1.Turkey ETF -40% YTD

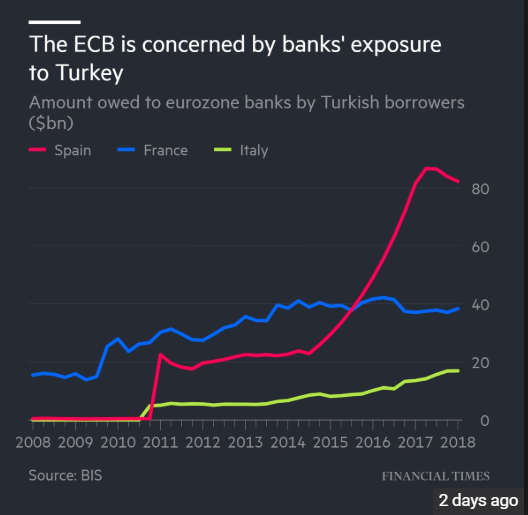

The roots of Turkey’s travails are no mystery. Erdogan pumped a congenitally volatile economy full of steroids in the election run-up, restraining interest rates and pushing a large guaranteed loan program through the banks. That jolted gross domestic product growth north of 7%, but fueled a vertiginous current-account deficit at 6% of GDP. Stress is focused on the banking system, whose clients owe $180 billion in short-term foreign-currency debt, figures Timothy Ash, senior emerging markets sovereign strategist at BlueBay Asset Management. That gets more expensive in lira by the day. “Turkey’s Achilles’ heel is that its banking system is used to intermediate large-scale foreign-currency borrowing,” says Robin Brooks, chief economist at the Institute for International Finance in Washington.

Erdogan compounded his problems by stumbling into conflict with President Donald Trump’s administration over Andrew Brunson, a U.S.-born, Turkey-based Protestant pastor arrested two years ago on charges of colluding with Kurdish terrorists.

Turkey Pays a Financial Price for Its Politics

By

Craig Mellow

https://www.barrons.com/articles/turkey-pays-a-financial-price-for-its-politics-1533916009

2.S&P Companies Had 85% Positive Earnings Surprises.

Equity Markets: This has been a strong earnings season.

Source: Market Ethos, Richardson GMP

https://blogs.wsj.com/dailyshot/

3.Consumer Staples Best Post Earnings Performance.

Best Sector This Earnings Season — Consumer Staples?

Aug 10, 2018

As noted in our prior post, the average stock that has reported earnings this season has gained 0.52% on its earnings reaction day. Below we break down the average earnings reaction day change by sector this season.

As shown, Consumer Staples stocks that have reported have averaged a huge gain of 2.09% on their earnings reaction days this season. Coming into this quarter, Consumer Staples was one of the most beaten down sectors of the year, so it looks as if investors got a little too bearish. Industrials and Consumer Discretionary stocks are also averaging big gains on their earnings reaction days, while Technology stocks are outperforming as well.

Not all sectors are seeing gains in reaction to earnings reports. Five of eleven sectors have seen their stocks average declines on their earnings reaction days this season. Real Estate, Health Care, and Materials stocks have been the weakest, but with average declines of just -0.20% or less, the declines haven’t been that painful.

https://www.bespokepremium.com/think-big-blog/best-sector-this-earnings-season-consumer-staples/

4.Top of Market?—Not by Flows….Money Markets and Bonds Take in Cash….International Markets Dumped Even Though Record Low Valuations Versus U.S.

FLOW SHOW– Investors in U.S.-based taxable bond funds deposited $4.2 billion for the week ended on Wednesday, the largest weekly inflow since April, according to Lipper. Of that amount, fund investors put $2.8 billion into U.S.-based corporate investment-grade bond funds, extending a streak since March, and deposited $828 million into high-yield bond funds

- Fund investors also showed demand for safe-haven assets and cash. U.S. Treasury funds took in $991 million, and money market funds attracted more than $16.6 billion, which was the most in a month.

- Domestic equity funds posted withdrawals of $2.5 billion, after three weeks of inflows, Lipper data showed. U.S.-based international equity funds attracted $1.5 billion, the most since April.

Europe’s equity funds have suffered outflows of about $55.8 billion in the five months through the end of July, the longest streak of redemptions since February 2017, according to data from EPFR Global

Chinese Investors Are Back to Dumping Hong Kong Stocks – Traders have sold more than $1 billion through the first two weeks of August

From Dave Lutz at Jones

5.Aerospace Defense ETF +60% Since Election…Almost a Double Since Early 2016

ITA ETF

6.Household/Consumer Debt in Great Shape….Corporate Debt See #7

Financial Obligation Ratio – FOR

What is the ‘Financial Obligation Ratio – FOR’

The financial obligation ratio is the ratio of household debt payments to total disposable income in the United States, and is produced by the Federal Reserve. It measures how much household income is being spent on repaying debts and other financial obligations.

https://www.investopedia.com/terms/f/financial-obligation-ratio-for.asp

7.Corporate Debt

The Big, Dangerous Bubble in Corporate Debt

By William D. Cohan

Mr. Cohan is a former investment banker and the author of four books about Wall Street.

The $30 trillion domestic stock market seems to get all the attention. When the stock market sets new highs, we instinctively feel things are good and getting better. When it tanks, as happened in the initial months of the 2008 financial crisis, we think things are going to hell.

But the larger domestic debt market — at around $41 trillion for the bond market alone — reveals more about our nation’s financial health. And right now, the debt market is broadcasting a dangerous message: Investors, desperate for debt instruments that pay high interest, have been overpaying for riskier and riskier obligations. University endowments, pension funds, mutual funds and hedge funds have been pouring money into the bond market with little concern that bonds can be every bit as dangerous to own as stocks.

Unlike buying a stock, which is a calculated gamble, buying a bond or a loan is a contractual obligation: A borrower must repay a lender the borrowed amount, plus interest as compensation. The upside in a bond is limited to the contractual interest payments, but the downside is theoretically protected. Bondholders expect to get their money back, as long as the borrower doesn’t default or go bankrupt.

Leveraged Loans Outstanding Hit A Record

http://www.leveragedloan.com/leveraged-loans-cov-lite-volume-reaches-yet-another-record-high/

8.China Reviewing One Child Policy….Looking to the Future of Demographics.

China State Researcher Predicts End to Child Birth Restrictions

Bloomberg News

August 10, 2018 6:51 AM

- Latest sign policy makers reconsidering limits on family size

- Zhang called similar shift to two-child cap three years ago

A Chinese government researcher called for lifting limits on the number of children a family can have, in the latest sign that policy makers are considering ending decades of restrictive birth-control policies.

“We need to lift restrictions on births completely,” Zhang Juwei, director of the state-run Chinese Academy of Social Sciences’ Institute of Population and Labor Economics, said in an interview published Friday in China Newsweek magazine. “It has become an irresistible trend to allow people to make their own decisions on fertility, which will be the direction for the adjustment of population policy in the future.”

Bloomberg News reported in May that the country was planning to scrap birth limits as soon as this year. It would be a landmark end to a globally criticized policy — one of history’s biggest social experiments — that left the world’s most-populous nation with a worker shortage and an aging population comprised of 30 million fewer women than men.

Such demographic trends have weighed on President Xi Jinping’s efforts to develop China’s economy, driving up pension and health care costs and sending foreign companies looking elsewhere for labor. China’s State Council last year projected that about a quarter of its population will be 60 or older by 2030 — up from 13 percent in 2010.

Similar remarks by Zhang three years ago presaged China’s last move to relax family planning policies. Back then, Zhang published an article in state media calling for raising the birth limit to two children from one and allowing families to “make their own reproductive decisions.” Three weeks later, the ruling Communist Party announced that it would adopt a two-child policy.

Chinese Premier Li Keqiang in April received an initial feasibility study that said the impact of lifting birth restrictions across the country would be “limited,” Bloomberg reported in May, citing a person familiar with discussions. Li asked for further research on the social effects of ending the policy altogether.

“There have always been concerns in the past that the Chinese population might explode after the implementation of a two-child policy, but that absolutely didn’t happen,” Zhang said in the interview.

— With assistance by Dandan Li

9.Sell High and Buy Low….Most Investors Would Rather Sit in Traffic Jam? The Psychology of Re-Bal.

Portfolio Rebalancing? Clients Would Literally Rather Be In Traffic

AUGUST 8, 2018 • JADAH RILEY

Nearly one third (31 percent) of investors said they would rather spend an hour sitting in traffic rather than rebalancing their portfolios, according to a recent study from Wells Fargo.

Many investors’ natural “wait-and-see” tendencies could be hindering investment return over time, according to a new report by Brent Leadbetter, John West and Amie Ko at Research Affiliates. In their report, the Research Affiliates cited the Wells Fargo study about investors’ inertia as evidence that ordinary individuals, left to their own devices, could harm themselves

Systemically rebalancing investment portfolios in a timely manner can help keep clients on the road to achieving their financial goals — improving long-term risk-adjusted returns and investment outcomes. For example, as if June 30, a portfolio with a 60/40 allocation of stocks and bonds, respectively, would have expected volatility of 8.6 percent, compared with volatility of 11.4 percent, a 30 percent increase, for an 80/20 portfolio, Research Affiliates said. Regular rebalancing can help investors maintain risk exposure that matches their tolerance, it added.

One problem: Most investors would rather be in bumper-to-bumper traffic rather than face-to-face with their portfolios, Research Affiliates said. This could be because traffic is a routine occurrence where drivers can passively spend the time listening to the radio, podcasts, or audiobooks.

Rebalancing requires investors to actively engage with their investments. They are forced to endure the highly emotional task of buying more assets that may have under-performed and selling assets that have proven to be winners in the recent past, the report said.

Maintaining a disciplined approach when rebalancing is key to staying on track. Financial advisors can help investors overcome their behavioral barriers by adopting a systematic rebalancing approach, the study found.

Advisors can first help clients to identify their limiting financial behaviors, the report said. Next, enacting a rules-based rebalancing framework, free of emotion and subjectivity, will create clear guidelines for investors. By “institutionalizing contrarian investment behavior,” advisors can dramatically increase the likelihood that their clients will receive the benefits of rebalancing, the study suggests.

To read more stories , click here

10.4 Steps to Becoming a Great Team Leader, From a Top-Rated CEO

Four key areas to focus on to help you become a stronger leader and allow your team the room they need to succeed.

By Robert GlazerFounder, Acceleration Partners, speaker, and author of Performance Partnerships@robert_glazer

CREDIT: Shutterstock

I recently learned that I have been ranked the No. 2 CEO in the United States in the small and medium business category by Glassdoor.

The ranking, which compares voluntary employee feedback from over 770,000 companies found on Glassdoor, is certainly an honor. But the recognition, to my mind, is misleading. I’m not the best CEO; I happen to lead the best team, and that makes my job easy.

The job of CEO is decidedly team- and direction-focused. CEOs need to set the course, ensure consistency and develop and reinforce core values. After that, the job is simply to hire great people and get out of their way. Ultimately, what has made Acceleration Partners (AP) successful is my team.

Of course, it’s not really that easy to create and lead a successful team-based company. It helps to focus in on the following four key areas. Advancing in these areas will help you become a better leader, one whose employees will thrive both on the job and off.

- Values and vision

All CEOs must establish and define what kind of company they want to be leading and why. Think carefully. What are your goals?

Defining your company’s vision and core values forms the foundation for what both you and your employees do every day.

Successful teams depend on this common knowledge. They look to the company’s values and vision to help them make decisions in times of uncertainty or adversity. That’s why you must establish your vision and values early, communicate them clearly and reinforce them often.

Having a deep understanding of who you are and what you want to accomplish will make every other step easier. You will be able to assemble teams of people who share your core values and are excited by your vision, and those people will propel the business forward.

- Consistency and clarity

More than anything else, CEOs need to be honest, authentic and consistent about the values they set, their behavior and the expectations they have for everyone on their teams.

At AP, the core values that we determined were critical years ago have held firm through a lot of changes. Business strategies may come and go, but I remain committed to the company’s core principles. This allows me to be my authentic self; I never have to say or do something that conflicts with my personal values.

Leaders need to be comfortable being unapologetically who they are, because that’s the way to set the tone for an honest and authentic company. As Gandhi once said, “Happiness is when what you think, what you say and what you do are in harmony.”

Employees do their best when they know what to expect. There is nothing that alienates employees faster or creates a toxic culture more quickly than doing one thing and saying another.

- Holistic focus and capacity-building

Great CEOs focus first and foremost on their people–helping them improve and build their capacity so they can be the best version of themselves.

This isn’t just about what happens in the office. I want my employees to improve and grow holistically, across all areas of their lives. I’ve found this approach helps my employees become happier and healthier, which translates naturally to increased performance.

Too many CEOs focus only on that last piece–performance at work. But caring solely about results instead of people tends to burn people out. Great CEOs seek a greater purpose. They help their people thrive by setting high standards and holding everyone accountable–even themselves.

- Personal development

It’s difficult to lead others if you don’t have a clear sense of who you are and where you are going. Leadership programs are designed to help you discover your own best leadership style. They can also help you learn how to design the systems that will work best for you and your particular mission.

If you aren’t sure what you want or what your core values are, this is also the place to start–because you won’t be able to create company values without being clear about your own values first (see No. 1 above).

Plus, investing in personal development allows you to lead by example. Part of managing productive, happy teams involves consistently raising the proverbial bar–both for employees and for yourself.

Whatever I expect of my employees at AP, I need to expect of myself too. I’m uncompromising in my standards, but I live by those same standards. I’m right there in the trenches, doing the same things and demonstrating a commitment to meet the same goals I set for my team.

In the end, great leadership is about cultivating greatness in others. If you set goals you are passionate about and work toward them authentically, your team will take care of the rest.

PUBLISHED ON: AUG 1, 2018