Traveling again this week…

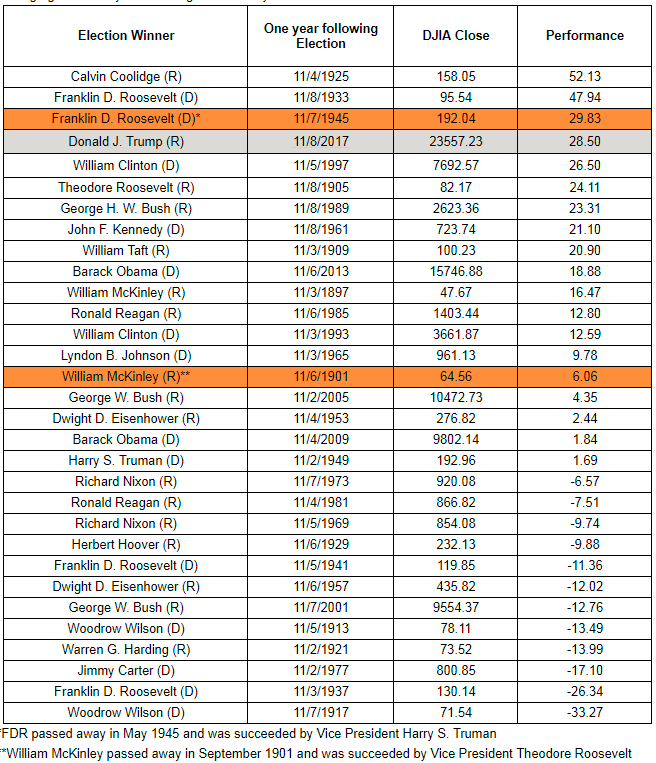

1. Dow’s 1-year gain since Trump’s win is its biggest post-Election Day rise since 1945

That represents its best performance after a White House contest since 1945, when the blue-chip gauge was up 29.83% in a year following the election of Franklin D. Roosevelt and his vice president Harry S. Truman. (FDR died early his fourth term, putting Truman in the Oval Office in April 1945.)

Check out: Good news for the president in latest Trump Scoreboard

The table below from WSJ Market Data Group shows that Calvin Coolidge ranks No. 1 by this measuring stick, FDR gets the silver and bronze medals, Trump is fourth, and Bill Clinton, fifth.

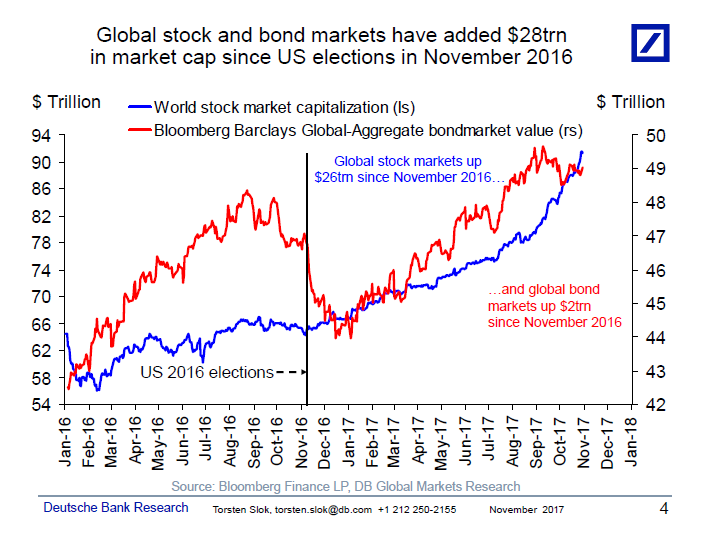

2.Global Stock Markets Added $28 Trillion in Global Wealth Since Election.

Since the election in November 2016 global stock markets are up by $26trn and global bond markets are up by $2trn, see chart below. It is not a surprise that this $28trn global wealth gain is having a big positive impact on consumer and capex spending decisions in the US, Europe, and EM. Global growth is accelerating, and the chances of overheating and an associated pick-up in inflation are significantly higher than the chances of a recession. For more see also my latest client presentation here.

Torsten Sløk, Ph.D.

Chief International Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

Tel: 212 250 2155

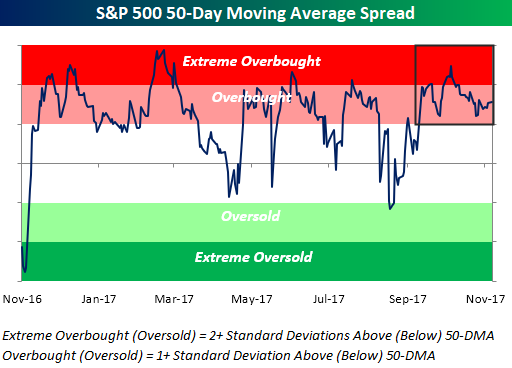

3.For Short-Term Traders….Longest Overbought Streak For S&P 500 Since 2012

Nov 7, 2017

It’s been quite a run for the S&P 500 over the last several weeks, and the chart below illustrates just how consistent the equity market’s strength has been. The chart comes from the second page of our daily Morning Lineup report, which is available to all Bespoke Premium and Institutional clients. In it, we show the S&P 500’s daily close relative to its 50-day moving average (DMA) where overbought levels are considered to be readings where the S&P 500 closes one or more standard deviations above its 50-DMA, while oversold levels are readings where the S&P 500 closes one or more standard deviations below its 50-DMA. As shown in the chart, ever since September, a period now covering 42 trading days, the S&P 500 has closed at either an overbought or extreme overbought level.

LIMITED TIME 2018 ANNUAL OUTLOOK SPECIAL

Looking at the chart, the current streak of overbought closes is easily the longest of the last year, but looking further back at the current bull market, there have only been three other periods where the S&P 500 closed at overbought levels for 40 or more trading days. The chart below shows the S&P 500 through the course of the entire bull market dating back to March 2009. As shown, two of those prior streaks occurred within ten trading days of each other when a 45 trading day streak ended on 11/12/10 and another one began on 12/1/00. Besides those two streaks, the only other streak of 40 or more trading days was back in early 2012 when a 43 trading day streak came to an end in March 2012. Finally, while it may be hard to see on the chart, in both the one and six months that followed these prior streaks coming to an end, the S&P 500 was up all three times. Three months later the S&P 500 was up two out of three times with the one down period coming after the March 2012 streak when we saw a decline of 5.8%.

https://www.bespokepremium.com/think-big-blog/

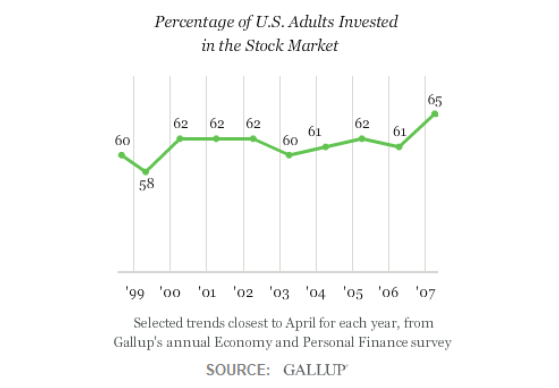

4.Percentage of U.S. Households Owning Stock Nowhere Near 2007 Highs…Surprising that 2007 was Higher than 1999

What Bubble? Household Stock Ownership At Multi-Year Lows

A Euphoric, All-In Bubble?

Once a year, Gallup conducts a poll that provides some insight into the sustainability of the bull market in stocks. The concept of an investment bubble implies irrational investor confidence.

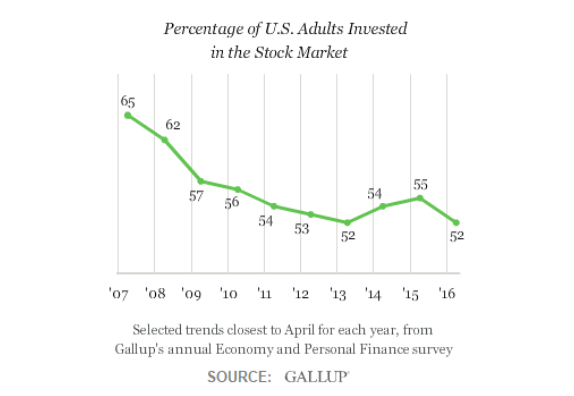

Therefore, if skepticism and fear were near all-time, bubble-like lows, we would expect a very high percentage of U.S. households to be in the stock market, as was the case near the euphoric 2007 stock market peak (see graph below).

2007 peaked with 65 percent of adults invested in the stock market, reflecting a bubble-like investor climate.

Are We Back To Bubble Territory In 2017?

Therefore, it would be helpful to know if stock ownership figures are back near the bubble-like 2007 levels in 2017. From Gallup:

“Before the 2008 financial crisis, 62% of U.S. adults, on average, said they owned stocks. Since then, the average has been 54%, including lows of 52% in 2013 and 2016. In Gallup’s April 2017 update, 54% of Americans report having money invested in stocks.”

Household Figures Align With 2017 Annual Charts

If the stock market had a chance to go on a surprising multiple-year run from present levels, we would expect a healthy dose of skepticism and a significant amount of people not yet participating, which is exactly what the Gallup numbers tell us. We would also expect long-term set-ups in the market to be similar to multiple-year bullish set-ups in the past. This week’s video explores annual charts to better understand the long-term outlook for stocks.

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

Many Investors Remain On The Sidelines

Fear of losses is a powerful factor in the financial markets. History tells us after a major financial crisis it can take years before fear of losses is overtaken by the fear of missing gains. From Gallup:

“The stock market lost more than half of its value during the bear market that coincided with the Great Recession and 2008 financial crisis, with many investors responding by taking their money out of the market.”

The chart below shows the trend of household stock ownership between 2007 and 2016; it was not screaming “bubble” in 2016, and it remains that way in 2017.

Twitter: @CiovaccoCapital

https://www.seeitmarket.com/what-bubble-household-stock-ownership-at-multi-year-lows-17446/

Story found at www.abnormalreturns.com

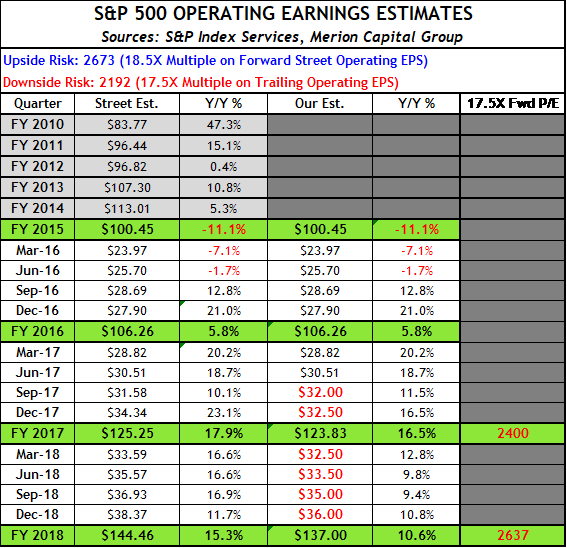

5. Implied EPS growth of +17.9% Y/Y and +15.3% Y/Y in 2017 and 2018, respectively…

In case anyone missed Jeremy Grantham’s interview in WSJ…He discusses the market being expensive but earnings growth being high plus low rates making it tough to call any top.

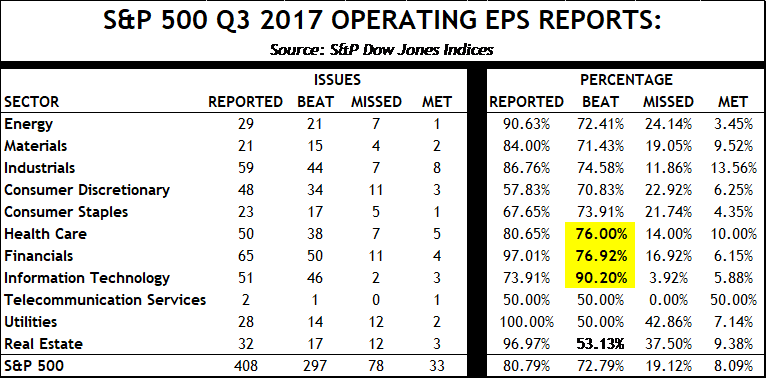

TECH, FINANCIALS, & HEALTH CARE LEAD Q3 S&P EARNINGS:

As of November 2nd, 408 of the S&P 500 Index companies have reported Q3 earnings, of which 297 have beaten earnings (72.8%) and 78 have missed (19.1%), albeit on lowered estimates. Thus far, the beats have been led by the Tech, Financial, Health Care, and Industrial sectors, as 46 out of the 51 Tech companies that reported earnings (including tech giants Apple, Google, Amazon, and Microsoft), 50 out of the 65 Financials companies, and 38 out of 50 Health Care companies that reported earnings have beaten estimates.

Over the past week, Wall Street analysts lowered their Q3 EPS estimates by -$0.18/share to $31.58. Therefore, the street lowered their 2017 EPS estimates by -$0.25/share to $125.25. However, they increased their 2018 EPS estimates by +$0.39/share to $144.46. This implies EPS growth of +17.9% Y/Y and +15.3% Y/Y in 2017 and 2018, respectively.

From my friends at Bluestone.

Written By:

Rich Farr, Chief Market Strategist

Jim McGovern, Market Strategist

info@bluestonecm.com

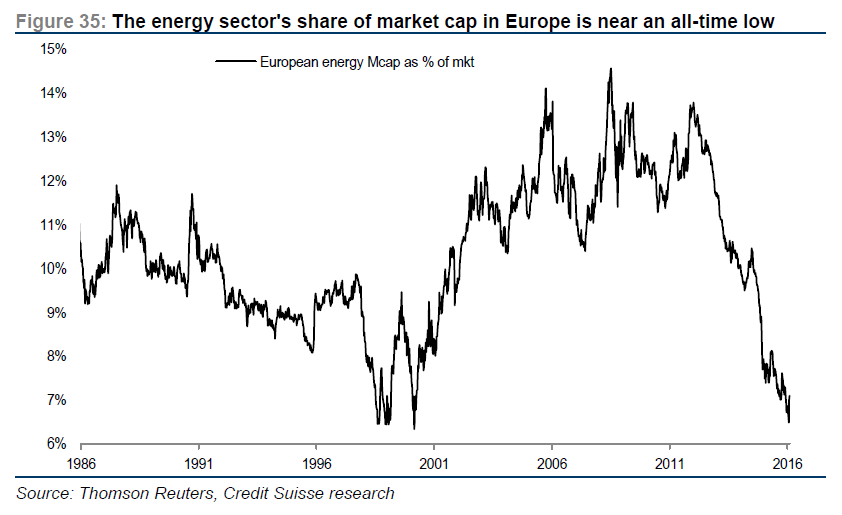

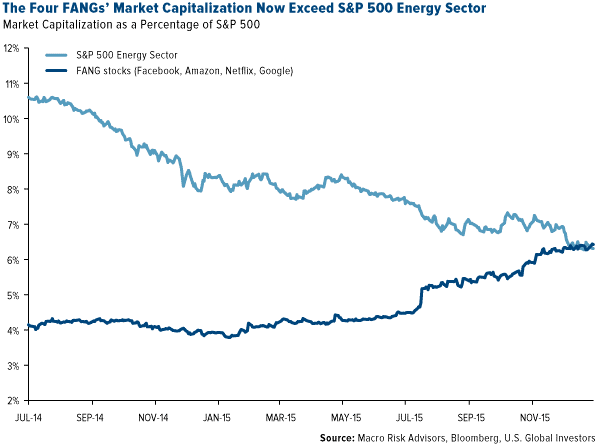

6.Energy Sector’s Share of Total Market Cap Sits at 5.5%….This is the Same Level as January 2016 when Oil was $26 Per Barrell.

Charts a little dated but you get the idea….Europe’s energy share of market cap at all-time lows.

FANG stocks bigger than S&P energy sector.

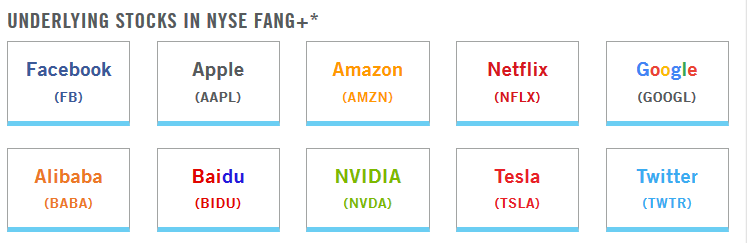

7.Speaking of FANG Stocks….FANG Index Futures Now Trade.

Great summary from Dave Lutz at Jones.

FANG TIME– FANG+ Futures start trading today, based on the NYSE FANG+ index which includes 10 highly liquid stocks that represent the top innovators across today’s tech and internet/media companies. The index’s underlying composition is equally weighted across all stocks, providing a unique performance benchmark that allows for a more value-driven approach to investing.

In contrast to ETFs or cash equities, trading futures only requires traders to post margin against their positions, tying up less capital. ICE described its products as a “hedging mechanism to quickly increase or decrease tech exposure in equities portfolios”. NYFANG is the ticker for the underlying Index, while FNG is the Futures Ticker, but Bloomie does not have it incorporated yet.

ICE, which also owns the New York Stock Exchange, created the NYSE FANG+ stock index in September. The equally-weighted basket is up 58 per cent in the year to date, compared to a 16 per cent gain for the S&P 500 stock index – NYFANG up 58% YTD – FANG up 49% – Spoostastic up 15%

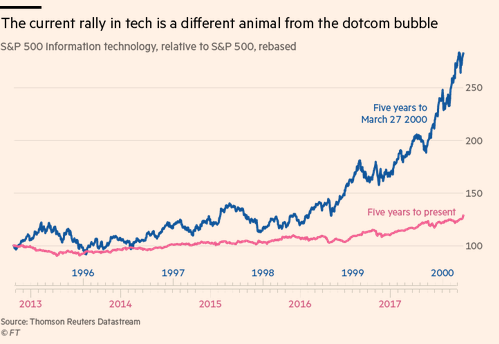

FT asks is there something alarming about the way tech is leading the Bull Run? In comparison to the dotcom bubble, the answer is another emphatic “no”.

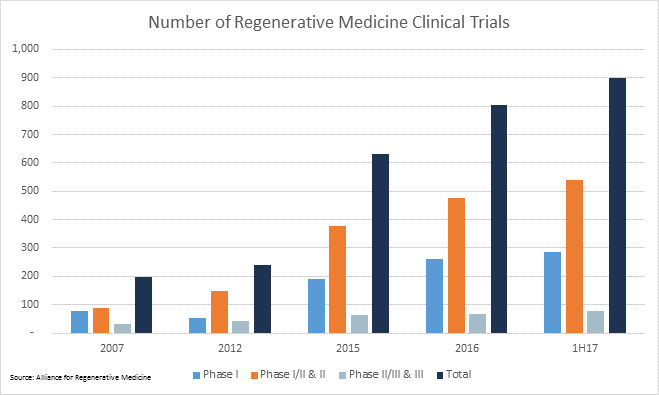

8.Regenerative Medicine..Number of Trials on the Rise.

Regenerative medicine is a branch of translational research[1] in tissue engineering and molecular biology which deals with the “process of replacing, engineering or regenerating human cells, tissues or organs to restore or establish normal function”.[2] This field holds the promise of engineering damaged tissues and organs by stimulating the body’s own repair mechanisms to functionally heal previously irreparable tissues or organs.[3]

Regenerative medicine also includes the possibility of growing tissues and organs in the laboratory and implanting them when the body cannot heal itself. If a regenerated organ’s cells would be derived from the patient’s own tissue or cells, this would potentially solve the problem of the shortage of organs available for donation, and the problem of organ transplant rejection.[4][5][6]

Some of the biomedical approaches within the field of regenerative medicine may involve the use of stem cells.[7] Examples include the injection of stem cells or progenitor cells obtained through directed differentiation (cell therapies); the induction of regeneration by biologically active molecules administered alone or as a secretion by infused cells (immunomodulation therapy); and transplantation of in vitro grown organs and tissues (tissue engineering).[8][9]

https://en.wikipedia.org/wiki/Regenerative_medicine

New Frontier for Cancer Treatments – Regenerative Medicine

Rough Estimates for Patient Size:

Phase I – 25 patients

Phase II – 50 patients

Phase III – 250 patients

Companies are rushing to develop utterly transformative Gene Therapies

On July 12th an FDA advisory committee recommended the approval of Novartis’ revolutionary Therapy (developed here in Philly @ CHOP) in a unanimous 10-0 vote clearing the way for full approval in September. Read the article above to get a better understanding of this ground breaking technology.

From Mike Nolan at janney

9.How the U.S. Senate Might Alter Tax Reform

The U.S. Senate is known as the more deliberative chamber of Congress. It’s also the chamber where the GOP majority in thinner than the House’s.

So how will the Senate, the body in which the GOP has 52 seats out of 100, alter tax reform once it stakes it claim in the coming weeks?

Dan Clifton, the head of policy research with Strategas Research Partners, is following the legislation closely. His thinks the Senate bill will differ from the proposal being marked up in the House in the following areas.

According to Clifton, the Senate bill will likely:

* Create a net $1 trillion tax cut over 10 years (House is at $1.5 trillion).

* Provide more ways to raise revenues and also have more phased out tax cuts rather than cuts that take place in one fell swoop.

* Knock the top corporate tax rate down to 20%, like the House bill, but may require other revenue raisers in the back end of the budget window to pay for these cuts.

* Allow for the mortgage interest deduction to extend to pricier homes than the House bill, which surprised many by capping the deduction to the first $500,000 on loans on new homes

* Provide more tax relief to “pass through” small-business entities such as sole proprietorships, partnerships and S-Corps. The House legislation gives this business a tax rate of 25% instead of the current law, which taxes business owners using individual income tax rates as high as 30.6%.

* Fully repeal the state and local tax deduction (SALT). The House measure comes closer, but allows for a deduction on $10,000 of property taxes.

Clifton writes that the Senate legislation could also have new revenue-raising provisions not included in the House plan released last week, including a limitation on expensing of advertising. “This could give them a couple of hundred billion dollars more in revenue to play with than the House,” he adds.

On Monday, the House began its mark-up of its version of tax reform. According to the Washington Post, lawmakers in the Ways and Means Committee has made changes designed to remove the so-called carried interest loophole that has allowed hedge fund managers and other managers of private pooled investments to pay a relatively low 23.8% rate on performance-related gains. President Trump has long contended that hedge fund managers get away will paying too little in taxes on their profits.

According to the Post, the proposed change in the law would require any asset to be held for three years before a taxpayer could claim the carried-interest provision. Ways and Means Committee Chairman Kevin Brady, R-Texas, said on CNBC-TV Monday that such a change would “make sure it really is focused on those long-term, traditional real estate partnerships” rather than hedge funds.

Meanwhile, John Lynch, Chief Investment Strategist for LPL Financial, issued a note Tuesday that discusses several obstacles to congressional passage of tax reform.

Among the hurdles Lynch describes:

Congressional Republicans (high hurdle) – With majorities in both the House and Senate, congressional Republicans’ ability to achieve a compromise is the only hurdle that really matters. In a two-party system like ours, there’s a wide range of views within each party and common ground on the details may be hard to find. With a narrow majority in the Senate in particular, the bill needs to satisfy multiple wings of the party to get the necessary votes, making the path to acceptable compromise navigable but narrow.

Reconciliation instructions (high hurdle) – According to the budget reconciliation instructions, the bill may not add more than $1.5 trillion to the deficit in the next 10 years, and it may not add to the deficit at all after year 10. The House draft meets the first requirement; it may not meet the second. While even this $1.5 trillion was a concession by deficit hawks, it means that the bill will have losers as well as winners as the proposed cuts far exceed this total. While limiting the impact on the deficit is a virtue, it will create the battles that are most likely to sink the bill.

K Street (high hurdle) – Washington, D.C.’s K Street is the geographical heart of the nation’s lobbyists and advocacy groups, and they will all be trying to advance their constituents’ interests. Groups that have already announced opposition to the House bill include the National Federation of Independent Businesses, the National Association of Homebuilders, and the National Association of Realtors.

President Trump (low hurdle) – There are two plausible ways that the president can make the bill more difficult to pass. He can undermine its support with distracting or confusing messaging as the bill grinds through the legislative process, as he did at times in the effort to repeal the Affordable Care Act. He can also add to Congress’ legislative burden with items like renegotiating the Iran nuclear deal or responding to the defunding of insurance subsidies. Nevertheless, we don’t expect either of these to derail the process and they can be partially offset by the president’s ability to act as an advocate.

http://www.barrons.com/articles/how-will-u-s-senate-alter-tax-reform-1510084221?mod=hp_RTA&

10.Want That New Habit to Stick? Science Says Do It in the Morning

If you’re trying to add a new behavior to your routine, earlier is better.

Establishing new habits is notoriously difficult. New science might make it just a little easier.

A study published in the journal Health Psychology has some dead simple advice for anyone hoping to finally make that new, healthy habit stick. Instead of trying to do whatever it is before bed, make your new habit the first thing you do when you get up in the morning.

The findings suggest that if you make this small change, the new habit will become automatic 50 days sooner than if you do the habit at night.

105 days versus 154 days.

To figure this out, scientists recruited a small group of 48 university students for a 90-day experiment. Each day the students were instructed to do a simple 15-second stretch. Half were told to do it first thing in the morning, while the other half were told to do it at night. The researchers then used an app to check up on whether the students remembered to stretch and how much thought had gone into carrying out the new habit. They also took a saliva sample from participants each morning to analyze the level of the hormone cortisol.

As you’d expect, the new routine became easier to remember over time for both groups. But remembering to stretch was easier more quickly for those who did it first thing. In fact, the researchers projected that it would take the morning stretchers 105 days for the stretching to become entirely automatic. For the night stretchers it would take 154 days.

Why habits are easier to form in the morning.

Why is it so much easier to make a new habit stick in the morning? This is a small study that can’t definitively answer that question, but the research does offer some clues. Cortisol levels, it found, are highest in the morning, and this might offer a leg up to those looking to change their lives for the better. In fact, those participants with the highest levels of cortisol had the easier time making the new habit stick.

ADVERTISING

While you have a higher probability of success in the morning, the researchers don’t suggest that doing something first thing is a magic bullet for establishing a new habit. While most of us have higher cortisol levels in the morning, different people’s hormones rise and fall at different times, and medications like hormonal birth control pills and medical conditions like obesity can influence when an individual’s levels are highest.

It’s also still a good idea to follow best practices for establishing a new habit — like giving yourself a trigger and starting with small, winnable goals — rather than relying on hormones or scheduling to magically get you to your goal.

“If you decide to start your day with a glass of water, use a cue — a note on the kitchen table you’ll see when you wake up, for example — to remind you at the beginning,” lead author Marion Fournier, a lecturer at the Université Nice Sophia Antipolis in France recommended to Time. “After a while, the cue won’t be necessary.”

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.

PUBLISHED ON: NOV 8, 2017