1..One in Four Shares in $12 Billion Bond ETF Are Now Sold ShortBy Katherine Greifel

TLT short interest hits 25%, highest since 2017: IHS Marki

‘Sizzling hot’ inflation will slam long-dated Treasuries: RBA

As the U.S. economic rebound continues to dazzle, the mood music in the world’s biggest bond market is getting darker.

Short interest in the $12 billion iShares 20+ Year Treasury Bond exchange-traded fund (ticker TLT) now clocks in at 25% of shares outstanding, the highest since early 2017, according to data from IHS Markit Ltd. Meanwhile, investors are ditching the ETF in droves: TLT has posted outflows every day so far this week, putting the fund on track for weekly withdrawals of over $1 billion — the worst stretch since November, Bloomberg data show.

After a lull, the rise in Treasury yields resumed this week as inflation expectations hit multi-year highs. Exacerbating matters was the Federal Reserve’s April policy meeting, where Chairman Jerome Powell stressed that the central bank views any jump in price pressures as fleeting and it won’t be dialing back crisis-level monetary support any time soon. That’s given the green light for long-dated Treasuries to sell off, according to Richard Bernstein Advisors LLC.

“What they’re saying is, we want inflation and growth to run sizzling hot. We aren’t worried about inflation because we can deal with that if we have to,” said Michael Contopoulos, the firm’s director of fixed income and portfolio manager. “So it’s a free pass to inflationary pressures and pressure on the long end.

TLT surged 16% in 2020 as the coronavirus pandemic upended global markets, but has since given back most of those gains. The ETF has slumped 12% so far this year as the U.S. vaccine rollout and economic reopening boost expectations for a jump in inflation, which could eat into fixed-income returns.

Flows into funds with heavy duration — or sensitivity to interest-rate changes — have dried up as a result, while investors pour billions into ETFs focused on shorter-dated Treasuries. In particular, five-year notes look attractive to offset equity downside should risk appetite sour, since the tenor has cheapened as traders have priced in Fed rate hikes, in the eyes of Mizuho International Plc.’s Peter Chatwell.

“For those looking at TLT as an equity downside hedge, the belly of the curve can now serve this purpose,” Chatwell, head of multi-asset strategy, said. “If there was to be a macro problem, these hikes would be quickly priced out, and the five-year would generate a capital gain.”

2. Solana Tokens Trading 10x More Transactions than Ethereum….+40% in Value Last Week

It Seems Like Every Token This Crypto Billionaire Touches Has Gone Up 1000% This Year

BY TYLER DURDEN

Tokens associated with 29 year old crypto billionaire Sam Bankman-Fried are skyrocketing.

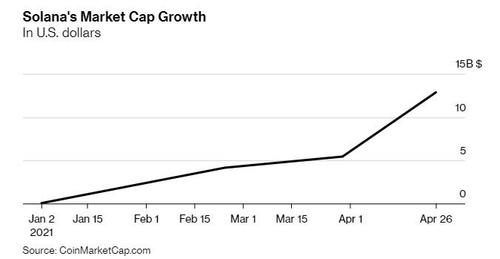

Solana, abbreviated as SOL, is up about 40% over the past week, according to Bloomberg. This makes it “the top performing large coin among those tracked by CoinMarketCap.com”. It also moves its market cap up to $11.6 billion. SOL token is used on the Solana blockchain, which is a network attempting to compete with ethereum.

SOL is already doing 10 times more in daily transactions than ethereum, Kyle Samani, co-founder of Multicoin Capital said. Aaron Brown of Bloomberg Opinion, said: “Solana is a promising competitor in a crowded space. It’s been going up because it’s a good blockchain that seemed to be gaining ground recently, but there are lots of good blockchains and (as everyone knows) the sector is volatile and prone to short-term enthusiasms.”

Another token associated with Bankman-Fried, Serum, has seen its value almost 10x to a $494 million market cap this year alone. FTX’s FTT coin is also up about 10x in the same time period.

https://www.zerohedge.com/markets/it-seems-every-token-crypto-billionaire-touches-has-gone-1000-year

3.Sell in May Seasonality has not Worked in U.S.

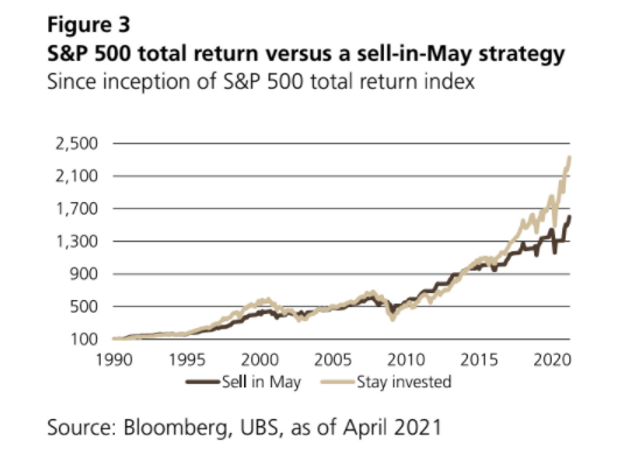

“In the U.S., a stay invested strategy has tended to outperform, particularly in recent years,” the strategists said. “Market composition, with the U.S. market more tilted towards growth stocks, partly explains the outperformance.”

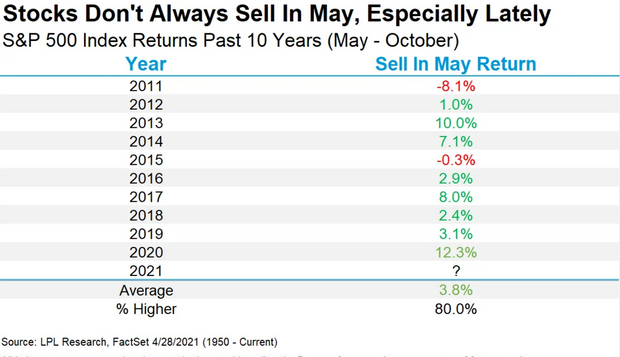

Ryan Detrick, chief market strategist for LPL Financial, said in a blog Friday that the six months from May through October have been “some of the weakest months of the year for stocks” in the past 10 years. “But with an accommodative Fed, fiscal and monetary policy, along with an economy that is opening faster than nearly anyone expected, we’d use any weakness as an opportunity to add to positions,” he said.

“Here’s the catch,” Detrick said. “Stocks have actually been higher during these worst months of the year eight of the past ten years.”

U.S. stocks have risen to all-time highs this year. Should you ‘sell in May and go away’?

4. Going Green Increases Demand for Copper

Going Green

Copper has enjoyed an unstoppable rally for more than a year thanks to pledges by governments to boost renewable energy and electric vehicle use. That’ll make all the various forms of green technology that rely on it a bit more expensive.

Bigger power grids is one such case. About 1.9 million tons of copper was used to build electricity networks in 2020, according to BloombergNEF, and the price of the red metal is up more than 90% in the past year. Usage will almost double by 2050, BNEF forecasts, while demand from other low carbon technologies like electric vehicles and solar panels will also balloon.

Copper’s Brilliant Year

Copper ETF Double Off Lows

©1999-2021 StockCharts.com All Rights Reserved

The green revolution is creating huge demand for copperSource: London Metal Exchange, Bloomberg

5. U.S. Cannabis Companies Profits

Barrons-Growing Like Weeds

Despite cost burdens from pot’s federal illegality, U.S. cannabis sales yield nice profits.

| Company / Ticker | Recent Price | Market Value (bil) | 2021E Revenue (mil) | 2021E Adjusted Ebitda (mil) | 2021E Adjusted EPS |

| Curaleaf Holdings / CURLF | $13.36 | $9.1 | $1,260 | $370 | $0.06 |

| Green Thumb Industries / GTBIF | 30.55 | 6.6 | 860 | 320 | 0.47 |

| Trulieve Cannabis / TCNNF | 40.57 | 5.0 | 850 | 380 | 1.48 |

| Cresco Labs / CRLBF | 12.29 | 4.5 | 810 | 260 | 0.16 |

| TerrAscend / TRSSF | 11.08 | 3.5 | 300 | 120 | 0.11 |

| Columbia Care / CCHWF | 6.28 | 1.8 | 510 | 100 | 0.02 |

| Ayr Wellness / AYRWF | 29.18 | 1.5 | 380 | 140 | 0.39 |

| Harvest Health & Recreation / HRVSF | 2.83 | 1.2 | 390 | 80 | 0.01 |

E=estimate; Ebitda=earnings before interest, taxes, depreciation, and amortization

Sources: Sentieo; FactSet; company reports

Marijuana Legalization Will Be Good News for Pot Stocks. How to Play the Sector.

By Max A. Cherney and Connor Smith

6. MSOS Pure U.S. Cannabis ETF

MSOS 65% Derivatives

©1999-2021 StockCharts.com All Rights Reserved

MSOS Fund Description

MSOS is an actively managed narrow portfolio of US stocks or swap contracts related to the domestic cannabis and hemp industry.

MSOS Factset Analytics Insight

MSOS is the first US-listed actively managed ETF to provide exposure solely to American cannabis and hemp companies, including multi-state operators (MSOs). This is the second fund from AdvisorShares dedicated to the cannabis investment strategy. MSOS seeks long-term capital appreciation by investing entirely in legal, domestic cannabis equity securities. Stocks may be of mid- and small-cap companies. In addition, the fund will use total return swap contracts to create such exposure. The fund advisor uses a variety of tools and ratings sources to select securities. Companies must be registered with the DEA specifically for the purpose of handling marijuana for lawful research and development of cannabis or cannabinoid-related products. Stocks selected may focus on areas such as REITs, health care, cannabidiol (CBD), pharmaceutical and hydroponics. In addition to investment risks, investors need to be aware of the ongoing regulatory risks.

MSOS Top 10 Holdings

MUTUAL FUND (OTHER)20.75%

Green Thumb Industries Inc.8.66%

Trulieve Cannabis Corp. 9.75% 18-JUN-20248.12%

Curaleaf Holdings, Inc.7.54%

Cresco Labs, Inc.6.78%

Innovative Industrial Properties Inc4.85%

TerrAscend Corp.4.81%

GrowGeneration Corp.4.74%

Columbia Care, Inc.3.34%

Total Top 10 Weighting135.05%

https://www.etf.com/MSOS#overview

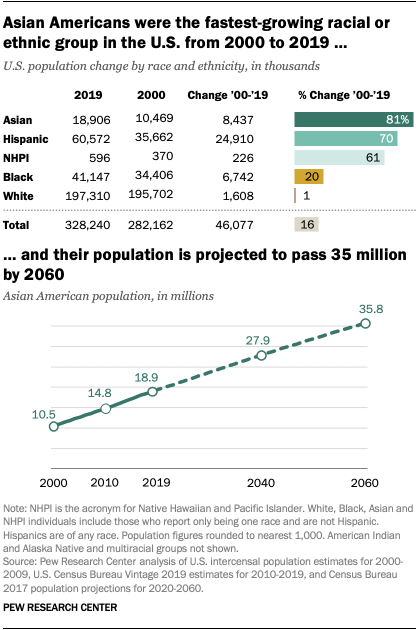

7. 2000-2020 Asian Americans Fastest-Growing Racial or Ethnic Group

Pew Research

8. Millennials have been moving out of big cities — here’s where they are going

Published Thu, Apr 15 202112:43 PM EDTUpdated Thu, Apr 15 20211:21 PM EDT

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Hero Images | Getty Images

The lure of big cities like New York, Los Angeles and Chicago had seemingly already started to wane in young professionals before Covid-19 hit in 2020, according to recent report.

Using the most recent data available from the Census Bureau’s 2019 1-year American Community Survey, financial planning website SmartAsset, found millennials aged 25 to 39 were already migrating from major cities like New York City and Chicago and moving to states like Texas, Colorado, Washington and Arizona.

According to the report, cities like Denver, Seattle, Phoenix and Austin saw the biggest bump with millennials during 2019.

Since the pandemic in March 2020, those trend have continued, according to data from LinkedIn and U-Haul.

In December, LinkedIn found that cities like Austin, Phoenix, Nashville and Tampa gained the most LinkedIn members (from all age groups) based of a change in the zip codes from April 2020 to October 2020.

While a U-Haul report in January found the most one-way U-Haul’s headed towards states like Tennessee, Texas, Florida, Ohio and Arizona.

Here are the cities where millennials were already moving to in 2019, according to SmartAsset and based on census data.

1. Denver, Colorado

Denver had the biggest net migration of millennial residents with 10,974 millennials moving to the city from a different state in 2019, resulting in about 33% of Denver’s population being millennials.

2. Seattle, Washington

Seattle had a net migration of 6,164 millennials from out of state, making them 34% of the city’s population.

3. Phoenix, Arizona

Phoenix had a net migration of 5,958 millennials. Twenty-three percent of the city’s population were millennials post-migration.

4. Austin, Texas

Austin had a net migration of 5,686 millennials from out of state, making them 31% of the city’s population.

5. Colorado Springs, Colorado

Colorado Springs had a net migration of 5,050 millennials from out of state in 2019. Millennials made up about 24% of the city’s population.

6. Frisco, Texas

Frisco, which is in the Dallas-Fort Worth metro area, had a net migration of 3,516 millennials from out of state in 2019, to total about 19% of the city’s population.

7. Cary, North Carolina

Cary, whichi is about 15 minutes west of Raleigh, had a net migration of 3,364 millennials from out of state in 2019. No data was available on the millennial population.

8. Portland, Oregon

Portland had a net migration of 3,311 millennials from out of state, resulting in them making up about 29% of the city’s population.

9. Henderson, Nevada

Henderson, which is about 25 minutes from downtown Las Vegas, had a net migration of 3,042 millennials from out of state in 2019. Millennials made up about 20% of the city’s population.

10. Cape Coral, Florida

Cape Coral, which is about 20 minutes from Fort Meyers and is located on the Gulf coast, had a net migration of 2,666 millennials from out of state in 2019. Millennials made up about 18% of the city’s population.

9. Covid cases fall sharply in U.S., Gottlieb calls vaccination campaign ‘monumental achievement’

Tucker Higgins@IN/TUCKER-HIGGINS-5B162295/@TUCKERHIGGINS

KEY POINTS

· As of Saturday, the 7-day average of daily new cases fell to under 50,000, down 17% from a week prior. Hospitalizations and deaths from the disease are also falling.

· Former FDA commissioner Scott Gottlieb said a precipitous drop in new Covid-19 cases was likely to continue, predicting a “relatively quiet summer when it comes to coronavirus spread.”

· More than 100 million people in the U.S. are fully vaccinated against Covid-19, or nearly a third of the population.

A person walks in Times Square after the Centers for Disease Control and Prevention (CDC) announced new guidelines regarding outdoor mask wearing and vaccination during the outbreak of the coronavirus disease (COVID-19) in Manhattan, New York City, New York, U.S., April 27, 2021.

Andrew Kelly | Reuters

New cases of Covid-19 are dropping sharply across the U.S. as millions of people get vaccinated daily, fueling optimism that the nation may have averted the surge of infections gripping other parts of the world and is finally turning the corner on what was one of the worse outbreaks globally.

As of Saturday, the 7-day average of daily new cases fell to under 50,000 for the first time since October and is down 17% from a week prior, according to a CNBC analysis of data from Johns Hopkins University. Hospitalizations and deaths from the disease are also falling.

Cases are falling as more Americans get vaccinated. To date, more than 100 million people in the U.S. have been fully vaccinated against Covid-19, according to the Centers for Disease Control and Prevention, or nearly a third of the population. About 146 million people, or 44% of the population, has received at least one dose of a vaccine.

Former Food and Drug Administration commissioner Scott Gottlieb on Sunday said that the precipitous drop in new Covid-19 cases in the U.S. was likely to continue, predicting a “relatively quiet summer when it comes to coronavirus spread.”

“Look, the situation in the U.S. continues to improve, and I think in the coming weeks we are going to see an acceleration in the decline in cases,” Gottlieb said on CBS News’ “Face the Nation.”

The physician credited the mass vaccination campaign that got underway under President Donald Trump and has been continued under President Joe Biden for the country’s ability to rein in the spread of the disease.

The rate of vaccine administration has declined somewhat in recent weeks after rising for months, now that most of the individuals who were most eager to receive a shot have gotten one. However, Gottlieb said continued vaccinations, even at a slower place, will lower virus transmission.

“This has been a monumental achievement — rolling out this vaccine, getting that many Americans vaccinated — and it’s going to continue,” Gottlieb said. “We’ll continue to chip away at it. The rate of vaccination is going to slow in the coming weeks. But we’ll continue to pick up more people as we get into the summer.”

Dr. Anthony Fauci, the White House pandemic advisor, suggested last week that he expected a “significant diminution in the number of infections per day and a significant diminution in all of the parameters, namely hospitalizations and deaths” to come in a matter of weeks.

The CDC has revised its public health guidance and said fully vaccinated people can attend small gatherings outdoors without wearing a mask.

“Today is another day we can take a step back to the normalcy of before,” CDC Director Rochelle Walensky said during a press briefing about the announcement. “If you are fully vaccinated, things are much safer for you than those who are not fully vaccinated.”

Biden has celebrated the decline in cases, predicting that Americans may be able to gather with friends and family to celebrate the Fourth of July.

“After a long, hard year, that will make this Independence Day truly special — where we not only mark our independence as a nation but we begin to mark our independence from this virus,” he said in March.

Cities and states have moved at different paces in response to the progress in controlling the spread of Covid-19. New York Mayor Bill de Blasio has said he intends to fully reopen the city on July 1, a prospect that some experts have said is plausible, while Gov. Andrew Cuomo has said he hopes that the city can open even sooner.

The optimism has spread to the stock market, where U.S. indices have been powered to near record highs.

To get a sense of what may be coming around the corner for the U.S., Gottlieb said it could be helpful to look at heavily vaccinated San Francisco.

“About 71% of people in San Francisco have had at least one dose of the vaccine, 47% have been fully vaccinated. They are recording about 20 cases a day. They have about 20 people who have been hospitalized,” Gottlieb said.

“They’ve dramatically reduced Covid in that city, and it’s largely the result of vaccination,” he added.

Using financial terms, Gottlieb suggested that the gains from vaccination were “locked in” and “pretty sustainable.”

“We are entering warm months, when this is going to create a backstop against the spread of the coronavirus, and so we are locking in these gains,” Gottlieb said.

More than 577,000 people have died in the U.S. from Covid-19 and more than 32 million have been infected. During period of December and January, public health authorities were reporting more than 200,000 new infections a day on average.

Even as the health situation appears on the cusp of normality in the U.S., it is worsening in other countries with fewer resources. In India, new daily cases surpassed 400,000 on Saturday, a record.

Disclosure: Scott Gottlieb is a CNBC contributor and is a member of the boards of Pfizer, genetic testing start-up Tempus, health-care tech company Aetion Inc. and biotech company Illumina. He also serves as co-chair of Norwegian Cruise Line Holdings’ and Royal Caribbean’s “Healthy Sail Panel.”

10. Our Obsession With Achievement Is Fueling Anxiety

Why we should think differently about success—and how to start.

KEY POINTS

- Pressure to achieve and perfectionism may help explain increased levels of anxiety and depression among youth.

- Helping young people relate to achievement differently can begin with self-reflection by adults.

- Ways to rethink achievement include challenging idealized notions of success and aiming to make a positive contribution to the lives of others.

Source: Razvan Chisu/Unsplash

In our fiercely competitive society, achievement has become the top priority for many.

According to a national survey of 10,000 students, almost 80 percent of youth identified individual achievement or happiness as most important to them, while only 20 percent selected caring for others.

Our youth often strive to be successful even if it comes at a cost to their mental health. A report from the Robert Wood Johnson Foundationincluded the pressure to excel—along with poverty, trauma, discrimination, and issues related to social media and the internet—in a list of environmental forces disrupting adolescent wellness. Data from 40,000 college students in the U.K., U.S., and Canada from 1989 to 2016 indicates that perfectionism is on the rise, which may help explain increasing rates of anxiety and depression among the youth.

Youth Attitudes About Achievement Start With Adults

These figures are not surprising. Young people follow in the footsteps of adults. They can see how we treat success and productivity as badges of honor. We reward the youth for being straight-A students and the star on their soccer team. We encourage them to boost their resumes with endless extracurricular activities. We may tell our children that we value kindness and empathy but do not always promote these values with the same vigor.

Helping our youth starts with helping ourselves. We need to reflect on how we are living our lives. We have raised the bar of our expectations to unattainable and unsustainable levels. We expect to earn a healthy income, excel professionally, raise perfect children, have a beautiful house, keep a full social schedule, and be pillars of our communities.

article continues after advertisement

Anxiety can arise from the pressure to meet self-imposed expectations. In a 2018 poll from the American Psychiatric Association, almost 40 percent of adult American respondents said they were more anxious than they had been the previous year. The COVID pandemic has further increased rates of anxiety.

We are spread too thin and overwhelmed. We are pushing ourselves to the point of exhaustion. Yet we refuse to take a break.

Studies also suggest that empathy has been on a decline in recent years, while self-reported narcissism has been on the rise. As we become self-absorbed in our pursuit of individual goals, we may forget to appreciate the humanity in others. We may view them as competition that must be trounced as we march towards individual aspirations.

How to Think Differently About Achievement

Our current obsession with achievement is likely fueling anxiety while damaging the fabric of our society. If we want to heal individually and collectively then we need to examine this relationship.

This process starts by recognizing that success is not synonymous with sustained happiness. As parents, we encourage our youth to be successful, believing this path sets them up for happiness. As the son of immigrant parents who came from humble beginnings, I can appreciate the intent behind this message.

However, many are idealizing success and forgetting that it comes with a host of challenges. For example, people who achieve professional success may be under greater scrutiny as they carry greater responsibility.

When I was younger, I had also idealized the path to professional success by assuming that becoming a physician would equate to happiness. It did not take long to discover the error in my thinking. Physicians suffer from high rates of burnout as they deal with endless administrative tasks, documentation requirements, a loss of autonomy, and the fear of litigation, which affects how they practice medicine. All this while trying to pay off a heavy student loan burden that often exceeds $200,000.

Achieve with the aim of making a positive contribution to the life of others. If you gauge success by individual measures such as money, power, or fame, you will probably be disappointed. Happiness becomes elusive as you constantly compare yourself to people you identify as more wealthy, powerful, or famous. In a study of millionaires, the majority of participants predicted that an increase in wealth was needed to make them happier.

When I find myself frustrated with the practice of medicine, I shift the focus from myself to my patients. I remind myself of the privilege of earning a human being’s trust as they share their life story with me. They are someone’s spouse, parent, child, or friend. By alleviating their mental suffering, my work has a ripple effect on others in their social circle.

Finally, let’s bust the myth that kindness is a barrier to achievement. There is a false narrative that kindness is weakness. However, the opposite is true. Evidence suggests that children who care for others achieve more than those who do not. Kindness and achievement are not mutually exclusive. One can strive to achieve their individual goals andbe kind to others.

Our drive to achieve is not necessarily a bad thing. It can have a positive impact on the lives of others. The problem occurs when we pursue success solely for individual purposes. This may ultimately come at a cost to our mental health, our loved ones, and society.

LinkedIn image: ShotPrime Studio/Shutterstock

Dimitrios Tsatiris M.D.

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..