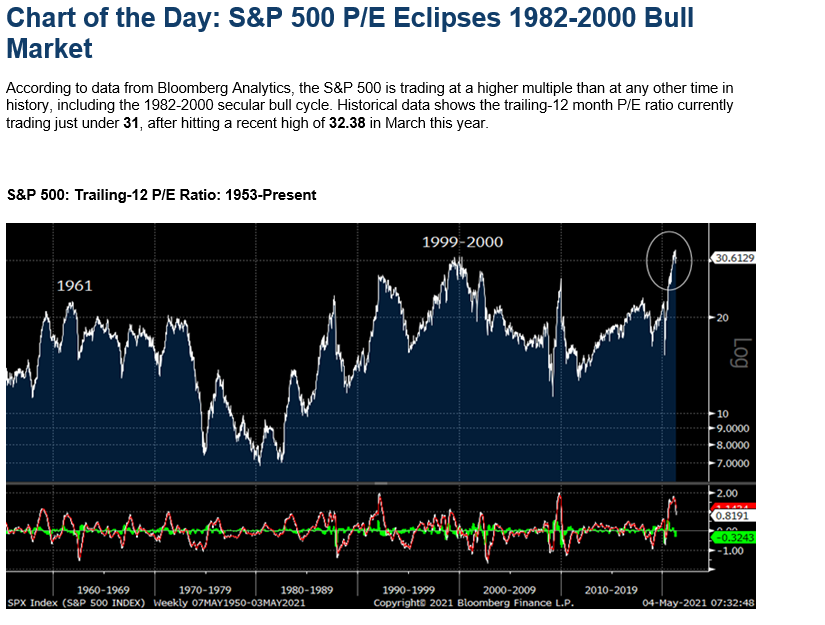

1. S&P 500 P/E Eclipses 1982-2000 Market

Dan Wantrobski Janney Technical Strategist

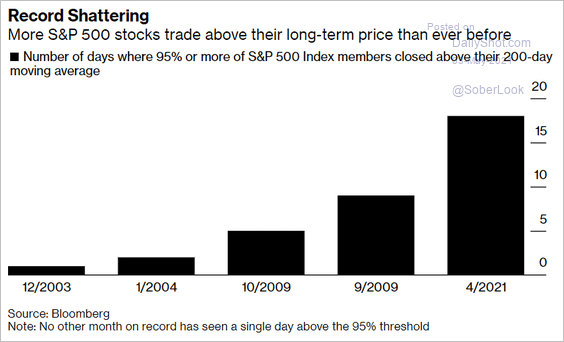

2. Equities: How frequently did 95% of S&P 500 stocks close above their 200-day moving average?

Source: @markets Read full article

https://dailyshotbrief.com/the-daily-shot-brief-may-3rd-2021/

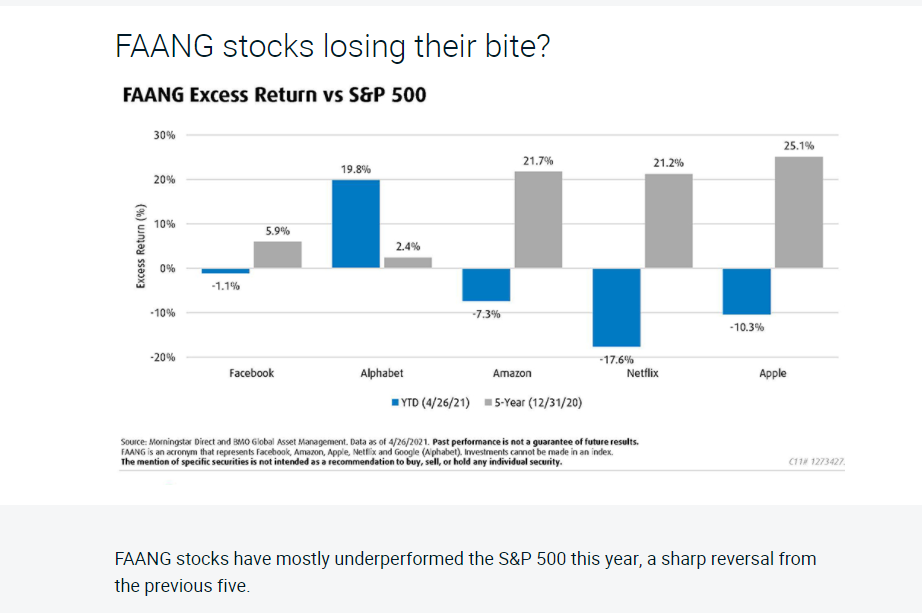

3.FANG Stocks Lagging S&P

BMO Global Research

FAANG stocks losing their bite? | BMO Global Asset Management (bmogam.com)

4. 90% of S&P Companies Beat Earnings.

Dave Lutz Jones Trading Nearly 90% of S&P 500 companies beating earnings estimates this quarter (65% is post-1994 average) – At the beginning of the year, “the consensus Wall St. SPX earnings estimate for 2021 earnings was $167. Today its $186. In four short months, WallStreet has had to revise up their outlook by 11%. That’s a massive miscalculation YTD:” MS’s Andrew Slimmon

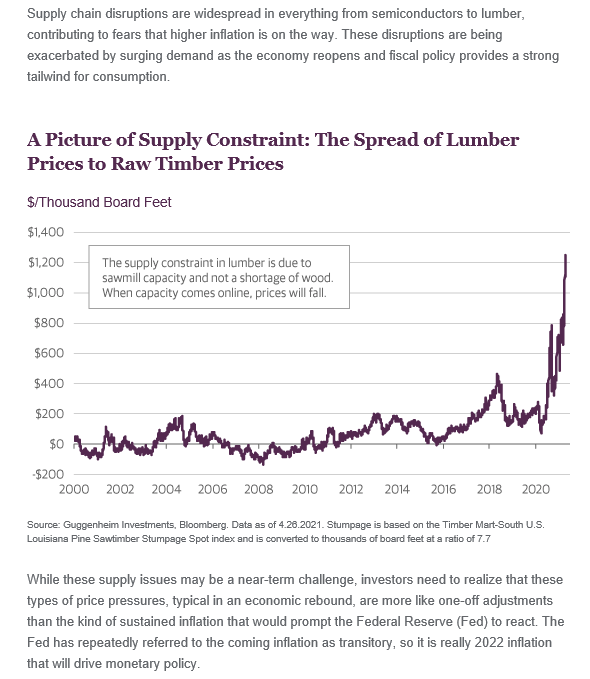

5. Lumber-Plenty of Supply of Wood…Price Increase Driven by Supply Chain Disruptions.

Guggenheim-The Coming Disinflation

https://www.guggenheiminvestments.com/perspectives/macroeconomic-research/the-coming-disinflation

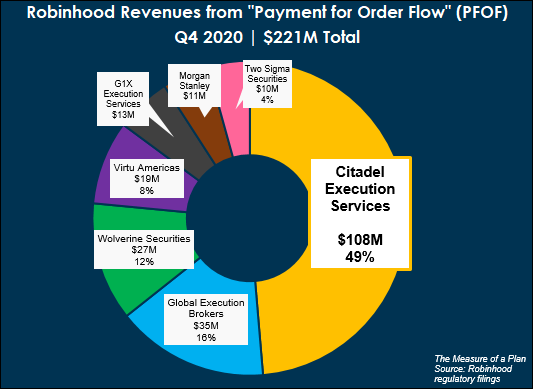

6. Robinhood Earnings

A federal securities filing shows that Robinhood was paid $331 million by market-makers that execute stock and options orders for the broker’s clients in the first quarter, when the GameStop frenzy grabbed hold of the market. That is up from $91 million in the first quarter of 2020.

This kind of revenue, called payment for order flow, has become a more important way for brokers to make money now that they don’t charge commissions on each trade. Robinhood doesn’t release its full revenue or expense numbers, so the filings are the clearest window into its operations. They show that Robinhood is on track to make well over $1 billion in revenue this year and perhaps more than $2 billion, should this level of activity hold up.

Robinhood Filing Shows Enormous Growth in Controversial Revenue Source By Avi Salzman https://www.barrons.com/articles/robinhood-filing-shows-enormous-growth-in-controversial-revenue-source-51620065477

Robinhood End of 2020 Payment for Order Flow Breakdown

https://themeasureofaplan.com/robinhood/

7. ARKK Innovation Hits -30% from Highs

ARKK….Closes right on 200 day.

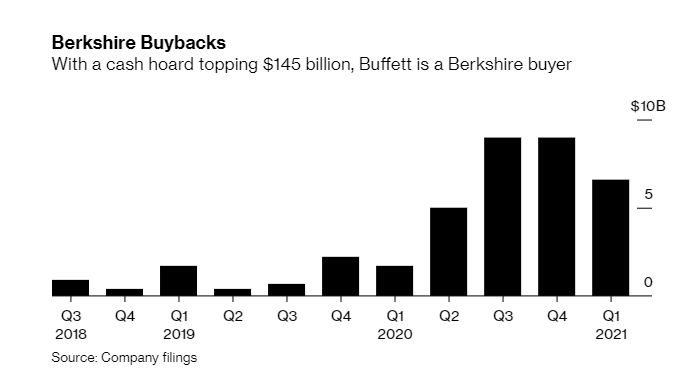

8. Buffett Buys Back $6B Shares First Quarter.

With a cash pile of more than $145 billion at the end of the 2021’s first quarter, Buffett bought back some $6.6 billion in Berkshire shares during the first quarter. The pace of buybacks has been decelerating from prior quarters, however.

Buffett used to describe share buybacks as basically an accounting gimmick, as something done in order to goose a stock price, and often done without enough price discipline. He’s typically wanted to deploy cash in big acquisitions or stock purchases.

But in 2018 he loosened his buyback policy as Berkshire’s cash kept growing. “We can’t buy companies as cheap as we buy our own and we can’t buy stocks as cheap as our own,” Buffett said.

Warren Buffett Wants to Make You Happier, Smarter and Richer By Suzanne Woolley

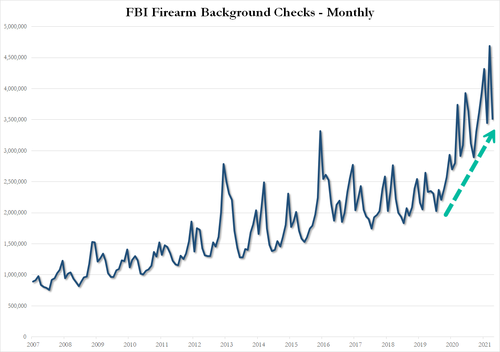

9. 3.5M Gun Background Checks in April 2021

Panic Hoarding Guns Now Enters 16th Month As Biden Seeks Ban BY TYLER DURDEN

Americans continued to panic hoard guns for the 16th straight month in April, according to the FBI’s National Instant Criminal Background Check System’s (NICS) statistics report. The data provides insight into the trends behind Americans purchasing firearms.

The FBI’s NICS logged 3.514 million background checks in April 2021, which is more than any other April on record. Background checks have been elevated since the virus pandemic began and recently supercharged under an anti-gun Biden administration.

Visualizing the panic hoarding…

The Small Arms Analytics & Forecasting group (SAAF) told the Washington Examiner that gun sales topped 1.8 million for the month, another record for April.

“The April 2021 number of just over 1.8 million firearms sold is large,” SAAF Chief Economist Jurgen Brauer said. “In fact, it is the largest April figure on record. While the year-over-year percentage increase of 2.1% is relatively modest, it nonetheless represents growth on top of last year’s COVID-19 panic-driven sales boom. Handgun sales declined in April 2021 relative to the same month last year, so that long-gun sales drove this April’s overall increase.”

https://www.zerohedge.com/political/panic-hoarding-guns-now-enters-16th-month-biden-seeks-ban

10. Master your Emotional Intelligence For Better Communication

By Eddy Baller | 09/23/2017 | 0 Comments

Emotional intelligence—or “EQ”—is one of the most powerful tools for success in life. It’s arguably a bigger factor than IQ in determining the success of our relationships. And since relationships are at the core of everything we do in life, it makes sense that EQ would be at the top of the list for crucial life skills.

What is EQ?

Emotional intelligence has five main components:

Self-awareness—The ability to understand our own emotions, where they come from, and what effects they have on others.

Motivation—An internal drive to do better and achieve more.

Self-regulation—Our ability to control our emotions, especially when things get tense. People with high EQ will avoid hurling personal insults or engaging in emotional outbursts.

Empathy—The ability to recognize the feelings of others and put ourselves in their place for better understanding.

Social skills—Being able to communicate what we mean so that others understand.

When we’re skilled in all of these areas, we can readily gain the support of others, avoid conflicts, and lower stress. Our relationships—both personal and professional—will flourish.

How to increase your EQ

Unlike IQ, emotional intelligence is something we can develop with practice and time. It’s a skill that will pay off many times over in the workplace, at home, in our romantic lives—and for our own peace of mind.

Here are 4 ways to improve emotional intelligence:

1. Pay attention to your own feelings

One of the first steps in improving your EQ is paying attention to how you feel. It may seem simple enough, but our own feelings can be neglected in day-to-day life. This can increase stress and affect other people around us as we become more fatigued from built-up pressure.

Start with body language. Pause and pay attention to your body language when you experience different emotions, positive or negative. What do you instinctively do when you get bad news? A lot of people will clench their fists, tighten their breathing, and tense up their shoulders. Release the tension consciously and take control of your breath.

Also, consider writing down your feelings in a journal. It’s not only a good release, but can help you understand more details about how you came to feel a certain way.

SUGGESTED READING: Communication is Your Responsibility

2. Observe other people

How do people react around you in different situations or when you do certain things? Many people with low EQ will blame others for their feelings and reactions, never taking responsibility for how they process external events. By paying close attention to others, you may notice a pattern of personal behavior which will give you the opportunity to nip your negative and reactionary responses in the bud.

3. Empathize

Pause before reacting and put yourself into the other person’s place. How would you feel in his or her position?What could be a possible reason for their behavior? I’ll often do this while driving. It’s a quick way to release tension and prevent road rage. Sure, “X” drove fast and cut me off, but maybe “X” just had a fight with his or her spouse and isn’t conscious of erratic driving. That’s not a justification, but understanding others’ behavior helps diffuse many situations—while also making us better negotiators.

4. Active listening

Here’s one skill that many people could improve. Active listening is a deliberate attempt to not only hear what someone is saying, but to understand it. This sounds simple enough, but many people will nod to give the impression of listening, but will actually just be waiting to reply—or ignore the other person altogether.

Those with low EQ will impulsively start talking about themselves every chance they get, no matter what the topic is.

For active listening, try what I call the “Snowball Technique.” This approach, when successfully employed, will build a conversation, “snowballing” into mutual understanding. Here’s how it works:

Listen to his/her words—Focus on each thing he/she says and pay attention to key points. This will come in handy later.

Repeat the message back to him/her—Repackage what he/she just said in your own words. This will show you’re listening and also help you understand better because you’re using your own language. Any misunderstandings can be filtered out here.

Add your opinion, if appropriate—To keep things conversational, consider adding your two cents. But be aware of others sharing thoughts or feeling that don’t need your opinion. In these cases, just acknowledge that you heard and understand.

Dig deeper—Now bring it full circle and ask a “why” question. Why is he/she interested in that? Why did he/she start engaging in this activity? This question will uncover motivations and go beyond the superficial.

Recall—Since you were paying close attention, you’ll be able to bring up points or topics that came up earlier in the conversation. You can tie it into the current topic or move to another one. Either way, your listening abilities will be clear and will create the opportunity to connect on a deeper level.

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..