1. Groundhogs Day UBS and Credit Suisse get urgent bailout funds-NY Times Story from 2008

By Alan Cowell Oct. 16, 2008

PARIS — As the financial crisis continued to roll through world markets, the two leading Swiss banks said Thursday they had secured emergency support totaling some $14.1 billion, either from the Swiss authorities or from outside investors, including the Qatar Investment Authority.

UBS said it would receive a direct injection of government money worth some $5.3 billion, while Credit Suisse said it had raised $8.8 billion from “a small group of major global investors” including the Qatari authorities. The government injection of funds into UBS could represent a 9 percent stake in the bank, whose $44 billion write-downs related to toxic assets have been Europe’s worst.

Credit Suisse also reported a net third quarter loss of $1.3 billion after further write-downs.

Additionally, the Swiss National Bank said it had created a fund that would enable UBS, the country’s biggest bank, to transfer $60 billion worth of toxic assets from its balance sheet. UBS said the fund would be capitalized with $6 billion of equity capital provided by UBS and $54 billion from the Swiss National Bank.

UBS said in a statement: “With this transaction, UBS caps future potential losses from these assets, secures their long-term funding, reduces its risk-weighted assets and materially de-risks and reduces its balance sheet.”

For its part, the Swiss government said in separate statement that it was “confident that this package of measures will contribute to the lasting strengthening of the Swiss financial system.”

“The resulting stabilization is beneficial for overall economic development in Switzerland and is in the interests of the country as a whole,” the statement said.

Previously, the Swiss authorities had seemed to be standing apart from the wave of bailouts among European countries, who have pledged around $1.8 trillion to free up credit markets and support the continent’s banking system. But such is the size of the Swiss banking industry in relation to the overall economy that the Swiss might not have had the resources to bail out UBS and Credit Suisse if they ran into deep trouble.

https://www.nytimes.com/2008/

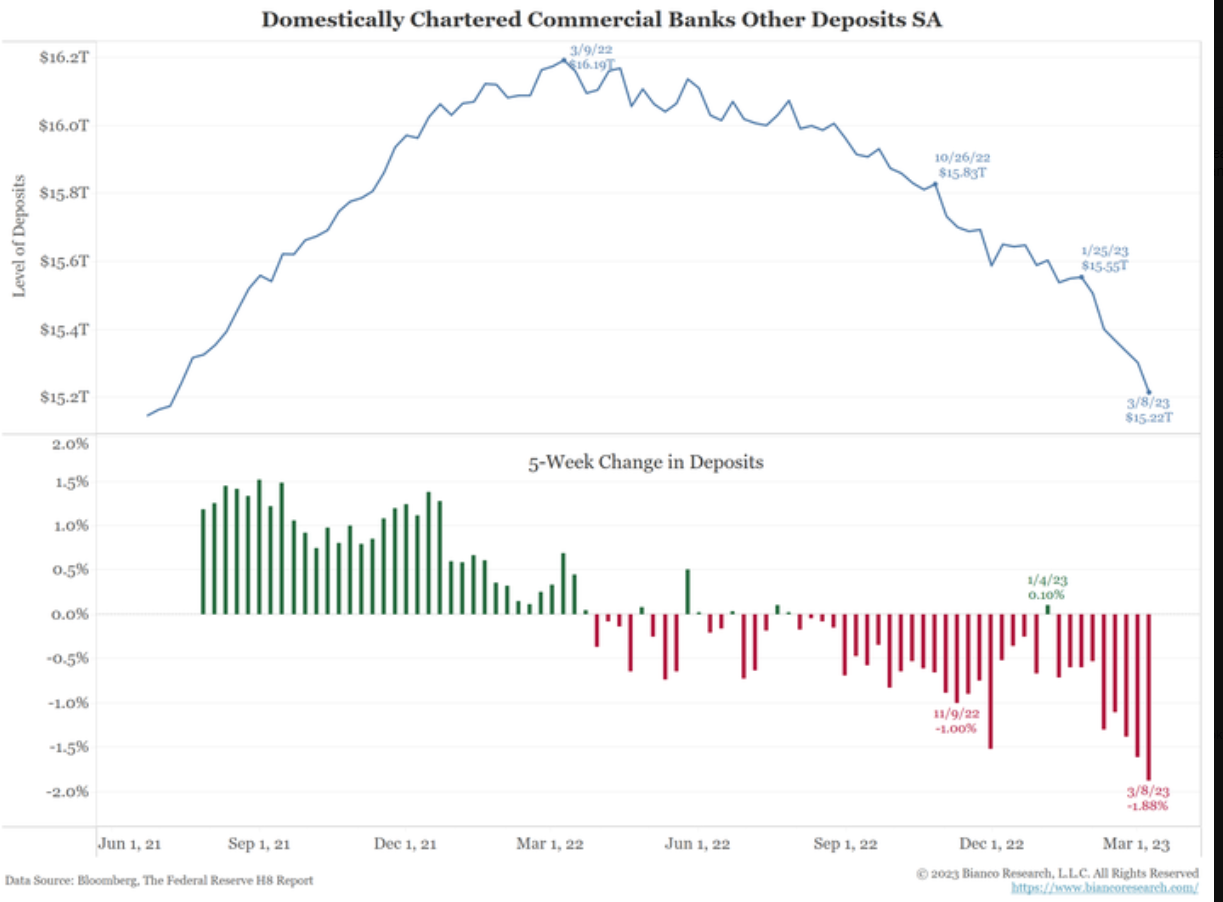

2. Five Week Change in Deposits Leading Up to Banking Crisis

Jim Bianco Research

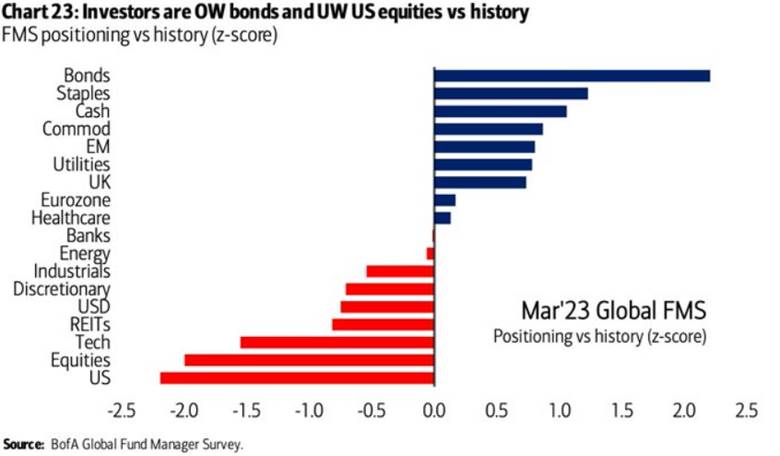

3. The Money Flows Still Going to Bonds

From Dave Lutz at Jones Trading Fund managers are still in bear town: long bonds, staples and cash; US equity weighting is at an 18 yr low. From BAML yesterday

4. XLE Energy ETF Never Made New 2023 Highs….Trading below 200day Moving Average.

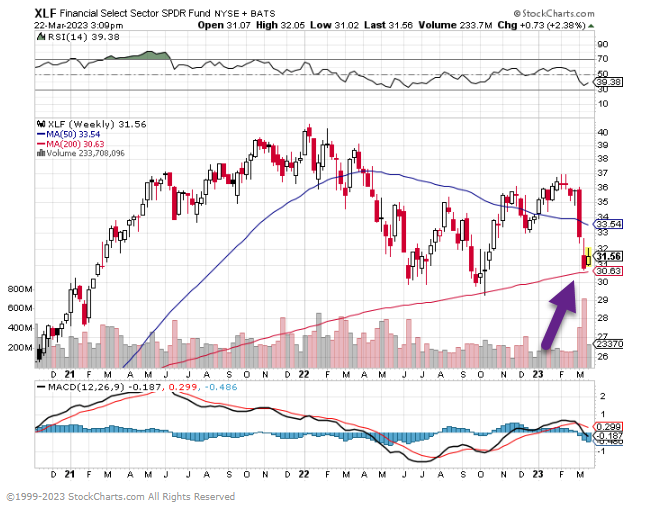

5. XLF Financial Sector ETF 3rd Run at 200 Week Moving Average

XLF more diversified than bank ETFs ….touching 200 week moving average for third time since mid-2022

Top Holdings 25% of Portfolio Berkshire and JP Morgan

https://www.etf.com/XLF

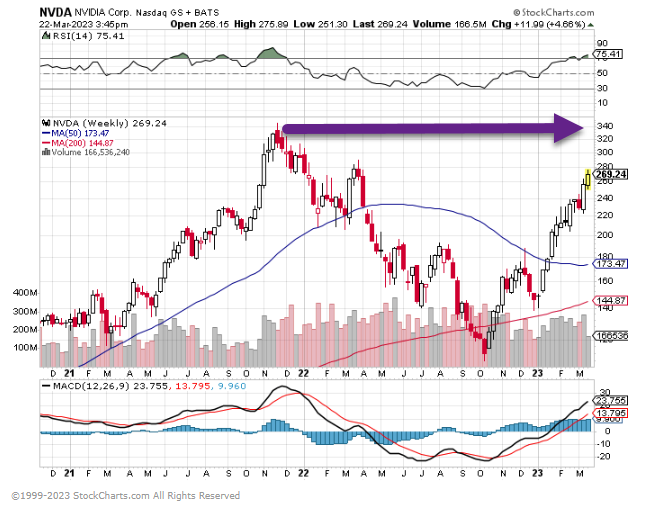

6. NVIDIA Runs Up to Highs from One-Year Ago

NVDA almost hits exact number from last March

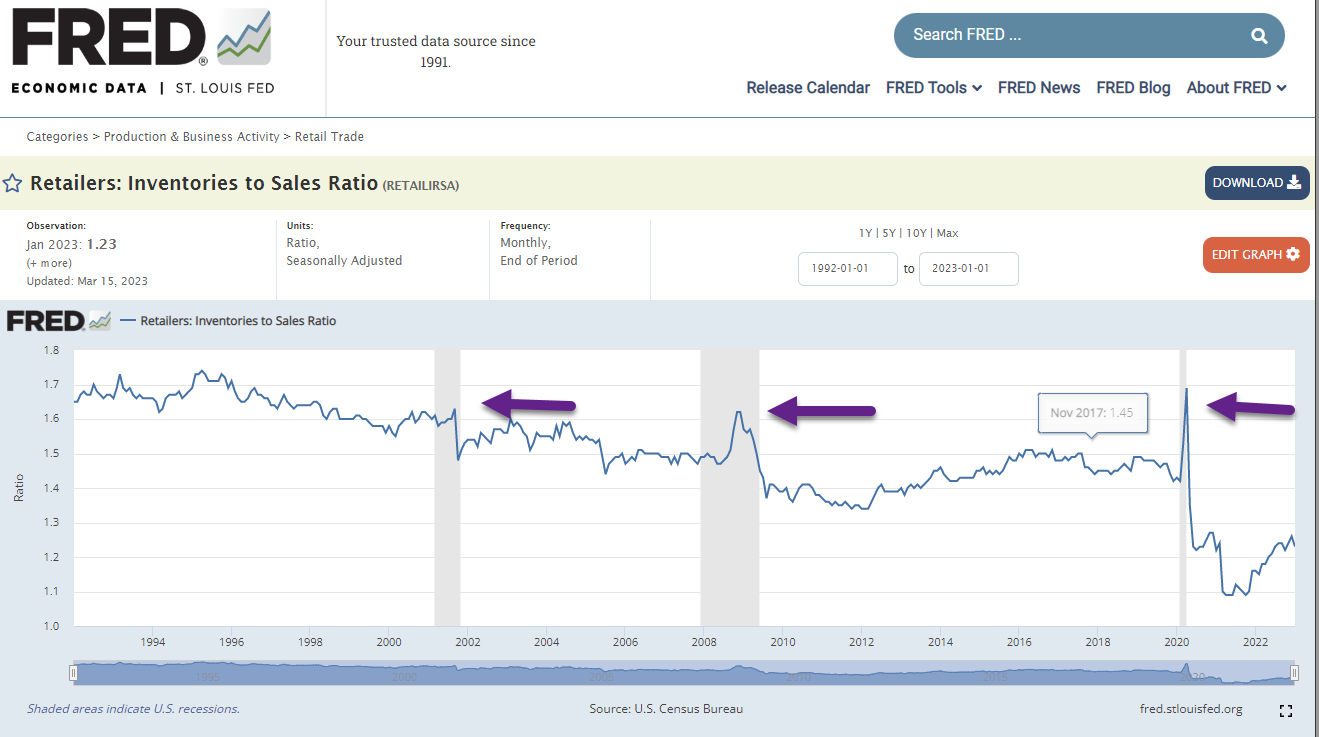

7. Recession Indicator Inventories to Sales Ratio

This ratio is not yet near previous recession levels…See arrows on chart.

https://fred.stlouisfed.org/series/RETAILIRSA

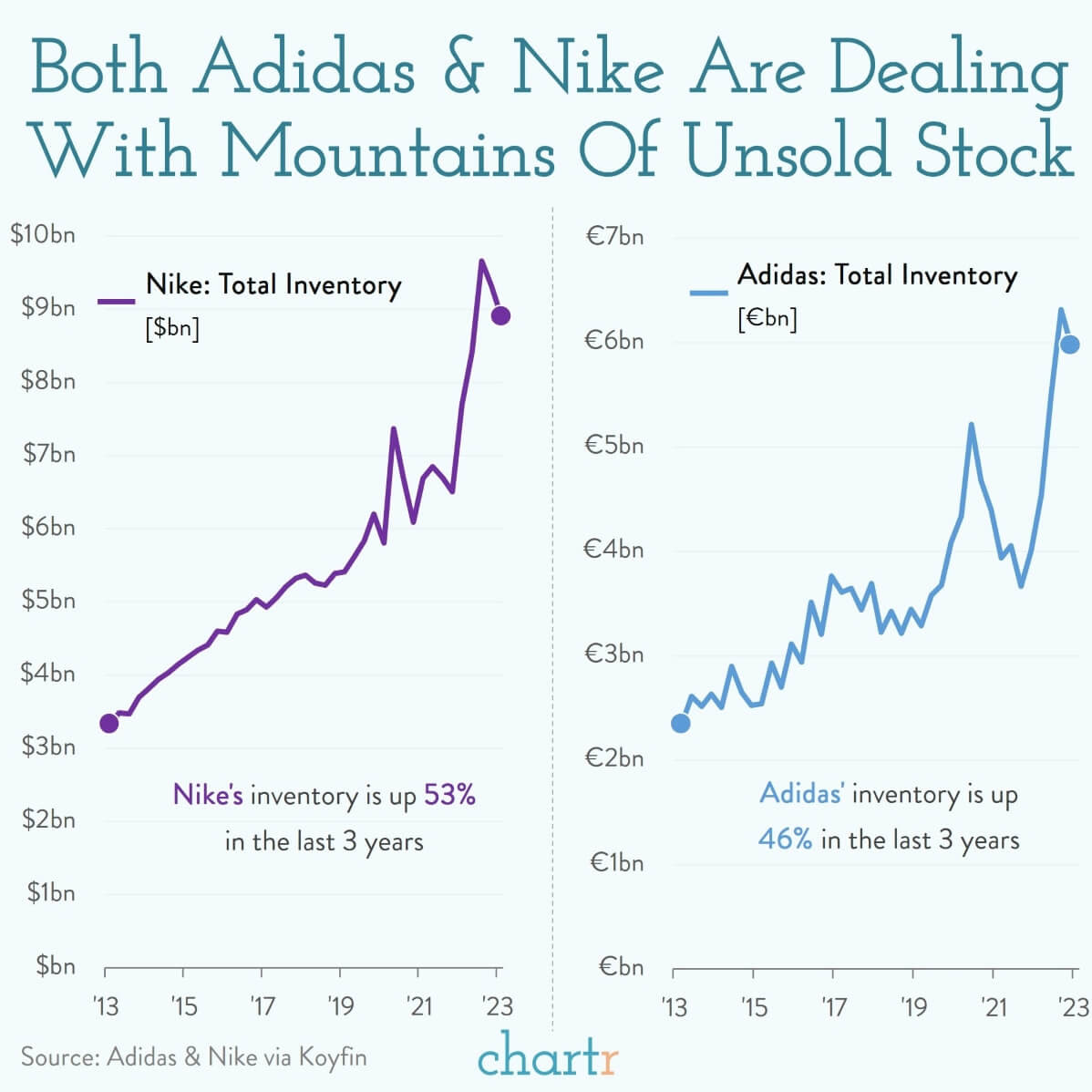

8. One Sub-Sector with Massive Inventory Build Up….Nike and Adidas 50% Increases in Inventory.

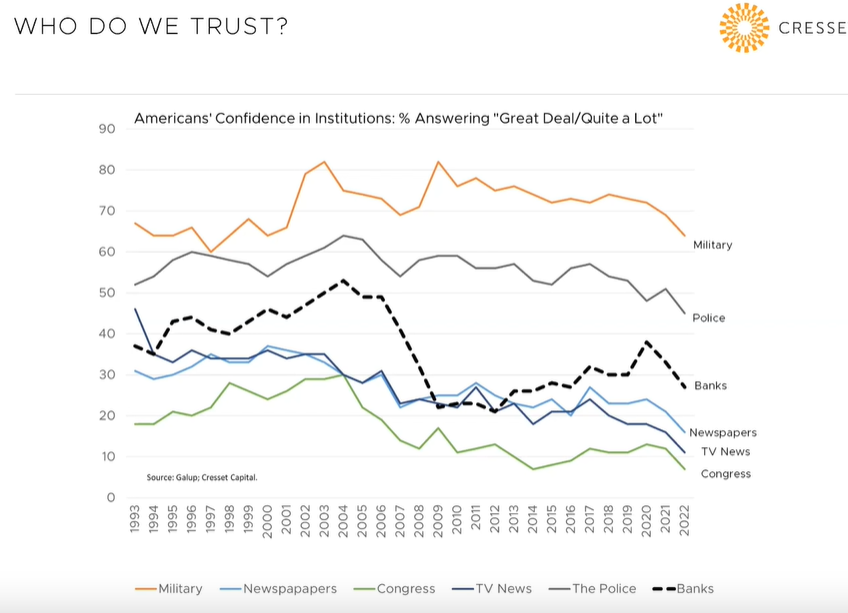

9. Who Do Citizens Trust? Congress Single Digits

Jack Ablin Cresset https://cressetcapital.com/

10. Founders Podcast Dinner with Charlie Munger

David SenraDavid Senra• 2nd• 2ndFounder at Founders PodcastFounder at Founders Podcast

I had dinner with Charlie Munger.

I spent over 3 hours with him.

I got to see his library. I could ask him any question I wanted.

At 99 he is still *ferociously* intelligent.

The most important lesson I learned from him that night was: GO FOR GREAT.

In typical Charlie fashion it is a combination of 4 simple ideas:

1. Charlie looks at everything through the lens of history. Human nature does not change. The same behaviors repeat forever.

2. Problems from time to time should be expected. This is an inescapable part of life.

3. Wise people do not whine about problems. They prevent them:

“Wisdom is prevention.” —Charlie Munger

4. Great businesses are rare. Great people are rare too. Great people and great businesses produce fewer problems.

Your mission in life is to get into a great business (and stay there)

and build relationships with great people.

Doing that will prevent the majority of problems that are under your control.

Go for great.

I made a podcast about what I learned from having dinner with Charlie Munger and rereading The Tao of Charlie Munger, you can listen to it here: https://lnkd.in/ezHrDnCb

https://www.linkedin.com/in/