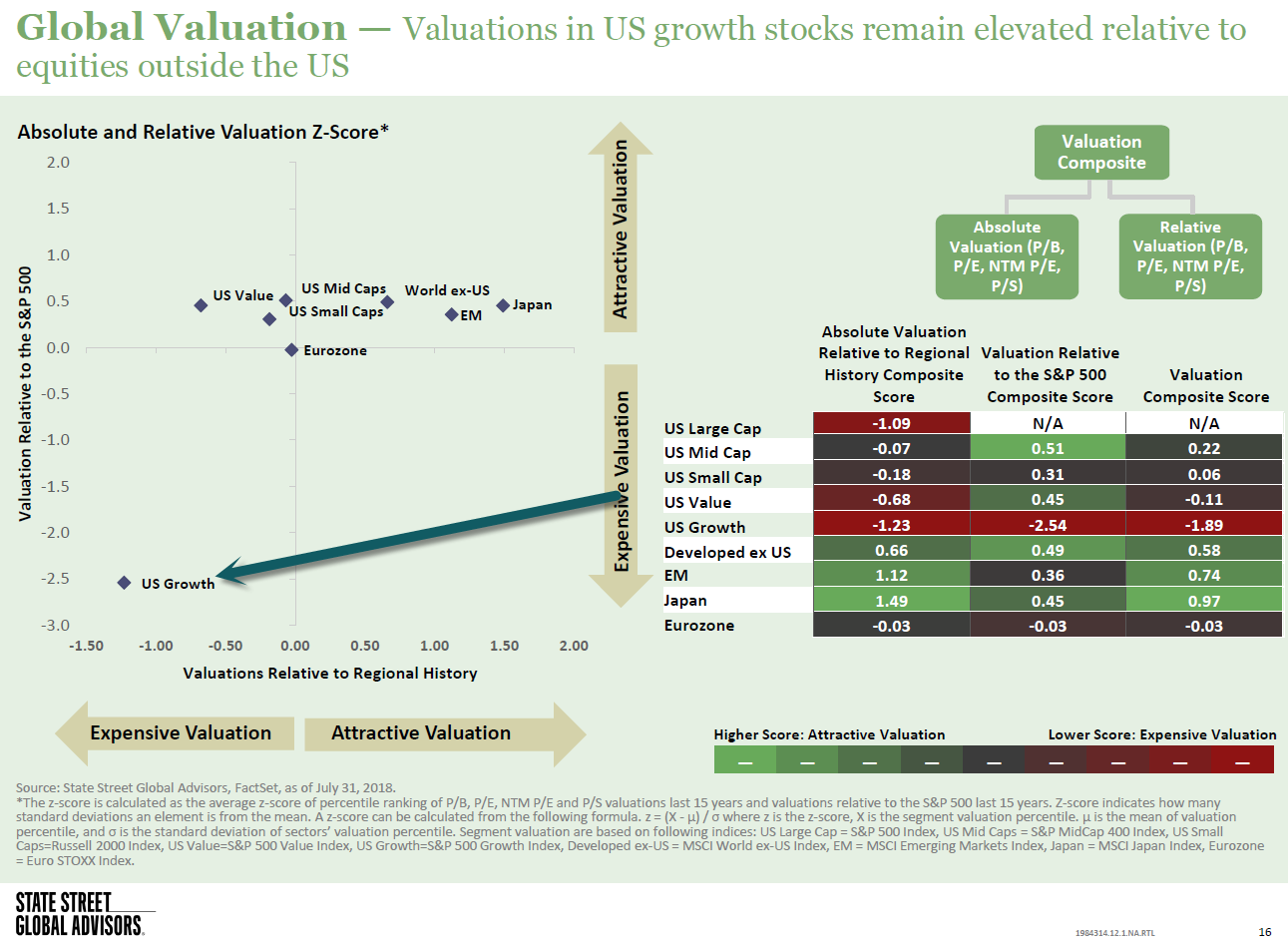

1.Interesting Look From State Street….Growth Expensive vs. All Equities Moderate to Attractive Valuation.

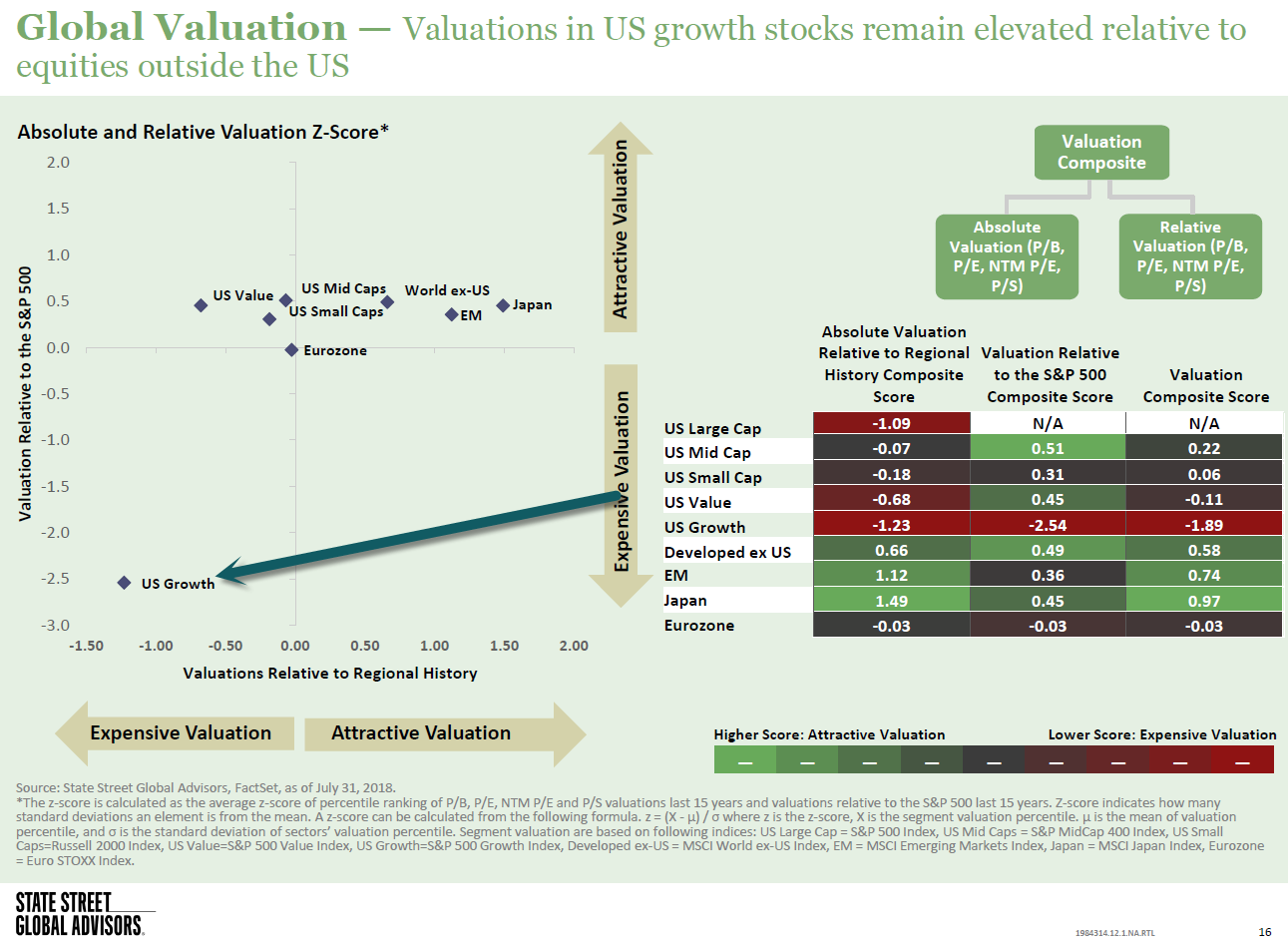

Source: Citi, @DriehausCapital

Posted by lplresearch

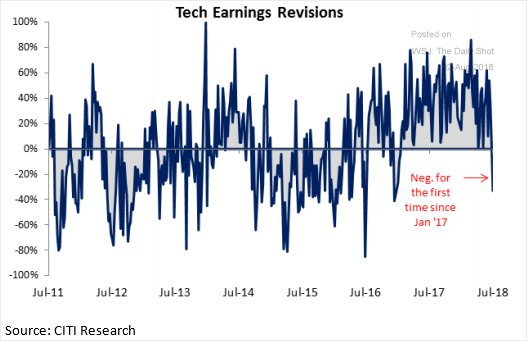

One of the more popular narratives we’ve heard this year is that only a few large stocks are pulling the overall market higher. We don’t agree with this assessment, and have cited several metrics over the last few months that showed market participation has been broad and eventual new highs in the S&P 500 Index were likely. Remember, when more stocks are moving higher, the bull market’s momentum increases.

Below are a few reasons why we still see broad participation and a continuation of the bull market:

“The one constant that has suggested higher equity prices this year has been market breadth. Tariffs, tweets, and rate worries might be in the headlines, but we’ve been comforted by the fact that many market measures of breadth have suggested eventual new highs and we are happy to report this is still the case today,” explained LPL Research Senior Market Strategist Ryan Detrick.

There has been a lot of news coverage around the five largest companies now being worth more than the bottom 250 in the S&P 500. Thanks to data from our friends at Ned Davis Research (NDR), the top five stocks in the S&P 500 account now for 13.98% of the total index. As our LPL Chart of the Day shows, the current weight of the top five stocks is actually beneath the average of 14.33% using NDR’s data going back to 1972.

This is another sign that investors should ignore the narrative that only a few stocks are leading us higher and that the market is doomed.

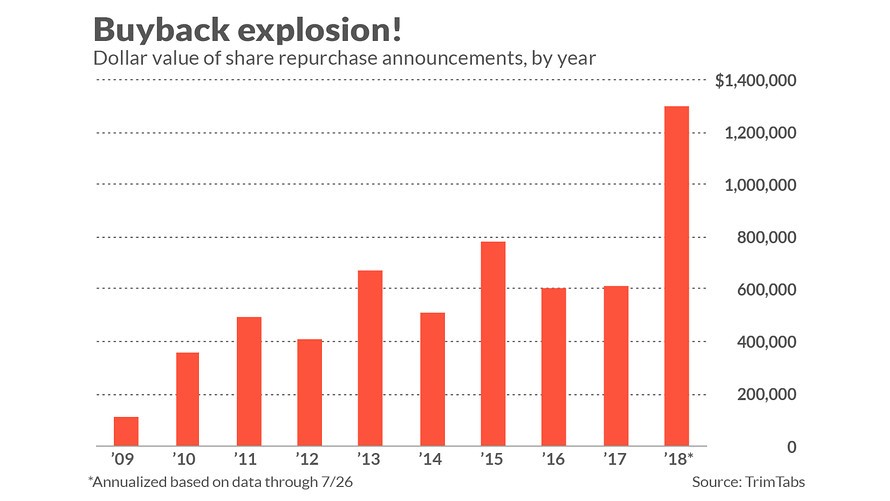

You will notice that this new quarterly record was nearly double that previous one. Corporations aren’t just gradually ramping up their repurchases; they’re falling over themselves to do so.

But is total buyback activity a good stock market indicator? In the 1980s and 1990s, at least, it was. In those decades, a number of academic studies found, the stock of the average company that announced a new buyback company proceeded to significantly outperform the market over several years following that announcement.

Since then, the situation has changed. One recent study, for example, found no outperformance from buyback activity over the decade through 2012 — that the stock of the average company announcing a buyback performed no better than the S&P 500 SPX, -0.58% after that repurchase program was announced.

Opinion: Stock buybacks are no reason to buy a stock

https://www.marketwatch.com/story/stock-buybacks-are-no-reason-to-buy-a-stock-2018-07-31