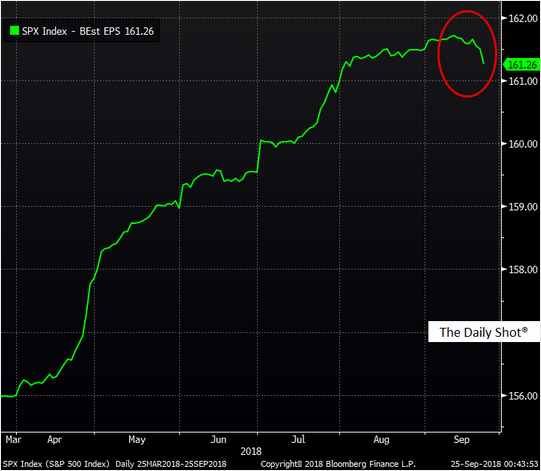

1.The Big Question..Can Earnings Keep Growing at these Levels?

And analysts are turning a bit more cautious on corporate profits. This chart shows Bloomberg’s consensus estimate of the S&P 500 earnings per share for the next twelve months.

Source: @TheTerminal

https://blogs.wsj.com/dailyshot/

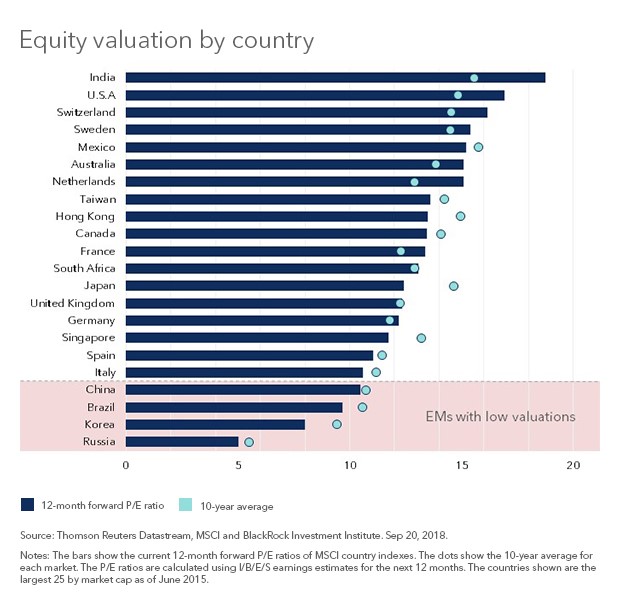

2.Emerging Markets Price to Book 35% Discount to Developed Markets.

Emerging markets’ lost (near) decade

Russ Koesterich, CFA Portfolio Manager for BlackRock’s Global Allocation Team

Since coming out of their own financial crisis in late 1990s, emerging market stocks have tended to trade in a well-defined range versus developed markets: a 45% discount to a 10% premium (based on price-to-book). Periods when EM stocks traded at a premium, such as late 2007 and 2010, turned out to be market tops. Interestingly, EM’s recent 20% drop was not proceeded by egregious valuations. In January, EM stocks were trading at approximately 1.9 times x book, a 23% discount to the MSCI World Index.

Another bottom?

Following the recent correction, EM stocks are trading at levels that preceded previous rebounds. EM equities are trading at roughly 1.55 times price-to-book (P/B), the lowest since late 2016 and a 35% discount to developed markets. Price-to-earnings (P/E) measures paint a similar picture. Current valuations represent a 33% discount to developed markets. Today, countries from Russia to South Korea are trading at less than 10x earnings (see Chart 1).

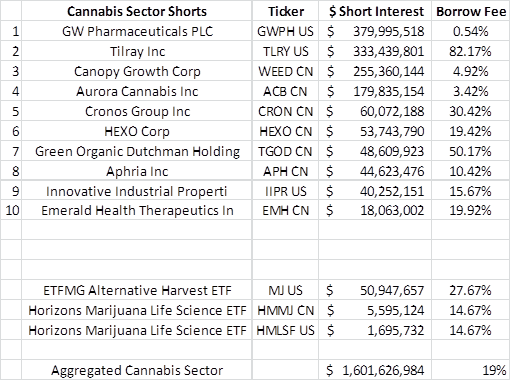

3.Classic Small Floats and High Borrow Rates Crushing Weed Shorts.

Investors betting against weed stocks are getting crushed — but they refuse to throw in the towel (TLRY, CRON, CGC)

Graham Rapier

- Short sellers, or investors betting against weed stocks, have $1.7 billion on the line as valuations have surged this quarter.

- Investors are paying $1.1 million a day to borrow stocks in order to short them, data from the financial-analytics firm S3 Partners shows.

- Despite the surge in prices, not many of those short sellers are buying shares to cover their bets — a sign of their conviction.

High-flying marijuana stocks have already cost short sellers more than $900 million this year, but those skeptics don’t appear to be giving up anytime soon.

There’s at least $1.7 billion riding against the sector, according to data from the financial-analytics firm S3 Partners, and very few of those investors have bought shares outright in order to cover their wagers.

“It looks like the shorts have just as much conviction as the longs in this sector and both sides are hanging tough even with the wild price swings we’ve had over the last week,” Ihor Dusaniwsky, the firm’s managing director of predictive analytics, told Business Insider.

Short sellers are paying an average of 19% to bet against marijuana stocks, with GW Pharmaceuticals, Tilray, Canopy Growth, and Aurora Cannabis topping their list of targets. That’s $1.1 million every day paid across the sector just to borrow stocks in order to short them.

S3 Partners

In the 61 marijuana stocks and exchange-traded funds that S3 tracks, Dusaniwsky says short-interest against that basket has increased by 58% since the end of the second quarter. Most of that chunk has gone against Tilray, whose stock price is up a whopping 535% since its July initial public offering. Tuesday’s 7% rally — fueled by an announcement from the company that it was exporting medical CBD products to Australia — produced $60 million in mark-to-market losses for those betting against the stock.

“Shares shorted are down slightly over the last week, down 40k shares, but there has by no means been a short squeeze in the stock with only 149k shares covers in September as Tilray’s stock price rose $52/share,” added Dusaniwsky.

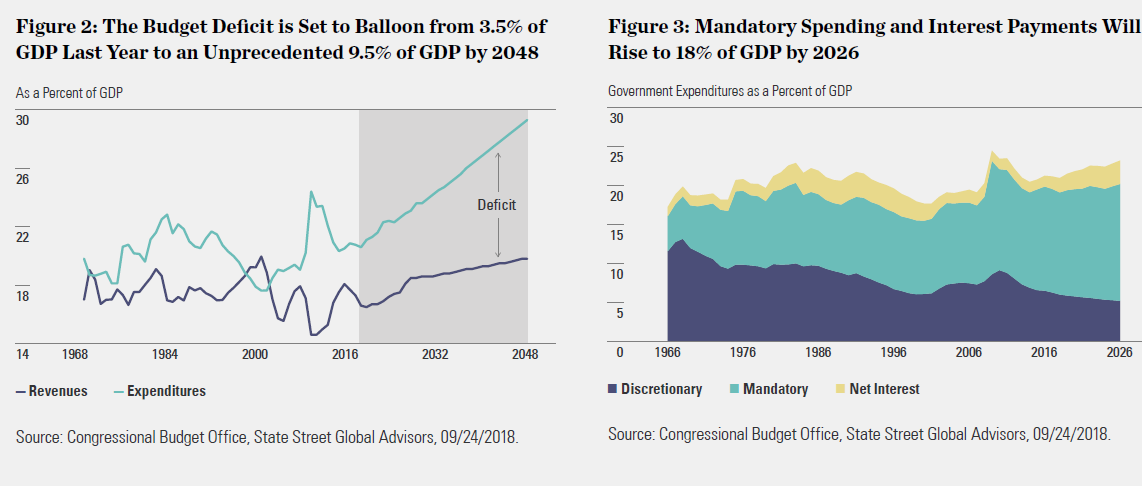

4.Future Deficits.

5.Defining Length and Breadth of This Bull Market.

From Nasdaq Dorsey Wright.

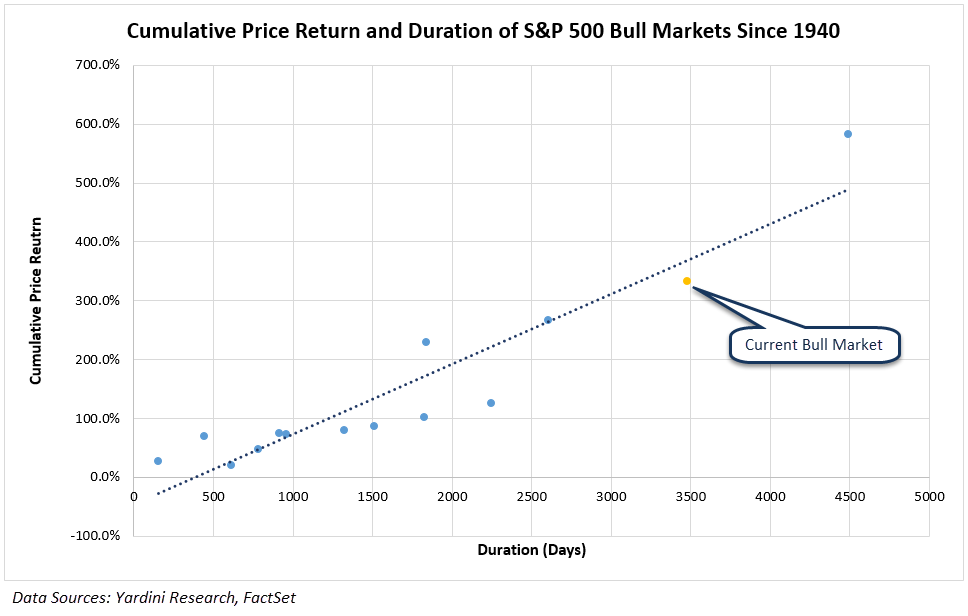

Depending on how you define “bull” and “bear” markets, whether you use intraday or closing prices, and which index you use as your proxy for the market, it is possible to arrive at the conclusion that we are now in the longest running bull market in history. Any way we define bull and bear markets is, by its nature, arbitrary. However, we believe the most traditional definition of a bear market is when the market closes down 20% or more from its peak and a bull market is a period from a bear market bottom until the market peaks before again entering a bear market. Using this definition, we would conclude that the duration of the current bull market is still far shorter than that of the one that ran from December 1987 until the dot-com bubble burst in March 2000.

In terms of cumulative gain during a bull market, the current bull market also lags behind the 1987 – 2000 bull market. Between December 4, 1987, and March 24, 2000, the S&P 500 SPX gained more than 580% (price return basis). Meanwhile, since March 9, 2009, SPX’s bottom during the last bear market, through the most recent peak (which occurred on 9/20/18), SPX has returned 333% or 16.61% on an annualized basis. The ’87 – ’00 bull market also slightly edges out the current market on an annualized return basis, returning 16.88%.

It is also worth noting that had it not been for the brief bear market in 1987 which occurred around the Black Monday crash and lasted just over three months, the 1982 – 1987 bull market would have extended all the way until 2000, more than 17 years.

The graph below shows the length and cumulative return of each bull market since 1940. As the graph shows, the current bull market (as we’ve defined it) is the second longest bull market after the ’87 – ’00 market. However, you can also see the current market sits below the trend line, which showing that the rate at which SPX has appreciated during this bull market has been slower than in the average bull market since 1940. The ’87 – ’00 bull market sits well above the trend line, showing that bull market had a greater than average rate of appreciation, even with a significantly longer duration.

https://oxlive.dorseywright.com/research/bigwire

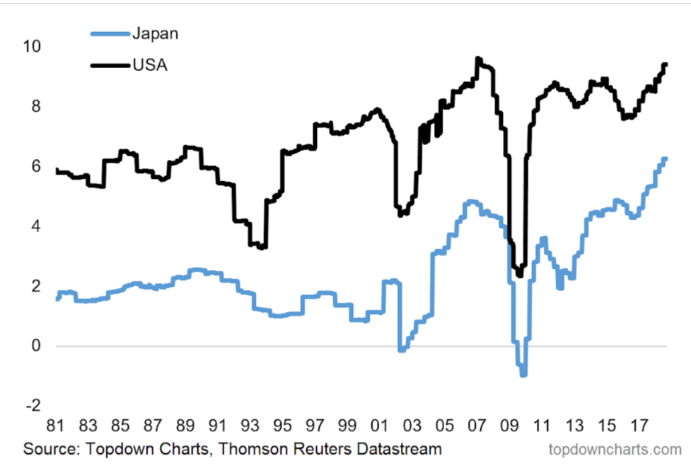

6.Wisdom Tree Piece Earlier in Week on Japanese Valuations….Profit Margins Growing in Chart Below.

Japanese Profit Margins: Something very interesting is going on with Japanese equities. No, it’s not the Bank of Japan buying up equities as part of its QE program (although, that is interesting!), and it’s not the upside breakout in the Nikkei or the decoupling with the Yen (again, two very interesting things). The breakout in question is less about price and more about profit… (source)

Callum Thomas

Head of Research at Topdown Charts – Global Economics & Asset Allocation research28 articles

https://www.linkedin.com/pulse/top-5-charts-week-callum-thomas-6d/

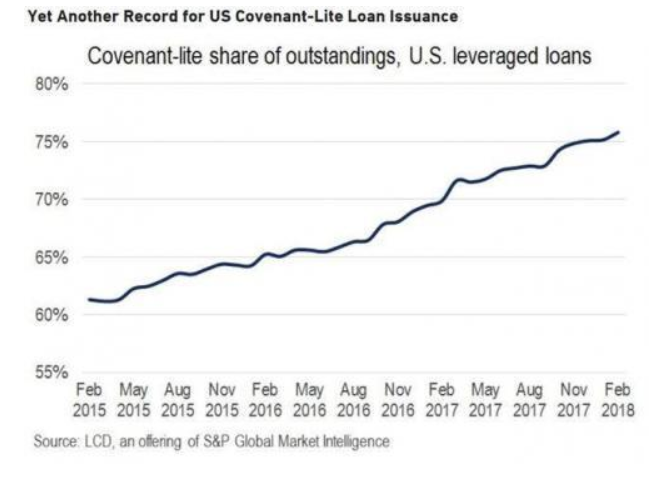

7.Covenant-Lite Leveraged Loans Another Record.

https://www.zerohedge.com/news/2018-09-27/janet-yellen-says-its-time-alarm-loan-bubble-runs-amok

8.Manhattan Builders’ 5-Year Plan: 33,000 New Rentals and Condos

By

Oshrat Carmiel

September 27, 2018, 4:21 PM EDT

Construction will focus on northern and southern neighborhoods

Developers are already struggling to fill their existing units

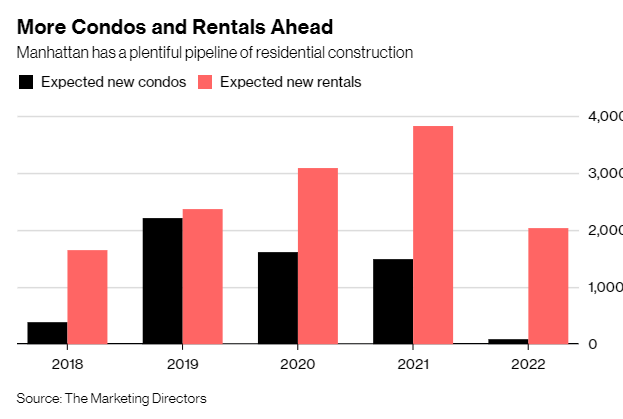

There’s a surplus of homes in Manhattan, and here come tens of thousands more.About 33,000 new units for sale or rent are expected within the next five years, with the largest concentrations in the northern and southern parts of the borough, according to an analysis from Marketing Directors, a new-development brokerage.

More Condos and Rentals Ahead

Manhattan has a plentiful pipeline of residential construction

Source: The Marketing Directors

The trouble is, Manhattan is already flooded with high-end condos and apartments from a post-recession building boom — a glut that’s put a damper on both rents and purchase prices as New Yorkers take their time to shop for the best deals. For developers, the next wave of construction could add to the pressure to find tenants and buyers.

“It’s really the top question we get from our developer clients, after ‘How much can we sell this for?’ and ‘How fast can we sell it?’” said Joshua Silverbush, director of market insights for the New York-based brokerage. “What else is coming up, and what are we competing against?”

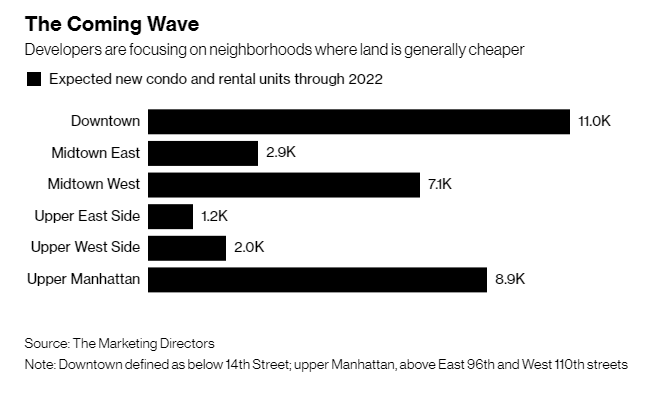

The Coming Wave

Developers are focusing on neighborhoods where land is generally cheaper

Source: The Marketing Directorsz

Note: Downtown defined as below 14th Street; upper Manhattan, above East 96th and West 110th streets

An estimated 1,643 new rentals are expected to reach the market between now and the end of this year. The apartment pipeline will swell to 3,831 in 2021, according to the firm, which tallied both units that have secured and applied for building permits, as well as announced projects for which paperwork hasn’t begun.

More new condos are coming too — more than 2,000 of them in 2019 alone. For projects with detailed sales plans, the average price per unit is $2.7 million, according to Silverbush. That suggests much of upcoming supply is smaller homes, and less focused on grand spaces aimed at ultra-wealthy investors, he said.

9. China’s overseas investment drops in 2017 for the first time on record

- The drop came as leaders of the world’s two largest economies increased scrutiny on cross-border deals, following a surge of Chinese investments in the U.S.

- Beijing would like to stem capital flight, while the Trump administration is citing national security reasons for slowing or preventing Chinese acquisitions of U.S. companies.

The Waldorf Astoria on October 6, 2014 in New York City. Anbang Insurance Group bought the Waldorf from Hilton Hotel group for $1.95 billion in 2014.

China‘s annual foreign direct investment outflows declined in 2017 for the first time on record, according to a government report released Friday.

The drop came as leaders of the world’s two largest economies increased scrutiny on cross-border deals, following a surge of Chinese investments in the U.S. — which included the high-profile purchase of New York’s landmark Waldorf Astoria hotel by Chinese insurer Anbang in 2015.

Beijing would like to stem capital flight, while the Trump administration is citing national security reasons for slowing or preventing Chinese acquisitions of U.S. companies.

Last year, China’s annual outward direct investment dropped 19.3 percent to $158.29 billion, from $196.15 billion in 2016, according to government statistics. That marked the first decline recorded in data going back to 2002, according to the report from China’s Ministry of Commerce, National Bureau of Statistics and State Administration of Foreign Exchange.

Figures from 2002 to 2005 include only non-financial outward foreign direct investment, while numbers from 2006 onward include all industries.

Chinese investments in the U.S. was $6.43 billion in 2017 — down 62.1 percent from a year ago, the report showed.

In contrast, flows to Europe rose to a record $18.46 billion in 2017, or 72.7 percent higher than a year ago, the report said.

10.Ethos.

are imbedded in an organization’s ethos? If you Google the word ethos, you’ll find this Merriam-Webster definition:

the distinguishing character, sentiment, moral nature, or guiding beliefs of a person, group, or institution

Recently, I have had the honor of attending the Navy SEAL Foundation gala events in both Denver and Chicago. At both events, a good friend and former combat SEAL led his current and former Naval Special Warfare teammates in reciting the Navy SEAL Ethos (see link here for the full text: https://www.public.navy.mil/nsw/pages/ethoscreed.aspx).

Many lessons can be pulled from this powerful credo and perhaps translated to high-performing teams in the business setting (in order):

- On reputation and trust: “It is a privilege that I must earn every day.”

- On humility: “I do not advertise the nature of my work, nor seek recognition for my actions.”

- On character on and off the battlefield (in and out of the boardroom): “Uncompromising integrity is my standard.”

- On leadership in a team context: “We expect to lead and be led. In the absence of orders I will take charge, lead my teammates and accomplish the mission. I lead by example in all situations.”

- On grit: “I will never quit. I persevere and thrive on adversity…If knocked down, I will get back up, every time…I am never out of the fight.”

- On constant improvement: “We expect innovation…My training is never complete.”

- On team: “In the worst of conditions, the legacy of my teammates steadies my resolve and silently guides my every deed.”

The Navy SEAL Ethos is a statement about what it takes to join and uphold the standards of this elite team. In any setting, an ethos, a set of values, a mission or vision statement is only effective if leaders and teammates live and breathe the words in everything they do. In the case of the Navy SEALs, we have no doubt.

@navy-seal-foundation