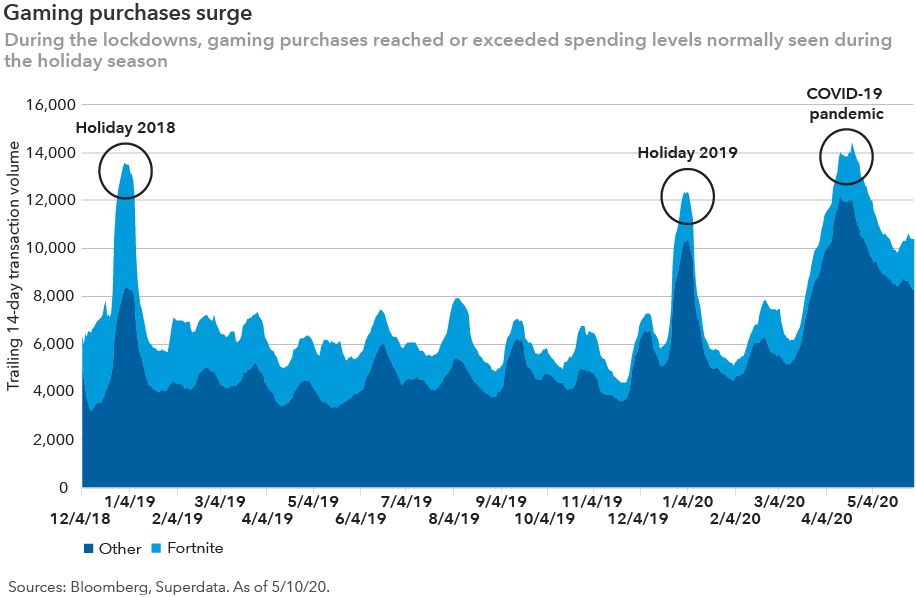

5. Adoption of Online Gaming Accelerated During Covid….AMZN E-Gaming 100% Year Over Year Growth

Capital Group

The adoption of online gaming also quickened during the lockdowns. Video game companies benefited from accelerated demand similar to what is usually seen during the holidays. Twitch, Amazon’s e-game livestreaming platform, saw 100% year-on-year growth in hours watched in April, to 1.65 billion. That compares favorably to the 2018 NFL season monthly average of 1.6 billion hours watched. Twitch also reached a record number of concurrent viewers (4.3 million).

This strong performance was shared across other gaming platforms. China’s Tencent — the world’s largest gaming company by revenue — reached record daily spending and daily active users (DAU) for its games Honor of Kings and Peacekeeper Elite (approximately 200 million DAU combined) during Chinese New Year. Nintendo saw record Switch console sales in March, while Steam marked a record number of concurrent players (24 million).

Looking at China as a guide to future trends, daily users specific to Tencent declined as people returned to work. Interestingly, however, time spent on gaming has remained higher than levels seen before COVID-19 struck. People who became more financially and emotionally invested in their gaming during the pandemic-related lockdown have continued playing even as physically experiential activities opened back up. There’s also a social element to the games, particularly on mobile devices, that has added to their lasting attractiveness — in and beyond the lockdown period.

Gaming remains one of the least expensive forms of consumer entertainment, with significant potential to capture a greater share of discretionary spending. Moreover, several analysts anticipate that the shift to digital entertainment may improve content holder profitability. However, cloud gaming — which provides access to any game, anywhere, on any device — has emerged as the next major platform in video games, and we continually assess which firms might be the beneficiaries of this shift.

Five technology trends to watch in a post-COVID world

6. Goldman Plots Florida Base for Asset Management in a Blow to New York

- Remote-work experience speeds plan to shift New York-area jobs

- Elliott, Blackstone and Citadel have been expanding in Florida

Goldman Sachs Group Inc. is weighing plans for a new Florida hub to house one of its key divisions, in another potential blow to New York’s stature as the de facto home of the U.S. financial industry.

Executives have been scouting office locations in South Florida, speaking with local officials and exploring tax advantages as they consider creating a base there for its asset management arm, according to people with knowledge of the matter. The bank’s success in operating remotely during the pandemic has persuaded members of the leadership team that they can move more roles out of the New York area to save money.

Goldman may yet decide against centering asset management in Florida, where it would join a growing list of firms seeking tax and lifestyle advantages. It also may opt for another destination like Dallas, where it has been accelerating its expansion, the people said.

The deliberations at the Wall Street icon, often a trendsetter for the industry, adds to the cloud over New York’s future. As restaurants and stores fight to survive, the city is trying to stem the flight of white collar jobs to states with lax tax regimes and lower costs of living.

Manhattan now has the most office space available since the aftermath of the Sept. 11 attacks. This time, the trend began even before the pandemic struck, with AllianceBernstein Holding LP shaking up city boosters in 2018 with plans to move its headquarters to Nashville.

Inside Goldman, sentimental attachment to the city where it rose to prominence is taking a back seat to the company’s ambitious target unveiled early this year to cut $1.3 billion in costs, in part by shifting employees to cheaper locales. It’s unclear how many people could eventually go to Florida. In the last decade, Goldman has incrementally expanded offices in places like Dallas and Salt Lake City to thousands of jobs in an effort to trim expenses. The virus has cemented its resolve to accelerate that shift.

“We are executing on the strategy of locating more jobs in high-value locations throughout the U.S., but we have no specific plans to announce at this time,” a spokesman for Goldman Sachs said in an emailed statement.

The firm’s newly reconfigured asset-management division pulls in about $8 billion in annual revenue and is a critical pillar of Goldman’s plans to diversify its ways of making money. Goldman Sachs, which employed almost 41,000 people at the end of September, doesn’t disclose its divisional headcount. Asset management has accounted for about a quarter of the firm’s revenue in recent years.

A decision to create a central location for the business in Florida would not only include back-office staff but also some investment professionals, two of the people said. The shift would be carried out over time.

Goldman has looked at potential office space in the corridor north of Miami that covers places like Palm Beach County and Fort Lauderdale, the people said.

Florida’s warm weather and lack of a state income tax have lured wealthy Americans for years. But until 2020, the region struggled to peel away the rainmaking class from Wall Street’s most elite firms. Most hedge funds that relocated to the state were relatively small. And while Deutsche Bank AG built a Jacksonville campus, many personnel there have focused on back-office and other support functions.

Now the migration of larger financial firms and money managers is showing signs of gaining momentum. Some employers are trying to accommodate owners or top talent who prefer the state. Such pressure may build as throngs of New Yorkers decamp to the Sunshine State as they wait for a vaccine in spacious homes with private pools.

Already, Paul Singer’s Elliott Management Corp. plans to move its headquarters to West Palm Beach from midtown Manhattan. Other investing powerhouses like Blackstone Group Inc. and Ken Griffin’s Citadel have been bulking up their presence in the state.

Meanwhile, New York’s defenders have been calling on business leaders to stand by the metropolis, predicting it will rebound once the pandemic passes.

“With all due respect to Florida, no place can compare to New York City’s concentration of talent, education, innovation and next-generation technology,” said Bill Neidhardt, press secretary to New York Mayor Bill de Blasio. “The city continues to see new expansions and investments from the leading industries and we expect more to come.”

Goldman’s top competitors have flirted with the idea in the past. JPMorgan Chase & Co. CEO Jamie Dimon in 2013 praised Florida’s business-friendly policies and joked that he sometimes wonders aloud why the nation’s biggest bank doesn’t relocate to Miami. Executives at one point floated the possibility of moving the firm’s headquarters to the state, but dismissed the proposal over issues including the quality of Florida’s schools.

The coronavirus has stoked more serious conversation inside boardrooms, especially as executives fret about the new Democratic administration raising taxes and look to cut expenses to improve returns in an ailing economy.

— With assistance by Amanda L Gordon, Jonathan Levin, Shahien Nasiripour, and Henry Goldman

7. Biden’s plan to forgive student debt could have limited economic benefits, and carry risks

PUBLISHED SUN, DEC 6 20208:52 AM ESTUPDATED SUN, DEC 6 20203:16 PM EST

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

· President-elect Joe Biden campaigned on a promise to provide relief on student debt.

· Expectations are for forgiveness around $10,000 per borrower.

· The larger economic benefits of that are debatable, with one prominent study saying adjusting loan payments for income would have more impact.

· Biden could announce his forgiveness plan early in his administration, setting up a battle against congressional Republicans.

If President-elect Joe Biden follows through on his campaign promise to forgive student loans to many borrowers, he’ll be checking off an important box for his political constituency.

As a boost to the struggling U.S. economy, however, the move may not have much impact and will draw substantial opposition early in his presidency.

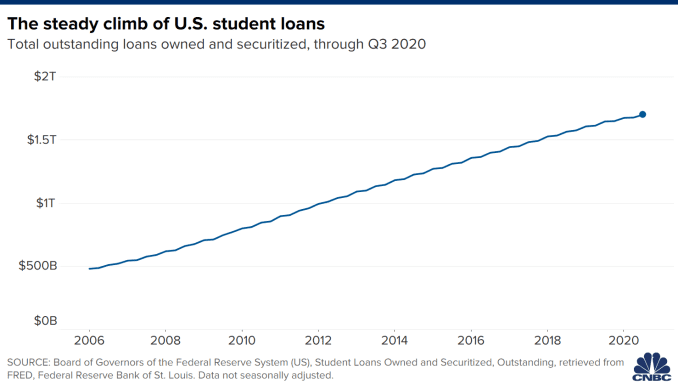

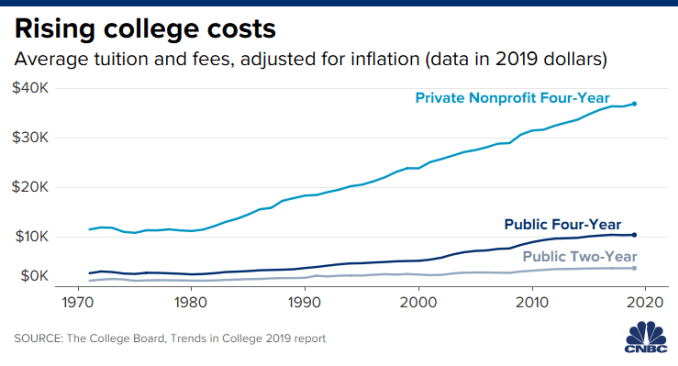

What to do about the burgeoning $1.6 trillion in education debt has been a nagging question for government officials. Fully half of the debt has piled up over the past decade, when effective nationalization of the process opened a floodgate of tuition increases and college loans that left many graduates struggling to pay bills, buy homes and raise families.

The most likely path Biden will follow is a $10,000 forgiveness plan at a time when the average burden per graduate is just shy of $30,000.

That would provide an aggregate savings of more than $400 billion, according to many estimates.

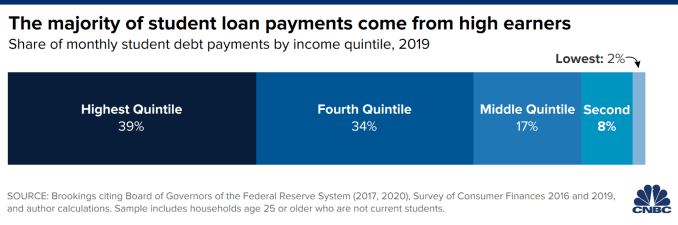

But in doing so, it would raise a series of thorny questions that the new administration may have a hard time answering. Among them are issues over wealth inequality, given that higher-income borrowers owe a larger share, moral hazard of wiping out loans to a select group, and whether forgiveness is even the most effective way to address the issue.

“There is growing evidence that student loan debt does have macroeconomic consequences,” said Mark Zandi, chief economist at Moody’s Analytics. “Outside of mortgage debt, it’s the largest amount of household debt outstanding, and it’s still growing rapidly.”

Indeed, education loans outstanding totaled just $480 billion at the beginning of 2006. However, two pieces of legislative action that effectively guaranteed access to college, and the funds needed to pay the way, caused that figure to jump 67% over the next four years to $800 billion, and it’s more than doubled that total in the decade since.

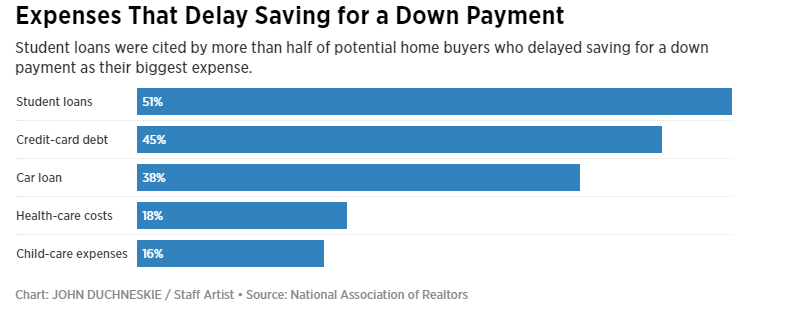

Studies have linked the burden to lower household formation, higher delinquency rates and lower confidence about the future for borrowers.

But whether just wiping the slate clean would really help is an open question.

For his part, even while Zandi insists the idea would benefit the middle class, he sees significant weakness.

“How I would provide relief to hard-pressed student loan borrowers, I think I’d focus more on income-based repayment plans,” he said. “If you’re really trying to address our long-term education needs, which I think is critical to long-term economic growth, we need to be thinking more expansively about providing higher levels of education at a much lower cost.”

Providing outright debt relief, he added, raises the question of, “Do we really want to subsidize tuitions? That’s what you’re doing. You’re giving money to students to give to universities that raised the tuition … and it doesn’t really help anybody.”

The larger efficacy question of loan forgiveness was the study of a working paper released last month by the prestigious University of Chicago Booth School of Business.

Researchers Sylvain Catherine, of the University of Pennsylvania’s Wharton School of Business, and Constantine Yannelis, from the Booth school, compared the benefits of forgiveness against those of income-based payment plans that Zandi mentioned. They found the latter provided better benefit, particularly for lower-income borrowers.

Those with higher debt loads, the study found, tend to be students in post-graduate programs who also are making more money. Thus, they would benefit more from forgiveness and widen a growing disparity among income classes in the U.S.

“We find that universal and capped forgiveness policies are highly regressive, with the vast majority of benefits accruing to high-income individuals,” the authors said. “On the other hand, enrolling more borrowers in [Income-Driven Repayment] plans linking repayment to earnings leads to forgiveness for borrowers in the middle of the income-distribution.”

Current IDR plans, as they are known, would have payments pegged at 10%-15% of discretionary income for borrowers with incomes 150% above the poverty line. Any remaining balances would be forgiven after 20-25 years. The provisions mean that low-income debt holders still might end up paying nothing or very little over the lives of their loans.

“Forgiveness would benefit the top decile as much as the bottom three deciles combined,” Catherine and Yannelis wrote. “Blacks and Hispanics would also benefit substantially less than balances suggest. Enrolling households who would benefit from income-driven repayment is the least expensive and most progressive policy we consider.”

Selling those types of economics, though, could be tough at a time when debt holders and progressive politicians on Biden’s side of the aisle are demanding immediate relief.

The president-elect made such populist themes as easing the student loan burden a centerpiece of his campaign and he will be pushed to come through, with some members of his party advocating forgiveness as high as $50,000.

Following through, “will be transformational and provide a boost to Biden’s approval among the borrowers who will benefit, further cementing educated millennials and other post-generation X age cohorts into the Democratic coalition,” Beacon Research said in a recent policy note on the issue.

Beacon said it expects the issue to be part of Biden’s first-100-days agenda.

But opposition is likely to be substantial, providing an early faceoff for the new president and Republican lawmakers who could still control the Senate.

The Committee for a Responsible Budget, fearing more kindling on the nation’s $27.4 trillion debt, said the $115 billion to $260 billion economic benefit would yield “a much smaller return than other options available to policymakers.”

The organization said government spending would be more beneficial in the form of direct payments like extended unemployment benefits, which are part of stimulus packages being bandied about in Congress.

There also will be general political backlash on moral hazard grounds from those who see folly in rewarding students for racking up huge debts they couldn’t afford to colleges that took advantage of government largesse to jack up costs.

Government has “allowed universities to go on this crazy trajectory of increasing their costs without any additional benefit to students,” said Carol Roth, head of Intercap Merchant Partners.

“Colleges bear a lot of the responsibility, and they have basically been taking the dollars facilitated by government in a predatory way,” she added.

While Roth acknowledges the larger economic issues, she said it’s wrong that taxpayers have to pick up the tab for some borrowers and not others.

“We have to move away from governments picking winners and losers,” she said. “The government shouldn’t be doing that, and it’s not fair to have people who decided not to go to college, whether it’s directly or indirectly, bearing the burden for the situation they had no role in causing.”

8. Student Loans #1 Delay in Home Buying.

Home buyers taking advantage of low interest rates can put down less money than they think-by Michaelle Bond

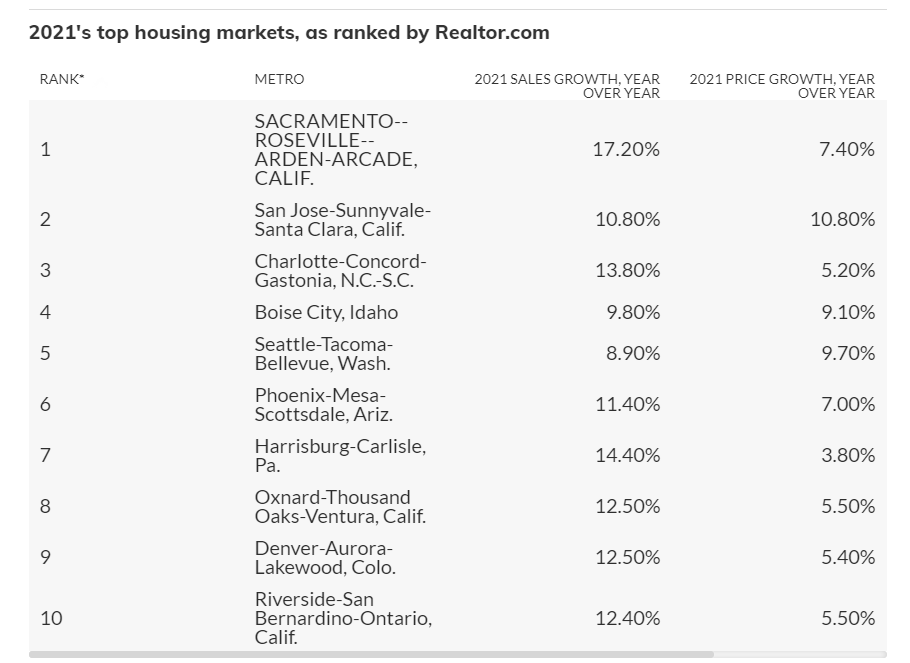

9. 2021 Top Housing Markets Ranked by Realtor.com

10. 5 Toxic Personalities Successful People Avoid

By Tyler Leslie | April 26, 2016 | 0

One of my favorite quotes is by Jim Rohn: “You are the average of the five people you spend the most time with.” These words opened my eyes to the fact that the people we hang out with, the people we call friends, they all have an influence on the decisions we make in life, and therefore the success we have (or don’t have).

Unfortunately, not everyone pushes us to be better. Some people stop us from following our dreams or talk us out of taking a risk, and we don’t always realize that it’s happening. So it’s important to be aware and consciously choose who we spend time with, to limit spending time with toxic people—like these five personalities you should avoid when chasing goals.

Related: 12 Ways Successful People Handle Toxic People

1. The Complainers

Complainers are people who are always complaining about how bad their life or job or whatever is. They constantly whine about everything but never do anything about it.

Being around a complainer can take a toll on you—maybe you begin to join in on the complaints, and before you know it, you adopt their same way of negative thinking. That pessimism is contagious. Which is why you should think twice before sitting down with a complainer.

2. The Entitled

These are the people who feel like they are entitled to certain things in life, like they do not have to work for anything, that the people around them owe them something. They are also the ones who will try to talk you out of following your dreams.

This mindset can be deadly to a person trying to be successful. It blocks your determination and can kill your motivation in a heartbeat. Know this: You, or anyone else, are not entitled to anything. If you want the good life, you have to create it.

3. The Conformers

Conformers are the most popular of all. They are the ones who conform to the limits set on them. They do not have any dreams they are chasing after, and they are not doing something that goes against the status quo. They are simply living like robots—waking up, working 40 hours a week at a job they hate, going home, sleeping and doing it all over again.

There are many people who are content with this, and that is perfectly fine. But a person who is following their dreams simply cannot conform to the average life. So while working your full-time job, put in the extra effort on the side to start building toward something that’s more in line with your dreams. And eventually you will be able to leave your day job to pursue your passion full time.

4. The Party Animals

They’re the one who’s planning happy hours five days a week, the one who lives to go out every night. Sure, the party animal might be fun, but beware—they can distract you from your dreams.

Don’t get me wrong, you should take time to relax and clear your head on occasion, but bar hopping is not the solution and it’s not going to get you the life you’re after. By making partying a priority, you’re distracting yourself and breaking focus on your goals—things bigger than dollar beers and half-price apps. In order to grow as a person, you have to grow up first.

5. The Doubters

Doubters can be downers—they will listen to your big dreams, but they will be the first ones to tell you they don’t think it is a good idea or not to get your hopes up. They are the ones who believe you have to “be somebody” in order to do something extravagant.

As somebody who is chasing their dreams, this can be very discouraging, so identifying the doubters in your group will be beneficial to you and your success in the future. Likewise, it is extremely important to keep supportive people around you, people who encourage you and lift your spirits when you are losing motivation.

So, surround yourself with people who will support and encourage you to chase your dreams, through the good and the bad. Your success depends on it.

Related: What Happened When I Tried to Cut the Negative People Out of My Life

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.