1. 10 Year Treasury Yield Closing in on 1%

10 Year Treasury Yield

©1999-2020 StockCharts.com All Rights Reserved

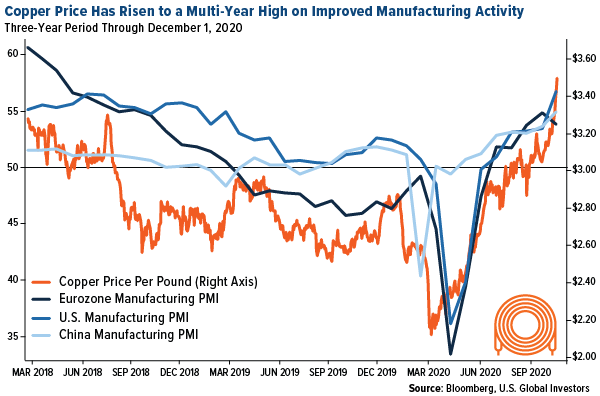

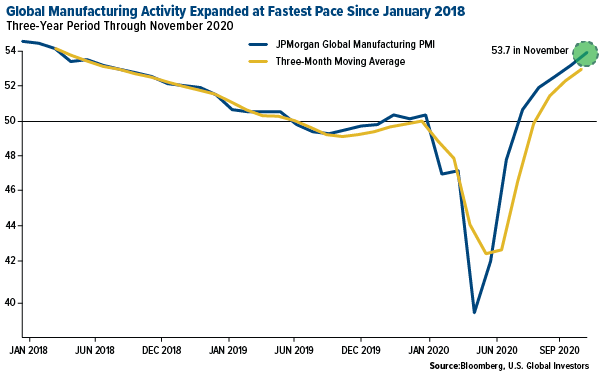

2. Chinese Manufacturing Surges to 10 Year High….Global Manufacturing 10 Year High

Chinese factories signaled their strongest improvement in over a decade. The Caixin China General Manufacturing PMI posted 54.9 in November as output and new orders surged to 10-year highs. European factories also continued to expand, though at a slightly slower pace than the previous month.

Looking at manufacturers on a global scale, the data is just as strong. The JPMorgan Global Manufacturing PMI climbed from 53.0 in October to 53.7 in November, a 33-month high. According to JPMorgan economists, this marks the fastest pace since January 2018.

Dr. Copper Gives the Economy a Clean Bill of Health

by Frank Holmes of U.S. Global Investors, 12/4/20

3. $69 Trillion in U.S. Private Equity

The 25 Largest Private Equity Firms in One Chart

By Omri Wallach

4. MJ-Weed ETF +50% Pop

MJ-50% Rally…50 day thru 200day to upside.

©1999-2020 StockCharts.com All Rights Reserved

But….Still Way Off 2019 Highs

©1999-2020 StockCharts.com All Rights Reserved

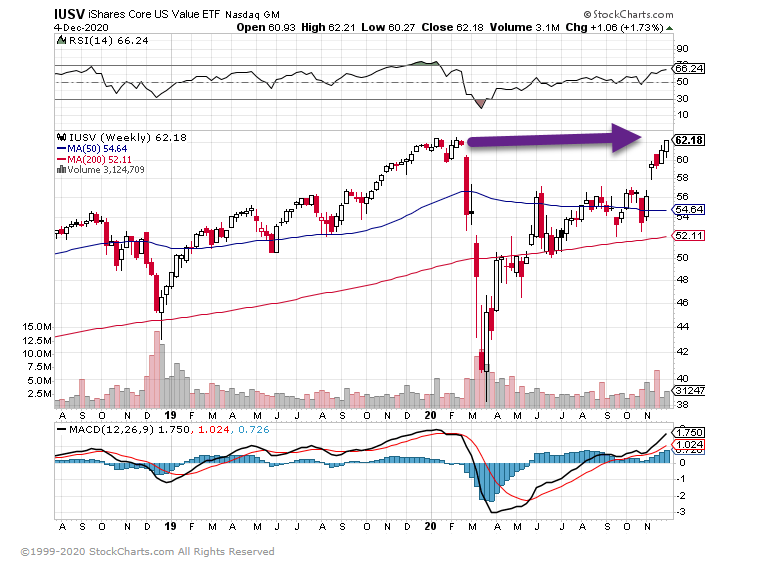

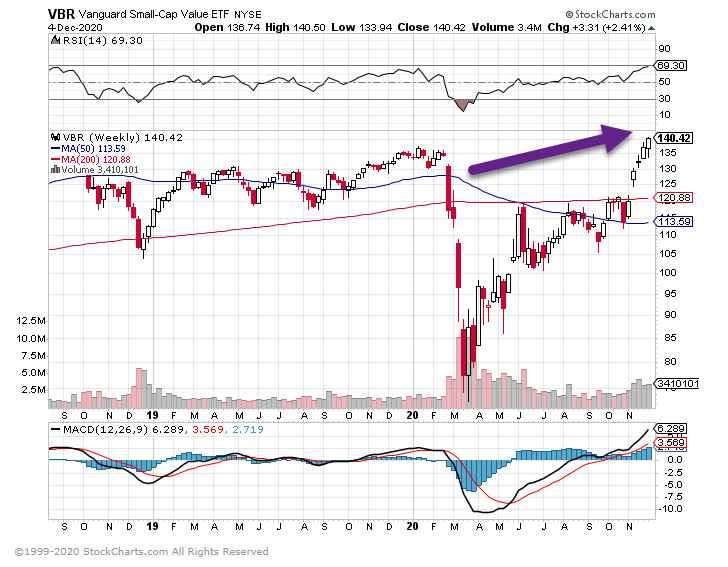

5. Value ETFs Approaching Highs.

IUSV Core Value at Previous Highs

VBR-Vanguard Small Cap Value Hits New High

6. Tech Stocks Two-Standard Deviations Above 50 Day Moving Average.

Stretched Tech–Although technology shares have taken a back seat to the recent market narrative looking for gains in cheaper value stocks, the Nasdaq 100 Index still managed to hit a fresh record high Thursday. The tech-heavy gauge — up 43% this year — is now trading about two standard deviations above its 50-day moving average, a signal its rally may have gone too far.

These Five Charts Throw Cold Water on Chances of Santa Rally

7. You might be a Permabear if….

All-Star Charts

Here is a short list of questions to ask and see if you’re one of these people poisoning yourself and others around you:

1) Do you ignore arguments that you don’t agree with?

2) Do you regularly stay wrong well after the market has proven your thesis to be invalid?

3) Does it bother you to be bullish of equities?

4) Do you ignore price in favor of conspiracy theories?

5) Do other permabears look up to you as some sort of cult leader?

6) Do you block open-minded people on twitter because their logical arguments make your brain hurt?

7) Do you wake up looking for reasons to be angry?

8) Do you find yourself blaming others, instead of your own ego? Common examples include the Fed, ETFs, Trump and Fiat Currency.

9) Do you pivot to other asset classes in an attempt to make everyone forget just how wrong you were about everything else?

10) On every down tick in the market do you pound your chest, and then go back into hiding and change the subject when they break out again to new highs?

11) Do you believe that a higher high is most likely the Head of a Head & Shoulders Top?

12) Do you use arithmetic scale charts irresponsibly to make your charts more dramatic?

These people are a real problem. They do harm to themselves, their families and unfortunately anyone who they can get to listen. It’s a sickness.

I was once sick like that. I know the feeling. It’s not fun. It’s a very sad place to be in.

Found at Abnormal Returns. www.abnormalreturns.com

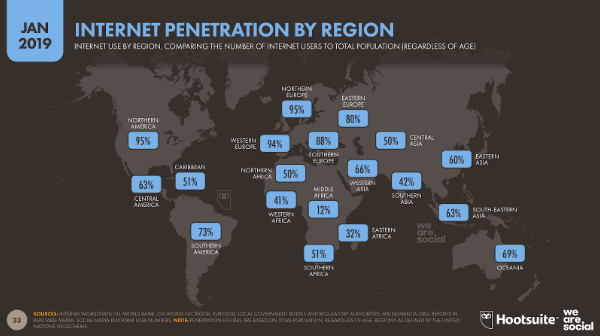

8. 40% of World No Internet Access

https://wearesocial.com/blog/2019/01/digital-2019-global-internet-use-accelerates

9. The $2 Billion Mall Rats…Excellent Long Read on the Mall Short

The inside story of a black sheep hedge fund, their massive bet that shopping malls would crash, and how they proved Wall Street wrong.

By Ian Frisch

Nov 30, 2020

MIKE KIM / GETTY

Catie McKee, Dan McNamara, and their boss Marc Rosenthal had millions of dollars riding on Crystal Mall in Waterford, Connecticut. The trio worked at MP Securitized Credit Partners, a tiny Wall Street hedge fund, and they’d stopped by the typical middle class shopping center in search of signs of life: Who was at JCPenney? Claire’s? Hot Topic? ThriftBois? What was up at VAPE CITY or BrowArt23? They couldn’t help but notice there was something depressing about the place: discounts galore, emptiness in every direction, a foreboding aura that signaled the end was near. It didn’t look good for anyone hoping for the mall’s success. But Rosenthal, McKee, and McNamara weren’t betting on Crystal Mall thriving—they were betting on it failing, and spectacularly.

It was October 2019. The threesome was in the business of betting against—or “shorting,” in financial jargon—commercial mortgage bonds, specifically those heavily weighted with debt issued to shopping malls. A year prior, in 2018, the team made a $2 billion bet that a series of shopping malls, including Crystal Mall, would eventually fail. If retail tenants vacated and the malls’ landlords defaulted on their mortgages, MP stood to make a killing. They had taken many trips like the one to Crystal Mall over the past two years: this downtrodden mall after that one, seeing firsthand the shopping centers, once the heart of the American retail sector that, they were certain, would soon be underwater.

It was a proposition which, in the age of Amazon, couldn’t possibly be considered risky on its face, but in the minds of traders on Wall Street, the threesome was taking a contrarian view: The conventional wisdom stood to reason that the debt propping up these shopping centers was stable, at least for now, whereas the team at MP was convinced that the malls’ landlords would default on their mortgages by 2022—and, most importantly, that if they didn’t have their bet placed now, they’d miss the chance at a huge payday.

After a long morning casing the storefronts, the team headed down the street to Olive Garden for a late lunch. The past ten months had proved to be near-fatal for their firm. A year into their trade, they hadn’t yet made a profit—in fact, they were losing millions of dollars every month. By the time McKee and McNamara took their boss to Crystal Mall, investors had pulled out of their fund, the small team was struggling to source more financing, and they even found themselves in a war over their trade with two big Wall Street investment firms. Although locked in a battle akin to David versus Goliath, Rosenthal’s excitement was palpable. It was his first mall tour, and to see the struggling center first-hand reinvigorated the kind of macabre confidence that accompanies any short bet. “He was like a little kid in a candy store,” McNamara remembered. Rosenthal told his employees that he wanted to drive deeper into Connecticut, to check out another struggling mall. He pulled out his phone. “It’s only an hour away,” Rosenthal said, pointing to his screen. “Let’s go!” It was late afternoon on a Friday, so McKee and McNamara convinced their boss to save it for another day. The team finished eating and drove back to Manhattan, their conviction cemented that they were on the right side of the trade.

mall began with the suburbs. In 1956, the Southdale Center, America’s first indoor mall, opened in Edina, Minnesota, just outside of Minneapolis. Life called it “The Splashiest Center in the U.S.,” and praised its “goldfish pond, birds, art and 10 acres of stores all…under one Minnesota roof.” The famed architect Victor Gruen designed Southdale, and his inspiration came from a place of disgust. He hated what American suburbia had become, likening their roads, to The New Yorker‘s Malcolm Gladwell, in a 2004 piece, to “avenues of horror…flanked by the greatest collection of vulgarity—billboards, motels, gas stations, shanties, car lots, miscellaneous industrial equipment, hot dog stands, wayside stores—ever collected by mankind.” He hoped the mall, a centralized retail destination, would fix that. (It did, for a while, until the veneer of “mall rats” and Black Friday stampedes diminished the allure of malls.) The indoor shopping craze soon spread to every corner of the United States. Three hundred malls opened by 1970, mainly catering to homemakers. The women could pop down, buy all the things they needed for their household, and potentially snag a new outfit along the way. The trend continued and, by 2017, at its peak, America was home to over 1,200 malls.

https://www.esquire.com/news-politics/a34785141/shopping-mall-short-hedge-fund-covid-19/

10. The 10 Laws of Cultivating Influence

By Michael Pietrzak | August 4, 2020 | 0

Then I witnessed JT’s brilliance in The Social Network and I was converted. In that movie he delivers a near perfect performance as the founder of Napster, and a textbook example of an influencer, leading Mark Zuckerberg around under his spell, all without force.

I started to wonder: Can that kind of influence be learned?

The Opposite of Force

Have you ever worked for a boss who ruled with an iron fist, maybe even threatened your job? If you didn’t drag your feet in subtle protest, you are a better person than I.

Intimidation and coercion only work in the short term. Influence lasts.

Sadly, our powers of influence are usually about as strong as gas station coffee (that is to say, watery). It’s not a skill we’re taught in school, or by sleep-deprived parents who prefer the shortcut of “because I said so” to “here’s why this is in your best interest.”

If you’re having trouble getting people to like your Facebook page, now you know why. But influence is a skill that can be learned. Apply these 10 laws and you’ll plow a direct path to your best life.

Law #1: Get Clear on Your Outcome.

“You can’t hit a target you cannot see, and you cannot see a target you do not have.” —Zig Ziglar

The first law of cultivating influence is: Know exactly what you want the other person to do. This seems obvious, but many walk right over this step. Have you ever found yourself complaining to your partner about his or her work hours? What you’re probably saying is, “Love me more, dang-it.”

Have you argued over how much your partner spends on clothes or coffee? I’d bet what you truly want is to feel the sense of security that comes from having a few months of rent money stashed away.

We try to influence hundreds of situations daily, and when we accidentally get what we want, wonder why we’re still unhappy. Have you ever landed the promotion or raise only to find out that what you really wanted was a few more vacation days every year, or just a little more appreciation from the boss?

Without exception, all that we do or don’t do in life is ultimately to get some kind of feeling: security, excitement, love, and so on. Start with how you want to feel, then turn on the influence.

Law #2: Listen First.

“Change happens by listening and then starting a dialogue with the people who are doing something you don’t believe is right.” —Jane Goodall

After you know what you want, it’s time to chase after it like a speeding freight train full of angry bulls. No wait, that’s not right. Slow. Down. You can get everything you want, but not with the bulldozer approach.

Toddlers thrash and scream for shiny objects; capable influencers exercise patience, and start by posing questions to their targets of influence.

Sometimes this calls for direct questions, like, “What can I do to sell you this new car?” More often, subtle, open-ended queries work best: “What are you working on?” for example.

When you listen to your partner or colleague, he or she will feel heard. And when that person is glowing with those feel-good vibes, they will usually bend over backwards to hear you out.

Listening does more than create receptivity; it will help you discover what a person wants. You can use this to negotiate some kind of trade (see Law #8). Be interested in people. Ask questions with enthusiasm and a genuine desire to serve, and you’ll multiply your influence.

Law #3: Tell Stories.

“The human species thinks in metaphors and learns through stories.” —Mary Catherine Bateson

When I worked in politics, I heard a lot of, “You should vote for me because we doubled funding for schools, put 10% more cops on the street, funded your local museums, blah, blah, blah.”

Even I was bored by our party message. That’s because logic, statistics and facts don’t move most people. We think we are rational animals, but it’s emotion that puts a fire in our bones.

Stories—not white papers—create emotion, and emotion leads to action. Stories have been a universal constant throughout history and across cultures. We seem to be hard wired to both tell ‘em and hear ‘em.

Compare these two approaches:

“620,000 people worldwide have died from COVID-19, so you should wear a mask.”

“A 3-month-old baby girl died yesterday from the virus. The grieving parents urge you to wear a mask.”

Stories speak directly to the best in each of us—our compassion, nobility, enthusiasm, inspiration—in a way that hard facts can’t. Learn to tell stories and you’ll wield what the ancient Greeks called Pathos: the ability to employ emotion to move your audience.

Law #4: Be an Authority.

“Leadership is influence, nothing more and nothing less.” —John C. Maxwell

Are you more likely to cooperate if a doctor tells you, “Here, take this medication,” or if a stranger does?

Would you be more likely to move out of the fast lane on the highway if a police car—or a smart car—barrels down on you from behind, flashing its lights?

We’re more likely to comply with someone who we perceive as an authority; and you don’t need to wear a uniform to influence others (although it helps).

One study showed that real estate agents could increase their business by 15% by simply having a receptionist tell callers about the agent’s qualifications before transferring the client to the agent.

You can do the same by showcasing testimonials on your website or marketing material, hanging your diplomas in your office, or seeking celebrity endorsements. Even if you lack any real authority, you can project it by speaking confidently or dressing well.

Even better, get someone else to sing your praises in front of the person you seek to influence; this carries more credibility than tooting our own horn.

Law #5: Be Likeable.

“This is the Law of Likability: The real you is the best you.” —Michelle Tillis Lederman

Dr. Robert Cialdini spent a lifetime researching influence, and found that likeability was one key to cultivating influence. We like people who are like us. We want to be around people who seem magnetic, and make us feel good.

Have you ever found yourself saying about a stranger, “She’s brilliant!” That’s probably because you see in her the traits you admire in yourself.

But what if you’re a Rolling Stones fan trying to influence a Beatles lover? You’re in luck: There are tactics you can use to become more likeable in the eyes of the object of your influence.

One of the simplest ways, according to Cialdini, is to pay that person a compliment. Just ensure that yours are genuine and sincere, otherwise they become the false praise of flattery, which people can smell from a mile away.

Small talk works, too. Effective salespeople start by asking a lot of questions about you: your kids, job, interests, and so on in order to find commonalities—it’s not just empty banter.

In a series of studies about negotiation, one group was told to get straight to business, and about half came to an agreement. The other group was told to exchange some personal information first, and their success rates shot up to 90%.

Get people to like you and your influence will soar.

Law #6: Create Scarcity.

“Praise, like gold and diamonds, owes its value only to its scarcity.” —Samuel Johnson

Daniel Kahneman won a Nobel Prize for proving that people aren’t all that rational. He showed that we obsess over avoiding losses over taking calculated risks.

It’s why we stay in a job or relationship that’s “not bad” instead of risking a career change. “Things could be worse, right?” It’s why we sell a stock that’s losing value instead of doing the rational thing: Buy more of it.

And it’s why we’re easily motivated by scarcity: We want more of what there is less of. We fear losing out on an opportunity, and so we Act Now. Limited time or quantity offers work. “5 tickets left!” and “Price goes up at midnight!” are tactics that will be just as effective in the year 2099.

To grow your influence, show a person what they will miss out on if they don’t cooperate with you.

Law #7: Appeal to Reason.

“The only way on Earth to influence other people is to talk about what they want and show them how to get it.” —Dale Carnegie

Humans rarely ascend to Dr. Spock-levels of logic, but we undoubtedly have the capacity for reason. Even Captain Kirk solved problems without a phaser or fists from time to time.

Both Starfleet and Greek philosophers knew the power of logos, or reason, to win over minds. The origin of the term means, “argument.” But don’t conjure up an image of that couple bickering on the street—to argue is literally “to give reasons.”

Great arguments involve presenting watertight reasons to someone for doing what you want them to do, even though they or others may present powerful motives for doing the opposite. Reason can work even when the person you are trying to influence doesn’t feel like doing what you suggest. This is why people vote for a certain party “so the other guy doesn’t get in.”

Arguing is a skill you can certainly develop with practice in your everyday life, or through public speaking groups like Toastmasters. Reason is never as powerful or long-lasting as emotion in driving change, but if you’re only after short-term action, then this can be a powerful lever in your influence toolkit.

Law #8: Trade.

“You can have everything in life you want, if you will just help other people get what they want.” —Zig Ziglar

If you can’t get what you want through emotional appeals, reason or being likeable, there’s always bribery! I jest, sort of, but the adage “you scratch my back, and I’ll scratch yours” persists for a reason. Everyone wants to know, “What’s in it for me?” and so an appeal to others’ baser self-interests can be highly motivating.

The Law of Reciprocity compels us to pay someone back for a kindness they do for us—even to one-up our generosity! It’s why free samples and paying for your date’s dinner brings rewards. Cialdini found this play out in his research, which showed that a diner’s tips increase by up to 23% if a server handed out a couple of mints with the bill.

To boost your influence, start accumulating favors. Help people achieve their goals without asking for anything in return up front, then later call in your chips. You can quickly understand what people want by practicing Law #2: Listen First.

Just be aware: Once you start incentivizing people, they will always expect a reward. Use this influencing tactic sparingly.

Law #9: Encourage Consistency.

“We all fool ourselves from time to time in order to keep our thoughts and beliefs consistent with what we have already done or decided.” —Dr. Robert Cialdini

The “flip-flopper” holds a special place of disdain in our minds. The person who says one thing on Monday and does another on Tuesday puts a bitter taste in our mouth.

When it comes to our own behavior, we’ll do backflips to appear consistent. Effective influencers, especially salespeople, know this. That’s why they get you saying “yes” at the start of a conversation with innocent questions, and avoid all questions that could elicit a “no.”

“When you have said ‘no,’ all your pride of personality demands that you remain consistent with yourself,” writes Dale Carnegie in How to Win Friends & Influence People. Start out seeking small yesses, or small commitments, and you’ll find more success asking for bigger ones.

You can also encourage consistency by having your target write down their commitment or make it public (try this tactic with your own goals—accountability works!) One doctor’s office found that they could reduce missed appointments by 18% if they had patients write out their own appointment cards at the previous check-up, because writing it down makes a commitment more concrete in our brains.

Give people a chance to prove their consistency and your influence will grow.

Law #10: Build Consensus.

“Example is not the main thing in influencing others. It is the only thing.” —Albert Schweitzer

We seek to be consistent not only with ourselves, but with others. Peer pressure is part of every high school experience, but a study of British drinkers showed that it operates on adults, too. Those who drank little to no alcohol gave into binge drinking when other pub-goers egged them on.

Human evolution favored social groups over lone wolves, and that genetic wiring plays out today in Black Friday hysteria, dressing like your peers, even your strongest political beliefs.

If you can leverage this primordial need for harmony, you can exert a lot of influence, and in some cases even convince people to act against their wishes (but let’s use this power for good, OK?)

Let’s say that you’re trying to convince your tech-challenged boss to support your proposal for a paperless office. He’s more likely to go digital if you build a coalition of your colleagues first, then bring him that unanimity.

This effect is also called “herd” or “flock mentality,” and was illustrated recently by a study at University of Leeds. Researchers had groups of people walk randomly around a large room. The kicker? Five percent of participants were told to take a certain route. After a short time, the other 95% were following the same path without knowing why.

Success in life means getting what you want at least a majority of the time. And nobody, not even the most talented individual, can do this alone. We rely on others, whether it’s to buy our product or give us a job.

Many people rely on weak arguments, coercion, begging, nagging or even tantrums to sway others, which is why so many people don’t have what they want yet. Influence says: You can have it all, if only you convince others to see that your interests are theirs.

Follow these 10 laws and you’ll find out that you’ve always had the power of influence inside of you.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.