Traveling again this week…

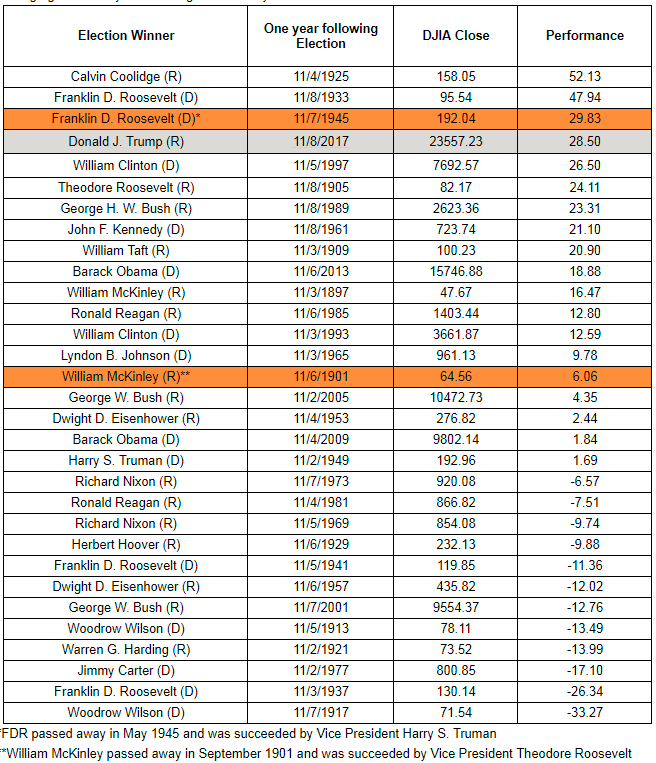

1. Dow’s 1-year gain since Trump’s win is its biggest post-Election Day rise since 1945

That represents its best performance after a White House contest since 1945, when the blue-chip gauge was up 29.83% in a year following the election of Franklin D. Roosevelt and his vice president Harry S. Truman. (FDR died early his fourth term, putting Truman in the Oval Office in April 1945.)

Check out: Good news for the president in latest Trump Scoreboard

The table below from WSJ Market Data Group shows that Calvin Coolidge ranks No. 1 by this measuring stick, FDR gets the silver and bronze medals, Trump is fourth, and Bill Clinton, fifth.