1. ETFs With The Lowest Valuations

Bargains Abroad

Instead, most of the bargains are found in ETFs that focus on equities outside the U.S. Of the 20 cheapest funds by valuation, the vast majority target international equities, and emerging market stocks in particular.

Of course, an ETF with a low P/E ratio doesn’t necessarily mean it’s a great investment. It simply means most of the stocks in the fund are trading at low prices compared to their recent earnings.

It’s a good starting point for value investors, but it’s just the first step in a more comprehensive due diligence process.

https://www.etf.com/sections/features-and-news/etfs-lowest-valuations?nopaging=1

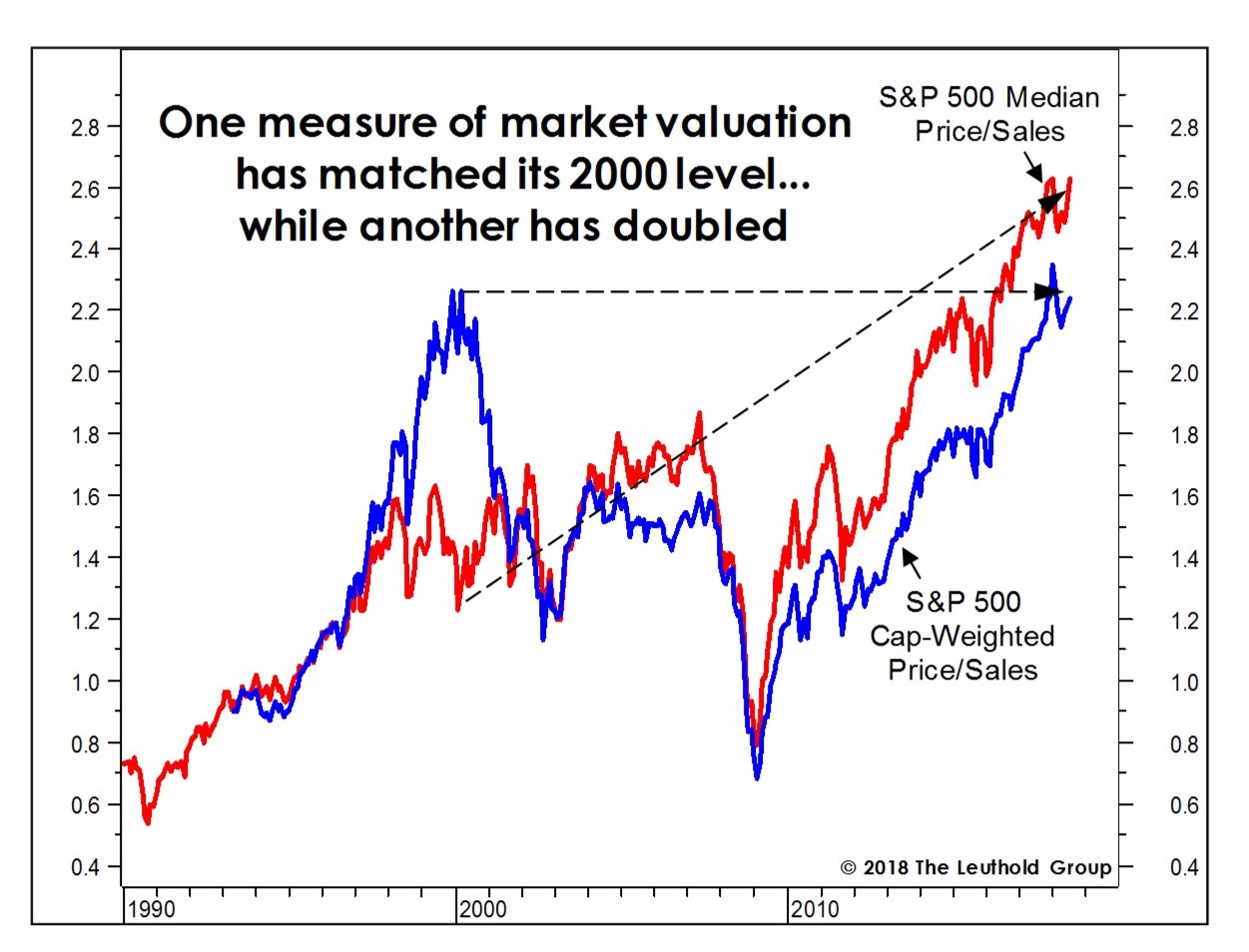

2.Medi an Price to Sales S&P 2x Higher than 2000

“Overvaluation in 2000 was highly concentrated; today it is pervasive, with the median S&P 500 Price/Sales ratio of 2.63 times more than double the 1.23 times prevailing in February 2000.

By Sue Chang

marketwatch

https://www.marketwatch.com/story/behold-the-scariest-chart-for-the-stock-market-2018-08-08

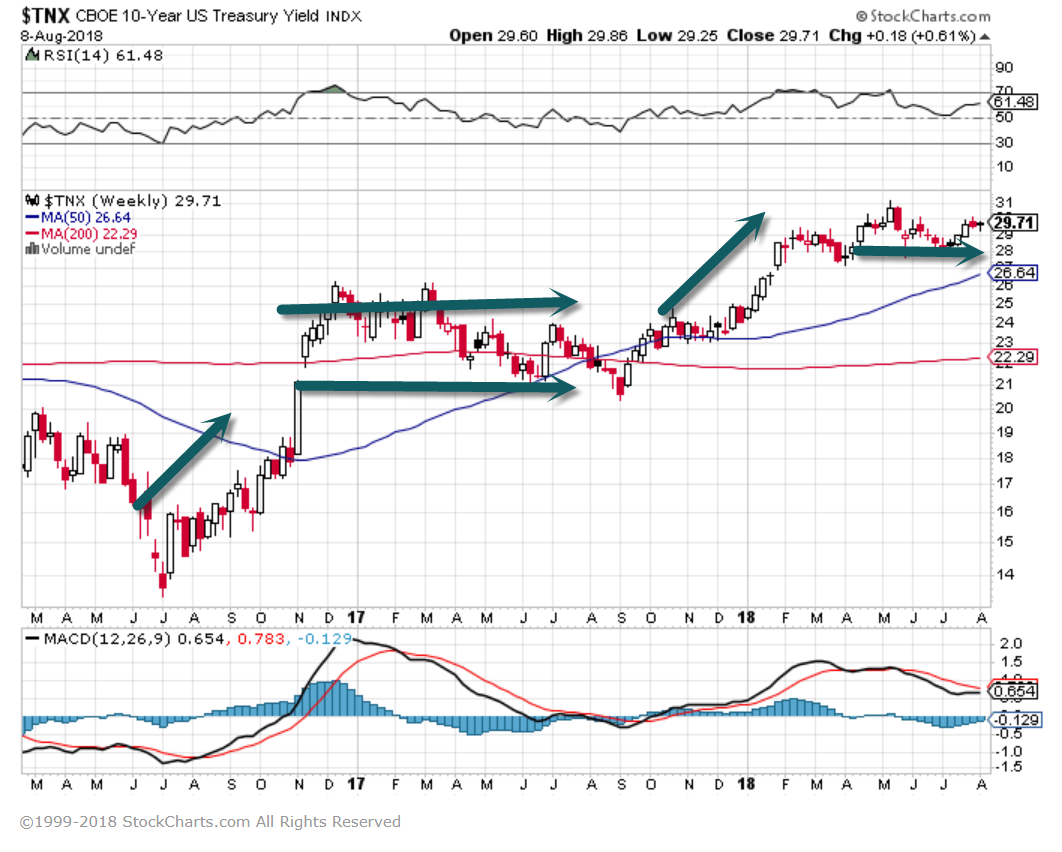

3.10 Year Treasury Yield Index…Spiked end 2016..Sideways 9 months…Spiked end 2017…sideways 7 months…..Rest of Year???

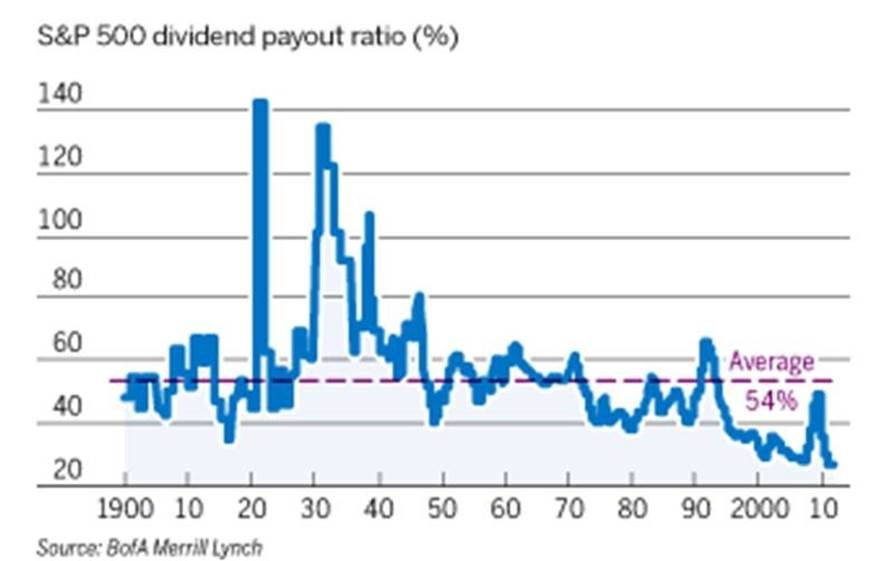

4.Dividend Payout Ratio has Dropped from 52% to 40% 1954-2017

That said, the dividend payout ratio for S&P 500 companies dropped from an average of 52% from 1954 through 1994 to an average of just 35% from 1995 through 2017. It was at 40% as of year-end 2017.

https://www.etf.com/sections/swedroe-valuations-too-high/page/0/2

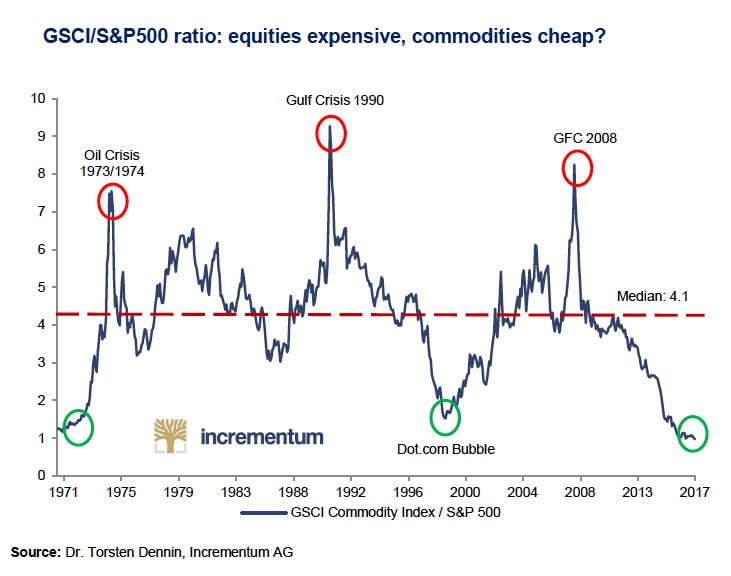

5.Ratio of Commodities to S&P 500….Cheapest in History?

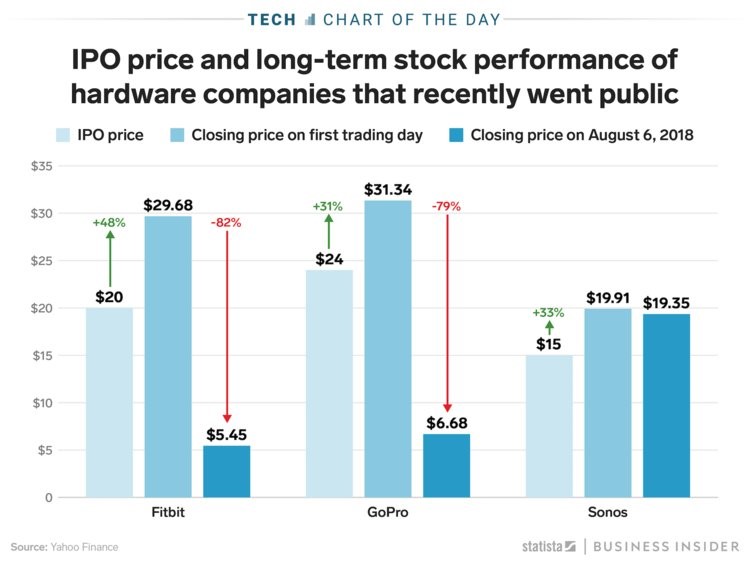

6.Sonos IPO Affected by Trade War and Recent Hardware Offerings.

Sonos will attempt to avoid the same fate suffered by fellow hardware companies FitBit and GoPro, whose share prices have dropped 80% since they went public

Aug. 7, 2018, 1:39 PM

Sonos’ IPO last week showed a promising forecast for the home audio system company, with shares eventually level ling out to about $19.

The company is now valued at $1.5 billion , but investors are concerned about Sonos’ long-term endurance as it gravitates toward producing products with longer shelf lives, which result in longer replacement cycles.

As this chart from Statista shows, the track record of other consumer hardware companies like Fitbit and GoPro is a trajectory that Sonos should avoid. Both companies saw encouraging IPO results before declining sales eventually caused share prices to drop nearly 80%.

Jenny Cheng/Business Insider

Get the latest Fitbit stock price here.

https://www.businessinsider.com/sonos-fitbit-gopro-ipo-company-shares-dropped-80-percent-2018-8

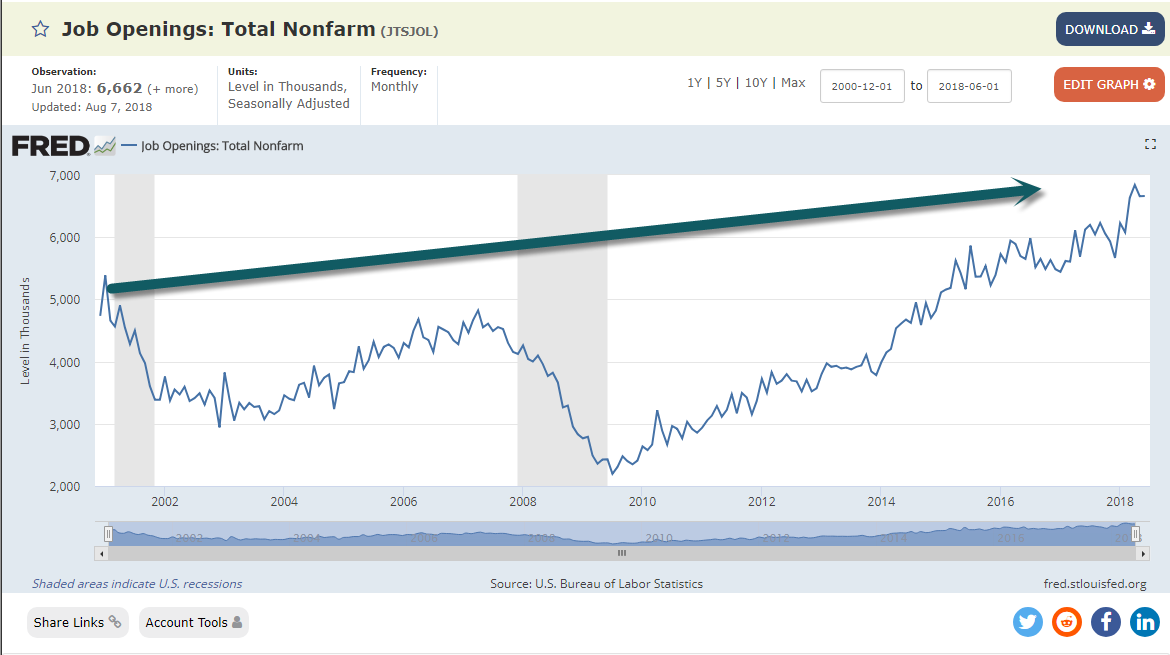

7. 6.7M Job Openings Unreal….17 Year High.

Jobs Go Unfilled as the Economy Expands

U.S. job openings reached 6.7 million last quarter, a 17-year high, with demand for workers growing the most in transportation

https://www.wsj.com/articles/jobs-go-unfilled-as-the-economy-expands-1533677955

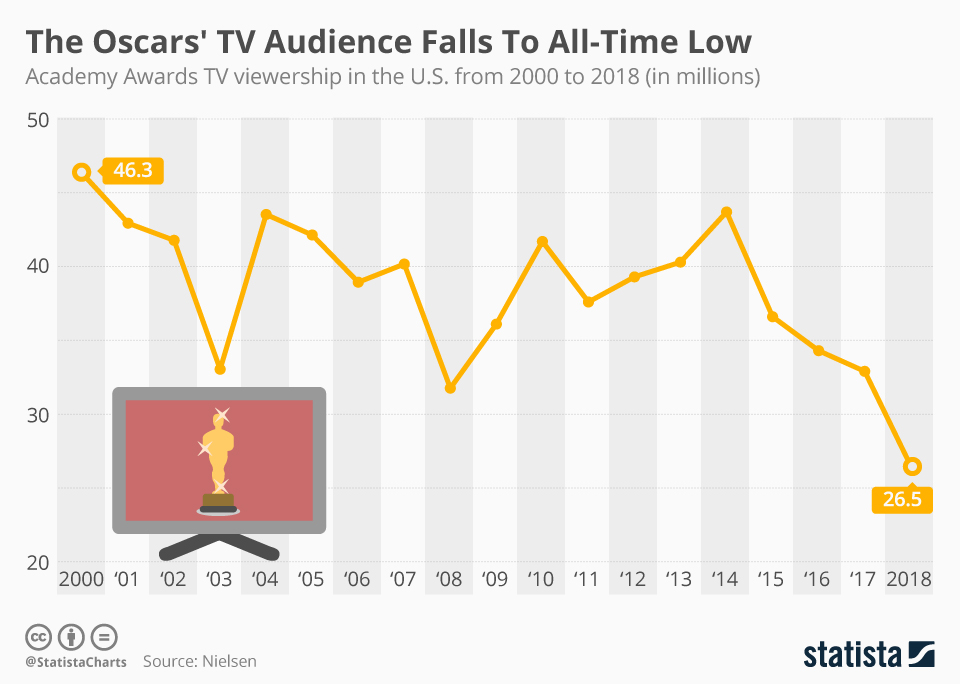

8.Oscar Audience Down 40% Since 2000.

So why switch things up?

This year’s Oscars audience was 26.5 million…second only to the Super Bowl as the most-watched TV broadcast in the U.S. The bad news? That was the least-watched Oscars telecast since they’ve been keeping track.

Via Statista

From Morning Brew

9.Read of the Day….Howard Marks: We Are in the 8th Inning

A summary of Marks’ interview at the Delivering Alpha conference

August 05, 2018 | About: OAK +0%

Howard Marks (Trades, Portfolio) of Oaktree Capital was just interviewed at the 2018 Delivering Alpha conference. Marks (Trades, Portfolio) is the author of :The Most Important Thing” and the upcoming “Mastering the Market Cycle.” He has been the chairman of Oaktree Capital Management LP since the inception of Oaktree in 1995. His public memos are famous in the investing world and Warren Buffett famously said they are the first thing he reads when he finds them in the mail.

I read everything Marks puts out and try to listen closely when he speaks somewhere. There are a few key takeaways from this appearance although his message remains nuanced.

Marks estimates we are late cycle

Marks believes we are in the eighth inning, but there could be extra innings. Extended bull markets are usually greeted with four words: “It’s different this time.”

It seems to me there is some of this dynamic going on. Retail is an industry that’s been proclaimed dead. We’ve gotten used to the current super low interest rates which have favored certain business models relying on future cash flows (that may or may not appear) and highly levered ones. Interestingly, both tend to be avoided by value investors.

In the 50 years Marks has followed markets he observed that people tend to come up in the later stages with rationalizations why cyclicality no longer applies. According to Marks the current key question is: Do you want to push your chips out or do you want to take a few off?

What to expect from the market

Marks said eight months ago before the tax bill passed that the market was actually less attractive. The forward price-earnings ratios went down from meaningfully overpriced to about average. Even though earnings projections have risen by double digits, the market is only up a few percent. Meanwhile there are a lot of potential negatives out there, Europe and trade wars for example.

The most important thing, he said, is, “People who haven’t been around very long tend to think good news means more appreciation. But that’s not necessarily true.”

Investors underestimate the discounting mechanism of the markets and expect that when things are good (as they currently are) that means the market will run up.

What cracks the bull market?

The earnings-per-share growth we are experiencing is a bump due to the tax bill. It is not due to continuing earnings-per-share growth. Next year it may not be there. Specifially asked to guess what will crack the bull market, Marks offered four suggestions:

- $100 dollar oil.

- Rising interest rates.

- Strong dollar.

- Something else.

He says his money is always on the fourth.

If he can’t bet on a surprise, rising interest rates seem most threatening.

We have artificial low rates and have had them for nine or 10 years. It is unclear how the unwind will go. The yield curve is something people are talking about already. That’s the curve you’ll observe if you draw a line through treasury interest rates at various maturities, two-year, five-year, 10 year, and so forth. Usually the interest rate rises as you go further out in maturity. When it doesn’t and interest rates on the two-year and the 10-year are the same, you have a flat yield curve. This happpened before almost every recession. However, it signals false positives as well.

Another worry of Marks is the national debt. We will add a trillion per year to the national debt. Is there a number that matters? People used to be prudent about national debt, but now there is no prudence, he said. If you want to take away the punchbowl you aren’t getting votes. The Republicans used to play this role, but they voted on the tax bill knowing what it would do.

Where are the best opportunities?

Move forward but with caution. Marks said Oaktree is already a cautious firm and currently more cautious than usual.

“The greatest achievement of Alpha is to generate almost the same return as the risk taker but without that much risk,” he said. “There is a lack of scepticism and a lot of risk appetite. It is a mistake to try and match the best performance.”

On a high level Marks suggests this isn’t a great time to try and hit the ball out of the park. Which is something I wholeheartedly agree with.

Specific markets Marks likes are emerging market equities, private lending, real estate lending and infrastructure. He jokingly calls everything with a CUSIP overpriced.

Disclosure: Author is long Oaktree Capital (NYSE:OAK).

https://www.gurufocus.com/news/717732/howard-marks-we-are-in-the-8th-inning

10.What the Hell Are Your Blind Spots?

LEVEL 3 – WHAT THE HELL ARE YOUR BLIND SPOTS?

The more you become aware of your own emotions and your own desires, the more you discover something terrifying: you are full of shit.

We realize that a large percentage of our thoughts, arguments, and actions are merely reflections of whatever we are feeling in that moment. If I am watching a movie with my wife and I’m cranky because I had an argument with my editor that afternoon, I’ll decide that I hate the movie. And the more my wife tries to convince me the movie was good, the more I’ll relish the fact that I get to argue with her about it – because it suddenly becomes a way to justify my anger.

(By the way, if you ever wondered why we tend to fight the most with the ones we love the most, this is partly why: we can use them as an emotional punching bag to validate all the crap that we are feeling, whether they deserve it or not – usually not.)

We all think of ourselves as independent thinkers who reason based on facts and evidence, but the truth is that our brain spends most of its time justifying and explaining what the heart has already declared and decided. And there’s no way to fix that until you’ve learned to recognize what the heart is saying.

I’ve written quite a bit about how flawed our conscious minds are, both in my book and on this site. But to give a quick synopsis:

- Our memories are unreliable and often flat-out wrong, especially when it comes to remembering how we felt at a certain time or place. Our ability to predict our thoughts and feelings in the future is even worse.

- We constantly overestimate ourselves. In fact, as a general rule, the worse we are at something, the better we think we are, and the better we are at something, the worse we believe we are.

- Contradictory evidence can often make us surer of our position rather than inspire us to question it.

- Our attention naturally only focuses on things that already cohere to our pre-existing beliefs. This is why two people can watch the exact same event and come away with two completely contradictory memories of it (think of two opposing sports fans both convinced they saw the ball land in or out of bounds.)

- Most of us, when given the opportunity, will tell small lies to improve our results. Sometimes (i.e., usually), we’ll even tell these lies to ourselves.

- We are abysmal at estimating statistics, making cost-benefit decisions, or reasoning about large populations of people. It’s actually both depressing and hilarious how bad we are this.

I could keep going, but I’ll stop there. Basically, the point is that you suck, I suck, everybody sucks. Humans kind of suck. All the time.

And that’s OK. The important thing is just that we’re self-aware about it. If we know our weaknesses then they stop being weaknesses. Otherwise, we become enslaved to our mind’s faulty mechanisms.

Most of this comes down to a few things:

- Hold weaker opinions.Recognize that unless you are an expert in a field, there is a good chance that your intuitions or assumptions are flat-out wrong. The simple act of telling yourself (and others) before you speak, “I could be wrong about this,” immediately puts your mind in a place of openness and curiosity. It implies an ability to learn and to have a closer connection to reality.

- Take yourself less seriously. Most of your thoughts and behaviors are simply reactions to various emotions. And we know that your emotions are often wrong and/or meaningless. Ergo, you should take your shit less seriously.

- Learn your bullshit patterns. When I get angry, I get argumentative and arrogant. When I get sad, I shut down and play a lot of video games. When I feel guilty, I word vomit my conscience all over people. What are your ticks? Where does your mind go when you feel sad? When you feel angry? Guilty? Anxious? Learn to spot your coping mechanisms because that will tip you off next time you’re distracting yourself from your feelings. I realized years ago that when I’m healthy and happy, I enjoy playing video games a few hours a week. But when I start binging on a game, staying up all night and skipping work, it’s almost always because I’m avoiding some problem in my life. This has become a huge cue for me to sit down and figure out what’s going on with myself.

- Recognize the problems you create for yourself. My biggest problem is probably not being able to talk about my anger or sadness. I either escape through video games or become passive-aggressive by sniping at people around me. Both of these tendencies don’t help me. And I’ve learned to recognize myself when I start doing them. I’m able to say, “Hey Mark, you do this shit when you’re sad and you always regret not talking to someone.” Then I go talk to someone.

- Be realistic. It’s not about removing your faulty psychological reactions. It’s about understanding them so that you can adjust to them. The same way we all have some skills and activities we’re better at than others, we all have emotions we’re better at than others. Some people are bad with happinessbut good at managing their anger. Others are terrible with their anger but relish their happiness. Other people never feel depressed but suffer uncontrollable guilt. Others never feel guilty but struggle with feelings of depression. Where are your strong emotions and weak emotions? Which emotions do you respond poorly to? Where are your biggest biases and judgments coming from? How can you challenge or re-evaluate them?

Also, if you’re having trouble with this, one of the best ways to wrap your head around your blind spots is to get feedback from other people. Others often have a better perspective on us than we do, especially friends and family close to us. Asking them in a simple and safe way (by “safe,” I mean not exploding and threatening to castrate them with a spoon for insulting your honor) can lead to great gains in self-awareness.

This, of course, is much easier said than done.

THE THREE LEVELS