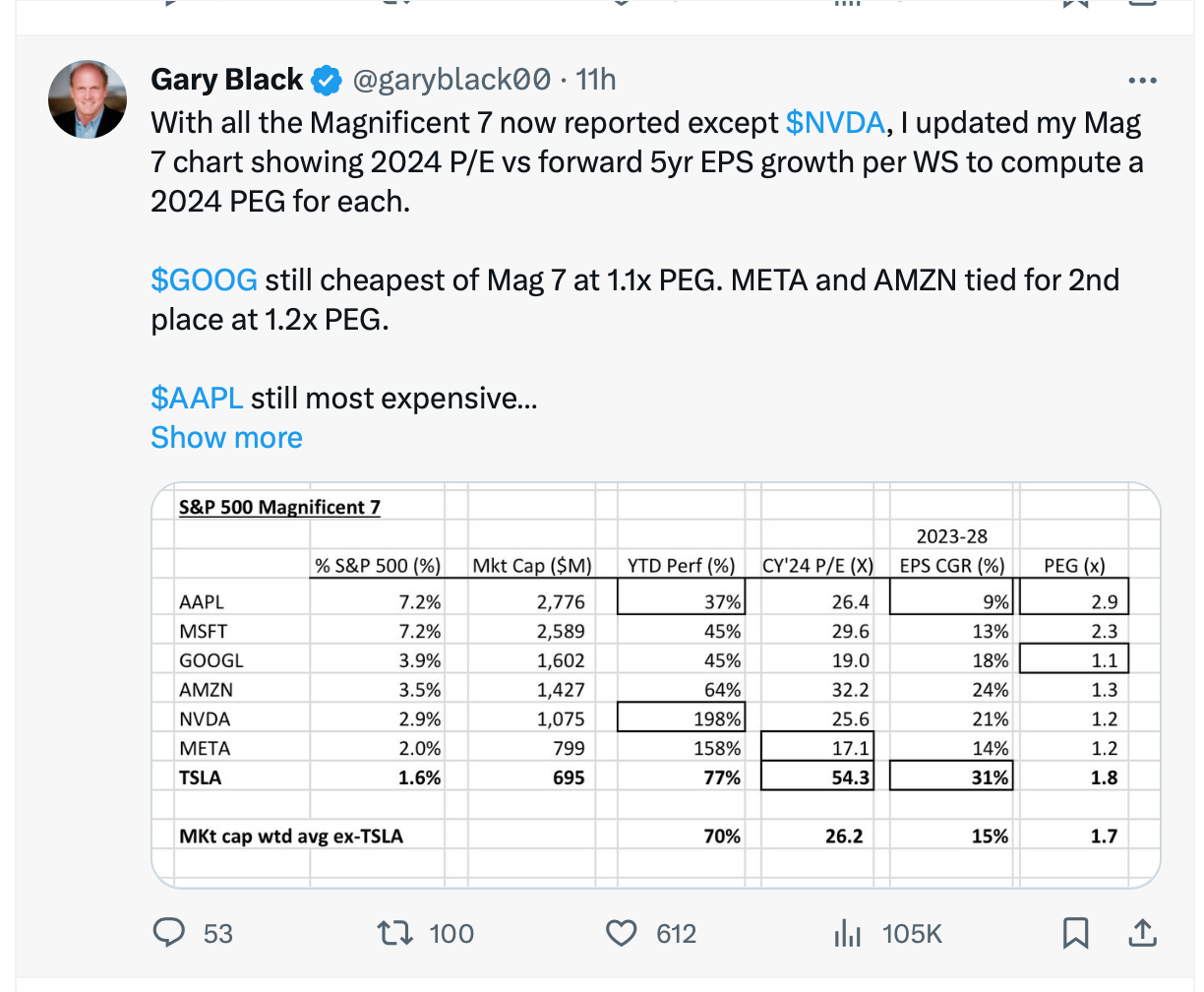

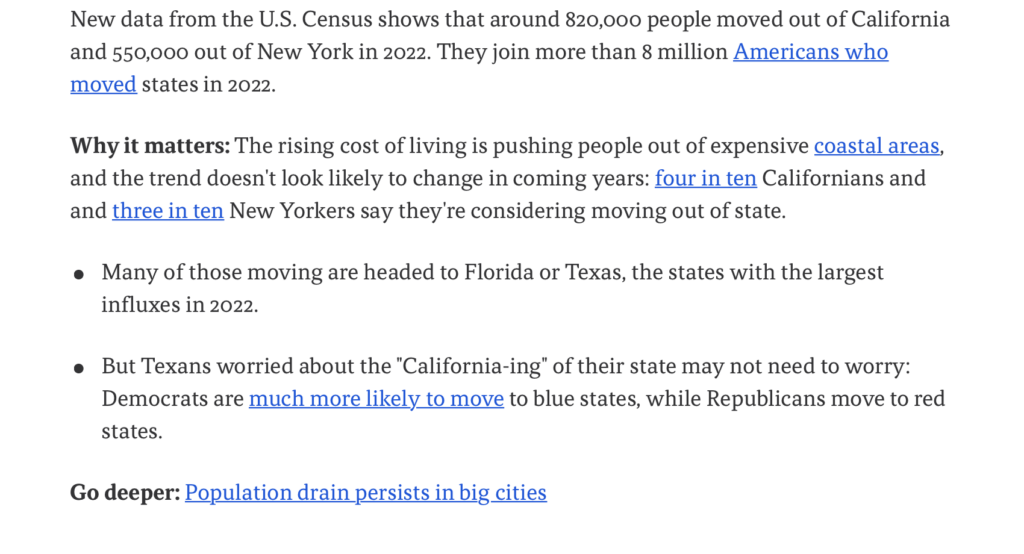

1. NVDA vs. AAPL

At 27 times projected earnings, Apple trades roughly in line with Nvidia. One company isn’t growing. One company is on fire. Investors can do the math. Barrons Eric J. Savitz https://www.barrons.com/articles/apple-nvidia-stock-price-tech-earnings-478083ec?mod=past_editions

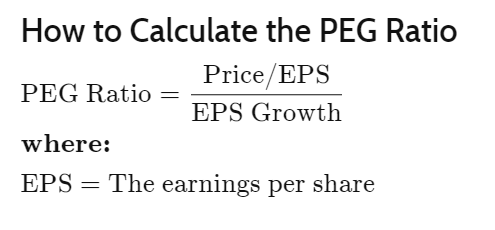

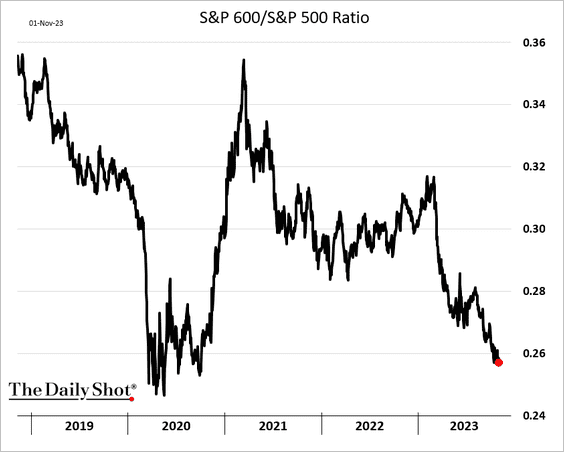

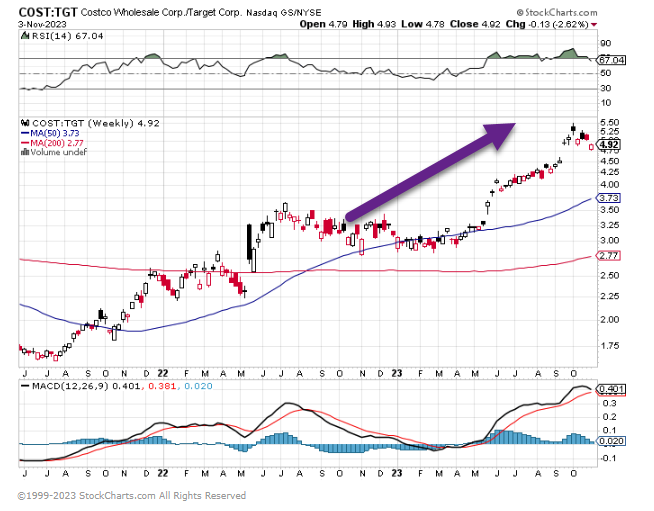

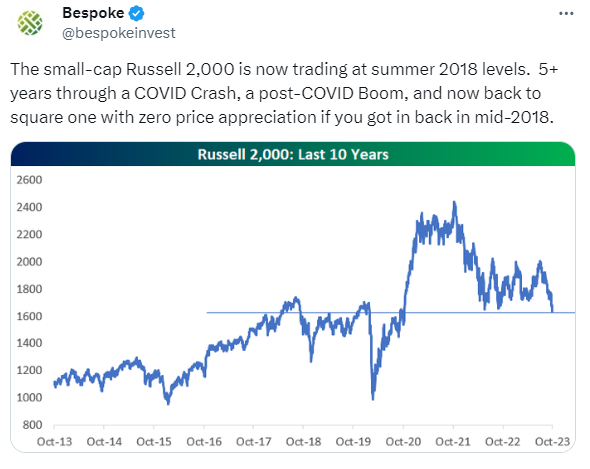

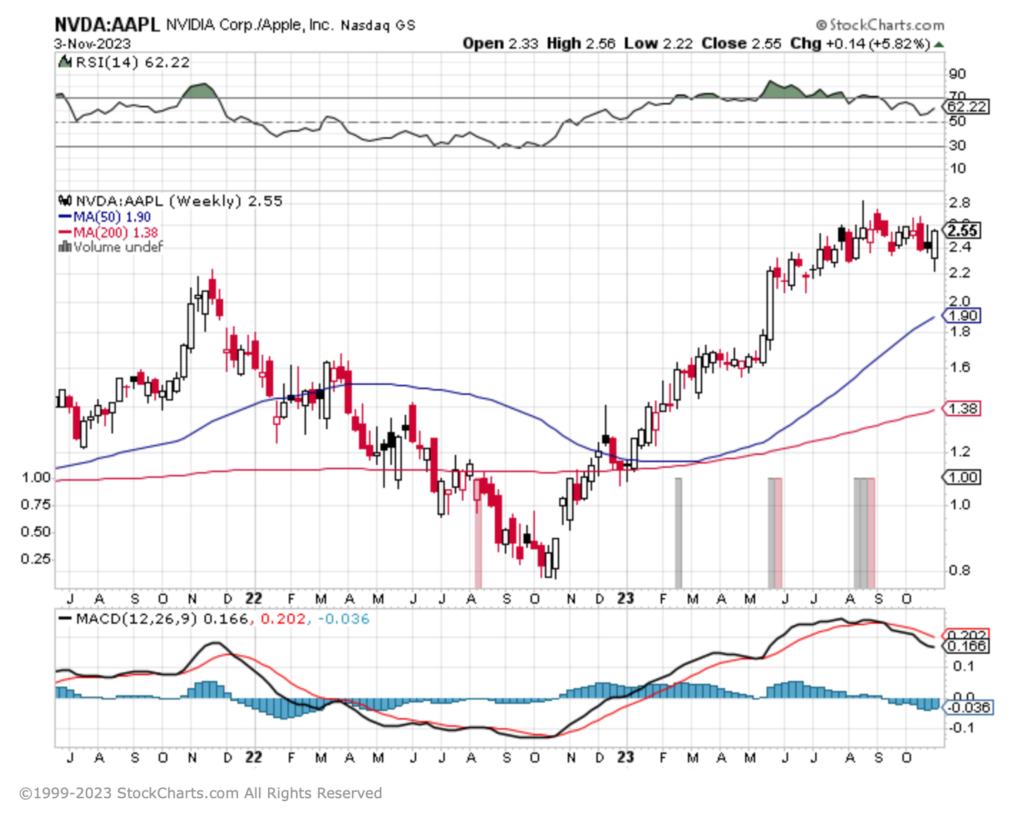

2. Another Look at Small Cap vs. QQQ

Chart of the Day—Found at Abnormal Returns Blog www.abnormalreturns.com

Large cap tech stocks have been outperforming small caps for awhile now.

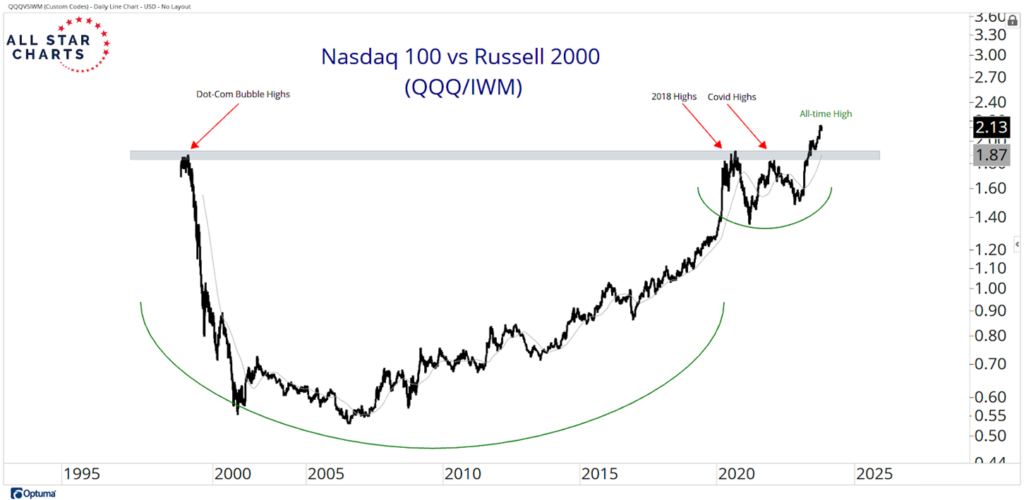

3. By Far the Longest Drawdown in Bond History

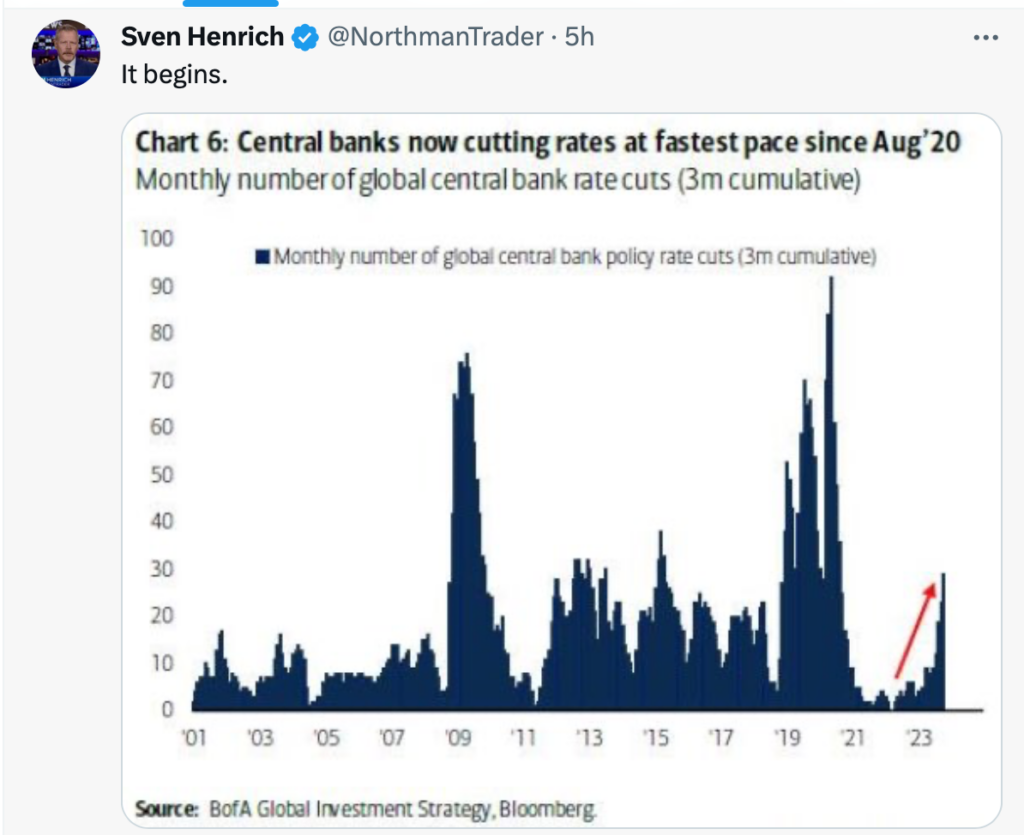

4. Global Central Banks Already Cutting Rates.

5. Companies with Huge Cash Stockpiles.

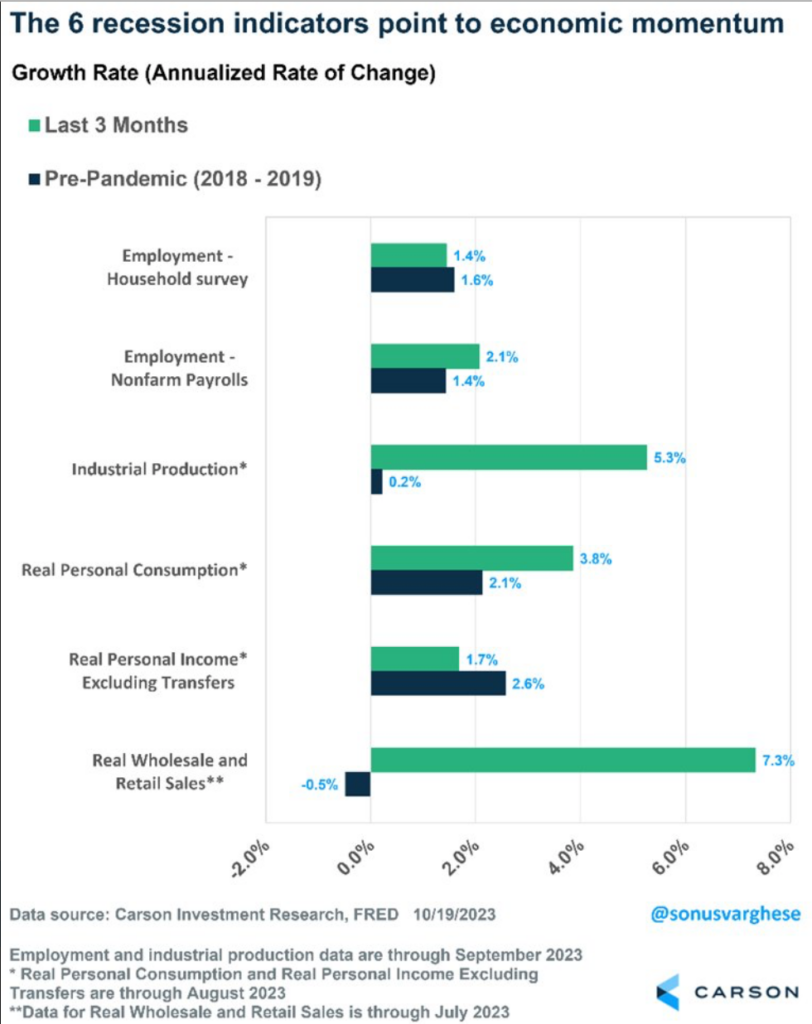

6. Ryan Detrick Carson—Recession Not In Numbers Yet.

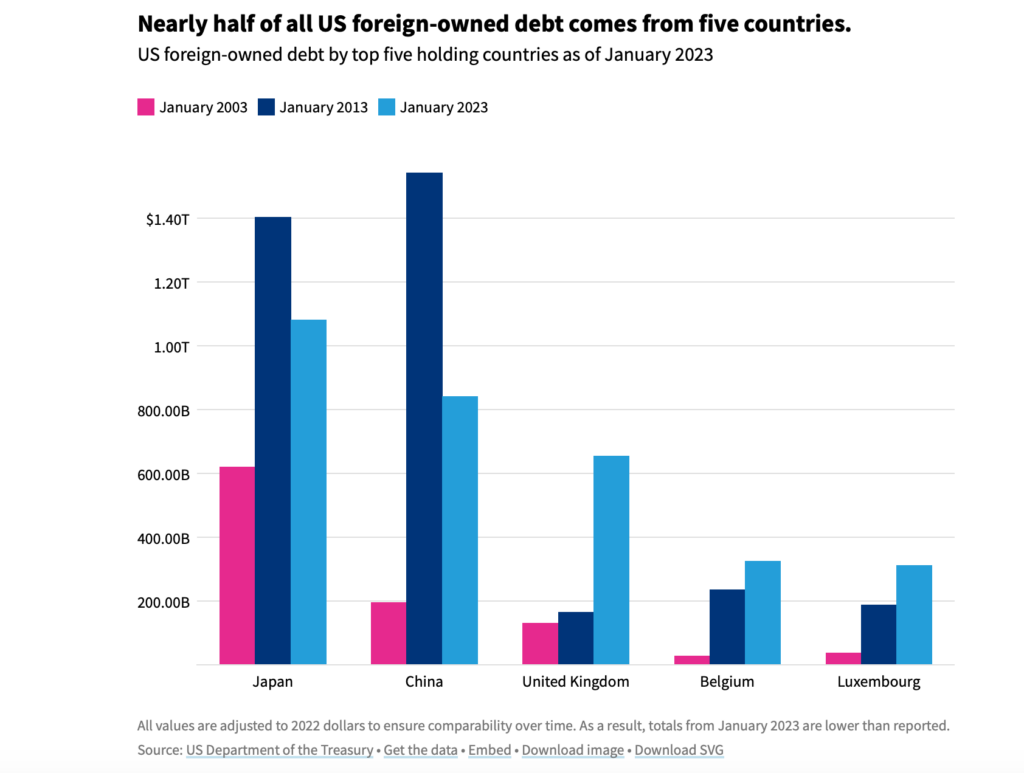

7. Who Owns U.S. Debt 2023? China Selling and Japan May Start Selling

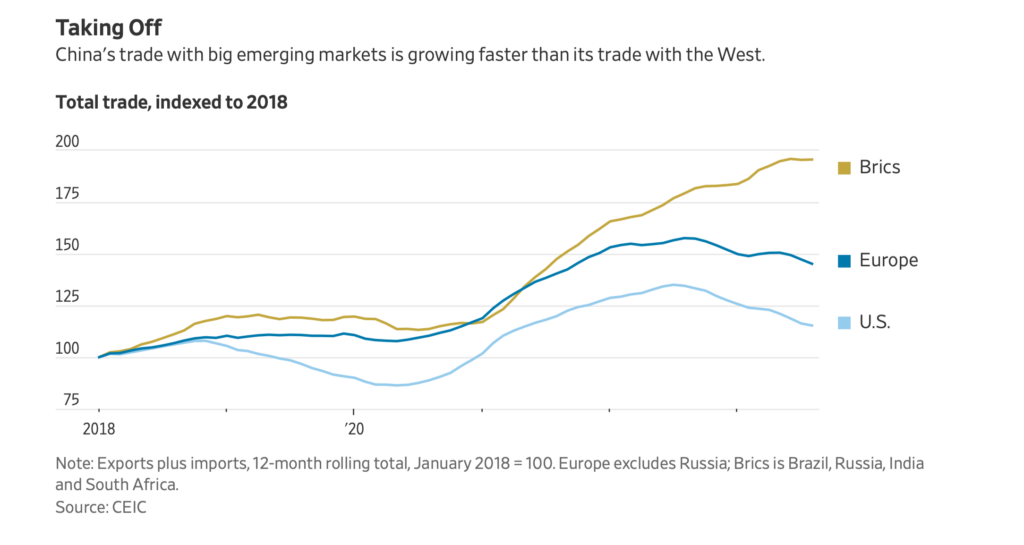

8. U.S. Dropping as China Trade Partner

WJS Latin America, Africa and developing markets in Asia now account for 36% of overall Chinese trade, compared with 33% for its trade with the U.S., Europe and Japan, according to a Wall Street Journal analysis of Chinese customs data. As recently as last summer, that trio of advanced markets accounted for a larger share of Chinese trade. Write to Jason Douglas at jason.douglas@wsj.com and Tom Fairless at tom.fairless@wsj.com

https://www.wsj.com/economy/trade/economy-us-china-tariffs-trade-investment-1c58d24e?mod=itp_wsj

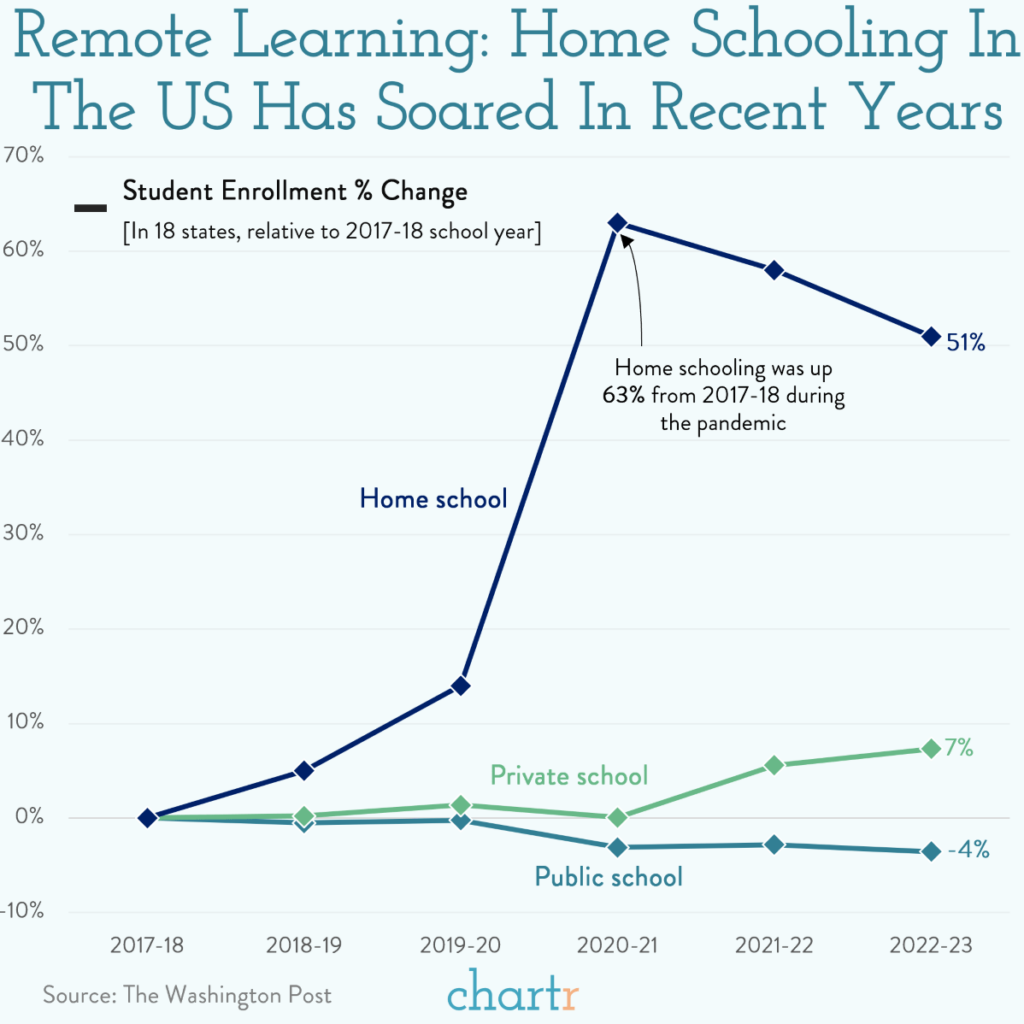

9. Growth of Home Schooling in U.S.

10. The Secret to Persuading Almost Anyone Comes Down to 4 Simple Words

Getting buy-in is all about creating the right expectations.

BY JASON ATEN, TECH COLUMNIST@JASONATEN

Getting someone to do a thing you want them to do is one of the most challenging things about interacting with other humans. We all have our own agendas and desires and they are often informed by our individual values and perception of the world around us.

If you are in a job that involves persuading people–like sales, or leading a team–you know that one of the most important aspects of persuasion is creating the right expectations. If you want a person to do something, it’s helpful to start by getting buy-in from them, and expectations help to do just that.

For example, imagine you are sitting across the table from someone who is trying to figure out what to buy from you. For them, this is all new, and they’re having to make a series of decisions about whether all of the things you offer will be a good fit. You can see that they’re trying to sort through it all when you say, “Most of my customers…” followed by whatever it is that most of your customers choose.

“Most of my customers find that option ‘C’ gives them the flexibility they need, while scaling affordably as they grow.”

There’s a very simple reason this works. Most people want to be like most people, most of the time. That’s human nature. If someone is considering becoming your customer, they aren’t just buying a thing, they’re buying into the experience of being your customer. For them, knowing what that means creates expectations and makes them more comfortable.

Look, even though they may say otherwise, most people don’t want to be unique. They want to be like the rest of your customers and you can help by telling them what that means. That is, after all, the entire point of almost all marketing–to tell a story about what it looks like to use a product or service.

There are, of course, a few important caveats. The first is that whatever comes after those four words have to be true. If you just make stuff up, it might persuade someone for a short time, but, eventually, it will become obvious that you lied. Not only will they not be persuaded, they won’t ever trust you again. It’s just not worth it.

This is important because it can be tempting to try this trick to persuade people to spend more or to choose something that isn’t in their best interests. That’s a different four-word phrase altogether: “Everyone is doing it.” The difference is, that’s about putting peer pressure on someone to do something for your own benefit. Again, it might work for a little while, but it will cost you your credibility.

Second, this works best when the person you are persuading is making a decision to buy in. The key is that the person wants to be a part of the group, whether that’s your customers or your team. It’s not helpful to tell someone what all of your customers do if they aren’t in any way interested in being one of your customers.

Finally, those four words work even better when you follow them with an explanation of why. For example, “most of our clients choose option ‘C’ because it gives them the flexibility they need while allowing them to scale affordably,” gives your potential customer the information they need to see themself in that situation.

Obviously, this doesn’t work for everyone. That’s why I say “almost anyone,” because there will always be someone who resists any attempt to conform to whatever is normal. That’s okay. When you find that it doesn’t work, it’s probably a good sign that that customer wasn’t a good fit anyway.