Sorry to all Subscribers – we experienced some technical difficulties during the past week. All notifications and posts will now resume as normal.

Thank you!

View From the Top Team

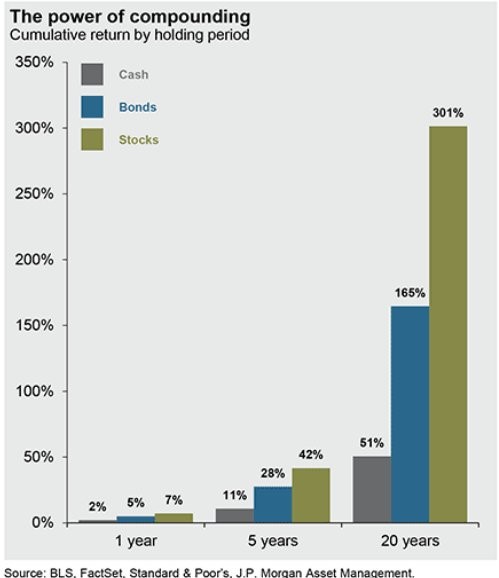

1.The Power of Compounding….Holding through 2 Massive Bear Markets.

In the past 20 years, equity investors have suffered through the two largest bear markets since the 1930’s yet ended up 300% ahead

https://twitter.com/ukarlewitz

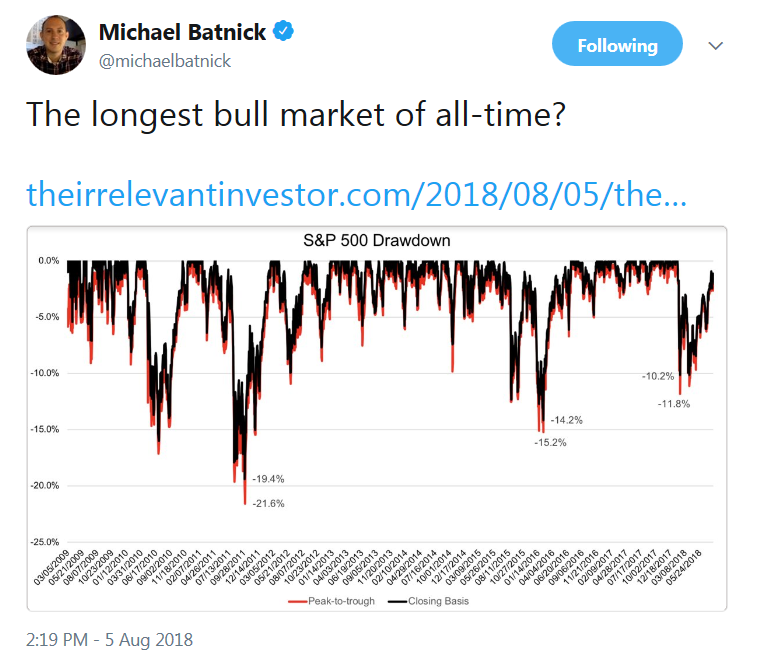

2.Double Digit Drawdowns in the Bull Market.

https://twitter.com/michaelbatnick

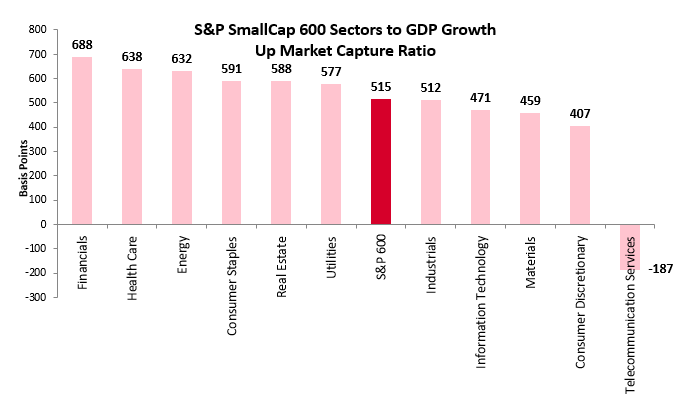

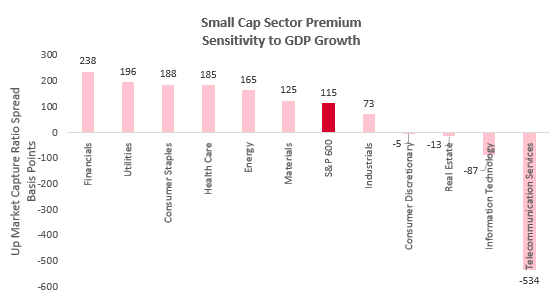

3.In Small Caps, Financials Rise Most From GDP Growth

While U.S. GDP growth is beneficial for stocks in general, the growth has been better for small caps than for large- or mid-caps. On average for every 1% of GDP growth, the S&P SmallCap 600 has risen 5.2%, while S&P MidCap 400 and S&P 500 have risen a respective 4.9% and 4.0%. Within small caps, the financials, health care and energy sectors have risen most with growth, gaining on average 6.9%, 6.4% and 6.3%, respectively for every 1% of GDP growth.

Sources: S&P Dow Jones Indices and Bureau of Economic Analysis, U.S. department of Commerce. https://www.bea.gov/national/index.htm#gdp Data is Gross Domestic Product percent change from preceding period, annual. S&P 600 and sector data is from 1995 – Dec 2017, except Real Estate is from 2002. All Data ending Dec. 29 ,2017. Index data is Total Return.

Although in small caps, financials have delivered 50 basis points more of return than health care from each 1% of GDP growth on average, the financial small cap premium is by far the most sensitive to GDP growth. For every 1% of GDP growth on average, small cap financials have returned 2.4% more than large cap financials.

Sources: S&P Dow Jones Indices and Bureau of Economic Analysis, U.S. department of Commerce. https://www.bea.gov/national/index.htm#gdp Data is Gross Domestic Product percent change from preceding period, http://www.indexologyblog.com/2018/07/27/in-small-caps-financials-rise-most-from-gdp-growth/annual. S&P 600 and sector data is from 1995 – Dec 2017, except Real Estate is from 2002. All Data ending Dec. 29 ,2017. Index data is Total Return.

http://www.indexologyblog.com/2018/07/27/in-small-caps-financials-rise-most-from-gdp-growth/

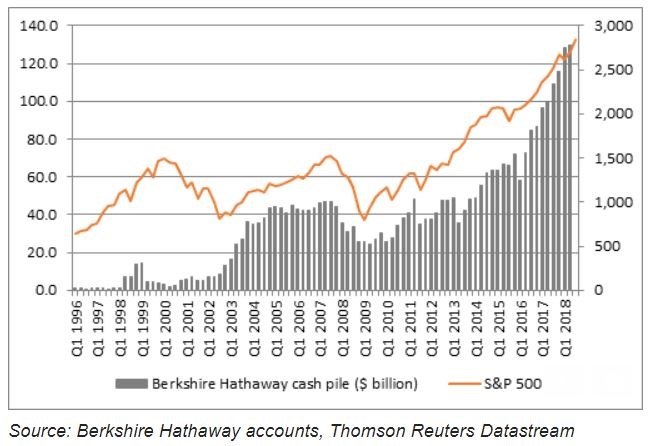

4.Warren Buffett’s growing cash pile and the big read-in for investors

Watch out when the ‘ultimate contrarians’ are sitting on the sidelines, says AJ Bell investment director

The latest results from Berkshire Hathaway Inc. show that the Oracle of Omaha has plenty of cash sloshing around.

And that could be a warning sign for a bull market that’s pushing ever higher, as well as clear evidence that Berkshire BRK.A, +1.31% BRK.B, +1.64% Chairman Warren Buffett is having a tough time putting the conglomerate’s money to work, according to Russ Mould, investment director at AJ Bell, which provides online investment platforms and stockbrokerage services.

“Yet another increase in the total cash pile at his Berkshire Hathaway, to $129.6 billion, despite $12 billion in net new investments in traded securities in the second quarter (mainly Apple AAPL, -0.80% ), suggests that master investor Warren Buffett is still having difficulty in finding value in U.S. — and perhaps global — stocks,” Mould said in a note to clients on Monday.

Read: Profit surges at Buffett’s Berkshire Hathaway in the second quarter

Here’s his chart showing how Buffett’s cash mound has grown and grown:

“This is something that investors should consider, as key indexes such as the S&P 500 SPX, +0.38% and FTSE 100 UKX, +1.09% make heavy weather of getting back to, and breaking away from, the all-time highs they set earlier in the year,” said Mould.

As well, investors and executives should take note that “ultimate contrarians” Buffett and partner Charlie Munger are sitting on the sidelines when it comes to acquisitions. Mould noted how Buffett warned in his annual shareholder letter in February of this very thing: Not enough good companies were available to buy at reasonable prices.

Yet research from Moody’s Analytics shows the value of global mergers and acquisitions shooting to $2.6 trillion in the first half of this year, just below a record set in 2007, said Mould.

“M&A tends to peak when animal spirits are running high and often when executives feel their own shares are expensive enough to make them a valuable acquisition currency (not that this is necessarily a good thing for the sellers and the recipients of those shares, namely investors),” he said.

He noted that Berkshire Hathaway’s cash pile grew in 1998-99, just ahead of the bursting of a tech-stock bubble, then again in 2005 to 2007, as markets again became frothy. But then the Berkshire sage and company used the period from 2000 to 2003, and then 2007 and 2009, to buy assets at lower valuations as markets were melting down.

Also read: Warren Buffett’s favorite metric suggests some serious pain awaits investors

Berkshire’s growing mound of money comes as the stock market is just three weeks away from making history as the longest bull market on record.

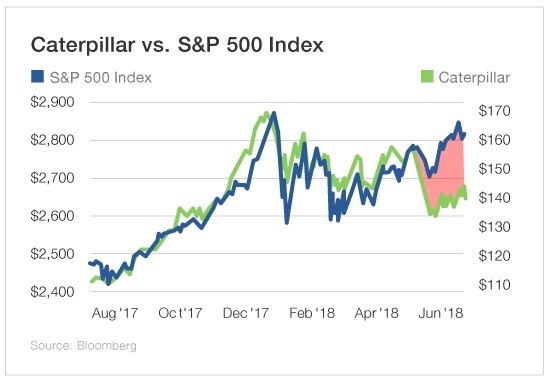

5.CAT Tractor Diverges from the Market

Are Industrials Like Caterpillar Still Market Movers?

by Benjamin DressingSaturday, August 4, 2018

The correlation between the S&P and industry is traditionally a tight one. Historically, as industrials perform well, the market follows suit.

However, over the past year or so, the S&P has outperformed industrials, due in no small part to the overperformance of tech stocks. This is worrying analysts who fear a market correction will be necessary to return the correlation to traditional levels.

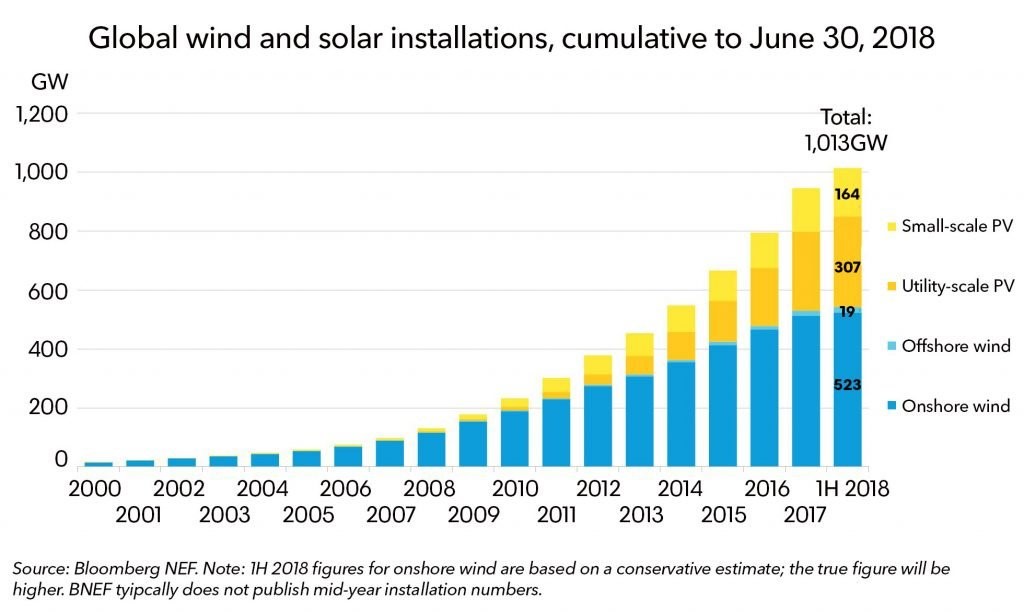

6.Global Wind and Solar Installations Update.

https://twitter.com/THEnergyNet

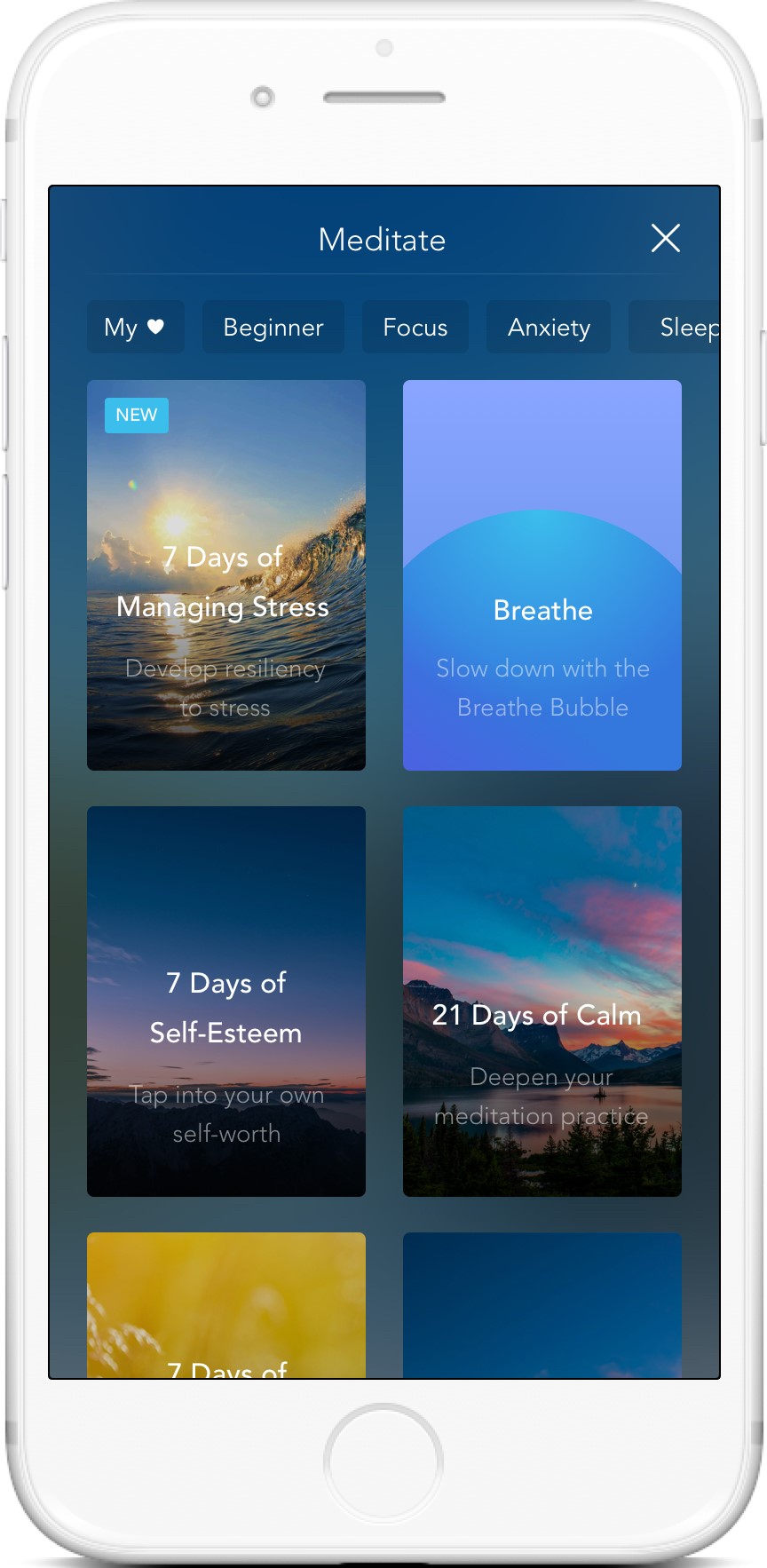

7.Read of the Day….Meditation App Hits $250m Valuation.

Meditation app Calm hits a $250M valuation amid an explosion of interest in mindfulness apps

Matthew Lynley@mattlynley / Jun 20, 2018

Just a few years ago, it might have been a bit of a challenge to convince investors that a mindfulness app would end up being a big business — but thanks to an increasing focus on mental health from both startups and larger companies, companies like Calm are now capturing the excitement of investors.

From meditation sessions like you might find on other apps to tracks called “sleep stories” designed to help people get control of their sleep, Calm serves as a suite of content for users focusing on mental wellness. It’s one of an increasingly hot space centered around mental wellness and maintaining a sort of mindfulness in the hope that it’ll convert into a daily habit and help people just generally feel, well, more calm . The company says it has raised $27 million in a new financing round that values it at a $250 million pre-money led by Insight Venture Partners with Ashton Kutcher’s Sound Ventures also participating. Before this, Calm raised around $1.5 million in seed funding.

“There’s definitely a bias toward the physical body in fitness,” co-founder Michael Acton Smith said. “For a long time there’s been a certain amount of embarrassment and shame talking about our own feelings. A lot of people are realizing that we’re all, at different times, going through tough times. I think that’s part of the culture we’ve grown up in. Everything’s been about improving the efficiency and improving the effectiveness and the external circumstances. We haven’t considered the internal circumstances the same way. The same thing isn’t true of Eastern philosophies. This crossover is just beginning to happen in a big way.”

Calm, at its core, is a hub of content centered around mindfulness ranging from in-the-moment sessions to tracks that are designed to be soothing enough to help people get ready to go to sleep. Everything boils down to trying to help teach users mindfulness, which is in of itself a skill that requires training, co-founder Alex Tew said. This itself has morphed into a business in of itself, with the company generating $22 million in revenue in 2017 and reaching an annual revenue run rate of $75 million.

And the more content the company creates, and the more people come back, the more data it acquires on what’s working and what isn’t. Like any other tech tool or service, some of the content resonates with users and some doesn’t, and the startup looks to employ the same rigor that many other companies with a heavy testing culture to ensure that the experience is simple for users that will jump in and jump out. For example, it turns out a voice named Eric reading stories about being on a train struck a chord with users — so the company invested more in Eric.

“It’s a tricky balance,” Tew said. “Sometimes we’ll launch things that we think are popular but don’t end up being popular, but there’s never been any kind of dramatic errors. We try to create content that will appeal to the biggest range of users. We speak to our customers and find out what they would like.”

Calm’s focus is built off of an increasingly important topic the technology industry is grappling with — mental health. As more and more users pick up Calm and start listening to the tracks, the company can start to figure out what kinds of sessions or tools are helping people want to come back more often and, in theory, start feeling better with those kinds of practices. If you talk to investors in the Valley, helping founders manage the highs and lows of starting a company is increasingly part of the discussion, with the refrain that ‘people are at least talking about it now’ showing up more and more often. That’s also helping companies like Calm and Headspace attract funding from the venture community.

“It does feel like a major societal shift,” Acton Smith said. “Just a few years ago no one talked about mental health, it was very much in the shadows. As more politicians talk about it, as the media treat it as something normal and healthy to do, more and more people step out of the shadows and into the light. We realize the brain is pretty much the most complex thing in the known universe, it’s not surprising it goes wrong every now and then. To be able to talk about that and understand it is a very healthy and positive thing. It just feels like we’re at the start. Fifty years ago the wave began around physical fitness, jogging, aerobics, and now we’re at the start of this new wave.

Calm and other mindfulness apps are not the only companies at play here. Indeed, the two largest direct owners of smartphone platforms — Apple and Google — this year announced a suite of tools geared toward trying to manage the amount of time users end up glued to their screens. While those are centered around helping users manage their time on their phones, it does show that even the largest companies in the world are increasingly aware of the potential negative effects their devices may have spawned from people spending all their time on their phones.

But by extension, Calm is not the only app where people can throw on some headphones and listen to a soothing voice with a British accent. Headspace is another obvious player in the space, having also raised a substantial amount of funding. Tew said the goal is to remain focused on simplicity, which in the end will keep people coming back over and over — and then end up continuing to drive that business.

“There was a lot of skepticism around Calm and this category as recently as a year ago,” Acton Smith said.” People were concerned that there was a lot of competition, and wondered whether people would really pay for this. We’ve quite convincingly shown we’ve answered all those questions with the growth we’ve had in our user numbers and our revenue. This is a successful business with very high margins and a huge addressable market. If you think about Nike, and the physical exercise boom being worth tens of billions, there’s no reason why mental wellness won’t be.”

Image Credits: Calm

8.15 Things Mattis Taught Me About Real Leadership

I first met Marine Gen. James Mattis in the summer of 2000 when he took command of the 1st Marine Expeditionary Brigade. After his change of command ceremony, I introduced myself as his new public affairs officer. “PAO, huh?” Mattis said. “What, are you going to follow me around all day and make sure I don’t say ‘fuck?’”

I had served as an infantry officer in a battalion in his former regiment, 7th Marines, so I said, “General, I was a platoon commander with 2/7. Treat me like just another gun-hand around the ranch.” Mattis then smiled, laughed, patted me on the shoulder and said, “I think you and me are going to get along just fine.”

From the start, it became evident that Mattis was of a different kind altogether. Instead of micromanaging, he fired those who were incapable or lazy, and empowered his staff to make decisions and carry out his intent. When Marines failed by omission, he helped them learn. When people failed by commission, they disappeared. Morale soared under his command and we truly believed we were unstoppable.

First and foremost, Mattis is a thinker. He made being smart cool in a tribe that is notoriously anti-intellectual. He is the most well-read person I’ve ever met. We heard he didn’t own a television and owned more than 6,000 books.

Related: For Some Reason, Mattis Likes To Wear His Flak Jacket Backward »

His recall is amazing. Were you to ask him what leader most inspired him, you might get a short lesson about the Sioux warrior chiefs, or his thoughts on Marcus Aurelius. This is why the “Mad Dog” sobriquet just doesn’t fit. I’ve never seen him lose his cool. Mattis often reminded us that, “everyone needs a coach, but nobody needs a tyrant.” Sure, he could get Marines fired up, but I’ve never seen him yell or scream. Ever.

Photo courtesy of Joe Plenzler.

1st Marine Division Public Affairs Officer Captain Joe Plenzler, Commanding General Major General James N. Mattis, and Aide D’Camp Captain Warren “Bunge” Cook pause for a photo near Al Diwaniyah, Iraq in May of 2003.

Mattis assumed command of 1st Marine Division in the summer of 2002. He immediately brought the division staff together so that we might better understand his intent and leadership style. What follows are 15 of the key ideas he expressed during that initial session. You can find his staff guidance embedded at the bottom of this article.

- “All of us are MAGTF (Marine Air Ground Task Force) leaders.”

Mattis was unconcerned with a Marine’s MOS. He only cared about how smart you were, how tough you were, and whether you’d “stick around and fight when the chips were down.” He expected all Marines to lead at their respective levels and fully recognized the team aspect and interdependence of all members of the division.

- “Attitude is a weapon.”

Mattis said that a leader’s job is to win the hearts of those they lead and remember that it is the subordinates who actually accomplish every mission. Done right, Marines will charge forward and fight with a happy heart. He said, “We must remember that we only need to win one battle: for the hearts and minds of our subordinates. They will win all the rest at the risk and cost of their lives.”

- “Everyone fills sandbags in this outfit.”

In other words, rank has no privileges when there is work to be done and too few hands. Everyone was expected to roll up their sleeves and pitch in to accomplish the mission. Officers were not exempt and were expected to lead by example to help the team when needed.

- “If a Marine or a unit is screwing up, hug them a little more.”

Mattis believed in compassionate leadership and intrusive coaching. He also believed in tempering zeal so that, leaders “don’t allow their passion for excellence to destroy their compassion for subordinates.”

- “There are only two types of people on the battlefield: hunters and the hunted.”

It was clear which he wanted us to be, and he encouraged us to inculcate a “hunter/ambush” mindset within the division. He told us that we were there to lead and reinforce his strengths, and to shore up his weaknesses. He hated brittleness in any form, and knew that any idea that could not withstand challenge would fail in the face of the enemy.

- He encouraged simplicity in planning, and speed, surprise, and security in execution.

Mattis knew control in combat is an illusion — a ghost fools often chased. He preferred “command and feedback,” not command and control.

- “The two qualities I look for most in my Marines are initiative and aggressiveness.”

He knew that these qualities create speed and focus, the two key elements of generating combat power.

- “Remember, Orville Wright flew an airplane without a pilot’s license.”

He encouraged Marines to embrace new challenges. He knew the fog of war is both ubiquitous and relentless and that if you wait for perfect information, you will become paralyzed and irrelevant.

- “No better friend, no worse enemy.”

The Roman general Lucius Cornelius Sulla once remarked, “No friend ever served me and no enemy ever wronged me whom I have not repaid in full.” When he became division commander, Mattis made his version of Sulla’s epitaph the 1st Marine Division motto. He told us Iraq has a population of 33 million people, and we sure as hell didn’t want to fight all of them. We only wanted to fight the ones that were working to keep Saddam Hussein in power. He told his Marines that if the Iraqi people we encountered wanted to help us, or just stand aside, they would find no better friend than a U.S. Marine. If any opposed us, they would rue the day. He sought to limit damage and loss of life whenever possible.

- “Treat every day as if it were your last day of peace.”

Mattis told us that if you aren’t in combat, you should be preparing your Marines and sailors to go to combat. This is the sole purpose of the Marine Corps — to support our Constitution and defend the American people. He told us of another Roman, Publius Flavius Vegetius Renatus, who said, “If you want peace, prepare for war.”

- “This is not some JV, bush-league outfit. We’re the Marines.”

Mattis knew that most people generally perform to the level of expectation that their leaders set. If a leader demands excellence and provides realistic and challenging training for their people, the people will respond. This was a moral imperative for Mattis, who often remarked that combat is unforgiving and the price of bad leadership is the butcher’s bill with the names of young Americans that comes with every war.

- “I have been accused of making my subordinates my equals, and I happily stand guilty.”

Mattis has always been more interested in the six inches between a Marine’s ears than the rank on his or her collar. I frequently saw him go out of his way to empower talented people to do what they do best. His lead intelligence analyst in his command post during the initial invasion of Iraq was a Marine lance corporal savant who knew the Iraqi order of battle better than anyone in the division.

- “I don’t want us to put someone in front of the the media that is going to have their second childhood. I only want tough Marines in front of the camera.”

Mattis knew that the invasion of Iraq was going to be a major historic event, and 1st Marines would embed more than 100 reporters. He expressed a healthy respect for the role journalists play in our democracy and believed the press was “an entirely winnable constituency.” He knew that journalists would be the ones telling the American people about what his Marines were doing in combat, and he encouraged his Marines to “share their courage with the world.” When planning the embed program, Mattis told me to focus my efforts on telling the division’s story where the fighting and dying would take place — at the lance corporal and lieutenant level. He then quoted the Greek poet Pindar who said, “Left unsung, the noblest deed will die.”

- “Engage your brain before you engage your trigger.”

Mattis would often tell Marines that taking the life of another human being is a significant act — one that they must be prepared to do as military professionals, but that they must think before they shoot. He said that killing the wrong people on the battlefield would drive more people to the enemy’s cause, and that such mistakes haunt people for the rest of their lives.

Lastly, my favorite of the things he told us:

- “The number-one authority you have as a leader is your moral authority and your number one power is expectation.”

Mattis knew that Marines expect to see their leaders at the front sharing hardship and danger. He also knew that when leaders at the front expect Marines to move forward against the enemy, they will. A leader’s example and moral authority are what truly take a unit forward. He said, “In two minutes at the front edge of the combat zone, you know if the troops feel confident, if the battle is going the way they want it to, or if they need something. You can sense it, and you can apply something.”

Your browser cannot view this PDF.

You can click here to

download and read the Commanding General’s Staff Guidance Document.

1st Marines, iraq, James Mattis, mad dog mattis, secretary of defense

https://taskandpurpose.com/gen-mattis-no-mad-dog-told-1st-marine-division-proves/amp/