1.Stocks and Bonds Going Down Together Like Last Week is a Rare Occurrence.

When Stocks and Bonds Go Down Together

Charlie Bilello

High on the list of the greatest fears among investors is a scenario in which stocks and bonds go down together.

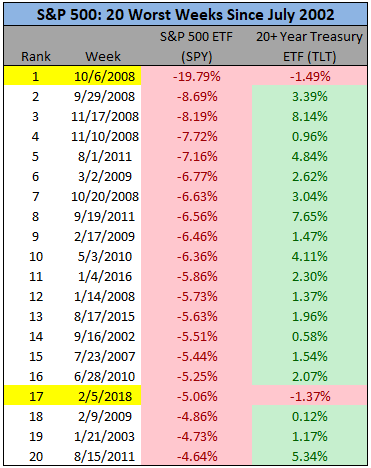

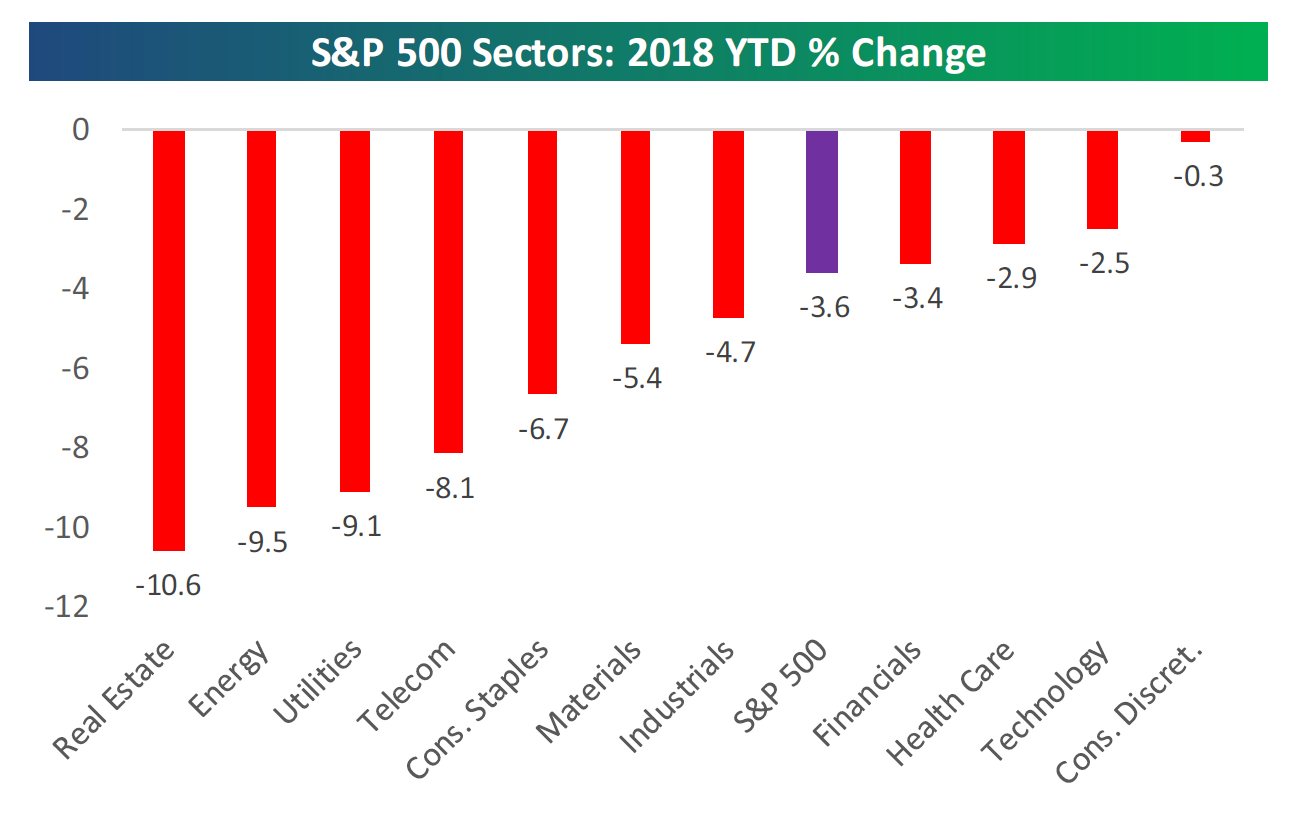

Last week those fears were realized when the S&P 500 (SPY) suffered its worst week since January 2016 while long-term Treasury bonds (TLT) also declined.

Source Data: Pension Partners, YCharts

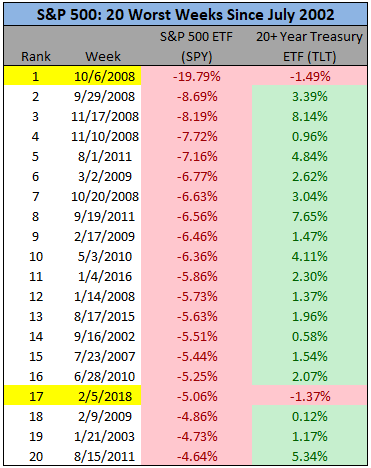

This was an unusual occurrence to say the least. Of the 20 worst weekly S&P 500 declines since July 2002 (inception of the long duration ETF), last week was only the 2nd time long duration Treasuries also finished lower.

Treasuries tend act as a safe haven during times of equity market stress, showing positive returns on average during the worst stock market declines. This tendency is amplified on the long end of the curve, as investors are often positioning for weaker economic conditions that coincide with falling interest rates. A precipitous drop in interest rates, of course, is the best friend of duration.

However, there are certain times when the very source of equity market anxiety is a rise in interest rates and potential inflation. During such times you can see stocks and long bonds fall together. We last saw this briefly in 2013 during the so-called “taper tantrum”…

https://pensionpartners.com/when-stocks-and-bonds-go-down-together/

Found at www.abnormalreturns.com

Continue reading →