Category Archives: Daily Top Ten

Topley’s Top Ten – May 23, 2017

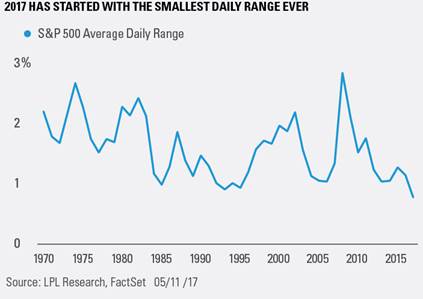

1.Global Price to Book Comparison…U.S. Large Cap Most Expensive Market by Price/Book.

http://blog.spdrs.com/

Daily Top 10 – May 19, 2017

1.Global Farming Recession Over? John Deere Good Numbers.

How much is priced in??? DE +45% Since Sept. 2016

Topley’s Top Ten – May 18, 2017

1.Western Europe, U.S. and China Car Sales Drop…

For the first time since January 2009, sales of cars declined year-over-year in all three of the world’s largest auto markets of Western Europe (-6.8%), China (-1.8%) and the United States (-3.7%). Combined, these three markets account for roughly 70% of the world’s auto sales

Lots of cars coming off lease.

www.zerohedge.com

Topley’s Top Ten – May 16 & 17, 2017

Sorry…Some technical difficulties on train this morning.

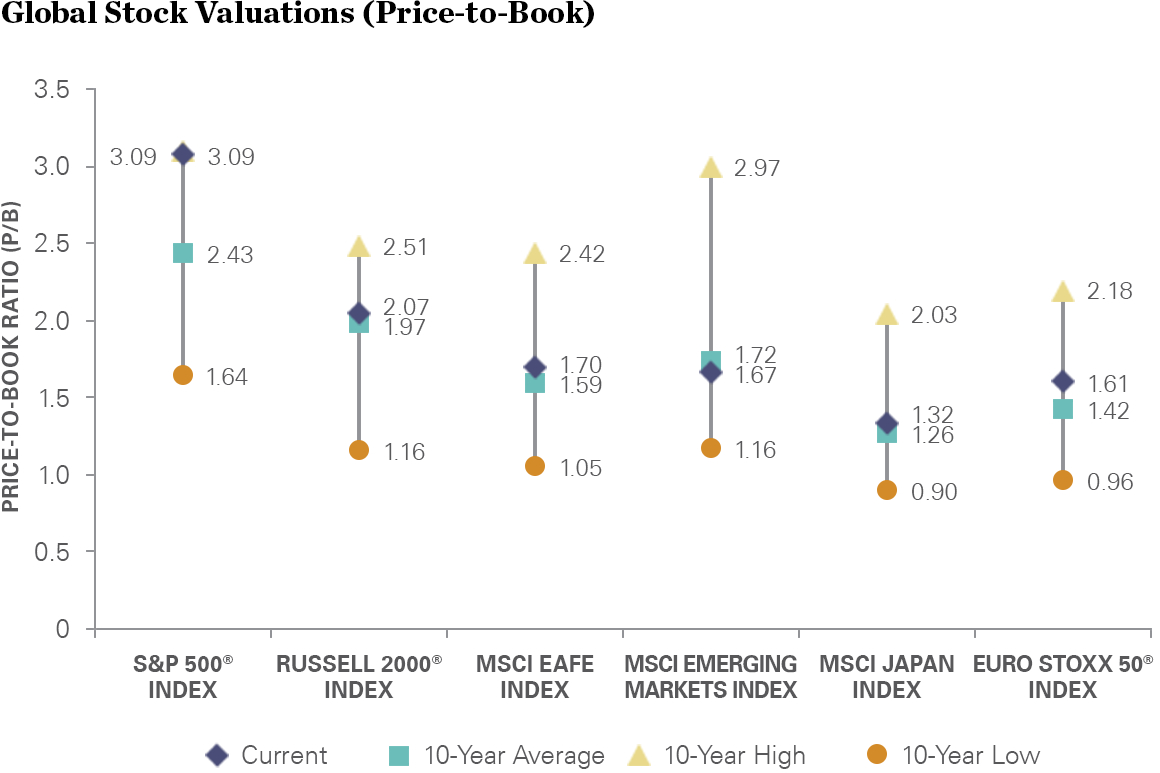

1.Volatility ….Average Daily Range of S&P 500 Lowest Since 1970

From Dave Lutz at Jones

“The average daily range for the S&P 500 Index so far this year is 0.57%, which is the lowest range going back to 1970” says LPL