1.#1 and #2 Today…Two Market Indicators…One Stocks Cheap and One Stocks 2nd Most Expensive Ever.

S&P Dividend Yield Versus U.S. Treasuries…Above 1 is cheap

A Favorite Bullish Indicator For Stocks Is Still Flashing Green

Take a look at the chart below that shows the ratio of the S&P 500 dividend yield to the 10-year treasury yield. The ratio skyrocketed because the 10-year bond yield has plummeted, yet the S&P 500 dividend yield has remained relatively steady between 1.8% – 2%.

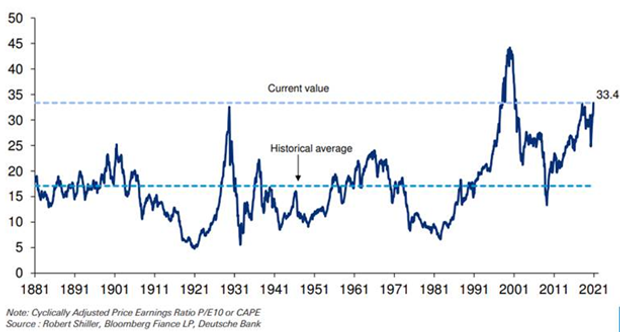

2. CAPE Ratio at 2nd Highest Level Ever.

CAPE is not a market timing tool

SOURCE: VIA DEUTSCHE BANK

The cyclically adjusted price-to-earnings (CAPE) ratio captures the ratio of the real (inflation-adjusted) share price to the 10-year average of real earnings per share, and is used by some as one measure, outside of traditional P/Es, to assess how pricey stocks have become.

Reid cautions that the CAPE ratio isn’t a perfect tool if considered as a market-timing tool because values can persists at elevated heights for longer than one can predict.

“The CAPE ratio is not perfect for many reasons and note we’ve been above the long-term average of 17 since early 1991 outside of 10 months during the [2008 financial crisis],” he wrote in a research note on Wednesday.

The Deutsche Bank strategist says that one reason for pricey stocks is the extremely low levels of government bond yields.

Stock-market values recently reached levels seen on the eve of 1929 crash, by one measure

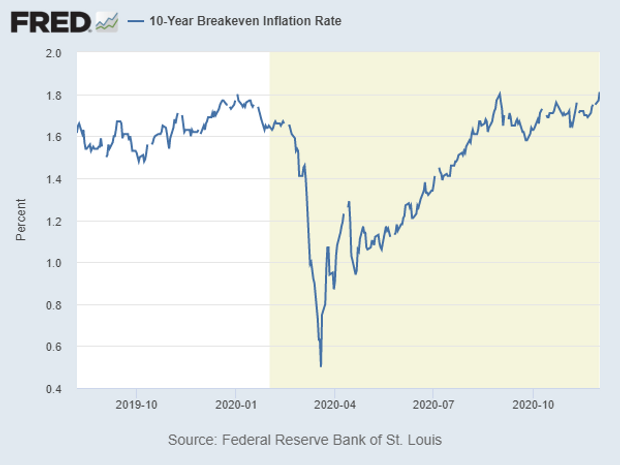

3. 10 Year Break-Even Inflation

Marketwatch–Mirroring this rise, expectations for where consumer prices will average over the next decade among holders of inflation insurance rose to 1.84%, the highest since July 2019.

Inflation fears heat up in bond market as ‘reflation story’ gains ground

4. Short 20 Year Treasury ETF

Forming a bottom??

5. The Difference with this Year’s Bitcoin Boom….It’s Driven by Americans. Volume at U.S. Exchanges Doubles vs. Asian Exchanges +16%

Reuters

East Asia, North America and Western Europe are the biggest bitcoin hubs, with the first two alone accounting for about half of all transfers, according to Chainalysis, which gathers data by region with tools such as tagging cryptocurrency wallets.

Industry experts caution it is too early to call a fundamental shift in the market, particularly in an unprecedented year of pandemic-induced financial turmoil.

Growing flows to North America this year are not necessarily “an indication that the centre of gravity is tilting towards the U.S.,” said James Quinn of Q9 Capital, a Hong Kong cryptocurrency private wealth manager.

Others also point out that cryptocurrency trading is highly opaque compared to traditional assets and patchily regulated, making comprehensive data on the emerging sector rare.

Nonetheless, Chainalysis found North American trading volumes at major exchanges – those with the most blockchain activity – had eclipsed East Asia’s this year. This is not unheard of, with North America having moved ahead on occasions in the past, but never by such a large margin.

Volumes at four major North American platforms have doubled this year to reach 1.6 million bitcoin per week at the end of November, while trading at 14 major East Asian exchanges have risen 16% to 1.4 million, according to the data.

By comparison, a year before, East Asia led the way with 1.3 million a week versus North America’s 766,000.

How American investors are gobbling up booming bitcoin

By Tom Wilson, Alun John

Found at Crossing Wall Street Blog. https://www.crossingwallstreet.com

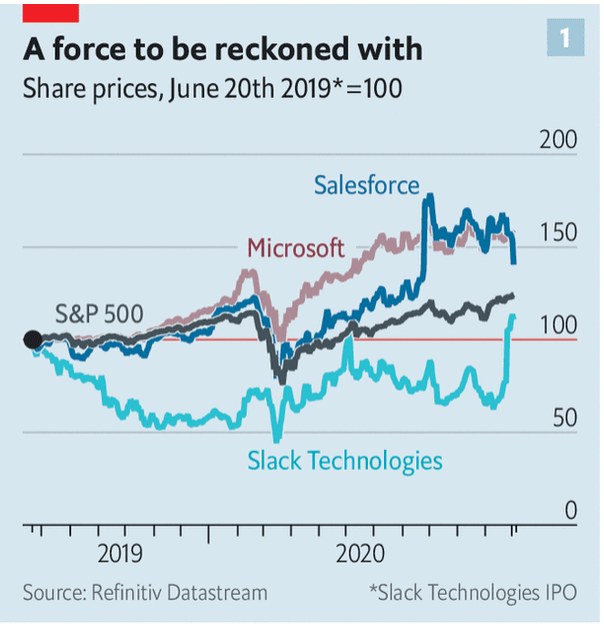

6. Salesforce gets some Slack

Like many family alliances the tie-up is partly about power and feuds. Slack’s product has a cultlike following, which Salesforce wants to harness to build a tech platform that sells digital tools that no firm can do without. Stewart Butterfield, Slack’s co-founder, hailed it (hyperbolically) as “the most strategic combination in the history of software”. The feud is with Microsoft, whose advances Slack spurned four years ago. The deal makes Salesforce a far more formidable challenger to the giant.

https://www.economist.com/business/2020/12/05/salesforce-gets-some-slack

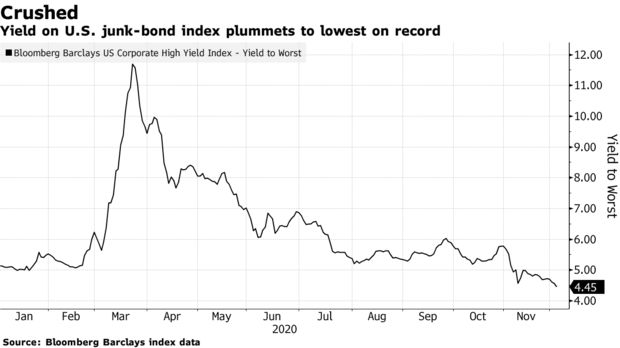

7. U.S. Junk Bond Yields Drop to All-Time Lows.

US junk bond yields drop to All-time lows as yield hunting credit investors are piling into riskier assets amid hopes that coronavirus vaccine will boost econ. Avg yield on corp bonds rated below investment grade hit 4.45%, down from 5.52% 1mth ago & 2020 peak of 11.69% (via BBG)

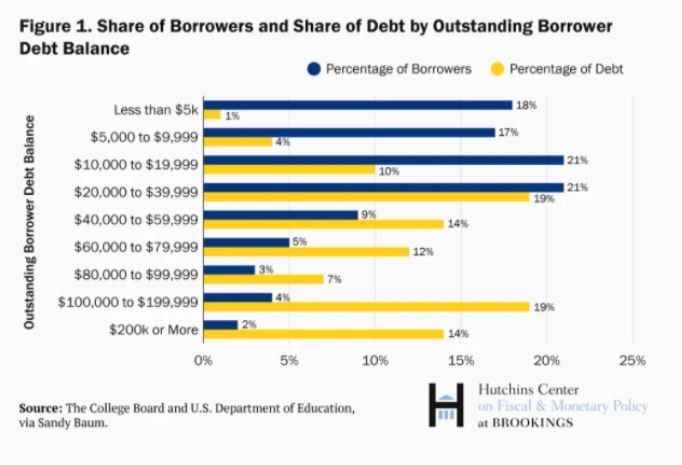

8. Percentage of Borrowers with Over $60,000 of Student Debt is Only 14%

Irrelevant Investor Blog …

https://theirrelevantinvestor.com/wp-content/uploads/2020/11/12.jpg

9. ‘This is going to be challenging:’ How the UK will roll out Pfizer’s coronavirus vaccine

· The U.K. was the first country in the world to approve Pfizer and BioNTech’s groundbreaking coronavirus vaccine on Wednesday for widespread use.

· Now the hard work begins to deliver a vaccination program nationwide.

· Prime Minister Boris Johnson and other top officials say the task ahead of them will be “difficult” and “challenging.”

When will people get vaccinated?

The U.K. pre-ordered 40 million doses of Pfizer and BioNTech’s vaccine — enough to vaccinate 20 million people — but the delivery won’t be fulfilled all at once.

“The delivery of the 40 million doses will occur throughout 2020 and 2021, in stages, to ensure an equitable allocation of vaccines across the geographies with executed contracts,” Pfizer said on Wednesday.

“Now that the vaccine is authorized in the U.K., the companies will take immediate action to begin the delivery of vaccine doses. The first doses are expected to arrive in the U.K. in the coming days, with complete delivery fulfilment expected in 2021.”

Hancock told the U.K.’s House of Commons on Wednesday that each batch of the vaccine would be tested for safety. “I can confirm batch testing has been completed this morning for the first deployment of 800,000 doses of the vaccine,” he told Parliament.

The country’s National Health Service would begin vaccination next week, but Simon Stevens, chief executive of NHS England, stressed on Wednesday that the bulk of the vaccination program would take place from January 2021 through to March and April “for the at-risk population.”

The government plans to start delivering the vaccine from 50 “hospital hubs,” as well as from community settings such as doctors’ surgeries at a later point.

Who gets it first?

The Joint Committee on Vaccination and Immunisation (JCVI) in the U.K. set out on Wednesday who it believes should received the vaccine first, noting that “the first priorities for any Covid-19 vaccination programme should be the prevention of COVID-19 mortality and the protection of health and social care staff and systems.”

The priority list is as follows:

- Residents in a care home for older adults and their carers

- Those 80 years of age and over and frontline health and social care workers

- Those 75 years of age and over

- Those 70 years of age and over and clinically extremely vulnerable individuals

- Those 65 years of age and over

- Individuals aged 16 years to 64 years with underlying health conditions which put them at higher risk of serious disease and mortality

- Those 60 years of age and over

- Those 55 years of age and over

- Those 50 years of age and over

Shore Capital’s health analysts said they expected volunteers across multiple disciplines (from nurses and paramedics, to trained volunteers and even vets) to be involved in the rollout. On Wednesday, the NHS’ Volunteers Responders network called for volunteers that could be trained to either deliver the vaccine or assist those receiving it.

Aside from the need to recruit people to deliver the vaccines, other challenges include the need for a robust IT system to track who has been vaccinated. It will also be required to notify individuals when they need to get the second dose of the candidate, which comes 21 days after the first dose.

“In addition, Pfizer/BioNTech’s product must be diluted with saline before it is administered, which isn’t very common with other vaccines. Coordinating all necessary support components to deliver the candidate (e.g. syringes, alcohol wipes, gloves) will also have to run smoothly,” Shore Capital’s Barker and Raveendran added.

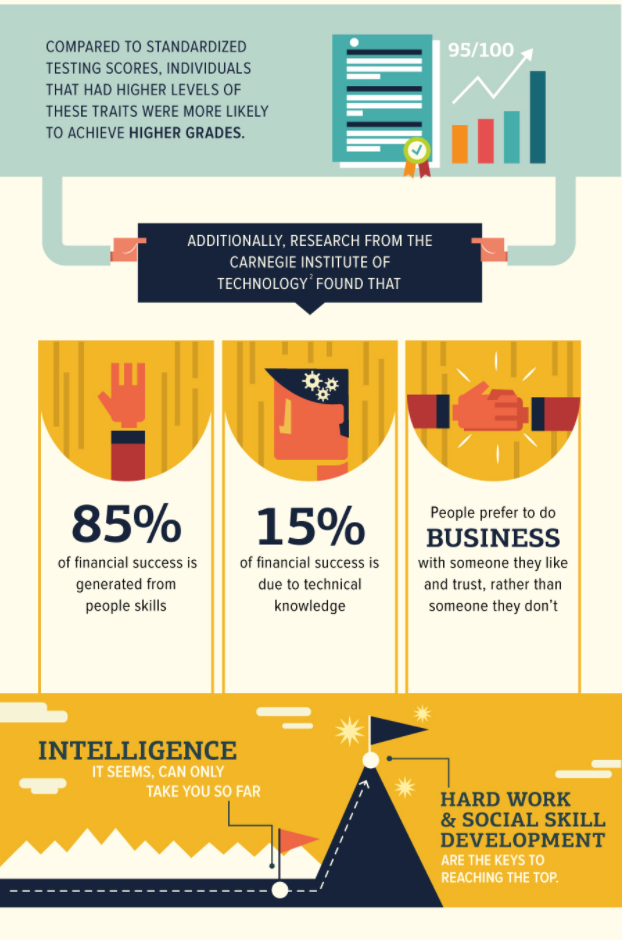

10. 8 Things That are More Important than Intelligence.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.