Short Version Today – No Top Ten Tomorrow.

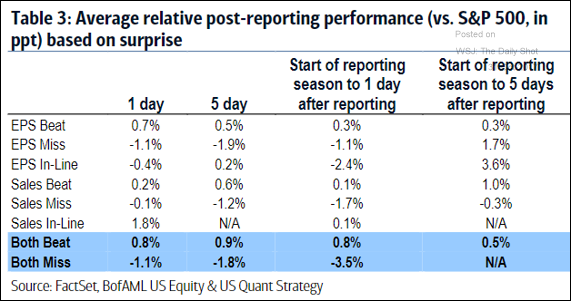

1.Positive Earnings is Only Having Mild Upside Reaction

Equity Markets: Market reaction to better than expected earnings reports has been muted (on average).

Source: BofAML

2.Some Analysts Use Caterpillar as Measure of Global Economic Growth

CAT almost a double off 2016 bottom

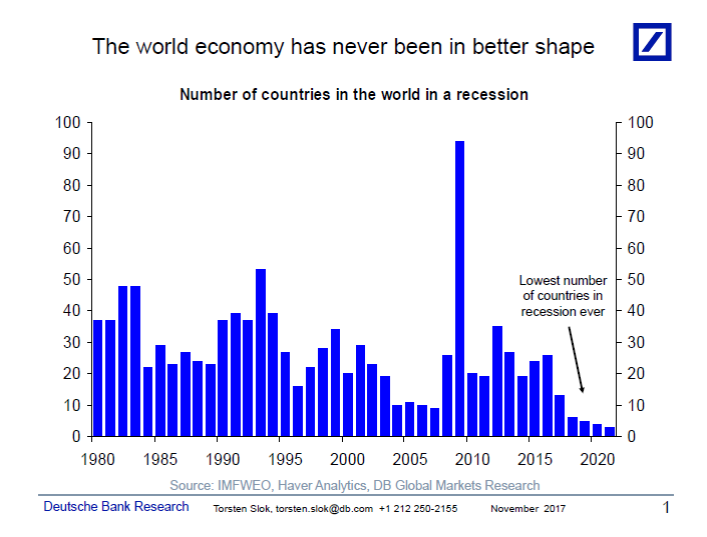

3.By this Stat CAT Numbers Make Sense….Lowest Number of Countries in Recession Ever

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief International Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

Tel: 212 250 2155

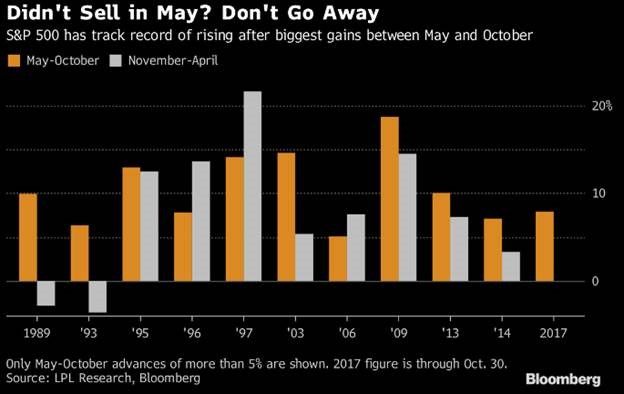

4.When Sell in May Does Not Work? What Happens? Seasonality Stats

Bloomberg notes “Sell in May and go away” didn’t pay this year in U.S. stocks, as the S&P 500 Index climbed 7.9 percent through Monday. LPL presented data for 23 other periods since 1950 in which the index rose at least 5 percent between May and October. The index then rose in November through April on all but two occasions

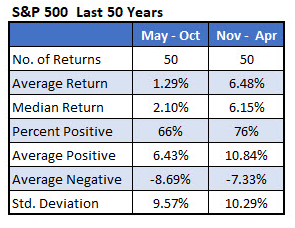

Over the past 50 years the S&P has averaged a gain of 6.48% from November to April — much higher than the average 1.29% May-to-October return — and boasts a stronger 76% win rate. Schaffer’s notes the 25 Best November Stocks

From Dave Lutz at Jones

5.Another Favorite Economic Indicator Surging…F-150 Sales.

Ford Struck Sales Surge 16%

Nov 1, 2017

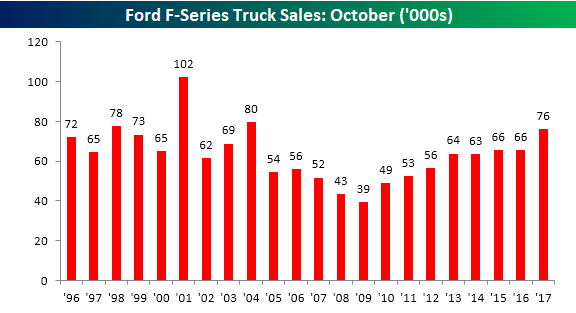

We like to track sales of pickup trucks (specifically at Ford) as they are often a sign of strength or weakness in the small business and construction sectors, and based on these numbers from Ford, the small business sector looks strong. For the month of October, Ford sold 75,974 F-Series trucks. That represents a y/y increase of 16% and is the strongest October sales figure for the company since 2004. Going back to 1996, the only three Octobers that were better than 2017 were 2001 (102K), 2004 (80K), and 1998 (78K). When comparing sales on a m/m basis, it isn’t always an apples to apples comparison because of differences in ‘selling’ days, but a 16% y/y increase is positive no matter how you look at it.

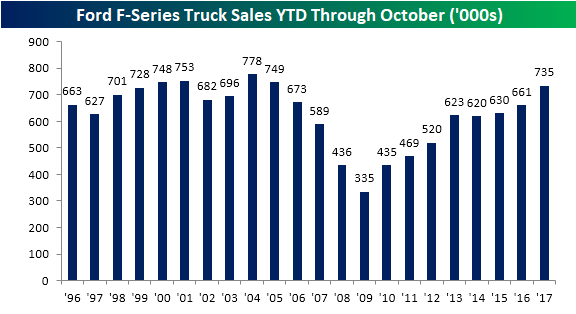

While differences in the number of selling days can skew results over the short-term when comparing figures on a YTD basis, unadjusted numbers provide more of an apples to apples comparison, and here again, Ford’s results for 2017 continue to be very strong. Through the end of October, total sales of F-Series trucks have been 734,610. That represents an increase of 11.1% and is the best YTD reading for the first ten months of the year since 2005.

https://www.bespokepremium.com/think-big-blog/

6.IPO Market Up Double the S&P YTD

One thing we have not seen on the euphoria side of bull market was robust IPO market…Keeping a close watch..

IPO ETF VS. S&P ytd

7..Read of the Day….8 most important things to know about the GOP tax plan

From the child care credit to the estate tax, here’s how the proposed changes could impact you

Getty Images

President Trump has stated he wants to cut taxes for the middle class, but the current version of the Republican plan would hurt some in the middle class.

In a document called the Uniform Framework for Fixing Our Broken Tax Code, President Trump and GOP congressional leaders briefly outlined their tax reform proposal. Here are the most important points in the proposal for individual taxpayers, along with some commentary.

Individual tax rates

The Republican plan would reduce the number of individual tax rates from the current seven to three: 12%, 25% and 35%. Under current law, the highest rate is 39.6%. The Republican plan reserves the right to add a fourth rate that would be higher than 35%. That will probably be necessary to disarm critics who charge that the GOP plan is “tax cuts for the rich.”

The plan doesn’t specify the income levels that will determine the new tax brackets. However during the presidential campaign and shortly thereafter, President Trump proposed the following brackets for married joint-filing couples:

- Less than $75,000: the lowest rate bracket

- $75,000 to $225,000: 25% rate bracket

- More than $225,000: 35% rate bracket

For unmarried individuals, the following brackets were proposed.

- Less than $37,500: the lowest rate bracket

- $37,500 to $112,500: 25% rate bracket

- More than $112,500: 35% rate bracket

Personal and dependent exemptions and standard deductions

Under current law, personal and dependent exemption deductions are $4,050 each for 2017. The standard deduction is $6,350 for single taxpayers and married individuals who file separately, $9,350 for heads of households, and $12,700 for married joint-filing couples.

The Republican proposal would eliminate personal and dependent exemptions. To compensate, standard deductions would be increased to $12,000 for singles and married individuals who file separately and to $24,000 for married joint-filing couples.

Itemized deductions

The Republican proposal would apparently eliminate itemized deductions except those for home mortgage interest and charitable contributions. Naturally, politicians from both parties that represent high-tax states are screaming about the apparent elimination of itemized deductions for state and local taxes. A possible compromise would be to allow deductions for state and local property taxes but not income taxes. Another possible compromise would only eliminate state and local taxes for folks with really high incomes.

Also see: The Trump tax calculator — what do you owe?

Eliminating itemized deductions for medical expenses and personal casualty losses could also prove to be controversial, but there has not been much visible pushback so far.

401(k) plan contributions

Under the current rules, you can potentially make salary-reduction 401(k) plan contributions of up to $18,000 for the 2017 tax year or up to $24,000 if you are age 50 or older. Salary-reduction contributions lower your taxable salary which, in turn, lowers your federal income tax bill. There was some speculation that the GOP plan might cut maximum allowable 401(k) contributions to something like $2,400. President Trump scotched that rumor, and I don’t think there will be any such reduction.

The Republican plan could instead require employers to offer both traditional 401(k) plans and Roth 401(k) plans, as suggested here. Contributions to Roth 401(k) plans aren’t deductible, so they don’t reduce the Treasury’s current tax take. The tax break comes on the back end when you can receive federal-income-tax-free distributions after age 59½. While that back-end break would reduce the Treasury’s tax take in future years, politicians aren’t known for taking a long-term view.

Child tax credit

Without being specific, the Republican proposal promises a significant increase in the child tax credit, which is currently set at $1,000 per qualifying child. In addition, the income levels at which the credit begins to be phased out would be increased to make the credit available to more taxpayers. These proposed changes are noncontroversial.

Alternative Minimum Tax (AMT)

The AMT was originally intended to ensure that high-income taxpayers who claim lots of write-offs and other tax breaks pay at least some federal income tax. Over the years, however, the tax has morphed into something that hits many upper-middle-income taxpayers. Since it’s difficult to find anyone who admits to liking the AMT, this change could happen.

Estate tax and generation skipping transfer tax

Under current law, the 40% federal estate tax hits estates that exceed the estate tax exemption ($5.49 million for 2017). The 40% generation skipping transfer tax (GSTT) hits gifts or bequests made to beneficiaries who are more than one generation below the giver and that exceed the GSTT exemption (also $5.49 million for 2017). The Republican proposal would repeal both of these taxes. Opponents of the idea are, of course, pointing out that this is a “tax cut for the rich.” Since that’s true, a possible compromise would be establishing a higher threshold for these taxes without killing them off entirely.

Winners and losers

While President Trump has repeatedly stated that he wants to cut taxes for the middle class, the current version of the Republican plan would produce both winners and losers in what I would call the middle class. For instance:

- If you live in a high tax state, you might lose some or all of your deduction for state income and property taxes. The valid counter argument is that you should not receive a federal income tax subsidy for choosing to live in a high-tax state.

- If you have lots of kids, you might lose your dependent exemption deductions ($4,050 for each kid for 2017.) One wag described the Republican tax plan as “anti-Mormon.” The valid counter argument is that you should not receive a federal income tax subsidy for choosing to have lots of kids.

- If you qualify as a head of household under the current rules, the tax brackets and standard deduction are better than if you file as a single. Head of household filing status is most commonly used by single parents who have one or more dependent children living with them. The current Republican proposal would apparently eliminate head of household filing status. I would bet against that happening, because it would adversely affect lots of lower-income and middle-income taxpayers.

- If you are single, with taxable income above $112,500 or a married joint-filer with taxable income above $225,000, you might be in the 35% tax bracket under the GOP plan. Under the current rules, you don’t enter the 35% bracket until your taxable income exceeds $416,700 for 2017.

- Under the Republican plan, the 20% maximum rate on long-term capital gains and dividends might kick in at taxable income of $112,500 for singles and $225,000 for married joint-filers. Under the current rules, the 20% maximum rate doesn’t kick in for 2017 unless you are a single filer with taxable income in excess of $418,400 or a married joint-filer with taxable income in excess of $470,700.

- On the other hand, you could come out ahead under the Republican proposal if you are single with taxable income of less than $112,500 or a married joint-filer with taxable income of less than $225,000 and don’t live in a high-tax state and don’t have lots of kids. Many taxpayers fit that description. You might also come out ahead if you owe the AMT under the current rules.

The bottom line

The Republican tax reform proposal would make big changes, but specifics are still lacking. Also, there is always resistance to change. The House Ways and Means Committee and the Senate Finance Committee will be tasked with the difficult job of hashing out the details, and the devil will most certainly be in those details. For example, one Republican Senator has already stated that he will not support any tax reform package that increases the federal deficit. Any road to tax reform will be bumpy. Stay tuned. We will keep you informed of developments.

https://www.marketwatch.com/story/8-most-important-things-to-know-about-the-gop-tax-plan-2017-11-01

8.The Meaning of Regret

You wouldn’t do it again, but does that have to mean you’re sorry it happened?

Posted Oct 31, 2017

Life’s too short to waste even one second of it on regrets.

Or so centenarians often tell us when they’re asked to share a crumb of wisdom from the cupboard. “Proceed boldly!” they say. “Don’t leave yourself open to saying, on your deathbed, ‘I wish I had…’”

Regret is the second-most common emotion people mention in daily life, some studies show. And it’s the most common negative emotion. We start expressing regrets at around the age of two—as soon as we’re able to articulate the concept of “If only…” And thereafter, we’re continually rewriting history in our heads instead of playing the cards in our hand. Counter-productive, right?

Not always.

It isn’t actually so bad to catch yourself thinking, I wish things had turned out differently—everyone does, the psychologist Amy Summerville noted recently. It’s what you think next that matters.

Summerville runs the Regret Lab at the University of Miami in Ohio. By her lights, regret is only toxic when it becomes habitual. That is, when we develop the reflex to chew and chew on an unfortunate turn of events, like a cow on its cud, till there’s not a lick of nutrition left in it. By contrast, as something to dial up and analyze once, a regrettable experience can be quite useful.

Stuff happens. Here are three ways to turn it into compost:

Reframe 1: Embrace the Learning Op

Something just went sideways. Now it’s up to you which side of the ledger to write that thing on: Bad Break or Lucky Break.

Whatever went wrong needs fixing (if indeed it can still be fixed). Since we tend to neglecteven routine maintenance on things we don’t think need fixing, that insight alone is the first step to growth. Regret is a sign that you’re paying attention. You detected the problem. With the next step, wondering what you could have done differently, you’ve already started rewiring your circuitry, preparing it for a different response next time.

Regret spurs us to action—so long as we feel like we can still do something about it. And like a burr under the saddle, studies show, regret becomes more and more of an irritant the longer we fail to take action.

Reframe 2: It could have been worse

When we regretfully ask ourselves, “What if things had gone differently?” what we really mean is, “What if things had gone better?” But it’s equally valid to ask, “What if things had gone worse?”

During the 1992 summer Olympics in Barcelona, Cornell psychologist Thomas Gilovich noticed something strange at the awards ceremonies. When the cameras panned across the faces of the athletes on the podium, here’s what the viewers saw: the bronze medalists showed big smiles. The silver medalists showed decidedly more muted enthusiasm. Wait, what? Is it better to come in third than second?

Ask yourself: What’s the easiest alternative to imagine is for each athlete? The silver medalist just came within a whisker of being world champion. Gold medal. Endorsement riches. Speaking career. Wheaties Box. “Second place is just first place among losers,” as Nike’s Phil Knight used to say. No wonder she looks so glum. The silver medalist is sinking under the weight of a depressing “downward counterfactual”: What if I’d just given one percent more and won this friggen’ thing?

The bronze medalist, on the other hand, is riding an “upward counterfactual” to the sky. She really didn’t come that close to winning. She actually came closer to finishing in the dreaded fourth place, out of the medals, with nothing to show for years and years (really a whole lifetime) of effort. Whew! Close shave! But look, Mom, here I am! Like Ringo Starr, she is (as the Beatle drummer often said) “just happy to be here.” No wonder she’s beaming.

Studies of test-score satisfaction tell a similar story. Students who scored 89 were typically unhappier than students who scored 87. Both marks merited the same grade: a B-plus. But that 89, man, that’s so close to the coveted A. If I’d just concentrated a wee bit harder, or got 15 minutes more sleep instead of watching those cat videos. Whereas the student who pulled the 87, well, that’s really not all that close to an A. It’s actually closer to 85, a B. Props to me, the student says feeling lucky. But hey, you’ve gotta be good to be lucky, he thinks, and stands a little taller.

article continues after advertisement

Reframe 3: Not My Circus, Not My Monkeys

Social science tells us that we ought to judge people’s behavior in context. What were the pressures or extenuating circumstances that might help explain the loopy thing this person just did?

Failing to properly consider context is a “fundamental attribution” error. An example is when we shirk blame for our own failures, chalking them up to bad luck/dust-in-the-eyes/lousy equipment/sunspots, instead of “owning” them.

But it can also happen that we own things that weren’t actually our fault, thereby beating ourselves up unnecessarily.

Last year, to commemorate the 30th anniversary of the space shuttle Challenger disaster, NPR ran a story about Bob Ebeling, the NASA engineer who had tried to warn his higher-ups that it was too cold to launch that morning; those rubber-gasket “o rings” weren’t going to hold up.

In a devastating display of self-flagellation, Ebeling bore the weight of the astronauts’ deaths. It was his failing, he maintained, that he wasn’t persuasive enough to get the launch aborted. “I think that’s one of the mistakes God made,” Ebeling said. “He shouldn’t have picked me for the job.”

There was such an outpouring of support for this humble man after the story aired that the station did a follow-up program. Ebeling was interviewed again. This time he said he felt buoyed and less regretful. The feedback and interviews with NASA brass helped him accept that the tragedy wasn’t his fault. That shuttle was going to fly and even the world’s best trial lawyer could not have changed those minds.

We tend to feel far less regretful when it wasn’t our fault.

article continues after advertisement

The good news is that, as we grow older, that corrosive personal fault-finding seems to fade away. The older brain, new German research seems to confirm, is just less susceptible to regret. This may be nature’s way of saying, Hey, even if it were your fault, you don’t have time left to fix it anyway, so let it go.

So to recap: We can train ourselves to regret less, or to regret better, in at least the following three ways:

- To see a regretful outcome as a useful data point in our ongoing self-improvement project.

- To consider the worse fate we dodged, rather than the sweeter fate we missed out on.

- To be honest about where the fault lies in the regrettable thing, and cut ourselves some slack if it doesn’t lie with us.

Sometimes a past mistake is useful as a growth-op and sometimes it isn’t. The wisdom is in knowing the difference.

https://www.psychologytoday.com/blog/the-carpe-diem-project/201710/the-meaning-regret