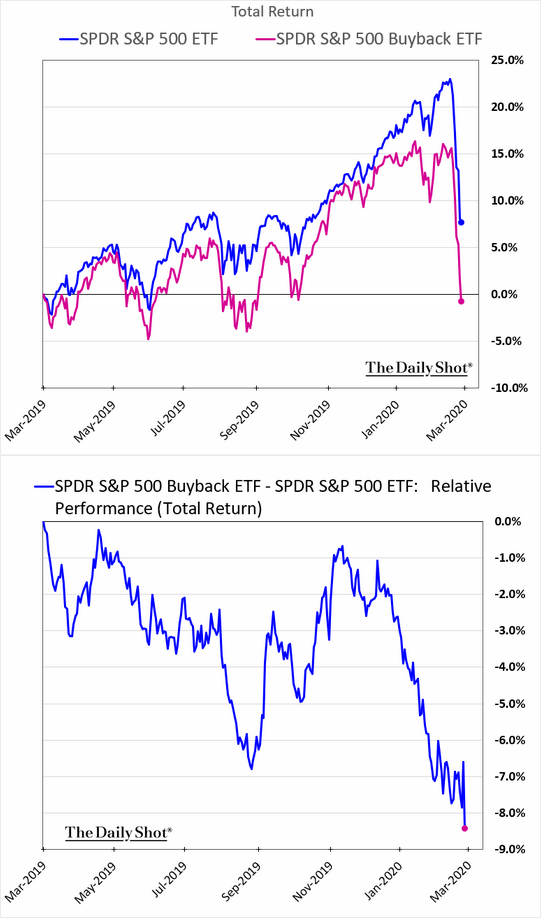

1.Stock Buyback ETF Lagging the S&P During This Correction.

Bull Market Winner PKW-Buyback ETF lagging.

The Daily Shot https://blogs.wsj.com/dailyshot/

Continue reading

The Daily Shot https://blogs.wsj.com/dailyshot/

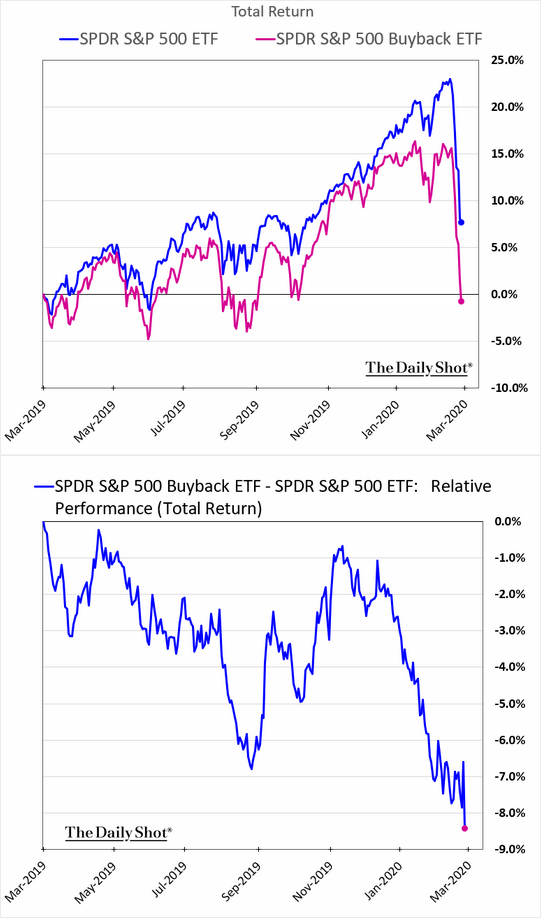

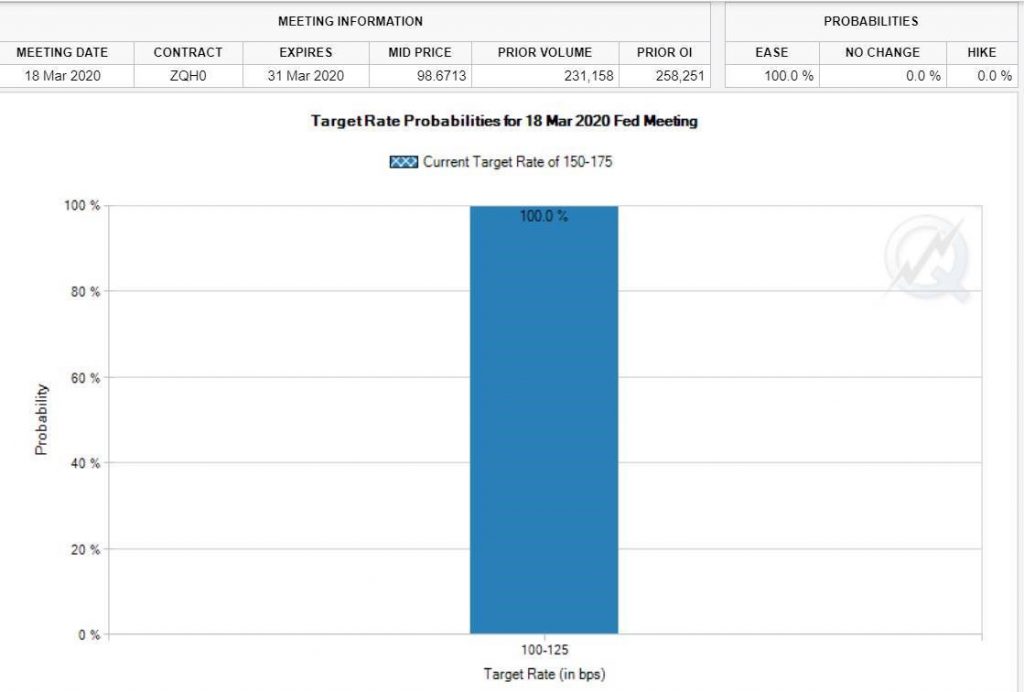

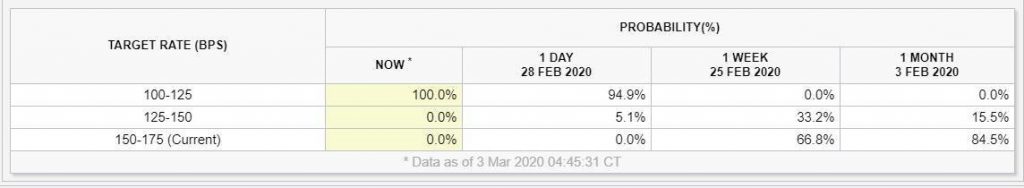

Continue readingCME GROUP

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

Continue reading

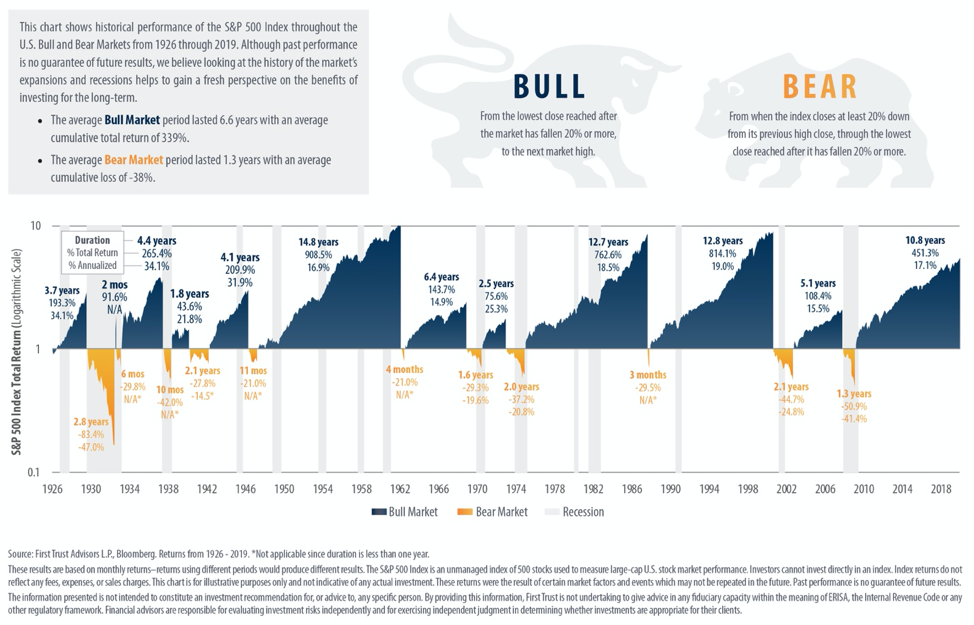

Brian Westbury-First Trust Economics Blog

Much

of the pessimism surrounding the virus focuses on the Chinese under-counting

the number of infected to save face. However, it’s important to note that a

shortage of specialized test kits has caused health officials in many countries

to rely on observable symptoms for diagnoses, and because coronavirus mimics

the flu and pneumonia in its early stages, it’s also possible that authorities

may be over-counting as well.

Instead of looking at it from a total confirmed case perspective, we think the

number of total active cases provides a better look into what is happening.

This measure takes total confirmed cases and subtracts deaths and recoveries.

This gives the total amount of people who have the potential to spread the

virus further.

According to Worldometer, which

aggregates statistics from health agencies across the world, total active cases

peaked about a week ago at 58,747 and have since been declining. Even with all

the new cases we are seeing in South Korea, Italy and Iran (where data is

suspect). There have been 30,597 cases with an outcome (2,699 deaths and 27,898

recovered). In other words, the total active cases now stand at 49,923, a drop

of 15% from the peak on February 17th.

One death is too many, but to put that number into a little bit of perspective,

according to the World Health Organization, in the United States alone for the

2019-2020 season, there have been at least 15 million flu illnesses, 140,000

hospitalizations and 8,200 deaths. Imagine if everyone with an internet

connection followed the spread of this annual flu, case by case, hour by hour.

It’s true that the death rate from Coronavirus appears to be around 2% in

China, which is much higher than the death rate from the normal flu, but like

the flu increases with age. However, outside of China the death rate is far

less than inside China, roughly 1%. And, there is already a drug that will

combat COVID-19 moving toward first phase clinical trials. It took three months

for this to happen in 2020, versus 20 months for SARS back in 2002/03 – a

testament to advances in drug technology.

From a macro-economic point of view, the real question is how will this impact

the US economy over the coming year. In short, our view has not changed. The US

we believe is relatively insulated, with a fantastic health system. The US

started the year with solid economic data and so far, nothing has changed. In

fact, with all the data we already have on hand, we are expecting around 2%

growth in Q1. Most of the impact to the US from the corona virus will come in

Q2.

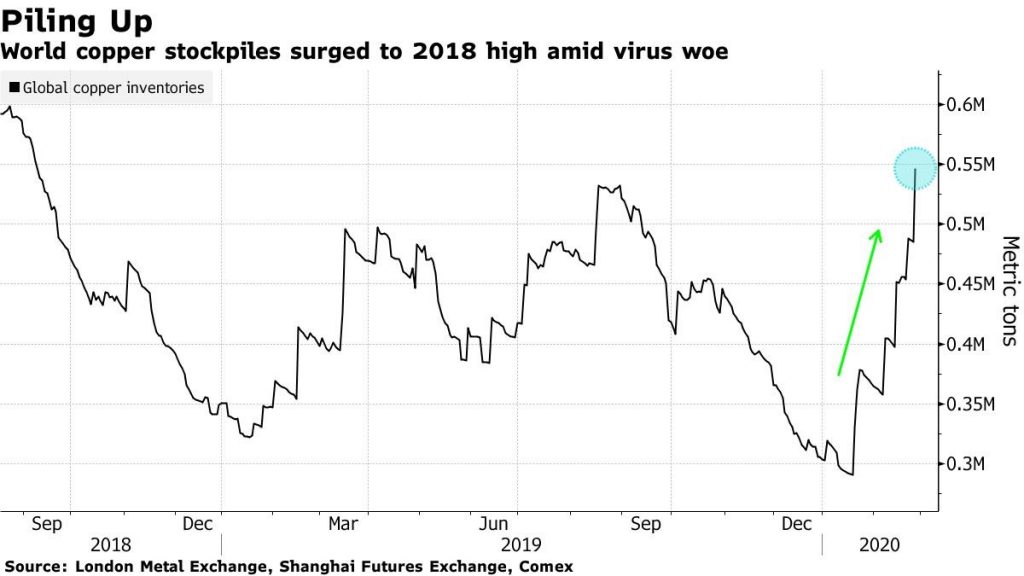

Capital goods exports to China along with imports from China are sure to be

depressed given the struggles to reopen factories abroad. Most Chinese

factories are still only operating at about 50-60% of capacity. Shipping giant

Maersk has already said it has cancelled more than 50 trips to and from Asia.

With China being home to seven of the world’s busiest container ports there is

bound to be some impact. Inventories in the US will be depleted more rapidly,

but once the virus subsides, expect faster accumulation of inventories in the

second half of the year.

Revenues and earnings from companies that are highly exposed to China will

definitely be affected. China being shut down for a month will have a global

impact. But lower earnings in the first half of the year should be made up by a

strong rebound in the second half of the year with payback from lost months.

Demand remains strong and there has been no visible impact yet on the job market

as shown by initial unemployment claims. Supply disruption is the issue. We

suggest looking through any earnings weakness as we expect it to be transitory.

One small nugget of good news is that many companies had already been shifting

supply chains from China due to the Trump Tariffs. If they weren’t considering

it before they will be now as they realize the importance of diversification.

Expect this trend to accelerate moving forward.

The US consumer is on solid footing and will continue to be one of the key

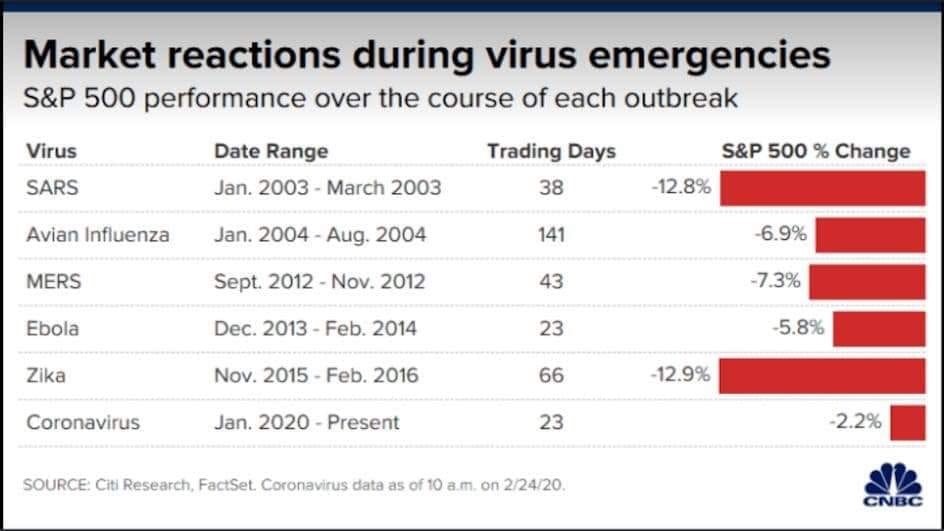

drivers to US economic growth in the year to come. We believe, just like all

the other viruses we have seen over the past decades that have dissipated, the

Coronavirus will be no different. Some have suggested that the 1918 Spanish

Flu, which killed hundreds of thousands in the US could happen again. No one

knows, but 2020, is not 1918. Technology and news move much faster and the US

rebounded from the Spanish Flu when all was a said and done. We suspect that

any drop in earnings or economic activity will be short lived, and more than

made up for in the year to come. Don’t panic, stay invested.

Brian S. Wesbury – Chief Economist Robert Stein, CFA – Deputy

Chief Economist

https://www.ftportfolios.com/retail/blogs/economics/index.aspx

BABA Alibaba Holdings

Tencent Holdings

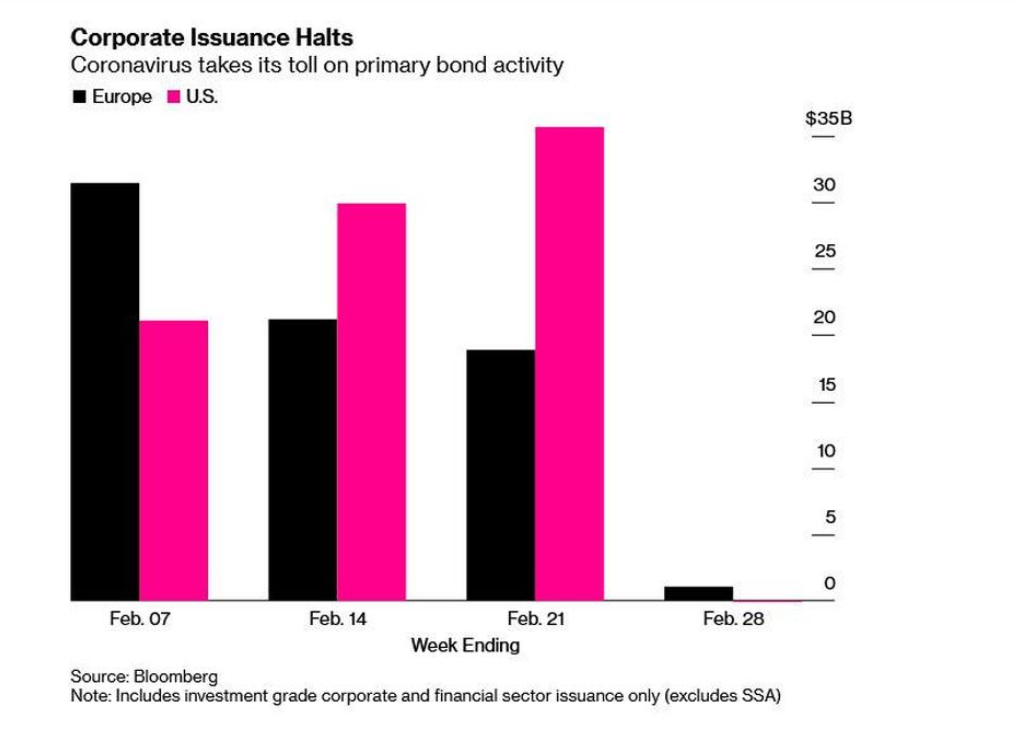

Wall Street banks recorded their third straight day without any high-grade bond offerings, an unheard of event

As Bloomberg puts it, “it has been a remarkable turn of events for a market where investors had been snapping up almost anything on offer amid a global dash for yield. Europe had been enjoying its strongest ever start to a year for issuance, and sales of U.S. junk bonds have been on the busiest pace in at least a decade. With so many borrowers having postponed their issuance plans, a

, a calming in global markets could kickstart debt sales again.”

“Coronavirus Paralyzes Global Credit Market As New Issuance Crashes To Zero by Tyler Durden

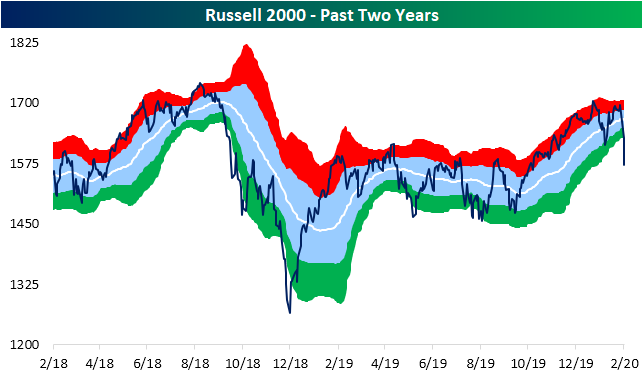

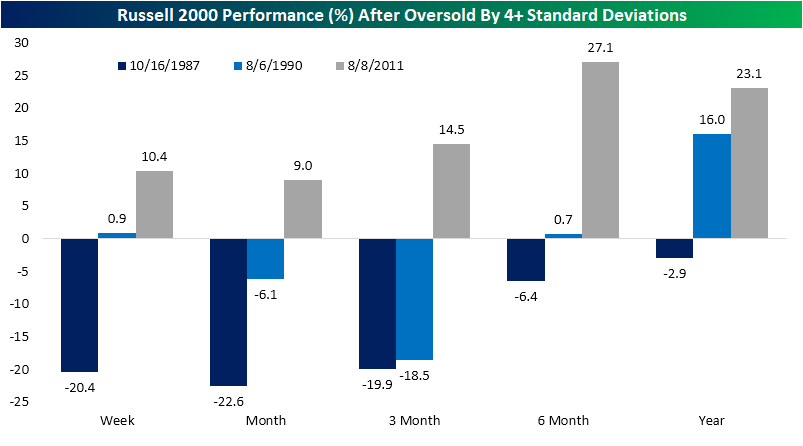

The small-cap Russell 2000 has generally underperformed large-caps for much of the past two years (it still has not gotten back up to its summer 2018 all time highs), and this recent weakness leaves it much more dramatically oversold than other major indices. As of yesterday’s close, the Russell sat over 4 standard deviations below its 50-DMA. That compares to the prior day when it was just over 2 standard deviations below and the day before when it was within one standard deviation of its 50-DMA.

This is only the sixth day in the index’s history that it had gotten this oversold. The last time this happened was in August 2011. Prior to that there was one occurrence in August 1990 and another cluster of three days in during the October 1987 crash. Performance following these prior instances have been very mixed. While the 1987 and 1990 instances were followed by severe declines in the Russell 2000 over the next few months, more recently in 2011 performance was very strong over the next year. Join Bespoke Premium to access Bespoke’s most actionable stock market research and analysis. Start a two-week free trial now!

Russell Rarely This Oversold https://www.bespokepremium.com/interactive/posts/think-big-blog/russell-rarely-this-oversold

Dr. Bertalan Mesko, aka The Medical Futurist, says with advancements in exoskeleton technology, AI’s ever-increasing importance in health care, and technologies like 5G and quantum computing soon going mainstream, there’s much to be excited about

Illustration by Doug Chayka

ByDR.BERTALAN MESKO

The past decade was about the rise of digital health technology and patient empowerment. The next decade will be about artificial intelligence, the use of health sensors and the so-called Internet of Healthy Things and how it could improve millions of lives.

The cultural transformation of health care we call digital health has been changing the hierarchy in care into an equal-level partnership between patients and physicians as 21st century technologies have started breaking down the ivory tower of medicine. But these milestones are nothing compared with what is about to become reality.

With advancements in exoskeleton technology, AI’s ever-increasing importance in health care, and technologies like 5G and quantum computing soon going mainstream, there’s much to be excited about.

Here are the five biggest themes for health and medicine for the next 10 years.

Artificial intelligence in medicine

Developments in artificial intelligence will dominate the next decade. Machine learning is a method for creating artificial narrow intelligence — narrow refers to doing one task extremely well — and a field of computer science that enables computers to learn without being explicitly programmed, building on top of computational statistics and data mining. The field has different types: it could be supervised, unsupervised, semi-supervised or reinforcement learning, among

If we consider how AlphaGo, the AI developed by Google’s DeepMind lab, beat world champion Lee Sedol at the classic Chinese game Go by coming up with inventive moves that took experts by surprise, we can get a glimpse at what AI can hold for health care. Such moves were made possible by the combination of neural networks and reinforcement learning that this AI uses. This enabled the software to operate without the restrictions of human cognitive limitations, devise its own strategy and output decisions that baffled experts.

We can expect to see the same surprises in medical settings. Imagine new drugs designed by such algorithms; high-level analysis of tens of millions of studies for a diagnosis; or drug combinations nobody has thought of before. When applied to medicine, an algorithm trained via reinforcement learning could discover treatments and cures for conditions when human medical professionals could not. Cracking the reasoning behind such unconventional and novel approaches will herald the true era of art in medicine.

In global health, for example, an algorithm can provide a reliable map of future measles outbreak hot spots. It uses statistics on measles vaccination rates and disease outbreaks from the Centers for Disease Control and Prevention, as well as non-traditional health data, including social media and a huge range of medical records. That’s just one example, but the field is already buzzing with smart algorithms that can facilitate the search for new drug targets; improve the speed of clinical trials or spot tumors on computed tomography (CT) scans.

However, while experts believe that AI will not replace medical professionals, it also seems true that medical professionals who use AI will replace those who don’t.

A myriad of health sensors

Medical technology went through an amazing development in the 2010s, and there’s now no single square centimeter of the human body without quantifiable data. For example, AliveCor’s Kardia and Apple Watch measure electrocardiogram and detect atrial fibrillation with high sensitivity. The EKO Core digital stethoscope records heart and lung sounds as a digital stethoscope, while blood pressure is monitored with the Omron Blood Pressure Smartwatch, the MOCAcare pocket sensor, and blood pressure cuff, the iHealth Clear, the Skeeper, a pocket cardiologist, or the Withings Blood Pressure Monitor, and of course, dozens of traditional blood pressure cuffs.

There are dozens of health trackers for respiration, sleep, and, of course, movement. And while researchers can’t decipher your dreams yet — they are working on it, alongside figuring out all kinds of brain activity. For example, through EEG. That’s a method that records electrical activity in the brain using electrodes attached externally to the scalp. The NeuroSky biosensor and the Muse headband use it to understand the mind better and in the latter case allow for more effective meditation. As you see, there’s not much left unmeasured in your body — and it will even intensify in the future. For example, we expect digital tattoos to become commercially available within five years, which will not only measure the majority of the above-mentioned vital signs, but they will do so continuously. These tiny sensors will notify us when something is about to go wrong and we will need medical advice or intervention.

Moreover, with developments in 3-D printing as well as circuit-printing technologies, flexible electronics and materials, applying so-called digital tattoos or electronic tattoos on the skin for some days or even weeks became possible.

Made of flexible, waterproof materials impervious to stretching and twisting coupled with tiny electrodes, digital tattoos are able to record and transmit information about the wearer to smartphones or other connected devices. While these are only in use in research projects, they could allow health-care experts to monitor and diagnose critical health conditions such as heart arrhythmia, heart activities of premature babies, sleep disorders and brain activities noninvasively. Moreover, by tracking vital signs 24 hours a day, without the need for a charger, it is especially suited for following patients with high risk of stroke, for example. Although we are not there yet, there are certain promising solutions on the market such as MC10’s BioStampRC Sensor.

Quantum computing puts medical decision-making on a new level

In 2019, Google claimed “quantum supremacy” and made the cover of Nature magazine. One example of how this technology will have a major impact on the health-care sector is quantum computing taking medical decision-making to a whole new level and even augmenting it with special skills. What if such computers could offer perfect decision support for doctors? They could skim through all the studies at once, they could find correlations and causations that the human eye would never find, and they might stumble upon diagnoses or treatment options that doctors could have never figured out by themselves.

At the very endpoint of this development, quantum computers could create an elevated version of PubMed, where information would reside in the system but not in the traditional written form — it would reside in qubits of data as no one except the computer would “read” the studies anymore.

In addition, the applications of quantum computing to health care are manifold, ranging from much faster drug design to quicker and cheaper DNA sequencing and analysis to reinforced security over personal medical data. While the technology does hold such promises, we still have to be patient before practical solutions can be implemented in medicine. However, with continued progress in this area, even though quantum computing has been something from a science fiction novel, this decade will see the first such computer used in the clinical practice too.

Chatbots as the first line of care

Symptom checkers that function on the same principle as chatbots are already available, free of charge. However, these rely on the user inputting symptoms and complaints manually. We yearn for one that can make predictions and suggestions based on a user’s data, like sleep tracking, heart rate and activity collected via wearables. With such features, those bots can help users make healthier choices without having to drag themselves to their doctor.

There was a “Black Mirror” episode titled “Rachel, Jack, and Ashley Too” that featured an incredibly smart and emotional chatbot that had human-like conversations with the character. Think about having a similar personalized chatbot that’s accessible via your smart device and with additional health and lifestyle features. This chatty virtual being can wake you up at the appropriate time based on your sleep pattern and advise you to take your antihistamines as the pollen concentration is particularly high during your commute that day, before you even get out of bed. It can even recommend what you should consume for each meal based on your nutrigenomic profile. It could find the best words for you to motivate you to go to the gym. It could find the best jokes that help you get into a good mood. But would you rather bend to the rules of an AI, essentially forgoing your freedom of choice, than experience life based more on your own will?

5G serving the whole ecosystem of digital health

5G networks will enable data to be downloaded at more than 1 gigabit per second, allowing for downloads 10 to 100 times faster than the currently available 4G services. 4G networks can only serve around a thousand devices within a square kilometer, while 5G can serve a million. It will make the era of the Internet of Things (IoT) possible by connecting a huge amount of health trackers with laptops, smartphones and many more digital devices. There will be no connection issues or latency, as the trackers will be able to work in harmony while getting the most out of our data.

Such a boost will allow for more reliable communication, which is a must in areas like telesurgery, remote consultation and remote monitoring. With bigger bandwidth and faster connection, there might be a boost in wearables as health IoT networks become more stable and reliable, and further help with patient engagement in relation to their health.

Major applications of 5G are expected to be apparent starting in 2021.

Dr. Bertalan Mesko, Ph.D., is The Medical Futurist and director of The Medical Futurist Institute, analyzing how science fiction technologies can become reality in medicine and healthcare. As a geek physician with a Ph.D. in genomics, he is a keynote speaker and an Amazon Top-100 author.

Engaging with the unfamiliar can keep mind and body fit. So how to pump up one’s levels of curiosityAnyone who has spent time around kids knows that their young minds are powered by curiosity. The average child probably asks more questions in 10 minutes than the average adult does in 10 days. Kids are curiosity personified.

But as people age, their reservoirs of curiosity tend to dry up. Studies have found that, on average, a person’s openness to new experiences and new sensations declines steadily with age. At the same time, apathy increases. While plenty of older adults buck these trends, there’s some truth to the cliché of the narrow-minded, novelty-averse fogey who rigidly adheres to his time-worn routines and opinions.

For years, mental health researchers have noted this age-related dip in curiosity. They’ve also noticed that high levels of curiosity often correlate with many different measures of mental health and vigor. One 2018 paper from the journal Neuroscience & Biobehavioral Reviews found evidence that maintaining curiosity in old age is protective against cognitive and physical decline. Compared to the incurious, older adults who score high in curiosity tend to perform better on tests of memory and general cognitive functioning. The authors of that study point out that curiosity activates brain areas that are involved in other high-level cognitive processes, and over time this increased activation could help explain some of curiosity’s brain benefits.

And in people both young and old, research has found that high and consistent levels of curiosity correlate with mental well-being and life satisfaction. Curious people also seem protected from depression.

The more that experts examine curiosity, the more they find evidence to suggest that it’s the secret sauce in a happy, fulfilling life. “If you take the fundamental things that people tend to want out of life — strong social relationships and happiness and accomplishing things — all of these are highly linked to curiosity,” says Todd Kashdan, a professor of psychology at George Mason University and author of Curious?

What exactly does it mean to be curious? “If you go by the typical dictionary definition, curiosity is simply a desire to seek out new knowledge or experiences,” Kashdan says. While this definition is a useful starting point, he says curiosity also involves a willingness to engage with complex, unfamiliar, and challenging concepts or endeavors.

Kashdan has helped develop two widely used scientific models for measuring curiosity. The newer of these models breaks curiosity down into five different categories or “dimensions.” He terms the first of these “joyous exploration,” and it hews closely to the dictionary definition of curiosity. The second and third dimensions have to do with a person’s level of focus and commitment when confronted with the uncertainties that newness breeds. “When you explore new terrain” — whether it’s an exercise class you’ve never attended or a dinner date with a new friend — “you’ll probably be exposed to feelings of stress and anxiety,” he says. While these states tend to be thought of as negative, he says curious people are not easily deterred by them. In other words, they display resilience or “grit” (to use the buzzword du jour) when exploring new concepts or scenarios.

The more that experts examine curiosity, the more they find evidence to suggest that it’s the secret sauce in a happy, fulfilling life.

“The fourth dimension is thrill-seeking, which is a willingness to take financial or social or personal risks in pursuit of new experiences,” he explains. He says thrill-seeking could take the form of extreme sports, experimenting with psychedelics, or starting a new business venture. The fifth and final dimension is “social curiosity,” he says, which is taking an interest in other people’s views and opinions.

People who score high on some or all of these five measures of curiosity almost transcend questions of happiness or fulfillment. “When you lose yourself in the exploration of things that are new and that you find interesting, you’re not stopping to ask yourself if you’re happy or depressed,” Kashdan says.

That said, there’s some evidence that the relationship between curiosity and happiness is bidirectional, meaning one fuels the other. A 2019 study in the Journal of Personality found that on days when people experience positive emotions like happiness, they also tend to display more curiosity than on days when they aren’t happy. These sorts of findings have led some researchers to hypothesize that positive emotions may exist in part to help encourage curiosity and the fruitful exploration it encourages.

“There’s the ‘broaden and build’ theory that says positive emotions have a lot of function, and one of them is to get us to engage in things we wouldn’t normally do,” says David Lydon-Staley, first author of that study and a postdoctoral researcher in the department of bioengineering at the University of Pennsylvania. Curiosity can lead to new relationships, new skills, or new areas of knowledge that enrich a person’s life at many levels, he explains.

But is it possible to pump up one’s levels of curiosity? Lydon-Staley’s research found that exercise seems to promote curiosity — perhaps by improving a person’s mood. (The mood-elevating effects of exercise are well established.)

Kashdan says having strong personal relationships also seems to feed curiosity. “Having secure attachments is like having a home base in a game of tag,” he says. “They allow people the freedom to be less inhibited and to explore.”

But by far the best way to feed curiosity is to engage with new people, new places, and new points of view. Kashdan says an aversion to the unfamiliar — or what he calls “premature closure” — stifles curiosity. But novelty, even if uncomfortable or scary at first, acts like curiosity fertilizer. “The more you interact with new experiences or information, the more you realize you don’t know, which makes further exploration more attractive,” he says. At the same time, engaging with something new tends to drain it of its power to cause anxiety. “The highest level of anxiety you feel is always during the anticipation of something new,” he says. “Stick it out, and you see that the anxiety is manageable and can even be enjoyable.”

There may be safety and security in the familiar. But there’s evidence that curiosity and the novel experiences that nourish it may pave the way toward a more meaningful and fulfilling life.

Your life, sourced by science. A new Medium publication about health and wellness.

https://elemental.medium.com/curiosity-is-the-secret-to-a-happy-life-3dc5d940d602