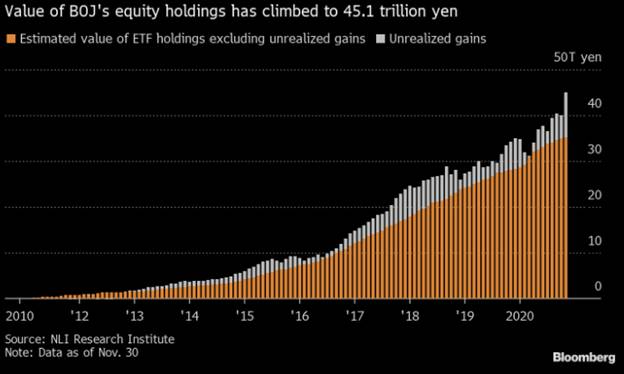

1. Bank of Japan Increasing Equity Buying During Pandemic…….Now Long $400B of Japanese Stocks.

WHALE BUYER– The Bank of Japan has taken over as the biggest owner of the nation’s stocks, with the total value of its holdings climbing well above $400 billion – Massive exchange-traded fund purchases by the BOJ to support the market amid the pandemic this year combined with subsequent valuation gains pushed its Japanese equity portfolio to 45.1 trillion yen ($434 billion) in November.

That marks the first time that the central bank’s holdings have eclipsed those of the Government Pension Investment Fund, which Ide estimates stood at 44.8 trillion yen last month

From Dave Lutz at Jones Trading.

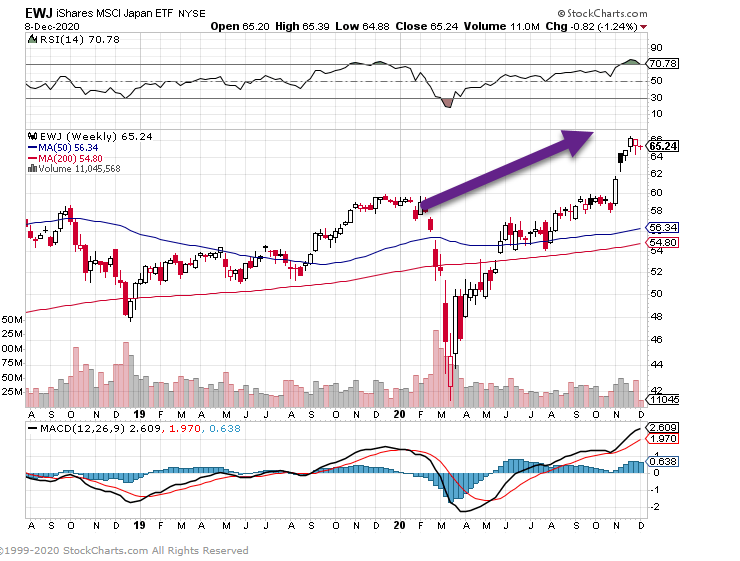

2. EWJ…Japan ETF New Highs.

Bank of Japan prints money and buys ETF…great work if you can get it.

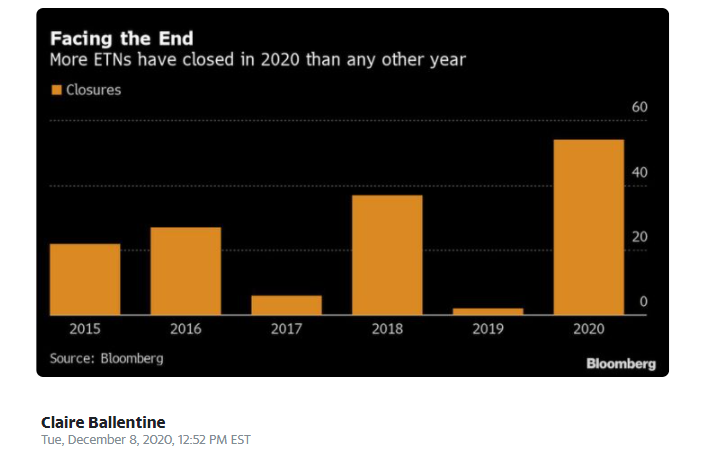

3. 54 ETN’s Exchange Traded Notes Funds Have Closed This Year.

Riskier Cousins of ETFs Are Shutting Down Like Never Before

Claire Ballentine

Tue, December 8, 2020, 12:52 PM EST

(Bloomberg) — A risky corner of the exchange-traded universe is facing closings at the fastest pace ever.

So far this year, 54 exchange-traded notes have either liquidated or delisted, the most in a single year on record, according to data compiled by Bloomberg.

These instruments faced a wild year, even by 2020’s standards, with violent market swings at the beginning of the coronavirus pandemic leading several issuers to pull the plug. Then a massive price surge in August highlighted how over-the-counter trading for ETNs can unexpectedly whipsaw investors.

“There were some well-known events that haven’t put ETNs in the best spotlight,” said Linda Zhang, chief executive officer of Purview Investments. “I wouldn’t be surprised that ETNs have become less popular.”

The list of ETNs that were killed off this year includes a $1.5 billion volatility-linked product from Credit Suisse Group AG, two leveraged notes tracking mortgage real-estate investment trusts from UBS Group AG, and two leveraged oil notes offered by Citigroup Inc.

Unlike exchange-traded funds, the notes are unsecured debt obligations issued by banks and are backed by the issuer, instead of the assets the products track. They’re frequently used as a tool for investing in assets that are hard to access. Many implement derivatives to boost returns or deliver the inverse performance of their index.

But those same perks can also spell trouble for inexperienced investors, as well as headaches for issuers. Regulators have closely eyed the space, although recent rules for leveraged ETFs — which prevent new triple-leveraged products from using a streamlined approval process — sidestepped imposing restrictions on ETNs.

The total ETN market in the U.S. currently holds $4.1 billion in assets, down from $7.2 billion at this time last year. New launches have sputtered, with just 10 notes starting trading in 2020, compared with 20 last year.

https://finance.yahoo.com/news/riskier-cousins-etfs-shutting-down-175248415.html’

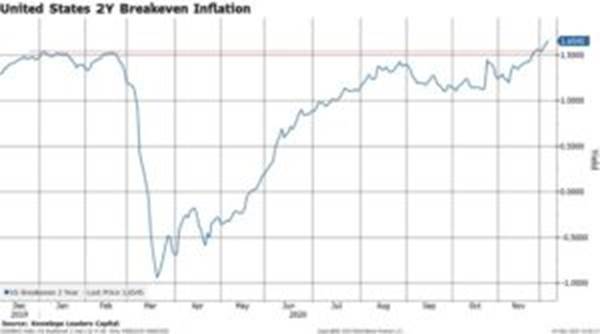

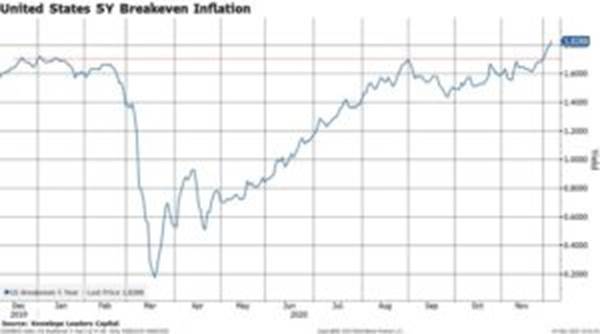

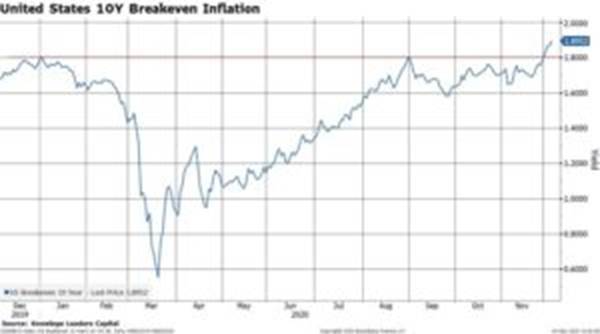

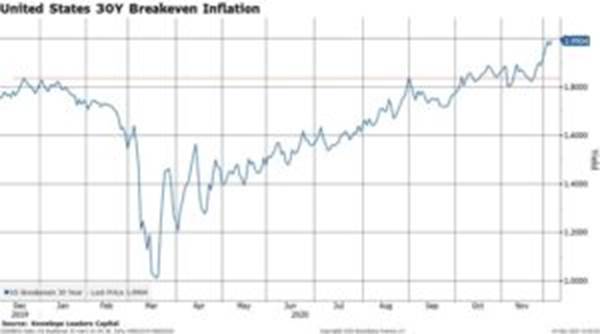

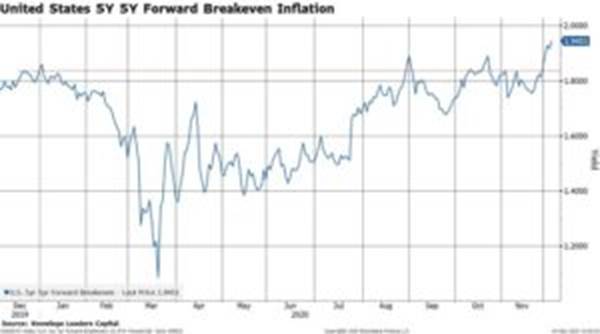

4. Breakeven Inflation Levels Breaking Out Across the Board.

Breakeven Inflation is Breaking Out-Advisor Perspectives

by Bryce Coward of Knowledge Leaders Capital, 12/8/20

Inflation expectations as priced by the Treasury market are hitting 18 month highs just now. As the reader can see, inflation expectations across all treasury maturities are at cycle highs. This is happening coincident with growing expectations for the $908bn bipartisan stimulus deal and widespread expectations that the Fed will ease in some additional way at their next meeting 12 days from now. That these two events are anticipated by the market does pose some near-term downside risk for inflation expectations, since there is now room for disappointment. Even still, keeping the long game in mind is useful. Indeed, there exist multiple structural catalysts for inflationary pressure that haven’t existed in quite some time:

- de-globalization

- USD which may be under continued pressure from massive twin current account and budget deficits

- the possibility that US oil production has peaked, or at least will not grow as it did last cycle

- raw material (especially base metal) inflation from the acceleration of green transport and power generation trends

- demand-pull inflation from fiscal stimulus

https://www.advisorperspectives.com/commentaries/2020/12/08/breakeven-inflation-is-breaking-out

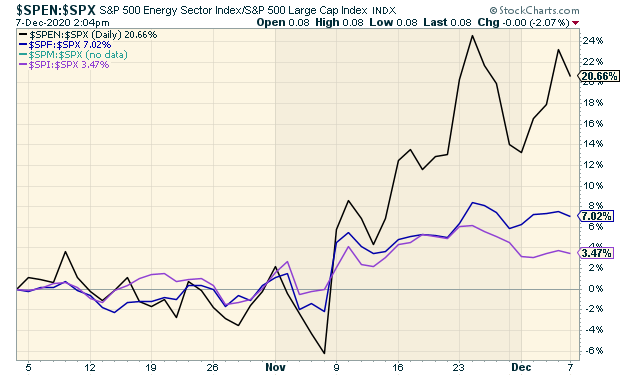

5. Value has Led Growth 4 Weeks in a Row

What’s Driving Value

Posted by Eddy Elfenbein on December 7th, 2020 at 2:09 pm

For the first time in two years, value has led growth for four weeks in a row. What’s driving it? Here’s a look at the relative strength of the four major cyclical sectors. Financials, Industrials, Energy and Materials have all led the market over the past month.

The key drivers have been Energy and Financials. These are also two of the major value sectors. This shows us the strength of value stocks and how the market is shifting towards cyclicals.

https://www.crossingwallstreet.com

6. Investment Grade Corporates Providing No Yield Over Inflation

Chart of the Day

Investment grade corporate bonds no longer provide any real yield over expected inflation.

From Abnormal Returns Blog. https://abnormalreturns.com/2020/12/08/tuesday-links-imperfect-portfolios/

7. Put/Call Ratio Hits the Lowest Levels in Years Signaling Few Bears Alive

©1999-2020 StockCharts.com All Rights Reserved

A “put” or put option is a right to sell an asset at a predetermined price. A “call” or call option is a right to buy an asset at a predetermined price.

If traders are buying more puts than calls, it signals a rise in bearish sentiment. If they are buying more calls than puts, it suggests that they see a bull market ahead.

Understanding the Put-Call Ratio

The put-call ratio is calculated by dividing the number of traded put options by the number of traded call options.

KEY TAKEAWAYS

- A put option gets the trader the right to sell an asset at a preset price.

- A call option is a right to buy an asset at a preset price.

- If traders are buying more puts than calls, it signals a rise in bearish sentiment.

- If they are buying more calls than puts, watch out for a bull market ahead.

https://www.investopedia.com/ask/answers/06/putcallratio.asp

8. U.S. Geographic Concentration of Wealth

by Barry Ritholtz-THE BIG PICTURE

9. Follow Up On Water Futures from Yesterday

| COMMODITIES Back to the Futures |

Francis Scialabba

| Looking for a liquid investment? As of yesterday, you can buy a futures contract for 3.3 million gallons of water on the Chicago Mercantile Exchange.Quick detour to Finance 101Well, maybe 301. If you buy a commodity or security in a spot market, i.e., a physical or cash market, you purchase that thing for immediate delivery. California’s spot water market is worth ~$1.1 billion. If you buy a futures contract, you agree to purchase the asset at a predetermined price on a future date. Investors can buy futures contracts for commodities (like crude oil and wheat), foreign currency exchanges, precious metals, stocks, or bonds. California farmers could use the helpCalifornia is the country’s largest water market by a magnitude of four, but its water supply is less consistent than a container of strawberries in January. The state is regularly hit by droughts, which can send affected farmers, utilities, and cities to the spot market—where prices are likely rising.The new water futures, which are tied to a California water index, are supposed to help with risk management. Investors hope that locking in prices will let buyers hedge (insure) against price fluctuations, especially during months when droughts and other factors strain supply. Why now?Investors can buy futures contracts for everything from fresh bacon to Burgundy wine, but the commoditization of an element critical to daily life is worrying to some observers—especially as water access becomes more strained.”Climate change, droughts, population growth, and pollution are likely to make water scarcity issues and pricing a hot topic for years to come,” RBC Capital Markets Managing Director Deane Dray told Bloomberg. Over 2 billion people already live in countries with high water stress, a number the UN sees as only getting bigger.Bottom line: While these water futures are a first, climate change could spur more innovation around securing access to scarce resources. |

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.