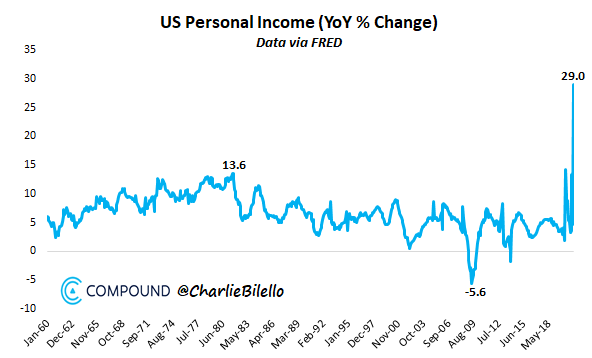

1. Personal incomes in the US rose 29% over the last year, the highest increase in history.

Charlie Bilel, @charliebilello

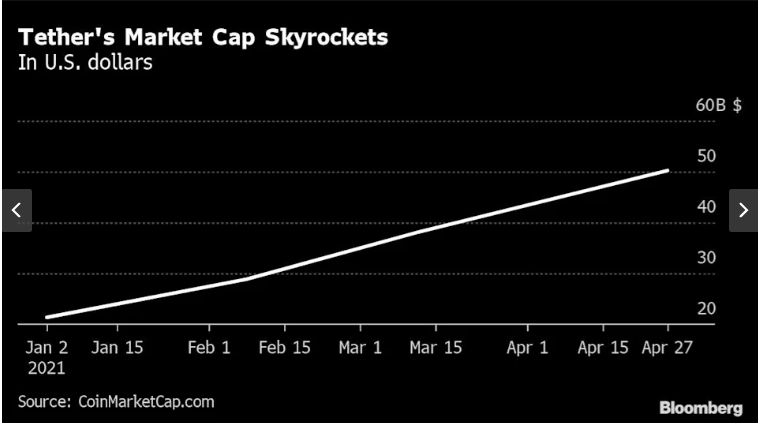

2. Crypto’s Shadow Currency Surges Past Deposits of Most U.S. Banks

Olga Kharif-Crypto’s Shadow Currency Surges Past Deposits of Most U.S. Banks

(Bloomberg) — Tether, the crypto stablecoin backed one-for-one by fiat currencies, surpassed $50 billion in circulation, a sum that’s more than the insured deposits at all but 44 of the thousands of U.S. banks.

It’s a remarkable milestone for a token that enjoys wide use as a method of payment in the crypto ecosystem, even as the eponymous private company behind it has endured regulatory scrutiny for its opacity on where it holds the enormous sum of reserves that back the token.

Tether is set to release the first quarterly statement on its reserves to the New York Attorney General this month. The disclosure is part of a settlement of a long-running dispute with state regulators over whether it actually has the reserves, but it is unclear whether investors will get a glimpse at it.

Not that Tether investors seem to care either way. The token’s popularity has only grown amid the legal hubbub, as it became the most traded cryptocurrency in the world, exceeding even the volume of market leader Bitcoin. Traders and speculators use it as a conduit to conduct transactions on crypto-only exchanges such as Binance and to park assets to avoid the sector’s extreme price volatility.

“At those offshore exchanges Tether is the main collateral and margin type,” said Nic Carter, co-founder of researcher Coin Metrics. “Exchange volumes are way up and Binance volume is way up. For traders to get access to these crypto-only exchanges they often prefer a stablecoin like Tether. You can think of the supply of Tether as a transparent proxy for the balance sheet of both the crypto-only exchanges as well as the funds trading crypto on those exchanges.”

About 66% of Bitcoin is bought using Tether, according to data tracker CryptoCompare. And Tether’s use is likely to expand since Coinbase Global Inc., the largest U.S. crypto exchange, is planning to allow trading of the stablecoin on its Coinbase Pro platform.

The quarterly report will be released to New York in May, according to Stuart Hoegner, general counsel for the crypto exchange Bitfinex and Tether. The companies, which are based primarily in the British Virgin Islands, settled without admitting or denying any wrongdoing.

When the settlement was announced, New York Attorney General Letitia James said “Bitfinex and Tether recklessly and unlawfully covered-up massive financial losses to keep their scheme going and protect their bottom lines. Tether’s claims that its virtual currency as fully backed by U.S. dollars at all times was a lie.”

The cryptosphere saw few ripples in the wake of the settlement, with the amount of Tether created continuing to surge after the announcement. Market participants anticipate a similar reaction no matter what that quarterly report reveals.

“The fact that Coinbase added it tells you everything you need to know,” said Kyle Samani, co-founder of Multicoin Capital.

For more articles like this, please visit us at bloomberg.com

Crypto’s Shadow Currency Surges Past Deposits of Most U.S. Banks (yahoo.com)

3. Commodity ETFs on 30 Day Rally

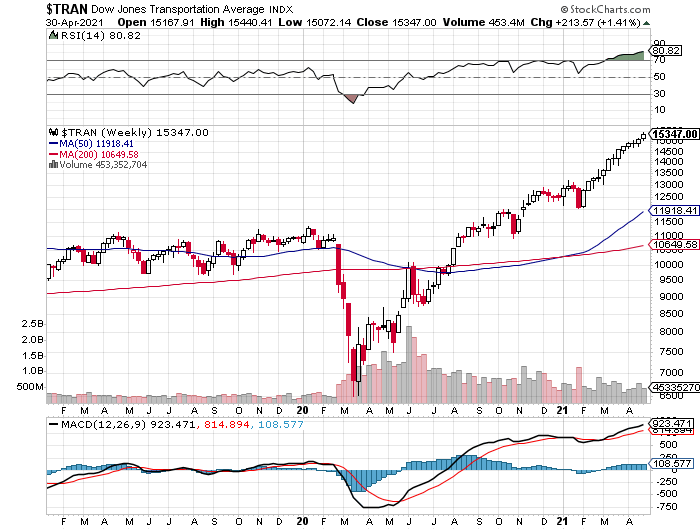

4. Transports 12,500 to 15,500 in 2021

Dow Transports

YTD–Transports +18% vs. Industrials +11.6%

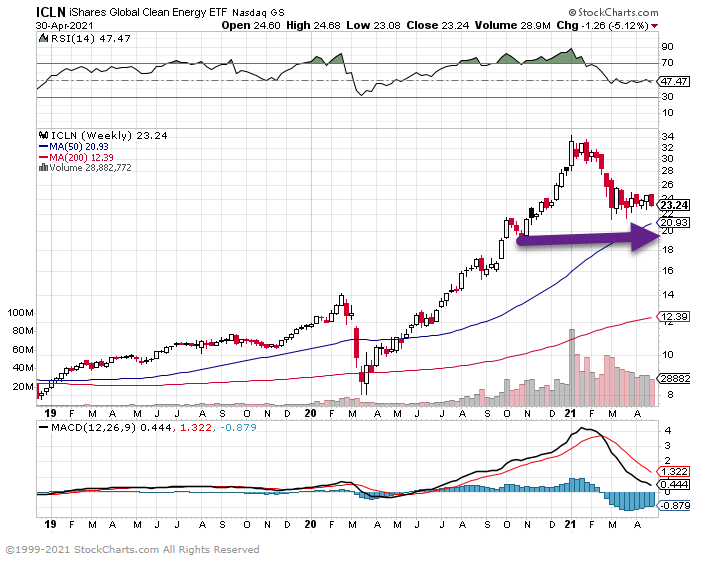

5. ICLN ETF AUM Up 10x…They Increased Holdings from 30 to 81

Understand your ETFs…Some of the names gathering assets have to expand holdings in huge way to make liquidity work.

BARRONS-These ETFs Have Become Too Popular. What That Means for Investors.

Two weeks ago, the underlying index of the iShares Global Clean Energy exchange-traded fund (ticker: ICLN) changed its construction and significantly increased its number of holdings, from 30 to 81. The changes came after the fund’s size ballooned nearly tenfold over the past year, to $6 billion in assets, as clean energy became one of the hottest investment themes in 2020. Its sister fund in Europe has amassed $5.5 billion following a similar surge in popularity.

The huge inflows have significantly boosted the funds’ stake in some smaller, thinly traded holdings—a situation that could be problematic if investor sentiment suddenly reverses and the funds need to exit those thinly traded shares. The goal of the index expansion, says Ari Rajendra, senior director at S&P Dow Jones Indices, is to ease any potential liquidity problems and allow the funds to grow even larger.

ICLN-Green Energy ETF

6. Update on U.S. Dollar Weakness

U.S. Dollar…Rolling back over but holding 2020-2021 lows….50 day crossed below 200 day bearish Jan. 2021

7. App Store on Trial…The Backdrop.

| App Store on Trial -MorningBrew |

Apple

| Does Apple have an illegal monopoly over app distribution?Good question—a hugely consequential trial exploring just that is starting today between Epic Games and Apple.The backstory: Last August, Fortnite maker Epic Games allowed users to pay for in-app purchases directly, violating Apple’s App Store rules. Turns out, the whole thing was an elaborate plan meant to poke the $2 trillion bear. Epic knew Apple would boot Fortnite off its App Store (which it did), and then Epic hit Apple and Google with lawsuits and unleashed a 1984-style hype video. Epic’s argument: Because the App Store is the only way iOS users can access apps, Apple has a monopoly over app distribution and uses that power to unfairly extract $$$ from developers through fees.Apple’s argument: Our phone, our rules. Don’t like ’em? You can always go to Google’s Android, or play Fortnite on PlayStation or Xbox. No monopoly here. Looking ahead…Epic CEO Tim Sweeney, one of the all-star witnesses, will kick off testimony today. https://www.morningbrew.com/ |

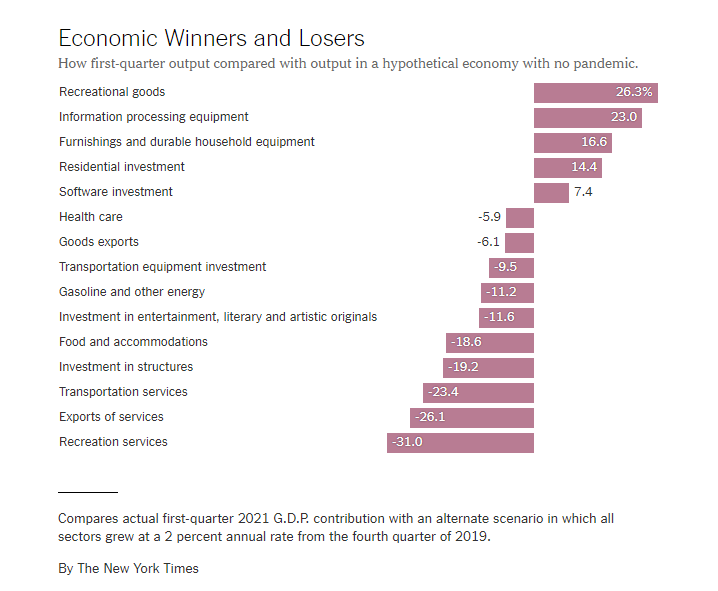

8. Economic Winners and Losers in One Chart

By The New York TimesBy Neil Irwin–The Economy Is (Almost) Back

https://www.nytimes.com/2021/04/29/upshot/economy-gdp-report.html

9. Netflix Shrinking Movie Library

|

| In the last decade, Netflix has made a pretty clear move towards beefing up its TV show roster. Known more for movies back in 2010, Netflix has roughly quadrupled the number of TV shows in its US library since, as its movie library has shrunk (data from ReelGood). That means that if you just want a series to dip into on a couple of weekday evenings, you’ve got 2000+ shows to choose from (and that’s just Netflix) — a decent chunk of which you probably have absolutely no interest in. That makes deciding what to watch quite hard. Netflix, hit shuffle Netflix has launched a new feature, which they’re calling “Play Something”, which the company hopes will take the dithering out of deciding what you want to watch. The button, which is being rolled out this week to all of its users, will choose something from Netflix’s content that it thinks you’ll like. This is a pretty big test of just how good the Netflix algorithm is. Can an algorithm really make a better decision about what you want to watch on a regular basis? Or is this button only going to help those houses where arguments over what to watch boil over every night? Time will tell. |

10. Making Joy a Priority at Work

by Alex Liu

Amid the dazzle and hopes of the digital age, it is easy to forget that old-fashioned human desire is as essential to achieving business goals as ever.

Right now, for example, companies are making massive investments in technologies that can more closely link their people to each other, to customers, and to other stakeholders. Yet many companies struggle because their cultures get in the way — too many layers and silos, too many colleagues who prefer to stay in their comfort zones, bask in their KPIs, and resist new ways of connecting and working.

This is a big problem. And joy can be a big part of the solution. Why? For two reasons. People intrinsically seek joy. And joy connects people more powerfully than almost any other human experience.

The connective power of joy is clearly visible in sports. When a team performs at its awe-inspiring best, overcoming its limitations and challenges, every player — indeed, the entire arena — experiences a brimming ecstasy that lifts the team even further. Success sparks joy. Joy fuels further success. Everyone is caught up in the moment.

Can the joy that is so apparent in championship athletics be replicated in business? Absolutely.

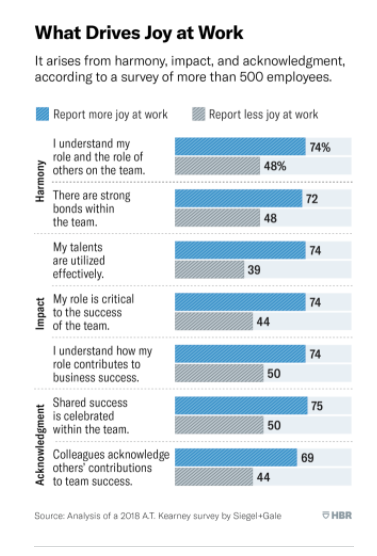

In any team environment, joy arises from a combination of harmony, impact, and acknowledgment — all of which business leaders can engender in their organizations.

Harmony. On winning teams, each player has a distinct role in achieving the goal. One player might be a great passer. Another is a great scorer. Yet another may bring a certain intensity and competitive fire. When the diverse skills and strengths of teammates are really clicking together, it feels great.

Impact. Team harmony leads to impact, which further fuels joy. Even if the result is just a single sublime play or golden moment, the palpable joy of each teammate rises. You can see it in their faces as they throw their arms around each other and jump up and down like jubilant children. They are saying to each other: “Can you believe we did that?!”

Acknowledgment. Great coaches instruct their players to, when they score, immediately point to the teammates who created the scoring opportunity. Acknowledging each player’s contributions and cheering for each other powers the entire joy-success-joy cycle.

This is a pattern rife with opportunity for business leaders. By providing people with more of the experiences that engender joy in any team setting, leaders can tap more of the practical power of joy in their companies.

To test this premise, A.T. Kearney conducted a survey in December 2018 that explored people’s workplace experiences across the Americas, Europe, the Middle East, Africa, and the Asia-Pacific region. The sample included more than 500 employees of various ages in companies with more than $2 billion in revenues and in a range of industries.

We first asked respondents to report how much joy they experience in the workplace. We then asked them to rate how well a series of statements reflects their professional experience, so we could gauge whether these variables correlate with feeling joy at work.

As shown in the figure below, employees who reported feeling more joy at work strongly agreed with each statement much more frequently than did employees who said they feel less joy at work. This suggests that the full range of experiences that visibly yield joy in team athletics — namely harmony, impact, and acknowledgment — can have much the same effect in the business world.

Our survey findings further suggest that joy stems from believing one’s work is truly meaningful. Employees who believe their “company makes a positive societal contribution” and who feel “personally committed to achieving the company’s vision and strategy” experienced the most joy at work. In my industry, where almost 100% of newly recruited consultants are Millennials, providing an overarching purpose is critical to attracting and retaining great talent.

These findings make perfect sense to me. Life is a vector requiring both force and direction. The pursuit of happiness sets the direction, but feeling joy provides the daily confirmation that we are doing exactly what we should be doing, for the company and for the teammates who energize our efforts.

The lesson? Crafting business cultures that more consistently engender such experiences can create a much stronger sense of personal interconnection, shared purpose, and heartfelt pride across the organization.

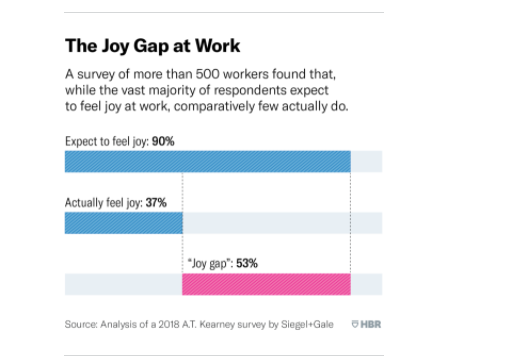

However, the survey also points to a pronounced “joy gap” at work. Nearly 90% of respondents said that they expect to experience a substantial degree of joy at work, yet only 37% report that such is their actual experience. Nor is this joy gap confined to any particular generational cohort. For Gen Xers and Millennials (the vast majority of our sample), the joy gap was 57% and 44%, respectively.

Business leaders tend to think a great deal about success, but rarely about joy. Chances are, few are even aware of the joy gap in their organization and the resulting lack of interpersonal connection and team aspiration. That must change.

Here are some specific steps leaders can take to increase joy at work:

Set the agenda. Make the experience of joy an explicit corporate purpose. Strengthen your inclusion agenda to incorporate meaningful efforts toward ensuring all employees feel heard, recognized, and acknowledged. Fund mental health benefits for all employees.

Set the stage. Staff your new digital/culture programs with true cross-unit, cross-silo teams, where joint teamwork delivers maximum impact, shared success, and fun.

Set the tone. Encourage and celebrate individual and corporate social impact efforts. Authentically express more of the joy you personally experience in your role. Joy begets joy. In my firm, I have emphasized the need to joyfully “dial up” the culture with a sustained emphasis on diversity, inclusion, apprenticeship, and personal day-to-day leadership.

Joy can pack as much practical punch as technology if we allow it to. Both are required to maintain the cohesion that helps large organizations nimbly communicate and adapt to unprecedented challenges. Technology provides the infrast

ructure for connectivity, but the foundation must be a culture dedicated to the human experience of harmony, impact, and acknowledgment. In sum, joy.

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..