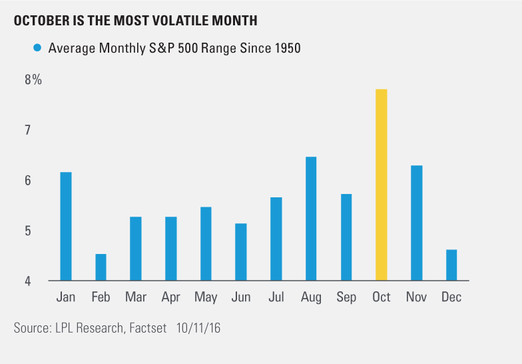

1.2017-The Least Volatile October Since 1928

And it is strange how quiet the market is. October, remember, is supposed to be the market’s most volatile month. Through Thursday, however, it was the least volatile October on record going back to 1928, according to Ben Bowler, global head of equity derivatives research at Bank of America Merrill Lynch

http://www.barrons.com/articles/stocks-surge-to-highs-as-tech-roars-again-1509158124

The Most Volatile Month Not This Year.

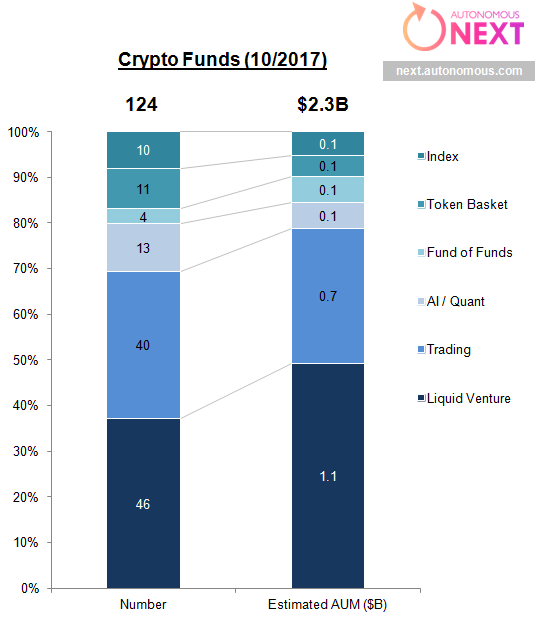

2.90 New Cryptocurrency Hedge Funds in One Year.

There are now more than 120 hedge funds focused solely on bitcoin, digital currencies

Data shared exclusively with CNBC from financial research firm Autonomous Next shows the number of funds investing in digital assets like bitcoin has grown rapidly to 124.

Autonomous Next also estimates that the “crypto-funds” have about $2.3 billion in total assets under management.

While several leading Wall Street banking executives remain skeptical about bitcoin, more seasoned money managers are moving into digital assets management.

More than 90 funds focused on digital assets like bitcoin have launched this year, bringing the total number of such “crypto-funds” to 124, according to financial research firm Autonomous Next.

Data shared exclusively with CNBC Friday showed that the largest share of the funds, 37 percent, used venture capitalist-type strategies and had about $1.1 billion in assets under management. Funds focused on trading digital assets came second at 32 percent, with about $700 million in assets under management.

Funds specifically using machine learning, data science or statistical arbitrage on digital currencies came in third at 10 percent and $100 million in assets under management, the data showed.

Total assets under management by crypto-funds now stands at $2.3 billion, according to Autonomous Next’s estimates.

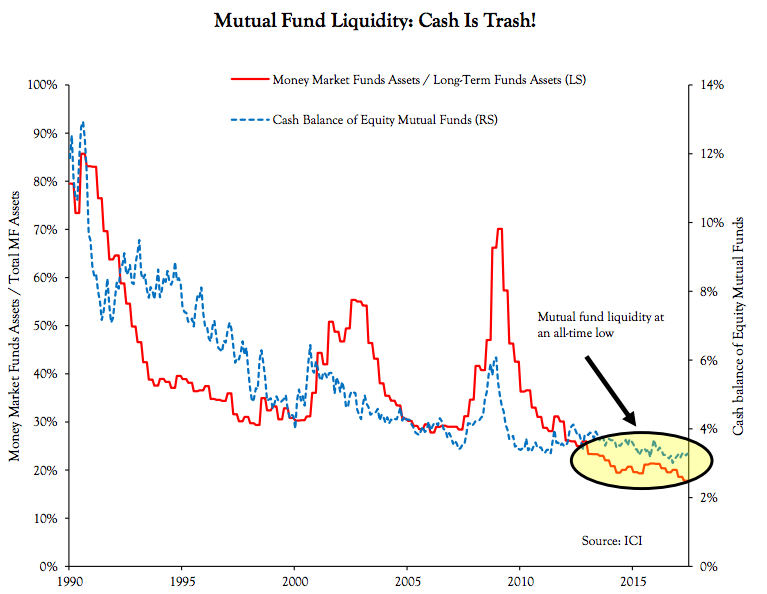

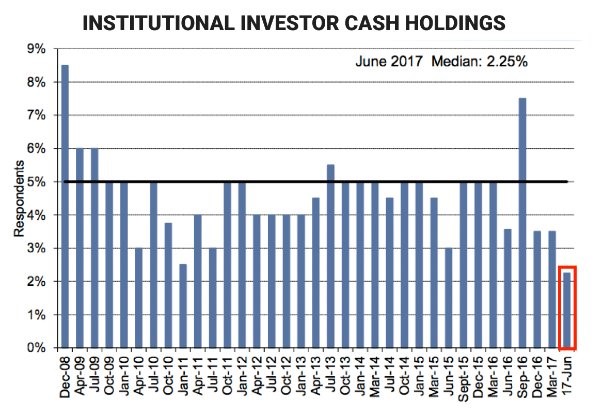

3.Institutional Investors Go All In…Cash Balances Hit Record Lows.

- Joe Ciolli

- Business Insider

Business Insider

A few weeks earlier, also in July, Citigroup said that institutional investors they surveyed were holding roughly 2.25% of assets under management in cash, the lowest since at least the start of the eight-year bull market.

Institutional investors were holding the least cash since at least December 2008 back in June, which was and has continued to be a sign that confidence is overheating. Citigroup

All of this combined marks an interesting twist for a stock market landscape that’s long been buoyed by the presence of money on the sidelines. Throughout the past couple years, bulls have cited that excess capital as waiting to flood back into stocks, pushing the market higher.

That argument holds less water now, and a red flag has been raised. After all, in 2000 and 2007, prior to bear market downturns, investors were confidently holding similarly low levels of cash.

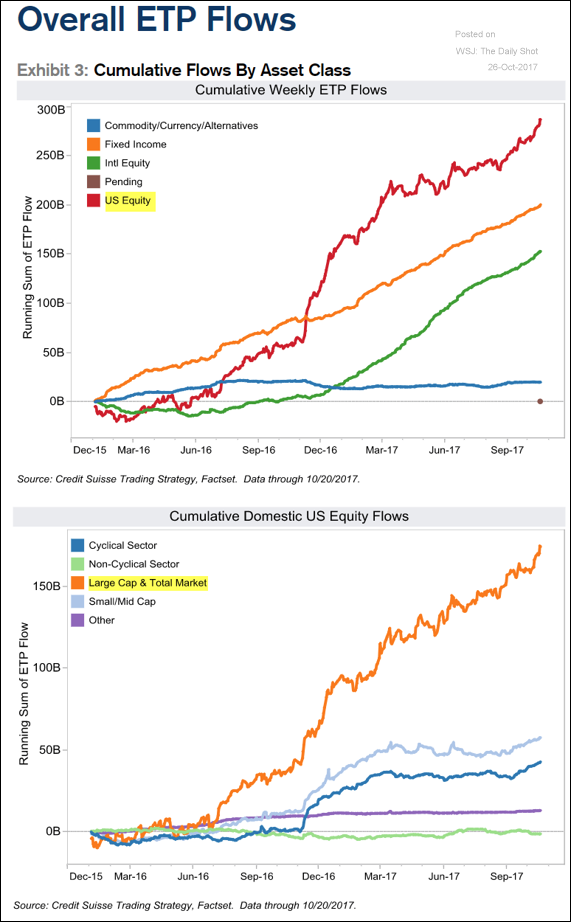

4.Massive Flows into Equity ETFs….A Large Percentage Going to Large Cap

Equity Markets: ETF inflows have been one of the reasons for the persistent market rally.

Source: Credit Suisse

www.thedailyshot.com

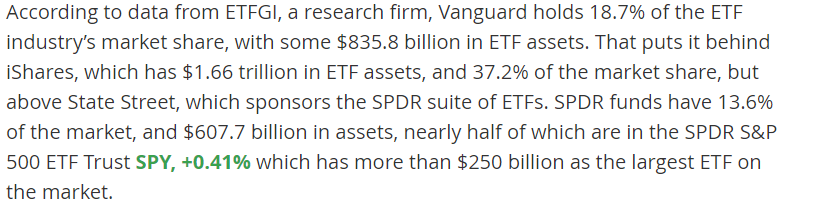

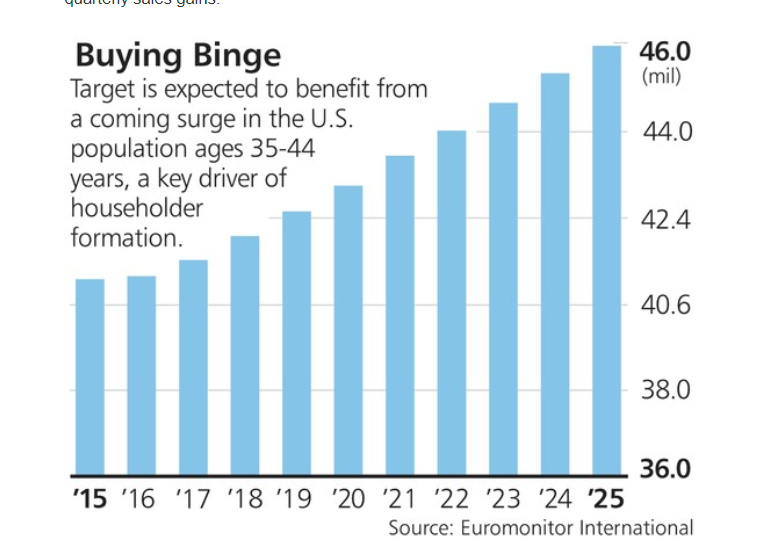

5.I-Shares 37% Market Share …Vanguard 18.7% Market Share

How Could Indexing Slowdown?

Another factor Bogle said could be on the horizon, as pertaining to Vanguard’s size and popularity, involved the regulatory environment. He noted that the Investment Company Act of 1940 essentially prohibits a mutual fund from owning more than 10% of the voting shares of any security.

“If you had an index fund that owned 10% of the company, they’d have to stop buying it,” he said. “They couldn’t own any more.” He suggested that if such a case were to occur now, the manager could simply create another index fund to bypass this issue. Such a workaround is “totally legal right now,” he said, though this could be changed, speculating that the limit could be raised above 10%, or that it could even apply to “all the holdings of a given management company or fund sponsor,” which he said would be “a limiting factor.”

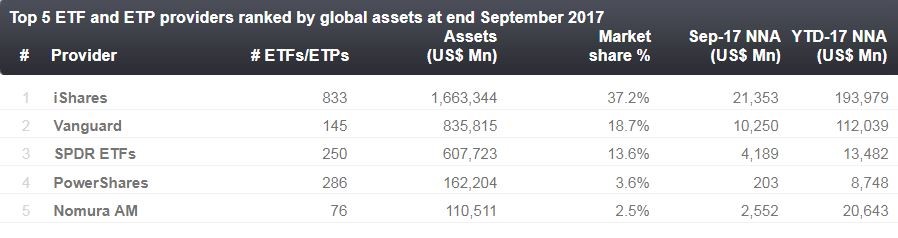

6.Coming Surge of 35-44 Year Olds After 15 Year Decline….Number Could Hit 48 Million by 2030.

Jason Clark, a senior portfolio manager at AFAM Capital, cites a coming surge in the number of Americans 35 to 44 years old, after a 15-year decline. This population cohort, responsible for a significant share of U.S. household formation, could total about 48 million by 2030, according to Euromonitor International, up from roughly 40 million now. As younger adults marry, buy homes, and have children, says Clark, many will look to Target for its wide selection of low-priced but trendy “stuff” for their kids and homes.

http://www.barrons.com/articles/targets-renovation-could-pay-off-nicely-for-investors-1509161942

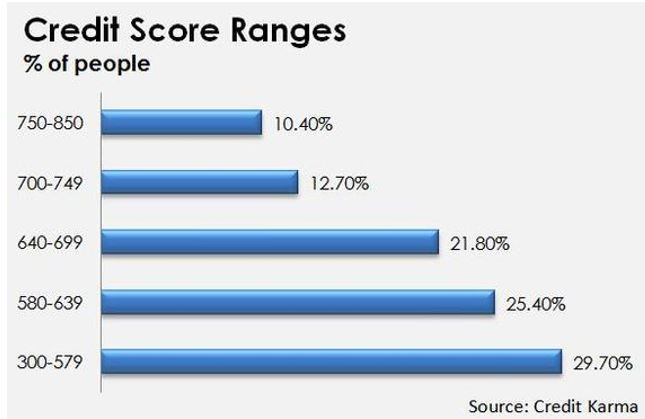

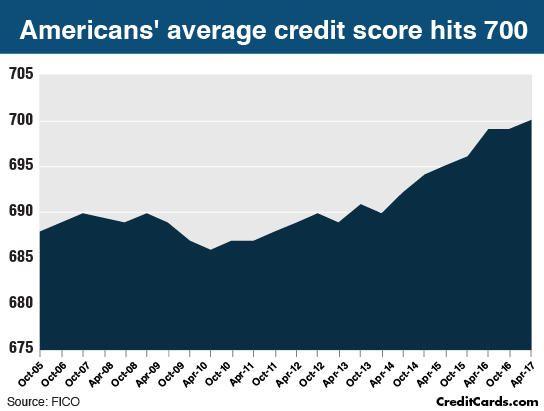

7.America is a Nonprime Nation….Two-Thirds of Americans Have a Nonprime Credit Score Below 700.

- America is a nonprime nation. An astounding two-thirds of Americans have a nonprime credit score (below 700) or no score at all, according to the Corporation for Enterprise Development and FICO. Due to high credit-score requirements, some 160 million Americans find it difficult or impossible to access traditional bank credit. The way for banks to grow and better serve their communities is to figure out how to lend again, safely and profitably, to a much broader range of customers. Banks need a new generation of nonprime credit products.

The Good News is Improvement Since Great Recession.

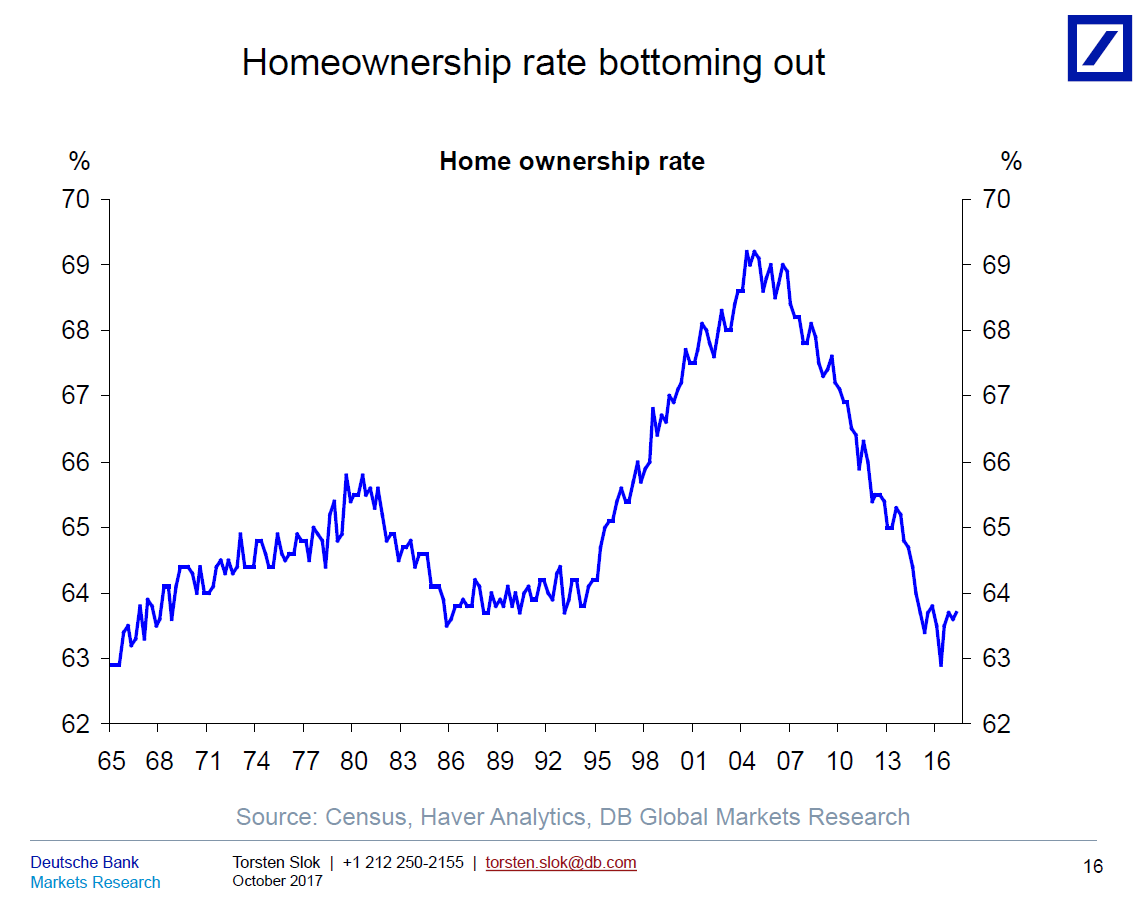

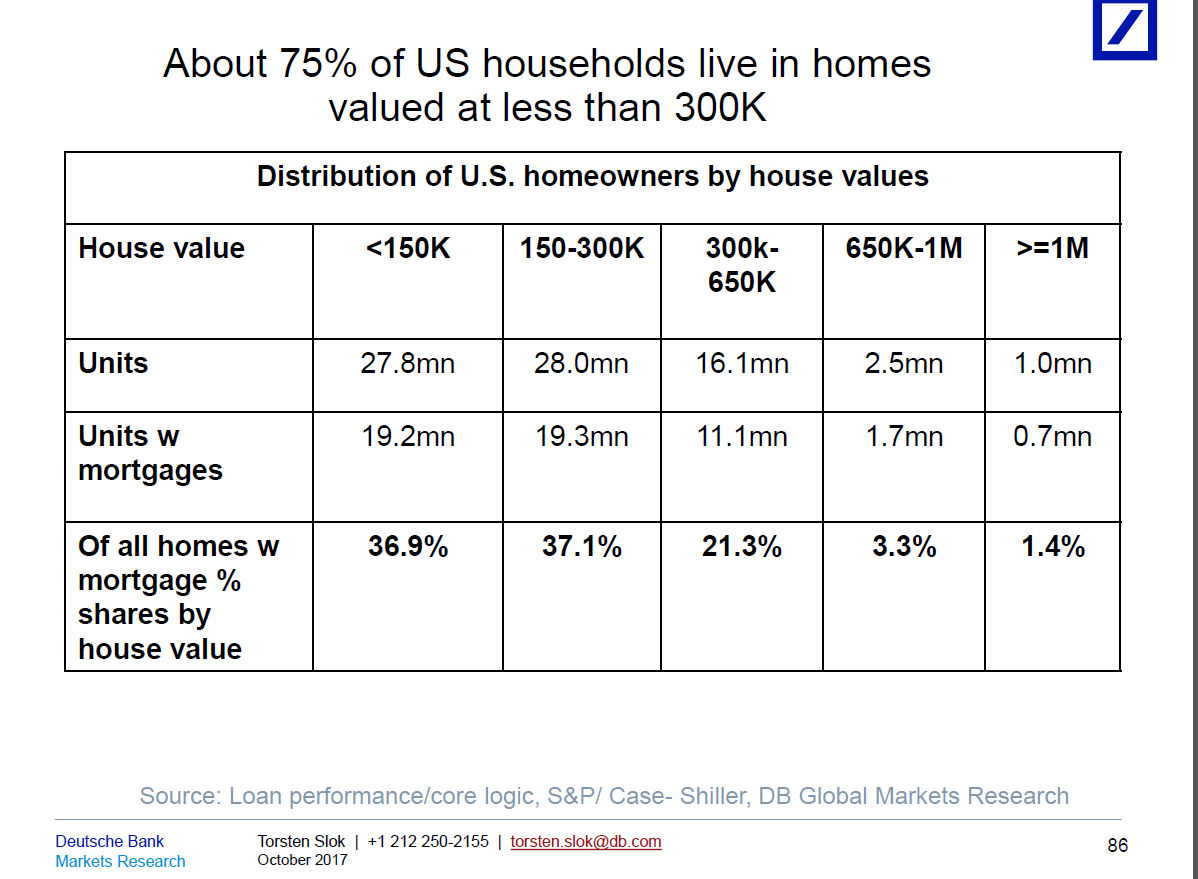

8. Has the Home Ownership Rate Bottomed Out?

Torsten Slok DB Bank

9.Read of the Day…A Moment of Silence Please…World wine production ‘to hit 50-year low’

24 October 2017

Global wine production is expected to fall to its lowest in more than 50 years, according to the International Organisation of Vine and Wine (OIV).

The group blamed the decline on extreme weather in Italy, France and Spain – the world’s top three producers.

Total world output is projected to fall 8% from last year to about 247 million hectolitres.

This could raise prices and dissipate a global surplus caused by a demand slump in the wake of the financial crisis.

According to OIV estimates, Italian wine production will fall 23% to 39.3 million hectolitres.

Levels will drop 19% to 36.7 million hectolitres in France which is predicted by the European Commission to be facing its worst harvest since 1945.

Meanwhile in Spain, production will be 15% lower at 33.5 million hectolitres.

A hectolitre is 100 litres, equivalent to about 133 standard 750mL bottles.

As a result, small producers hit by several years of small harvests “are facing the very real problem of having to sell family domains because, unless the banks are going to help them in some way, they’re stuck,” according to Rupert Millar, fine wine editor of industry journal The Drinks Business.

“But just how many this is happening to is another question,” he adds.

For wine-growing regions outside Europe, OIV’s forecasts are more optimistic.

Australian production is expected to rise 6% to 13.9 million hectolitres, and by as much as a quarter in Argentina to 11.8 million hectolitres.

Output in the US – the world’s fourth-largest producer and its biggest wine consumer – is also due to fall by only 1% since reports indicate wildfires struck in California after the majority of wine producers had already harvested their crops.

There was no data available for producers such as China, which produced 11.4 million hectolitres last year.

View comments

http://www.bbc.com/news/business-41728536

10.A Winning Frame of Mind

How to Stay on Top of Your Game

A Winning Frame of Mind

Bryan E. Robinson, Ph.D.

Why are some people more accomplished than others? Aside from sheer talent, highly successful people have a winning frame of mind that catapults them to untold heights. Billie Jean King had it with tennis. Michael Phelps had it with swimming. Tiger Woods had it with golf. Meryl Streep had it with acting.

Scientists say Mother Nature hardwired us with a negativity bias for survival. The brain is like Velcro for negative experiences and Teflon for positive ones. We routinely assess risks by making judgments about people and situations for safety. To keep us out of harm’s way, negative events grab more of our mind’s attention than positive ones. You probably remember where you were on 9/11 but not the following week. Forget the blooming azaleas along the roadside. If you don’t focus on the car in the other lane zooming ninety miles an hour, you’re road kill.

Experts tell us that it takes three positive thoughts to offset one negative thought. No wonder it’s difficult to remain hopeful and persevere in uphill challenges where we’re bombarded with the same bad-news bias that keeps us safe. We tend to overestimate threats and underestimate possibilities. Without realizing it, we build a negativity lens: the same lousy job, the usual inconsiderate coworkers, or the lackluster party that was nothing to write home about.

But here’s the good news: grass grows through concrete. When negativity strikes, you can underestimate threats and overestimate possibilities with the same tried-and-true strategies that highly successful people use to navigate obstacles. Studies show that optimists, compared to pessimists, have lower stress levels, move faster up the careerladder, have fewer health complaints, and live longer. But you don’t have to be a card-carrying optimist to realize that misfortunes are rarely as bad as the brain registers them. Here are some strategies you can use to cultivate a winning frame of mind:

- Focus on the upside of a downside situation. Every loss contains a gain if you look for it. “I have to pay more taxes this year than ever before” becomes “I made more money this year than I’ve ever made.”

- Pinpoint the opportunity contained in the difficulty. Make it a habit to focus on the good news wrapped around bad news. Ask, “How can I make this situation work to my advantage? Can I find something positive in it? What can I manage or overcome in this instance?”

- Develop a growth mindset. Think of a setback as a lesson to grow from instead of a failure to endure. Ask what you can learn from difficult outcomes or failures and use them as stepping-stones instead of roadblocks.

- Broaden your scope.When threatened, your brain is designed to constrict and target the threat like the zoom lens of a camera. This limits your ability to see the bigger picture. Expand your outlook with a wide-angle lens that steers you beyond doom and gloom to bigger possibilities.

article continues after advertisement

- Be chancy. Take small risks in a new situation instead of predicting negative outcomes before giving them a try. “I won’t go to the party because I’m afraid I won’t know anyone” becomes “If I go to the party, I might make a new friend.”

- Avoid blowing a negative situation out of proportion.Don’t let one bad experience rule your whole outlook: “I didn’t get the promotion, so I’ll never reach my career goals” becomes “I didn’t get the promotion, but there are more steps I can take to reach my career goals.”

- Focus on the solution, not the problem. You’ll feel more empowered to cope with life’s curve balls when you step away from the problem and brainstorm a wide range of possibilities.

- Practice positive self-talk.After a big letdown, underscore your triumphs and high-five your “tallcomings” instead of bludgeoning yourself with your “shortcomings.” Give yourself a fist pump when you reach a milestone or accomplishment.

- Hang out with positive people. Optimismis contagious. When you surround yourself with optimistic people, positivism rubs off.

- Strive to see fresh starts contained in adversity.Failure is neither personal nor final. Envision letdowns as temporary and know that you can overcome them. Every time you get up and brush yourself off one more time than you fall, you succeed. Perseverance increases the likelihood of propelling you to the top of the leader board.

Baseball great Babe Ruth, arguably one of the best ballplayers of all time said, “Every strike brings me closer to the next home run.” You can use Ruth’s wisdom in your pursuits by stacking your positivity deck and allowing setbacks to bring you closer to your goals. So keep swinging with that winning frame of mind until you hit your dreams out of the park.

https://www.psychologytoday.com/blog/the-right-mindset/201710/winning-frame-mind