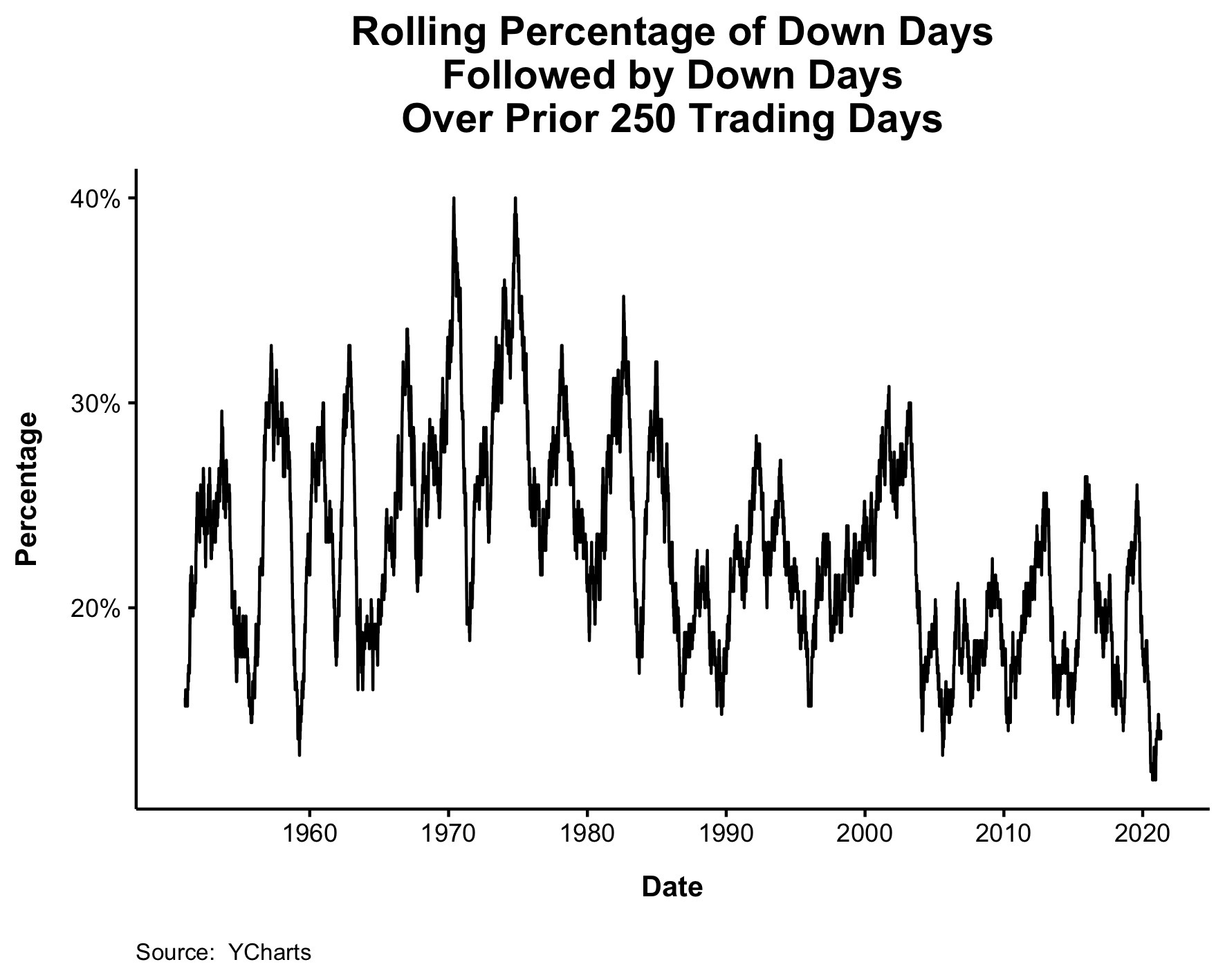

1. Least Amount of Back to Back Down Days in 70 Years.

Irrelevant Investor-Michael Batnick

We just lived through a year with the least amount of back-to-back down days (going back to 1950).

Replying to

We just lived through a year with the least amount of back-to-back down days (going back to 1950).

https://twitter.com/michaelbatnick/status/1387912853961723910/photo/1

2. Share Buyback Chart 25 % above highs……Actual Share Buybacks Still 30% Below Highs.

PKW-Buyback ETF Gapping Above Highs in Front of Buyback Volume Catching Up

3. A $246 Billion Bonanza Means Stock ETF Inflows Already Beat 2020

Claire Ballentine

Wed, April 28, 2021, 2:52 PM

(Bloomberg) — In less than four months, investors have already poured more cash into ETFs tracking U.S. stocks than they did in all of 2020.

The inflows of $246 billion this year eclipse last year’s total of $231 billion, according to data compiled by Bloomberg. Equity exchange-traded funds have added more than $26 billion so far in April, after taking in over $80 billion in both February and March.

With stocks trading near all-time highs, cash continues to flood into the $6.2 trillion ETF market, especially from new traders looking for a piece of the action as the economy rebounds. There’s also been growing interest in the category due to its tax efficiencies and lower costs relative to mutual funds.

“Investors usually are slow on the uptake when it comes to buying in after a bear market, and this was the swiftest bear market on record,” said Sam Stovall, chief investment strategist at CFRA Research. “The market is doing so well, and they are preferring equity ETFs over mutual funds because of the tax consequences.”

As cash floods into ETFs, debuts have also ramped up, notching the best start to a year in at least a decade, according to data compiled by Bloomberg. Issuers have rolled out numerous thematic funds in particular, as they try to tap retail investor demand for betting on hot market niches.

The ETF industry overall lured a record $251 billion in the first quarter, with $210 billion going into equities.

Passively managed mutual funds tracking equities have lost $46.5 billion this year and their actively managed peers have faced about $11 billion in outflows, the latest data from Bloomberg Intelligence shows.

Leading the equity ETF inflows in 2021 are two Vanguard Group products — the Vanguard S&P 500 ETF (VOO) and the Vanguard Total Stock Market ETF (VTI), with $20.3 billion and $13.7 billion, respectively. The BlackRock Inc.’s iShares Core S&P 500 ETF (IVV) has lured $10.8 billion.

“Investors continue to flock to equity for growth and income,” said James Pillow, managing director at Moors & Cabot Inc. “With most debt instruments at negative real yields, while S&P 500 constituents are beating their respective earnings estimates by more than 20%, there is little surprise money continues to pour into equity markets.”

Stocks climbed on Wednesday as Federal Reserve officials strengthened their assessment of the economy and signaled that risks have diminished while leaving their key interest rate near zero and maintaining a $120 billion monthly pace of asset purchases. The S&P 500 rose 0.3% at 2:52 p.m. in New York, heading toward an all-time high.

(Adds stock reaction to the Fed decision to last paragraph.)

For more articles like this, please visit us at bloomberg.com

https://finance.yahoo.com/news/stock-etf-inflows-246-billion-150802470.html

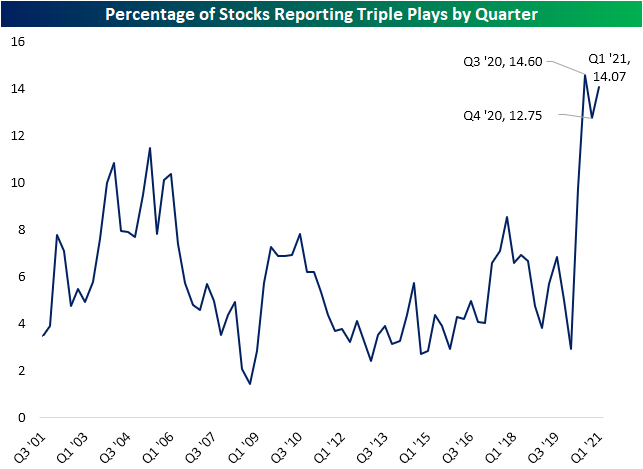

4. Triple Plays-Earnings Beat, Sales Beat and Raise Guidance Hit Record

Triple Plays Waking Up With Good Breadth

Since March 1st, three-quarters of companies have beaten consensus analyst estimates on the top and bottom line, while 16% have raised guidance. Given this, the number of stocks reporting a triple play—EPS and sales beat alongside raised guidance—has been back on the rise. In the chart below we show the percentage of stocks reporting triple plays by quarter throughout the history of our earnings database dating back to 2001. With strong beat rates over the past year, the rate of triple plays has ripped higher to unprecedented levels. After a slight dip during the Q4 2020 reporting period, 14.1% of all earnings reports have been triple plays since March 1st. That’s almost as high as the record reading of 14.6% seen during the Q3 2020 period.

5. Mega Cap Tech Revenue Growth 20-75% Year Over Year

Q1 Revenue Growth, YoY % Change… Tesla $TSLA: +73.6% Apple $AAPL: +53.6% Facebook $FB: +47.5% Amazon $AMZN: +43.8% Google $GOOGL: +34.4% Netflix $NFLX: +24.1% Microsoft $MSFT: +19.1% S&P 500 $SPY: +5.6%

4:22 PM · Apr 29, 2021·Twitter Web App

https://twitter.com/charliebilello/status/1387865015118614529

Mega Cap Tech ETF Gaps Up Another 10 Points

©1999-2021 StockCharts.com All Rights Reserved

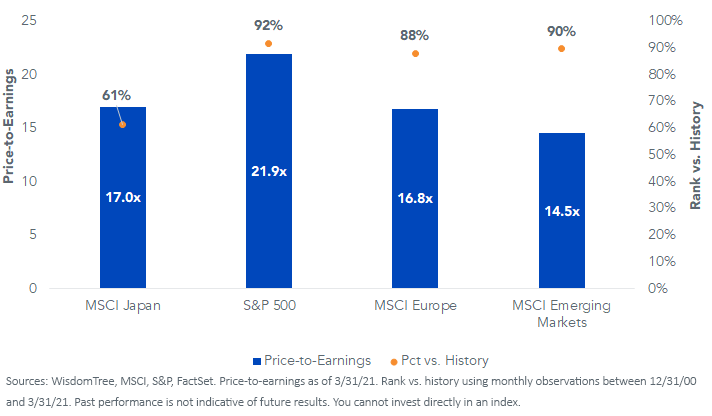

6. Investors Exit Japan as Valuations Lowest in Developed Markets and Buffett Going Long.

WisdomTree Matt Wagner, CFA

In part as a byproduct of low international investor interest, Japanese equities are significantly discounted relative to the U.S., and have a much lower valuation relative to its own history than most other major markets.

These valuations are what attracted Warren Buffett to initiate a 5% stake in five Japanese trading houses in August of last year.

https://www.wisdomtree.com/blog/2021-04-29/japan-opening-up-the-playbook

7. Household Savings and Government Debt Growth a Global Phenomenon.

Will Household Savings Provide an Upside Growth Surprise?

Darren Williams is Director—Global Economic Research at AllianceBernstein (AB).

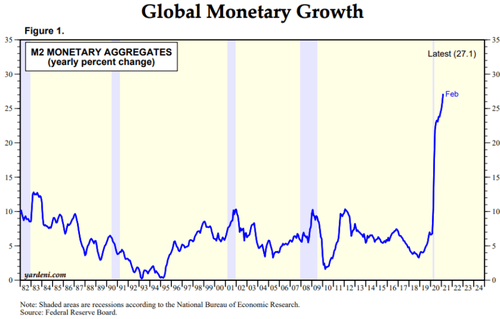

8. Global Monetary Growth Quadrupled

The effect of central bank actions has spilled over into a ballooning of global money supply: –

Source: Yardeni, Federal Reserve

Found at Zerohedge

https://www.zerohedge.com/markets/everything-bubble-and-what-it-means-your-money

9.Big Cities Become More Affordable to Rent

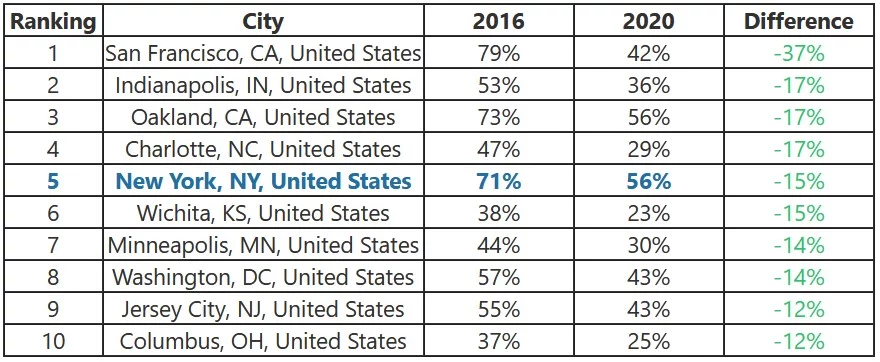

ValueWalk Blog-NYC has become more affordable for the average person to rent property-

B Jacob Wolinsky Renting for the average person in NYC has become 15% more affordable between 2016 and 2020.

· In 2016, the average New Yorker had to set aside 71% of their monthly income to afford rent, whereas that has dropped to 56% in 2020.

· Again, this places NYC in the top 10 cities that have become more affordable for renters in the US.

https://www.valuewalk.com/nyc-become-affordable-buyers-renters/

10.Why Intelligent Minds Embrace the Rule of Focus

Multitasking hurts more than it helps. Here’s how to stop.

I have to let you in on a secret:

I may be the worst multitasker on earth.

Seriously. You know the joke about not being able to walk and chew gum properly at the same time? That’s me. I can’t do it.

But here’s the thing. While you may be a much better multitasker than me, you’re bad at it too.

Studies show that when our brain is constantly switching gears to bounce back and forth between tasks–especially when those tasks are complex and require our active attention–we become less efficient and more likely to make a mistake.

The crazy thing is, despite if you’re fully aware of research like this, the temptation’s still always there. It may be the inclination to check social media at a red light, the urge to respond to a message while having a conversation with your significant other.

And by giving into these temptations, you’re hurting yourself, and the people you care about.

So, how do you break the habit?

I’d like to share a simple rule that can help:

I like to call it, “the rule of focus.”

The rule of focus

The rule of focus is simple. Here’s how it works:

1. If you notice yourself trying to multitask, stop.

2. Decide which of the tasks you’re trying to care for is the highest priority.

3. Push the lesser important task(s) aside, and focus on being present with the most important task.

Sounds easy, right?

Well, it kind of is–once you get the hang of it. But for many people, the habit of trying to do more than one thing at the same time is so deeply ingrained that you don’t even notice it. So it takes practice to build the self-awareness you need to take step one.

Additionally, it can be difficult to stop some activities once they’ve registered. Just think of how hard it is to resist responding to a text message once you’ve read it.

There’s an easy fix for that, though. Simply address the one thing that’s distracting you as quickly as possible. For example, go ahead and respond to that one message, but then silence your notifications. If you’re engaged with another person when you get distracted, apologize and ask for a second to address the interruption so you can focus and give them your full, undivided attention.

I know what you’re thinking: Sometimes you just have to multitask.

OK. Maybe you’re right.

But most of the time, trying to split your attention just means you’re doing two or three things worse than you would if you concentrated on doing them one at a time.

So, use the rule of focus to:

Be present in meetings, and focus on the colleagues right in front of you instead of the emails on your phone.

Be present when doing deep work, and focus on creating something special, instead of things that you won’t care about five minutes from now.

Be present when it comes time to respond to messages, or post something on social media, or take a call, and focus on saying what you mean and meaning what you say.

Be present in conversations with your significant other, because by focusing on them, you show that they’re your priority.

Remember that you multitask because you want to be able to do it all. But in the end, you end up not giving anything–or anyone–the attention it deserves.

So, don’t give in. Follow the rule of focus, and go all in with the most important things.

https://www.inc.com/justin-bariso/why-intelligent-minds-embrace-rule-of-focus.html?cid=sf01003

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information include herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.