3. Weed Stocks Rally in 2024…Outperforming Bitcoin.

Why Marijuana Stocks, Cannabis ETFs Are Up Now Cannabis ETFs like the AdvisorShares Pure Cannabis ETF (MSOS) and the Roundhill Cannabis ETF (WEED)jumped as much as 25% this month after a release of documents that support a recommendation by the U.S. Department of Health and Human Services to lower the federal classification of cannabis to Schedule III from Schedule I.

The recommendation from HHS would make it harder for the Drug Enforcement Administration (DEA) to reject, thereby opening the door for wider state legalization, as well as the potential for increased capital from investors, investment firms and banks.

From its August 2023 low, the WEED ETF is up 85%. The ETFMG Alternative Harvest ETF (MJ), which is the first ETF to focus on the global cannabis market, has not had a positive calendar year return since 2017, with its worst year in 2022 as it fell 60%.

5 Top Cannabis ETFs of 2024 by Performance

|

Ticker |

Fund |

Expense Ratio |

AUM |

YTD Return |

|

0.40% |

$3.89M |

23.91% |

||

|

0.83% |

$775.57M |

23.40% |

||

|

0.76% |

$143.18M |

22.94% |

||

|

0.75% |

$555.1K |

20.24% |

||

|

1.03% |

$45.4M |

14.57% |

Total return as of January 22, 2023. Leveraged ETFs were not considered for our list. https://www.etf.com/sections/etf-basics/why-cannabis-etfs-are-flying-high-again

4. Lithium ETF Makes New Lows.

Check in on this chart every few months…..50week thru 200week to downside.

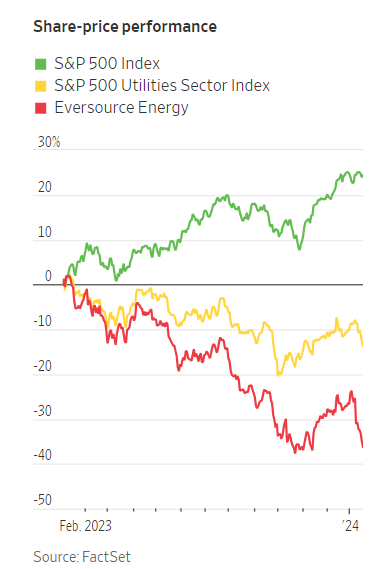

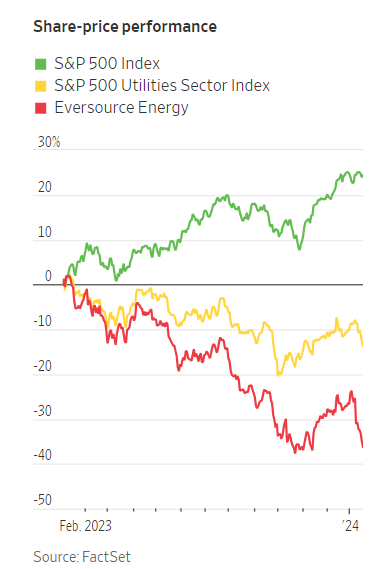

5. The Multibillion-Dollar Clean Energy Bet Gone Wrong

Offshore wind turbines are proving too risky for many utilities

By David Uberti Building gigantic turbines in the ocean is more of a challenge than expected for some energy industry players.

U.S. power companies raced to get in on the offshore wind boom a few years ago. Now some are rushing to get out.

Already, utilities have unloaded pieces of a planned New Jersey wind farm and a yet-to-be-built seabed off Massachusetts. Now, “for sale” signs sit on stakes in four developments aimed at electrifying hundreds of thousands of homes in New York, Connecticut, Rhode Island and Virginia.

The pullback is adding to the turmoil in a new industry at the center of the U.S.’s renewable-energy ambitions. Developers behind projects totaling 8.5 gigawatts of electricity—more than a quarter of President Biden’s 2030 goal—canceled or are expected to cancel state-approved power contracts to propose deals with new terms, according to Intelatus Global Partners. Two projects have been nixed outright.

The retreat by utilities underscores the challenge of building turbines the size of skyscrapers in the ocean, with supply-chain snarls and higher interest rates blowing up project budgets.

https://www.wsj.com/business/energy-oil/renewable-energy-wind-utility-companies-reconsider-329df2b7

6. BABA Insider Buying.

CEO Tsai has bought about $151 million worth of Alibaba’s U.S.-traded shares in the fourth quarter, via his Blue Pool Management family investment vehicle, a securities filing confirmed on Tuesday. Ma, who stepped down as the company’s executive chairman in 2019 but remains a major shareholder, bought $50 million worth of Hong Kong-traded stock in the quarter, according to a person with knowledge of the matter. (Both men already hold sizable amounts of Alibaba stock.)

https://www.nytimes.com/2024/01/23/business/dealbook/jack-ma-alibaba-shares.html

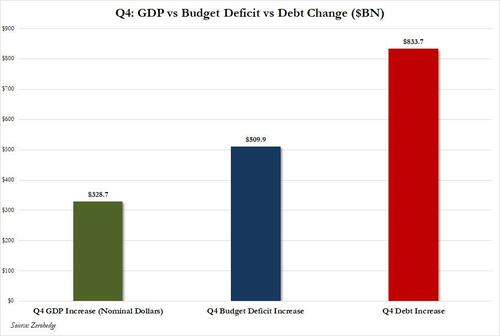

7. GDP…Behind the Number.

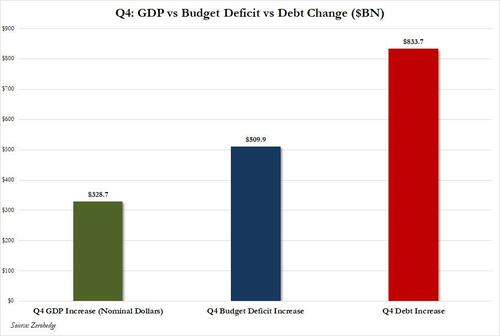

Zerohedge The result, for better or worse, speak for themselves: while Q4 GDP rose by $329 billion to $27.939 trillion, a respectable if made up number, what is much more disturbing is that over the same time period, the US budget deficit rose by more than 50%, or $510 billion. And the cherry on top: the increase in public US debt in the same three month period was a stunning $834 billion, or 154% more than the increase in GDP. In other words, it now takes $1.55 in budget deficit to generate $1 of growth… and it takes over $2.50 in new debt to generate $1 of GDP growth!

https://www.zerohedge.com/markets/gdp-number-was-great-there-just-one-huge-problem

8. Ranked-The Most Popular AI Tools

Visual Capitalist

https://www.visualcapitalist.com/ranked-the-most-popular-ai-tools/

9. Watch This Weekend…”Dumb Money” on Netflix

The Story Behind the Real Amateur Investors Who Inspired Dumb Money

TIME BY MARIAH ESPADA Dumb Money dramatizes the true story behind working class Redditors turned investors who flipped Wall Street on its head. Currently out in limited theaters and expanding in the coming weeks, director Craig Gillespie’s comedy-drama, written by Lauren Schuker Blum and Rebecca Angelo, weaves together multiple storylines to bring to life the GameStop saga of 2021. That story, which dominated headlines while many were stuck at home during the days of the Omicron variant, has its roots in the practice by mega hedge funds to invest stock in companies like the gaming retailer, with the hopes for a short selling, an investment strategy that looks to profit from their falling stock prices. And those top dogs appear in Dumb Money, in the form of characters played by Nick Offerman, Seth Rogen, and Vincent D’Onofrio.

But the story really got interesting when working class investors banded together on the Reddit Internet forum r/WallStreetBets and short-squeezed the billionaire investors, causing a rapid rise in the stock’s price, thus leading to short sellers losing big. At its peak, GameStop stock traded at $483 per share. With these individual investors making an unprecedented impact on the market, the short sellers were offered several bailouts—leading to criticism that the system was rigged in their favor.

“I think it’s very easy to look around and see how broken, fragmented, and seemingly hopeless things are,” Schuker Blum tells TIME. “But here was an inspiring story of an incredibly diverse and large group of people coming together around an idea.”

And that group of people—represented in the film by characters portrayed by Paul Dano, America Ferrera, and Anthony Ramos, among others—serve as the audience’s stand-in for the every-person. Some depict real-life characters, while others play fictional or composite characters based on the experiences of several investors.

During their research process, the filmmakers sourced a wealth of information from interviews with Reddit investor participants like Harmony Murphy (whom the movie character Harmony Williams was named for, but not directly based on, and who is currently in a pending lawsuit against Robinhood, the app that controversially froze trades on GameStop). They also used as source material Ben Mezrich’s 2021 book The Antisocial Network: The GameStop Short Squeeze and the Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees. Mezrich was one of the executive producers on the film.

https://time.com/6315779/dumb-money-real-people/

10. Investing Lessons From Nick Saban

Savant Wealth by Chip Kalousek With the retirement of revered University of Alabama football coach Nick Saban set against a backdrop of other significant personnel changes, such as the retirement of Bill Belichick and departure of Pete Carroll from the Seattle Seahawks, the beginning of 2024 has marked substantial shake-ups in the world of football. This slew of transitions signals not only the end of an era, but the start of a new chapter for the sport.

Seasons of change provide great opportunities for reflection and personal growth. In my 12 years of living in Alabama, I’ve had the chance to study Coach Saban and his many successes. His profound impact is evident not only in football, but his principles are often applied in business strategy and leadership. It’s intriguing to draw parallels between Saban’s approach to the game and the intricacies of the investment world. Here are investment lessons inspired by Coach Saban’s prolific career, offering insights derived from his methods for success that transcend the boundaries of sport.

Follow “The Process”

Saban’s well-honed philosophy, “The Process,” emphasizes focusing on what one can control in the present moment, and not on a distant, lofty goal, such as a National Championship. For investors, the message is this: don’t obsess over short-term market movements or get distracted by “hot tips.” Instead, follow an investment process that relies on empirical data and research, guided by discipline.

Pay Attention to Detail: Everything Matters

Saban spent decades developing his unparalleled eye for detail, studying player metrics, opponent strategies, and game film. In investing, well-informed decision making becomes elevated through meticulous data examination, leaving no stone unturned to make informed decisions. Small details such as taxes, turnover, and transaction costs can have a significant impact on investment outcomes.

Build a Diversified Team

Saban’s success was due in part to his ability to recruit a well-rounded and diverse team of players. In investing, this equates to being broadly diversified across assets, market cap, style, and geography for better risk-adjusted returns. Research shows that a diversified portfolio, rather than individual stock picking, tends to outperform the market over the long term.

Surround Yourself with the Right People

Coach Saban never failed to credit his carefully curated staff for his team’s success. He understood you are the sum of those with whom you choose to surround yourself. Similarly, successful investors surround themselves with a sort of personal board of directors who will hold them accountable and offer practical and objective advice. This personal board can include professionals (accountants, financial advisors, or attorneys) or informal relationships, such as family and friends.

Have a Plan and Execute It

Saban was a master strategist. His clear, well thought-out game plans were key to his success. Investors should similarly have a solid plan and understanding of their personal risk tolerance, goals, and objectives to help create a roadmap for investment success.

A Winning Combination

Nick Saban’s principles of being process-focused, detail-oriented, diversified, well supported, and meticulously planned can be a winning combination for financial success. At Savant, this wisdom and foresight are integrated into our evidenced-based investing approach. If you’d like to learn more about how our investment approach helps clients pursue their ideal futures please consider talking with one of our financial advisors.

Congratulations on your retirement, Coach Saban. Roll Tide!

![]() Chip KalousekSenior Investment Research Analyst

Chip KalousekSenior Investment Research Analyst

Found at Abnormal Returns Blog. www.abnormalretrurns.com

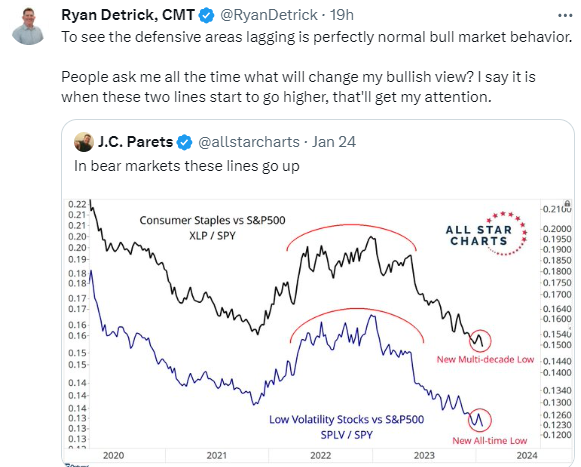

1. Defensive Stock Sectors Continue to Make New Lows.

2. 30-Year Treasury Yield Update.

Keeping in mind this bounce went from 1% to 5%…Breaking red downtrend line that went back to 1982

3. Weed Stocks Rally in 2024…Outperforming Bitcoin.

Why Marijuana Stocks, Cannabis ETFs Are Up Now Cannabis ETFs like the AdvisorShares Pure Cannabis ETF (MSOS) and the Roundhill Cannabis ETF (WEED)jumped as much as 25% this month after a release of documents that support a recommendation by the U.S. Department of Health and Human Services to lower the federal classification of cannabis to Schedule III from Schedule I.

The recommendation from HHS would make it harder for the Drug Enforcement Administration (DEA) to reject, thereby opening the door for wider state legalization, as well as the potential for increased capital from investors, investment firms and banks.

From its August 2023 low, the WEED ETF is up 85%. The ETFMG Alternative Harvest ETF (MJ), which is the first ETF to focus on the global cannabis market, has not had a positive calendar year return since 2017, with its worst year in 2022 as it fell 60%.

5 Top Cannabis ETFs of 2024 by Performance

|

Ticker |

Fund |

Expense Ratio |

AUM |

YTD Return |

|

0.40% |

$3.89M |

23.91% |

||

|

0.83% |

$775.57M |

23.40% |

||

|

0.76% |

$143.18M |

22.94% |

||

|

0.75% |

$555.1K |

20.24% |

||

|

1.03% |

$45.4M |

14.57% |

Total return as of January 22, 2023. Leveraged ETFs were not considered for our list. https://www.etf.com/sections/etf-basics/why-cannabis-etfs-are-flying-high-again

4. Lithium ETF Makes New Lows.

Check in on this chart every few months…..50week thru 200week to downside.

5. The Multibillion-Dollar Clean Energy Bet Gone Wrong

Offshore wind turbines are proving too risky for many utilities

By David Uberti Building gigantic turbines in the ocean is more of a challenge than expected for some energy industry players.

U.S. power companies raced to get in on the offshore wind boom a few years ago. Now some are rushing to get out.

Already, utilities have unloaded pieces of a planned New Jersey wind farm and a yet-to-be-built seabed off Massachusetts. Now, “for sale” signs sit on stakes in four developments aimed at electrifying hundreds of thousands of homes in New York, Connecticut, Rhode Island and Virginia.

The pullback is adding to the turmoil in a new industry at the center of the U.S.’s renewable-energy ambitions. Developers behind projects totaling 8.5 gigawatts of electricity—more than a quarter of President Biden’s 2030 goal—canceled or are expected to cancel state-approved power contracts to propose deals with new terms, according to Intelatus Global Partners. Two projects have been nixed outright.

The retreat by utilities underscores the challenge of building turbines the size of skyscrapers in the ocean, with supply-chain snarls and higher interest rates blowing up project budgets.

https://www.wsj.com/business/energy-oil/renewable-energy-wind-utility-companies-reconsider-329df2b7

6. BABA Insider Buying.

CEO Tsai has bought about $151 million worth of Alibaba’s U.S.-traded shares in the fourth quarter, via his Blue Pool Management family investment vehicle, a securities filing confirmed on Tuesday. Ma, who stepped down as the company’s executive chairman in 2019 but remains a major shareholder, bought $50 million worth of Hong Kong-traded stock in the quarter, according to a person with knowledge of the matter. (Both men already hold sizable amounts of Alibaba stock.)

https://www.nytimes.com/2024/01/23/business/dealbook/jack-ma-alibaba-shares.html

7. GDP…Behind the Number.

Zerohedge The result, for better or worse, speak for themselves: while Q4 GDP rose by $329 billion to $27.939 trillion, a respectable if made up number, what is much more disturbing is that over the same time period, the US budget deficit rose by more than 50%, or $510 billion. And the cherry on top: the increase in public US debt in the same three month period was a stunning $834 billion, or 154% more than the increase in GDP. In other words, it now takes $1.55 in budget deficit to generate $1 of growth… and it takes over $2.50 in new debt to generate $1 of GDP growth!

https://www.zerohedge.com/markets/gdp-number-was-great-there-just-one-huge-problem

8. Ranked-The Most Popular AI Tools

Visual Capitalist

https://www.visualcapitalist.com/ranked-the-most-popular-ai-tools/

9. Watch This Weekend…”Dumb Money” on Netflix

The Story Behind the Real Amateur Investors Who Inspired Dumb Money

TIME BY MARIAH ESPADA Dumb Money dramatizes the true story behind working class Redditors turned investors who flipped Wall Street on its head. Currently out in limited theaters and expanding in the coming weeks, director Craig Gillespie’s comedy-drama, written by Lauren Schuker Blum and Rebecca Angelo, weaves together multiple storylines to bring to life the GameStop saga of 2021. That story, which dominated headlines while many were stuck at home during the days of the Omicron variant, has its roots in the practice by mega hedge funds to invest stock in companies like the gaming retailer, with the hopes for a short selling, an investment strategy that looks to profit from their falling stock prices. And those top dogs appear in Dumb Money, in the form of characters played by Nick Offerman, Seth Rogen, and Vincent D’Onofrio.

But the story really got interesting when working class investors banded together on the Reddit Internet forum r/WallStreetBets and short-squeezed the billionaire investors, causing a rapid rise in the stock’s price, thus leading to short sellers losing big. At its peak, GameStop stock traded at $483 per share. With these individual investors making an unprecedented impact on the market, the short sellers were offered several bailouts—leading to criticism that the system was rigged in their favor.

“I think it’s very easy to look around and see how broken, fragmented, and seemingly hopeless things are,” Schuker Blum tells TIME. “But here was an inspiring story of an incredibly diverse and large group of people coming together around an idea.”

And that group of people—represented in the film by characters portrayed by Paul Dano, America Ferrera, and Anthony Ramos, among others—serve as the audience’s stand-in for the every-person. Some depict real-life characters, while others play fictional or composite characters based on the experiences of several investors.

During their research process, the filmmakers sourced a wealth of information from interviews with Reddit investor participants like Harmony Murphy (whom the movie character Harmony Williams was named for, but not directly based on, and who is currently in a pending lawsuit against Robinhood, the app that controversially froze trades on GameStop). They also used as source material Ben Mezrich’s 2021 book The Antisocial Network: The GameStop Short Squeeze and the Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees. Mezrich was one of the executive producers on the film.

https://time.com/6315779/dumb-money-real-people/

10. Investing Lessons From Nick Saban

Savant Wealth by Chip Kalousek With the retirement of revered University of Alabama football coach Nick Saban set against a backdrop of other significant personnel changes, such as the retirement of Bill Belichick and departure of Pete Carroll from the Seattle Seahawks, the beginning of 2024 has marked substantial shake-ups in the world of football. This slew of transitions signals not only the end of an era, but the start of a new chapter for the sport.

Seasons of change provide great opportunities for reflection and personal growth. In my 12 years of living in Alabama, I’ve had the chance to study Coach Saban and his many successes. His profound impact is evident not only in football, but his principles are often applied in business strategy and leadership. It’s intriguing to draw parallels between Saban’s approach to the game and the intricacies of the investment world. Here are investment lessons inspired by Coach Saban’s prolific career, offering insights derived from his methods for success that transcend the boundaries of sport.

Follow “The Process”

Saban’s well-honed philosophy, “The Process,” emphasizes focusing on what one can control in the present moment, and not on a distant, lofty goal, such as a National Championship. For investors, the message is this: don’t obsess over short-term market movements or get distracted by “hot tips.” Instead, follow an investment process that relies on empirical data and research, guided by discipline.

Pay Attention to Detail: Everything Matters

Saban spent decades developing his unparalleled eye for detail, studying player metrics, opponent strategies, and game film. In investing, well-informed decision making becomes elevated through meticulous data examination, leaving no stone unturned to make informed decisions. Small details such as taxes, turnover, and transaction costs can have a significant impact on investment outcomes.

Build a Diversified Team

Saban’s success was due in part to his ability to recruit a well-rounded and diverse team of players. In investing, this equates to being broadly diversified across assets, market cap, style, and geography for better risk-adjusted returns. Research shows that a diversified portfolio, rather than individual stock picking, tends to outperform the market over the long term.

Surround Yourself with the Right People

Coach Saban never failed to credit his carefully curated staff for his team’s success. He understood you are the sum of those with whom you choose to surround yourself. Similarly, successful investors surround themselves with a sort of personal board of directors who will hold them accountable and offer practical and objective advice. This personal board can include professionals (accountants, financial advisors, or attorneys) or informal relationships, such as family and friends.

Have a Plan and Execute It

Saban was a master strategist. His clear, well thought-out game plans were key to his success. Investors should similarly have a solid plan and understanding of their personal risk tolerance, goals, and objectives to help create a roadmap for investment success.

A Winning Combination

Nick Saban’s principles of being process-focused, detail-oriented, diversified, well supported, and meticulously planned can be a winning combination for financial success. At Savant, this wisdom and foresight are integrated into our evidenced-based investing approach. If you’d like to learn more about how our investment approach helps clients pursue their ideal futures please consider talking with one of our financial advisors.

Congratulations on your retirement, Coach Saban. Roll Tide!

![]() Chip KalousekSenior Investment Research Analyst

Chip KalousekSenior Investment Research Analyst

Found at Abnormal Returns Blog. www.abnormalretrurns.com