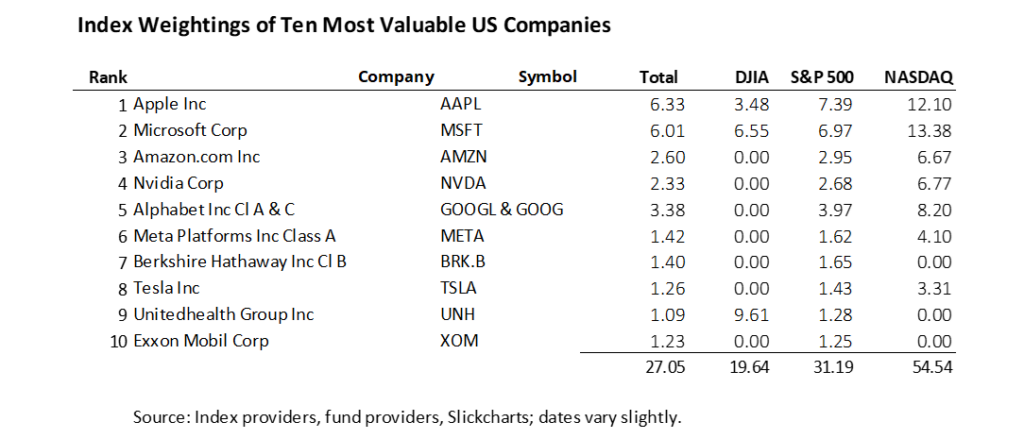

1. Big 3 Indexes…Difference in Weightings from Mega Cap Leaders

by Allan Roth, 6/12/23 Advisor Perspectives

https://www.advisorperspectives.com/articles/2023/06/12/dividend-factor-equity-global-roth

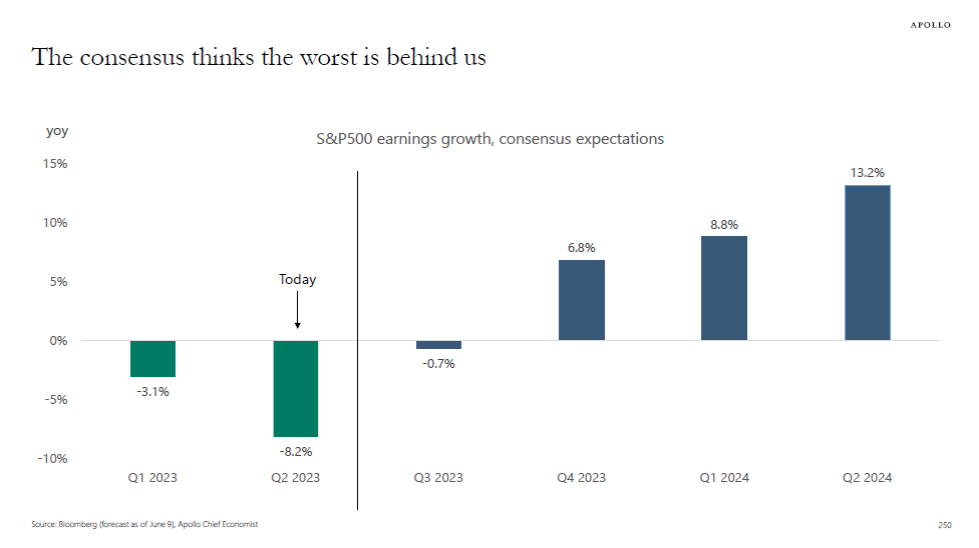

2. Torsten Slok on Earnings Expectations

The stock market thinks we have the worst behind us, see chart below, which shows that earnings growth is expected to bottom this quarter and then improve quite rapidly over the coming four quarters. This forecast will only be correct if core inflation moves quickly down towards 2%. If core inflation remains around 5% then the Fed will have to put additional downward pressure on demand in the economy and ultimately earnings. If core inflation remains sticky around 5%, we will likely remain longer in a period with high capital costs and low earnings growth. Torsten Slok, Ph.D.Chief Economist, PartnerApollo Global Management

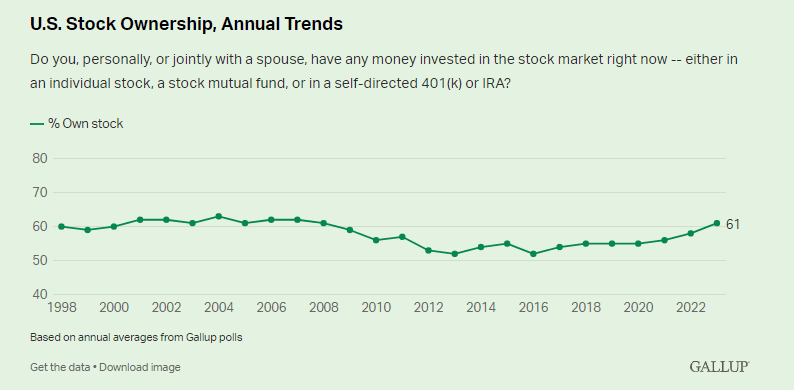

3. U.S. Stock Ownership Stats

@Charlie Bilello Highest Stock Ownership since 2008

Stock ownership in the US is on the rise. 61% of people reported owning stocks in the latest Gallup poll, the highest % since 2008. After the global financial crisis and stock market crash, we saw a decline in ownership for a number of years, but that trend is now moving in the opposite direction.

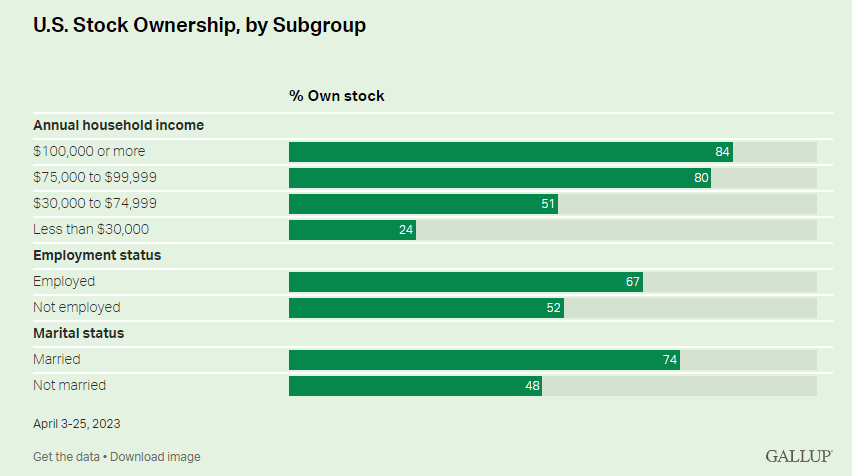

The most predictive factor when it comes to owning stock? Incomes. The higher your household income, the more likely you are to own stocks.

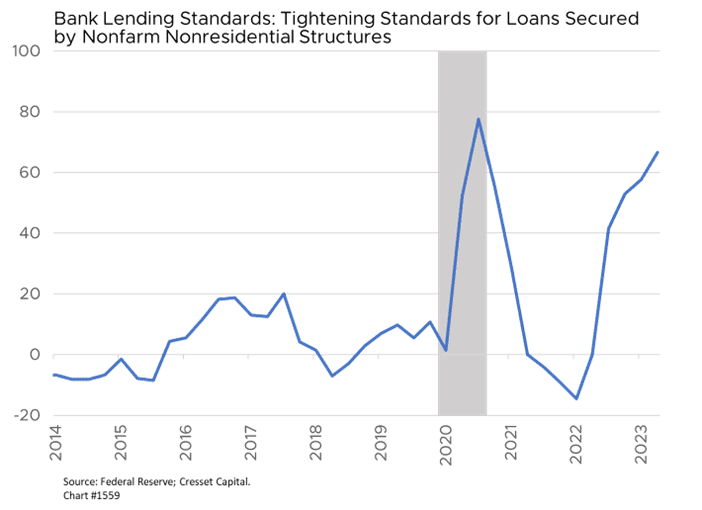

4. Bank Lending Standards Tighten Back to Covid Levels

Jack Ablin-Cresset

https://cressetcapital.com/post/strong-case-for-a-fed-pause/

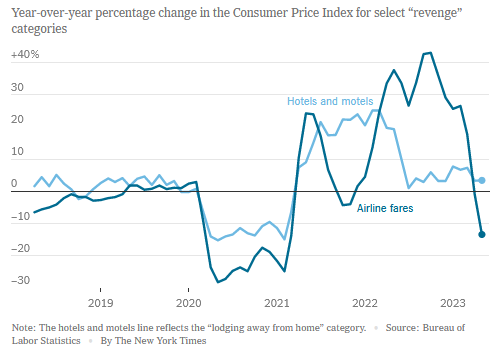

5. Revenge Spending Cools Down

Dave Lutz Jones Trading REVENGE SPENDING– After two years of spending heavily on vacations and other experiences that they were deprived of during pandemic lockdowns, Americans may be on the brink of pulling back — a cool-down that could help slow inflation. The nation witnessed two years of red-hot “revenge spending,” the name economists and corporate executives gave to a spike in recreational spending and vacation splurging that followed coronavirus lockdowns. As demand rose, so did prices for airfares, hotels and other sought-after services.

But many of those price categories are now cooling. Hotel prices have recently climbed much more slowly on a year-over-year basis, and airfares fell in May, a report on Tuesday showed. If that trend continues this summer, it could contribute to a continuing slowdown in overall services inflation, something the Fed has been watching and waiting for, NYT Reports.

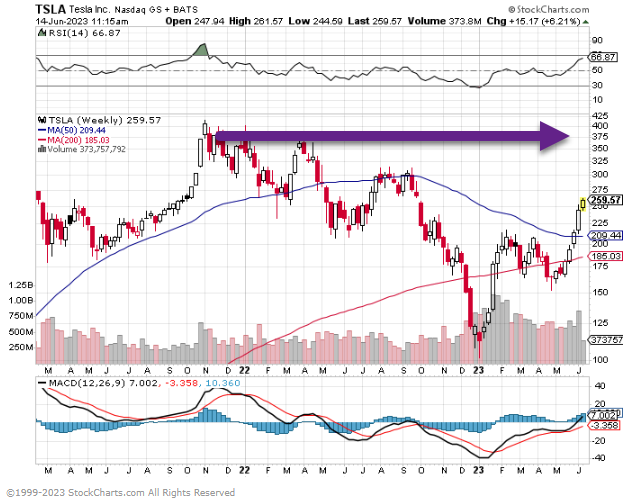

6. Tesla $102 to $260 in 2023

7. U.S. Dollar Trading Sideways for 6 Months

8. Crude Oil Trades Down to 200-Week Moving Average….$120 to $69

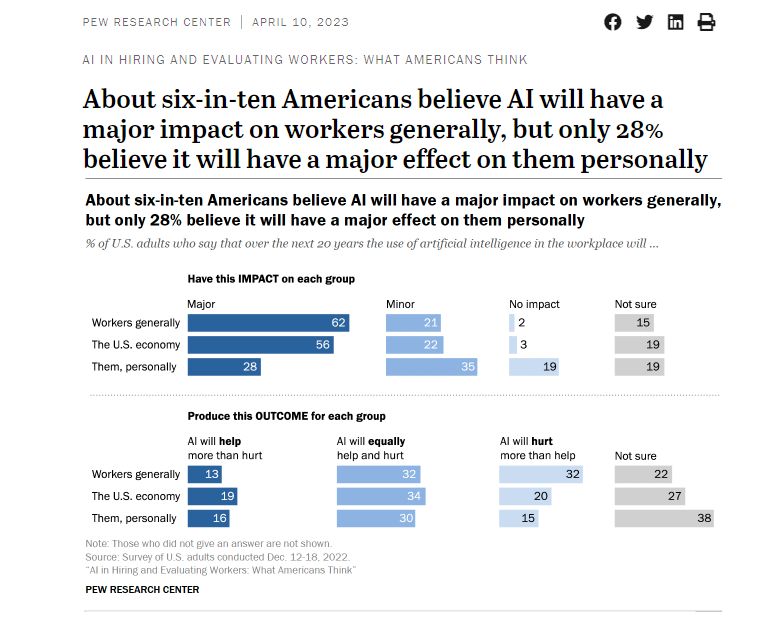

9. American Workers Thoughts on AI

10. Forget Macro Events

The Daily Stoic So much happens in life. There is so much happening. Forget macro events—there are dogs that get sick in the middle of the night. There are trips that need to be made to the store. There are unpleasant conversations to have. Bills that somebody has to pay. Dishes to be done. Hard decisions to make.

Most people’s reaction—especially when those macro events are stressing them out on top of everything—is to shirk. It’s to see if someone else can handle all that for them. It’s to try to get out of whatever can be got out of. It’s to resent even the idea of an obligation.

But the Stoic? A Stoic politely sings to themselves those lyrics from one of the greatest songs of all time:

And you put the load right on me

You put the load right on me

Remember, in a crisis Marcus Aurelius stepped up. In fact, the famous story about him is that he didn’t want to be emperor at all. He wasn’t sure he could do it. But the night Marcus was informed of the news, he had a dream. In that dream he had shoulders made of ivory. It was a sign: He could do it. His shoulders could bear the weight. Put the load right on me, he said to himself. And he bore it for the rest of his life.

Things are hard right now. They’re scary. They’re not your fault. But they are your responsibility. They are yours to step up and carry. Because you have the shoulders that can bear the weight.

Ryan Holiday tells the story of that dream in his book The Boy Who Would Be King, which you can get for 75% off if you bundle with The Girl Who Would Be Free! Grab a signed bundle here, and a personalized bundle here.