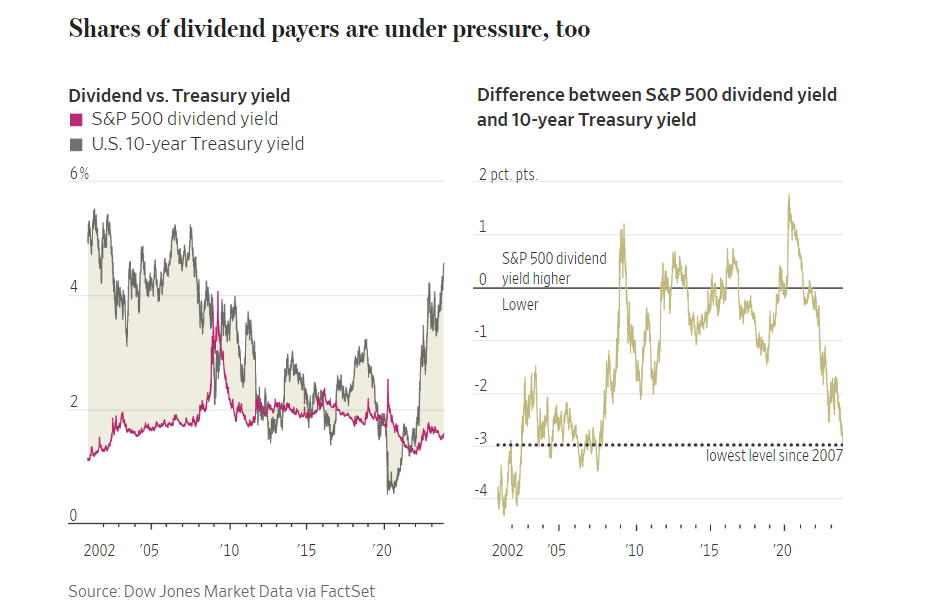

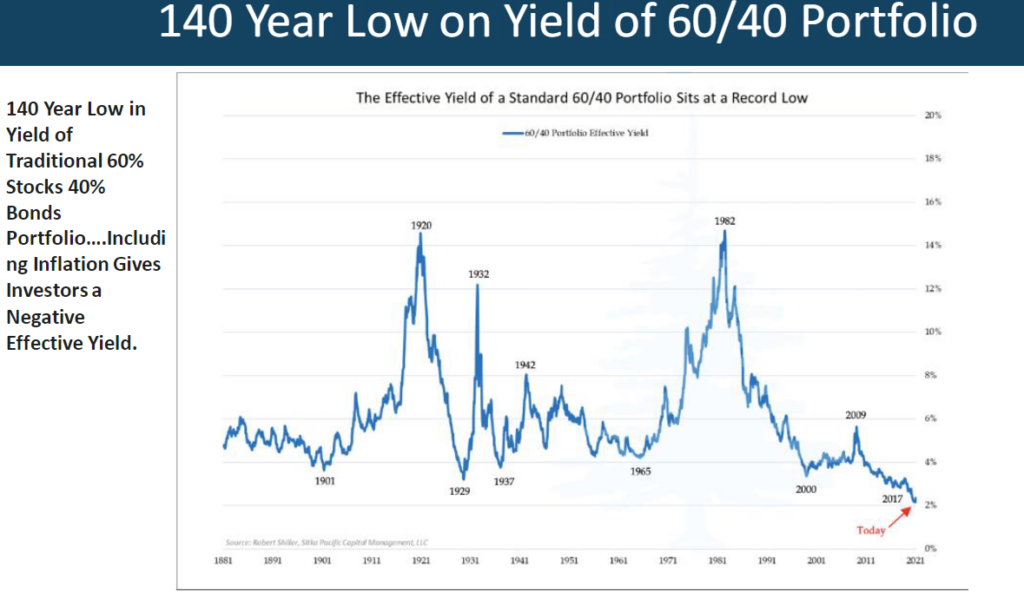

1. Found this Chart in an 2020 Slide Deck…We Hit 140-Year Low in Yield on 60/40 Portfolio Before Fed Started Raising Rates.

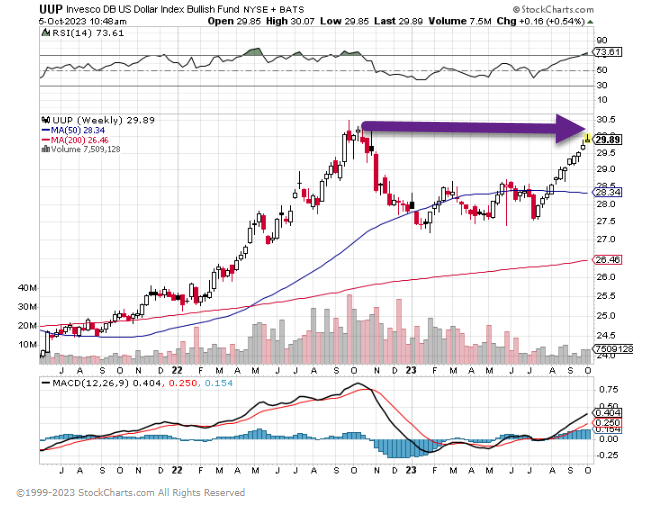

2. U.S. Dollar About to Break-Out to New Highs.

3. U.S. Tech Stocks vs. China’s Tech Stocks

This chart shows Nasdaq 100 vs. China Tech ETF….U.S. straight up

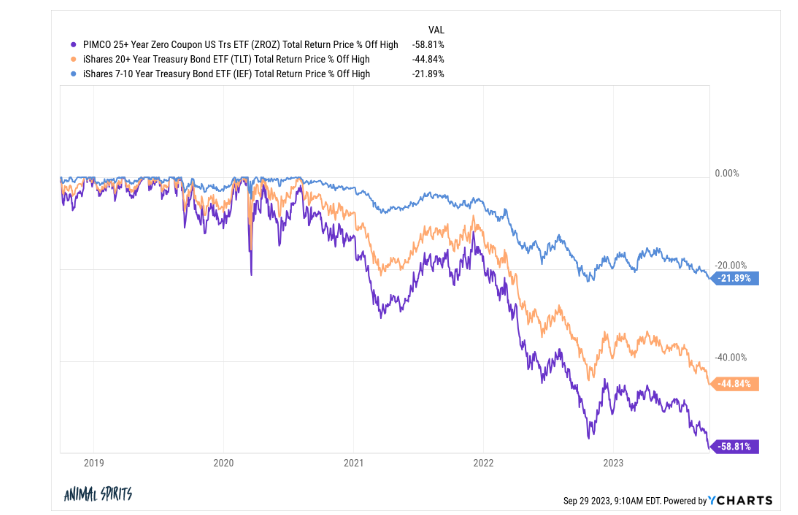

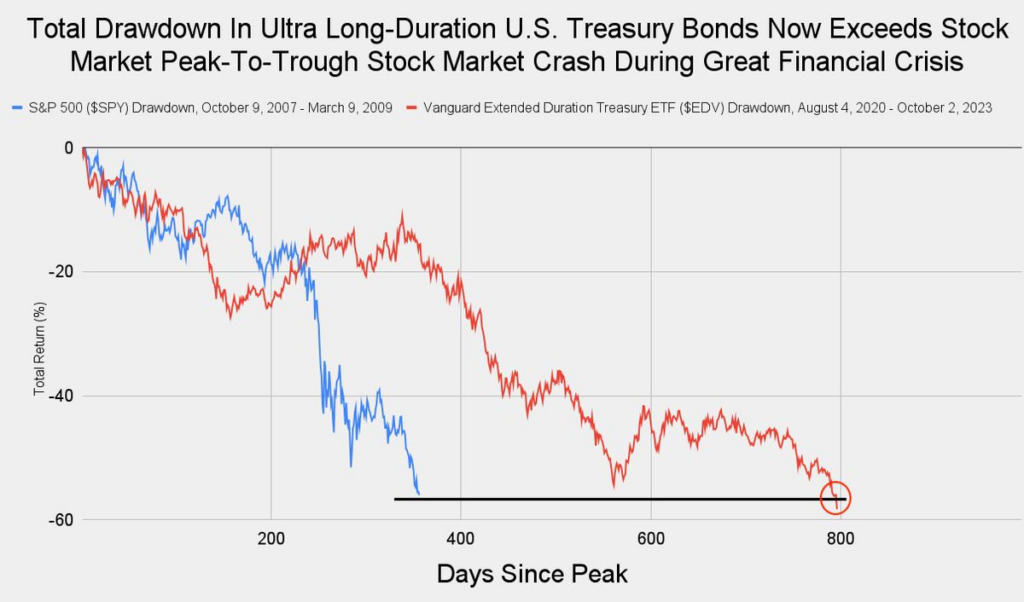

4. Long-Term Treasuries Equal to Stock Market Crash of Great Financial Crisis

Callum Thomas @Callum Thomas (Weekly S&P500 #ChartStorm). Deep Drawdown: A “wow-chart” to kick-off this session — turns out long-term treasuries are suffering a deeper peak-to-trough drawdown than what happened to stocks during the great financial crisis. I would note that this is price only, and the total return is slightly less bad (albeit only by 5 ppts). But still, simply catastrophic.

Source: @JackFarley96

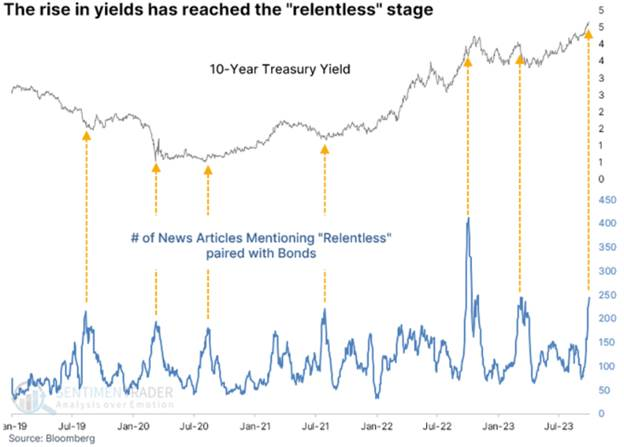

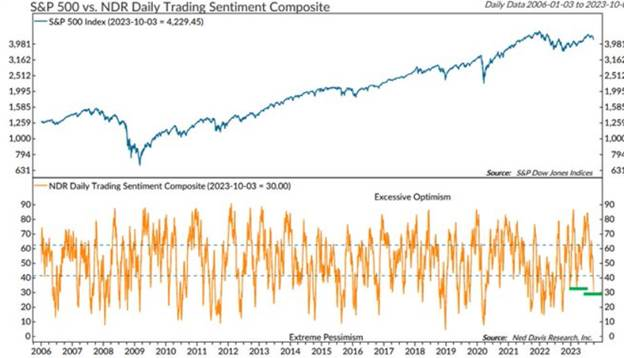

5. A Couple Sentiment Charts from Dave Lutz at Jones Trading.

SentimentTrader notes We’ve reached the “relentless” phase of the rise in yields. News articles mentioning that word and the bond market have spiked to the 2nd-highest in 8+ years. It was only higher once, which was almost exactly a year ago.

The level of Excessive Pessimism is now below what was registered at the December 2022 and March 2023 lows, based on the NDR_Research Daily Trading Sentiment Composite

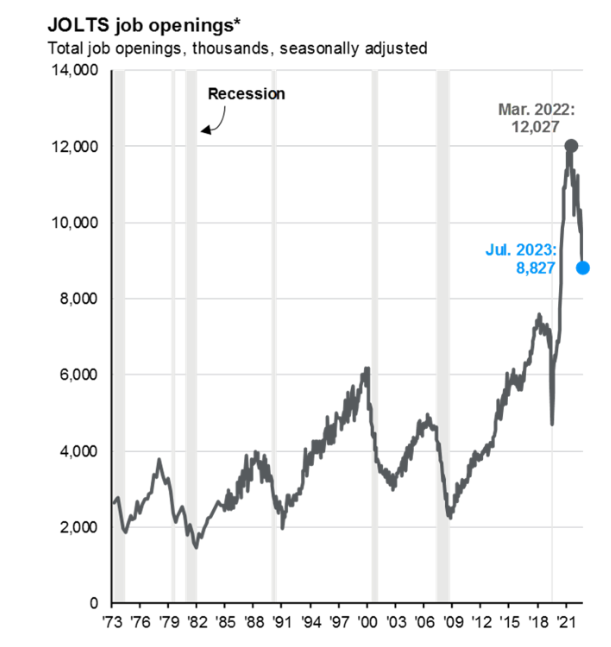

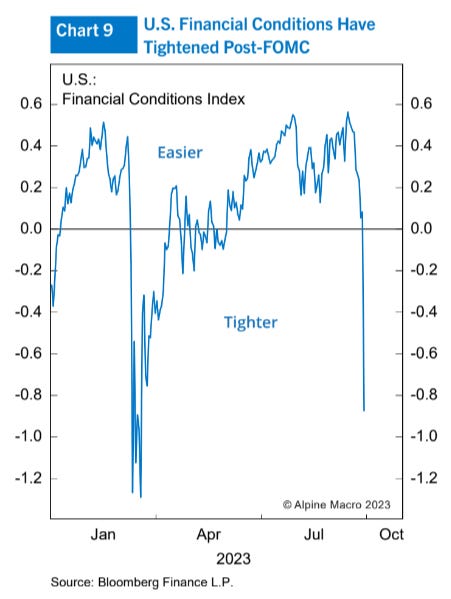

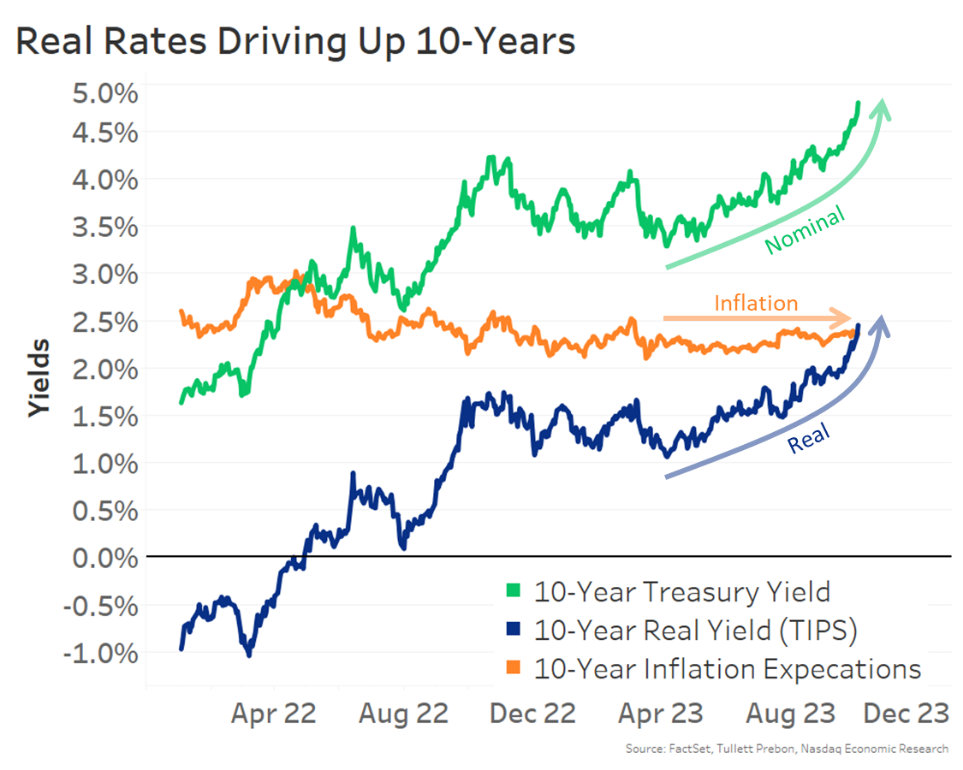

6. Real rates rising in recent months on soft landing hopes

Nasdaq Dorsey Wright In fact, real 10 year rates are already well above expected long-term inflation. Since April, inflation expectations have been mostly unchanged, at around 2.5%. That means “real” (after inflation returns) rates have gone from negative (-1.0%) in 2022, to almost +2.5%.

That’s partly because the economy is strong. In the last few months, there’s been plenty of strong economic data (low unemployment, resilient consumer spending, upward revisions to business investment). That in turn means we don’t need negative real rates any more to avoid a recession.

7. Microsoft Pulls Right Back to May Support Level…Low Key -15% Correction.

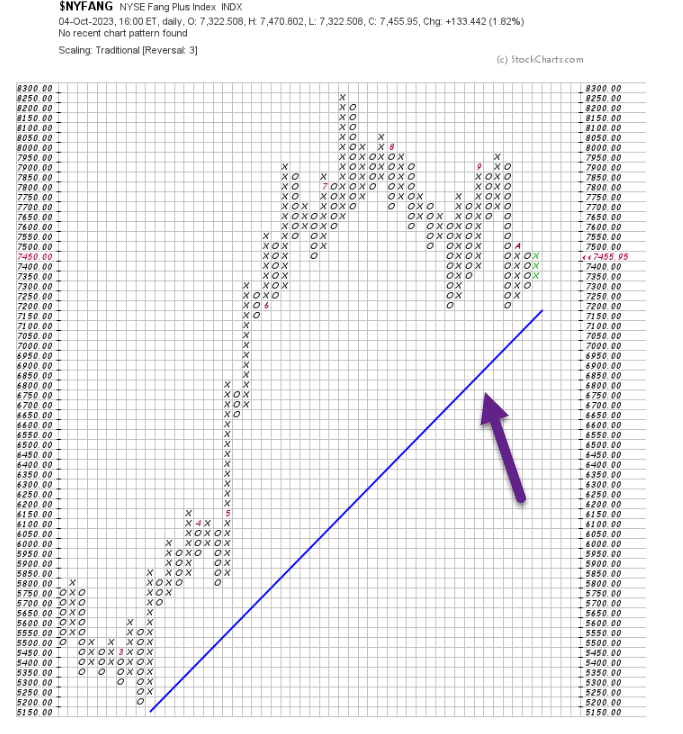

8. FANG+ ETF Did Not Break One-Year Trendline.

BLUE trendline line below holding so far

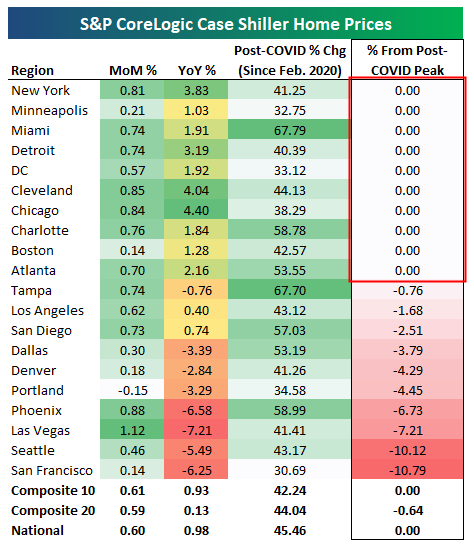

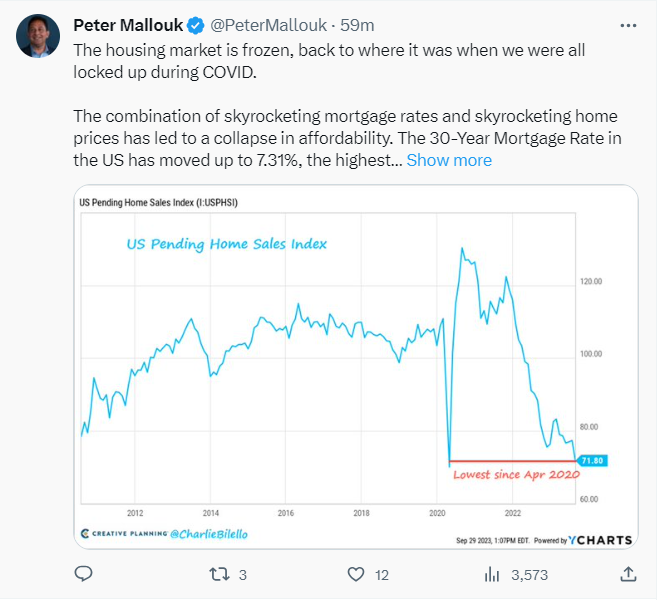

9. U.S. Pending Home Sales Index

10. This Is What Good Sleepers Think About While Falling Asleep (and How Bad Sleepers Can Steal Their Magic)…From INC.

Change what you think about in bed, and you can transform yourself into one of those people who fall asleep instantly.

BY JESSICA STILLMAN, CONTRIBUTOR, INC.COM@ENTRYLEVELREBEL

My daughter has unfortunately inherited my husband’s complete disinterest in sleep, and basically from birth has fought any and all attempts to put her to bed (thanks, honey). To cope with her tossing and turning, we developed a game we call “sleepy thoughts.” Every time I tuck her in at night I offer some pleasant but distracting scenario or a question for her to think about.

If you were an astronaut on a mission to Mars, who would you want to take with you and why? If you could have any birthday party you can dream up, what would it be like? Please describe in great detail. What is cuter, a marmot, an otter, or a bunny? (I was solidly team marmot, while she was forcefully in favor of the otter.)

I do this because I prefer her to be pondering cake flavors and furry critters rather than bothering me with complaints in the evening. But I just read an article that suggests I may have stumbled onto a real, scientifically validated trick for easier bedtimes, and one that exhausted adult entrepreneurs can use on themselves as well.

The bedtime thoughts of good sleepers versus insomniacs

The insight comes from a pair of Australian psychologists, Melinda Jackson and Hailey Meakin, who have investigated a question that is as everyday as it is impactful: What exactly do people think about when they’re lying in bed trying to sleep at night, and how does that impact their sleep?

If you’ve ever watched the person next to you peacefully conk out in a matter of minutes and wondered exactly what is happening in their head, Jackson and Meakin’s recent article for The Conversation may finally satisfy your curiosity.

“It turns out people who sleep well and those who sleep poorly have different kinds of thoughts before bed,” they write. “Good sleepers report experiencing mostly visual sensory images as they drift to sleep — seeing people and objects, and having dream-like experiences. They may have less ordered thoughts and more hallucinatory experiences, such as imagining you’re participating in events in the real world.”

Contrast that with insomnia sufferers, who tend to have pre-sleep thoughts that are “more focused on planning and problem-solving. These thoughts are also generally more unpleasant and less random than those of good sleepers. People with insomnia are also more likely to stress about sleep as they’re trying to sleep, leading to a vicious cycle; putting effort into sleep actually wakes you up more.”

Good sleepers imagine what it would be like to live in ancient Rome, or what they’d do if they met their childhood Hollywood crush. Bad sleepers are doing their taxes in their heads. Which, after you hear the psychologists lay it out, explains a lot about why some of us drift off on a cloud of idle imaginings and others can never seem to relax enough for sleep.

“Sleepy thoughts” work for adults too

While it’s fun to have science verify what many people suspected, noting that bad sleepers have trouble shutting off the worry and planning portions of their brains is hardly a huge shock. What’s more useful in Jackson and Meakin’s piece is when they move to suggestions on how people can use this insight to actively become more like those people who fall asleep in seconds.

I give my daughter “sleepy thoughts” to keep her out of my hair. But reading this article suggested to me that I may have inadvertently also found a way to nudge her toward the kind of bedtime imaginings that lead to easier, better sleep. And the psychologists confirm that adults can use this basic idea too.

“The good news is there are techniques you can use to change the style and content of your pre-sleep thoughts. They could help reduce nighttime cognitive arousal or replace unwanted thoughts with more pleasant ones. These techniques are called ‘cognitive refocusing,'” they explain.

Another, more colloquial way to describe this technique would be distracting yourself with pleasant night time “sleepy thoughts.” “Decide before you go to bed what you’ll focus on as you lie there waiting for sleep to come. Pick an engaging cognitive task with enough scope and breadth to maintain your interest and attention — without causing emotional or physical arousal. So, nothing too scary, thrilling, or stressful,” they instruct.

Feel free to steal my idea and ponder the relative cuteness of various animals, but Jackson and Meakin also offer some more adult-friendly suggestions like mentally redesigning a room in your house, replaying a particularly thrilling section of the big game (and maybe coming up with a game plan for the next one), or reciting lyrics from your favorite album.

Hopefully, these pleasant, diverting thoughts will crowd out any impulse you have to go over and over your to-do list or replay the most embarrassing moment of your day. And that, studies show, can lead to measurable improvements in your ability to get to sleep fast and slumber peacefully.

No one sleep technique is a silver bullet, though, so the article also stresses the importance of decent sleep hygiene. If you’re binge-watching horror films for hours before bed or going to sleep at wildly different times every night, don’t expect any kind of sleepy thought to be a magic solution. “Cognitive refocusing” is a useful technique to have in your arsenal though, as are these other research-backed tips on how to fall asleep faster we’ve featured here on Inc.com in the past.

INC.COM The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.